TIDMPHC

RNS Number : 7365N

Plant Health Care PLC

27 September 2023

27 September 2023

Plant Health Care plc

( " Plant Health Care", the " Group " and the " Company")

Unaudited Interim Results

Strong second half of 2023 expected to drive material revenue

growth

Plant Health Care(R) (AIM: PHC.L), a leading provider of novel

patent-protected biological products to global agriculture markets,

announces its unaudited interim results for the six months ended 30

June 2023 ("H1 2023").

Financial Highlights:

-- Overall revenue increased 1% to $5.6 million (H1 2022: $5.5 million)

-- Revenue in Brazil was up 48%, driven by in-market demand for

H2Copla(R) (up 29% on-ground) and Saori(R) (up 38%). Revenue in

Mexico was up 12%, while sales in Europe were flat.

-- In the US, distributors delayed purchases of all agricultural

inputs in H1 2023 to drive down inventories in a negative market.

Accordingly, US sales were down 56% in the period, resulting in low

inventories in the channel, pointing to strong sales in H2 2023.

Customer on-ground sales in the field grew strongly, with Employ(R)

up 35% and FASTAND up 9%.

-- Cash used in operations increased 33% to $2.8 million (H1

2022: $2.1 million) due to higher trade receivables and lower

accounts payable offset by inventory improvement. The Group's cash

burn is typically significantly higher in the first half than in

the second half.

-- In June 2023, the Group raised $3.3 million (net of

expenses). Cash as at 30 June 2023 was $5.7 million (2022: $6.3

million).

Operational Highlights:

Distributor agreements

-- Signed exclusive distribution agreement with Novozymes to

launch Harpin<ALPHA><BETA> in Indian sugar cane

production. First commercial sales are expected once registration

is achieved, expected in H1 2024.

-- Following the registration of PHC279 in the USA earlier this

year, a distribution agreement was concluded with Wilbur Ellis(R)

Agribusiness. OBRONA(R) was launched in June of 2023 as a foliar

fungicide for fruits, nuts, vegetables, and row crops. The Company

is now selling PREtec products on three continents.

New product registrations

-- A new PREtec product PHC68949 for the control of soil

nematodes received the first regulatory approvals for commercial

use in Brazil. Full registration is expected in late 2023 or early

2024, ahead of launch into soybeans in 2024. The Group expects to

introduce PHC68949 to other crops in Brazil subsequently.

-- Achieved three significant country registrations for

Harpin<ALPHA><BETA> in Europe (Poland, France and

Cyprus); plans are advancing for product launches in these

geographies, anticipated in 2024.

Outlook:

-- Strong second half of 2023 expected with material revenue

growth anticipated, resulting in revenue for the year in line with

market expectations.

-- On track to achieve revenue of $30 million by 2025 through

continued growth in Harpin<ALPHA><BETA> and the launch

of new peptides, supported by current and new distributor

relationships. This will deliver a fast-growing, profitable and

cash generative business.

Jeff Tweedy, CEO, Plant Health Care, commented: "Market

conditions in H1 2023 have been very challenging for traditional

agricultural input businesses, with most large companies reporting

significant reduction in revenue. The US has been particularly

difficult, with all distributors sharply reducing inventory to

reduce the impact of price volatility and slow demand. Most of the

agribusiness companies saw significant revenue decline in the first

half of 2023 as compared to last year.

In that context, growth outside the US allowed the Group to grow

revenue marginally; importantly, profit margins were maintained.

Strong on ground sales growth in our core markets gives us

confidence in robust revenue growth in H2.

The Group's first-half performance was driven by the growing

demand for Harpin 𝜶 <BETA> and Saori in Brazil.

The Brazilian market for Saori is significant, with potential for

$10 million in revenue. We expect a strong second half revenue

performance, which will underpin the Group's target to deliver $30

million in revenue in 2025.

The Group continues to register new products. We received the

first PREtec approval from the US EPA with the product being

marketed under the brand name OBRONA. With the launch of PREzym (R)

and OBRONA we now market PREtec on three continents, which is a

significant accomplishment. We plan to launch new PREtec products

for the next three years. Our strategy of expanding relationships

with major global distribution partners is on track.

