TIDMPOS

RNS Number : 5906U

Plexus Holdings Plc

19 October 2010

Plexus Holdings PLC / Index: AIM / Epic: POS / Sector: Oil

equipment & services

19 October 2010

Plexus Holdings plc ('Plexus' or 'the Group')

Preliminary Results for the year to 30 June 2010

Plexus Holdings plc, the AIM quoted oil and gas engineering

services business and owner of the proprietary POS-GRIP(R) method

of wellhead engineering announces its preliminary results for the

year ending 30 June 2010.

Results

-- Revenue of GBP13.1m (2009: GBP15.1m)

-- Profit before tax of GBP0.6m (2009: GBP1.8m)

-- EBITDA of GBP3.4m before IFRS 2 share based payment charges

of GBP0.21m (2009: GBP4.3m before IFRS 2 share based payment

charges of GBP0.19m)

-- Gross margin increase to 58.5% (2009: 57.9%)

-- Basic earnings per share of 0.88p (2009: 1.27p)

Highlights

-- EBITDA and profit before tax in line with market

expectations; profit after tax ahead of market expectations

-- Increasing industry awareness of the benefits of POS-GRIP(R)

friction grip technology wellhead equipment following recent events

in the Gulf of Mexico

-- Initiation of Joint Industry Project ('JIP') inviting

investment for the accelerated development of a POS-GRIP "HGSS"(TM)

subsea wellhead

-- New assembly and test facility building in Aberdeen opened

May 2010 to support anticipated future growth in High Pressure/High

Temperature ('HP/HT') and Extreme High Pressure/High Temperature

('X-HP/HT') activities

-- HP/HT contract wins with GDF Suez Egypt for GBP0.6m, Maersk

Oil North Sea UK Limited ('Maersk') for an estimated initial

GBP3.0m, Sonangol Pesquisa e Producao ('Sonangol') for GBP0.7m, and

new customer Senergy Limited at GBP0.7m

-- Expanding geographic reach - winning of business with new

customers in three new territories; offshore Cameroon in West

Africa with Bowleven plc, offshore Tunisia in North Africa with

Cairn Energy PLC Group, and offshore Angola in South West Africa

with Sonangol

-- Further contract wins with Dubai Petroleum Establishment,

Transocean Drilling U.K. Limited and Wintershall Noordzee B.V.

-- Post period end Plexus is confident that it will be awarded

its first contract win in Australia with another new customer

-- Continued capital investment of GBP3.3m (2009: GBP3.1m)

including the addition of two more HP/HT wellhead equipment sets at

a cost of circa GBP1.5m

-- Research and Development ('R&D') spend, excluding costs

of building new test fixtures, increased by 114% to GBP0.75m (2009:

GBP0.35m)

-- Strengthened the Board - appointed industry and wellhead

equipment specialist Geoff Thompson as Non-Executive Director in

June 2010

-- Post period end, renewal, increase, and extension of bank

facilities in September 2010. New GBP5m credit facility on a three

year revolving basis increased from GBP4m, with additional GBP1m

overdraft on a yearly term

-- The Board is today proposing an increased final dividend of

0.39p per share (2009: 0.38p), which will be subject to shareholder

approval at the Annual General Meeting ('AGM') to be held on 30

November 2010. If approved the dividend will be paid on 10 December

2010 to all members appearing on the register of members on the

record date 29 October 2010. The ex-dividend date for the shares is

27 October 2010.

For further information please visit www.posgrip.com or

contact:

Ben van Bilderbeek Plexus Holdings PLC Tel: 020 7795 6890

Graham Stevens Plexus Holdings PLC Tel: 020 7795 6890

Jon Fitzpatrick Cenkos Securities PLC Tel: 020 7397 8900

Ken Fleming Cenkos Securities PLC Tel: 0131 220 6939

Felicity Edwards St Brides Media & Finance Tel: 020 7236 1177

Ltd

Susie Geliher St Brides Media & Finance Tel: 020 7236 1177

Ltd

Results

Chief Executive Ben van Bilderbeek said:

"I am pleased to report that Plexus has maintained its level of

key POS-GRIP HP/HT wellhead revenues and has also continued to win

new customers in new territories around the world. This resulted in

sales being wider spread than ever before with our UK and European

sales in the year accounting for under half of revenues. This has

been achieved despite the difficult trading conditions faced by the

oil and gas industry and the world economy as a whole over the last

financial year, from which Plexus was not immune. Continuing oil

and gas price volatility, which by mid 2009 had taken prices close

to levels last seen in 2005, combined with continuing bank funding

constraints for smaller operators, inevitably meant that oil

companies reduced investment plans, and the associated expenditure

on oil services is only anticipated to strengthen in the second

half of 2010 and beyond. In the meantime a number of large mergers

and acquisitions have taken place between oil services companies,

particularly in the USA, which further underlines the changing

nature of the industry.

