TIDMPREM

RNS Number : 3353S

Premier African Minerals Limited

02 October 2017

For immediate release

2 October 2017

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO

CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE

MARKET ABUSE REGULATION (EU) NO. 596/2014. UPON THE PUBLICATION OF

THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE

IN THE PUBLIC DOMAIN.

NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION

WOULD BE PROHIBITED BY ANY APPLICABLE LAW.

Premier African Minerals Limited

("Premier" or the "Company")

Successful Fundraising of GBP3.5 Million via PrimaryBid

Repayment of Loan Note and Repurchase of Swap Agreement

Shares

Premier African Minerals Limited (AIM: PREM), AIM-traded

multi-commodity mining and resource development company focused on

Southern and Western Africa, announced on 29 September 2017 an

underwritten offer to raise approximately GBP3.5 million (before

expenses) at 0.3p per new Ordinary Share (the "Offer"). The Offer

was made exclusively available through PrimaryBid.com.

The Offer received a strong response from private as well as

institutional investors. The Offer was on a "first come, first

served" basis and was closed at 5:00 p.m. on Sunday 1 October 2017.

The Company has raised gross proceeds of GBP3,500,000 through the

Offer.

The Company will issue and allot an additional 654,761,906 new

Ordinary Shares at 0.3p each over and above the shares already

issued in regard to the swap agreement. The shares already issued

in regard to the swap agreement will be repurchased by the Company

and re-issued to subscribers under the Offer. The new Ordinary

Shares will rank pari passu with the Company's existing Ordinary

Shares and application will be made for the new Ordinary Shares to

be admitted to trading on AIM and admission is expected to take

place on or around 6 October 2017.

Total Voting Rights

Following the issue of the new Ordinary Shares, the Company will

have 6,248,216,350 Ordinary Shares in issue. This figure may be

used by the Company's shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

Company under the Financial Conduct Authority's Disclosure Rules

and Transparency Rules.

George Roach, Chief Executive Officer of Premier, commented:

"The primary purpose of this placement was to settle the

existing loan note and repurchase the shares issued under the swap

agreement, and I am pleased to report that will be settled

immediately. Underground development is fully funded and our team

at RHA is confident that the minimum required tonnage at grade will

be delivered to the plant during the latter part of Q4 to assure

profitable operations. No further capital raise is anticipated or

expected for RHA."

Enquiries

Fuad Sillem Premier African Minerals Tel: +44 (0)7734

Limited 922074

------------------ --------------------------- -----------------

Michael Cornish Beaumont Cornish Tel: +44 (0)20

/ Roland Cornish Limited 7628 3396

(Nominated Adviser)

------------------ --------------------------- -----------------

Jerry Keen/Edward Shore Capital Stockbrokers Tel: +44 (0)20

Mansfield Limited 7408 4090

------------------ --------------------------- -----------------

Jon Belliss Beaufort Securities Tel: +44 (0)20

Limited 7382 8300

------------------ --------------------------- -----------------

Charles Goodwin/ Yellow Jersey PR Tel: +44 (0)7747

Harriet Jackson Limited 788221

------------------ --------------------------- -----------------

Dave Mutton PrimaryBid Limited Tel: +44 (0)20

7491 6519

------------------ --------------------------- -----------------

Beaumont Cornish Limited is acting solely as the Company's

Nominated Adviser for the purposes of the AIM Rules and no one else

and will not be responsible to anyone other than the Company for

providing the protections afforded to its clients or for providing

advice in relation to the matters referred to in this announcement

and is not acting in respect of the Offer nor providing any advice

in relation thereto.

Forward-looking Statement

All statements in this announcement other than statements of

historical fact are, or may be deemed to be, "forward-looking

statements". In some cases, these forward-looking statements may be

identified by the use of forward-looking terminology, including the

terms "targets", "believes", "estimates", "anticipates", "expects",

"intends", "may", "will" or "should" or, in each case, their

negative or other variations or comparable terminology. They appear

in a number of places throughout the announcement and include

statements regarding the intentions, beliefs or current

expectations of the Company and/or Directors concerning, among

other things, the trading performance, results of operations,

financial condition, liquidity, prospects and dividend policy of

the Company. By their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future

performance. The Company's actual performance, result of

operations, financial condition, liquidity and dividend policy may

differ materially from the impression created by the

forward-looking statements contained in this announcement. In

addition, even if the performance, results of statements contained

in this announcement, those results or developments may not be

indicative of results or developments in subsequent periods.

Important factors that may cause these differences include, but are

not limited to, changes in economic conditions generally; changes

in interest rates and currency fluctuations; impairments in the

value of the Company's assets; legislative/regulatory changes;

changes in taxation regimes; the availability and cost of capital

for future expenditure; the availability of suitable financing; the

ability of the Group to retain and attract suitably experienced

personnel and competition within the industry. Prospective

investors should specifically consider the factors identified in

this announcement which could cause actual results to differ before

making an investment decision.

This announcement has been issued by, and is the sole

responsibility, of the Company. No representation or warranty

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by

Beaumont Cornish Limited or by any of its respective affiliates or

agents as to or in relation to, the accuracy or completeness of

this announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

Notes to Editors

Premier African Minerals Limited (AIM: PREM) is a

multi-commodity mining and natural resource development company

focused in Southern and Western Africa with production started at

its flagship RHA project in Zimbabwe.

The Company has a diverse portfolio of projects, which include

tungsten, rare earth elements, gold, lithium and tantalum in

Zimbabwe and Benin, encompassing brownfield projects with near-term

production potential to grass-roots exploration. In addition, the

Company holds 5,010,333 million shares in Circum, the owner of the

Danakil Potash Project in Ethiopia, which has the potential to be a

world class asset. At present those shares are valued at US$10.2

million based on the latest price at which Circum has accepted

subscriptions. Premier also has an interest in Casa Mining Limited,

a privately-owned exploration company that has a 71.25 per cent

interest in the 1.5 million ounce inferred resource Akyanga gold

deposit in the DRC.

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBFLLBDBFFFBD

(END) Dow Jones Newswires

October 02, 2017 02:00 ET (06:00 GMT)

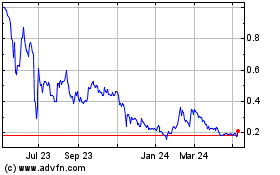

Premier African Minerals (LSE:PREM)

Historical Stock Chart

From Mar 2024 to Apr 2024

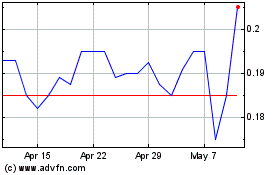

Premier African Minerals (LSE:PREM)

Historical Stock Chart

From Apr 2023 to Apr 2024