Strategic Investment

December 04 2007 - 4:04AM

UK Regulatory

RNS Number:1020J

John David Group (The) PLC

04 December 2007

THE JOHN DAVID GROUP PLC

4 December 2007

Strategic Investment in The Focus Group

The John David Group plc (JD), the sports and leisurewear retailer, announces

that on 3 December 2007 it acquired 49.0% of the entire issued share capital of

Focus Brands Limited (Newco) which is a new company set up for the purposes of

acquiring Focus Group Holdings Limited and its subsidiary companies (Focus

Group) from Michael Gilbert, David Gilbert, David Tolman, Mark Schaffer and

Trevor Freeman (the Vendors).

The Focus Group was founded in 1976 and has become one of the leading companies

in the UK for the design, sourcing and distribution of branded and own brand

footwear, apparel and accessories. Focus Group holds a number of third party

licences and also designs and sources product from a number of sports and

fashion retailers. Immediately prior to this transaction taking place Focus

Group's UK license with Converse has been transferred outside of the Focus

Group.

The key employees of the Focus Group are its two founders, Michael Gilbert and

David Gilbert, together with the Marketing and Design Director, David Tolman,

who joined the Focus Group in 1992. All three will continue in their current

operational roles within the management team of the Focus Group.

JD has invested #49,000 by way of share capital and #2.45m by way of loan notes

into Newco with these loan notes carrying a coupon of 1.5% above Barclays Bank

base rate.

Pending a refinancing of Newco, JD and the Vendors have guaranteed a #6.5m

bridging loan facility in Newco on a several basis with JD liable for 49% of

this guarantee in line with its shareholding. It is intended that the

refinancing will take place shortly after completion. Upon refinancing, it is

intended that the guarantee from JD and the Vendors will continue on a several

basis in the same proportions as the bridging loan facility.

Deferred consideration may be payable to the Vendors in the event that the

profit before amortisation and after tax of the Focus Group exceeds certain

thresholds in the period to 31 January 2013. The maximum total deferred

consideration that could be payable to the Vendors is approximately #12.4m.

The Vendors have also granted JD a call option over the 51.0% of Newco's issued

share capital which is owned by the Vendors. This option is exercisable by JD at

any time after the fifth anniversary of completion of the acquisition.

JD has also acquired a sub-licence to 2019 of the Sergio Tacchini brand in the

UK from Focus Italy srl, a wholly owned subsidiary of Focus Group Holdings

Limited, with advanced royalties of #4.3m payable in cash.

JD has also acquired from the Focus Group a freehold property in St Albans for

the current market valuation of #4m payable in cash. This building has been let

back to the Focus Group on a 15 year lease at an initial rental of #320,000,

which represents the market rent for the property.

For the year ended 31 May 2006, the audited loss before tax of the Focus Group

was #961,000 and the gross assets were #54,900,000.

The directors expect that the investment in Newco will be immediately earnings

enhancing to JD.

Peter Cowgill, Executive Chairman of JD, said:

"We are pleased to announce this investment in the Focus Group, which further

expands our unique product and brand offering. By drawing on the management

team's expertise and proven success in the development of product and brands, we

are confident that this investment will bring financial and strategic benefits

in the future."

Enquiries:

The John David Group Plc Tel: 0161 767 1000

Peter Cowgill, Executive Chairman

Brian Small, Finance Director

Hogarth Partnership Limited Tel: 0207 357 9477

Andrew Jaques

Barnaby Fry

Sarah Richardson

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQGCBDDCUGGGRS

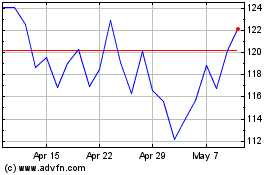

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jun 2024 to Jul 2024

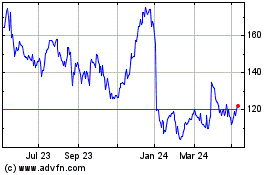

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jul 2023 to Jul 2024