RNS Number:5434V

John David Group (The) PLC

26 April 2007

26 April 2007

THE JOHN DAVID GROUP PLC

PRELIMINARY RESULTS

FOR THE 52 WEEKS ENDED 27 JANUARY 2007

The John David Group Plc (the "Group"), the specialist retailer of sports and

fashion footwear and apparel, today announces its Preliminary Results for the 52

weeks ended 27 January 2007.

2007 2006 % Change

#000 #000

Revenue 530,581 490,288 +8%

Gross profit % 47.5% 46.2%

Operating profit (before net financing costs and

exceptional items) 27,301 20,121 +36%

Profit before tax and exceptional items 25,066 16,633 +51%

Exceptional items (7,799) (12,983)

Profit before tax 17,267 3,650 +373%

Basic earnings per ordinary share 21.52p 4.92p +337%

Adjusted basic earnings per ordinary share (see 36.41p 25.32p +44%

note 3)

Total dividend payable per ordinary share 7.20p 6.90p +4%

Net cash / (debt) at end of period (1) 10,932 (13,247)

(1) Net cash / (debt) consists of cash and cash equivalents together with

interest bearing loans and borrowings, loan notes and finance lease and hire

purchase contracts.

Highlights

* Total revenue increased by 8.2% in the year and by 4.7% on a like for

like basis.

* Gross margin improved from 46.2% to 47.5%.

* Group profit before tax and exceptional items up 51% to #25.1 million

(2006: #16.6 million).

* Group has now eliminated its year end net debt and has year end net cash

balances of #10.9 million - a three year improvement of #61.9 million after

acquisitions at a cost of #24.1 million in the same three year period.

* Exceptional items of #7.8m mainly as a result of impairment of goodwill

(#4.0 million) and continuing store portfolio rationalisation.

Peter Cowgill, Executive Chairman, said:

"I am pleased with the progress of the Group during the year and, specifically,

the improvement in profit before tax and exceptional items from #16.6 million to

#25.1 million accompanied by the continuing level of cash generation.

"Trading since the year end has been encouraging with like for like sales for

the Group for the 12 weeks ended 21 April 2007 being up 7.5%. Overall the Board

expects a further improvement in the Group's results for the first half of the

current year but remains aware of the more challenging environment which is

likely to prevail in the balance of the year."

Enquiries:

The John David Group Plc Tel: 0870 873 0333

Peter Cowgill, Executive Chairman

Barry Bown, Chief Executive

Brian Small, Finance Director

Hogarth Partnership Limited Tel: 020 7357 9477

Andrew Jaques

Barnaby Fry

Charlie Field

EXECUTIVE CHAIRMAN'S STATEMENT

INTRODUCTION

The 52 weeks ended 27 January 2007 represented another year of delivery of our

plan to enhance operating margins and eliminate underperforming stores. We have

improved our profit before tax and exceptional items by 51% in the year to #25.1

million (2006: #16.6 million).

Group profit before tax was #17.3 million (2006: #3.6 million) and Group profit

after tax was #10.4 million (2006: #2.3 million).

Group operating profit before exceptional items and net financing costs for the

year of #27.3 million (2006: #20.1 million) comprises a Sports Fascias profit of

#29.7 million (2006: #22.6 million) and a Fashion Fascias loss of #2.4 million

(2006: loss of #2.5 million).

SPORTS FASCIAS

The Sports Fascias' turnover increased to #492.8 million (2006: #448.9 million).

Like for like sales for the year in the Sports Fascias excluding the Allsports

and Hargreaves Airport stores portfolios were up 4.8%. Gross margin rose to

47.6% (2006: 46.3%).

The 73 ex-Allsports stores retained in the Sports Fascias as JD branches were

fully integrated relatively early in the year and are performing satisfactorily.

The 14 Hargreaves Airport stores, acquired from Hargreaves (Sports) Limited on

23 June 2006, were not great contributors to profit during the year and were

adversely affected by new security measures operational at all airports since

last August. We still believe that once these stores have been refurbished and

refascia'd as necessary, with the right product offer and brand support, they

will trade successfully and help us broaden our offer and appeal.

