THIS ANNOUNCEMENT CONTAINS INSIDE

INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF REGULATION (EU) NO

596/2014 (“MAR”) AND MAR WHICH IS PART OF UK LAW BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED (“UK

MAR”)

30 May 2024

Renewi plc

Renewi announces sale of UK Municipal

business to Biffa

Renewi plc ("Renewi" or the

"Group") (LSE: RWI.L: Euronext Amsterdam: RWI.AS), a leading

European waste-to-product company, is pleased to announce that,

following the strategic review of its UK Municipal operations (“UK

Municipal”), announced in September 2023, it has entered into a

binding agreement to sell UK Municipal to Biffa Limited (“Biffa"),

a leading UK-wide integrated waste management business (the

“Divestment”).

Renewi’s CEO, Otto de Bont:

"The sale of UK Municipal to Biffa is a transformational milestone

which marks the beginning of a new chapter for Renewi. The exit of

UK Municipal will immediately improve our cashflow and profit

margins, and enable us to drive sustainable growth.

We will now fully focus on growing in Europe’s

most attractive and advanced recycling markets. Biffa’s financial

position, operational expertise, and presence in the UK municipal

landscape make them the right new home for our UK Municipal

business and we are confident this transaction benefits all

stakeholders."

Biffa’s CEO, Michael Topham:

“The addition of UK Municipal’s five contracts to our existing

contracts in West Sussex, Leicester and Somerset further

establishes our reputation as a trusted provider of complex,

long-term waste treatment contracts to local governments.

Our combined expertise will position us well for

the future as we seek to help local governments deliver their net

zero targets. We look forward to welcoming the Renewi UK team to

Biffa and to working with our new customers in due course."

Transaction Highlights

Supporting Renewi’s transformation, the

Divestment:

- will immediately increase Renewi’s free cash flow by €15-20m

per annum and drive at least c.50bps of EBIT margin expansion;

- significantly de-risks the Group’s balance sheet as

unpredictable UK Municipal liabilities, Onerous Contract Provisions

(OCPs), will be replaced by conventional and competitively priced

debt financing, enabling increased visibility on future capital

outflows; and

- focuses resources and management time on strategic initiatives

for stronger growth and shareholder returns.

The transaction will be effectuated through a combination of a

nominal cash consideration payable to Biffa and pre-completion

capitalisation of UK Municipal (together, the “Capitalisation”).

The Capitalisation ensures UK Municipal's ability to fulfil its

future contractual obligations.

- Capitalisation is

expected to be approximately £125m1 (€146m2) on completion which,

when offset against the reduction of liabilities of €89m, equates

to a net cost of c. €57m to Renewi and a total cash impact of

€154m, including transaction costs.

- Core net debt / EBITDA immediately following the transaction is

expected to be approximately 2.9x, falling to our target of 2.0x in

the medium-term, with improved margins and cash generation driving

accelerated deleveraging.

- The transaction will be funded

through the existing revolving credit facility, supplemented by a

€120m bridge facility.

The Divestment provides UK Municipal customers,

employees and other stakeholders with strong strategic backing from

a respected scale operator in the UK market. The transaction is

expected to complete before 31 December 2024, subject to receipt of

a limited suite of regulatory and other consents.

Rationale for the

Divestment

Renewi’s core strategy is focused on growth in

commercial and industrial waste in the Benelux region and expanding

its Specialities businesses, Maltha, Coolrec and Mineralz &

Water. UK Municipal comprises five highly bespoke legacy contracts

to process municipal waste for a geographically disparate group of

local authorities across England and Scotland, the longest dated of

which run until the 2040s. As the Group’s only operations in the

United Kingdom, it has limited operational or strategic synergy

with the rest of the Group. The contracts were entered into more

than 10 years ago, by a Renewi predecessor; they are break-even or

structurally loss-making and, in the absence of a legislative shift

or significant changes in market conditions, can be neither

prematurely terminated nor renegotiated by Renewi. In this context,

Renewi publicly announced the strategic review of UK Municipal in

September 2023.Biffa emerged as the most attractive buyer in a

competitive process due to the terms of its offer, as well as its

strong financial position, expertise in operations, and established

presence in the UK municipal landscape. Renewi believes UK

Municipal customers, employees and other stakeholders including

councils, lenders and regulators will benefit from the transfer of

ownership to Biffa.

Completion of the Divestment is anticipated

before the end of the calendar year and is subject to receipt of a

limited number of regulatory and other consents. Renewi will be

working collaboratively with Biffa to secure these consents in a

constructive manner. Following completion, Renewi will support the

smooth transition of the business to Biffa through various

transitional service arrangements.

Delivering on portfolio optimisation and

shareholder returns

The Divestment concludes addressing legacy

aspects of Renewi’s portfolio and will allow the Group to

prioritise resources towards the strategic initiatives where it

anticipates the strongest growth, financial performance and

shareholder returns.

The Group has a disciplined capital allocation

policy backed by a flexible balance sheet. The significant undrawn

capacity in its RCF (due 2028) provides an attractive option to

finance the Capitalisation through existing financial facilities,

whilst retaining significant covenant and liquidity headroom. The

Group also agreed an 18-month standby facility to increase

liquidity headroom by €120m, which is expected to be refinanced

later this year.

Assuming completion of the Divestment prior to

31 December 2024 and inclusive of the previously announced

intention to pay a modest full-year dividend, the Group expects

core net debt / EBITDA leverage (for the purposes of its half-year

covenant test) to be less than 3.0x EBITDA. With the free cash flow

generation of the Group further enhanced by the Divestment, and

cost and growth actions driving margin improvement, leverage is

expected to drop back to 2.0x over the medium-term.