During the first half of the year, we signed a new agreement

with Novozymes in India and a new commercial agreement for OBRONA

with Wilbur-Ellis.

There continues to be strong demand and interest in our

products. The world has an ever-increasing need for more food with

sustainable agriculture at the heart of meeting this need. Farmers

face many challenges, including the impacts of climate change such

as drought, to ensure food security. Plant Health Care helps

farmers solve these problems. Our biological products produce

better quality crops and deliver higher yield, and we are well

placed to benefit as the need for our products increases."

Change of Name of Nominated Adviser and Joint Broker

The Company also announces that its Nominated Adviser and Broker

has changed its name to Cavendish Securities plc following the

completion of its own corporate merger.

Plant Health Care plc Tel: +1 919 926 1600

Jeffrey Tweedy - Chief Executive Officer

Jeffrey Hovey - Chief Financial Officer

Cavendish Securities plc - Nomad & Broker Tel: +44 (0) 131 220 9771

Neil McDonald / Peter Lynch

SEC Newgate (Financial Communications) Tel: +44 (0)7540 106366

Robin Tozer / George Esmond Email: phc@secnewgate.co.uk

About Plant Health Care

Plant Health Care offers products to improve the health, vigour

and yield of major field crops such as corn, soybeans, potatoes and

rice, as well as specialty crops such as fruits and vegetables. We

operate globally through subsidiaries, distributors and supply

agreements with major industry partners. Our innovative,

patent-protected biological products help growers to protect their

crops from stress and diseases, and to produce higher quality fruit

and vegetables, with a favourable environmental profile.

Find out more at www.planthealthcare.com

Chief Executive Officer's Statement

Overview

Plant Health Care is at the heart of the movement toward

sustainable food production. Our core products are derived from

naturally occurring proteins, which make crops healthier, grow

better and able to withstand stress such as drought and disease.

They provide growers with higher yield and better-quality crops,

while having a much lower impact on the environment than

conventional agricultural chemicals.

The last six months have seen difficult economic conditions

around the globe, including high interest rates, causing growers,

particularly in the US, to delay purchases of new supplies, and to

focus on reducing existing inventories. This meant our product

consumption plans previously agreed with distributors were not met

as growers waited for prices to fall. Despite these headwinds,

revenue increased 1% to $5.6 million (H1 2022: $5.5 million). As in

previous years, annual revenue is second half weighted. Most of the

agribusiness companies saw significant revenue decline in the first

half of 2023 as compared to last year. With lower inventories and

strong customer on-ground sales, we are expecting a strong second

half of 2023 with material revenue growth anticipated.

Our balance sheet is strong, with cash used in operations

increasing 33% to $2.8 million (H1 2022: $2.1 million) due to

higher trade receivables and lower accounts payable offset by

inventory improvement. Cash burn is typically significantly higher

in the first half of the year than in the second half. In June

2023, the Group raised $3.3 million (net of expenses). Cash as at

30 June 2023 was $5.7 million (2022: $6.3 million).

Products

While our sales to distributors declined, sales by our

distributors to growers (on-ground sales), increased for various

products, including 9% for FASTAND, 35% for Employ, 29% for

H2Copla, of which 27% is for sugar cane processers. These are all

Harpin<ALPHA><BETA> products. Sales of our first PREtec

product, Saori, increased 38%.

During the period, the Group began switching to our new European

toll manufacturer. Due to this, the Group paid for excess

Harpin<ALPHA><BETA> inventory to ensure that stock

levels are adequate to meet the second half 2023 expected

demand.

Harpin<ALPHA><BETA>

Harpin<ALPHA>ß is a recombinant protein that acts as a

powerful biostimulant, improving the yield and quality of crops.

The Group sells Harpin<ALPHA>ß through specialist

distributors around the world. During the first half of 2023, the

Group continued to see the accelerated adoption of

Harpin<ALPHA>ß in Brazil as sales to sugar processors

increased.

