Petrofac Limited ( PFC) Petrofac Limited: Trading update

12-Apr-2023 / 07:00 GMT/BST

-----------------------------------------------------------------------------------------------------------------------

Press Release

12 April 2023

TRADING UPDATE

Petrofac issues the following trading update ahead of the

announcement of its full year results for the year ending 31

December 2022.

During the extended post-balance sheet period for the Group's

full year 2022 consolidated financial statements, management has

conducted a thorough review of the portfolio of contracts,

associated outstanding contractual and commercial issues and

opportunities to improve liquidity by accelerating working capital

inflows.

As a result of the portfolio review, the Group is recognising an

additional EBIT reduction of USUSD140 million to USUSD160 million

in the full year financial statements for 2022. This comprises both

incremental project costs and a cautious view of the quantum and

timing of recognition of certain revenue claims that would have

partly offset those costs.

As a consequence, Petrofac now expects to report a full year

Group EBIT loss of approximately USUSD150 million to USUSD170

million for 2022, including an EBIT loss of approximately USUSD240

million to USUSD260 million in Engineering & Construction

(E&C) (1).

Approximately 50% of these additional costs are expected to be

paid over the remainder of 2023, with the balance spread over 2024

and 2025. Any future recoveries from clients would mitigate this

outflow.

Additional costs

Thai Oil Clean Fuels: following the December 2022 Trading

Update, the execution strategy for this uniquely complex project

has been subject to further review during Q1 2023, in consultation

and cooperation with our client and joint venture partners. In

order to de-risk delivery, operational changes have been made,

including changes to subcontractors. A significant proportion of

the resulting costs are expected to be recovered but discussions

have not yet reached a sufficient level of maturity to recognise

this incremental revenue.

Legacy contracts: additional costs relate to final completion

activities on our legacy portfolio, primarily on projects that are

now substantially completed (2). The figures announced today also

include an allowance for adverse settlements as part of our efforts

to accelerate the release of working capital balances.

Liquidity

Net debt at 31 December 2022 was USUSD349 million (3), with

liquidity of USUSD506 million (4).

Petrofac remains focused on ensuring the Group has sufficient

liquidity to support its strategy, including unlocking the

significant working capital balances built up over the period of

the pandemic, as well as collecting cash advances on new

awards.

The Group has made significant progress in extending its

borrowing facilities, having reached agreement in principle with

its lenders to extend all three facilities by 12 months to October

2024. We will update the market following the signing of the

extension agreements.

Tareq Kawash, Petrofac's Group Chief Executive as of 1 April

2023, commented:

"Petrofac's focus is on completing legacy contracts as quickly,

efficiently and safely as possible. We are taking steps to ensure

the financial strength of the business by unlocking working capital

and, where appropriate, balancing long-term value against near-term

liquidity.

"Although we are disappointed to announce additional costs on

these legacy contracts, in particular the Thai Oil Clean Fuels

project, ongoing collaboration with clients and partners will

de-risk future delivery.

"I joined Petrofac because the business has a significant

opportunity to deploy its leading capabilities to help clients

deliver much needed energy infrastructure. This was demonstrated in

the recent significant award of a long-term agreement to support

critical European offshore wind infrastructure. Alongside

converting a healthy pipeline of future opportunities - with a

number of awards at preferred bidder stage - we are working to draw

a line under the projects of the past, putting Petrofac in a strong

position to deliver future growth."

NOTES 1. In the December 2022 Trading Update, the Group EBIT

loss was forecast to be USUSD100 million and the E&CEBIT loss

was forecast to be USUSD190 million. The Group has further analysed

the appropriate timing of therecognition of the incremental costs

on the Thai Oil Clean Fuels project identified in 2022 and

concluded that apost-balance sheet adjustment should have been made

in the income statement of the E&C division for 2021. As

aresult, we will be making a prior year adjustment of approximately

USUSD90 million to the 2021 comparator in the fullyear 2022

consolidated financial statements. This is a reallocation of costs

from 2022 to 2021 and has no impact onthe Group's financial

position at the end of 2022. This adjustment has been included in

the 2022 EBIT loss figuresdisclosed in the main body of this

trading update. 2. Substantially completed contracts are contracts

where a Provisional Acceptance Certificate or thetransfer of care

and custody to the client are imminent and no substantive work

remains to be performed byPetrofac. 3. Net debt comprises

interest-bearing loans and borrowings less cash and short-term

deposits (i.e. excludesIFRS 16 lease liabilities). 4. Liquidity

consists of gross cash and undrawn committed facilities. Gross cash

includes balances held incertain countries whose exchange controls

significantly restrict or delay the remittance of these amounts

toforeign jurisdictions. It also includes balances in joint

operation bank accounts which are generally available tomeet the

working capital requirements of those joint operations, but which

can only be made available to the Groupfor its general corporate

use with the agreement of the joint operation partners.

ENDS

For further information contact:

Petrofac:

James Boothroyd, Head of Investor Relations

James.boothroyd@petrofac.com

Sophie Reid, Group Head of Communications

Sophie.reid@petrofac.com

Teneo (for Petrofac):

+44 (0) 207 353 4200

petrofac@teneo.com

NOTES TO EDITORS

About Petrofac

Petrofac is a leading international service provider to the

energy industry, with a diverse client portfolio including many of

the world's leading energy companies. Petrofac designs, builds,

manages and maintains oil, gas, refining, petrochemicals and

renewable energy infrastructure. Our purpose is to enable our

clients to meet the world's evolving energy needs. Our four values

- driven, agile, respectful and open - are at the heart of

everything we do. Petrofac's core markets are in the Middle East

and North Africa (MENA) region and the UK North Sea, where we have

built a long and successful track record of safe, reliable and

innovative execution, underpinned by a cost effective and local

delivery model with a strong focus on in-country value. We operate

in several other significant markets, including India, South East

Asia and the United States. We have 8,000 employees based across 31

offices globally. Petrofac is quoted on the London Stock Exchange

(symbol: PFC). For additional information, please refer to the

Petrofac website at www.petrofac.com.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B0H2K534

Category Code: TST

TIDM: PFC

LEI Code: 2138004624W8CKCSJ177

OAM Categories: 2.2. Inside information

Sequence No.: 236099

EQS News ID: 1605237

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1605237&application_name=news

(END) Dow Jones Newswires

April 12, 2023 02:00 ET (06:00 GMT)

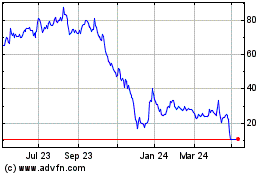

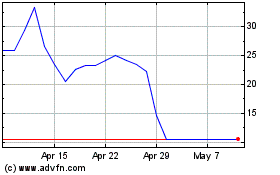

Petrofac (LSE:PFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petrofac (LSE:PFC)

Historical Stock Chart

From Apr 2023 to Apr 2024