Horizonte Minerals PLC Update on Araguaia Nickel Project Construction (2643O)

October 02 2023 - 1:00AM

UK Regulatory

TIDMHZM

RNS Number : 2643O

Horizonte Minerals PLC

02 October 2023

NEWS RELEASE

2 October 2023

HORIZONTE MINERALS PROVIDES UPDATE ON ITS ARAGUAIA NICKEL

PROJECT CONSTRUCTION

Horizonte Minerals Plc (AIM/TSX: HZM) ("Horizonte" or the

"Company"), the nickel company developing two Tier 1 assets in

Brazil, announces today that it has made good progress in

completing the final detailed engineering and construction design

for Line 1 of its 100%-owned Araguaia Nickel Project ("Araguaia" or

"the Project"). This work, along with a comprehensive cost review,

has resulted in changes to the design and execution scope, which

are expected to increase the overall capital expenditure

requirement by at least 35% (of current capex budget) and delay

first production to Q3-2024.

Given the progress made to date with construction, the value of

the Araguaia Line 1 Project and the upcoming delivery of the

Feasibility Study on Araguaia Line 2, the Company continues to have

strong support from its major partners. The Company is working on a

plan with its various financial institutions together with the

cornerstone shareholders for a financing solution to complete

construction.

Construction work on site continues to progress well with all

key engineering drawings issued for construction. Ore stockpiling

activities commenced last quarter, and ROM build-up is progressing

to schedule. The rotary dryer is now in place, with all shells

aligned for final welding. Construction of the 126km, 230kV

transmission line is well advanced, with all pylons erected and

118km of conductor cable installed. Construction of the water

storage reservoir is also well advanced, with the initial sections

of the water abstraction pipeline positioned and foundations poured

for the river abstraction pump station.

To de-risk the operation, the final detailed engineering work

has added additional scope items linked to the major equipment

packages, made several enhanced design changes from the original

engineering study (including changes to the water abstraction

pipeline design and water storage reservoir), and has identified

the requirement for additional civil works and quantities.

Additionally, changes have been required with selected suppliers

who have not been able to deliver to the project timeframe, which

has added further cost pressures.

Accordingly, the Company engaged Reta Engenharia to undertake an

independent review of the remaining capital expenditure and

schedule, incorporating the change in scope, material and quantity

variations, increased project duration to first metal and

associated costs, and additional working capital requirements. The

Company has also undertaken a detailed review of the ramp up and

operational costs. The Company expects to publish an update by mid

Q4-2023 once this review is complete.

The results from the Feasibility Study on Araguaia Line 2 remain

on track to be published in Q4-2023. The combined production of

Araguaia Line 1 and 2 is expected to be 29,000 tonnes per

annum.

Jeremy Martin, CEO of Horizonte, commented:

"We continue to make solid progress with construction at

Araguaia Line 1 and are confident that the Project is now

significantly de-risked given the near-finalization of detailed

engineering and procurement, together with the detailed review of

the costs to project completion, ensuring successful delivery.

Despite the anticipated higher capital requirement, Araguaia

remains a Tier 1 asset that will deliver strong margins over its

28-year mine life once production commences next year. Moreover,

the imminent completion of the Feasibility Study on Line 2 will

demonstrate Araguaia's capacity to support an annual production of

29,000 tonnes per annum.

We appreciate the strong support provided by both local

stakeholders and cornerstone shareholders, as we work towards a

financing solution to complete construction."

Further updates will be provided in due course. This

announcement contains inside information for the purposes of

Article 7 of EU Regulation 596/2014, as retained in the UK pursuant

to the European Union (Withdrawal) Act 2018.

For further information, visit www.horizonteminerals.com or

contact:

Horizonte Minerals plc info@horizonteminerals.com

Jeremy Martin (CEO) +44 (0) 203 356 2901

Simon Retter (CFO)

Patrick Chambers (Head of IR)

Peel Hunt LLP (Nominated Adviser

& Joint Broker)

Ross Allister

Bhavesh Patel +44 (0)20 7418 8900

---------------------------

BMO (Joint Broker)

Thomas Rider

Pascal Lussier Duquette

Andrew Cameron +44 (0) 20 7236 1010

---------------------------

Barclays (Joint Broker)

Philip Lindop

Richard Bassingthwaighte +44 (0)20 7623 2323

---------------------------

Tavistock (Financial PR)

Jos Simson

Cath Drummond +44 (0) 20 7920 3150

---------------------------

ABOUT HORIZONTE MINERALS

Horizonte Minerals Plc (AIM/TSX: HZM) is developing two

100%-owned, Tier 1 projects in Pará state, Brazil - the Araguaia

Nickel Project and the Vermelho Nickel-Cobalt Project. Both

projects are high-grade, low-cost, with low carbon emission

intensities and are scalable . Araguaia is under construction and

when fully ramped up with Line 1 and Line 2, is forecast to produce

29,000 tonnes of nickel per year. Vermelho is at feasibility study

stage and is expected to produce 24,000 tonnes of nickel and 1,250

tonnes of cobalt to supply the EV battery market. Horizonte's

combined production profile of over 60,000 tonnes of nickel per

year positions the Company as a globally significant nickel

producer. Horizonte's top three shareholders are La Mancha

Investments S.à r.l., Glencore Plc and Orion Resource Partners

LLP.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFLTIDLLIIV

(END) Dow Jones Newswires

October 02, 2023 02:00 ET (06:00 GMT)

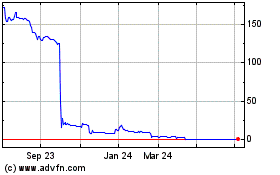

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Jan 2024 to Jan 2025