FASHION FASCIAS

The Fashion Fascias have been engaged in a further year of transition with

underperforming stores gradually being eliminated and the remaining ATH- and AV

stores being converted to the Scotts Fascia. Currently, there are only 6 ATH-

and AV stores remaining.

In spite of a positive like for like sales performance of 3.7% for the year,

turnover declined to #37.7 million (2006: #41.4 million) as a result of the

store disposal programme. Eight underperforming stores were closed in the year

and a further two have already been closed since the year end. Substantial

losses were borne on some of these stores before they were disposed of, meaning

that the results suffered from the early year losses, and did not benefit from

the normal anticipated Christmas trading period profit in the year. Gross margin

improved to 46.3% (2006: 45.5%).

The young branded fashion sector remains competitive and we continue to believe

the Fashion Fascias will only deliver profit to the Group when its major

property issues are resolved. The disposals of Liverpool Open in July 2006 and

Bluewater Scotts in January 2007 have both been significant steps towards this

goal. We are increasingly focussed on making the right property and buying and

merchandising decisions to deliver shareholder value from these Fascias.

GROUP PERFORMANCE

Revenue

Total revenue increased by 8.2% in the year (2007: #530.6 million; 2006: #490.3

million) as a result of the Group's positive like for like sales performance of

4.7% (excluding ex Allsports and ex Hargreaves Airport stores), combined with

increased turnover from the ex Allsports stores in their first full year (not

all of which have been retained) and from the ex Hargreaves Airport stores.

Turnover growth continues to be held back in both sets of Fascias by the store

rationalisation programme but enhancement of profitability will continue to be

our fundamental goal rather than absolute turnover growth. Like for like sales

growth is, however, essential to the achievement of our long term goals.

Gross margin

We are pleased with the progress made in enhancing Group gross margin from 46.2%

to 47.5% which we had expected to take two years to achieve. However, there

remains downward pressure on selling prices and we expect economic conditions to

be less favourable in the second half as recent and anticipated interest rate

increases take effect. The best prospects for margin growth come from own and

licensed brands if we can continue to increase their share of sales in the

Sports Fascias.

Overheads

Overheads generally remain tightly controlled wherever possible though rents,

rates and minimum wage rates are outside our control and represent a significant

part of our cost base. We have substantially increased our marketing spend to

continue developing the profile of JD and its brand offer, including support for

own brands such as Carbrini and Brookhaven. We have also begun to invest more

heavily in other support functions such as IT, merchandising and own brand

design.

Operating profits and results

Operating profit before net financing costs and exceptional items increased by

#7.2 million to #27.3 million (2006: #20.1 million) which represents a 36%

increase on last year. Our Group operating margin (before net financing costs

and exceptional items) has therefore increased to 5.1% (2006: 4.1%).

As a result of reduced exceptional items of #7.8 million (2006: #13.0 million),

operating profit after exceptional items but before net financing costs rose

sharply from #7.1 million to #19.5 million.

The exceptional items comprise:

#m

Impairment of RD Scott goodwill 2.0

Impairment of ex Hargreaves Airport stores goodwill 2.0

Lease variation costs 2.3

Onerous lease costs 1.5

Impairment of fixed assets in underperforming stores 1.5

Profit on disposal of fixed assets (1.5)

--------

Total Exceptional Charge 7.8

--------

RD Scott Limited was acquired through a share purchase in December 2004. Whilst

this acquisition has assisted us by providing increased focus on the separate

operations of our two sets of Fascias, the results of the acquired Scotts stores

and of the Fashion Fascias have been disappointing since the acquisition.

Although progress is being made, it has been necessary to impair the goodwill

carried forward from this acquisition by #2.0 million, reducing it from #4.6

million to #2.6 million.

The ex Hargreaves Airports stores were acquired in the current year and the #4.0

million initial goodwill arising from this trade and asset purchase has been

impaired by #2.0 million to #2.0 million reflecting disappointing trading since

acquisition. For the purposes of assessing goodwill fair values, current

expectations are that concession agreements will not be extended. This

assumption has been made based on the experience at Stansted Airport where BAA

would not renew the concession agreement on the landside store as the space was

required for additional security measures.