"Looking to the future it is inevitable that many of our current

engineering initiatives, which form an important part of our growth

strategy, have to be considered against the back-drop of the recent

incident in the Gulf of Mexico earlier this year. Although it is

still unclear what the definitive causes were as the official

reports have not yet been published, or indeed what the full

regulatory impact and industry responses will be over the coming

months and years, what is clear is that there will be more scrutiny

and assessment of current drilling practices and technologies than

ever before.

"Plexus has consistently maintained that the unique advantages

of its proprietary POS-GRIP technology in terms of safety,

operational performance, and cost savings will result in its wider

acceptance and deployment, not only for jack-up surface drilling

but also for production wellheads and subsea wellhead applications,

and we believe that the conditions for communicating this message

are now more favourable than ever before.

"In view of these developments we make no apologies for

repeating that we advocate, in the strongest possible terms, a

number of basic engineering and common sense principles which

POS-GRIP wellhead technology addresses. In simple terms these are

that for all oil and gas drilling applications the blow out

preventers ('BOP') should not be lifted from the well to enable the

landing of casing and energising of seals; that all casing and

tubing hangers should be locked down with sufficient capacity to

withstand the forces that can manifest themselves in the well; that

wellheads which have to provide effective sealing throughout and

beyond the productive life of a well should be designed using seals

which avoid the loss of integrity over time as is often the case

with alternative sealing methods; and that wellhead equipment test

standards need to reflect a system's ability to withstand 'true'

field life conditions, and need to match the accepted higher

standards of other critical performance items of equipment in the

well such as casing and tubing couplings.

"For these reasons we remain confident that our organic business

and relationships with key customers will continue to develop and

grow, whilst at the same time we pursue commercial opportunities

with potential licensees and alliance partners over the coming

years. Finally I am pleased to announce that the Directors propose

an increased final dividend of 0.39p per share for the year ended

30 June 2010 which will be submitted for formal approval at the

Annual General Meeting."

Summary of Results for the year ended 30 June 2010

2010 2009

GBP'000 GBP'000

Revenue 13,142 15,105

EBITDA - before the effect of

IFRS 2 3,416 4,316

EBITDA - after the effect of IFRS

2 3,202 4,126

Profit before taxation 645 1,798

Basic earnings per share (pence) 0.88 1.27

Chairman's Statement

Business progress

I am pleased to report that the Group made strong progress in a

number of strategic areas including the winning of new customers

and expansion into new territories together with the ongoing

development of key intellectual property and associated research

and development. A stronger second half resulted in a full year

EBITDA of GBP3.4m (before IFRS 2 share based payment charges of

GBP0.21m) in line with market expectations, resulting in earnings

per share of 0.88p.

Strategy

As Plexus continues to extend its geographic reach, which during

the last financial year included for the first time offshore

Cameroon, Tunisia, and Angola we are in no doubt that the industry

is becoming increasingly aware of our proprietary and patented

friction grip technology and the significant advantages that it can

deliver in terms of safety, time savings, and operational

performance throughout the field life of a well. We are committed

to the growth of our organic exploration wellhead rental business

and are continuing to invest in the necessary infrastructure,

systems, and processes to support this strategy. At the same time

we fully recognise that the POS-GRIP method of engineering also

delivers particular advantages for production wellhead applications

and for subsea wellheads, as well as related new product

development opportunities such as our 15,000psi Tieback project

which we hope will be of major benefit to the HP/HT jack-up

drilling exploration sector, hence the 114% increase in our R&D

spend (excluding costs of building new test fixtures) during the

last financial year.

Our continued investment in a number of key areas has given

strategic support to our day to day operations during the last

financial year, and is an indicator of the continuing maturity of

the business and our ability to play an important role in the oil

services arena. These included the GBP0.6m investment in a new

assembly and test building at our facility in Aberdeen which opened

on time and on budget in May 2010, the initiation of a number of

new patents which we believe will have considerable value over the

coming years, and the successful certification of the Plexus

management system for both ISO 9001:2008 and OHSAS 18001:2007. Such

systems and health and safety initiatives are an increasingly

important part of our customers' requirements and both standards

are recognised throughout the industry as important operational and

commercial milestones.

Turning to non organic strategic initiatives these inevitably

centre on POS-GRIP friction grip technology and our ongoing drive

and determination to gain the widest acceptance of our technology

within the oil and gas industry. We believe that there are very

good reasons for revisiting certain industry standards and

practices surrounding wellhead equipment testing and design, some

of which have been highlighted as a result of the Gulf of Mexico

subsea incident in April 2010. For example the importance of casing

being locked down in place in the seal assembly with sufficient

force, and in a timely manner with the minimum opportunity for

delays and failures as can happen with lock down rings has been

cited by the USA Department of Interior. The simplicity and

predictable nature of POS-GRIP technology addresses these issues in

a uniquely beneficial way as inherent in the POS-GRIP design is

anti-rotation and preloaded lockdown as friction works in all

directions (i.e. tubular members are held radially and axially).

