Q1 Trading Update

06 August 2024

Renewi plc

Q1 Trading Update

Renewi plc ("Renewi" or the

"Group") (LSE: RWI.L: Euronext Amsterdam: RWI.AS), a leading

European waste-to-product company, provides the following trading

update for the three months ended 30 June 2024 (“Q1”).

Financial Highlights (note

financial results are shown for continuing operations, excluding UK

Municipal given its status as an asset held for sale)

- Revenue: €434.4m, 3% year-on-year growth

underpinned by higher core volumes and input prices in both

Commercial Waste and Specialities (FY24: €421.7m). In particular,

volumes for Commercial waste in the Netherlands continued to

recover, with Belgium showing a slowdown of topline growth.

- Underlying EBIT: €22.3m, 3% higher

year-on-year. The contribution of lower one-off gains in the

Commercial Waste division compared to prior year was largely offset

by higher input prices and the impact of SG&A cost reduction in

Commercial Waste (FY24: €21.7m).

- Core net debt: €430.8m compared to €368.1m at

the end of March 2024 largely driven by seasonal working capital,

which is expected to normalise over the course of the year.

- Sale of UK Municipal: CMA approval has now

been obtained and good progress made on the remaining few

Conditions Precedent required for completion. Timing remains on

track to complete over the course of this calendar year.

Delivery against strategic

objectives

Renewi continues to deliver against its

medium-term strategic priorities of portfolio optimisation,

strengthening its core operations, and organic growth of

>5%.

Portfolio optimisation

The sale of UK Municipal to Biffa, announced on 30 May 2024, has

progressed well and is on track for completion as expected.

Mineralz & Water (“M&W”) has continued the positive

momentum that started in the 2H of FY24, with the business on track

to deliver a year of good progress in FY25 in line with its

recovery plan.

Stronger platform

The Group's Simplify programme, announced in FY24 to streamline

staff functions and reduce costs, continued to yield benefits and

remains on track to deliver the expected run rate savings in FY25.

The roll out of Group’s Future Fit digitisation programme which

will replace legacy IT systems is also progressing well, giving the

Group a stronger foundation to improve future efficiency and drive

growth in the medium term.

Organic growth

The acceleration of the Commercial Waste sales strategy, initiated

in the second half of FY24 has generated further new business wins

in Q1, particularly in the small-to-medium enterprise segment,

which has helped to mitigate the effect of ongoing mixed market

conditions. Within Specialities, Coolrec and Maltha continued their

strong growth performance, fuelled by additional volume from new

contracts combined with investments in quality and accretive

operational improvements, which continued to yield benefits.

During the quarter Renewi announced its intention to partner

with Freepoint Eco-Systems, a leading provider of advanced plastic

recycling solutions. The partnership aims to divert end-of-life

plastics from incineration by developing the sorting and treatment

infrastructure. The goal is to supply up to 80,000 tonnes of

feedstock to Freepoint Eco-Systems’ first European advanced

recycling facility, located in Ghent, Belgium.

In May 2024, Renewi announced that it will offer

an innovative digital CO2 and recycling reporting tool to all its

Dutch customers this year. This tool meets the European Corporate

Sustainability Reporting Directive (“CSRD”). The new CSRD requires

companies to report their impact on climate, society and policy,

with waste being a key theme. The Company has commenced offering

its reporting tools to companies and recently announced its

collaboration with Heijmans, a leading Dutch construction company,

to help provide them with a waste monitor via the MyRenewi

portal.

Q1 FY25 performance

Throughout the quarter recyclate prices in the

market remained largely stable, with a slight year-on-year increase

across most categories, except for recycled wood.

The Commercial Waste division continued to

experience mixed demand conditions, reflective of the wider

economic backdrop in the region.

Cost of waste was higher due to higher transport

and treatment costs caused by temporarily constrained incinerator

capacity. The construction sector in the Netherlands remained

subdued during the quarter though incoming volumes from

construction and demolition waste improved in Q1.

SG&A costs were lower in Q1, reflecting the

impact of the Simplify cost initiatives and further reduction of

excess capacity. The Group’s cost and efficiency programmes are

expected to deliver an increasing benefit through the FY25 as

initiatives reach full run rate impact.