The lease variation costs are incurred in negotiating break options in onerous

leases for stores in Oxford Street and Bluewater. The onerous lease costs

provision net charge of #1.5 million comprises a charge of #1.8 million on four

overrented trading stores and a credit of #0.3 million on vacant stores. The

impairment charge is on a further four Sports stores and two Fashion stores

which are earmarked for disposal if suitable deals can be negotiated.

Net financing costs

Net financing costs are down from #3.5 million to #2.3 million as a result of

continuing debt reduction.

Debt reduction and working capital

Year end net debt of #13.2 million in the previous year was eliminated and

replaced by net cash balances of #10.9 million, an improvement of #24.1 million

after acquisitions and dividends. Free cash flow generated in the last three

years has been in excess of #92 million.

Stocks were reduced in the year by a further #4.7 million and the other net

working capital movements were small. Suppliers continue to be paid to agreed

terms and settlement discounts are taken.

STORE PORTFOLIO

Since March 2004, we have been working hard to rationalise our store portfolio

and it is pleasing to be reporting further substantial progress this year and at

a net cost below our expectations. We have closed a further 34 underperforming

stores during the period and a further nine stores have already been closed

since the year end. At this time last year, we indicated that this process would

take at least a further year and it has not been made any easier by the number

of retailers who are either ceasing trading or having to rationalise their

portfolios nor by the number of new retail developments opening or in the

pipeline. Therefore, we believe that it will take another year to see us through

the major rationalisation programme though a fast moving environment, higher

interest rates and the danger of assignments failing means that this continues

to be a challenge and one for which the cost is difficult to estimate.

During the year store numbers moved as follows:

Sports Fascias

Units '000 sq ft

Start of year 370 1,133

New stores 7 14

Additional Allsports assignment 1 5

Hargreaves Airport stores 14 15

Conversions to Fashion (incl. three ex Allsports) (4) (5)

Closures (26) (64)

-------- ---------

Close of year 362 1,098

-------- ---------

Fashion Fascias

Units '000 sq ft

Start of year 46 144

New stores 2 7

Conversions to Fashion (incl. three ex Allsports) 4 5

Closures (8) (39)

------- ---------

Close of year 44 117

------- ---------

DIVIDENDS AND EARNINGS PER ORDINARY SHARE

The Board proposes paying a final dividend of 4.80p (2006: 4.60p) bringing the

total dividend payable for the year to 7.20p (2006: 6.90p) per ordinary share.

The proposed final dividend will be paid on 30 July 2007 to all shareholders on

the register at 11 May 2007.

The adjusted earnings per ordinary share before exceptional items is 36.41p

(2006: 25.32p).

The basic earnings per ordinary share was 21.52p (2006: 4.92p).

CURRENT TRADING AND OUTLOOK

Trading since the year end has been encouraging with like for like sales for the

Sports Fascias excluding the ex Hargreaves Airport stores for the 12 weeks ended

21 April 2007 being up 8.1%. The Fashion Fascias had a particularly difficult

period in February 2007 and its like for like sales for the same 12 week period

were down 2.1%. The Group like for like sales for this 12 week period are

therefore up 7.5%.

It is the Board's view that the recent good weather and the store

rationalisation programme have considerably enhanced these figures and that

these benefits are unlikely to continue to the same degree in the remainder of

the year. In addition, we will shortly be coming up against World Cup

comparatives and interest rate increases are expected to have more impact later

in the year.

Overall, the Board expects a further improvement in the Group's results for the

first half of the current year but remains aware of the more challenging

environment which is likely to prevail in the balance of the year.

EMPLOYEES

The Group continues to enjoy the support of a dedicated and large workforce

without whom our continued improvement in performance could not be delivered.

The retail environment is a tough one to work in and the Board appreciates the

hard work and commitment which has led to these results in all our shops,

offices and warehouses. Thank you to everybody concerned.

