TIDMQLT

RNS Number : 4744V

Quilter PLC

10 August 2022

NEWS RELEASE

10 August 2022

Quilter plc interim results for the six months ended 30 June

2022

Stable revenue and cost discipline drive 9% increase in adjusted

profit

Management basis - Continuing business (excluding Quilter

International for comparative data)

-- Assets under Management and Administration ("AuMA") of

GBP98.7 billion at the end of June 2022, a decrease of 12% from 31

December 2021 (GBP111.8 billion) principally due to adverse market

movements of GBP14.5 billion and:

o Quilter Investment Platform net inflows of GBP1.6 billion (H1

2021: GBP1.8 billion) representing 4% of opening AuMA (H1 2021:

6%), reflecting an industry wide slowdown in new client flows

during the second quarter.

o Quilter channel flows onto the Quilter Investment Platform of

GBP954 million up 10% on the GBP868 million achieved in 2021.

o Quilter High Net Worth net inflows of GBP0.5 billion (H1 2021:

GBP0.4 billion) representing 3% of opening AuMA (H1 2021: 4%).

o Net outflows of GBP0.6 billion (H1 2021: net outflows GBP0.3

billion) of assets held on third party platforms reflecting

non-core, legacy business in run off and transition of assets

advised by Quilter Financial Planning on other platforms to the

Quilter Investment Platform.

o Leading to Group net inflows of GBP1.4 billion for the first

half (H1 2021: 2.0 billion).

-- Flat revenues and cost discipline drove a 9% increase in

adjusted profit before tax to GBP61 million (H1 2021: GBP56

million).

-- Improved operating margin of 20% (H1 2021: 18%), reflecting

stable revenues and a reduction in expenses of 2% through lower

FSCS levies and tight control of costs despite the inflationary

environment and the return to more normalised investment spend

post-pandemic.

-- Adjusted diluted earnings per share decreased 5% to 3.7 pence

(H1 2021: 3.9 pence), reflecting a more normal tax rate (as a

result of the non-repetition of a deferred tax credit in the first

half of 2021) partially offset by a reduced share count following

completion of our capital return programme.

-- Interim dividend of 1.2 pence per share unchanged on 2021

(excluding the contribution from Quilter International).

Statutory results

-- IFRS profit before tax attributable to equity holders from

continuing operations of GBP182 million (H1 2021: GBP(21) million),

largely driven by policyholder tax credits of GBP145 million (H1

2021: tax charge GBP(48) million). This income tax credit/(charge)

can vary significantly period-on-period as a result of market

volatility and the impact this has on policyholder tax.

-- Negotiations concluded with the insurers who provided

professional indemnity cover for Lighthouse resulting in the

payment of the full amount due under the policy of GBP15 million,

including amounts received since the period end, with the benefit

of this excluded from adjusted profit. Net cost of post-acquisition

Lighthouse remediation totals GBP12 million.

-- Basic earnings/(loss) per share from continuing operations of

11.3 pence (H1 2021: (0.9) pence).

-- Diluted earnings/(loss) per share from continuing operations

of 11.2 pence (H1 2021: (0.9) pence).

-- Solvency II ratio of 219% after payment of the interim dividend (December 2021: 275%).

Strategic progress

-- Significant expansion of our successful WealthSelect managed

portfolios, with a simpler charging structure. We now offer a full

spectrum of portfolios to cover clients' risk, investment

preferences with an ESG overlay.

-- Good progress building incremental platform flows from

targeted IFA firms with 80 adviser firms adopting Quilter as a

platform of choice during the period and contributing to

incremental gross inflows.

-- Continued build out of our integrated advice and investment

proposition in the High Net Worth segment, with eight additional

investment managers added since June 2021.

-- Good initial progress with our GBP45 million Business

Simplification programme, with annualised run-rate savings of GBP13

million achieved to date.

-- Completion, in January 2022, of the GBP375 million share

buyback programme from the Quilter Life Assurance sale proceeds.

Since the programme's inception, 264 million shares were purchased

at an average price of 141.97 pence per share.

-- GBP328 million capital return in June 2022, (20 pence per

share) through B share scheme accompanied by a 6 for 7 share

consolidation to return the net surplus proceeds from the sale of

Quilter International to shareholders.

Paul Feeney, Chief Executive Officer, said:

"Operating conditions in the first six months of 2022 have been

challenging. Global equity markets have experienced one of the

worst periods of negative performance in recent years and

traditional 60:40 multi-asset portfolios have had their largest

negative year-to-date return on record. In that context, our

overall AuMA has been relatively resilient, down 12% to GBP98.7

billion on the December 2021 level. Despite the market volatility,

we generated net inflows of GBP1.6 billion (H1 2021: GBP1.8

billion) on the Quilter Investment Platform and a further GBP0.5

billion of net inflows (H1 2021 GBP0.4 billion) through our High

Net Worth segment, modestly reducing the negative mark-to-market

and third party platform net outflow impacts.

"Against this backdrop we delivered a 9% increase in our

adjusted profit in the first half of 2022. Our focus remains on

managing our business towards the targets set out at our Capital

Markets Day last November, although an absence of an improvement in

market levels and investor sentiment over the remainder of this

year and 2023 may impact on the timing of delivery. My priorities

continue to be growth in the IFA and Quilter adviser franchises,

cost discipline to deliver a right-sized cost base for the new

streamlined Quilter, investing for future growth through

initiatives such as hybrid advice, and embedding ESG into the

services we provide for clients and tools we provide for

advisers".

Quilter highlights from continuing operations(1) H1 2022 H1 2021

---------------------------------------------------------------- -------- --------

Assets and flows

AuMA (GBPbn)(2, 5) 98.7 106.4

Gross flows (GBPbn)(2, 5) 5.9 6.7

Net inflows (GBPbn)(2, 5) 1.4 2.0

Net inflows/opening AuMA(2) 3% 4%

Gross flows per adviser (GBPm)(2, 3) 2.4 2.4

Asset retention(3) 92% 91%

Profit and loss

IFRS profit/(loss) before tax attributable to equity

holders (GBPm)(2) 182 (21)

IFRS profit/(loss) after tax (GBPm) 151 (13)

Adjusted profit before tax (GBPm)(2) 61 56

Operating margin(2) 20% 18%

Revenue margin (bps)(2) 47 48

Return on equity(2) 5.9% 7.3%

Adjusted diluted earnings per share (pence)(2) 3.7 3.9

Basic earnings/(loss) per share (pence) 11.3 (0.9)

Non-financial

Restricted Financial Planners ("RFPs") in Affluent

segment(4) 1,512 1,639

Discretionary Investment Managers in High Net Worth

segment(4) 176 168

Quilter Private Client RFPs in High Net Worth segment(4) 55 62

---------------------------------------------------------------- -------- --------

(1) Continuing operations represent Quilter plc, excluding the results

of Quilter International. Adjusted profit before tax for Quilter International

in H1 2021 was GBP 29 million. Adjusted diluted EPS from Quilter International

in H1 2021 was 1.9 pence per share.

(2) Alternative Performance Measures ("APMs") are detailed and defined

on pages 4 to 6.

(3) Gross flows per adviser is a measure of the value created by our

Quilter distribution channel.

(4) Closing headcount as at 30 June.

(5) H1 2021 asset and flow comparators have been restated to exclude

amounts relating to Quilter International to align with information

presented at the Company's Capital Markets Day on 3 November 2021 and

its fourth quarter trading statement 2021 on 26 January 2022.

Adjusted profit presented in this announcement

Adjusted profit is presented in this announcement in a number of ways

to provide readers with a view of adjusted profit for the Group excluding

Quilter International (on a continuing basis) and for the total Group

(on a continuing and discontinued basis). A full reconciliation of these

views is provided on page 16 and definitions of adjusted profit are

explained on page 4.

