Petrofac Limited: Petrofac makes Board appointment and provides business update (1788035)

December 04 2023 - 1:00AM

UK Regulatory

Petrofac Limited ( PFC)

Petrofac Limited: Petrofac makes Board appointment and provides business update

04-Dec-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Press Release

4 December 2023

This announcement contains inside information

PETROFAC MAKES BOARD APPOINTMENT

AND PROVIDES BUSINESS UPDATE

Petrofac Limited ("Petrofac" or "the Company") announces that Aidan de Brunner has today joined the Company as a

Non-Executive Director. Aidan brings to Petrofac over 20 years of board, management, investment and financial advisory

experience gained across a variety of global businesses.

As the Group pivots to the execution of the new contracts won in 2023, Aidan will commit a significant portion of his

time to supporting the Board for a limited period. He will drive engagement with finance providers, investors and other

stakeholders in an active review of strategic and financial options to deliver on Petrofac's potential following its

most successful period for new awards in many years.

Strategic and financial options to strengthen balance sheet

The Board is examining a range of strategic and financial options with the objective of materially strengthening the

Company's balance sheet, securing bank guarantees and improving short-term liquidity. A key aim of this review is to

protect the interests of Petrofac's shareholders, creditors and employees while the Group continues its focus on safe

and effective delivery for its clients.

Management has been making progress in organic actions to unwind working capital, collect receipts on ongoing and new

contracts and to unlock long-outstanding commercial settlements. In addition, Management is considering the sale of

non-core assets, and is actively engaged in discussions with financial investors to take a non-controlling position in

certain other components of the business portfolio. As part of an overall plan, these transactions would result in a

material improvement on the balance sheet. The Company is also exploring potential new financial options across all its

classes of capital.

Business update

Operationally, as demonstrated by its backlog growth, the Group continues to deliver well for its clients, and has a

healthy Group pipeline scheduled for award in the period to the end of 2024.

The full year free cash flow guidance1 provided with our interim results was based, in part, on unwinding historical

working capital and collecting advance payments on the new contracts secured in 2023. While the Group has made progress

in reaching contractual settlements and unwinding working capital, given delays in securing advance payment guarantees,

it no longer expects to receive these advances before the year-end. Consequently, it no longer expects to meet the

guidance previously provided for full year cash flow.

The Group has continued to maintain liquidity above its financial covenant2 and will provide further details in its

trading update on 20 December 2023.

Update on performance guarantees

As noted in Petrofac's H1 results, it is an industry standard contractual requirement to provide Performance Guarantees

for EPC contracts. Banking and surety market appetite for the provision of these guarantees in support of the contracts

won by Petrofac has reduced, resulting in delays in their provision. Petrofac remains in active discussions with its

credit providers to secure the guarantees on the new contracts as well as with the clients of these new contracts. The

measures being taken to strengthen the balance sheet are, in part, designed to secure future guarantees.

Group Chief Executive Tareq Kawash commented: "Petrofac's underlying business is robust with material growth in our

backlog from approximately USUSD5.5 billion in new awards in new and traditional energy this year. This demonstrates our

competitive strength and long-term potential. To deliver on this, we are working hard to address short-term liquidity

challenges and strengthen the financial position of the Group. I am grateful for the continued efforts of our people,

and the support of our clients and other stakeholders, as we work to deliver a positive future for Petrofac."

The Chairman René Médori commented: "The Board is fully focused on reviewing a range of strategic and financial options

with the objectives of strengthening the Group's balance sheet and protecting the interests of all our stakeholders.

The appointment of Aidan de Brunner reinforces the skills and experience of the Board in support of these efforts."

Petrofac will issue its pre-close trading update on 20 December 2023.

Notes

In accordance with Listing Rule 9.6.15, the information to be disclosed pursuant to Listing Rule 9.6.13, are that Aidan

de Brunner is also a non-executive director of Babylon Holdings Limited, a company that was previously listed on the

NYSE. There are no other details to be disclosed.

1 Free cash flow guidance provided with the interim results was that, at Group level, we expected cash flow to be

broadly neutral in 2023.

2 The financial covenant for liquidity is that the Group's liquidity (excluding cash held in joint operations) shall

exceed USUSD75m at each month end.

ENDS

For further information contact:

Petrofac:

James Boothroyd, Head of Investor Relations

James.boothroyd@petrofac.com

Sophie Reid, Group Director of Communications

Sophie.reid@petrofac.com

Teneo (for Petrofac):

+44 (0) 207 353 4200

petrofac@teneo.com

NOTES TO EDITORS

Petrofac

Petrofac is a leading international service provider to the energy industry, with a diverse client portfolio including

many of the world's leading energy companies.

Petrofac designs, builds, manages, and maintains oil, gas, refining, petrochemicals, and renewable energy

infrastructure. Our purpose is to enable our clients to meet the world's evolving energy needs. Our four values -

driven, agile, respectful, and open - are at the heart of everything we do.

Petrofac's core markets are in the Middle East and North Africa (MENA) region and the UK North Sea, where we have built

a long and successful track record of safe, reliable, and innovative execution, underpinned by a cost effective and

local delivery model with a strong focus on in-country value. We operate in several other significant markets,

including India, South East Asia, and the United States. We have 8,500 employees based across 31 offices globally.

Petrofac is quoted on the London Stock Exchange (symbol: PFC).

For additional information, please refer to the Petrofac website at www.petrofac.com

=----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside information in accordance with the Market Abuse

Regulation (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B0H2K534

Category Code: BOA

TIDM: PFC

LEI Code: 2138004624W8CKCSJ177

OAM Categories: 2.2. Inside information

Sequence No.: 289297

EQS News ID: 1788035

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1788035&application_name=news

(END) Dow Jones Newswires

December 04, 2023 02:00 ET (07:00 GMT)

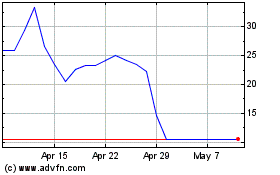

Petrofac (LSE:PFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

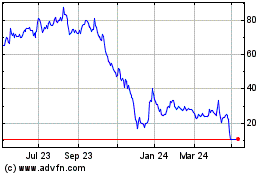

Petrofac (LSE:PFC)

Historical Stock Chart

From Apr 2023 to Apr 2024