Harpin revenue in South America and Mexico increased but fell in

North America. This meant overall Harpin 𝜶 <BETA>

revenue decreased by 15% to $2.8 million (H1 2022: $3.3 million).

This decrease was due to severe drought in the Midwest and delayed

purchases by growers.

PREtec

The Company's PREtec technology platform (Vaccines for

Plants(TM)) continues to develop. Derived from natural proteins,

PREtec is an environmentally friendly technology which stimulates

crop growth and ability to withstand a variety of abiotic stresses

as well as to improve disease control, plant health and yield.

PREtec is compatible with mainstream agricultural practices.

The Group is building on the successful launch of our first

PREtec product, Saori used in Brazil for the prevention and

treatment of soybean diseases. Saori was fully launched in Brazil

in the second quarter of 2022 and has generated revenue of $1.8

million. Overall sales of PREtec products are $2.0 million.

After ten years and an investment of more than $25 million, the

Group has launched PREtec on three continents with new launches

planned every year for the next three years pending regulatory

approvals.

The Group is extending the development of PREtec products in

Europe and elsewhere over the coming years. Europe is the world's

largest market for sustainable agriculture with annual sales of

over $2 billion and is, therefore, an attractive opportunity for

PREtec. Substantial opportunities also exist for PREtec products in

other countries across South and Central America, Mexico,

Australia, and Asia. These markets will be pursued as resources

permit.

Geographic growth

During the period, the Group continued to expand and deepen its

presence across the world, focusing on the largest agricultural

producers, in North and South America, Europe, and most recently,

India.

North America

Total revenue in North America was $0.6 million (2022: $1.4

million) which follows 2022 which was the best year in North

America in the Group's history. Delayed grower purchases reduced

first half purchases of our products by distributors. However,

Harpin on-ground sales in North America were up 52% versus

2022.

In June, the Group concluded a distribution agreement with

Wilbur-Ellis(R) Agribusiness, one of the largest US retailers of

agricultural products. The agreement will support commercial sales

of OBRONA , a foliar fungicide recently approved by the US EPA. In

June of 2023, the Group had its first sale of OBRONA generating

revenue of $0.1 million to Wilbur-Ellis. OBRONA is a unique product

developed to help growers control a wide range of fungal and

bacterial plant pathogens in fruits, nuts, vegetables, and row

crops.

Plant Health Care and Wilbur-Ellis have been working together in

an exclusive partnership since 2020 to evaluate and develop PHC279,

the active ingredient in OBRONA, for high value specialty and row

crop markets. PHC279 is the first product from the Company's PREtec

technology platform that is available to US farmers.

Looking ahead, we expect growth in the US, especially for our

OBRONA and Employ products used for row crops.

South America

The Group is present in Brazil, Argentina, and Chile with plans

to launch in Uruguay by 2024. Total revenue was $1.9 million (2022:

$1.3 million) , primarily driven by increased sales of Saori onto

soybeans and continued strong demand for H2Copla

(Harpin<ALPHA><BETA>) from sugar cane processors. In

the 2023/24 season, the area planted with sugar cane in Brazil is

forecast to be 9.8 million hectares, and in the 2022/23 season,

sugar cane was planted on 8.3 hectares.

In May 2022, Plant Health Care and Nutrien Soluções Agrícolas,

the retail business of Nutrien in Brazil, signed a five-year

commercial agreement under which the Group will supply Saori for

Nutrien's use on soybeans in Brazil. Nutrien is the world's largest

provider of crop inputs and services. Nutrien expects to expand

Saori use to more than one million hectares by 2025. The Company's

revenue from sales of Saori to Nutrien is expected to grow to more

than $5 million by 2025.

In May, o ur new PREtec product PHC68949 received the first

stage of regulatory approval for commercial use in Brazil. This is

a novel technology that amplifies a plant's natural defence against

damaging nematodes, resulting in increased plant health and yield

in a variety of crops. Nematodes are microscopic parasitic worms

living in the soil where they feed on plant roots, killing plants

and reducing crop yields. Globally, nematodes have been estimated

to cause up to 12.3% of annual crop loss, worth approximately $157

billion per year.