Peter Cowgill

Executive Chairman

26 April 2007

CONSOLIDATED INCOME STATEMENT

for the 52 weeks ended 27 January 2007

Note 52 weeks to 52 weeks to

27 January 2007 28 January 2006

Continuing Continuing

Operations Operations

#000 #000

REVENUE 530,581 490,288

Cost of sales (278,331) (263,608)

------------------------------------- ------ ------------ -----------

GROSS PROFIT 252,250 226,680

Selling and distribution expenses -

normal (209,270) (192,730)

Selling and distribution expenses -

exceptional (3,799) (11,206)

Administrative expenses - normal (17,409) (15,438)

Administrative expenses - exceptional (4,000) (1,777)

Other operating income 1,730 1,609

------------------------------------- ------ ------------ -----------

OPERATING PROFIT BEFORE FINANCING 19,502 7,138

------------------------------------- ------ ------------ -----------

Before exceptional items 27,301 20,121

Exceptional items 2 (7,799) (12,983)

------------------------------------- ------ ------------ -----------

OPERATING PROFIT BEFORE FINANCING 19,502 7,138

Financial income 177 230

Financial expenses (2,412) (3,718)

------------------------------------- ------ ------------ -----------

PROFIT BEFORE TAX 17,267 3,650

Income tax expense (6,879) (1,302)

------------------------------------- ------ ------------ -----------

PROFIT FOR THE PERIOD 10,388 2,348

------------------------------------- ------ ------------ -----------

Basic earnings per ordinary share 3 21.52p 4.92p

------------------------------------- ------ ------------ -----------

Diluted earnings per ordinary share 3 21.52p 4.92p

------------------------------------- ------ ------------ -----------

The Group has no recognised gains or losses other than the results reported

above.

CONSOLIDATED BALANCE SHEET

as at 27 January 2007

As at As at

27 January 2007 28 January 2006

#000 #000

Restated (1)

ASSETS

Intangible assets 20,562 20,517

Property, plant and equipment 41,919 49,040

Other receivables 2,753 2,515

-------------------------------------------- ------------ -----------

TOTAL NON-CURRENT ASSETS 65,234 72,072

-------------------------------------------- ------------ -----------

Inventories 51,469 56,168

Income tax receivable - 1,736

Trade and other receivables 13,012 12,539

Cash and cash equivalents 11,230 9,336

-------------------------------------------- ------------ -----------

TOTAL CURRENT ASSETS 75,711 79,779

-------------------------------------------- ------------ -----------

TOTAL ASSETS 140,945 151,851

-------------------------------------------- ------------ -----------

LIABILITIES

Interest bearing loans and borrowings (106) (12,178)

Trade and other payables (58,849) (56,202)

Provisions (2,130) (2,569)

Income tax liabilities (3,477) -

-------------------------------------------- ------------ -----------

TOTAL CURRENT LIABILITIES (64,562) (70,949)

-------------------------------------------- ------------ -----------

Interest bearing loans and borrowings (192) (10,405)

Other payables (8,189) (9,299)

Provisions (4,829) (4,988)

Deferred tax liabilities (1,571) (1,617)

-------------------------------------------- ------------ -----------

TOTAL NON-CURRENT LIABILITIES (14,781) (26,309)

-------------------------------------------- ------------ -----------

TOTAL LIABILITIES (79,343) (97,258)

-------------------------------------------- ------------ -----------

TOTAL ASSETS LESS TOTAL LIABILITIES 61,602 54,593

-------------------------------------------- ------------ -----------

CAPITAL AND RESERVES

Issued ordinary share capital 2,413 2,413

Share premium 10,823 10,823

Retained earnings 48,366 41,357

-------------------------------------------- ------------ -----------

TOTAL EQUITY ATTRIBUTABLE TO EQUITY HOLDERS

OF THE PARENT 61,602 54,593

-------------------------------------------- ------------ -----------

(1) The Consolidated Balance Sheet at 28 January 2006 has been restated in

accordance with IFRS3 "Business Combinations" to reflect fair value adjustments

made on the acquisition of Allsports during the hindsight period.