Alternative Performance Measures ("APMs")

We assess our financial performance using a variety of measures including

APMs, as explained further on pages 4 to 6. In the headings and tables

presented from page 11 onwards, these measures are indicated with an

asterisk: *.

Quilter plc results for the six months ended 30 June 2022

Investor Relations

John-Paul Crutchley UK +44 77 4138 5251

Keilah Codd UK +44 77 7664 9681

Media

Tim Skelton-Smith UK +44 78 2414 5076

Camarco

Geoffrey Pelham-Lane UK +44 77 3312 4226

Paul Feeney, CEO, and Mark Satchel, CFO, will host a

presentation and Q&A session via webcast at 08:30am (BST)

today, 10 August 2022.

The presentation will be webcast live and is available via our

website: 2022 results and presentations | Quilter plc

A conference call facility will also be available should you

wish to join by telephone:

United Kingdom /

Other +44 333 300 0804

South Africa +27 21 672 4118

United States +1 631 913 1422

Access Code 11389415#

Note: Neither the content of the Company's website nor the

content of any website accessible from hyperlinks on this

announcement (or any other website) is incorporated into, or forms

part of, this announcement.

Disclaimer

This announcement may contain certain forward-looking statements

with respect to Quilter plc's plans and its current goals and

expectations relating to its future financial condition,

performance, and results.

By their nature, all forward-looking statements involve risk and

uncertainty because they relate to future events and circumstances

which are beyond Quilter plc's control including amongst other

things, international and global economic and business conditions,

the implications and economic impact of the COVID-19 pandemic,

market-related risks such as fluctuations in interest rates and

exchange rates, the policies and actions of regulatory authorities,

the impact of competition, inflation, deflation, the timing and

impact of other uncertainties of future acquisitions or

combinations within relevant industries, as well as the impact of

tax and other legislation and other regulations in the

jurisdictions in which Quilter plc and its affiliates operate. As a

result, Quilter plc's actual future financial condition,

performance and results may differ materially from the plans, goals

and expectations set forth in Quilter plc's forward-looking

statements.

Quilter plc undertakes no obligation to update the

forward-looking statements contained in this announcement or any

other forward-looking statements it may make.

Alternative Performance Measures

We assess our financial performance using a variety of

alternative performance measures ("APMs"). APMs are not defined

under IFRS, but we use them to provide further insight into the

financial performance, financial position and cash flows of the

Group and the way it is managed.

APMs should be read together with the Group's condensed

consolidated financial statements, which include the Group's income

statement, statement of financial position and statement of cash

flows, which are presented on pages 32 to 36.

Further details of APMs used by the Group in its Financial

review are provided below.

APM Definition

Adjusted profit before tax Adjusted profit before tax represents

the Group's IFRS profit, adjusted

for specific items that management

consider to be outside of the Group's

normal operations or one-off in nature,

as detailed on page 41 in the condensed

consolidated financial statements.

The exclusion of certain adjusting

items may result in adjusted profit

before tax being materially higher

or lower than the IFRS profit after

tax.

Adjusted profit before tax does not

provide a complete picture of the

Group's financial performance, which

is disclosed in the IFRS income statement,

but is instead intended to provide

additional comparability and understanding

of the financial results.

Adjusted profit before tax is presented

for the continuing Group (excluding

Quilter International), for discontinued

operations (Quilter International),

and for the total Group for continuing

and discontinued operations.

A detailed reconciliation of the

adjusted profit before tax metrics

presented, and how these reconcile

to IFRS, is provided on page 16 of

the Financial review. Adjusted profit

before tax is referred to throughout

the Chief Executive Officer's statement

and Financial review, with comparison

to the prior period explained on

page 12.

A reconciliation from each line item

on the IFRS income statement to adjusted

profit before tax is provided in

note 5(c) to the condensed consolidated

financial statements on page 44.

----------------------------------------------

Adjusted profit after tax Adjusted profit after tax represents

the post-tax equivalent of the adjusted

profit before tax measure, as defined

above.

----------------------------------------------

Adjusted profit before tax after Adjusted profit before tax after

reallocation reallocation reflects adjusted profit

before tax including certain costs

within continuing operations relating

to Quilter International that did

not transfer to Utmost Group on completion

of the sale, as detailed above.

A reconciliation from each line item

on the IFRS income statement to adjusted

profit before tax after reallocation

is provided in note 5(c) to the condensed

consolidated financial statements

on page 44.

----------------------------------------------

IFRS profit before tax attributable IFRS profit before tax attributable

to equity holders to equity holders represents the

profit after policyholder tax ('tax

attributable to policyholder returns')

but before shareholder tax (' tax

attributable to equity holders').

The tax charge for the Group's UK

life insurance entity, Quilter Life

& Pensions Limited, comprises policyholder

tax and shareholder tax. Policyholder

tax is regarded economically as a

pre-tax cost to the Group, in that

it is based on the return on assets

held by the Group's life insurance

entity to match against related unit-linked

liabilities in respect of clients'

policies, and for which the Company

charges fees to clients. As such,

policyholder tax can be a charge

or credit in any period depending

on underlying market movements on

those assets held to cover linked

liabilities.

Shareholder tax is the remaining

tax after deducting policyholder

tax and is more reflective of the

profitability of the entity.

This metric is included on the face

of the Group's income statement on

page 32 and is included in the adjusted

profit before tax to IFRS profit

after tax reconciliation in note

5(a) to the condensed consolidated

financial statements.

----------------------------------------------

Revenue margin (bps) Revenue margin represents net management

fees, divided by average AuMA. Management

use this APM as it represents the

Group's ability to earn revenue from

AuMA.

Revenue margin by segment and for

the Group is explained on page 12

of the Financial review.

----------------------------------------------

Operating margin Operating margin represents adjusted

profit before tax divided by total

net fee revenue.

Management use this APM as this is

an efficiency measure that reflects

the percentage of total net fee revenue

that becomes adjusted profit before

tax.

Operating margin is referred to in

the Chief Executive Officer's statement

and Financial review, with comparison

to the prior period explained in

the adjusted profit section on page

12.

----------------------------------------------

Gross flows Gross flows are the gross client

cash inflows received from customers

during the period and represent our

ability to increase AuMA and revenue.

Gross flows are referred to in the

Financial review on page 12 and disclosed

by segment in the supplementary information

on pages 24 to 25.

----------------------------------------------

Net flows Net flows is the difference between

money received from and returned

to customers during the relevant

period for the Group or for the business

indicated.

This measure is a lead indicator

of total net fee revenue. Net flows

is referred to throughout this document,

with a separate section in the Financial

review on page 12 and is presented

by business and segment in the supplementary

information on pages 24 to 25.

----------------------------------------------

Assets under Management and Administration AuMA represents the total market

("AuMA") value of all financial assets managed

and administered on behalf of customers.

AuMA is referred to throughout this

document, with a separate section

in the Financial review on page 12

and is presented by business and

segment in the supplementary information

on pages 24 to 25.

----------------------------------------------

Average AuMA Average AuMA represents the average

total market value of all financial

assets managed and administered on

behalf of customers. Average AuMA

is calculated using a 7-point average

(half year) and 13-point average

(full year) of monthly closing AuMA.

----------------------------------------------

Total net fee revenue Total net fee revenue represents

revenue earned from net management

fees and other revenue listed below

and is a key input into the Group's

operating margin.

Further information on total net

fee revenue is provided on page 13

of the Financial review and note

5(c) in the condensed consolidated

financial statements.

