TIDMHZM

RNS Number : 5626J

Horizonte Minerals PLC

17 August 2023

NEWS RELEASE

17 August 2023

INTERIM FINANCIAL RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Horizonte Minerals Plc (AIM/TSX: HZM) ("Horizonte" or the

"Company") , a nickel company developing two Tier 1 assets in

Brazil, announces it has today published its unaudited financial

results for the six-month period to 30 June 2023.

Highlights of the period, as per the announcement on 3 August

2023:

-- Araguaia Nickel Project Line 1 construction activities

continued to make good progress with first metal production

on-schedule for Q1 2024

o Strong safety performance, no lost time injuries with close to

3.8 million hours worked

o Approximately 65% of the overall construction of Araguaia was

completed as of 30 June 2023, with physical site construction 53%

complete

o Several major milestones were achieved during the period

including the delivery of the Rotary Kiln and commencement of ore

mining

o US$329 million has been spent on the Araguaia construction out

of the budgeted capital requirement of US$537 million

-- Araguaia Nickel Project Line 2 Feasibility Study ("FS"),

which aims to double nickel production from 14,500 tonnes per annum

to 29,000 tonnes per annum, to be published later this year

-- Liquidity and funding sources of US$344 million as of 30 June 2023

-- Published fourth consecutive standalone Sustainability Report for 2022

-- A recent video of the project progress is available: https://horizonteminerals.com/uk/en/videos_and_audio/

This announcement has been posted on the Company's website

www.horizonteminerals.com and is also available on SEDAR at

www.sedar.com .

For further information, visit www.horizonteminerals.com or

contact:

Horizonte Minerals plc info@horizonteminerals.com

Jeremy Martin (CEO) +44 (0) 203 356 2901

Simon Retter (CFO)

Patrick Chambers (Head of IR)

Peel Hunt LLP (Nominated Adviser & Joint

Broker)

Ross Allister

David McKeown +44 (0)20 7418 8900

---------------------------

BMO (Joint Broker)

Thomas Rider

Pascal Lussier Duquette

Andrew Cameron +44 (0)20 7236 1010

---------------------------

Barclays (Joint Broker)

Philip Lindop

Richard Bassingthwaighte +44 (0)20 7623 2323

---------------------------

Tavistock (Financial PR)

Emily Moss

Cath Drummond +44 (0) 20 7920 3150

---------------------------

ABOUT HORIZONTE MINERALS

Horizonte Minerals Plc (AIM/TSX: HZM) is developing two

100%-owned, Tier 1 projects in Pará state, Brazil - the Araguaia

Nickel Project and the Vermelho Nickel-Cobalt Project. Both

projects are high-grade, low-cost, with low carbon emission

intensities and are scalable. Araguaia is under construction with

first metal scheduled for 1Q 2024. When fully ramped up with Line 1

and Line 2, Araguaia is forecast to produce 29,000 tonnes of nickel

per year. Vermelho is at feasibility study stage and is expected to

supply nickel to the critical metals market. Horizonte's combined

production profile of over 60,000 tonnes of nickel per year

positions the Company as a globally significant nickel producer.

Horizonte's top three shareholders are La Mancha Investments S.à

r.l., Glencore Plc and Orion Resource Partners LLP.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to the

Company, certain information contained in this press release

constitutes "forward-looking information" under Canadian securities

legislation. Forward-looking information includes, but is not

limited to, the ability of the Company to complete any planned

acquisition of equipment, statements with respect to the potential

of the Company's current or future property mineral projects; the

ability of the Company to complete a positive feasibility study

regarding the second RKEF line at Araguaia on time, or at all, the

ability of the Company to complete a positive feasibility study

regarding the Vermelho Project on time, or at all, the success of

exploration and mining activities; cost and timing of future

exploration, production and development; the costs and timing for

delivery of the equipment to be purchased, the estimation of

mineral resources and reserves and the ability of the Company to

achieve its goals in respect of growing its mineral resources; the

realization of mineral resource and reserve estimates and achieving

production in accordance with the Company's potential production

profile or at all. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is based on the reasonable

assumptions, estimates, analysis and opinions of management made in

light of its experience and its perception of trends, current

conditions and expected developments, as well as other factors that

management believes to be relevant and reasonable in the

circumstances at the date that such statements are made, and are

inherently subject to known and unknown risks, uncertainties and

other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially

different from those expressed or implied by such forward-looking

information, including but not limited to risks related to: the

inability of the Company to complete any planned acquisition of

equipment on time or at all, the ability of the Company to complete

a positive feasibility study regarding the implementation of a

second RKEF line at Araguaia on the timeline contemplated or at

all, the ability of the Company to complete a positive feasibility

study regarding the Vermelho Project on the timeline contemplated

or at all, exploration and mining risks, competition from

competitors with greater capital; the Company's lack of experience

with respect to development-stage mining operations; fluctuations

in metal prices; uninsured risks; environmental and other

regulatory requirements; exploration, mining and other licences;

the Company's future payment obligations; potential disputes with

respect to the Company's title to, and the area of, its mining

concessions; the Company's dependence on its ability to obtain

sufficient financing in the future; the Company's dependence on its

relationships with third parties; the Company's joint ventures; the

potential of currency fluctuations and political or economic

instability in countries in which the Company operates; currency

exchange fluctuations; the Company's ability to manage its growth

effectively; the trading market for the ordinary shares of the

Company; uncertainty with respect to the Company's plans to

continue to develop its operations and new projects; the Company's

dependence on key personnel; possible conflicts of interest of

directors and officers of the Company, and various risks associated

with the legal and regulatory framework within which the Company

operates, together with the risks identified and disclosed in the

Company's disclosure record available on the Company's profile on

SEDAR at www.sedar.com, including without limitation, the annual

information form of the Company for the year ended December 31,

2022, and the Araguaia and Vermelho Technical Reports available on

the Company's website https://horizonteminerals.com/. Although

management of the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements.