RECONCILIATION OF MOVEMENT IN CAPITAL AND RESERVES

as at 27 January 2007

Issued Ordinary Share Retained Total

Share Capital Premium Earnings Equity

#000 #000 #000 #000

Balance at 29 January 2005 2,364 9,042 42,194 53,600

Issue of ordinary share capital 37 1,160 - 1,197

Total recognised income and expense - - 2,348 2,348

Dividends - - (3,185) (3,185)

Irrevocable dividend waiver 12 621 - 633

------------------------------------- -------- --------- --------- ---------

Balance at 28 January 2006 2,413 10,823 41,357 54,593

Total recognised income and expense - - 10,388 10,388

Dividends - - (3,379) (3,379)

------------------------------------- -------- --------- --------- ---------

Balance at 27 January 2007 2,413 10,823 48,366 61,602

------------------------------------- -------- --------- --------- ---------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the 52 weeks ended 27 January 2007

52 weeks to 52 weeks to

27 January 2007 28 January 2006

#000 #000

Restated (1)

CASH FLOWS FROM OPERATING ACTIVITIES

Profit for the period 10,388 2,348

Income tax expense 6,879 1,302

Financial expenses 2,412 3,718

Financial income (177) (230)

Depreciation of property, plant and equipment 11,451 10,236

Impairment of property, plant and equipment 1,482 3,172

Amortisation of non-current other receivables 437 396

Impairment of non-current other receivables - 34

Impairment of intangible assets 4,000 -

Profit on disposal of non-current assets (1,491) (676)

Decrease in inventories 5,299 10,585

(Increase) / Decrease in trade and other

receivables (475) 669

Increase in trade and other payables and provisions 1,488 13,895

Interest paid (2,412) (3,718)

Income taxes paid (1,712) (2,841)

--------------------------------------------------- ------------ -----------

NET CASH FROM OPERATING ACTIVITIES 37,569 38,890

--------------------------------------------------- ------------ -----------

CASH FLOWS FROM INVESTING ACTIVITIES

Interest received 177 230

Proceeds from sale of non-current assets 11,099 1,782

Disposal costs of non-current assets (2,188) (683)

Acquisition of property, plant and equipment (13,665) (6,566)

Acquisition of non-current other receivables (434) (261)

Cash consideration of acquisitions (5,000) (14,520)

Net cash balances acquired on acquisitions - 3

--------------------------------------------------- ------------ -----------

NET CASH USED IN INVESTING ACTIVITIES (10,011) (20,015)

--------------------------------------------------- ------------ -----------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from issue of ordinary share capital - 1,197

Repayment of interest bearing loans and borrowings (22,000) (12,500)

Payment of finance lease and hire purchase

contracts (285) (415)

Dividends paid (3,379) (2,552)

--------------------------------------------------- ------------ -----------

NET CASH USED IN FINANCING ACTIVITIES (25,664) (14,270)

--------------------------------------------------- ------------ -----------

NET INCREASE IN CASH AND CASH EQUIVALENTS 1,894 4,605

--------------------------------------------------- ------------ -----------

(1) The Consolidated Statement of Cashflows for the 52 weeks to 28 January 2006

has been restated in accordance with IFRS3 "Business Combinations" to reflect

fair value adjustments made on the acquisition of Allsports during the hindsight

period.

ANALYSIS OF NET DEBT

for the 52 weeks ended 27 January 2007

At 28 Other non At 27

January cash January

2006 Cashflow changes 2007

#000 #000 #000 #000

Cash at bank and in hand 9,336 2,098 - 11,434

Overdraft - (204) - (204)

------------------------------ --------- --------- --------- ---------

Cash and cash equivalents 9,336 1,894 - 11,230

Interest bearing loans and

borrowings

Current (12,000) 12,000 - -

Non-current (10,000) 10,000 - -

Loan notes (287) - - (287)

Finance lease and hire purchase

contracts (296) 285 - (11)

------------------------------ --------- --------- --------- ---------

(13,247) 24,179 - 10,932

------------------------------ --------- --------- --------- ---------

1. SEGMENTAL ANALYSIS

The Group manages its business activities through two Divisions - Sport and

Fashion. Each Division has its own executive board responsible for managing day

to day operations through its trading outlets. Revenue and costs are readily

identifiable for each segment, for the 52 weeks ended 27 January 2007.