Furthermore we believe that effective seals that provide protection

beyond the productive life of a well and which do not rely on the

use of elastomeric/resilient seals which lose integrity should be a

basic requirement of well design. This is even more the case with

subsea wellheads where unlike surface wellheads remedial solutions

are not readily available, and where POS-GRIP can deliver true

metal to metal seals with a large contact area activated by large

external forces. To accelerate the possibility of developing a

superior POS-GRIP subsea wellhead we have launched a JIP initiative

that invites a number of key operators and oil service companies to

participate in funding the development of a POS-GRIP HGSS subsea

wellhead.

The subsea wellhead JIP is an exciting new development. We are

proposing to develop and build a subsea wellhead system that will

have fewer parts in the well bore than any other wellhead equipment

available on the market, a system which seals and locks hangers

down as soon as cementing is complete, and a system which is

inherently resistant to contamination as our system has no moving

parts exposed to well bore fluids.

Such Plexus initiatives to improve existing standards and

practices extend also to surface wellheads where the chance of

avoiding and controlling potential blow outs are clearly

significantly increased by the use of "through the BOP" wellhead

designs such as POS-GRIP, as opposed to spool type (often known as

'slip and seal') wellheads where the removal of the BOP is required

to cut casing. Such established procedures cost time and generate

unnecessary risk to personnel and the environment, and are related

to the fact that such designs are based around generally accepted

American Petroleum Institute ('API') standards for conventional and

historical wellhead designs. These standards are in turn supported

by test standards for wellheads that do not require multi-sample

testing, and some seals are not tested at all. Such tests do not

reflect real field conditions, and are much less stringent than

those required for example for casing and tubing couplings. We

believe that this is because unlike POS-GRIP designs these

conventional wellhead designs have been unable to pass such higher

standards due to seals moving during testing and because annular

pockets are non concentric.

Alongside our strategic focus on leveraging the technical

benefits of POS-GRIP technology we continue to address the funding

of future projects. I am pleased therefore to confirm that we have

further strengthened our relationship with Bank of Scotland

Corporate and have agreed the renewal, increase, and extension of

bank facilities for a new GBP5m (increased from GBP4m) three year

revolving credit facility plus a GBP1m overdraft on a yearly term.

We do not intend to utilise all of these facilities during the

current financial year, but believe that it is sensible to have

secured the ability to invest in the future growth of the business

as the need arises.

Staff

On behalf of the Board, I would like to thank all our employees

for their dedication and hard work during a year which has seen a

continued broadening of our geographical areas of operation,

further raising the awareness of the benefits of POS-GRIP friction

grip technology. I would also like to welcome Geoff Thompson, a

specialist in the design, testing and specifications of oil

industry well equipment, as a non-executive director to the

Board.

Outlook

Plexus has continued to make strong progress during the year

through a number of key strategic activities all of which centre

around our patented proprietary POS-GRIP friction grip technology.

We believe that we are able to offer the oil and gas industry a

range of superior wellhead equipment not only for exploration, but

also for production operations whether for surface or in due course

subsea. The fact that we continue to win business from some of the

largest operators for some of the most challenging conditions

particularly for use in HP/HT wells, demonstrates that our

technology has an increasingly important role to play at a time

when access to innovative and enabling technology with clear safety

advantages is so necessary, particularly as the incidence of blow

outs is significantly higher in HP/HT versus normal pressured

wells. Furthermore we believe these initiatives will also enable us

to over time broaden our range of products to include for example

valves and connectors. In the meantime our main goal is to address

some of the technical and engineering issues that have been brought

sharply into focus following the recent Gulf of Mexico incident. Of

particular note is the importance of full metal to metal sealing

capability for the life of a well together with the provision of

effective and fast locking down of the casing, where we believe

conventional technology and traditional methods have performance

limitations which can be empirically proven. This is especially

relevant where HP/HT conditions exist and which lead to axial and

radial movement of tubular members which if not contained can be so

damaging to the integrity of wellhead seals. This is why we have

launched our JIP initiative inviting the industry to participate in

the development of a new and we believe superior POS-GRIP HGSS

subsea wellhead.

For these reasons I look forward to the future with confidence,

and although global economic conditions remain volatile, and indeed

in some areas fragile, Plexus is beginning to see signs of

increased organic activity as energy prices stabilise and demand

strengthens. At the same time a number of important dialogues are

being maintained with a range of key industry entities. These

include operators, oil services companies, regulators, standards

organisations, and health and safety bodies which we hope will

further move us towards a point where we will be able to secure the

interest of potential licensees and alliance partners which will

help accelerate the roll out of our technology which we believe

will deliver significant value for our shareholders.