After its initial launch for use in soybeans, the Group expects

to introduce PHC68949 in other crops in Brazil. According to a

recently published report by Kynetec, the use of nematicides in

Brazil has increased 10-fold since 2015, with soybeans accounting

for 52% of the use, followed by sugarcane at 23%, with the

remainder on corn, cotton, coffee, potatoes and 14 other crops.

After the period-end in August, the Group's biochemical

fungicide, PHC279, for the control of sugar cane and coffee disease

received federal approval in Brazil. As well as being the world's

largest producer of sugar cane, Brazil is also the biggest coffee

producer. In the 2023/24 season, the area planted with coffee was

more than 2.5 million hectares. In the 2021/22 season, Brazilian

farmers spent more than US$127 million on the control of coffee

diseases.

Overall, South America has performed well despite significant

market headwinds. We expect significant growth to continue as more

products are approved.

Mexico

In Mexico, the Group also distributes third-party biological

products. In Mexico, revenue was up 12% to $2.0 million (H1 2022:

$1.7 million) due to continued expansion into the agave and avocado

markets. In September, Plant Health Care submitted applications to

the Mexican regulatory agency for approval to commercialise the

newest products derived from the Company's PREtec technology

platform (Vaccines for PlantsTM), PHC25279 and PHC68949, for use on

major crops

EMEAA

Revenue in EMEAA was flat at $1.2 million (2022: $1.2 million)

due to drought conditions in Spain.

Following the initial regulatory approval of Harpin

<ALPHA><BETA> in France in October 2022, Plant Health

Care has pursued Mutual Recognition to expand the use of

Harpin<ALPHA><BETA> across Europe. Europe is the

world's largest market for sustainable agriculture with annual

sales of over $2 billion.

In August, Harpin<ALPHA><BETA> successfully achieved

Mutual Recognition in Poland. This is a major milestone for the

Group and permits immediate sales of

Harpin<ALPHA><BETA> in Poland. Poland is the sixth

largest agricultural producer in the European Union, and the second

largest potato producer behind Germany, growing around 322,000

hectares.

The Group launched PREzym in Portugal, and last year, announced

a trials agreement with Agrii UK under which Agrii evaluated the

Group's PREtec technology. Studies indicated promising results with

PREtec products in potatoes, resulting in improved potato quality

and yield, with significantly lower environmental impact than many

agrochemical treatments.

In January 2023, the Group signed an agreement for the exclusive

distribution of Harpin<ALPHA><BETA> for use in sugar

cane production in India with Novozymes South Asia Pvt. Ltd. First

commercial sales are expected to commence in the first half of

2024, after receipt of the required regulatory approvals. This is

the first product introduced into India by the Group. India is the

world's second largest producer of sugar cane with about five

million hectares under cultivation.

Looking ahead, the Group will continue to expand across Europe

and India and is exploring new opportunities in Asia.

Outlook

We are expecting a strong second half of 2023 with material

revenue growth anticipated. The Board expects to achieve full-year

market expectations despite macro-level, market-driven challenges

like inflation and increasing interest rates.

The continued expansion of Plant Health Care's relationships

with large distributors has given us greater visibility of

on-ground sales, which improves our ability to forecast demand,

plus broad access to specialty and row crop markets.

The Board remains confident about the prospects of building a

growing, profitable commercial business, as sales of

Harpin<ALPHA><BETA> continue to increase due to market

expansion and new registrations.

We are on track to achieve revenue of $30 million by 2025

through the launch of new PREtec peptides, and organic business

growth through current and future distributor relationships.

