TIDMHZM

RNS Number : 6732U

Horizonte Minerals PLC

27 November 2023

NEWS RELEASE

27 November 2023

BOARD AND MANAGEMENT CHANGES

Horizonte Minerals Plc (AIM/TSX: HZM) ("Horizonte" or the

"Company") the nickel development company, announces the following

changes to its board of directors (the "Board") and senior

leadership team. These changes have been made as the Company

advances discussions for a financing solution for its flagship

Araguaia Nickel Project ("Araguaia" or "the Project") and the

completion of construction of the Project.

Jeremy Martin, Co-Founder and Chief Executive Officer of the

Company ("CEO") will step down as CEO and as a member of the

Company's Board alongside Simon Retter, Chief Financial Officer of

the Company who will step down as CFO and as a member of the

Company's Board. In addition, in accordance with best practice

corporate governance William Fisher, Non-Executive Interim Chair

and Owen Bavinton, Non-Executive Director, will step down from the

Company's Board having served as directors since 2011 and 2012

respectively. These director and officer changes are effective

today with all departing directors and officers agreeing to assist

the Board with an orderly handover.

Jeremy is a founding director of Horizonte and has led the

business as CEO since 2010. Under his leadership, Horizonte

discovered, acquired and consolidated its interests in the

Company's two tier-one nickel assets in Brazil. Jeremy oversaw the

development of these assets and took Araguaia from a greenfield

project through the feasibility stage and onto construction. The

Board is appreciative of his significant contribution to the

Company.

New Management and Board Appointments

The Company is pleased to announce the following proposed

appointments (subject to receipt of the usual director

certifications where applicable in accordance with the AIM Rules)

with further proposed Board directors expected to be announced in

the coming weeks.

Appointment of interim Chief Executive Officer:

The Board is pleased to announce the appointment of Karim Nasr

as interim CEO and his proposed appointment as a Board director.

Mr. Nasr will lead the financing and restructuring process and will

work with the Board to appoint a new senior leadership team.

Mr. Nasr is Managing Partner and Co-Chief Investment Officer of

La Mancha Resource Capital LLP ("La Mancha"), which advises La

Mancha Resource Fund SCSp, one of the Company's major shareholders.

Mr. Nasr has over 25 years of experience in corporate finance and

investments, including experience of restructurings in Brazil. Mr.

Nasr will step down from his day-to-day executive role within La

Mancha to devote himself to Horizonte and put in place a financing

plan to restart construction.

Proposed appointment of Paul Smith as Non-Executive Director and

Chair:

Mr. Smith is a corporate finance professional and senior board

member with extensive experience in driving industry-leading

performance at natural resource focused companies. Upon his

appointment taking effect, Mr. Smith will act as the Chair of the

Board. Pending such appointment taking effect, Non-Executive

Director, Vincent Benoit has agreed to act as interim Chair.

Appointment of interim Chief Operating Officer ("COO"):

The Company is pleased to announce the appointment of Maryse

Bélanger as interim COO in a non-board capacity. Ms. Bélanger was

recently Chair of IAMGOLD Corporation (TSX: IMG) (NYSE: IAG). Ms.

Bélanger has been a consultant to the Company in recent months. Ms.

Bélanger has more than 30 years of experience in the global mining

sector with proven strengths in operational excellence and

turnaround, technical services and organizational efficiency,

including in Brazil.

The proposed new Board appointments of Karim Nasr and Paul Smith

are subject to the standard AIM director due diligence procedure.

Once completed, these appointments will become effective with a

further announcement to be released in due course. Mr. Nasr will

act as interim CEO in a non-board capacity with immediate

effect.

Non-Executive Director John MacKenzie commented, "Firstly, we

would like to thank Jeremy for his leadership and contributions to

the Company. Jeremy was a founding director of Horizonte and has

led the Company since 2010. We are grateful for his dedication to

the business and wish him well for the future.

I would also like to thank Simon Retter, William Fisher and Owen

Bavinton, who are also stepping down today as part of a

restructuring of the senior leadership team, for their contribution

to the evolution and growth of the business.

