Reabold Resources PLC Further Investment into LNEnergy (2483W)

December 11 2023 - 1:00AM

UK Regulatory

TIDMRBD

RNS Number : 2483W

Reabold Resources PLC

11 December 2023

11 December 2023

Reabold Resources plc

("Reabold" or the "Company")

Further Investment into LNEnergy

Reabold Resources plc, the oil & gas investing company with

a diversified portfolio of exploration, appraisal and development

projects , is pleased to announce that it has exercised the Second

Option to subscribe for 116 new ordinary shares in LNEnergy Limited

("LNEnergy") through an aggregate further investment of

GBP1,650,000 . Reabold will fund GBP750,000 of this from its

existing cash resources, while the remaining GBP900,000 will be

satisfied through the issue of 486,486,487 new ordinary shares of

0.1p each in the capital of the Company ("Ordinary Shares") at a

price of 0.185 pence per share to LNEnergy Limited (the

"Consideration Shares"). This

increases Reabold's shareholding in LNEnergy to 26.1 % of its enlarged share capital .

LNEnergy's primary asset is an exclusive option over a 90%

interest in the Colle Santo gas field. The Colle Santo gas field is

a highly material gas resource with an estimated 65Bcf of 2P

reserves([1]) , with two production wells already drilled and

flow-tested, making the field development ready. LNEnergy believes

that the field has the potential to generate an estimated EUR11-12m

of gross post-tax free cash flow per annum.

Colle Santo update

The University of Chieti-Pescara of the Region of Abruzzo

announced the formation of a Technical Scientific Committee (the

"Committee") on 17 November 2023 in support of the development of

the Colle Santo Gas Field in Abruzzo, Italy.

The Committee will work in collaboration with LNEnergy's

technical and engineering advisors, Italfluid, to provide third

party expert support in the evaluation of data to be collected in

advance and during LNEnergy's proposed controlled long-term test

and monitoring campaign., .

The presence of Italfluid's substantial expertise in field

development, local and regional authorities and in particular

representatives of the Engineering and Geology Department of the

University of Chieti-Pescara (leading experts in the subsurface of

the Abruzzo Region) is a material step forward in LNEnergy's

ongoing concession authorization work.

Sachin Oza , Co-CEO of Reabold, commented:

"Reabold is excited by the potential of the Colle Santo project

and confident in its decision to invest further in LNEnergy. T he

formalisation of the Technical Scientific Committee at the

University of Chieti-Pescara shows constructive local stakeholder

engagement in the Colle Santo project and follows on from positive

regulatory progress taking place at a government level, as Italy

looks to secure domestic energy supply. We look forward to updating

shareholders on our progress in Italy as we develop this important

regional project."

(1) RPS estimate, September 2022

Admission and total voting rights

Application has been made for admission of the 486,486,487

Consideration Shares to trading on AIM ("Admission") and it is

expected that Admission will occur at 8.00 a.m. on or around 12

December 2023. The Consideration Shares will rank pari passu with

the existing Ordinary Shares.

Following Admission, the total issued share capital of the

Company will consist of 10,363,112,370 Ordinary Shares. The Company

holds 111,572,837 Ordinary Shares in treasury. Accordingly, on

Admission, the total number of voting rights in the Company will be

10,251,539,533 and this is the figure that may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change in their interest in, the share capital of the Company

under the FCA's Disclosure Guidance and Transparency Rules.

Unless otherwise defined, capitalised terms used in this

announcement have the same meanings as ascribed to them in the

Company's announcement of 9 May 2023 entitled "Investment in

LNEnergy".

Ends

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757

Stephen Williams 4980

Strand Hanson Limited - Nominated +44 (0) 20 7409

& Financial Adviser 3494

James Spinney

James Dance

Rob Patrick

Stifel Nicolaus Europe Limited +44 (0) 20 7710

- Joint Broker 7600

Callum Stewart

Simon Mensley

Ashton Clanfield

Cavendish - Joint Broker +44 (0) 20 7220

Barney Hayward 0500

Camarco

Billy Clegg

Rebecca Waterworth +44 (0) 20 3757

Sam Morris 4980

Notes to Editors

Reabold Resources plc has a diversified portfolio of

exploration, appraisal and development oil & gas projects.

Reabold's strategy is to invest in low-risk, near-term projects

which it considers to have significant valuation uplift potential,

with a clear monetisation plan, where receipt of such proceeds will

be returned to shareholders and re-invested into further growth

projects. This strategy is illustrated by the recent sale of the

undeveloped Victory gas field to Shell, the proceeds of which are

being returned to shareholders and re-invested.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAPAPEDDDFFA

(END) Dow Jones Newswires

December 11, 2023 02:00 ET (07:00 GMT)

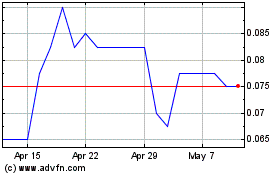

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Jan 2024 to Jan 2025