Jeffrey Tweedy

Chief Executive Officer

27 September 2023

Chief Financial Officers Statement

Summary of financial results

Financial highlights for the six months ended 30 June 2023, with

comparatives for the six months ended 30 June 2022, are set out

below:

2023 2022

$'000 $'000

Revenue 5,603 5,554

Gross profit 3,386 3,411

Research and development (1,357) (1,433)

Sales and marketing (2,202) (2,136)

Administrative (1,553) (1,630)

Non-cash expenses (831) (787)

Foreign exchange gain/ (loss) *** 18 (3,607)

----------------------------------- ----------- ----------

Total operating expenses (5,925) (9,593)

Operating loss (2,539) (6,182)

----------------------------------- ----------- ----------

Net finance (expense)/ income 24 (105)

Net loss for period before tax (2,515) (6,287)

----------------------------------- ----------- ----------

*** - includes non-cash currency gain of $18 thousand primarily

related to inter-group loans with subsidiaries and other payments

in foreign currencies (H1 2022: $3.6 million currency losses).

Cash operating expenses decreased $0.1 million to $5.1 million

(H1 2022: $5.2 million).

The reconciliation of operating loss to LBITDA is as

follows:

2023 2022

($'000) ($'000)

Operating loss (2,539) (6,182)

Depreciation/amortisation 338 322

Share-based payments 473 465

Intercompany foreign exchange

(gain) / loss (18) 3,607

Adjusted LBITDA (1,746) (1,788)

Revenue

Revenues for the six-month period ended 30 June 2023 were $5.6

million (H1 2022: $5.5 million) producing a gross profit of $3.4

million (H1 2022: $3.4 million) and the loss before tax was $2.5

million (H1 2022: $6.3 million). The gross profit margin was 60%

(H1 2022: 61%). The decrease in gross margin was due to decreased

sales into the North American market due to market severe drought

in the Midwest and excess inventory in the channel, offset by

higher margin Saori sales in South America.

Harpin<ALPHA><BETA> revenue decreased 15% (19% constant

currency) to $2.8 million (H1 2022: $3.3 million).

Harpin<ALPHA><BETA> revenues were primarily lower than

prior year due to severe drought in the Midwest and excess

inventory in the channel in the US specialty markets, offset by

increased sales of 68% into the sugar cane market in Brazil. Saori

revenues increased 38% to $1.1 million (H1 2021: $0.8 million) in

Brazil due to increased demand from soybean producers.

Cash operating expenses

Operating expenses, excluding non-cash items, decreased $0.1

million to $5.1 million (H1 2022: $5.2 million) due to decreased

Administration expenses offset by increased sales and marketing

expenses associated with the expansion of the commercial business

globally. Adjusted LBITDA decreased $0.1 million to $1.7 million

(H1 2021: $1.8 million) primarily due to decreased operating

expenses and gross margin was consistent with the prior year.

Operating expenses

Operating expenses decreased by $3.7 million for the six-month

period to $5.9 million (2021: $9.6 million). This is primarily due

to $3.6 million of non-cash currency losses primarily related to a

Pound Sterling loan with a subsidiary company (H1 2022: $3.6

million currency losses).

Cash position and liquidity

As of 30 June 2023, the Group had cash and investments of $5.7

million. Cash, working capital and costs continue to be tightly

controlled.

Net cash outflows from operating activities increased 33% to

$2.8 million (H1 2022: $2.1 million and H2 2022: $0.6 million ).

The increase is due to increased inventory payments due to the

switch to a new toll manufacturer to ensure adequate stock to meet

second half demand and increased receivable balance due to delay in

payment from a North American customer.

Net cash used in financing activities increased $3.4 million (H1

2022: $9.2 million net cash flows from financing activities). The

increase is due to the June 2023 equity raise of $3.3 million (net

of costs).

Jeffrey Hovey

Chief Financial Officer

27 September 2023

Consolidated statement of comprehensive income

FOR THE SIX MONTHSED 30 JUNE 2023

Six months Six months

to 30 June to 30 June

2023 2022

(Unaudited) (Unaudited)

Note $'000 $'000

Revenue 5,603 5,554

Cost of sales (2,217) (2,143)

Gross profit 3,386 3,411

Research and development (1,546) (1,740)

Sales and marketing (2,221) (2,136)

Administrative expenses (2,158) (5,717)

-------------------------------------- ----- --------------------- -------------------

Operating loss 3 (2,539) (6,182)

Finance income 68 11

Finance expense (44) (116)