I am pleased to welcome Karim Nasr as interim Chief Executive

Officer. Karim is a highly respected senior leader and it is a

credit to Horizonte as a group that we are able to call on someone

of his calibre. The Board is grateful that Karim has agreed to lead

the Company through this financing and restructuring process.

I am also very pleased to welcome Paul Smith to our Board, which

he will chair after the usual onboarding procedures are

completed."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, as retained in the UK

pursuant to the European Union (Withdrawal) Act 2018.

For further information, visit www.horizonteminerals.com or

contact:

Horizonte Minerals plc info@horizonteminerals.com

Patrick Chambers (Head of IR) +44 (0) 203 356 2901

Peel Hunt LLP (Nominated Adviser & Joint

Broker)

Ross Allister

David McKeown

Bhavesh Patel +44 (0)20 7418 8900

---------------------------

BMO (Joint Broker)

Thomas Rider

Pascal Lussier Duquette

Andrew Cameron +44 (0) 20 7236 1010

---------------------------

Barclays (Joint Broker)

Philip Lindop

Richard Bassingthwaighte +44 (0)20 7623 2323

---------------------------

Tavistock (Financial PR)

Jos Simson

Cath Drummond +44 (0) 20 7920 3150

---------------------------

ABOUT HORIZONTE MINERALS

Horizonte Minerals Plc (AIM/TSX: HZM) is developing two

100%-owned, Tier 1 projects in Pará state, Brazil - the Araguaia

Nickel Project and the Vermelho Nickel-Cobalt Project. Both

projects are high-grade, low-cost, with low carbon emission

intensities and are scalable. Araguaia is under construction and

when fully ramped up with both Line 1 and Line 2, is forecast to

produce 29,000 tonnes of nickel per year. Vermelho is at

feasibility study stage. Horizonte's combined production profile of

over 60,000 tonnes of nickel per year positions the Company as a

globally significant nickel producer. Horizonte's top three

shareholders are La Mancha Investments S.à r.l., Glencore Plc and

Orion Mine Finance.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to the

Company, certain information contained in this press release

constitutes "forward-looking information" under Canadian securities

legislation. Forward-looking information includes, but is not

limited to, the ability of the Company to complete any planned

acquisition of equipment, statements with respect to the potential

of the Company's current or future property mineral projects; the

ability of the Company to complete a positive feasibility study

regarding the second RKEF line at Araguaia on time, or at all, the

ability of the Company to complete a positive feasibility study

regarding the Vermelho Project on time, or at all, the success of

exploration and mining activities; cost and timing of future

exploration, production and development; the costs and timing for

delivery of the equipment to be purchased, the estimation of

mineral resources and reserves and the ability of the Company to

achieve its goals in respect of growing its mineral resources; the

realization of mineral resource and reserve estimates and achieving

production in accordance with the Company's potential production

profile or at all. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is based on the reasonable

assumptions, estimates, analysis and opinions of management made in

light of its experience and its perception of trends, current

conditions and expected developments, as well as other factors that

management believes to be relevant and reasonable in the

circumstances at the date that such statements are made, and are

inherently subject to known and unknown risks, uncertainties and

other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially

different from those expressed or implied by such forward-looking

information, including but not limited to risks related to: the

inability of the Company to complete any planned acquisition of

equipment on time or at all, the ability of the Company to complete

a positive feasibility study regarding the implementation of a

second RKEF line at Araguaia on the timeline contemplated or at

all, the ability of the Company to complete a positive feasibility

study regarding the Vermelho Project on the timeline contemplated

or at all, exploration and mining risks, competition from

competitors with greater capital; the Company's lack of experience

with respect to development-stage mining operations; fluctuations

in metal prices; uninsured risks; environmental and other

regulatory requirements; exploration, mining and other licences;