Financial effects of the

Divestment

Performance of the UK Municipal’s contractual

obligations is guaranteed by the Group through various contractual

protections benefiting local authorities. For several years,

meeting contractual performance requirements has cost the Group

more than the aggregate operator fees received, resulting in OCPs,

being recognised in respect of various loss-making contracts. These

annually reviewed OCPs have repeatedly required further upward

revision as a result of both market conditions and operational

factors, translating into greater levels of annual negative cash

flow being absorbed by the UK Municipal portfolio.

In recent years, Renewi has stabilised and

strengthened the UK Municipal operations, resulting in optimised

operational performance. However, the portfolio remains a

significant cash drag on the Group – with a total cash outflow of

approximately €28m over the last 24 months. The Group expects its

free cash flow generation to improve by c €15-20m per annum as a

result of the Divestment.

The unpredictability and sensitivity of OCP

revisions (size, timing and impact on overall cost of capital for

the Group) has significantly contributed to risk in the Group’s

balance sheet. Through the Divestment, these unpredictable

liabilities will be replaced by highly predictable conventional

debt financing, enabling visibility on future capital outflows and

derisking the Group’s balance sheet.

The Capitalisation was derived and agreed

through multiple approaches, including referencing the level of

Onerous Contract Provisions (€130m on 31 March 2024), the Net

Present Value of the cash flow impact of the operations for the

remainder of the contracts, and cross-checked against the carrying

values of UK Municipal assets and liabilities on the Renewi balance

sheet. In utilising its existing debt financing capacity for the

capitalisation, Renewi has chosen to maximise shareholders’ ability

to benefit from the value creation opportunities unlocked from

completion of the Divestment.

As a result of the provisioning that has been

necessary with respect to UK Municipal, the Divestment is not

expected to materially impact the Group’s statutory profitability

metrics – however the deconsolidation of €180m of low margin

revenue is expected to improve Group EBIT margins by c. 50bps. More

detailed financial impacts can be found in the Group’s FY24

financial results published today, in which UK Municipal will be

classified as an asset held for sale.3

About Biffa

Biffa has been at the forefront of the UK waste

industry for over 100 years. It is a leader in sustainable waste

management in the UK, operating across the waste value chain from

collection through sorting, processing, treatment, and

disposal.

Biffa is an established operator in the

Municipal landscape with over 65 years of expertise in Municipal

operations. This is underpinned by a strong financial position and

ongoing investment in its treatment facilities and new technology

including carbon capture. The company is enabling the UK circular

economy by expanding its low carbon collections network, building

out its plastic recycling capacity and investing in energy

recovery. Since 2002 they’ve cut their carbon emissions by 70%.

Biffa’s ultimate owners are funds managed by

Energy Capital Partners, who are leading infrastructure investors

based in Summit, New Jersey, at the forefront of renewable energy

investing since its inception in 2005.

| For

further information: |

|

|

Renewi plcAnne Metz, Director of Investor

Relations+31 6 4167 9233investor.relations@renewi.com |

FTI ConsultingRichard Mountain / Ben

Fletcher+44 203 727 1340FTI_RWI@FTIconsulting.com |

| |

|

| |

|

Notes:

- Subject to customary closing

adjustments; Capitalisation at completion will be net of any normal

course capitalisation provided by Renewi to UK Municipal in the

period between 31 March 2024 and completion of the Disposal.

- Based on GBP/EUR exchange rate of

€1:£0.855.

- For the purposes of UK Listing Rule

10.4, as at 31 March 2024 the gross assets of UK Municipal

(adjusted for the estimated pre-completion Capitalisation) are

€348m; and in the financial year ending 31 March 2024, UK Municipal

contributed €0.7m to the Group’s statutory profit before tax.

Greenhill & Co. International LLP and

Ashurst LLP are respectively acting as financial and legal advisers

to Renewi in the context of the Divestment.

About Renewi

Renewi is a pure-play recycling company that

focuses on extracting value from waste and used materials rather

than disposing of them through incineration or landfill. The

company plays an important role in combating resource scarcity by

creating circular materials. In giving new life to used materials,

Renewi addresses both social and regulatory trends, contributing to

a cleaner and greener world.

Our vision is to be the leading waste-to-product

company in the world's most advanced circular economies. With a

recycling rate of 63.2%, one of the highest in Europe, Renewi puts

6.6 million tonnes of low-carbon circular materials back into use

each year. This contributes to mitigating climate change and

promotes the circular economy. Our recycling efforts help to

protect natural resources and prevent more than 2.5 million tonnes

of CO2 emissions annually.

Renewi leverages innovation and the latest

technology to turn waste into circular materials such as paper,

metals, plastics, glass, wood, building materials, compost, and

water. We employ over 6,000 people across 154 operational sites in

five countries in Europe. Renewi is recognised as a leading

waste-to-product company in the Benelux region and a European

leader in advanced recycling.

Visit our website for more information:

www.renewi.com.

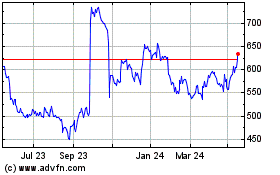

Renewi (LSE:RWI)

Historical Stock Chart

From Oct 2024 to Nov 2024

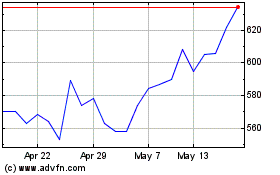

Renewi (LSE:RWI)

Historical Stock Chart

From Nov 2023 to Nov 2024