Robert Adair

Non-Executive Chairman

18 October 2010

Chief Executive's Review

Plexus as reported at the half year has been operating in

challenging market conditions both in global economic terms and

within an oil and gas industry where the prospects of oil service

companies are unavoidably related to energy prices. At the

beginning of the financial year continuing oil and gas price

volatility had reduced oil prices to levels last seen in 2005 of

c.$45USD per barrel which was approximately one third of peak

levels that had been reached in mid-2009 of c.$140USD per barrel.

The subsequent slow down and reduction in investment plans,

combined in some instances with constraints on securing adequate

capital funding, impacted on the sector as a whole.

I am pleased to report however that despite a difficult trading

environment Plexus has continued to make strong progress in terms

of increasing the awareness of POS-GRIP friction grip technology

wellhead equipment. With the stabilising of the oil price at levels

which ensures the viability of more projects, we are beginning to

see an increasing level of activity as we move into 2011.

In particular our focus on winning new contracts both from

existing customers and new customers in new regions around the

world has continued to be successful, and resulted for FY2010 in

our Rest of the World (non UK and non European) sales accounting

for 56.3% of revenue. The most significant contract wins together

with certain other notable commercial developments were as

follows:-

-- In July 2009 Plexus signed a two year contract with a further

two year option with Talisman Energy Inc. with an initial value of

approximately GBP1.5m for the supply of HP/HT and standard pressure

wellhead and mudline suspension equipment in the Norwegian North

Sea.

-- In July 2009, and following on from a first agreement in 2007

with Gaz de France Britain Ltd to supply wellhead systems in the

North Sea, Plexus won a contract to supply GDF Suez Egypt with its

POS-GRIP 15 000psi HP/HT and standard 10,000psi wellhead equipment.

This was not only a new customer win but also the addition of a

third customer in the region to add to Shell Egypt and BP

Egypt.

-- In December 2009 Maersk extended the working relationship

with Plexus by awarding a three year contract with a further two

year option for the supply of HP/HT wellhead equipment with an

initial estimated value of GBP3m for the exploration of a minimum

of two wells in the UK's central North Sea.

-- Over the three month period of January to March 2010 Plexus

won a series of contracts with three new customers in West Africa,

North Africa, and South West Africa. These were for supplying

standard pressure equipment for exploration drilling to Bowleven

plc in offshore Cameroon, Cairn Energy plc Group in offshore

Tunisia, and for HP/HT wellhead equipment for Sonangol in offshore

Angola. It is hoped that as our reputation grows in these important

regions additional contract opportunities will follow.

-- In May 2010 Plexus won a further HP/HT contract in the North

Sea from Senergy Limited, which is managing exploration activities

for Valiant Petroleum plc, with an approximate value of GBP0.7m.

This further underpins Plexus' strong presence in the North Sea

where we are one of the leading suppliers for wellhead equipment

for HP/HT drilling activities.

-- Post year end Plexus has been pursuing its first contract win

opportunity in Australia with another new customer and is confident

that this will be secured over the coming weeks and which will be

announced in due course.

-- Since August 2009 as part of Plexus' ongoing expansion plans,

GBP0.6m has been invested in the construction of a new assembly and

test building at our main facility in Dyce Aberdeen. The building

was completed on time at the end of April and officially opened in

May and has been specially designed to allow more efficient

handling, assembly, qualification and testing of our POS-GRIP HP/HT

and X-HP/HT wellhead systems.

-- Continuing focus on the 15,000psi HP/HT Mudline Tieback

project to demonstrate to the industry that tie back can for the

first time be achieved for HP/HT exploration wells and pre-drilled

production wells by using POS-GRIP set metal to metal "HG"(R)

seals. The technical specification, detailed design of the system,

and the test fixture for qualification testing of the prototype

have now been completed, and the testing and manufacture of the

prototype will begin shortly.

-- In response to the growing focus on subsea drilling standards

and technology Plexus has initiated the call for a JIP to look at

funding the accelerated development of a POS-GRIP "HGSS" subsea

wellhead system. This product would have fewer parts in the well

bore than conventional systems, reliable metal to metal system

seals, and locks hangers down as soon as cementing is complete. The

system has an inherent resistance to contamination as there would

be no moving parts exposed to well bore fluids.

It can be clearly seen that Plexus has been able to combine

important organic developments together with a number of strategic

initiatives which have underpinned our financial performance during

the year, which strengthened significantly at the EBITDA and PBT

level in the second half. I believe this has resulted in Plexus

significantly raising industry awareness of the unique advantages

of POS-GRIP technology as we pursue our goal of improving current

industry wellhead equipment standards, particularly for HP/HT

applications where our superior and enabling POS-GRIP technology is

increasingly being recognised as having safety, operational, and

time saving benefits.

The results for the year as indicated at the interims stage

reflect the fact that Plexus was not immune from a range of adverse

trading conditions particularly during the first half of the year.