The Divisional results for the 52 weeks to 27 January 2007 are as follows:

INCOME STATEMENT Sport Fashion Unallocated Total

#000 #000 #000 #000

Revenue 492,833 37,748 - 530,581

---------------------------------- --------- ---------- ----------- --------

Operating profit/(loss) before

financing and exceptional items 29,658 (2,357) - 27,301

Exceptional items (4,786) (3,013) - (7,799)

Financial income - - 177 177

Financial expenses - - (2,412) (2,412)

---------------------------------- --------- ---------- ----------- --------

Profit/(loss) before tax 24,872 (5,370) (2,235) 17,267

---------------------------------- --------- ---------- ----------- --------

The Board consider that net funding costs are cross-divisional in nature and

cannot be allocated between the Divisions in a meaningful way.

BALANCE SHEET Sport Fashion Unallocated Total

#000 #000 #000 #000

Total assets 110,792 14,253 15,900 140,945

---------------------------------- --------- ---------- ----------- --------

Total liabilities (54,650) (19,645) (5,048) (79,343)

---------------------------------- --------- ---------- ----------- --------

Unallocated assets and liabilities relate to items which are cross-divisional

including tax, elements of goodwill and bank debt.

OTHER SEGMENT Sport Fashion Unallocated Total

INFORMATION #000 #000 #000 #000

Capital expenditure:

Property, plant and equipment 11,045 2,620 - 13,665

Non-current other receivables 339 95 - 434

Goodwill on acquisition 4,045 - - 4,045

Depreciation, amortisation and

impairments:

Depreciation 10,211 1,238 - 11,449

Amortisation of non-current other

receivables 412 25 - 437

Impairments of intangible assets 2,000 2,000 - 4,000

Impairments of property, plant

and equipment 840 642 - 1,482

The restated comparative Divisional results for the 52 weeks to 28 January 2006

are as follows:

INCOME STATEMENT Sport Fashion Unallocated Total

#000 #000 #000 #000

Revenue 448,884 41,404 - 490,288

---------------------------------- --------- ---------- ----------- --------

Operating profit/(loss) before

financing and exceptional items 22,659 (2,538) - 20,121

Exceptional items (8,716) (4,267) - (12,983)

Financial income - - 230 230

Financial expenses - - (3,718) (3,718)

---------------------------------- --------- ---------- ----------- --------

Profit/(loss) before tax 13,943 (6,805) (3,488) 3,650

---------------------------------- --------- ---------- ----------- --------

The Board consider that net funding costs are cross-divisional in nature and

cannot be allocated between the Divisions in a meaningful way.

BALANCE SHEET (Restated) Sport Fashion Unallocated Total

#000 #000 #000 #000

Total assets 114,262 15,336 22,253 151,851

---------------------------------- --------- ---------- ----------- --------

Total liabilities (54,103) (19,490) (23,665) (97,258)

---------------------------------- --------- ---------- ----------- --------

Unallocated assets and liabilities relate to items which are cross-divisional

including tax, goodwill and net debt.

OTHER SEGMENT Sport Fashion Unallocated Total

INFORMATION #000 #000 #000 #000

Capital expenditure:

Property, plant and equipment 4,786 1,780 - 6,566

Non-current other receivables 192 69 - 261

Goodwill on acquisition (Restated) - - 924 924

Depreciation, amortisation and

impairments:

Depreciation 9,121 1,115 - 10,236

Amortisation of non-current

other receivables 363 33 - 396

Impairments of property,

plant and equipment 1,605 1,567 - 3,172

Impairments of non-current

other receivables 23 11 - 34

The Segmental Analysis for the 52 weeks to 28 January 2006 has been restated in

accordance with IFRS3 "Business Combinations" to reflect fair value adjustments

made on the acquisition of Allsports during the hindsight period.

The financial operation and assets of the Group are principally located in the

United Kingdom. Accordingly, no geographical analysis is presented.

2. EXCEPTIONAL ITEMS

52 weeks to 52 weeks to

27 January 2007 28 January 2006

#000 #000

Profit on disposal of non-current assets (1,491) (676)

Provision for rentals on onerous property

leases 1,558 6,954

Impairment of intangible assets 4,000 -

Impairment of property, plant and

equipment 1,482 3,172

Impairment of non-current other receivables - 34

Lease variation costs 2,250 1,722

Allsports restructuring costs - 1,777

------------------------------------------- ----------- ------------

7,799 12,983

------------------------------------------- ----------- ------------

Non-current other receivables comprises legal fees and other costs associated

with the acquisition of leasehold interests.

