itim Group PLC Admission to AIM and First Day of Dealings (2293D)

June 28 2021 - 1:00AM

UK Regulatory

TIDMITIM

RNS Number : 2293D

itim Group PLC

28 June 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, REPUBLIC OF IRELAND, OR REPUBLIC OF SOUTH

AFRICA OR ANY JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS

ANNOUNCEMENT

itim Group plc

("itim", or "the Company", and together with its subsidiaries

"the Group")

ADMISSION TO AIM AND FIRST DAY OF DEALINGS

itim Group plc, a SaaS based technology company that enables

store-based retailers to optimise their businesses to improve

financial performance and effectively compete with online

competitors, is pleased to announce that admission of its entire

issued and to be issued share capital to trading on the AIM market

of the London Stock Exchange. Admission will take place and

dealings will commence at 8.00 a.m. today under the ticker ITIM and

the ISIN GB00BMD2H500.

The Company has successfully raised GBP8 million (before

expenses) by way of a placing of 5,194,806 new Ordinary Shares with

institutional and other investors at a price of 154 pence per

Ordinary Share (the "Placing Price"). Itim's market capitalisation

at the Placing Price on admission will be GBP48.1 million. WH

Ireland Limited is acting as Sole Broker and Nominated Adviser in

relation to the Admission.

The net proceeds will principally be used to continue the

development and refinement of the Company's software; to invest in

marketing; to increase the international reach of the Company

through investment in new territories; to repay GBP2.1 million

linked to the acquisition of EDI Plus Limited; and to advance

potential acquisition opportunities.

The Company's Admission Document is available to view on the

Company's website at www.itim.com

Ali Athar, Chief Executive of itim Group, said:

"Today marks an exciting new chapter for itim. Our successful

IPO and admission to AIM represents a significant moment for the

Company. We have enjoyed strong growth and a clear strategy to

execute this growth over the coming years as traditional retailers

convert to omni-channel. I am pleased to welcome our new

shareholders to itim and look forward to the future with

confidence."

Enquiries

itim Group Limited (to be renamed itim Group plc)

Ali Athar, Chief Executive via Hudson Sandler

WH Ireland Limited (Nominated Adviser and Sole Broker)

Harry Ansell/Fraser Marshall (Broking) 020 7220 1666

Katy Mitchell (Corporate Finance)

Jessica Cave

Darshan Patel

Hudson Sandler (Public Relations)

Dan de Belder/Alex Brennan 020 7796 4133

itim@hudsonsandler.com

Notes to editors

Background to the Company

itim was established in 1993 by its founder, and current Chief

Executive Officer, Ali Athar. itim was initially formed as a

consulting business, helping retailers effect operational

improvement. From 1999 the Company began to expand into the

provision of proprietary software solutions and by 2004 the Company

was focused exclusively on digital technology. itim has grown

through a series of acquisitions of small, legacy retail software

systems and associated applications which itim has redeveloped to

create the holistic end-to-end solution for retailers that supports

omni-channel retailing through the internet.

Forward looking statements

All statements other than statements of historical fact,

contained in this announcement constitute "forward looking

statements". In some cases forward looking statements can be

identified by terms such as "may", "intend", "might", "will",

"should", "could", "would", "believe", "forecast", "anticipate",

"expect", "estimate", "predict", "project", "potential", or the

negative of these terms, and similar expressions. Such forward

looking statements are based on assumptions and estimates and

involve risks, uncertainties and other factors which may cause the

actual results, financial condition, performance or achievements of

the Company, or industry results, to be materially different from

any future results, performance or achievements expressed or

implied by such forward looking statements. Except as required by

the AIM Rules for Companies, the Company expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements contained in this

announcement to reflect any change in the Group's expectations with

regard thereto or any change in events, conditions or circumstances

on which any such statement is based. New factors may emerge from

time to time that could cause the Company's business not to develop

as it expects, and it is not possible for the Company to predict

all such factors. Given these uncertainties, prospective investors

are cautioned not to place any undue reliance on such

forward-looking statements except as required by law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBRGDLXBDDGBU

(END) Dow Jones Newswires

June 28, 2021 02:00 ET (06:00 GMT)

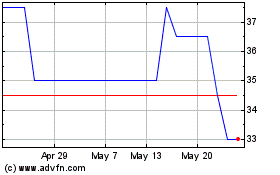

Itim (LSE:ITIM)

Historical Stock Chart

From Jan 2025 to Feb 2025

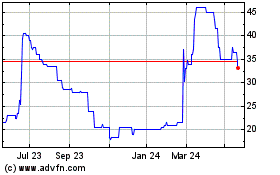

Itim (LSE:ITIM)

Historical Stock Chart

From Feb 2024 to Feb 2025