Horizonte Minerals Plc

Unaudited Condensed Consolidated Interim Financial Statements

for the six months ended 30 June 2023

Condensed Consolidated Statement of Comprehensive Income

6 months ended

30 June

2023 2022

--------------------------------------------------------------------------- ------ ---------- ------------------

Unaudited Unaudited

Amended (Note 2)

--------------------------------------------------------------------------- ------ ---------- ------------------

Notes US$'000 US$'000

--------------------------------------------------------------------------- ------ ---------- ------------------

Administrative expenses (10,453) (7,326)

Share based payments 11 (1,196) -

Gain/(loss) on foreign exchange 10,987 9,383

(Loss)/profit before interest and taxation (662) 2,057

Net finance (costs)/income 5 (2,144) (2,984)

---------------------------------------------------------------------------- ------ ---------- ------------------

Loss before taxation (2,807) (927)

Taxation - -

--------------------------------------------------------------------------- ------ ---------- ------------------

Loss for the period (2,807) (927)

============================================================================ ====== ========== ==================

Other comprehensive income items that may be reclassified subsequently to

profit or loss

Cash flow hedges - foreign forward contracts 9 9,291 (4,638)

Currency translation differences on translating foreign operations 28,019 (9,789)

---------------------------------------------------------------------------- ------ ---------- ------------------

Other comprehensive income / (loss) for the period, net of taxation 37,310 (14,427)

---------------------------------------------------------------------------- ------ ---------- ------------------

Total comprehensive income / (loss) for the period attributable to equity

holders of the

Company 34,503 (15,354)

Earnings per share attributable to the equity holders of the Group

Basic & Diluted earnings per share (pence per share) 20 (1.045) (0.487)

Condensed Consolidated Statement of Financial Position

30 June 31 December

2023 2022

Unaudited Audited

------------------------------ ------ ---------- ------------

Notes US$'000 US$'000

------------------------------ ------ ---------- ------------

Assets

Non-current assets

Intangible assets 6 19,714 13,209

Property, plant & equipment 7 449,880 277,902

Right of use assets 1,033 958

Trade and other receivables 21,015 9,966

Derivative financial

assets 9 - 62

491,642 302,097

------------------------------ ------ ---------- ------------

Current assets

Trade and other receivables 36,253 48,774

Derivative financial 9,

asset 13b 25,220 15,342

Cash and cash equivalents 8 138,682 154,028

------------------------------ ------ ---------- ------------

200,155 218,144

------------------------------ ------ ---------- ------------

Total assets 691,797 520,241

============================== ====== ========== ============

Equity and liabilities

Equity attributable

to owners of the parent

Issued capital 10 70,423 70,333

Share premium 10 306,946 306,720

Other reserves (1,919) (29,938)

Cash flow hedge reserve 10,379 1,088

Share options reserve 11 2,612 1,416

Accumulated losses (52,994) (50,188)

------------------------------ ------ ---------- ------------

Total equity 335,446 299,430

------------------------------ ------ ---------- ------------

Liabilities

Non-current liabilities

Contingent consideration 12 7,131 6,896

Royalty Finance 13a 96,661 89,745

Deferred consideration 12 3,815 4,808

Convertible loan notes

liability 14 64,123 59,448

Cost overrun facility 15 23,872 23,810

Senior debt facility 16 128,317 4,328

Environmental rehabilitation

provision 1,158 635

Lease liabilities 669 715

Trade and other payables 363 723

326,109 191,109

------------------------------ ------ ---------- ------------

Current liabilities

Trade and other payables 28,760 28,481

Deferred consideration 12 1,061 950

Lease liabilities 421 272

30,242 29,703

------------------------------ ------ ---------- ------------

Total liabilities 356,351 220,811

------------------------------ ------ ---------- ------------

Total equity and liabilities 691,797 520,241

============================== ====== ========== ============

Condensed Statement of Changes in Shareholders' Equity

Attributable to the owners of the parent

---------------------------------------------------------------------------------

Share Share Accumulated Other Cash flow Share

capital premium losses reserves hedge options Total

US$'000 US$'000 US$'000 US$'000 reserve reserve US$'000

US$'000 US$'000

---------------------- --------- --------- ------------ ---------- ---------- --------- ----------

As at 1 January

2022 52,215 245,388 (45,078) (23,273) - - 229,253

---------------------- --------- --------- ------------ ---------- ---------- --------- ----------

Comprehensive

income

Loss for the period - - (927) - - - (927)

Other comprehensive

income

Cash flow hedges

- foreign forward

contracts - - - - (4,638) - (4,638)

Currency translation

differences - - - (9,789) - - (9,789)

---------------------- --------- --------- ------------ ---------- ---------- --------- ----------

Total comprehensive

loss - - (927) (9,789) (4,638) - (15,354)

---------------------- --------- --------- ------------ ---------- ---------- --------- ----------

Transactions with

owners

Issue of ordinary

shares 78 261 198 - - - 537

Total transactions

with owners 78 261 198 - - - 537

As at 30 June

2022 (amended note

2 and unaudited) 52,293 245,649 (45,807) (33,062) (4,638) - 214,436

---------------------- --------- --------- ------------ ---------- ---------- --------- ----------

Attributable to the owners of the parent

-------------------------------------------------------------------------------------------

Share Share Accumulated Other Cash flow Share options

capital premium losses reserves hedge reserve reserve Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------------- --------- --------- ------------ ---------- --------------- -------------- ----------

As at 1 January

2023 70,333 306,720 (50,188) (29,938) 1,088 1,416 299,430

----------------------- --------- --------- ------------ ---------- --------------- -------------- ----------

Comprehensive income

Loss for the period - - (2,807) - - - (2,807)

Other comprehensive

income

Cash flow hedges

- foreign forward

contracts - - - - 9,291 - 9,291

Currency translation

differences - - - 28,019 - - 28,019

----------------------- --------- --------- ------------ ---------- --------------- -------------- ----------

Total comprehensive

income / (loss) - - (2,807) 28,019 9,291 - 34,503

----------------------- --------- --------- ------------ ---------- --------------- -------------- ----------

Transactions with

owners

Issue of ordinary

shares 90 226 - - - - 316

Share options granted - - - - - 1,196 1,196

Total transactions

with owners 90 226 - - - 1,196 1,512

As at 30 June 2023

(unaudited) 70,423 306,946 (52,995) (1,919) 10,379 2,612 335,446

======================= ========= ========= ============ ========== =============== ============== ==========

Condensed Consolidated Statement of Cash Flows

6 months ended

30 June

---------------------------------------------------- ------ ------------------------------

2023 2022

Amended (Note 2)

---------------------------------------------------- ------ ---------- ------------------

Unaudited Unaudited

---------------------------------------------------- ------ ---------- ------------------

US$'000 US$'000

Cash flows from operating activities

Loss before taxation (2,807) (927)

Net finance costs 5 2,144 2,984

Share based payment 11 1,196 -

Exchange differences (10,987) (9,383)

Operating loss before changes in working capital (10,453) (7,326)

Decrease/(increase) in trade and other receivables (16,799) (3,057)