----------------------------------------------

Net management fees Net management fees consist of revenue

generated from AuMA, fixed fee revenues

including charges for policyholder

tax contributions, less trail commissions

payable. Net management fees are

presented net of trail commission

payable as trail commission is a

variable cost directly linked to

revenue, which is a treatment and

presentation commonly used across

our industry. Net management fees

are a part of total net fee revenue

and is a key input into the Group's

operating margin.

Further information on net management

fees is provided on page 13 and note

5(c) in the condensed consolidated

financial statements.

----------------------------------------------

Other revenue Other revenue represents revenue

not directly linked to AuMA (e.g.

encashment charges, closed book unit-linked

policies, non-linked Protect policies,

adviser initial fees and adviser

fees linked to AuMA in Quilter Financial

Planning (recurring fees). Other

revenue is a part of total net fee

revenue, which is included in the

calculation of the Group's operating

margin.

Further information on other revenue

is provided on page 13 and note 5(c)

in the condensed consolidated financial

statements.

----------------------------------------------

Operating expenses Operating expenses represent the

costs for the Group, which are incurred

to earn total net fee revenue and

excludes the impact of specific items

that management considers to be outside

of the Group's normal operations

or one-off in nature. Operating expenses

are included in the calculation of

adjusted profit before tax and impact

the Group's operating margin.

A reconciliation of operating expenses

to the applicable IFRS line items

is included in note 5(c) to the condensed

consolidated financial statements,

and the adjusting items excluded

from operating expenses are explained

in note 5(b). Operating expenses

are explained on page 14 of the Financial

review.

----------------------------------------------

Cash generation Cash generation is calculated by

removing non-cash generative items

from adjusted profit before tax,

such as deferrals required under

IFRS to spread fee income and acquisition

costs over the lives of the underlying

contracts with customers. It is stated

after deducting an allowance for

net cash required to support the

capital requirements generated by

new business offset by a release

of capital from the in-force book.

Cash generation is explained on page

17 of the Financial review.

----------------------------------------------

Asset retention The asset retention rate measures

our ability to retain assets from

delivering good customer outcomes

and investment performance. Asset

retention reflects the annualised

gross outflows of the AuMA during

the period as a percentage of opening

AuMA. Asset retention is calculated

as: 1 - (annualised gross outflow

divided by opening AuMA).

Asset retention is provided for the

Group on page 11 , and by segment

on page 27.

----------------------------------------------

Net inflows/opening AuMA This measure is calculated as total

net flows annualised (as described

above) divided by opening AuMA presented

as a percentage.

This metric is provided on page 2.

----------------------------------------------

Gross flows per adviser Gross flows per adviser is a measure

of the value created by our Quilter

distribution channel and is an indicator

of the success of our multi-channel

business model. Gross flows per adviser

is calculated as gross flows generated

by the Quilter channel through the

Quilter Investment Platform, Quilter

Investors or Quilter Cheviot (annualised)

per average Restricted Financial

Planner in both segments.

Gross flows per adviser is provided

on pages 2, 11 and 12.

----------------------------------------------

Return on Equity ("RoE") Return on equity calculates how many

pounds of profit the Group generates

from continuing operations with each

pound of shareholder equity. This

measure is calculated as adjusted

profit after tax divided by average

equity. Equity is adjusted for the

impact of discontinued operations,

if applicable .

Return on equity is provided on page

2.

----------------------------------------------

Adjusted diluted earnings per share Adjusted diluted earnings per share

represents the adjusted profit earnings

per share, calculated as adjusted

profit after tax divided by the weighted

average number of shares. Refer to

page 54 and note 8 in the condensed

consolidated financial statements.

A continuing and discontinued view

of diluted earnings per share has

also been presented, and the calculation

of all EPS metrics, is shown in note

8 to the condensed consolidated financial

statements.

Adjusted diluted earnings per share

is referred to throughout this document,

with additional details in the EPS

section in the Financial review on

page 14.

----------------------------------------------

Headline earnings per share The Group is required to calculate

headline earnings per share in accordance

with the Johannesburg Stock Exchange

Limited Listing Requirements, determined

by reference to the South African

Institute of Chartered Accountants'

circular 1/2021 Headline Earnings

. This is calculated on a basic and

diluted basis. For details of the

calculation, refer to note 8 of the

condensed consolidated financial

statements.

----------------------------------------------

Chief Executive Officer's statement

Since Quilter listed just over four years ago, we have

successfully transformed our business to be a simpler, more focused

client centric organisation while responding to a number of

external challenges including:

Ø the market and broader political uncertainty following the

Brexit referendum;

Ø the COVID-19 pandemic and its consequences from both a health

and social perspective as well as the changes it has brought to our

working practices; and

Ø geopolitical uncertainty which has manifested both through

rising tensions between global superpowers over the last few years

and, more directly, this year through the war in Ukraine with its

huge humanitarian cost. We have all felt the broader consequences

of this through increased oil prices and concerns over food

sufficiency driving sharply higher inflation which has led to a

global tightening of monetary policy and a "cost of living"

crisis.

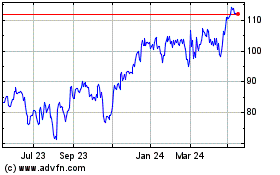

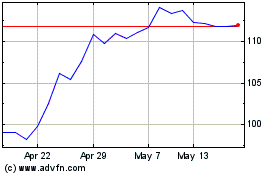

This year global equity markets have experienced one of the

worst periods of negative performance in recent years. While the UK

has been perceived as an outperformer with the FTSE 100 'only' down

3% over the same period, in contrast the FTSE 250 and the FTSE AIM

100 both declined 20% and 25% respectively in the six months to end

June 2022.

Moreover, the traditional 60:40 multi-asset portfolio mix, a

bedrock of retirement planning, delivered the largest negative

year-to-date return on record as falling equity markets coupled

with rising bond yields led to both lower bond and equity portfolio

valuations. Our multi-asset portfolios are not constrained in this

manner and include liquid alternatives. This allows us to diversify

beyond equities and bonds. Some of our managers were able to

implement value biases in their portfolios, which has also proved

useful. We also use cash tactically and the majority of Quilter

Investors' assets performed well as they were defensively

positioned. Overall AuMA, declined 12% to GBP98.7 billion from 31

December 2021.

The first half of 2022 brought a tough operating environment,

probably the most challenging we have faced since Listing, but we

have delivered a good first half financial performance this year.

What differentiates Quilter at times like these is how we respond

and the opportunities we seize.

Our focus remains resolutely on both growing and simplifying our

business, improving business efficiency, and serving and supporting

our two core customer groupings in all market conditions. Notable

strategic achievements in the first six months of the year

include:

Ø significant expansion of our WealthSelect managed portfolios,

which introduced a simpler charging structure and increased the

number of portfolios to cover both risk appetite, investment style

and ESG preferences. These portfolios, together with two new tools

(client profiler and solution explorer), allow advisers to

incorporate clients' ESG preferences when determining the most

appropriate investment solution;

Ø the build out of our combined advice and investment

proposition in the High Net Worth segment which is already bearing

fruit with net inflows from the Quilter channel remaining

strong;

Ø the acceleration of cost savings from our GBP45 million

Business Simplification programme;

Ø building on the operational emissions reduction targets

announced in Q1, we commenced the wider development of our Climate

Action Plan, which will outline how we will seek to align our

business operations, value chain and investment activity with

science-based emissions reduction targets; and

Ø the launch of our inclusion and diversity plan.

Separately, I was also delighted to complete the GBP328 million

capital return to shareholders following the sale of Quilter

International to Utmost Group in November 2021.

Business performance

Given the market context, we are pleased with the 9% higher out

turn in adjusted profit before tax of GBP61 million (H1 2021: GBP56

million). Despite revenue headwinds, our cost discipline delivered

positive operating leverage and a solid P&L outturn in an

environment where costs were naturally higher than 2021 as we

emerged from the pandemic.

