TIDMSAV

RNS Number : 0762O

Savannah Resources PLC

29 September 2023

29 September 2023

Savannah Resources Plc

(AIM: SAV, FWB: SAV and SWB: SAV) ('Savannah', or the

'Company')

Interim Results for Six Months Ended 30 June 2023

Savannah Resources, the European lithium development company, is

pleased to announce its interim results for the six months ended 30

June 2023.

First half and recent highlights include:

Corporate:

-- Experienced Portuguese and international business leader,

Emanuel Proença appointed as Chief Executive Officer ('CEO') in

September with Interim CEO, Dale Ferguson, returning to his

previous role of Technical Director

-- Experienced mining executive, Bruce Griffin appointed as an

Independent Non-Executive Director in September

-- Experienced energy sector and strategy executive, Mohamed

Sulaiman appointed as a Non-Executive Director in September,

replacing the retiring Imad Sultan as the Board representative of

Savannah's largest shareholder, Al Marjan Ltd

-- Technical team expanded in line with increasing workload

-- GBP6.5 million (gross) fundraise completed at market price in July

-- The sad passing of former Non-Executive Director, Manohar Pundalik Shenoy

Barroso Lithium Project (the 'Project'):

Technical:

-- The Portuguese environmental regulator ('APA') gave its

endorsement ('DIA') to the Project in May. This was the successful

culmination of the Article 16 phase of the overall environmental

impact assessment ('EIA') process which Savannah agreed to enter in

July 2022

-- Following the DIA, work to complete the environmental

licencing process ('RECAPE' phase) and Definitive Feasibility Study

('DFS') is underway with key contractors either appointed or to be

appointed shortly. We expect to complete the environmental

licencing process and DFS in H2 2024

-- A new Scoping Study was published in June 2023 incorporating

the DIA approved Mine Plan and Project design. Based on average

production of 191,000tpa of spodumene concentrate, the Study

returned post-tax free cash flow of US$1.7 billion, net present

value at an 8% discount rate of US$953m (41p/share), internal rate

of return of 77%, and payback period of just 1.3 years

-- The initial phase of the decarbonisation study showed

electric mining equipment provides the best opportunity to reduce

the Project's Scope 1 emissions and that a number of viable options

exist to secure 100% renewable energy supply to reduce the

Project's Scope 2 emissions to zero. More detailed analysis of

these and other initiatives will be explored over the next 12

months

Stakeholder Engagement:

-- The EIA submission was accompanied by a 'Social Issues

Scoping Report', incorporating the views of local people about the

Project and Savannah, the proposed frameworks for the Benefit

Sharing Plan and Good Neighbour Plan, and the financial proposals

to acquire access to land required for the Project from two

relevant Baldios Community groups

-- To assist local stakeholders' understanding, Savannah held a

number of community meetings, produced two Community Information

Sheets, 17 Fact Sheets and a new corporate video in parallel with

the EIA submission

-- Community Insights Group has begun work on two elements of

the RECAPE which relate to the Project's interaction with local

communities and stakeholders

Commercial:

-- Following the DIA and Scoping Study there has been additional

interest in the Project and potential partnership collaborations

with Savannah from groups across the lithium value chain

-- The Company is currently working through an orderly process

to shortlist potential strategic partners for the Project, focusing

on groups willing to assist with the Project's financing and which

could bring complementary skills or additional opportunities to

Savannah

Next steps/future news flow:

-- Cash balance of GBP11.4m (July 2023) and expanding team

provides capacity to move the Project towards a final investment

decision

-- Environmental licencing and DFS related work to continue

(with regular updates provided) and be completed in H2 2024

-- Continuation of orderly process to identify a shortlist of potential strategic partners

-- Continue to secure the land or access to the land needed for

the Project, which we hope to do via negotiation and agreement with

relevant parties

-- Wider stakeholder engagement programme to continue, focused

on reaching mutually beneficial resolution on tailoring the

Project's Benefit Sharing Plan to meet the area's specific

needs

-- Continue efforts to have more of the Project's value

reflected in the Company's share price through achievement of

milestones and ongoing investor marketing

CHAIRMAN'S STATEMENT FOR THE SIX MONTHSED 30 JUNE 2023

The first half of 2023 was one of the busiest and most

successful periods during Savannah's ownership of the Barroso

Lithium Project in Portugal (the "Project"). The milestones are

already well known to shareholders, namely the endorsement of the

Project ('DIA') by Portugal's environmental regulator in May,

followed swiftly by the new Scoping Study in June, which

highlighted the Project's near US$1 billion value. These milestones

then paved the way for Savannah to complete a successful fundraise

at market price in July, which has given us the cash balance needed

to accelerate the work required to take the Project towards a final

investment decision.