(Decrease)/increase in trade and other payables (80) (11,841)

---------------------------------------------------- ------ ---------- ------------------

Net cash outflow from operating activities (27,332) (22,224)

==================================================== ====== ========== ==================

Cash flows from investing activities

Purchase of intangible assets 6 (5,396) (639)

Purchase of property, plant and equipment 7 (140,178) (67,047)

Interest received 5 4,368 2,394

---------------------------------------------------- ------ ---------- ------------------

Net cash outflow from investing activities (141,205) (65,292)

---------------------------------------------------- ------ ---------- ------------------

Cash flows from financing activities

Net proceeds from issue of ordinary shares 10 317 537

Proceeds from issue of convertible loan notes 14 - 61,263

Issue costs 14 - (950)

Proceeds from royalty finance arrangement 13a - 25,000

Issue costs 13a - (848)

Proceeds from senior debt facility 16 135,000 -

Lease liability payments (222) -

Commitment fees payments (4,219) -

Loan facilities interest payments 15,16 (2,024) -

Net cash inflow from financing activities 128,852 85,001

---------------------------------------------------- ------ ---------- ------------------

Net decrease in cash and cash equivalents (39,685) (2,515)

Cash and cash equivalents at beginning of period 154,028 210,492

Exchange gain/(loss) on cash and cash equivalents 24,340 (9,021)

---------------------------------------------------- ------ ---------- ------------------

Cash and cash equivalents at end of the period 138,682 198,956

==================================================== ====== ========== ==================

Extract from the Notes to the Financial Statements*

*The notes below are only an extract from the Unaudited

Condensed Consolidated Interim Financial Statements as at 30 June

2023. For the full disclosure please refer to the interim results

published on our website

General information

The principal activity of the Company and its subsidiaries

(together 'the Group') is the exploration and development of base

metals. There is no seasonality or cyclicality of the Group's

operations.

The Company's shares are listed on the Alternative Investment

Market of the London Stock Exchange (AIM) and on the Toronto Stock

Exchange (TSX). The Company is incorporated and domiciled in the

United Kingdom. The address of its registered office is Rex House,

4-12 Regent Street, London SW1Y 4RG.

Basis of preparation

The financial statements for the year ended 31 December 2022

were prepared in accordance with UK adopted international

accounting standards. The financial statements were prepared under

the historical cost convention except for the following items

(refer to individual accounting policies for details):

-- Contingent consideration

-- Financial instruments - fair value through profit and loss

-- Cash settled share-based payment liabilities

-- Cash flow hedges at fair value through other comprehensive income (OCI)

The condensed consolidated interim financial statements for the

six-month reporting period ended 30 June 2023 have been prepared in

accordance the UK-adopted International Accounting Standard 34,

'Interim Financial Reporting'.

The interim report does not include all of the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2022, and any public announcements made by

the Group during the interim reporting period.

The financial information for the year ended 31 December 2022

contained in these interim financial statements does not constitute

the company's statutory accounts for that period. Statutory

accounts for the year ended 31 December 2022 have been delivered to

the Registrar of Companies. The auditors' report on those accounts

was unqualified and did not contain a statement under 498(2) or

498(3) of the Companies Act 2006. The auditor's report drew

attention to a material uncertainty related to the Group's ability

to continue as a going concern (refer to the going concern note

below), however the auditor's opinion was not modified in respect

of this matter.

The level of rounding was changed to only reflect the nearest

thousand for the financial period ended

30 June 2023. Immaterial rounding adjustments were made to the

comparative information as a result of

this change.

Amendment to prior period figures

These financial statements have been restated to include certain

amendments to the figures for the 6 months to 30 June 2022. The

amendments are driven by the revised embedded derivative valuations

included in the convertible loan notes and Vermelho royalty

financing arrangement at initial recognition. None of these

adjustments have a cash impact on the balance sheet.

The effect of these amendments on the statement of financial

position and statement of comprehensive are set out in the table

below:

Property, Derivative

plant and financial Convertible Accumulated

equipment asset Royalties loan notes losses

US$'000 US$'000 US$'000 US$'000 US$'000

30 June 2022 -

as previously stated 155,467 9,540 (82,838) (57,142) 41,032

---------------------- -------------------- ----------------- --------------- ---------------- --------------

Convertible loan

note - revised

embedded

derivative valuation 3 - - (5,026) 5,023

Vermelho royalty

- revised buy-back

option derivative

valuation - 5,258 (5,010) - (248)

30 June 2022 -

Amended 155,470 14,798 (87,848) (62,168) 45,807

---------------------- -------------------- ----------------- --------------- ---------------- --------------

Revised Revised

As previously convertible allocation

stated loan note of convertible Revised unwinding Amended

as at embedded loan notes of discount as at

30 June derivative transaction on Vermelho 30 June

2022 valuation costs royalty 2022

US'000 US'000 US'000 US'000 US'000

---------------------- -------------- --------------- ------------------- -------------------- ------------

Statement of

comprehensive

income

---------------------- -------------- --------------- ------------------- -------------------- ------------

Administrative

expenses (6,664) - (663) - (7,326)

Change in fair value

of derivatives 4,361 (4,361) - - -

Gain/(Loss) on

foreign

exchange 9,383 - - - 9,383

Profit/(Loss) before

interest and

taxation 7,080 (4,361) (663) - 2,057

---------------------- -------------- --------------- ------------------- -------------------- ------------

Net finance costs (3,232) - - 248 (2,984)

Profit/(Loss) before

taxation 3,848 (4,361) (663) 248 (927)

---------------------- -------------- --------------- ------------------- -------------------- ------------

Taxation - - - - -

Profit/(Loss) for

the year from

continuing

operations 3,848 (4,361) (663) 248 (927)

---------------------- -------------- --------------- ------------------- -------------------- ------------

Going concern

The condensed consolidated interim financial statements have

been prepared on a going concern basis. Although the Group's assets

are not generating revenues, the Directors have a reasonable

expectation that the Group has sufficient funds to undertake its

operating activities for the foreseeable future. The Group has cash

reserves and access to liquidity which are considered sufficient by

the Directors to fund the Group's committed expenditure both

operationally and on its exploration project for the foreseeable

future.

The Group continued to make good progress on the construction of

its Araguaia Project during the six-month period ended 30 June

2023. The first drawdown under the senior debt facility was

completed in December 2022 following the satisfaction of certain

conditions precedent customary to a financing of this nature.