3. EARNINGS PER ORDINARY SHARE

Basic earnings per ordinary share

The calculation of basic earnings per ordinary share at 27 January 2007 is based

on the profit attributable to ordinary shareholders of #10,388,000 (2006:

#2,348,000) and a weighted average number of ordinary shares outstanding during

the 52 weeks ended 27 January 2007 of 48,263,434 (2006: 47,721,276), calculated

as follows:

52 weeks to 52 weeks to

27 January 2007 28 January 2006

Issued ordinary shares at

beginning of period 48,263,434 47,276,628

Effect of shares issued during the

period - 444,648

------------------------------------------- ----------- ------------

Weighted average number of ordinary shares

during the period 48,263,434 47,721,276

------------------------------------------- ----------- ------------

Diluted earnings per ordinary share

The calculation of diluted earnings per ordinary share at 27 January 2007 is

based on the profit attributable to ordinary shareholders of #10,388,000 (2006:

#2,348,000) and a weighted average number of ordinary shares outstanding during

the 52 weeks ended 27 January 2007 of 48,263,434 (2006: 47,721,276), calculated

as follows:

52 weeks to 52 weeks to

27 January 2007 28 January 2006

Weighted average number of ordinary

shares during the period 48,263,434 47,721,276

Dilutive effect of outstanding share

options - -

------------------------------------------- ----------- ------------

Weighted average number of ordinary shares

(diluted) during the period 48,263,434 47,721,276

------------------------------------------- ----------- ------------

Adjusted basic earnings per ordinary share

Adjusted basic earnings per ordinary share has been based on the profit

attributable to ordinary shareholders for each financial period but excluding

the post tax effect of certain exceptional items. The Directors consider that

this gives a more meaningful measure of the underlying performance of the Group.

52 weeks to 52 weeks to

27 January 2007 28 January 2006

Note #000 #000

Profit attributable to ordinary

shareholders 10,388 2,348

Exceptional items excluding profit on

disposal of non-current assets 2 9,290 13,659

Tax relating to exceptional items (2,107) (3,925)

------------------------------------- ------ ------------ -----------

Profit attributable to ordinary

shareholders excluding exceptional

items 17,571 12,082

------------------------------------- ------ ------------ -----------

Adjusted basic earnings per ordinary

share 36.41p 25.32p

------------------------------------- ------ ------------ -----------

4. ACCOUNTS

These figures are abridged versions of the Group's full accounts for the 52

weeks ended 27 January 2007 and do not constitute the Group's statutory accounts

within the meaning of Section 240 of the Companies Act 1985. The Group's

auditors have audited the statutory accounts for the Group and have issued an

unqualified audit opinion thereon within the meaning of Section 235 of the

Companies Act 1985 and have not made any statement under Section 237(2) or (3)

of the Companies Act 1985 for the 52 weeks ended 27 January 2007.

The comparative figures for the 52 weeks ended 28 January 2006 do not constitute

the Group's consolidated financial statements for that financial period. Those

accounts have been reported on by the Group's auditors and delivered to the

Registrar of Companies. The report of the auditors was unqualified and did not

contain statements under Section 237(2) or (3) of the Companies Act 1985. These

accounts were delivered to the Registrar of Companies following the Annual

General Meeting.

Copies of full accounts will be sent to shareholders in due course. Additional

copies will be available from The John David Group Plc, Hollinsbrook Way,

Pilsworth, Bury, Lancashire, BL9 8RR or online at www.thejohndavidgroup.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EANLSADEXEFE

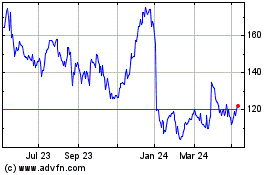

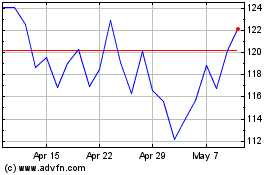

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jul 2023 to Jul 2024