TIDMPALM

RNS Number : 0366L

Asian Plantations Limited

01 July 2014

The following amendment has been made to the 'Final Results

& Notice of AGM' announcement released on 01 July 2014 at

7:00a.m. under RNS No 9969K.

The words "unaudited preliminary" were changed to "audited" in

the first line of the Chairman's Statement

All other details remain unchanged. The full amended text is

shown below.

Asian Plantations Ltd

("APL" or the "Company")

Final Results for the year ended 31 December 2013

& Notice of Annual General Meeting

Asian Plantations Limited (LSE: PALM), a palm oil plantation

company with operations in Malaysia, is pleased to announce its

audited results for the year ended 31 December 2013.

Highlights

-- US$23,763,000 of revenue reported (2012: US$2,820,000), an

increase of 742 per cent based on the production and sale of 26,584

tonnes of crude palm oil (CPO), 5,604 tonnes of palm kernel nuts

(PK) and 12,455 tonnes of fresh fruit bunches (FFB). In 2014, the

Company projects the sale of 45,000 tonnes of CPO, 10,000 tonnes of

PK and over 20,000 tonnes of FFB.

-- Completion of the Company's land consolidation strategy with

the closure of the Grand Performance Sdn Bhd acquisition on 21

August 2013.

-- Issuance of RM155,000,000 (US$49,800,000) of fixed income

notes on 15 March 2013 which completed the Company's Medium Term

Note Programme. On 23 August 2013, Issuance of the last tranche of

the convertible bond to OCBC Bank; the convertible bond issuances

were US$15,000,000 in total with an implied conversion price of 286

pence per share.

Graeme Brown, APL's Joint Chief Executive Officer, commented

"We are pleased with the results for 2013 which reported

substantial revenue growth. Taking account of our performance to

date we look forward to the future with confidence

In addition to its final results for 2013, the Company announces

that the Annual General Meeting ("AGM") relating to is financial

year ended 31 December 2013 will be held at The American Club at 10

Claymore Hill, Singapore 229573 on 25(th) August 2014 at 11:00 am

(local time). The AGM notice is available for download from the

Company's website at www.asianplantations.com

The Company's Annual Report and Accounts for the year ended 31

December 2013 have been posted to shareholders and are also

available on the Company's website at www.asianplantations.com.

-END-

For further information contact:

Asian Plantations Limited

Graeme Brown, Co-Founder & Joint Chief Tel: +65 6325 0970

Executive Officer

Dennis Melka, Co-Founder & Joint Chief

Executive Officer

Strand Hanson Limited

James Harris Tel: +44 (0) 20 7409

James Spinney 3494

Macquarie Capital (Europe) Limited

Steve Baldwin Tel: +44 (0) 203

Dan Iacopetti 037 2000

Panmure Gordon (UK) Limited

Tom Nicholson Tel: +65 6824 8204

Callum Stewart Tel: +44 (0) 20 7886

2500

Bankside Consultants

Simon Rothschild Tel: +44 (0) 20 7367

8871

CHAIRMAN'S STATEMENT

I am pleased to present the Company's audited results for the

year ended 31 December 2013.

On 24 March 2014, the Company announced that it had retained a

financial advisor to co-ordinate the potential sale of Asian

Plantations Limited. Whilst a difficult decision, particularly as

palm oil prices remain more than 30% below their 2011 and 2012

peaks, it is appropriate to explore a sale as we have completed

several important milestones since our admission to AIM

("Admission") on 30 November 2009:

-- Consolidation of our project area, culminating with the Grand

Performance Sdn Bhd acquisition on 21 August 2013, giving the

Company a total titled land resource of 24,622 hectares (60,840

acres) compared with 4,795 hectares (11,848 acres) at the time of

Admission;

-- Opening of our state-of-the-art crushing milling facility in

2013 allowing for integrated plantation operations and sale of

crude palm oil to the refineries at the port of Bintulu;

-- Planted estates totalling 16,300 hectares (40,277 acres)

compared with approximately 1,500 hectares (3,706 acres) at the

time of Admission.; and,

-- Excellent revenue growth since Admission from zero in 2009 to

US$ 23.7m in 2013. We anticipate further growth in unit volumes in

2014 as the estates mature and an increase in third party fresh

fruit bunch (FFB) processing.

As announced on 30 June 2013, discussions are on-going and we

look forward to reporting a positive conclusion in due course. We

appreciate our shareholders' and lenders' understanding and

patience as we conduct this process. Rest assured, we seek to

maximize the value of the equity capital contributed and ensure a

positive future for the Company and its dedicated employees in the

event of a sale.

FINANCIAL PERFOMANCE

For 2013, the Company reported substantially increased revenue

but a higher loss per share due to increased interest expense

associated with long term debt incurred for the opening of the

processing mill and other capital expenditures.