Subsequent drawdowns under the senior debt facility followed during

the six month period and further drawdowns are expected during the

remainder of the construction period, again following the

satisfaction of certain conditions precedent customary to a

financing of this nature including but not limited to satisfaction

of a cost to complete exercise prior to each draw down on the

facility, satisfaction of minimum order values from certain

suppliers, maintaining the good standing of operational licences

and permitting, and financial models detailing the Group's budget

forecasting compliance with covenants and ratios. There is no

guarantee that these conditions will be met.

The funds held at the end of the six-month period and the

satisfaction of any condition's precedent for further drawdowns of

the senior debt facility (including access to any of the funds

secured as part of the cost overrun facility), are considered

sufficient by the Directors to fund its general working capital

requirements for the foreseeable future. However, there exists a

risk that the senior debt facility is not able to be drawn due to

unforeseen circumstances or noncompliance with any conditions

precedent which may or may not be within the control of the

Group.

As at 30 June 2023 approximately 65% of the Araguaia Project

construction has been completed, a total of US$329million has been

spent out of the budgeted capital requirement of US$537million. As

at the half year end, the Group had total liquidity and funding

sources of US$344million.

Additionally, despite being approximately 65% complete a number

of risks still exist around escalation costs linked to several of

the major construction packages (these include labour, materials

and productivity). This could result in future drawdowns on the

senior debt facility not being permitted and require the Group to

pursue alternative sources of funding to meet its commitments.

As the project moves into operational ramp-up phase there are a

number of risk areas around commissioning the RKEF process plant.

If any of these ramp-up risks exceed the pre-production funding

allocated to the unit areas there will be a requirement for

additional funding.

As a number of these factors are outside of the Group's control,

a material uncertainty exists which may cast significant doubt

about the Group's continued ability to operate as a going concern

and its ability to realise its assets and discharge its liabilities

in the normal course of business.

The financial statements do not include any adjustments that

would result if the Group were unable to continue as a going

concern.

Intangible assets

Intangible assets comprise exploration and evaluation costs and

goodwill. Exploration and evaluation costs comprise internally

generated and acquired assets.

Exploration

and

Exploration evaluation

Goodwill licences costs Software Total

US$'000 US$'000 US$'000 US$'000 US$'000

------------------------- --------- ------------ ---------------- -------- ----------

Cost

At 1 January 2022 201 6,455 1,563 90 8,309

Additions - - 4,256 94 4,350

Amortisation for the

year - - - (31) (31)

Exchange rate movements 14 649 (88) 6 581

Net book amount at

31 December 2022 215 7,104 5,731 159 13,209

------------------------- --------- ------------ ---------------- -------- ----------

Transfers - - (10) 56 46

Additions - - 5,380 16 5,396

Amortisation for the

year - - - (25) (25)

Exchange rate movements 18 587 471 12 1,088

Net book amount at

30 June 2023 233 7,691 11,572 218 19,714

========================= ========= ============ ================ ======== ==========

Exploration and evaluation assets

The exploration licences and exploration and evaluation costs

relate to the Vermelho project. No indicators of impairment were

identified during the period for the Vermelho project.

Vermelho

In January 2018, the acquisition of the Vermelho project was

completed, which resulted in a deferred consideration of $1,850,000

being recognised and accordingly the amount was capitalised to the

exploration licences held within intangible assets shown above.

On 17 October 2020 the Group published the results of a

Pre-Feasibility Study on the Vermelho Nickel Cobalt Project, which

confirms Vermelho as a large, high-grade resource, with a long mine

life and low-cost source of nickel cobalt for the battery

industry.

The economic and technical results from the study supports

further development of the project towards a full Feasibility Study

and included the following:

-- A 38-year mine life estimated to generate total cash flows after taxation of US$7.3billion;

-- An estimated Base Case post-tax Net Present Value1 ('NPV') of

US$1.7 billion and Internal Rate of Return ('IRR') of 26%;

-- At full production capacity the Project is expected to

produce an average of 25,000 tonnes of nickel and 1,250 tonnes of

cobalt per annum utilising the High-Pressure Acid Leach

process;

-- The base case PFS economics assume a flat nickel price of

US$16,400 per tonne ('/t') for the 38-year mine life;

-- C1 (Brook Hunt) cash cost of US$8,020/t Ni (US$3.64/lb Ni),

defines Vermelho as a low-cost producer; and

-- Initial Capital Cost estimate is US$652 million (AACE class 4).

Nothing has materially deteriorated with the economics of the

PFS between the publication date and the date of this report and

the Directors undertook an assessment of impairment through

evaluating the results of the PFS along with recent market

information relating to capital markets and nickel prices and

judged that there are no impairment indicators with regards to the

Vermelho Project. Nickel prices remain higher than they were at the

time of the publication of the PFS and overall sentiment towards

battery metals and supply materials have grown more positive over

the period.

Property, plant and equipment

Mine Development Vehicles Office Land acquisition Buildings Total

Property and other equipment improvement

field

equipment

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

Cost

At 1 January 2022 59,418 858 141 10,310 - 70,727

Additions 184,319 - 167 2,607 38 187,131

Environmental rehabilitation

additions 635 - - - - 635

Transfers 781 (813) 32 - - -

Capitalised interest 13,176 - - - - 13,176

Disposals - - (3) - - (3)

Exchange rate movements 5,637 60 9 722 - 6,428

At 31 December 2022 263,966 104 348 13,639 38 278,094

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

Additions 143,093 - 78 24 - 143,195

Environmental rehabilitation

additions 436 - - - - 436

Transfers (178) 24 105 - 6 (43)

Capitalised interest 5,451 - - - - 5,451

Disposals - - (4) - - (4)

Exchange rate movements 21,827 9 29 1,128 3 22,996

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

At 30 June 2023 434,595 137 555 14,791 47 450,125

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

Accumulated depreciation

At 1 January 2022 - 81 52 - - 133

Charge for the year - 7 42 - 1 50

Transfer - (1) 1 - - -

Disposals - - - - - -

Exchange rate movements - 5 4 - - 9

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

At 31 December 2022 - 92 99 - 1 192

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

Charge for the period - 2 35 - 1 38

Transfers - - - - - -

Disposals - - - - - -

Exchange rate movements - 8 7 - - 15

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

At 30 June 2023 - 102 141 - 2 245

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

-

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

Net book amount as

at 30 June 2023 434,595 35 415 14,791 44 449,880

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

Net book amount as

at 31 December 2022 263,965 12 249 13,639 37 277,902

----------------------------- ----------------- ----------- ----------- ----------------- ------------- --------

In December 2018, a Canadian NI 43-101 compliant Feasibility

Study (FS) was published by the Company regarding the enlarged

Araguaia Project which included the Vale dos Sonhos deposit

acquired from Glencore. The financial results and conclusions of

the FS clearly indicate the economic viability of the Araguaia

Project with an NPV of $401M using a nickel price of $14,000/t Ni.