Average AuMA, the principal driver of net management fee

revenue, for the period of GBP105.3 billion is modestly ahead of

GBP101.7 billion in the first half of 2021. The decline in markets

over the course of the first half of 2022 took our end-June AuMA

below the end June 2021 level. Unless markets recover, this will

provide a headwind to our second half revenues relative to the

second half of 2021 when markets continued to rise from the

end-June 2021 reference point.

Total net fee revenue of GBP303 million decreased by GBP1

million. The modestly higher average AuMA base was offset by a

small mix-related decline in revenue margins. The repositioning of

our advice business since the beginning of 2021 contributed to

lower other revenues reflecting the decline in advisers over the

course of 2021, coupled with a reduced contribution from mortgage

and protection fees.

Despite heightened cost inflation pressures, we managed

operating expenses down GBP6 million in the first half as we

adjusted to the market environment. This took the cost base to

GBP242 million, with an GBP8 million reduction in the base costs of

running the business to GBP112 million (H1 2021: GBP120 million).

An increase in variable costs reflected investment in the business

and higher development spend relative to subdued pandemic levels in

the prior period. We also enjoyed the benefit of lower FSCS levies

due to the surplus carried forward from last year. Positive

operating leverage demonstrates our cost discipline has been

maintained despite the inflationary pressures across the

business.

Our operating margin improved to 20% (H1 2021: 18%). Markets'

performance in the second half of 2021 helped support a strong

operating margin outcome for 2021. Should market levels remain

around current levels, we expect the full-year operating margin to

be lower than the level achieved in 2021. We remain committed to

our stated 2023 and 2025 operating margin targets but note current

market levels provide a meaningful headwind. Without an improvement

in market levels in the remainder of this year and over the course

of 2023, this may delay achievement of these targets.

The Group's IFRS profit after tax from continuing operations was

GBP151 million, compared to a loss of GBP13 million for H1 2021.

The increase in profit is attributable to a policyholder tax credit

of GBP145 million to June 2022 (H1 2021: tax charge GBP(48)

million).

Adjusted diluted earnings per share was 3.7 pence (H1 2021: 3.9

pence), supported by a reduction in the share count from our

capital return programmes, with this offset by a more normalised

tax charge as the net deferred tax credit in the comparable period

of 2021 did not repeat. On an IFRS basis, we delivered basic EPS of

11.3 pence versus a loss of (0.9) pence per share for the

comparable period of 2021 on the same basis.

Period-end shares of 1.404 billion have declined 26% and by

c.500 million shares since the beginning of 2020 reflecting the

completion of our GBP375 million share buyback programme in early

2022 and the GBP328 million capital return through a B share

issuance and share consolidation which completed in early June

2022.

Given the uncertain outlook, the Board considers it appropriate

to declare an unchanged 2022 interim dividend at 1.2 pence per

share (excluding the contribution from Quilter International in

2021). As was the case in 2020 with the uncertainty caused by the

COVID-19 pandemic, the Board will make an appropriate decision on

the overall dividend for the 2022 financial year when it considers

the final dividend, with a view to maintaining a progression up our

target pay-out range of 50% to 70%, over time.

Client flows

Supporting trusted, advice-based relationships through two

distribution channels - our restricted financial advisers and

open-market independent financial advisers - is at the core of the

Quilter business model. It is in difficult markets that the

resilience of this model becomes evident. We support our customers

to ensure they are engaged with their long-term financial plan and

continue to save for retirement despite the near-term vagaries of

markets.

Our investment platform is central to our proposition, providing

the tax efficient investment 'wrappers' to meet client needs, while

linking advisers with our investment solutions and competitively

priced third-party alternatives to deliver the outcomes sought by

clients. Confidence in our proposition is demonstrated through both

the continued attraction to our solutions by financial advisers and

the increased integrated nature of net inflows.

The environment for new inflows has become more challenging over

the course of the first half of the year. Up until the end of

March, our net flows were broadly comparable with the same period

in 2021 despite total market flows being lower, pointing to an

improvement in market share in the first quarter that has been

sustained in the second quarter. While we continued to enjoy net

inflows throughout the second quarter, we also experienced clients

stepping back from discretionary investment. As a result, gross

inflows in the first half were 12% lower at GBP5.9 billion (H1

2021: GBP6.7 billion). While we experienced improved persistency in

client assets across each of our businesses, the lower level of new

sales volumes translated into lower net inflows which were 30%

lower at GBP1.4 billion versus GBP2.0 billion in the comparable

period of 2021. The main decline in net flows was recorded in

outflows on external third party platforms.

The Quilter Investment Platform continued to perform well

attracting GBP4.2 billion of new sales making it the leading

platform for retail advised sales in the first half. After

redemptions, this led to GBP1.6 billion of net inflows, while the

High Net Worth segment improved on the prior period flows by

delivering GBP0.5 billion of net inflows. Within this, the overall

level of Defined Benefit ("DB") to Defined Contribution ("DC")

flows at GBP0.2 billion were 33% lower than the comparable period

of 2021 (GBP0.3 billion) and continue to be a decreasing proportion

of our overall flows.

Our High Net Worth segment delivered better retention and stable

gross sales which contributed to a strong improvement in net flows

at GBP0.5 billion against GBP0.4 billion in the prior period. The

Quilter Cheviot Climate Assets fund continued to make excellent

progress, reaching the GBP400 million milestone in the period, of

which c.GBP150 million is held on the Quilter Investment Platform

within our Affluent segment. The fund's momentum underlines

Quilter's ability to meet the specific wishes of clients who are

increasingly seeking investments that deliver a broader out turn

than just financial performance.

Investment performance

Quilter Cheviot continued to outperform relevant ARC benchmarks,

remaining principally first or second quartile, to the end of March

2022, the most recent available performance period. Our investment

manager headcount within the High Net Worth segment increased by 8

year on year as we continued to build out our advice and investment

management capabilities.

The medium and longer-term performance of Quilter Investors'

multi-asset solutions remained good. The repositioning of our

managed portfolio solution, WealthSelect, has been well received by

clients and advisers, attracting GBP378 million of net inflows in

the period through the Quilter Investment Platform. WealthSelect's

performance remains strong over one, three and five years and since

inception seven years ago, having been predominantly first or

second quartile over all periods. Cirilium Active performance

remains strong on long-term metrics but, not surprisingly as a more

quality growth focused proposition, its short-term performance has

been weaker in these markets.

Transformation

Our transformation agenda remains firmly on track, with its

focus on:

Ø delivering an improvement in client flows to the Quilter

Investment Platform and into our investment solutions;

Ø repositioning our advice business through a focus on adviser

productivity; and

Ø investment in efficiency and digital initiatives to improve

productivity and client experience.

Taking each of these in turn:

A year on from the launch of our new platform, we have

experienced good take-up by IFA firms who were not active users of

our previous platform. As we said at our Capital Markets Day, we

are targeting increased business from 700 firms over a three-year

period. Thus far, we have secured commitment from 80 of these firms

who have gone through their due diligence and appointed us as a

platform of choice. Many have already started writing new business

on our platform with this representing around 10% of our gross

flows from the IFA channel this year. We are engaged in discussions

with another 60 firms and are in the early stage of negotiation

with a further 100 firms. This improvement reflects the broader

capabilities and functionality of our new platform and provides a

strong base from which we intend to accelerate flow momentum over

the coming years. We also continue to make good progress in

increasing usage of our new platform by Quilter Financial Planning

clients given its improved functionality. This is evidenced by an

improvement in Quilter channel flows onto the new platform and the

reduced flows from the Quilter channel onto third party

platforms.