the Company's future

payment obligations; potential disputes with respect to the

Company's title to, and the area of, its mining concessions; the

Company's dependence on its ability to obtain sufficient financing

in the future; the Company's dependence on its relationships with

third parties; the Company's joint ventures; the potential of

currency fluctuations and political or economic instability in

countries in which the Company operates; currency exchange

fluctuations; the Company's ability to manage its growth

effectively; the trading market for the ordinary shares of the

Company; uncertainty with respect to the Company's plans to

continue to develop its operations and new projects; the Company's

dependence on key personnel; possible conflicts of interest of

directors and officers of the Company, and various risks associated

with the legal and regulatory framework within which the Company

operates, together with the risks identified and disclosed in the

Company's disclosure record available on the Company's profile on

SEDAR at www.sedar.com, including without limitation, the annual

information form of the Company for the year ended December 31,

2022, and the Araguaia and Vermelho Technical Reports available on

the Company's website https://horizonteminerals.com/. Although

management of the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements.

Proposed new Board Directors:

Karim Nasr

Karim is Managing Partner and Co-Chief Investment Officer of La

Mancha Resource Capital LLP ("La Mancha"), which advises La Mancha

Resource Fund SCSp, one of the Company's major shareholders. Karim

has over 25 years of experience in corporate finance and

investments. He joined La Mancha in 2018 as CFO and became Managing

Partner & co-CIO in 2019. From 2011 to 2017, he was CEO of

Digital World Capital LLP, an alternative asset manager managing

the Cross Comms fund, a long/short equity & credit fund

investing in Telecom & Media securities, and advised clients on

special situation investments. From 2001 to 2011, Mr. Nasr was a

member of the Executive and Investment Committee, Audit & Risk

Committee, and Remuneration & Nomination Committee of Wind

Telecom and Orascom Telecom, in charge of Corporate Finance,

raising US$68bn in capital and closing US$67bn in M&A

transactions. In particular, he led the 2011 US$25bn merger with

VEON, the 2005 US$17bn Wind Telecom Leveraged Buy-Out and managed

the 2009 EUR3.8bn debt restructuring of Wind Hellas in Greece.

Mr. Nasr also serves on the board of Elemental Altus Royalties

Corp (TSX-V:ELE) (AIM:ALS) and G Mining Ventures Corp.

(TSX-V:GMIN). He holds a Master's in Management from the University

of Paris IX. He is fluent in English, Arabic and French

Paul Smith

Paul Smith is a corporate finance professional and senior board

member with extensive experience of driving industry-leading

performance at natural resource focused companies. Mr. Smith is a

co-founder of Voltaire Minerals Partners, which provides innovative

solutions to the critical minerals supply chain, and is also a

Non-Executive Director at Seadrill (NYSE:SDRL), a global offshore

drilling business for the oil and gas industry, Echion

Technologies, the world's leading supplier of niobium-based anode

materials and Bunker Hill Mining Corp TSXV:BNKR. He was until

recently Executive Chairman at Trident Royalties (LON:TRR), a

mining royalty business.

Mr. Smith worked for Glencore plc ("Glencore") from 2011 to 2020

where, as Head of Strategy, his principal areas of focus were

capital markets, M&A and capital allocation. During this

period, Glencore successfully completed numerous large scale

corporate and capital markets transactions, most notably a US$90

billion merger with Xstrata Plc.

He was also the CFO of Katanga Mining Limited, Glencore's

TSX-listed and DRC-based subsidiary from 2019 until its de-listing

in 2020. He represented Glencore as a non-executive director of

Lonmin plc and Glencore Agriculture Ltd, and chaired Glencore

Technology from 2013-2015.

Prior to Glencore, Mr. Smith was an analyst and fund manager at

Marshall Wace Asset Management, where he focused on cyclical

sectors, including mining. He qualified as a Chartered Accountant

and has an MA in Modern History from Oxford University.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOADGBDBXUDDGXL

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

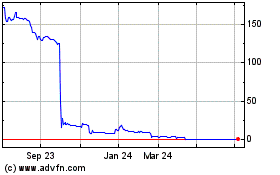

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Dec 2024 to Jan 2025

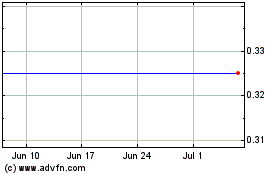

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Jan 2024 to Jan 2025