Nothing material has changed with the economics of the FS between

the publication date and the date of this report and the Directors

undertook an assessment of impairment through evaluating the

results of the FS along with recent market information relating to

capital markets and nickel prices and judged that there are no

impairment indicators with regards to the Araguaia Project.

Impairment assessments for exploration and evaluation assets are

carried out either on a project-by-project basis or by geographical

area.

The adjacent Araguaia/Lontra/Vila Oito and Floresta exploration

sites (the Araguaia Project), together with the Vale dos Sonhos

deposit acquired from Xstrata Brasil Mineração Ltda comprise a

resource of a sufficient size and scale to allow the Company to

create a significant single nickel project. For this reason, at the

current stage of development, these two projects are viewed and

assessed for impairment by management as a single cash generating

unit.

The mineral concession for the Vale dos Sonhos deposit was

acquired from Xstrata Brasil Mineração Ltda, a subsidiary of

Glencore Canada Corporation, in November 2015.

The NPV has been determined by reference to the FS undertaken on

the Araguaia Project. The key inputs and assumptions in deriving

the value in use were, the discount rate of 8%, which is based upon

an estimate of the risk adjusted cost of capital for the

jurisdiction, capital costs of $443 million, operating costs of

$8,194/t Nickel, a Nickel price of US$14,000/t and a life of mine

of 28 years.

Cash and cash equivalents

30 June 31 December

2023 2022

US$'000 US$'000

Cash at bank and

on hand 112,670 122,376

Short-term deposits 26,012 31,652

--------- ------------

138,682 154,028

--------- ------------

Access is restricted to cash and cash equivalents of US$29.8

million. These funds have been secured in the case of a cost

overrun against the construction schedule and budget of the

Araguaia Project. Refer to 'Cost overrun facility' note for more

details.

Royalty Financing liability

a.1) Araguaia royalty financing liability

On 29 August 2019 the Group entered into a royalty funding

arrangement with Orion Mine Finance ("OMF") securing a gross

upfront payment of $25,000,000 before fees in exchange for a

royalty, the rate being in a range from 2.25% to 3.00% and

determined by the date of funding and commencement of major

construction. The rate has been confirmed to be 2.95%. The royalty

is paid over the first 426k tonnes of nickel produced from the

Araguaia Ferronickel project. The royalty is linked to production

and therefore does not become payable until the project is

constructed and commences commercial production; more detail is

contained within the audited financial statements for the year

ended 31 December 2022. The agreement contains certain embedded

derivatives which as per IFRS9 have been separately valued and

included in the fair value of the financial instrument in note

13b).

The Royalty liability has initially been recognised using the

amortised cost basis with an effective interest rate of 14.5%. When

circumstances arise that lead to payments due under the agreement

being revised, the group adjusts the carrying amount of the

financial liability to reflect the revised estimated cash flows.

This is achieved by recalculating the present value of estimated

cash flows using the original effective interest rate of 14.5%. Any

adjustment to the carrying value is recognised in the income

statement.

The carrying value of the royalty reflects assumptions on

expected long term nickel price, update headline royalty rate as

well as the timing of payments related to expected date of

commencement of production and hence payment to be made under the

royalty agreement.

The assumption influencing the increase in the carrying value of

the royalty since year end is the long-term nickel price which has

increased from $18,721 t/Ni to $19,193 t/Ni. The royalty rate is

2.95%.

Management have sensitised the carrying value of the royalty

liability for a $1,000/t Ni increase/decrease in future nickel

price the carrying value would change by US$2,831,299.

a.2) Vermelho royalty financing liability

On 23 November 2021 the Group entered into a royalty funding

arrangement with Orion Mine Finance ("OMF") securing a gross

upfront payment of $25,000,000 before fees in exchange for a

royalty, at a rate of 2.1%. The royalty rate will increase to 2.25%

if substantial construction of the Vermelho Project has not

commenced within 5 years of the closing date, 30 March 2022. The

royalty will be paid over the life of mine of Vermelho. The Royalty

agreement has certain provisions to revise the headline royalty

rate should there be change in the mine schedule and production

profile prior to construction or if the resource covered in the

Vermelho Feasibility Study is depleted. The royalty is linked to

production and therefore does not become payable until the project

is constructed and commences commercial production; more detail is

contained within the audited financial statements for the year

ended 31 December 2022. The agreement contains certain embedded

derivatives which as per IFRS9 have been separately valued and

included in the fair value of the financial instrument in note

13b). The royalty funds were received on 30 March 2022.

The Royalty liability has initially been recognised using the

amortised cost basis with an effective interest rate of 17.66%.

When circumstances arise that lead to payments due under the

agreement being revised, the group adjusts the carrying amount of

the financial liability to reflect the revised estimated cash

flows. This is achieved by recalculating the present value of

estimated cash flows using the original effective interest rate of

17.66%. Any adjustment to the carrying value is recognised in the

income statement.

The carrying value of the royalty reflects assumptions on

expected long term nickel and cobalt prices, headline royalty rate

as well as the timing of payments related to expected date of

commencement of production and hence payment to be made under the

royalty agreement.

The assumptions influencing the increase in the carrying value

of the royalty since year end is the movement in the long-term

commodity prices - nickel price from US$18,721 t/Ni to US$19,193

t/Ni and the cobalt price from US$56,950 t/Co to US$53,846. The

royalty rate has remained at 2.1%.

Management have sensitised the carrying value of the royalty

liability by a change in the royalty rate to 2.25% and it would be

US$3,129,101 higher and for a $1,000/t Ni increase/decrease in

future nickel price and future cobalt price the carrying value

would change by US$2,090,138.

