TIDMNESF

RNS Number : 1546H

NextEnergy Solar Fund Limited

26 July 2023

LEI: 213800ZPHCBDDSQH5447

26 July 2023

NextEnergy Solar Fund Limited

("NESF" or the "Company")

Publication of Standalone Sustainability and ESG Report

Details provided of NESF's sustainability journey, proprietary

approach to biodiversity and industry leading ESG initiatives

NextEnergy Solar Fund, the specialist solar+ fund, has published

its second annual Sustainability and ESG Report for the year ended

31 March 2023 (the "Report").

The Report builds on NESF's first Sustainability and ESG report

published in 2022 and illustrates the breadth and depth of actions

NESF has taken across the three pillars that comprise its approach

to Sustainability and ESG - Biodiversity, Climate Change and Human

Rights. The Report also details NESF's sustainability journey,

including the development of its proprietary approach to

biodiversity, the strengthening of the Board's governance and

oversight of ESG, the advancement of ESG standards, and enhancement

of disclosure and reporting frameworks.

NESF continues to make progress against its current ESG

priorities and in spearheading sustainability and ESG initiatives

within the solar, storage and investment sectors. In addition to

generating enough clean electricity to power 242,000 UK homes over

the year, NESF has made a wider contribution to society. This

includes:

-- Championing Biodiversity: Promoting and preserving

biodiversity is as important to tackling climate change as reducing

carbon and other emissions. Over the year, NESF has taken

significant steps to promote natural capital and biodiversity

conservation best practice across its own portfolio and published

thought leadership pieces encouraging others to follow its

lead;

-- Solar Stewardship Initiative: NESF recognises that it has

responsibilities and impacts beyond its own borders when

contracting for goods or services. Alongside enhancing the

Company's management of its supply chain, NESF (through its

Investment Manager, NextEnergy Capital) has played a leading role

within the industry, such as the Solar Stewardship Initiative and

active involvement in Solar Energy UK, demonstrating NESF's

commitment to sustainable practices and transparency across the

supply chain; and

-- NextEnergy Foundation: NESF acknowledges its responsibility

as a successful, sustainable Company to support and fund

initiatives that deliver positive societal impacts around the

world. Through its donation to the NextEnergy Foundation during the

year, NESF has made an important contribution towards alleviating

poverty in parts of Africa through increasing access to renewable

energy, as well as supporting sustainable recovery activities in

Ukraine.

ESG Performance Highlights:

As at 31 March As at 31 March Change

2023 2022

Tonnes of CO(2) e emission

avoided per year 363,000 328,700 +10.43%

-------------------- --------------- --------

Equivalent to UK homes powered

for one year 242,000 216,300 +11.89%

-------------------- --------------- --------

Total emissions avoided since

2014 (ktCO(2) E) 2,181 1,818 +19.97%

-------------------- --------------- --------

Total fossil fuel avoided

since 2015 (kilotonnes of

oil equivalent) 929.4 769.1 +20.84%

-------------------- --------------- --------

Community funding (through

Special Purpose Vehicles) c.GBP104,000 c.GBP91,400 +13.78%

-------------------- --------------- --------

Donated to the NextEnergy

Foundation FY 2022-23 GBP400,000 GBP100,000 +300%

-------------------- --------------- --------

45, with 15

Universal Biodiversity Management more due by

Plan (UBPM) sites year end 30 +50%

-------------------- --------------- --------

Number of biodiversity exemplar 8 (completed

sites or in development) 6 +33.33%

-------------------- --------------- --------

Total acres of wildflowers

planted across portfolio 38 34 +12%

-------------------- --------------- --------

Equivalent cars taken off c.120,000* n/a n/a

UK roads for one year

-------------------- --------------- --------

*Comparative numbers have been given only where those metrics

were provided in the first report

Other ESG highlights in the period include:

-- Involvement in industry-wide projects, including the Solar

Stewardship Initiative, to help ensure responsible sourcing across

the solar supply chain;

-- Further development of NESF's approach to biodiversity, with

the expansion of its Universal Biodiversity Management Plan;

-- Continued development of NextEnergy Capital's ESG risk

management and proprietary due diligence processes, focused on

environmental and social impacts;

-- Direct funding to community initiatives and contribution to

the NextEnergy Group charity, the NextEnergy Foundation; and

-- Expansion of NextEnergy Capital's ESG and Sustainability

team, which advises NESF, doubling in size to six team members.

