TIDMROL

RNS Number : 2802Q

Rotala PLC

17 October 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS IS AN ANNOUNCEMENT FALLING UNDER RULE 2.4 OF THE CITY CODE

ON TAKEOVERS AND MERGERS (THE "CODE") AND DOES NOT CONSTITUTE AN

ANNOUNCEMENT OF A FIRM INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF

THE CODE. THERE CAN BE NO CERTAINTY THAT ANY OFFER WILL BE

MADE.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION WHICH IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

17 October 2023

Rotala PLC

("Rotala", the "Company" or the "Group")

Extension of PUSU deadline pursuant to Rule 2.6(c) of the

Code

On 19 September 2023, the Company announced that it had received

an indicative proposal from certain of its directors, being Simon

Dunn, Bob Dunn and John Gunn, its Chief Executive, Managing

Director - North West, and Non-Executive Chair respectively,

(together, the "Director Offerors") in relation to a possible offer

of 63.5 pence per share, payable in cash, for the Company (the

"Proposal"). Such offer would be made by a newly incorporated

entity established by the Director Offerors (and their spouses and

certain personal pension plans) (the "Potential Offeror").

The announcement stated that in accordance with Rule 2.6(a) of

the Code, the Potential Offeror was required, by not later than

5.00 p.m. on 17 October 2023 (the "PUSU Deadline") either to

announce a firm intention to make an offer for the Company in

accordance with Rule 2.7 of the Code or to announce that it did not

intend to make an offer for the Company, in which case the

announcement would be treated as a statement to which Rule 2.8 of

the Code applies.

A committee of independent directors, comprising Graham Spooner,

Non-Executive Deputy Chair and Senior Independent Director, Graham

Peacock, Independent Non-Executive Director, and Kim Taylor, Group

Finance Director, (together, the "Independent Directors"), was

formed to consider the Proposal.

Discussions between the Director Offerors and the Independent

Directors are continuing and therefore Rotala announces that the

Independent Directors have requested, and the Panel on Takeovers

and Mergers (the "Panel") has consented to, an extension to the

PUSU Deadline. Consequently, the Potential Offeror is now required

by 5.00 p.m. (London time) on 14 November 2023 to announce either a

firm intention to make an offer for the Company in accordance with

Rule 2.7 of the Code or that it does not intend to make an offer,

in which case the announcement will be treated as a statement to

which Rule 2.8 of the Code applies.

This deadline can be further extended with the consent of the

Panel in accordance with Rule 2.6(c) of the Code.

Although discussions between the Directors Offerors and the

Independent Directors are ongoing, this announcement does not

amount to a firm intention to make an offer under Rule 2.7 of the

Code, and there can be no certainty that any firm offer will be

made.

The Company remains in an 'offer period' in accordance with the

rules of the Code and the attention of Rotala shareholders is drawn

to the continuing disclosure requirements of Rule 8 of the Code,

which are summarised below.

This announcement has been made with the agreement and approval

of the Director Offerors.

A further announcement will be made in due course, as

appropriate.

Enquiries:

Rotala Plc 0121 322 2222

Kim Taylor, Group Finance Director

Graham Spooner, Deputy Chair and Senior Independent Director

Graham Peacock, Independent Director

Shore Capital 020 7408 4090

Tom Griffiths / James Thomas / Lucy Bowden (Corporate Advisory)

Henry Willcocks (Corporate Broking)

Disclaimer

Shore Capital and Corporate Limited ("Shore Capital") which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority is acting as financial adviser (Rule 3) and

nominated adviser to the Company and no one else in connection with

the matters described in this announcement, and will not be

responsible to anyone other than Rotala for providing the

protections afforded to clients of Shore Capital nor for providing

advice in connection with any of the matters referred to in this

announcement. Neither Shore Capital nor any of its affiliates,

directors or employees owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect,

consequential, whether in contract, in tort, in delict, under

statute or otherwise) to any person who is not a client of Shore

Capital in connection with this announcement, any statement

contained herein or otherwise.

Disclosure requirements of the Code

Under Rule 8.3(a) of the Code, any person who is interested in 1

per cent. or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by not later than

3.30 p.m. (London time) on the 10(th) business day following the

commencement of the offer period and, if appropriate, by not later

than 3.30 p.m. (London time) on the 10(th) business day following

the announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange

offeror(s), save to the extent that these details have previously

been disclosed under Rule 8. A Dealing Disclosure by a person to

whom Rule 8.3(b) applies must be made by not later than 3.30 p.m.

(London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk ,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Rule 26.1 disclosure

A copy of this announcement will be available (subject to

certain restrictions relating to persons resident in restricted

jurisdictions) on Rotala 's website at www.rotalaplc.com/investors

by no later than 12 noon (London time) on 18 October 2023. The

content of the website referred to in this announcement is not

incorporated into and does not form part of this announcement.

Inside information

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

(Amendment) (EU Exit) Regulations 2019. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBUBDGXSBDGXL

(END) Dow Jones Newswires

October 17, 2023 02:00 ET (06:00 GMT)

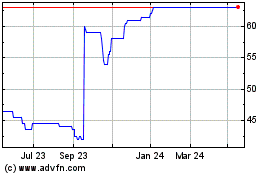

Rotala (LSE:ROL)

Historical Stock Chart

From Nov 2024 to Dec 2024

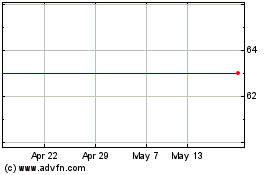

Rotala (LSE:ROL)

Historical Stock Chart

From Dec 2023 to Dec 2024