Araguaia Vermelho Total

Royalty valuation Royalty valuation

US$'000 US$'000 US$'000

-------------------------------- ------------------- ------------------- --------

Net book amount at 1 January

2022 44,496 - 44,496

Initial recognition - 25,000 25,000

Embedded derivative - initial

valuation - 9,848 9,848

Transaction costs - (848) (848)

Unwinding of discount 5,351 4,449 9,800

Change in carrying value (1,064) 2,513 1,449

Net book amount at 31 December

2022 48,783 40,962 89,745

--------------------------------- ------------------- ------------------- --------

Unwinding of discount 2,952 3,404 6,356

Change in carrying value 1,119 (559) 560

Net book amount at 30 June

2023 52,854 43,807 96,661

--------------------------------- ------------------- ------------------- --------

Derivative financial assets

b.1) Araguaia derivative financial assets

The aforementioned Araguaia royalty agreement includes several

options embedded within the agreement as follows:

-- If there is a change of control of the Group and the start of

major construction works (as defined by the expenditure of in

excess of $30m above the expenditure envisaged by the royalty

funding) is delayed beyond a certain pre agreed timeframe the

following options exist:

o Call Option - which grants Horizonte the option to buy back

between 50 - 100% of the royalty at a valuation that meets certain

minimum economic returns for OMF;

o Make Whole Option - which grants Horizonte the option to make

payment as if the project had started commercial production and the

royalty payment were due; and

o Put Option - should Horizonte not elect for either of the

above options, this put option grants OMF the right to sell between

50 - 100% of the Royalty back to Horizonte at a valuation that

meets certain minimum economic returns for OMF.

-- Buy Back Option - At any time from the date of commercial

production, provided that neither the Call Option, Make Whole

Option or the Put Option have been actioned, Horizonte has the

right to buy back up to 50% of the Royalty at a valuation that

meets certain minimum economic returns for OMF.

The directors have undertaken a review of the fair value of all

of the embedded derivatives and are of the opinion that the Call

Option, Make Whole Option and Put Option currently have immaterial

values as the probability of both a change of control and project

delay are currently considered to be remote. There is considered to

be a higher probability that the Group could in the future exercise

the Buy Back Option and therefore has undertaken a fair value

exercise on this option.

The initial recognition of the Buy Back Option has been

recognised as an asset on the balance sheet with any changes to the

fair value of the derivative recognised in the income statement. It

has been fair valued using a Monte Carlo simulation which runs a

high number of scenarios in order to derive an estimated valuation.

The Monte Carlo simulation was last performed at the 31 December

2022 year end. The Monte Carlo simulation is performed annually at

the year-end date. The assumptions driving the buy-back option

valuation were assessed as at 30 June 2023 and it was concluded

that the change in the valuation would not be material.

The assumptions for the valuation of the Buy Back Option (per

the Monte Carlo simulation) are the future nickel price of

(US$18,721/t Ni), the start date of commercial production (March

2024), the prevailing royalty rate (2.95%), the inflation rate

(2.22%) and volatility of nickel prices (39.7%).

Sensitivity analysis

The valuation of the Buyback option is most sensitive to future

nickel price estimates and nickel price volatility.

A 15% adjustment to the estimated future nickel price would

result in a variance between US$2.7 million and US$3 million in the

valuation.

b.2) Vermelho derivative financial assets

Horizonte has the right to buy back 50% of the royalty on the

first four anniversaries of closing (or on any direct or indirect

change of control in respect of Vermelho up until the fourth

anniversary of closing).

After the 4th anniversary, Horizonte has the right to buy back

50% of the royalty on any direct or indirect change of control in

respect of Vermelho at a valuation that meets certain minimum

economic returns for OMF.

The initial recognition of the Buy Back Option has been

recognised as an asset on the balance sheet with any changes to the

fair value of the derivative recognised in the income statement. It

has been fair valued using a Monte Carlo simulation which runs a

high number of scenarios in order to derive an estimated valuation.

The Monte Carlo simulation was last performed at the 31 December

2022 year end. The Monte Carlo simulation is performed annually at

the year-end date. The assumptions driving the buy-back option

valuation were assessed as at 30 June 2023 and it was concluded

that the change in the valuation would not be material.

The assumptions for the valuation of the Buy Back Option (per

the Monte Carlo simulation) are the future nickel price

(US$18,721/t Ni), the future cobalt price (US$56,950/t Co), the

production profile from 2027 to 2065, the expected royalty rate

(2.1%), the inflation rate (2,22%), volatility of nickel prices

(22.1%) and volatility of cobalt prices (28.0%).

Sensitivity analysis

The valuation of the Buyback option is sensitive to estimates

for nickel and cobalt prices and their respective volatilities.

A 15% adjustment to the estimated future nickel and cobalt

prices would result in a variance of US$3.7 million in the

valuation.

Refer to the table below for the summary of the derivative

financial asset's valuation:

Araguaia Royalty Vermelho Royalty Total

US$'000 US$'000 US$'000

----------------------------- ---------------- ---------------- -------

Value as at 1 January 2022 4,950 - 4,950

Initial recognition - 9,848 9,848

Change in fair value 57 (366) (309)

------------------------------ ---------------- ---------------- -------

Value as at 31 December 2022 5,007 9,482 14,489

------------------------------ ---------------- ---------------- -------

Value as at 30 June 2023 5,007 9,482 14,489

------------------------------ ---------------- ---------------- -------

Convertible loan notes

On 29 March 2022 the Company issued convertible loan notes to

the value of $65 million at an interest rate of 11.75% with

interest accruing quarterly in arrears. The convertible loan notes

were issued at a discount of 5.75%. The maturity date of the

instruments is 15 October 2032.

The convertible loan notes are unsecured and the noteholders

will be repaid as follows:

-- Interest shall be capitalised until the Araguaia Project

Completion date, estimated to be 31 December 2025 (subject to

various technical operating tests being passed)

-- After Project Completion Date, interest shall be paid

quarterly only if there is available cash (after the company meets

its senior debt and other senior obligations)

-- After Project Completion Date, principal repayments

(including accrued capitalized interest) shall be paid quarterly

subject to available cash for distribution. In addition, a cash

sweep of 85% of excess cash will apply on each interest payment

date

-- Any amount outstanding on the CLN on the maturity date 15

October 2032, Horizonte is obliged to settle in full on the

maturity date.

At any time until the Maturity Date, the Noteholder may, at its

option, convert the notes, partially or wholly, into a number of

ordinary shares up to the total amount outstanding under the

Convertible Note divided by the Conversion Price. The Conversion

Price is 125% of the Subscription Price of 1.40 pence, converted to

US$ at a rate of 1.3493. The Conversion Price is therefore US$1.89.

The Conversion Price was revised to GBP1.268/US$1.71 after the

completed equity fundraise on 8 November 2022.

The convertible loan is a hybrid financial instrument, whereby a

debt host liability component and an embedded derivative liability

component was determined at initial recognition. The conversion

option did not satisfy the fixed for fixed equity criterion (fixed

number of shares and fixed amount of functional currency cash) as

the currency of the convertible loan notes is US Dollar and the

functional currency of Horizonte Minerals Plc and its share price

is GBP.