-------------------------------------- ----- --------------------- -------------------

Loss before tax (2,515) (6,287)

Income tax expense (73) (50)

Net loss for the period (2,588) (6,337)

-------------------------------------- ----- --------------------- -------------------

Other comprehensive income:

Exchange difference on translation

of foreign operations 290 (446)

-------------------------------------- -----

Total comprehensive loss

for the period (2,298) (2,811)

====================================== ===== ===================== ===================

Basic and diluted loss per

share 6 $(0.01) $(0.01)

====================================== ===== ===================== ===================

Consolidated statement of financial position

AT 30 JUNE 2023

30 June 31 December

2023 2022

(Unaudited) (Audited)

Note $'000 $'000

Assets

Non-current assets

Intangible assets 1,985 1,620

Property, plant and

equipment 588 644

Right-of-use assets 367 586

Trade and other receivables 159 146

Total non-current assets 3,099 2,996

---------------------------------------- ------------------------- ------------------

Current assets

Inventories 3,072 3,371

Other receivables 2,520 1,801

Cash and cash equivalents 5,745 5,656

---------------------------------------- ------------------------- ------------------

Total current assets 11,337 10,828

---------------------------------------- ------------------------- ------------------

Total assets 14,436 13,824

---------------------------------------- ------------------------- ------------------

Liabilities

Current liabilities

Trade and other payables 2,508 3,235

Borrowings 167 55

Lease liabilities 289 437

Total current liabilities 2,964 3,727

---------------------------------------- ------------------------- ------------------

Non-current liabilities

Borrowings 188 215

Long term lease liabilities 108 192

Total non-current liabilities 296 407

---------------------------------------- ------------------------- ------------------

Total liabilities 3,260 4,134

---------------------------------------- ------------------------- ------------------

Total net assets 11,176 9,690

======================================== ========================= ==================

Capital and reserves

attributable to owners

of the Company

Share capital 4,788 4,352

Share premium 103,734 100,859

Foreign exchange reserve 3,146 2,856

Retained deficit (100,492) (98,377)

----------------------------------------

Total equity 11,176 9,690

======================================== ========================= ==================

Consolidated statement of cash flows

FOR THE SIX MONTHSED 30 JUNE 2023

Six months ended Six months ended

30 June 30 June

2023 2022

(Unaudited) (Unaudited)

$'000 $'000

Cash flows from operating activities

Loss for the year (2,589) (6,337)

Adjustments for:

Depreciation of property, plant

and equipment 107 112

Depreciation of right-of-use assets 231 215

Amortisation of intangibles - 1

Share-based payment expense 474 465

Finance income (68) (11)

Finance expense 44 116

Foreign exchange (loss)/ gain (18) 3,607

Income taxes paid 73 49

Decrease in trade and other receivables (634) 180

Gain on disposal of fixed assets - -

(Increase)/decrease in inventories 432 (1,275)

Increase/(decrease) in trade and

other payables (822) 560

Income taxes received (73) 179

Net cash used in operating activities (2,843) (2,139)

------------------------------------------ ----------------- -----------------

Investing activities

Purchase of property, plant and

equipment (37) (286)

Sale of property, plant and equipment - -

Finance income 68 (85)

Purchase of investments - -

Sale of investments - 3,868

Investment in internally generated (365) -

intangible assets

------------------------------------------ ----------------- -----------------

Net cash (used)/provided by investing

activities (334) 3,497

------------------------------------------ ----------------- -----------------

Financing activities

Finance expense (31) (90)

Lease payments (260) (235)

Issue of ordinary share capital 3,311 -

Borrowings 252 -

Payment of borrowings (170) (14)

------------------------------------------ ----------------- -----------------

Net cash provided/(used) by financing

activities 3,102 (339)

------------------------------------------ ----------------- -----------------

Net increase/(decrease) in cash

and cash equivalents (75) 1,019

Effects of exchange rate changes

on cash

and cash equivalents 164 (58)

Cash and cash equivalents at beginning

of period 5,656 1,005

------------------------------------------ ----------------- -----------------

Cash and cash equivalents at end

of period 5,745 1,966

========================================== ================= =================

Notes to the unaudited financial information

1 General information

Plant Health Care plc is a company incorporated and domiciled in

England. The unaudited interim financial information of the Group

for the six months ended 30 June 2023 comprise the Company and its

subsidiaries (together referred to as the "Group").