The work completed in the period also gives us the platform to

move forward on other fronts. We can identify those strategic

partners who are committed to building a long-term relationship

with Savannah and supporting us with financing the Project. It

provides a catalyst to increase our engagement with stakeholders as

we look to make firm commitments on benefit sharing and give clear

guidance on the Project's development. Finally, it has given us

long-term confidence to build out our team to make this Project and

its value a reality.

However, before speaking of those who have joined Savannah and

the Company's exciting future it is important to remember those who

are no longer with us. It was with deep sadness that we learnt of

the passing of Mr. Manohar Pundalik Shenoy, Non-Executive Director

of the Company earlier in September. Manohar was a dedicated member

of the Savannah Board who commanded great respect for his business

acumen and human decency. We will miss his valued contributions,

particularly as Chairman of our Audit and Risk Committee and extend

our deepest sympathies again to his family and friends.

Turning to Savannah's future, I would like to take this

opportunity to welcome again our new CEO, Emanuel Proença and

Non-Executive Directors, Bruce Griffin and Mohamed Sulaiman, who

all joined earlier in September and provide new key skills and

experience for developing the Project into a strategic part of

Europe's energy transition. I also express again my great

appreciation to Dale Ferguson, who led us so successfully through

the last 15 months as Interim CEO. He now assumes his former role

as Savannah's Technical Director and will lead the current work

programmes we have underway on the Project's environmental

licencing and Definitive Feasibility Study ('DFS'). He will also

retain his seat on Savannah's Board as an Executive Director.

Emanuel brings us a wealth of Portuguese and international

business experience gained across a range of industries and

disciplines. He joins Savannah from his role as CEO of the

industrial businesses of Prio, one of Portugal's 20 largest

companies and the country's largest green fuels and biodiesel

producer, and its second largest provider of electricity for

mobility and a network of charging points. The subsidiaries under

Emanuel's leadership experienced rapid growth with revenues and

profitability more than tripling in 7 years, resulting in over

EUR1.5 billion in revenue and accounting for approximately 80% of

the group's profitability in 2022. Thus, Emanuel is well placed to

lead the Company through significant change and growth as it

delivers the Project into production for the benefit of its

stakeholders.

His arrival adds new energy and a fresh approach to our

corporate culture and business practices as we look to press

forward with the Project. As Savannah's first Portuguese CEO,

located in Lisbon, Emanuel can give Savannah the constant, high

level, presence in Portugal, which it has not fully enjoyed to

date. He will be prioritising our engagement with all Portuguese

stakeholders including national and local government and local

communities. The Board and I all look forward to working with

him.

Mr Proença's appointment as CEO will initially be in a non-Board

capacity but the Company envisages that he will formally join

Savannah's Board during H1 2024. In the interim, we have made two

appointments to the Board as we look to add individuals to our

leadership team with the specific knowledge and experience needed

by a Company developing its first major natural resource project.

Over the next 2-3 years Savannah will be required to significantly

increase its interaction with all stakeholders including

governments, service providers, customers and communities, as well

as effectively assessing and executing financing and partnership

options. Hence, we must have the experience and capacity in our

team to allow us to do this successfully.

As part of this scale up we welcomed Bruce Griffin as an

additional, independent Non-Executive Director. Bruce may be

familiar to some shareholders from the period he spent advising

Savannah during its strategic review of its Mutamba mineral sands

project in 2021, which resulted in a successful transaction with

Rio Tinto. Bruce has over 20 years of mining sector experience

which crucially includes recent mining project construction. As the

Executive Chairman of Sheffield Resources Limited, Bruce is playing

a key role in commissioning the 10Mtpa Thunderbird minerals sands

project in Australia, which the Company has recently constructed

with its 50/50 JV partner YGH Australia Investment Pty Ltd

(Yansteel).

Al Marjan Ltd ("Al Marjan"), Savannah's largest shareholder,

also chose to change its representative on the Board. We give our

thanks to Imad Sultan who is stepping down from the Board after

seven years of valuable service and contribution. We wish him well

with his many other business interests. Going forward, Al Marjan

will be represented by Mohamed Sulaiman, Head of Strategy at the

Omani conglomerate business, Towell Group and the former lead for

Strategy and Performance at OQ, the Omani energy company. As with

Bruce's mining experience, Mohamed's experience in strategy

leadership, including in the energy sector, and his familiarity

with directorship roles from the Boards of other public and private

companies will be invaluable to Savannah and we look forward to his

contribution.

Importantly we are not just adding strength to our executive and

Board teams. We are actively recruiting for roles to ensure

delivery of the Project and have recently recruited a project

management expert, an Environmental Officer, and a new group of

geologists and technicians. This includes three new members of

staff from the local community, to be part of the team for the new

field programmes we are about to start as part of efforts to

conclude both the Environmental Licencing process and the DFS. It

is an exciting and defining time at Savannah, and I look forward to

us continuing with our current recruitment drive as we move to

deliver the Project for our shareholders, stakeholders and

Portugal's economic benefit.