For convertible notes with embedded derivative liabilities, the

fair value of the embedded derivative liability is determined first

and the residual amount is assigned to the debt host liability.

The initial recognition of the embedded derivative conversion

feature has been recognised as a liability on the balance sheet

with any changes to the fair value of the derivative recognised in

the income statement. It has been fair valued using a Monte Carlo

simulation which runs a high number of scenarios in order to derive

an estimated valuation. The Monte Carlo simulation was last

performed at the 31 December 2022 year end. The Monte Carlo

simulation is performed annually at the year-end date. The

assumptions driving the buy-back option valuation were assessed as

at 30 June 2023 and it was concluded that the change in the

valuation would not be material.

The assumptions for the valuation of the conversion feature (per

the Monte Carlo simulation), at the year-end date 31 December 2022,

are the Horizonte Minerals Plc future share price volatility

(42.9%), GBP:USD exchange rate volatility (10%) on the conversion

price.

The debt host liability will be accounted for using the

amortised cost basis with an effective interest rate of 19%. The

effective interest rate is recalculated after adjusting for the

transaction costs. The Group will recognise the unwinding of the

discount at the effective interest rate, until the maturity date,

the carrying amount at the maturity date will equal the cash

payment required to be made.

The directly attributable transaction costs were allocated

proportionately to the embedded derivative and the convertible loan

notes liability. The embedded derivative transaction costs were

recognised in profit and loss, whereas the convertible loan

liability transaction costs were deducted from the financial

liability carrying amount.

After the fifth anniversary of the closing date, Horizonte shall

have a one-time right to redeem the Convertible Notes, in whole, at

105% of the par value plus accrued and unpaid interest in cash

if:

1. The thirty-business day VWAP of Horizonte shares exceeds 200%

of the Conversion Price and the average daily liquidity of the

Company's shares (across all relevant exchanges) exceeds US$2.5

million per trading day over the prior 30 trading days; or

2. There is a change of control.

Management have assessed the likelihood of the above events

occurring is highly improbable and thus the value of the redemption

right is immaterial and was thus not considered in the valuation of

the instrument.

Sensitivity analysis - Conversion feature derivative

The valuation of the conversion feature derivative is sensitive

to the Company's equity price and share price volatility. A 15%

adjustment on the Company's equity price results in a variance of

between US$7.6million and US$8.3million in the valuation. A 30%

adjustment on the equity volatility results in a variance of

US$4.9million.

Refer to the table below for the summary of the convertible loan

notes valuation:

Embedded derivative Convertible loan notes liability Total

US$'000 US$'000 US$'000

---------------------------------------------- ------------------- -------------------------------- -------

Initial recognition (after discount on issue) 36,458 24,804 61,262

Transaction costs - (950) (950)

Unwinding of discount - 5,957 5,957

Change in fair value (6,821) - (6,821)

----------------------------------------------- ------------------- -------------------------------- -------

Value as at 31 December 2022 29,637 29,811 59,448

----------------------------------------------- ------------------- -------------------------------- -------

Unwinding of discount - 4,675 4,675

Value as at 30 June 2023 29,637 34,486 64,123

----------------------------------------------- ------------------- -------------------------------- -------

Cost overrun facility

On 30 November 2022, the Group satisfied all conditions

precedent in relation to the cost overrun facility (COF) and had

received all COF funds from Orion. The COF benefits from the same

security package as the senior debt facility but will be

subordinated to the senior debt facility. Access to the COF funds

is restricted and will only be available in the case of a cost

overrun against the Araguaia Project construction schedule and

budget, subject to certain conditions including:

1. 90% of the funding from the Equity Fundraise and Convertible

loan notes have been invested in the construction of the Araguaia

Project

2. A gearing ratio of 70:30 being met

The COF is US$25million with an interest rate of 13% and a

maturity date of 15 October 2032. Interest will be calculated

quarterly and be payable in arrears at the end of each interest

period - March 31, June 30, September 30 and December 31. The first

interest period was 30 November to 31 December 2022. The initial

principal repayment date is 31 March 2025. 3.23% of the outstanding

principal amount will be paid at each quarter end date starting

from 31 March 2025.

The COF will be accounted for using the amortised cost basis

with an effective interest rate of 15%. The effective interest rate

is recalculated after adjusting for the transaction costs. The

Group will recognise the unwinding of the discount at the effective

interest rate, until the maturity date, the carrying amount at the

maturity date will equal the cash payment required to be made.

Total

US$'000

----------------------------- -------

Initial recognition 25,000

Transaction costs (1,198)

Unwinding of discount 288

Interest repayments (280)

-------------------------------- -------

Value as at 31 December 2022 23,810

-------------------------------- -------

Unwinding of discount 1,705

Interest repayments (1,643)

Value as at 30 June 2023 23,872

-------------------------------- -------

Senior debt facility

On 15 March 2022 the Group entered into legally binding

documentation including a comprehensive intercreditor agreement and

loan agreements with two export credit agencies in relation to its

senior secured project finance debt facility of US$346.2 million.

The senior debt facility was executed between Araguaia Niquel

Metais LTDA, and a syndicate of international financial

institutions, being BNP Paribas, BNP Paribas Fortis, ING Capital

LLC, ING Bank N.V., Natixis, New York Branch, Société Générale and

SEK (Swedish Export Credit Corporation).

The senior debt facility includes the following:

-- Commercial senior facility of US$200,000,000 provided by the Senior Lenders;

-- ECA facility of US$74,562,000 guaranteed by EKF (Denmark's Export Credit Agency);

-- ECA facility of US$71,638,000 guaranteed by Finnvera plc (Finland's Export Credit Agency);

On 7 December 2022, the Group satisfied all conditions precedent

for the first utilisation under the senior debt facility of

US$346.2 million.

The interest rate on the ECA facility is calculated according to

this formula: Margin + Term SOFR (Secured Overnight Financing Rate)

+ Baseline Credit Adjustment Spread (CAS). The ECA Facility margin

is 1.8%. The Term SOFR at 30 June 2023 was 5.24187% and the

Baseline CAS 0.261610%. The ECA facility interest rate was

therefore 7.30348% at 30 June 2023.

