NextEnergy Solar Fund Limited Acquisition (7641P)

November 22 2016 - 1:01AM

UK Regulatory

TIDMNESF

RNS Number : 7641P

NextEnergy Solar Fund Limited

22 November 2016

22 November 2016

NextEnergy Solar Fund Limited (the "Company")

Acquisition of a plant with capacity of 5MWp and an investment

value of GBP4.4m

-- Share purchase agreement exchanged to acquire the 5MWp Kentishes solar plant

-- Completion of acquisition expected in the first half of 2017

-- The plant is nearing the end of construction and is set to be

accredited under 1.2 Renewable Obligation Certificate ("ROC")

regime qualifying for the significant investment grace period

-- NESF has now secured 34 assets totalling 419 MWp with a total

investment value of GBP485 million since its IPO in April 2014

NESF is pleased to announce the signing of the share purchase

agreement to acquire the Kentishes solar plant. The plant, located

in Essex, is currently under construction and is expected to be

connected well in advance of the 31 March 2017 deadline for

achieving 1.2 ROC accreditation.

The Company is familiar with the vendor, having acquired six

separate solar power plants from it previously. The completion of

the acquisition will follow accreditation and is expected to take

place within the first half of 2017.

For further information:

NextEnergy Capital Limited 020 3239 9054

Michael Bonte-Friedheim

Aldo Beolchini

Cantor Fitzgerald Europe 020 7894 7667

Sue Inglis

Fidante Capital 020 7832 0900

Robert Peel

Justin Zawoda-Martin

Shore Capital 020 7408 4090

Bidhi Bhoma

Anita Ghanekar

Macquarie Capital (Europe)

Limited 020 3037 2000

Nick Stamp

MHP Communications 020 3128 8100

Andrew Leach / Jamie Ricketts / Rebecca Emery

Notes to Editors:

NextEnergy Solar Fund (NESF)

NESF is a specialist investment company that invests in

operating solar power plants in the UK. Its objective is to secure

attractive shareholder returns through RPI-linked dividends and

long-term capital growth. The Company achieves this by acquiring

solar power plants on agricultural, industrial and commercial

sites.

NESF has raised equity proceeds of approximately GBP465m since

its initial public offering on the main market of the London Stock

Exchange in April 2014. It also has credit facilities of GBP210.0m

in place (Macquarie and Santander: GBP88.5m, of which GBP43.0m is

drawn; MIDIS: GBP44.9m; Bayerische Landesbank: GBP44.9m; and NIBC:

GBP21.7m).

NESF is differentiated by its access to NextEnergy Capital Group

(NEC Group), its Investment Manager, which has a strong track

record in sourcing, acquiring and managing operating solar assets.

WiseEnergy is NEC Group's specialist operating asset management

division, providing solar asset management, monitoring and other

services to over 1,250 utility-scale solar power plants with an

installed capacity in excess of 1.7 GW.

Further information on NESF, NEC Group and WiseEnergy is

available at www.nextenergysolarfund.com, www.nextenergycapital.com

and www.wise-energy.eu.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQUAAARNBAAUUA

(END) Dow Jones Newswires

November 22, 2016 02:01 ET (07:01 GMT)

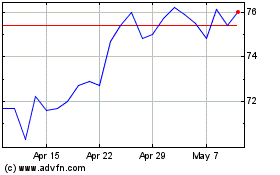

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jul 2023 to Jul 2024