It should be noted that the reduction in sales revenues of GBP13.1m

from GBP15.1m the previous year was achieved after a GBP1.1m

reduction in sales relating to the BP Shah Deniz contract as this

winds down from its inception in 2004. Our HP/HT rental revenues

held steady year on year at GBP9.4m and our confidence that our

expertise and growing reputation in this arena will become a key

element of future trading was demonstrated by the addition of two

new HP/HT wellhead equipment sets at a capital expenditure cost of

c.GBP1.5m.

Perhaps one of the most important components of the year's

activities concerns the investment in and expenditure on research

and development and engineering and testing. These activities focus

on the ongoing development of our patented POS-GRIP friction grip

method of engineering both through patent improvements and

continuations, and the design and development of new products such

as our 15,000psi Tieback initiative, and the launching of a JIP

seeking to fast-track the development of a POS-GRIP HGSS subsea

wellhead. Such investment comes at an important time as following

the incident in the Gulf of Mexico earlier this year a greater

amount of attention has been directed both by regulators and the

industry itself at current drilling practices and technologies than

ever before. Instead of what historically has been a gradually

evolving process for the development of methods and standards, it

may well be that a number of 'step changes' will be required and in

this environment it is essential that Plexus continues to invest in

its POS-GRIP technology. As a result research and development

spending (excluding the costs of building new test fixtures used in

development testing) increased by 114% to GBP0.75m from GBP0.35m

last year.

In summary I am pleased with the progress made during the year

in a difficult market, particularly with regard to the winning of

new customers and the expansion of our geographic reach around the

world. However, what is particularly exciting is the progress we

are making on a number of technical and product development fronts

including the ongoing 15,000psi Tieback equipment project and the

product design work that is now being aimed at accelerating our

future role in the increasingly important subsea exploration and

production arena. These initiatives are taking place at a time when

the sector is showing signs of growth due to a recovery in the oil

price, oil majors' capex spend recovering, increased global demand

for oil and gas as the world economy recovers, and the ongoing

trend of extraction from challenging locations. Indeed some

industry observers are saying that the North Sea is about to embark

on a "renaissance", and that according to UK Oil & Gas 24bn of

oil and gas equivalent have yet to be recovered. Such factors,

combined with ever more stringent health and safety regulations I

believe place Plexus in an excellent position from which to

capitalise on the safety, operational, and time saving advantages

that our technology offers.

Ben van Bilderbeek

Chief Executive

18 October 2010

Financial Review

Revenue

Revenue for the year was GBP13.1m, compared to GBP15.1m in the

previous year.

The rental of exploration wellhead equipment and related

services accounted for over 95% of revenue which was a 10% increase

from last year reflecting the fact that wellhead product sales

associated with the historic BP Shah Deniz contract reduced to

GBP0.2m compared to GBP1.3m in the prior year. Despite challenging

market conditions the rental of HP/HT equipment remained stable at

GBP9.4m and accounted for 71.6% of total sales revenues compared to

62.5% in the previous year. Revenue includes GBP0.2m of engineering

and testing which is an increase from the prior year's level of

GBP0.1m. This is a result of an increased level of development of

the Company's proprietary POS-GRIP technology as part of the

strategy to capitalise on the significantly increased levels of

interest in new technologies and methods following the recent major

incident in the Gulf of Mexico.

Margin

Gross margins have increased slightly to 58.5% from 57.9% in the

previous year as HP/HT rental sales continue to dominate sales and

generate higher margins than low pressure equipment contracts.

Overhead expenses

Overhead expenses were essentially unchanged year on year at

GBP6.9m compared to GBP6.8m the prior year following a significant

31% increase in 2008/09 when it was necessary to provide a broader

global operational support structure to service a growing number of

customers across a wider range of territories and regions. In line

with year on year total overhead expenses comparables, employee

headcount as at the year end was also essentially unchanged at 88

compared to 89 for the prior year.

EBITDA

The EBITDA for the year (before IFRS2 share based payment

charges of GBP0.21m) was GBP3.4m, down from GBP4.3m (before IFRS2

share based payment charges of GBP0.19m) the previous year, a

decrease of 20.9%. This performance was in line with market

expectations and was achieved during a twelve month period which

continued to be volatile for the oil and gas industry and during

which a number of major international oil services companies

reported significantly reduced sales and earnings numbers.

Furthermore oil and gas prices fell back in 2009 to levels which

resulted in nearly all oil companies reducing investment plans in

2009/2010 which impacted Plexus during the year. EBITDA margin for

the year was marginally lower at 26% as compared to 29% last year

which demonstrates that the proprietary nature of the Plexus

POS-GRP technology helps protect margins which bodes well for the

future as sales revenues recover.

Profit before tax

Profit before tax of GBP0.65m compares to a profit last year of

GBP1.8m, and again was in line with market expectations. It should

be noted that profit before tax was in part adversely impacted as a

result of absorbing a 14.7% increase in rental asset and other

property, plant and equipment depreciation and amortisation

totalling GBP2.43m, up from GBP2.1m last year. This once again

reflects significant ongoing levels of capital expenditure and the

higher level of depreciation of rental assets due to the steady

increase in the size of the rental asset inventory. The profit

before tax is stated after a higher IFRS2 charge for share based

payments under reporting standard IFRS 2; the charge for the full

year is GBP0.21m compared to GBP0.19m last year.

