itim Group PLC Trading Update (4630P)

February 10 2023 - 1:00AM

UK Regulatory

TIDMITIM

RNS Number : 4630P

itim Group PLC

10 February 2023

itim Group plc

("itim" or "the Company" and together with its subsidiaries "the

Group")

Trading Update

itim Group plc, a SaaS based technology company that enables

store-based retailers to optimise their businesses to improve

financial performance, is pleased to provide the following

unaudited trading update for the financial year ended 31 December

2022.

Financial highlights

-- Increased revenues are in line with current market

expectations at approximately GBP14.0m (2021: GBP13.5m)

-- Annual recurring revenue ("ARR") at the year-end is approximately GBP13.0m (2021: GBP11.1m)

-- EBITDA for the year is expected to be circa GBP0.2m below

current market expectations at approximately GBP0.2m (2021:

GBP2.2m) with a similar impact in the pre-tax loss outturn

-- The Group ended the year with cash balances of GBP3.9m with no outstanding loans.

In the year ended 31 December 2022, the Group showed steady

revenue growth of 4.5% increasing from GBP13.4m to GBP14.0m, with

subscription revenues representing 84% of total turnover (2021:

77%). Since the IPO in mid-2021, the Group has ramped up its sales

effort and ARR which increased from GBP11.1m in 2021 to GBP13.0m in

2022. The Group's pipeline for 2022 was strong, although contract

conversion continued to be a risk given the prevailing economic

climate while sales were challenged by a slowdown in

decision-making at the enterprise level. Many of the Group's

prospects have moved into 2023 and with the macro-economic

challenges of 2022, it was too early to see the benefits of the

investment feeding through to top line performance.

The Group has signed two new retailers during the year and has

also experienced growth in the existing customer base. This year,

management has put in place a streamlined team which will target a

smaller number of high-value, high-margin deals, with a focus on

developing enterprise corporate accounts to improve long-term ARR.

With close to 80 customers using all or some elements of our Retail

Suite platform, this provides itim with a stable recurring revenue

base and a good mix of UK and international growing revenues.

In the current market conditions, the Group's core products have

continued to perform well but risk remains around the pace of

growth of our enterprise offering, where budgets are under

pressure.

After admission to trading on AIM, the Board adopted a strategy

that most SAAS businesses use, which is to finance projects

ourselves to drive growth by offering to do the transition onto our

platform at no cost. Consequently, the Group increased its cost

base to allow for this and EBITDA subsequently fell to GBP0.2m from

GBP2.2m in 2021. The Board increased its investment in its head

count to support implementation projects in 2023, in addition, wage

inflation has been higher in our sector because of the acute

shortage of technology resources.

itim's focus is now on improving margin and cash generation with

the Group targeting an improvement in the adjusted EBITDA margin

during the current financial year before moving substantially

higher from 2024. To do so, the Company will be pivoting away

slightly from the strategy proposed during IPO and focussing on

achieving greater revenues and increasing our margins for our

services that will consequently improve EBITDA over time.

Ali Athar, Chief Executive officer, commented ; "I am pleased to

report steady revenue growth, increased ARR , as well as growth in

our existing customer base for the year ended 31 December 2022 .

The Board has invested heavily in the period which has impacted the

bottom line in the short term, however, the Group's renewed focus

is on margin enhancement and cash generation as it looks to further

build shareholder value. Selling additional services into our

considerable existing client base is bearing fruit as we continue

to see an increased demand for our products. The Board will

continue with investments in its next-generation products during

2023 and expects to experience an acceleration in ARR growth in the

UK. As a result, we are confident about the outlook for the

business."

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Enquiries:

Ali Athar, CEO

Itim Group plc Ian Hayes CFO 0207 598 7700

Katy Mitchell

WH Ireland (NOMAD & Harry Ansell

Broker) Darshan Patel 0207 220 1666

Graham Herring

IFC Advisory Florence Chandler 0207 3934 6630

ABOUT ITIM

itim was established in 1993 by its founder, and current Chief

Executive Officer, Ali Athar. itim was initially formed as a

consulting business, helping retailers' effect operational

improvement. From 1999 the Company began to expand into the

provision of proprietary software solutions and by 2004 the Company

was focused exclusively on digital technology. itim has grown both

organically and through a series of acquisitions of small, legacy

retail software systems and associated applications which itim has

redeveloped to create a fully integrated end to end Omni-channel

platform.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAEANEDEDEFA

(END) Dow Jones Newswires

February 10, 2023 02:00 ET (07:00 GMT)

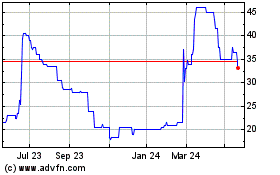

Itim (LSE:ITIM)

Historical Stock Chart

From Dec 2024 to Jan 2025

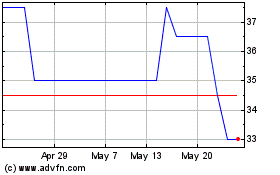

Itim (LSE:ITIM)

Historical Stock Chart

From Jan 2024 to Jan 2025