The interest rate on the Commercial facility is calculated

according to this formula: Margin + Term SOFR (Secured Overnight

Financing Rate) + Baseline Credit Adjustment Spread (CAS). The

Commercial Facility margin is 4.75%. The Term SOFR at 30 June 2023

was 5.24187% and the Baseline CAS 0.261610%. The Commercial

facility interest rate was therefore 10.25348% at 30 June 2023.

Interest is calculated quarterly and payable in arrears at the

end of each interest period - March 31, June 30, September 30 and

December 31. The initial principal repayment date is 31 March 2025.

The outstanding principal amount will be paid according to the

repayment schedule at each quarter end date starting from 31 March

2025.

The final maturity date on the Commercial Facility is 15 July

2030. The final maturity date on the ECA Facility is 15 July

2032.

The ECA and Commercial Facilities will be accounted for using

the amortised cost basis with effective interest rates of 12.25%

and 11.57% respectively. The effective interest rate is

recalculated after adjusting for the transaction costs. The Group

will recognise the unwinding of the discount at the effective

interest rate, until the maturity date, the carrying amount at the

maturity date will equal the cash payment required to be made.

The Senior Debt Facility is secured via a comprehensive security

package which includes:

-- Pledge of shares in the Araguaia Níquel Metais Ltda. (the "Borrower");

-- Pledge of shares of the guarantors (other than Horizonte Minerals plc);

-- First ranking security over all of the Araguaia Project's

assets (including its mineral rights);

-- Assignment of insurance policies;

-- Assignment of material project contracts (including rights under hedge agreements);

-- Charge over certain bank accounts of the Borrower (including

the debt service bank account, the cost overrun account and the

insurance proceeds account); and

-- Assignment of credit related to intercompany loans (by the

Group borrowing entity) and subordination of the debt related to

inter-company loans (by the Group lending entity).

ECA Facility Commercial Facility Total

US$'000 US$'000 US$'000

----------------------------- ------------ ------------------- --------

Initial recognition 2,111 2,889 5,000

Transaction costs (446) (232) (678)

Unwinding of discount 12 19 31

Interest repayments (8) (17) (25)

------------------------------ ------------ ------------------- --------

Value as at 31 December 2022 1,669 2,659 4,328

------------------------------ ------------ ------------------- --------

Loan drawdowns 57,010 77,990 135,000

Transaction costs (11,830) (5,464) (17,294)

Unwinding of discount 1,155 1,807 2,962

Interest repayments (872) (1,703) (2,575)

Change in carrying value 3,021 2,875 5,896

Value as at 30 June 2023 50,153 78,164 128,317

------------------------------ ------------ ------------------- --------

As at 30 June 2023 the drawn vs undrawn balance on the senior

debt facility was as follows:

Drawn Undrawn Total

US$'000 US$'000 US$'000

------------- ------- ------- -------

Commercial 80,879 119,121 200,000

EKF ECA 30,151 44,409 74,560

Finnvera ECA 28,970 42,670 71,640

-------------- ------- ------- -------

140,000 206,200 346,200

------------- ------- ------- -------

Note to statement of cash flows

Below is a reconciliation of borrowings from financial

transactions:

Senior Cost Overrun Convertible Royalty Derivative

Debt Facility Facility Loan Notes Financing asset

Liability Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

============================= =============== ============= ============ =========== =========== =========

Total non-current borrowings

31 December 2021 - - - 44,496 (4,950) 39,546

=============== ============= ============ =========== =========== =========

Cash flow adjustments:

=============== ============= ============ =========== =========== =========

Initial recognition 5,000 25,000 61,262 25,000 - 116,262

=============== ============= ============ =========== =========== =========

Transaction costs (678) (1,198) (950) (848) - (3,674)

=============== ============= ============ =========== =========== =========

Interest payments (25) (280) - - - (305)

=============== ============= ============ =========== =========== =========

Non cash flow adjustments:

=============== ============= ============ =========== =========== =========

Embedded derivative

- initial valuation - - - 9,848 (9,848) -

=============== ============= ============ =========== =========== =========

Unwinding of discount 32 288 5,957 9,799 - 16,076

=============== ============= ============ =========== =========== =========

Change in carrying value

/fair value - - (6,821) 1,449 309 (5,063)

=============== ============= ============ =========== =========== =========

Total non-current borrowings

31 December 2022 4,328 23,810 59,448 89,745 (14,489) 162,841

=============== ============= ============ =========== =========== =========

Cash flow adjustments:

=============== ============= ============ =========== =========== =========

Loan drawdowns 135,000 - - - - 135,000

=============== ============= ============ =========== =========== =========

Transaction costs (17,294) - - - - (17,294)

=============== ============= ============ =========== =========== =========

Interest payments (2,575) (1,643) - - - (4,218)

=============== ============= ============ =========== =========== =========

Non cash flow adjustments:

=============== ============= ============ =========== =========== =========

Unwinding of discount 2,962 1,705 4,675 6,356 - 15,698

=============== ============= ============ =========== =========== =========

Change in carrying value 5,896 - - 560 - 6,456

=============== ============= ============ =========== =========== =========

Total non-current borrowings

30 June 2023 128,317 23,872 64,123 96,661 (14,489) 298,484

============================= =============== ============= ============ =========== =========== =========

Events after the reporting period

The Company awarded new share options on 13 July 2023 (the

"Award Date") over 2,435,035 ordinary shares of GBP0.20 each in the

capital of the Company to executives (PDMRs) and key personnel in

the UK and Brazil under the Company's unapproved (or 'non

tax-advantaged') 2006 Share Options Scheme (the "Awards"). Each

Award is exercisable in return for one ordinary share in the

Company and will vest in three tranches on the 6-month, 12-month

and 18-month anniversaries of the Award Date (with additional 12

months vesting period for certain employees) at a ratio of 1/3 each

tranche, with exercise price of GBP1.70 per ordinary share. The

exercise price of GBP1.70 represents a premium of 10.4% to the

closing price on 12 July 2023 of GBP1.54.

On 28 July 2023 the Group issued 700,000 ordinary shares at a

price of 79.64 pence following the exercise of options by option

holders.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFITTRIRLIV

(END) Dow Jones Newswires

August 17, 2023 02:00 ET (06:00 GMT)

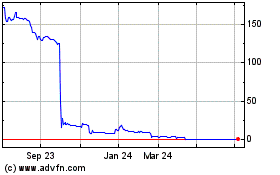

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Dec 2024 to Jan 2025

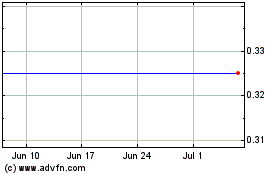

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Jan 2024 to Jan 2025