Tax

The Group UK Corporation Tax charge resulted in a tax credit of

GBP0.06m for the year as compared to a tax charge of GBP0.78m for

the prior year as a result of research and development related tax

credit claims.

EPS

The Group reports basic earnings per share of 0.88p compared to

1.27p in the prior year.

Cash and Balance Sheet

The balance sheet reflects the development of the business

during the year and ongoing capital expenditure with the net book

value of property plant and equipment including items in the course

of construction increasing to GBP8.9m up from GBP8.3m last year.

Capital expenditure on tangibles totalled GBP2.6m compared to

GBP2.7m last year, of which GBP1.5m was for the addition of two

more HP/HT wellhead equipment sets. Receivables increased to

GBP6.6m as compared to GBP4.8m as a result of an increase in the

level of business being generated from outside the UK and Europe

leading to corresponding increases in debtor days but with no

perceived increase in credit risk due to the 'blue chip' nature of

existing and new customers. Net bank borrowings closed at GBP2.9m

compared to GBP1.3m last year reflecting net cash outflow for the

year of GBP1.6m, as compared to net cash inflow of GBP1.8m last

year before the draw down on the bank loan of GBP4m. This movement

is accounted for by a combination of debtor inflows reducing to

GBP13m compared to GBP17.2m in the prior year, an increase of

GBP0.6m in corporation tax payments totalling GBP1.1m as opposed to

GBP0.5m in the prior year, and dividends paid of GBP0.6m which was

a GBP0.3m increase over the prior year. In ongoing recognition of

the unpredictable nature of the economy and capital markets, and

the continued constraints on many banks' lending capacities the

Group once again took the decision to review the level of its

lending facilities with Bank of Scotland Corporate. As a result

post period end in September 2010 Bank of Scotland Corporate agreed

to increase the bank facilities available to the Group from GBP5m

to GBP6m of which GBP5m of the credit facility is on a three year

revolving basis, and GBP1m is an overdraft facility on a yearly

term. This places Plexus in a strong position to fund ongoing

R&D, capital expenditure, and associated development

programmes.

Intellectual property

The Group carries in its balance sheet goodwill and intangible

assets of GBP7.62m. The Directors have considered whether there

have been any indications of impairment and have concluded that

there have been no such indications. The Directors therefore

consider the current carrying values to be appropriate. Indications

of impairment are considered annually.

Research and Development

Ongoing R&D programme continues to be an important element

of Plexus' future growth strategy and focuses on the further

development of the proprietary POS-GRIP method of engineering both

in terms of patent continuations and improvements to extend the

life of its extensive patent suite, and also to design and develop

new products that incorporate and benefit from the unique

advantages of POS-GRIP technology. Examples of these include the

15,000psi Tieback initiative, and the initiation of a JIP for the

fast track development of a POS-GRIP HGSS subsea wellhead system

which addresses a number of concerns and issues that have arisen

following the recent incident in the Gulf of Mexico. Consequently,

and excluding this year's spend of GBP0.14m and last year's spend

of GBP0.55m on the costs of building new test fixtures used in

development testing, R&D spend increased by 114% to GBP0.75m

from GBP0.35m in the prior year.

IFRS 2 (Share Based Payments)

IFRS2 charges have been included in the accounts, in line with

reporting standards. The "fair value" of share based payments has

been computed independently by specialist consultants and is

amortised evenly over the expected vesting period from the date of

grant. The charge for the year was GBP0.21m which compares to

GBP0.19m for last year.

Dividends

The Company announced on 18 March 2010 the payment of an interim

dividend of 0.33p per share which was approved for payment on 1

April 2010.

The Directors have further decided to propose an increased final

dividend of 0.39p per share for the year ending 30 June 2010

compared to 0.38p last year, which will be recommended for formal

approval at the Annual General Meeting to be held on 30 November

2010. Subject to this the dividend will be paid on 10 December

2010.

Graham Stevens

Finance Director

18 October 2010

Consolidated Income Statement

for the year ended 30 June 2010

2010 2009

Notes GBP'000 GBP'000

Revenue 1 13,142 15,105

Cost of sales (5,453) (6,364)

Gross profit 7,689 8,741

Administrative expenses (6,918) (6,799)

Operating profit 771 1,942

Finance income - 8

Finance costs (127) (197)

Share of profit of associate 1 45

Profit before taxation 645 1,798

Income tax expense 58 (780)