The introduction of our new platform last year was a catalyst to

drive higher adviser productivity in Quilter Financial Planning by

increasingly aligning our advisers to our integrated proposition.

While this led to an expected reduction in advisers over the course

of 2021, the more modest reduction in the current year has been

caused by challenges in the speed of recruiting external advisers

into the business, while our attrition rates of advisers have

normalised to pre-review levels. We have stepped up our new adviser

recruitment and resourcing. Our core focus has delivered a

sustained improvement in our adviser productivity, with the Quilter

channel gross flows per adviser being stable at GBP2.4 million

despite a more challenging market environment. While our work to

reshape our Advice business is ongoing, we currently expect adviser

numbers to stabilise and to resume growth by the end of the

year.

Our Optimisation programme is now complete having achieved cost

savings of more than GBP65 million over the three-year programme.

Our second phase of efficiency initiatives, known as Business

Simplification, continues to progress well. In recognition of the

more challenging operating environment, we are continuously seeking

opportunities to accelerate some of our identified plans to bring

forward anticipated cost savings. An example achieved is the faster

consolidation of our two Southampton offices into a single building

which was completed earlier this year, over a year ahead of the

original intended schedule.

We have continued to invest in technology to deliver better

customer outcomes and experiences. In the first half, this included

investing in mobile to allow Affluent customers to access our

Platform via a mobile app. The technology is in beta testing with a

select group of clients and, once we have gained relevant feedback,

we expect to be able to commence a wider roll out later this year.

Our hybrid advice investment plans are also progressing well. We

are advancing our plans here and expect to move the initiative into

its pilot stage in 2023.

Responsible business and stewardship

Quilter is committed to being a responsible business in the way

we act and by building these principles into both our investment

and advice processes.

First , in terms of how we act, we recognise the current

environment is not just tough for our business, but it is also

extremely challenging for our staff. Our people are our most

important asset and have been magnificent over the past two years,

digging deep to keep our services running and supporting our

clients throughout the various COVID-19-induced lockdowns. We are

putting in place additional support for our people to help them

through the cost of living crisis. All employees earning GBP50,000

and less will receive a one-off payment of GBP1,200 in August 2022

at a total cost of around GBP4 million in the second half. We know

this payment will not fully mitigate rising food and energy costs,

but we hope it will go some way to ease current difficulties felt

by some employees due to the strain of the increased cost of

living.

We also launched our Inclusion and Diversity Action Plan earlier

this year. We believe that financial services companies who fail to

address systemic diversity issues within the industry will

ultimately get left behind. The companies who make a concerted

effort to improve employee diversity will be able to attract

talented individuals, who may have previously not considered a

career in our sector and Quilter will benefit as a result. Our new

two-year action plan prioritises solutions with measurable impact

which we will track and sustain over the long-term so we can better

meet the differing needs of underrepresented groups.

Second , in terms of embedding behaviours, earlier this year we

updated our matrix for our restricted network advisers to

incorporate ESG ratings and specific responsible investment

solutions. The new responsible and sustainable portfolios allow

(alongside our two new tools: client profiler and solution

explorer) advisers to take clients' ESG preferences into account in

determining the most appropriate solution. We believe this approach

is market leading.

Third , we continue to work closely with the skilled person

review investigating the Lighthouse DB to DC transfers. Our focus

remains on doing the right thing by any customers who were poorly

advised, even though this advice predates our acquisition of

Lighthouse. The skilled persons review is reaching its final stages

and I can report we concluded negotiations with the insurers who

provided professional indemnity cover for Lighthouse resulting in

the payment of the full amount due under the policy of GBP15

million, including amounts received since the period end, with this

benefit excluded from adjusted profit.

In respect of Board matters, Glyn Jones stepped down as Chair at

the conclusion of the Company's 2022 Annual General Meeting, with

Ruth Markland appointed as Chair and Tim Breedon assuming the role

of Senior Independent Director, until such time as the permanent

Chair successor was confirmed. We were delighted to welcome Glyn

Barker to the Board as a Non-executive Director at the beginning of

June 2022 and, subject to regulatory approval for his permanent

appointment, Chair Designate.

Outlook

Quilter is well positioned in an industry with long-term secular

growth prospects, and we have made further good progress in the

execution of our strategy. Our focus remains on improving

operational efficiency through our Business Simplification

programme and driving the business towards the financial targets we

set out at the November 2021 Capital Markets Day, albeit that

current market levels provide a revenue headwind which may delay

the achievement of our operating margin targets.

My priorities continue to be growth in the IFA and Quilter

adviser franchises, cost discipline to deliver a right-sized cost

base for the new streamlined Quilter, investing for future growth

through hybrid advice, and embedding ESG into the services we

provide for clients and tools we provide for advisers. We remain

confident in our simpler, more focused, business model, our ability

to improve our market share of flows through our new platform, and

our prospects to deliver strong sustainable returns to shareholders

through the cycle.

Paul Feeney

Chief Executive Officer

Financial review

Review of financial performance

In this section, review of financial performance, unless

indicated otherwise, all results are presented excluding Quilter

International in both the current year and prior year comparative,

following its sale to Utmost Group in November 2021.

Alternative Performance Measures ("APMs")

We assess our financial performance using a variety of measures

including APMs, as explained further on pages 4 to 6 . In the

headings and tables presented, these measures are indicated with an

asterisk: *.

Key financial highlights

Quilter highlights from continuing operations (1) H1 2022 H1 2021

================================================================= ======== ========

Assets and flows

AuMA* (GBPbn)(2, 5) 98.7 106.4

-------- --------

Of which Affluent 74.2 79.6

Of which High Net Worth 25.2 27.0

Inter-segment dual assets (0.7) (0.2)

Gross flows* (GBPbn)(2, 5) 5.9 6.7

-------- --------

Of which Affluent 4.8 5.3

Of which High Net Worth 1.3 1.4

Inter-segment dual assets (0.2) 0.0

Net inflows* (GBPbn)(2, 5) 1.4 2.0

-------- --------

Of which Affluent 1.0 1.6

Of which High Net Worth 0.5 0.4

Inter-segment dual assets (0.1) 0.0

Net inflows/opening AuMA*(2) 3% 4%

Gross flows per adviser* (GBPm)(2, 3) 2.4 2.4

Asset retention*(3) 92% 91%

Profit and loss

IFRS profit/(loss) before tax from continuing operations

attributable to equity holders* (GBPm)(2) 182 (21)

IFRS profit/(loss) after tax from continuing operations

(GBPm) 151 (13)

Adjusted profit before tax* (GBPm)(2) 61 56

Operating margin*(2) 20% 18%

Revenue margin* (bps)(2) 47 48

Return on equity*(2) 5.9% 7.3%

Adjusted diluted EPS* from continuing operations (pence)(2) 3.7 3.9

Basic earnings/(loss) per share from continuing operations

(pence) 11.3 (0.9)

Non-financial

Restricted Financial Planners ("RFPs") in Affluent

segment(4) 1,512 1,639

Discretionary Investment Managers in High Net Worth

segment(4) 176 168

Quilter Private Client RFPs in High Net Worth segment(4) 55 62

------------------------------------------------------------------ -------- --------

(1) Continuing operations represent Quilter plc, excluding the results

of Quilter International. Adjusted profit before tax for Quilter International

in H1 2021 was GBP29 million. Adjusted diluted EPS from Quilter International

in H1 2021 was 1.9 pence per share.

(2) Alternative Performance Measures ("APMs") are detailed and defined

on pages 4 to 6.

(3) Gross flows per adviser is a measure of the value created by our

Quilter distribution channel.

(4) Closing headcount as at 30 June.

