TIDMKIE

RNS Number : 7395T

Kier Group PLC

16 November 2023

16 November 2023

KIER GROUP PLC

RESULT OF ANNUAL GENERAL MEETING

Kier Group plc (the "Company") announces the results of its

Annual General Meeting held on 16 November 2023. The voting was

held on a poll and the results for each resolution were as

follows:

Resolution Votes % votes Votes % votes Votes Total votes % voted(3)

for for(1) against Against(1) Withheld(2) validly

cast(2)

To receive the Annual

Report

and Accounts for the

year

1 ended 30 June 2023 267,582,970 99.99 17,669 0.01 565,221 267,600,639 59.95

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To approve the

Directors'

2 remuneration policy 158,612,472 61.40 99,696,433 38.60 9,860,396 258,308,905 57.87

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To approve the

Directors'

remuneration report

for

the year ended 30 June

3 2023 267,251,805 99.69 835,349 0.31 82,147 268,087,154 60.06

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To re-elect Mr MJ

Lester

4 as a Director 234,701,884 87.55 33,382,597 12.45 84,820 268,084,481 60.06

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To re-elect Mr AOB

Davies

5 as a Director 261,665,666 97.60 6,439,115 2.40 64,520 268,104,781 60.07

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To re-elect Mr SJ

Kesterton

6 as a Director 267,101,080 99.63 1,003,701 0.37 64,520 268,104,781 60.07

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To re-elect Mr JR

Atkinson

7 as a Director 255,425,116 95.28 12,649,628 4.72 94,557 268,074,744 60.06

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To re-elect Ms AJ

Atkinson

8 as a Director 263,589,918 98.33 4,468,524 1.67 103,996 268,058,442 60.06

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To re-elect Ms MC

Browne

9 OBE as a Director 263,333,064 98.24 4,711,339 1.76 124,898 268,044,403 60.05

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To elect Ms MG Hassall

10 as a Director 267,823,677 99.92 207,691 0.08 137,933 268,031,368 60.05

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To re-elect Mr CG

Watson

11 as a Director 262,060,542 97.76 6,007,222 2.24 101,537 268,067,764 60.06

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To re-appoint

PricewaterhouseCoopers

12 LLP as auditor 264,311,222 98.62 3,704,415 1.38 138,540 268,015,637 60.05

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To authorise the Risk

Management

and Audit Committee to

agree the remuneration

13 of the auditor 267,736,509 99.94 166,682 0.06 266,110 267,903,191 60.02

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To authorise pollical

14 donations 267,073,907 99.70 800,162 0.30 295,232 267,874,069 60.01

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To authorise the

Directors

15 to allot shares 258,042,503 96.31 9,873,616 3.69 238,058 267,916,119 60.02

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To authorise the

Directors

to disapply

pre-emption

16 rights (general) 266,059,625 99.24 2,034,322 0.76 75,354 268,093,947 60.06

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To authorise the

Directors

to disapply

pre-emption

rights (acquisition or

specified capital

17 investment) 265,341,195 98.97 2,768,710 1.03 59,396 268,109,905 60.07

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To authorise the

Company

to make market

purchases

of the Company's

ordinary

18 shares of 1p each 267,670,222 99.94 156,871 0.06 342,208 267,827,093 60.00

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To approve the

cancellation

of the Company's share

19 premium account 267,866,932 99.93 197,686 0.07 104,683 268,064,618 60.06

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To approve the

cancellation

of the Company's

capital

20 redemption reserve 267,936,317 99.95 132,553 0.05 100,431 268,068,870 60.06

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

To authorise the

Company

to call general

meetings,

other than annual

general

meetings, on not less

than

21 14 clear days' notice 263,521,613 98.29 4,595,572 1.71 52,116 268,117,185 60.07

----------------------- ------------ -------- ----------- ----------- ------------ ------------ -----------

Notes :

1. Expressed as a percentage of all votes validly cast (and does not include votes withheld).

2. A vote withheld is not a vote in law and is not counted in

the calculation of the proportion of votes validly cast.

3. Expressed as a percentage of the total issued share capital

on 14 November 2023. The number of ordinary shares in issue on 14

November 2023 was 446,354,414 .

Shareholders are entitled to one vote per share. Resolutions 1

to 15 (inclusive) were passed as ordinary resolutions and

resolutions 16 to 21 (inclusive) were passed as special

resolutions.

The Board notes that Resolution 2 (which related to the binding

vote on the Directors' Remuneration Policy) was passed with 61.4%

of votes in favour. The Chair of the Remuneration Committee

consulted extensively with a wide range of shareholders on the

proposed Directors' Remuneration Policy which was designed to

appropriately incentivise the Chief Executive and Chief Financial

Officer to continue to deliver on the medium-term value creation

plan, the achievement of which will benefit the Company, its

shareholders and other stakeholders. The Board is grateful to

shareholders for their engagement earlier in the year and in the

lead up to the AGM, during which shareholders expressed different

perspectives. The Company remains committed to ongoing shareholder

engagement and will continue to do so to ensure that the Company

understands shareholders' views and is able to consider feedback on

the Company's approach to remuneration going forward. The Company

will provide an update on engagement within six months and in next

year's annual report, in line with the provisions of the UK

Corporate Governance Code.

Following the passing of resolutions 19 and 20, the Company

intends to apply to the High Court of Justice in England and Wales

(the "Court") to approve the cancellation of both the Company's

share premium account and the Company's capital redemption reserve

(collectively, the "Capital Reduction"). The expected timetable of

principal events with respect to the Capital Reduction is as

follows:

Principal event Date

Expected date for the directions 1 December 2023

hearing for the Court to consider

the Capital Reduction application

----------------

Expected date for the hearing by 19 December

Court to confirm the Capital Reduction 2023

----------------

Expected date that the Capital Late December

Reduction becomes effective 2023

----------------

Notes :

1. The dates set out in this timetable are based on the

Company's current expectations and are subject to change. The times

and dates are indicative only and will depend, among other things,

on the date upon which the Court confirms the Capital Reduction.

The provisional final hearing date will be subject to change and

dependent on the Court.

2. All times shown are London times unless otherwise stated.

A copy of all resolutions passed, other than those concerning

ordinary business, will today be submitted to the National Storage

Mechanism in accordance with Listing Rule 9.6.2. These resolutions

will shortly be available for inspection at: https://

data.fca.org.uk/#/nsm/nationalstoragemechanism .

The Kier Group plc Legal Entity Identifier is

2138002RKCU2OM4Y7O48.

For enquiries, please contact:

Kier Group plc

Jaime Tham +44 (0) 7801 975

Company Secretary 672

FTI Consulting

Richard Mountain +44 (0) 20 3727

/ Ben Fletcher 1340

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGDZMMMKVGGFZM

(END) Dow Jones Newswires

November 16, 2023 11:00 ET (16:00 GMT)

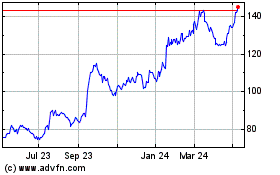

Kier (LSE:KIE)

Historical Stock Chart

From Apr 2024 to May 2024

Kier (LSE:KIE)

Historical Stock Chart

From May 2023 to May 2024