Profit after taxation and comprehensive

income for the year attributable to the

owners of the parent 703 1,018

Earnings per share 4

Profit for the year attributable to Plexus

Holdings shareholders

Basic 0.88p 1.27p

Diluted 0.87p 1.27p

Consolidated Balance Sheet

at 30 June 2010

2010 2009

Notes GBP'000 GBP'000

Assets

Goodwill 722 722

Intangible assets 5 6,897 6,618

Financial assets 60 60

Investment in associate 4 1

Property, plant and equipment 6 8,866 8,335

Total non-current assets 16,549 15,736

Inventories 3,332 3,794

Trade and other receivables 6,624 4,799

Current income tax assets 451 -

Cash and cash equivalents 1,470 2,655

Total current assets 11,877 11,248

Total Assets 28,426 26,984

Equity and Liabilities

Called up share capital 7 802 802

Share premium account 15,596 15,596

Share based payments reserve 764 550

Retained earnings 1,674 1,499

Total equity 18,836 18,447

Liabilities

Deferred tax liabilities 469 546

Bank loans 4,000 4,000

Total non-current liabilities 4,469 4,546

Trade and other payables 4,748 3,331

Current income tax liabilities - 660

Borrowings 373 -

Total current liabilities 5,121 3,991

Total liabilities 9,590 8,537

Total Equity and Liabilities 28,426 26,984

These financial statements were approved and authorised for

issue by the board of directors on 18 October 2010 and were signed

on its behalf by:

B van Bilderbeek G Stevens

Director Director

Consolidated Statement of Changes in Equity

for the year ended 30 June 2010

Share

Called Share Based

Up Share Premium Payments Retained

Capital Account Reserve Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 1

July 2008 802 15,596 360 787 17,545

Total comprehensive

income for the

period - - - 1,018 1,018

Share based

payments reserve

charge - - 190 - 190

Deferred tax

movement on share

options - - - (56) (56)

Dividends - - - (250) (250)

Balance as at 30

June 2009 802 15,596 550 1,499 18,447

Total comprehensive

income for the

period - - - 703 703

Share based

payments reserve

charge - - 214 - 214

Deferred tax

movement on share

options - - - 41 41

Dividends - - - (569) (569)

Balance as at 30

June 2010 802 15,596 764 1,674 18,836

Consolidated Cash Flow Statement

for the year ended 30 June 2010

2010 2009

GBP'000 GBP'000

Cash flows from operating activities

Profit before taxation 645 1,798

Adjustments for:

Depreciation, amortisation and impairment

charges 2,430 2,139

Loss on disposal of property, plant and

equipment 19 24

Charge for share based payments 214 190

Investment income - (8)

Interest expense 127 197

Changes in working capital:

Decrease/(increase) in inventories 462 (316)

(Increase)/decrease in trade and other

receivables (1,825) 2,084

Increase/(decrease) in trade and other

payables 1,417 (29)

Cash generated from operations 3,489 6,079

Income taxes paid (1,089) (517)

Net cash generated from operations 2,400 5,562

Cash flows from investing activities

Deferred consideration in respect of acquisition

of subsidiary entity - (151)

Acquisition of financial asset - (80)

Adjustment to value of associate undertaking (3) (1)

Purchase of intangible assets (707) (370)

Purchase of property, plant and equipment (2,560) (2,736)

Proceeds of sale of property, plant and

equipment 8 -

Net cash used in investing activities (3,262) (3,338)

Cash flows from financing activities

Loans drawn down - 4,000

Interest paid (127) (207)

Interest received - 32

Equity dividends paid (569) (250)

Net cash (used in)/generated from financing

activities (696) 3,575

Net (decrease)/increase in cash and cash

equivalents (1,558) 5,799

Cash and cash equivalents at 1 July 2009 2,655 (3,144)

Cash and cash equivalents at 30 June 2010 1,097 2,655

Notes to the Consolidated Financial Statement

1. Revenue

2010 2009

GBP'000 GBP'000

By geography

UK 1,341 5,314

Europe 4,427 4,933

Rest of World 7,374 4,858

13,142 15,105

Revenue is shown by destination as the origin of revenues is all

from the UK.

By type

Sale of goods 2,096 2,193

Services 10,859 11,613

Construction contract 187 1,299

13,142 15,105

2. Segment reporting

The Group derives revenue from the sale of its POS-GRIP

technology and associated products, the rental of wellheads

utilising the POS-GRIP technology and service income principally

derived in assisting with the commissioning and ongoing service

requirements of our equipment. These income streams are all derived

from the utilisation of the technology which the Group believes is

its only segment.

All of the Group's non-current assets are held in the UK.

The following customers each account for more than 10% of the

Group's revenue:

2010 2009

GBP'000 GBP'000

Customer 1 2,098 -

Customer 2 1,840 905

Customer 3 1,759 3,249

Customer 4 1,536 203

Customer 5 1,383 1,025

3. Dividends

2010 2009

GBP'000 GBP'000

Ordinary Shares

Interim paid of 0.33p (2009: 0.3118p) per share

for the year ended 30 June 2010 265 250

Ordinary Shares

Final dividend after the year end of 0.39p (2009:

0.38p) per share 313 305

The proposed final dividend has not been accrued

at the balance sheet date.