The Board of Directors approved this interim report on 26

September 2023.

2 Basis of preparation and accounting policies

These interim consolidated financial statements have been

prepared using accounting policies based on international

accounting standards in conformity with the requirements of the

Companies Act 2006. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 31 December 2022 Annual

Report. The financial information for the half years ended 30 June

2023 and 30 June 2022 does not constitute statutory accounts within

the meaning of Section 434 (3) of the Companies Act 2006 and both

periods are unaudited.

The annual financial statements of Plant Health Care Plc ('the

Group') are prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006. The statutory Annual Report and Financial Statements for the

year ended 31 December 2022 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Financial Statements for this year end was unqualified, did not

draw attention to a matter by way of emphasis, and did not contain

a statement under 498(2) or 498(3) of the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 31 December 2022 annual financial statements, except for

those that relate to new standards and interpretations effective

for the first time for periods beginning on (or after) 1 January

2023 and will be adopted in the 2023 financial statements. There

are deemed to be no new and amended standards and/or

interpretations that will apply for the first time in the next

annual financial statements that are expected to have a material

impact on the Group.

Going Concern

In assessing whether the going concern basis is appropriate for

preparing the interim results for 2023, the Directors have utilised

the Group's detailed forecasts, which take into account its current

and expected business activities, its cash and cash equivalents

balance and investments of $6.3 million. The principal risks and

uncertainties the Group faces and other factors impacting the

Group's future performance were considered. The directors confirm

that they have a reasonable expectation that the group will have

adequate resources to continue in operational existence for the

next 12 months from approval of these financial statements and

accordingly these financial statements are prepared on a going

concern basis, with no material uncertainty over going concern. As

such, the interim consolidated financial statements have been

prepared on a going concern basis.

3 Operating loss

Six months

to Six months to

30 June 30 June

2023 2022

(unaudited) (unaudited)

$'000 $'000

Operating loss is stated after

charging:

Depreciation 338 327

Amortisation - 1

Share-based payment expense 474 465

Foreign exchange (gain)/loss (18) 3,607

4 Segment information

The Group views, manages and operates its business according to

geographical segments. Revenue is generated from the sale of

agricultural products across all geographies.

Six months to 30 June 2023 (unaudited)

Rest

of Total New

Americas Mexico World Elimination Commercial Technology Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Revenue*

Proprietary

product

sales 2,541 460 1,101 - 4,102 - 4,102

Third-party

product

sales - 1,501 - - 1,501 - 1,501

Inter-segmental

product sales 630 - 130 (760) - - -

Total revenue 3,171 1,961 1,231 (760) 5,603 - 5,603

----------- ---------- ------- -------------- ------------- ------------- --------

Cost of sales (1,432) (1,038) (507) 760 (2,217) - (2,217)

Research and

development - - - - - (1,125) (1,125)

Sales and

marketing (1,294) (484) (460) - (2,238) (56) (2,294)

Administration (659) (205) (54) - (918) (95) (1,013)

Non-cash

expenses:

Depreciation (93) (43) (13) - (149) (189) (338)

Amortisation - - - - - - -

Share-based

payment (68) (1) (22) - (91) (213) (304)

----------- ---------- ------- -------------- ------------- ------------- --------

Segment

operating

(loss)/profit (375) 190 175 - (10) (1,678) (1,688)

Corporate

expenses

**

Wages and

professional

fees (824)

Administration

*** (27)

Operating loss (2,539)

Finance income 69

Finance expense (45)

----------- ---------- ------- -------------- ------------- ------------- --------

Loss before tax (2,515)

----------- ---------- ------- -------------- ------------- ------------- --------

* Revenue from one customer within the Americas segment totalled

$1,037,000 or 19% of Group revenues.

