Acquisition

December 15 2009 - 5:45AM

UK Regulatory

TIDMPALM

RNS Number : 1374E

Asian Plantations Limited

15 December 2009

Asian Plantations Limited

("APL" or the "Company")

Acquisition

Asian Plantations Limited (LSE: PALM), a palm oil plantation company with

operations in Malaysia, which was admitted to trading on AIM in November 2009,

is pleased to announce that it has entered into a conditional agreement to

acquire the entire issued share capital of Jubilant Paradise Sdn Bhd

("Jubilant") and Incosetia Sdn Bhd ("Incosetia") (the "Jubilant Group"), which

owns a partly developed palm oil plantation totalling approximately 5,850

hectares in Sarawak, Malaysia (the "Incosetia Estate") (the "Proposed

Acquisition").

The total consideration for the Proposed Acquisition, which is subject to

certain conditions including receipt of regulatory approvals, is RM68 million

(circa. GBP12.4 million), payable in three tranches. An initial tranche of

RM14.3 million (GBP2.6 million) is payable immediately, with a further tranche

of RM 7.3 million (GBP1.3 million) to be paid by 30 December 2009, and the

balance payable on completion, which is expected to take place no later than 31

January 2010. In the event that any of the conditions referred to above, each of

which are customary for a transaction of this nature, are not met and the

Proposed Acquisition does not complete, the Company will be entitled to seek

full recourse in respect of all previous consideration paid. The total purchase

price per hectare is approximately RM11,600 (circa. GBP2,116). The consideration

is to be funded as to RM55 million (circa. GBP10 million) from a new debt

facility, provided by a local bank in Malaysia, and RM13 million (circa. GBP2.4

million) from the GBP5.2 million of new equity capital raised at the time of the

Company's admission to trading on AIM in November 2009. The Proposed Acquisition

will be free of the Jubilant Group's existing liabilities.

The Incosetia Estate is less than five kilometres from APL's existing palm oil

plantation and consists of 1,000 hectares of planted land, with palms of

approximately three years of age. In respect of the unplanted land, nursery

operations are expected to commence in the first quarter of 2010, thereby

enabling in-the-ground planting on the remaining 4,850 hectares to occur within

12 months of completion of the Proposed Acquisition, subject to the availability

of sufficient working capital.

The audited accounts of Incosetia for the year ended 31 December 2008, which

have been prepared under Malaysian GAAP, showed revenues of RM155,752 (circa.

GBP28,421) and net losses of RM750,347 (circa. GBP136,924). Gross assets were

RM48.9 million (circa. GBP8.92 million). Jubilant is a holding company with no

significant assets, which has recently entered into an agreement to acquire

Incosetia. The acquisition of Incosetia by Jubilant is conditional upon and will

occur simultaneously with, the completion of the Proposed Acquisition.

The directors believe that the Proposed Acquisition offers numerous strategic

benefits to APL, including:

* increasing the scale of the Company's existing operations to approximately

10,635 hectares of plantation land, of which a combined 3,000 hectares is fully

planted, in line with the Company's previously stated objectives of exceeding

20,000 hectares within two years of admission to trading on AIM. This planted

land and the land available for further expansion provides a strong platform for

future revenue generation;

* allowing revenue generation to take place immediately after completion of the

Proposed Acquisition;

* providing the Company with the scale to meaningfully investigate the design,

planning and approval for a next-generation vertical sterilizer milling system,

which generally requires fresh fruit bunch output from at least 10,000 hectares

of planted land for maximum profitability, efficiency and sustainability; and

* benefiting from an attractive implicit valuation of the Incosetia Estate,

relative to other publicly announced land transactions in East Malaysia, at a

time of increasing agricultural land scarcity in Malaysia.

After completion of the Proposed Acquisition, the Company will also immediately

extend its community outreach initiative to the surrounding small villages

located outside the boundaries of the Incosetia Estate. These on-going

initiatives include clean water systems, employment opportunities and subsidised

palm oil seedlings.

Graeme Brown, APL's Joint Chief Executive Officer, commenting on the Proposed

Acquisition, said:

"We are excited to have secured this new parcel of land, which has tremendous

operational synergies with our existing estate operations and which are located

in close proximity to one another. Through our long standing local relationships

and on-the-ground presence, we were able to secure the parcel in a negotiated,

non-competitive situation, which demonstrates our ability to source acquisition

opportunities for the Company, as well as securing attractive local currency

bank financing, which we believe creates long term shareholder value."

For further information contact:

+---------------------------------------+--------------------------------+

| Asian Plantations Limited | Tel: +65 9878 4171 |

| Dennis Melka, Joint Chief Executive | Tel: +60 19 8660221 |

| Officer | |

| Graeme Brown, Joint Chief Executive | |

| Officer | |

| | |

+---------------------------------------+--------------------------------+

| Strand Hanson Limited | Tel: +44 (0)20 7409 3494 |

| James Harris | |

| Angela Peace | |

| Paul Cocker | |

| | |

+---------------------------------------+--------------------------------+

| Mirabaud Securities LLP | Tel: +44 (0)20 7878 3360 |

| Rory Scott | |

| | |

+---------------------------------------+--------------------------------+

| Bankside Consultants | Tel: +44 (0)20 7367 8871 |

| Simon Rothschild | Tel: +44 (0)20 7367 8874 |

| Oliver Winters | |

| | |

+---------------------------------------+--------------------------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQDGMMZMKFGLZM

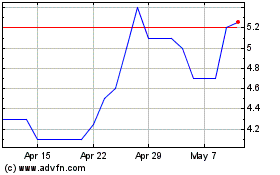

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

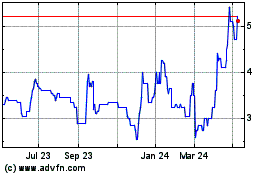

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024