Within Specialities, strong revenue growth

continued from both Coolrec and Maltha. However, M&W revenues

remained largely flat as the growth in soil and water treatment was

offset by the planned reduction in revenue from low-margin

activities, which were discontinued last year, including bottom ash

treatment. Underlying EBIT grew strongly across the Specialties

division, fuelled by M&W in line with its recovery plan and by

Coolrec also delivering strong EBIT growth.

Outlook

Whilst market conditions remain mixed,

particularly in the Commercial Waste division, the benefits of the

Group’s commercial and cost initiatives underpin the continued

expectation of good progress in FY25, with growth momentum

anticipated to increase as the year progresses. As previously

guided, leverage is expected to increase in the short term, to

approximately 2.9x upon completion of the sale of UK Municipal,

before reducing as the benefits of materially stronger cash

generation are delivered. Looking ahead, Renewi is committed to

delivering on its medium-term targets of a high-single digit

underlying EBIT margin and organic annual revenue growth of

>5%.

Commenting, Renewi’s CEO Otto de Bont said: "We

continue to deliver on our strategic objectives of portfolio

optimisation strengthening our platform and accelerating organic

growth. Throughout the quarter we continued to see the benefits of

our Simplify programme, which is helping to continually drive

improved performance and efficiency. Looking ahead, our FY25

outlook is unchanged, reflecting our strong foundation and our

strategic progress."

For further information: |

|

Renewi plc

Anne Metz, Director of Investor Relations

+31 6 4167 9233

investor.relations@renewi.com |

FTI Consulting

Richard Mountain / Ben Fletcher

+44 203 727 1340

renewi@fticonsulting.com |

About Renewi

Renewi is a pure-play recycling company that

focuses on extracting value from waste and used materials rather

than disposing of them through incineration or landfill. The

company plays an important role in combating resource scarcity by

creating circular materials. In giving new life to used materials,

Renewi addresses both social and regulatory trends, contributing to

a cleaner and greener world.

Our vision is to be the leading waste-to-product

company in the world's most advanced circular economies. With a

recycling rate of 63.2%, one of the highest in Europe, Renewi puts

6.6 million tonnes of low-carbon circular materials back into use

each year. This contributes to mitigating climate change and

promotes the circular economy. Our recycling efforts help to

protect natural resources and prevent more than 2.5 million tonnes

of CO2 emissions annually.

Renewi leverages innovation and the latest

technology to turn waste into circular materials such as paper,

metals, plastics, glass, wood, building materials, compost, and

water. We employ over 6,000 people across 154 operational sites in

five countries in Europe. Renewi is recognised as a leading

waste-to-product company in the Benelux region and a European

leader in advanced recycling.

Visit our website for more

information: www.renewi.com.

Cautionary note regarding forward looking

statements

This announcement contains certain statements which are, or may

be deemed to be, forward looking statements with respect to the

expectations and plans, strategy, management objectives, future

developments and performance, costs, revenues and other trend

information of Renewi. These forward looking statements can be

identified by the fact that they do not relate to historical or

current facts. Forward looking statements often use words such as

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "will", "may", "should", "would", "could" or

other words of similar meaning. These statements are based on

assumptions and assessments made by the Renewi board, in the light

of its experience and its perception of historical trends, current

conditions, expected future developments and other factors it

believes appropriate. By their nature, forward looking statements

involve risk and uncertainty and the factors described in the

context of such forward looking statements in this announcement

could cause actual results and developments to differ materially

from those expressed in or implied by such forward looking

statements.

Should one or more of these risks or uncertainties materialise,

or should underlying assumptions prove incorrect, actual results

may vary materially from those described in this announcement.

Except as required by applicable law and/or regulation Renewi does

not assume any obligation to update or correct the information

contained in this announcement.

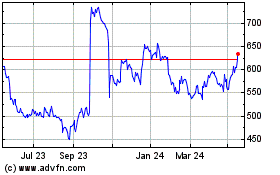

Renewi (LSE:RWI)

Historical Stock Chart

From Oct 2024 to Nov 2024

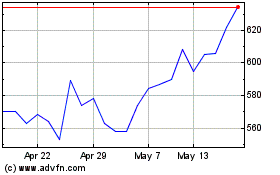

Renewi (LSE:RWI)

Historical Stock Chart

From Nov 2023 to Nov 2024