4. Earnings per share

2010 2009

GBP'000 GBP'000

Profit attributable to shareholders 703 1,018

Number Number

Weighted average number of shares in issue 80,182,569 80,182,569

Dilution effects of share schemes 47,294 205,301

Diluted weighted average number of shares in

issue 80,229,863 80,387,870

Basic earnings per share 0.88p 1.27p

Diluted earnings per share 0.87p 1.27p

Basic earnings per share is calculated on the results attributable

to ordinary shares divided by the weighted average number of

shares in issue during the year.

Diluted earnings per share calculations include additional shares

to reflect the dilutive effect of employee share schemes and

share option schemes.

5. Intangible fixed assets

Patent and

Intellectual Other Computer

Property Development Software Total

GBP'000 GBP'000 GBP'000 GBP'000

Cost

As at 1 July 2008 6,440 1,052 74 7,566

Additions - 331 39 370

As at 1 July 2009 6,440 1,383 113 7,936

Additions - 701 6 707

As at 30 June 2010 6,440 2,084 119 8,643

Amortisation

As at 1 July 2008 713 131 61 905

Charge for the year 330 61 22 413

As at 1 July 2009 1,043 192 83 1,318

Charge for the year 329 85 14 428

As at 30 June 2010 1,372 277 97 1,746

Net Book Value

As at 30 June 2010 5,068 1,807 22 6,897

As at 30 June 2009 5,397 1,191 30 6,618

As at 30 June 2008 5,727 921 13 6,661

Patent and other development costs are internally generated.

6. Property, plant and equipment

Assets under Motor

Buildings Equipment Construction Vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

As at 1 July

2008 - 9,694 222 22 9,938

Additions - 189 2,547 - 2,736

Transfers - 2,631 (2,631) - -

Disposals - (63) - - (63)

As at 1 July

2009 - 12,451 138 22 12,611

Additions 661 213 1,684 2 2,560

Transfers - 1,646 (1,646) - -

Disposals - (64) - (10) (74)

As at 30 June

2010 661 14,246 176 14 15,097

Depreciation

As at 1 July

2008 - 2,595 - 14 2,609

Charge for the

year - 1,702 - 4 1,706

On disposals - (39) - - (39)

As at 1 July

2009 - 4,258 - 18 4,276

Charge for the

year 10 1,990 - 2 2,002

On disposals - (39) - (8) (47)

As at 30 June

2010 10 6,209 - 12 6,231

Net book value

As at 30 June

2010 651 8,037 176 2 8,866

As at 30 June

2009 - 8,193 138 4 8,335

As at 30 June

2008 - 7,099 222 8 7,329

7. Share Capital

2010 2009

GBP'000 GBP'000

Authorised:

Equity: 110,000,000 Ordinary shares of 1p each 1,100 1,100

Allotted, called up and fully paid:

Equity: 80,182,569 (2009: 80,182,569) Ordinary

shares of 1p each 802 802

8. Reconciliation of net cash flow to movement in net debt

2010 2009

GBP'000 GBP'000

(Decrease)/increase in cash in the year (1,558) 5,799

Cash inflow from increase in net debt - (4,000)

Movement in net debt in year (1,558) 1,799

Net debt at start of year (1,345) (3,144)

Net debt at end of year (2,903) (1,345)

9. Analysis of net debt

At beginning At end

of year Cash flow of year

GBP'000 GBP'000 GBP'000

Cash in hand and at bank 2,655 (1,185) 1,470

Overdrafts - (373) (373)

2,655 (1,558) 1,097

Bank loans (4,000) - (4,000)

Total (1,345) (1,558) (2,903)

The financial information above does not constitute the

company's statutory accounts for the year ended 30 June 2010 but is

derived from those statements.

The statutory financial statements and this preliminary

statement for the year ended 30 June 2010 were approved by the

Board on 18 October 2010. On the same date the company's auditors,

Crowe Clark Whitehill LLP. issued an unqualified report on those

financial statements. The audit report did not include reference to

any matters to which the auditor drew attention by way of emphasis

without qualifying the report or contain a statement under section

498(2) or (3) of the Companies Act 2006. The Company's financial

statements have been prepared in accordance with International

Financial Reporting Standards, as adopted by the EU. A copy of the

statutory accounts will be delivered to the Registrar of Companies

in due course.

The Annual Report will be circulated to all shareholders and

thereafter, copies will be available from the registered office of

the company, Thames House, Portsmouth Road, Esher, Surrey, KT10

9AD.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BRBDGSBBBGGI

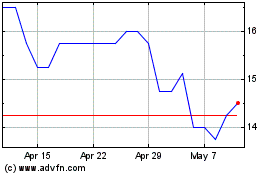

Plexus (LSE:POS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Plexus (LSE:POS)

Historical Stock Chart

From Jul 2023 to Jul 2024