FINANCIAL POSITION

The Company is pleased to report revenue of USD23,763,000 in

2013, an increase of 743% over the 2012 result. The Company's

balance sheet as at 31 December 2013 shows a net assets position of

USD43,199,000 (2012: USD57,033,000). The Company has gross

indebtedness of USD151,362,000 (2012: USD123,468,000). Cash

balances were USD10,813,000 at year-end 2013.

During 2014, the Company expects to sell in excess of 45,000

tonnes of palm oil (2013: 26,584 tonnes), 10,000 tonnes of palm

kernel nuts (2013: 5,604 tonnes) and 20,000 tonnes of FFB (2013:

12,455).

FINANCING ACTIVITIES

On 15 March 2013, the Company issued the second and final

tranche of loan notes totalling RM155,000,000 (USD49,800,000) under

its RM255,000,000 bond programme. The notes have maturities ranging

from four to eight years and were issued via Maybank Investment

Bank, a leading Southeast Asian investment bank. The notes are

unconditionally guaranteed by Maybank and therefore were accorded

an AAA rating in the local market. The all-in interest cost to the

Company, including the annual bank guarantee fee, is 5.85%, 5.95%,

6.05%, 6.15% and 6.25% for the four, five, six, seven and eight

year notes, respectively. This represents a 269 basis point ("bps")

premium for the four year tranche over the equivalent four year

Malaysian Government Securities ("MGS"), then trading at 3.16% and

a 282 bps premium over the equivalent eight year MGS then trading

at 3.43%.

Additionally in 2013, the Company issued convertible unsecured

bonds in three tranches totalling USD15,000,000 to OCBC Capital

Investment I Pte Ltd, a wholly owned subsidiary of OCBC Bank

("OCBC"). OCBC is one of the largest banks in Southeast Asia and

its securities are publicly traded on the Singapore Stock Exchange.

The convertible bonds bear a cash interest coupon of three month

Libor + 2.00 per cent per annum, which is payable quarterly in

arrears until the three year maturity is reached in 14 January

2016. The convertible bonds may be converted into a maximum of

3,260,041 new ordinary shares of the Company. This implies a

conversion price of 286 pence per share.

OPERATIONS & PLANTING STRATEGY

We have five wholly-owned estates:

BJ Corporation 4,795 ha

--------------- ------- -----------------------------

Incosetia 5,839 ha (acquired 30(th) December

2009)

--------------- ------- -----------------------------

Fortune 5,136 ha (acquired 30(th) December

2010)

--------------- ------- -----------------------------

Dulit 5,000 ha (acquired 28(th) February

2012)

--------------- ------- -----------------------------

GP 3,852 Ha (acquired 21(st) August

2013)

--------------- ------- -----------------------------

Total 24,622 ha (approximately 60,840

acres)

--------------- ------- -----------------------------

As at year-end 2013, the Company had approximately 16,300

hectares of land planted, with a further 157 hectares being used

for the mill site, seedling nurseries, staff housing, quarry and

related infrastructure works essential for plantation operations.

Whilst lower than expected, this compares favourably with 13,627

hectares planted as at year-end 2012. The Company believes that the

total planted area can reach 21,000 hectares, subject to sufficient

working capital, over the next two years.

It is important to note that the Company's estates are in close

proximity to each other, thereby simplifying operations and

management. Further, the estates are only 2.5 hours away, on a

combination of paved and unpaved roads, from the deep-water port of

Bintulu. This port is the only deep-water port in Sarawak and the

transit point for virtually all of Sarawak's CPO exports and

refining.

CLOSING COMMENTS

We wish to thank all our staff, who have worked to make the

Company the success that it is today. We wish to thank our

shareholders, who share our vision of creating a best-of-breed,

sustainable palm oil company in Malaysia, and we also take this

opportunity to thank our bankers at Malayan Banking Berhad and OCBC

for their continued support of our operations. Founded in 2008, the

Company is now in its seventh year of heavy capital investment. We

expect this investment to yield substantial cash flows to

shareholders in the medium to long term, as our planting works are

completed and estates mature.

The remainder of 2014 will be an exciting period for the

Company, as we continue to plant out the estates and increase

volume at our milling facility. We look forward to reporting

progress in the months ahead.

TAN SRI Datuk Linggi

Non-Executive Chairman

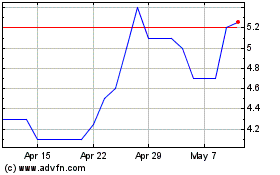

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

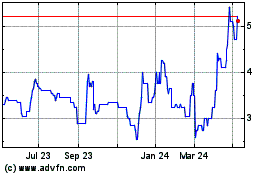

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024