(5) H1 2021 asset and flow comparators have been restated to exclude

amounts relating to Quilter International to align with information presented

at the Company's Capital Markets Day on 3 November 2021 and its fourth

quarter trading statement 2021 on 26 January 2022.

Overview

The Group's financial performance was resilient for the first

six months of the year in light of the volatile market environment,

with adjusted profit before tax up 9% to GBP61 million (H1 2021:

GBP56 million). This reflected stable revenues and a disciplined

focus on cost control as we regain momentum following the pandemic

and a reduction in FSCS levies. Global equity markets were down for

the first six months of the year, with the FTSE 100 down 3%, MSCI

World Index (GBP) down 12%, PIMFA Private Investor Balanced (Net)

down 9%, and Russell 1000 down 22% from the closing 2021 index

levels. The UK's rate of inflation hit a new 40-year high, with

corporate bond markets adversely affected by rising rates: the

Bloomberg Global Aggregate Bond index fell 10% from closing 2021

levels. The Group's AuMA ended the period at GBP98.7 billion, a 12%

decrease from the opening position at the start of 2022, resulting

from GBP14.5 billion of negative market movements more than

offsetting net inflows of GBP1.4 billion.

Net inflows of GBP1.4 billion for the period were down 30% on

the prior period (H1 2021: GBP2.0 billion), impacted by a dampening

in investor sentiment in light of the volatile global markets and a

weakening macro-economic environment. The net inflows are stated

inclusive of net outflows arising from assets on third party

platforms of GBP0.6 billion (H1 2021: GBP0.3 billion). Gross flows

for the Group were 12% lower than the prior period at GBP5.9

billion (H1 2021: GBP6.7 billion), primarily as a result of lower

flows into the Affluent segment due to lower adviser gross sales as

investor sentiment weighed on client's propensity to invest. As a

consequence, net inflows as a percentage of opening AuMA was 3% (H1

2021: 4%). Detailed analysis of net inflows by business segment is

shown in the Supplementary Information section of this

announcement.

-- The Affluent segment's net inflows of GBP1.0 billion were

down 38% on the prior period (H1 2021: GBP1.6 billion) due to

c.GBP0.2 billion lower net inflows in the Quilter Investment

Platform against a strong prior period comparative, and net

outflows of GBP0.6 billion (H1 2021: net outflows of GBP0.3

billion) in assets managed by Quilter solutions on third-party

platforms in relation to legacy and closed books of business. Net

inflows of GBP1.6 billion onto the Quilter Investment Platform were

down 11% (H1 2021: GBP1.8 billion), with lower sales in the IFA

channel as the prior period experienced strong inflows following

the completion of the Platform Transformation Programme and as

investor confidence improved as national lockdown restrictions

eased. Lower IFA channel flows were offset in the period by an

increase in net inflows in the Quilter distribution channel where

the Platform is winning a greater share of restricted sales,

weighted towards pensions, and we have established a simplified

procedure to allow us to accelerate back book transfers. Gross

flows on the Quilter Investment Platform of GBP4.2 billion (H1

2021: GBP4.5 billion) were 7% lower as clients reacted to the macro

environment. Pension and ISA product sales comprise GBP3.1 billion

(H1 2021: GBP3.3 billion) of the Quilter Investment Platform gross

flows of GBP4.2 billion, reflecting a similar proportion of overall

sales in comparison to the prior period.

-- The High Net Worth segment recorded net inflows of GBP0.5

billion which were up 25% from the prior period (H1 2021: GBP0.4

billion). Gross inflows of GBP1.3 billion were marginally down on

H1 2021 of GBP1.4 billion, offset by lower outflows on the prior

period. This is reflected in improved persistency at 94% versus 92%

in H1 2021.

Quilter channel gross flows per adviser* were stable at GBP2.4

million for the period (H1 2021: GBP2.4 million). Total average

RFP's for both segments combined have decreased 9% in H1 2022 to

1,603 (H1 2021: 1,765).

The Group's AuMA ended the period at GBP98.7 billion, down 12%

from the opening position at the start of 2022 (FY 2021: GBP111.8

billion), due to the fall in global equity and bond indices. The

Affluent segment AuMA of GBP74.2 billion decreased by 11% (FY 2021:

GBP83.3 billion) of which GBP24.5 billion is managed by Quilter,

down on the opening position at the start of 2022 (FY 2021: GBP27.4

billion). High Net Worth's AuM was GBP25.2 billion, down 12% from

opening 2022 (FY 2021: GBP28.7 billion), with all assets managed by

Quilter. In total, GBP49.5 billion of AuMA is managed by Quilter

across the Group (FY 2021: GBP56.1 billion).

The Group's revenue margin of 47 bps was 1 bp lower than the

prior period (H1 2021: 48 bps). For assets administered within the

Affluent segment, the revenue margin decreased by 1 bp to 26 bps

(H1 2021: 27 bps) as a result of higher average AuMA leading to

more clients moving into lower revenue margin tiers as the value of

their investments increase. Similarly, for assets managed in the

Affluent segment, the revenue margin decreased by 1 bp to 47 bps

(H1 2021: 48 bps) as a result of anticipated mix shifts in

underlying assets towards lower margin products. Within the High

Net Worth segment, the revenue margin of 70 bps decreased from the

prior period by 2 bps (H1 2021: 72 bps) as a result of the expected

reduction of non-recurring revenue from commission and contract

charges, and the impact of tiered fee structures on higher average

AuM.

Adjusted profit before tax increased by 9% to GBP61 million (H1

2021: GBP56 million). Higher net management fees of GBP245 million

(H1 2021: GBP242 million) were a result of higher average AuMA

period on period (H1 2022: GBP105.3 billion compared to H1 2021:

GBP101.7 billion) offset by lower other revenue of GBP58 million

(H1 2021: GBP62 million), due to lower mortgage and protection new

business levels and lower adviser headcount . Operating expenses in

H1 2022 were GBP242 million, 2% lower than the prior period (H1

2021: GBP248 million), primarily due to cost discipline and a

decrease in FSCS levies. The Group's operating margin increased to

20% (H1 2021: 18%), driven by the reduction in operating

expenses.

The Group's IFRS profit after tax from continuing operations was

GBP151 million, compared to a loss of GBP13 million for H1 2021.

The increase in profit is attributable to policyholder tax credits

of GBP145 million to June 2022 (H1 2021: tax charge GBP(48)

million).

Adjusted diluted earnings per share for continuing operations

decreased 5% to 3.7 pence (H1 2021: 3.9 pence), due to reduced

adjusted profit after tax as a result of the non-repetition of the

benefit from a deferred tax credit in 2021.

Financial performance by segment

Financial performance

from continuing operations High Head Continuing

H1 2022 (GBPm) Affluent Net Worth Office operations

----------------------------- --------- ----------- -------- ------------

Net management fee* 151 94 - 245

Other revenue* 42 14 2 58

------------------------------- --------- ----------- -------- ------------

Total net fee revenue* 193 108 2 303

Operating expenses* (146) (85) (11) (242)

------------------------------- --------- ----------- -------- ------------

Adjusted profit before

tax* 47 23 (9) 61

Tax (11)

--------

Adjusted profit after

tax* 50

--------- ----------- --------

Operating margin (%)* 24% 21% 20%

Revenue margin (bps)* 38 70 47

------------------------------- --------- ----------- -------- ------------

Financial performance

from continuing operations High Net Continuing

H1 2021 (GBPm) Affluent Worth Head Office operations

----------------------------- --------- --------- ------------ ------------

Net management fee* 149 93 - 242

Other revenue* 50 12 - 62

------------------------------- --------- --------- ------------ ------------

Total net fee revenue* 199 105 - 304

Operating expenses* (155) (79) (14) (248)

------------------------------- --------- --------- ------------ ------------

Adjusted profit before

tax*(1) 44 26 (14) 56

Tax 1

------------

Adjusted profit after

tax* 57

--------- --------- ------------

Operating margin (%)* 22% 25% 18%

Revenue margin (bps)* 39 72 48

------------------------------- --------- --------- ------------ ------------

(1) Total adjusted profit before tax including Quilter

International for H1 2021: GBP85 million. See note 5(a) to the

condensed consolidated financial statements on page 41.

