Asian Plantations Limited Operational & Financing Update (1535V)

January 09 2013 - 3:30AM

UK Regulatory

TIDMPALM

RNS Number : 1535V

Asian Plantations Limited

09 January 2013

9 January 2013

Asian Plantations Ltd

("Asian Plantations" or the "Company")

Operational & Financing Update

The board of directors of Asian Plantations (the "Board") is

pleased to provide the following update regarding its operations

and financing:

Operational Update

The Company's 60 tonne per hour Fresh Fruit Bunch ("FFB")

crushing mill has been completed and the boilers will be fired

during the week of 14 January 2013. The mill will be expanded, as

planned, to its full capacity of 120 tonnes per hour during the

course of 2014.

Financing Update

Issue of medium term notes

The Company intends to issue the second tranche of the medium

term notes ("MTN") by the end of March 2013. The first tranche of

RM 100.0m (approximately US$32.8m) was issued on 10 May 2012 (the

"First Tranche"). The second tranche will total RM 155.0m

(approximately US$50.9m) via an issuance of notes of five to nine

year maturities, on the same terms as those applicable to the First

Tranche, to the local Malaysian pension fund market (the "Second

Tranche"). Of the capital raised via the Second Tranche, it is

currently intended that RM 95.0m (approximately US$31.2m) will be

applied to the re-financing of existing debt facilities and the

remainder of RM 60.0m (approximately US$19.7m) is intended to be

used for plantation development and general working capital

requirements.

The MTN programme is fully guaranteed by Malayan Banking Berhad,

a leading Southeast Asian bank.

Issue of Convertible Bonds

Additionally, the Company has today entered into an agreement to

issue convertible unsecured bonds ("Convertible Bonds"), totalling

up to US$15.0m, via a Company sponsored placing, to OCBC Capital

Investment I Pte Ltd, a wholly owned subsidiary of OCBC Bank

("OCBC"). OCBC is one of the largest banks in Southeast Asia and

its securities are publicly traded on the Singapore Stock Exchange.

It has an equity market capitalisation in excess of US$25bn. OCBC

has been rated by Bloomberg Markets, in 2012, as the world's

strongest bank for a second consecutive year.

The Convertible Bonds bear a cash interest coupon of 3 month

Libor +2.00 per cent. per annum, which is payable quarterly in

arrears until the three year maturity is reached in 2016 (the

"Maturity Date").

The Convertible Bonds, if fully issued to US$15.0m, may be

converted at any time, in aggregate, into a maximum of 3,260,041

new ordinary shares of no par value in the Company (the "Ordinary

Shares"), representing approximately 7.01 per cent. of the

Company's currently issued share capital, until the Maturity Date

at the individual bondholder's election. This implies a conversion

price of 286 pence per Ordinary Share, based on the current

exchange rate (the "Conversion Price"). The Conversion Price

represents a 25 per cent. premium to the 20 day volume weighted

average price.

The Company expects to issue the first tranche of US$5.0m during

the course of the next ten business days. The remaining US$10.0m is

subject to certain conditions precedent including, inter alia,

completion of the proposed Grand Performance Sdn Bhd acquisition

previously announced on 28 September 2012. The Company expects to

issue the remaining tranches no later than 30 June 2013.

The Company shall redeem all outstanding, non-converted

Convertible Bonds, in whole, on the Maturity Date, such that the

amounts paid by the Company on redemption result in the bondholders

having achieved, in respect of the Convertible Bonds, including

coupon payments and issuance fees, an internal rate of return of 15

per cent.

Proceeds from the issuance of the Convertible Bonds will be

applied to the Company's general working capital requirements.

-ENDS-

For further information contact:

Asian Plantations Limited

Graeme Brown, Co-Founder & Joint Chief Tel: +65 6325 0970

Executive Officer

Dennis Melka, Co-Founder & Joint Chief

Executive Officer

Strand Hanson Limited

James Harris Tel: +44 (0) 20 7409

James Spinney 3494

Macquarie Capital (Europe) Limited

Steve Baldwin Tel: +44 (0) 203

Dan Iacopetti 037 2000

Panmure Gordon (UK) Limited

Tom Nicholson Tel: +65 6824 8204

Callum Stewart Tel: +44 (0) 20 7886

2500

Bankside Consultants

Simon Rothschild Tel: +44 (0) 20 7367

8871

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGCGDBLDGBGXC

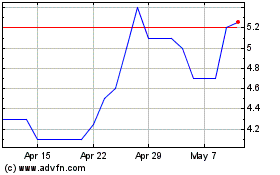

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

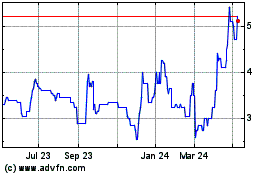

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024