Revenue from one customer within the Americas segment totalled

$862,000 or 15% of Group revenues.

Revenue from one customer within the Americas segment totalled

$784,000 or 14% of Group revenues

** These amounts represent public company expenses for which

there is no reasonable basis by which to

allocate the amounts across the Group's segments.

*** Includes net share-based payments expense of $170,000

attributed to corporate employees who are not affiliated with any

of the Commercial or New technology segments.

Six months to 30 June 2022 (unaudited)

Rest

of Total New

Americas Mexico World Elimination Commercial Technology Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Revenue*

Proprietary

product

sales 2,659 282 1,158 - 4,099 - 4,099

Third-party

product

sales 2 1,452 1 - 1,455 - 1,455

Inter-segmental

product sales 857 - - (857) - - -

Total revenue 3,518 1,734 1,159 (857) 5,554 - 5,554

----------- ------- ------- -------------- ------------- ------------- --------

Cost of sales (1,752) (897) (351) 857 (2,143) - (2,143)

Research and

development - - - - - (1,245) (1,245)

Sales and

marketing (1,254) (375) (411) - (2,040) (106) (2,147)

Administration (630) (128) (49) - (807) (130) (937)

Non-cash

expenses:

Depreciation (74) (41) (7) - (122) (200) (321)

Amortisation - - (1) - (1) - (1)

Share-based

payment (80) - (23) - (103) (223) (326)

----------- ------- ------- -------------- ------------- ------------- --------

Segment

operating

(loss)/profit (272) 293 317 - 338 (1,904) (1,566)

Corporate

expenses

**

Wages and

professional

fees (965)

Administration

*** (3,651)

Operating loss (6,182)

Finance income 11

Finance expense (116)

----------- ------- ------- -------------- ------------- ------------- --------

Loss before tax (6,287)

----------- ------- ------- -------------- ------------- ------------- --------

* Revenue from one customer within the Americas segment totalled

$1,146,000 or 21% of Group revenues.

* Revenue from one customer within the Americas segment totalled

$775,000 or 14% of Group revenues.

** These amounts represent public company expenses for which

there is no reasonable basis by which to

allocate the amounts across the Group's segments.

*** Includes net share-based payments expense of $80,000

attributed to corporate employees

who are not affiliated with any of the Commercial or New

technology segments. Includes $0.4

million foreign exchange gains in non-US dollar denominated

inter-company funding.

6 Loss per share

Basic loss per ordinary share has been calculated on the basis

of the loss for the period of $2,588,000 (loss for the six months

ended 30 June 2022: $6,337,000) and the weighted average number of

shares in issue during the period of 310,423,602 (six months ended

30 June 2022: 304,662,482).

The weighted average number of shares used in the above

calculation is the same as for total basic loss per ordinary share.

Instruments that could potentially dilute basic earnings per share

in the future have been considered but were not included in the

calculation of diluted earnings per share because they are

anti-dilutive for the periods presented. This is due to the Group

incurring losses on continuing operations for the period.

7 Cautionary statement

This document contains certain forward-looking statements

relating to Plant health Care plc ('the Group'). The Group

considers any statements that are not historical facts as

"forward-looking statements". They relate to events and trends that

are subject to risk and uncertainty that may cause actual results

and the financial performance of the Group to differ materially

from those contained in any forward-looking statement. These

statements are made by the directors in good faith based on

information available to them and such statements should be treated

with caution due to the inherent uncertainties, including both

economic and business risk factors, underlying any such

forward-looking information .

Copies of this report and all other announcements made by Plant

Health Care plc are available on the Company's website at

www.planthealthcare.com/for-investors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKABBABKDDCB

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

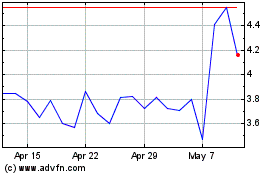

Plant Health Care (LSE:PHC)

Historical Stock Chart

From Apr 2024 to May 2024

Plant Health Care (LSE:PHC)

Historical Stock Chart

From May 2023 to May 2024