Total net fee revenue*

The Group's total net fee revenue of GBP303 million (H1 2021:

GBP304 million), is broadly unchanged on the prior period. Net

management fee revenue is up 1% on that of the prior period due to

the higher average Group AuMA of GBP105.3 billion (H1 2021:

GBP101.7 billion). The blended revenue margin for the Group,

calculated in reference to net management fees, marginally

decreased by 1 bp to 47 bps.

Total net fee revenue for Affluent was GBP193 million, down 3%

from the prior year (H1 2021: GBP199 million). Net management fees

of GBP151 million were marginally ahead of the prior period due to

the impact of higher average AuMA which increased by 4% to GBP78.8

billion in H1 2022. Other revenue predominantly reflects revenue

generated from the provision of advice within Quilter Financial

Planning. Within the revenue generated by advice, mortgage and

protection, recurring charges and fixed fees were at lower levels

than the prior period due to lower markets and lower average

adviser headcount.

Total net fee revenue in High Net Worth was GBP108 million for

the period, up 3% from the prior period (H1 2021: GBP105 million).

This was principally driven by higher average AuM which increased

by 5% to GBP27.0 billion, partially offset by an expected reduction

in commission revenue as the proportion of clients on fee-only

propositions continues to increase. Other revenue predominantly

reflects the revenue generated from Quilter Private Client Advisers

which was at similar levels to those of H1 2021. Within Quilter

Cheviot, other revenue was up GBP3 million (H1 2021: GBPnil) due to

fees generated from clients' cash assets as a result of the rise in

UK interest rates.

Operating expenses*

Operating expenses decreased by GBP6 million to GBP242 million

(2021: GBP248 million) despite the obvious pressures of a higher UK

inflationary environment and more normalised level of investment

spend which was suppressed during 2021 due to the pandemic. The

Group continues to exercise cost discipline with a particular focus

on managing discretionary spend in the wider context of

inflationary pressures in the global economy and supressed market

conditions. In H1 2022, the Group incurred lower FSCS levies and

regulatory fees (an overall reduction of GBP10 million) compared to

the prior period primarily as a result of updated FSCS levy

guidance from the FCA for 2022/23.

H1 2022 H1 2021

Operating expense split As a

(GBPm) Continuing percentage Continuing As a percentage

operations of revenues operations of revenues

---------------------------- ------------ -------------- ------------- ----------------

Support staff costs 58 63

Operations 9 13

Technology 14 16

Property 16 15

Other base costs(1) 15 13

------------------------------ ------------ -------------- ------------- ----------------

Sub-total base costs 112 37% 120 39%

Revenue-generating staff

base costs 49 16% 46 15%

Variable staff compensation 39 13% 39 13%

Other variable costs(2) 26 9% 17 6%

------------------------------ ------------ -------------- ------------- ----------------

Sub-total variable costs 114 38% 102 34%

Regulatory/professional

indemnity costs 16 5% 26 9%

Operating expenses* 242 80% 248 82%

------------------------------ ------------ -------------- ------------- ----------------

(1) Other base costs includes depreciation and amortisation, audit fees,

shareholder costs, listed Group costs and governance.

(2) Other variable costs includes FNZ costs, development spend and corporate

functions variable costs.

Support staff costs decreased by 8% to GBP58 million (2021:

GBP63 million) driven by transformation programmes continuing to

deliver sustainable benefits.

Operations costs decreased by 31% to GBP9 million (H1 2021:

GBP13 million), reflecting the move to the outsourced operations

model within the Quilter Investment Platform for the full period in

2022, and a simpler operational base following the business

divestments made in preceding years.

Technology costs decreased by 13% to GBP14 million (H1 2021:

GBP16 million). Technology costs reduced as a result of continuing

transformation activity, cessation of dual running activity

following the completion of the Platform Transformation Programme,

and the consolidation of contracts following the sale of Quilter

International.

Property costs increased by 7% to GBP16 million (H1 2021: GBP15

million) driven by an increase in operating costs as a result of

higher occupancy post-pandemic, and inflationary increases arising

from providing property management infrastructure, such as heating

and electricity.

Other base costs increased by 15% to GBP15 million (H1 2021:

GBP13 million) driven by increased depreciation charges following

the completion of capital projects in the property portfolio.

Revenue-generating staff base costs increased by 7% to GBP49

million (H1 2021: GBP46 million) principally as a result of the

build out of the combined advice and investment proposition in the

High Net Worth segment, and the increase in the number of

discretionary investment managers.

Variable staff compensation remained stable at GBP39 million (H1

2021: GBP39 million). Reductions in share based-payment accruals

following global equity market falls experienced in the first 6

months of 2022 is offset by increased short-term compensation

accruals reflecting inflationary base salary increases and improved

business performance versus that of the prior period.

Other variable costs increased by 53% to GBP26 million (H1 2021:

GBP17 million) principally driven by operating expenses associated

with the new platform, which are partially offset by decreases in

base costs, and increases in development spend as we regain

momentum following the deferral of change activity during the

pandemic.

Regulatory and insurance charges decreased by 38% to GBP16

million (H1 2021: GBP26 million) largely driven by the reduced FSCS

levy for 2022/23. This decrease across the industry, while

welcomed, is unlikely to be sustained in future years as part of

the decrease reflects the FSCS levy for the industry carrying

forward a surplus from 2021 following significant increases in the

levy over the past few years.

Taxation

The effective tax rate ("ETR") on adjusted profit before tax for

H1 2022 was 18% (H1 2021: (2)%). The Group's ETR is not materially

different from the UK corporation tax rate of 19%. The Group's ETR

is dependent on a number of factors, including future changes in

the UK corporation tax rate.

The Group's IFRS income tax expense for H1 2022 was a credit of

GBP114 million (H1 2021: charge of GBP(40) million). The income tax

expense or credit can vary significantly year-on-year as a result

of market volatility and the impact market movements have on

policyholder tax. The recognition of the income received from

policyholders (which is included within the Group's IFRS revenue)

to fund the policyholder tax liability can vary in timing to the

recognition of the corresponding policyholder tax expense, creating

volatility to the Group's IFRS profit or loss before tax

attributable to equity holders. An adjustment is made to adjusted

profit before tax to remove these distortions, as explained further

on page 16 and in note 5(b) of the consolidated financial

statements.

Earnings Per Share ("EPS")

Following the GBP328 million return of capital, a share

consolidation was completed so that comparability between the

market price for Quilter Ordinary Shares before and after the

implementation of the B share scheme was maintained.

New Ordinary Shares were issued for existing Ordinary Shares in

a ratio of six new shares of 8 1/6 pence each for seven existing

shares of 7 pence each resulting in a reduction in the numbers of

shares by 234 million. The prior period average number of shares

have been restated following the share consolidation, in line with

IAS33.

For H1 2022, basic EPS relating to the continuing business was

11.3 pence (H1 2021: (0.9) pence). The average number of shares in

issue used for the basic EPS calculation was 1,342 million (H1

2021: 1,443 million), after the deduction of own shares held in

Employee Benefit Trusts ("EBTs") and consolidated funds of 63

million (HY 2021: 79 million). The reduction in the number of

shares in issue in the period is due to the share buyback

programme, which completed in January 2022. The Share Buyback

Programme completed before the share consolidation, and the

unadjusted number of shares bought and cancelled over the life of

the programme was 264 million.