The report is now available to download from Reports and

Publication section of the Company's website:

https://www.nextenergysolarfund.com/reports-and-publications/

Josephine Bush, Chair of the NESF Board ESG Committee,

commented:

"We are delighted to publish this report looking at the

extensive action NESF has taken to deliver on its current ESG

priorities, and the strategic review being undertaken to ensure

that our overall approach reflects the changing expectations of

society and investors. We are committed to ensuring that our

approach to ESG is best-in-class and reflects evolving

international Sustainability and ESG standards. We look forward to

building on our progress in the period and presenting the outcome

of our strategic review in due course."

Ross Grier, COO of NextEnergy Capital, said:

"NESF continues to go from strength to strength and we are

excited to present further information on our current and future

ESG impacts in this report. Through measuring and disclosing NESF's

sustainability framework, we not only show the progress made during

the period but also identify how we are reducing risk within NESF

to make the strategy more sustainable. I would like to thank the

entire team for this detailed report and for continuing to

implement NESF's ESG framework that is delivering demonstrable

positive impacts for all our stakeholders."

For further information:

NextEnergy Capital 020 3746 0700

Michael Bonte-Friedheim ir@nextenergysolarfund.com

Ross Grier

Stephen Rosser

Peter Hamid (Investor Relations)

RBC Capital Markets 020 7653 4000

Matthew Coakes

Elizabeth Evans

Kathryn Deegan

Cenkos Securities 020 7397 8900

James King

William Talkington

H/Advisors Maitland 020 7379 5151

Neil Bennett

Finlay Donaldson

Alistair de Kare-Silver

Ocorian Administration (Guernsey) Limited 014 8174 2642

Kevin Smith

Notes to Editors(1) :

About NextEnergy Solar Fund

NESF is a specialist solar+ fund listed on the premium segment

of the London Stock Exchange and is a constituent of the FTSE 250.

NESF's investment objective is to provide ordinary shareholders

with attractive risk-adjusted returns, principally in the form of

regular dividends, by investing in a diversified portfolio of

utility-scale solar energy and energy storage infrastructure

assets. The majority of NESF's long-term cash flows are

inflation-linked via UK government subsidies.

The NESF portfolio has a combined installed power capacity of

865MW (excluding NextPower III MW on an equivalent look-through

basis). NESF may invest up to 30% of its gross asset value in

non-UK OECD countries, 15% in solar-focused private infrastructure

funds, and 10% in energy storage assets. As at 31 March 2023, the

Company had an audited gross asset value of GBP1,218m. For further

information on NESF please visit www. nextenergysolarfund.com

Article 9 Fund

NESF is classified under Article 9 of the EU Sustainable Finance

Disclosure Regulation and EU Taxonomy Regulation. NESF's

sustainability-related disclosures in the financial services sector

in accordance with Regulation (EU) 2019/2088 can be accessed on the

ESG section of both the NESF and NEC websites.

About NextEnergy Group

NESF is managed by NextEnergy Capital, part of the NextEnergy

Group. NextEnergy Group was founded in 2007 to become a leading

market participant in the international solar sector. Since its

inception, the Group has been active in the development,

construction, and ownership of solar assets across multiple

jurisdictions. NextEnergy Group operates via its three business

units: NextEnergy Capital (Investment Management), WiseEnergy

(Operating Asset Management), and Starlight (Asset

Development).

-- NextEnergy Capital: Ha s over 16 years' specialist solar

expertise, having invested in over 375 individual solar plants

across the world. NextEnergy Capital currently manages four

institutional funds with a total capacity in excess of 2.4GW and

has assets under management of $3.7bn.

www.nextenergycapital.com

-- WiseEnergy(R): Provides solar asset management, monitoring

and technical due diligence services to over 1,350 utility-scale

solar power plants with an installed capacity in excess of 1.8GW.

WiseEnergy clients comprise leading banks and equity financiers in

the energy and infrastructure sector. www.wise-energy.com

-- Starlight: H as d eveloped over 100 utility-scale projects

internationally and continues to progress a large pipeline of

c.10GW of both green and brownfield project developments across

global geographies.

Notes:

(1:) All financial data is audited at 31 March 2023, being the

latest date in respect of which NESF has published financial

information

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRFLFVSDDIEFIV

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

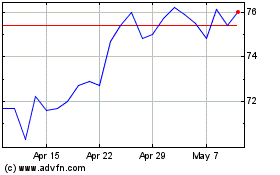

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Apr 2023 to Apr 2024