Aviva PLC, Phoenix Group Take on GBP1.4 Billion Bulk Annuities from M&S

May 17 2018 - 7:54AM

Dow Jones News

By Adam Clark

Insurers Aviva PLC (AV.LN) and Phoenix Group Holdings (PHNX.LN)

said Thursday that they have completed a combined 1.4 billion-pound

($1.88 billion) purchase of bulk annuities from the Marks &

Spencer Group PLC (MKS.LN) pension plan.

Aviva has taken on GBP925 million of bulk annuities, while

Phoenix has taken on GBP470 million of annuities. The insurers said

the deal will cover a proportion of the liabilities of M&S's

retired pension plan members.

Aviva said the deal builds on its existing insurance services

for M&S's retail banking operations. Both Aviva and Phoenix

said the deal establishes an umbrella framework for future

potential pension de-risking deals with M&S.

"Not only does this latest deal build on the great relationship

we already have with Marks & Spencer but as our largest bulk

annuity deal to date, it also perfectly demonstrates our increased

appetite for bigger deals," said Tom Ground, managing director of

defined benefit solutions at Aviva.

Justin Grainger, head of bulk purchase annuities at Phoenix,

said: "We announced our intention to enter this market in 2017 as

it offers an additional and complementary source of growth for

Phoenix. We look forward to building our relationship further with

Marks & Spencer and helping protect the security of their

members' benefits."

Write to Adam Clark at adam.clark@dowjones.com

(END) Dow Jones Newswires

May 17, 2018 08:39 ET (12:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

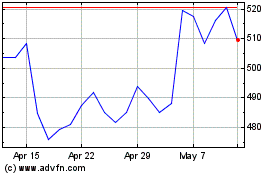

Phoenix (LSE:PHNX)

Historical Stock Chart

From Apr 2024 to May 2024

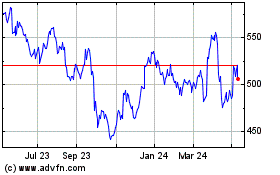

Phoenix (LSE:PHNX)

Historical Stock Chart

From May 2023 to May 2024