The average number of shares in issue used for the diluted EPS

calculation was 1,353 million (HY 2021: 1,479 million). This

includes the dilutive effect of shares and options awarded to

employees under share-based payment arrangements of 11 million (HY

2021: 36 million). The dilutive effect of share awards has

decreased due to movements in value of employee share schemes

compared to the prior period.

Optimisation

In H1 2022, we successfully deployed the final delivery of our

Group wide General Ledger and further consolidated our data centre,

telephony and data reporting solutions within the IT estate. This

work delivered GBP4 million of annualised sustainable cost savings

in H1 2022 against the 2018 cost base. The Optimisation programme,

which we announced in 2018, has now achieved its target of

delivering annualised run-rate cost savings of GBP65 million by

mid-2022, with total implementation costs since inception of GBP84

million. A limited amount of work on the programme remains

underway, and we anticipate the total delivery cost of the

programme to be no more than GBP87 million when it concludes at the

end of 2022, below the original GBP91 million estimate. Further

implementation costs in H2 2022 will include the final

decommissioning of the legacy finance systems together with

anticipated support costs.

Business Simplification

As announced at our Capital Markets Day in November 2021, our

Business Simplification programme is anticipated to reduce

operating costs by around GBP45 million by the end of 2024 on a

run-rate basis, with costs to achieve expected to be GBP55 million.

In H1 2022 we started to simplify Quilter's structures and organise

ourselves to support our two segments, Affluent and High Net Worth,

with further work planned into 2024. During the period we also

delivered early simplification benefits related to our property

strategy and technology estate enabled by the completion of the

Platform Transformation Programme and sale of Quilter

International. To date the programme has delivered GBP13 million of

annualised run-rate cost savings with an implementation cost of

GBP12 million.

Lighthouse DB pension transfer advice provision

As reported in the Group's 2021 Annual Report, a provision was

recognised in relation to DB to DC pension transfer advice provided

by Lighthouse advisers prior to Lighthouse transitioning to our

systems and controls following our acquisition of Lighthouse.

A total provision of GBP3 million (31 December 2021: GBP29

million) has been calculated for the remaining redress of British

Steel Pension Scheme cases and other DB to DC pension transfer

cases which are subject to the skilled person review. This includes

anticipated costs of legal and professional fees associated with

the redress activity. The provision reflects the outcome of the

suitability review for all cases currently identified as being in

scope, redress calculations performed by the skilled person and the

offers made to customers who received unsuitable advice which

caused them to sustain a loss. The provision decreased by GBP5

million during 2022, which has been recognised as a reduction

within expenses of the Group (and excluded from adjusted profit

before tax), in order to reflect the results of the redress

calculations performed under the skilled person review. Redress on

British Steel Pension Scheme cases and other DB to DC pension

transfer cases of GBP18 million and professional fees of GBP2

million were paid during the period. Payments are expected to be

completed during 2022. Subject to FCA confirmation of whether any

additional work is required, we anticipate the skilled person

review will conclude during 2022.

Insurance coverage in relation to claims in respect of legal

liabilities arising in connection with Lighthouse British Steel

Pension Scheme cases has been confirmed and a portion of the

proceeds received, contributing GBP10 million to the profit of the

Group, which has also been excluded from adjusted profit before

tax.

Reconciliation of adjusted profit before tax* to IFRS profit

Adjusted profit before tax for the Group on a continuing basis

was GBP61 million (H1 2021: GBP56 million).

Reconciliation of adjusted For the six months ended For the six months ended

profit before tax to IFRS 30 June 2022 30 June 2021(3)

profit/(loss) after tax

Continuing Discontinued Continuing Discontinued

GBPm operations operations(1) Total operations operations(1) Total

Affluent 47 - 47 44 29 73

High Net Worth 23 - 23 26 - 26

Head Office (9) - (9) (14) - (14)

--------------------------------- ----------- -------------- ----- ----------- -------------- -----

Adjusted profit before

tax* 61 - 61 56 29 85

Reallocation of Quilter

International costs - - - (5) 5 -

--------------------------------- ----------- -------------- ----- ----------- -------------- -----

Adjusted profit before

tax after reallocation* 61 - 61 51 34 85

Adjusting for the following:

Impact of acquisition and

disposal-related accounting (22) - (22) (23) - (23)

Loss on business disposals - (1) (1) - - -

Business transformation

costs (17) - (17) (32) - (32)

Managed Separation costs - - - (1) - (1)

Finance costs (5) - (5) (5) - (5)

Policyholder tax adjustments 146 - 146 (4) - (4)

Customer remediation 15 - 15 (7) - (7)

Exchange rate gain (ZAR/GBP) 4 - 4 - - -

--------------------------------- ----------- -------------- ----- ----------- -------------- -----

Total adjusting items

before tax 121 (1) 120 (72) - (72)

--------------------------------- ----------- -------------- ----- ----------- -------------- -----

Profit/(loss) before tax

attributable to equity

holders* 182 (1) 181 (21) 34 13

Tax attributable to policyholder

returns (145) - (145) 48 - 48

Income tax (expense)/credit 114 - 114 (40) (1) (41)

--------------------------------- ----------- -------------- ----- ----------- -------------- -----

Profit/(loss) after tax(2) 151 (1) 150 (13) 33 20

--------------------------------- ----------- -------------- ----- ----------- -------------- -----

(1) Discontinued operations in 2022 relate to the increase in

the Merian warranty provision on the Single Strategy Asset

Management business. In 2021, discontinued operations include the

results related to Quilter International.

(2) IFRS profit/(loss) after tax.

(3) The new segments replace the segments reported in the 2020

Annual Report: Advice and Wealth Management and Wealth Platforms.

June 2021 comparatives have been restated as appropriate to reflect

the new segmentation.

Adjusted profit before tax represents the Group's IFRS profit,

adjusted for specific items that management considers to be outside

of the Group's normal operations or one-off in nature, as detailed

on page 41 in the condensed consolidated financial statements. The

exclusion of certain adjusting items may result in adjusted profit

before tax being materially higher or lower than the IFRS profit

after tax.

Adjusted profit before tax does not provide a complete picture

of the Group's financial performance, which is disclosed in the

IFRS income statement, but is instead intended to provide

additional comparability and understanding of the financial

results.

The impact of acquisition and disposal related accounting costs

of GBP22 million (H1 2021: GBP23 million) include amortisation of

acquired intangible assets. These costs remained stable on those of

the prior period.

Business transformation costs of GBP17 million were incurred in

H1 2022 (H1 2021: GBP32 million) consisting of:

-- Business Simplification costs of GBP12 million (H1 2021:

GBPnil). In H1 2022, Group simplified its structures to support the

two segments, Affluent and High Net Worth, with further work

planned into 2024. During the period we also delivered early

simplification benefits related to our property strategy and

technology estate enabled by the completion of the Platform

Transformation Programme and sale of Quilter International. To date

the programme has delivered GBP13 million of annualised run-rate

cost savings with an implementation cost of GBP12 million.

-- The Optimisation programme incurred costs of GBP3 million (H1

2021: GBP10 million). The Optimisation programme commenced in 2018

to provide closer business integration, create central support,

rationalise technology and reduce third-party spend and is now

materially complete.

-- Restructuring costs following the disposal of Quilter Life

Assurance of GBP2 million in H1 2022 (H1 2021: GBPnil), including

property exit costs after the conclusion of the Transitional

Service Agreement with ReAssure.

-- The Platform Transformation Programme concluded in 2021 (H1