As Savannah delivered on its stated goals in the first half of

the year, we were pleased to see the share price responding

positively, increasing by over 115% from the start of the year to

reach its recent peak of 4.95p on 6 June 2023. However, we all

recognise that the share price started from a low base following

the additional uncertainty placed on the Project by the Article 16

process between July 2022 and the end of May 2023. As I have

highlighted before, the Board believes the current share price

remains wholly unreflective of the underlying project value (e.g.,

NPV/share of 41p/share) and we continue to flag this anomaly to

investors whenever possible. Equally, our share price and that of

many of our direct peers has not been helped by the significant

correction experienced in lithium prices during the year to date

and the wider macroeconomic issues impacting capital markets

recently.

Lithium raw material prices, including for spodumene

concentrate, all fell by over 40% during the first half of the year

but this must be seen in the context of the 1,200% to 2,000%

increases seen in prices in the two years up to November 2022. We

must be prepared to expect such volatility in a small volume

commodity and speciality chemical market like lithium. On prices it

is important to note that, despite the correction, the current

price of US$2,750/t for spodumene remains nearly twice the average

price we used in our Scoping Study.

The recent downtrend was likely driven by the temporary slowdown

in EV sales in the first quarter of the year, cooling buying

sentiment along the lithium battery supply chain. This was

predominantly the result of COVID lockdowns, New Year celebrations

and the removal of vehicle purchasing incentives in China, the

world's largest EV market, during January and February. Pleasingly,

sales have subsequently improved with EVvolumes.com reporting that

over 6 million plug-in vehicles were sold globally in the first

half of the year, representing a 39% increase on the first half of

2022. Encouragingly, that website is forecasting annual sales of 14

million plug-in vehicles for the full year (+33% vs. 2022),

implying an increase in sales of 33% for 2H 2023 over the first

half.

While stock markets often tend to respond badly, and quickly, to

falling commodity prices, groups within the commodity sector in

question usually continue to take a much more pragmatic view,

seeing strategic value in assets based on a longer-term

perspective. This is true in the lithium sector, and is reflected

in the amount of commercial interest we continue to receive about

the Project. Following the progress which we have made recently, I

believe that many in the lithium sector, and many keen to enter it,

see significant strategic value in a partnership with Savannah. Our

job is now to identify from the many groups who have approached us,

a shortlist which are really committed to helping make the Barroso

Lithium Project a reality.

Furthermore, with Sibanye-Stillwater's integrated spodumene and

lithium hydroxide Keliber project now in construction in Finland

and following the publication of the European Commission's Critical

Raw Material Act ('CRMA') in March, lithium raw material production

in Europe should be seen as a very likely reality in coming years.

Among a number of positive initiatives, the CRMA calls for at least

10% of Europe's future demand for critical materials, including

lithium, to be met from domestic supply sources such as the Barroso

Lithium Project.

To sum up, given the progress we have made in the first half of

the year, the personnel we have added and the robust cash position

we have, the Company can move forward to deliver its plans with

real confidence.

You will find further brief summaries of the major work streams

and topics below.

Barroso Lithium Project, Portugal

Environmental Licencing process

On 31 May Savannah announced the Portuguese environmental

regulator ('APA') had issued a positive Environmental Impact

Statement, the DIA, on the Project. This was the successful

culmination of the Article 16 phase of the overall Environmental

Impact Assessment ('EIA') process which Savannah agreed to enter in

July 2022.

Achieving the DIA award is the most challenging part of the

overall environmental licencing process. We can now say that the

regulator has agreed to the design of the Project and that Savannah

and APA have mutually agreed a set of accompanying conditions for

the Project's construction and operation. For the remaining

'RECAPE' phase (the Environmental Compliance Report of the

Execution Project), we are required to produce a final design which

complies with the DIA and its associated conditions.

Completion of the Article 16 process and award of the DIA

required a huge effort by all our team and our consultants.

Approval of the design shows that we have successfully captured and

responded to all of the feedback received from APA, the groups on

its evaluation committee, and other key stakeholders during the

Article 16 process. As a result, everyone can be assured that every

effort has been taken by all involved in the process to minimise

the Project's environmental and social impact while allowing the

production of over 2.5 million tonnes of lithium-bearing

concentrate which Europe so greatly needs for its energy

transition.

We are now underway with the work for the RECAPE phase, which we

expect to complete in the second half of 2024. The consultancy,

Quadrante, a major contributor to our successful DIA, has been

awarded the contract for the RECAPE work on the Project itself and

we expect to award the contract for the separate RECAPE on the new

bypass road shortly.

Scoping Study

The new Scoping Study published in June 2023, the first in five

years, combined the DIA approved Mine Plan and Project design with

a conservative average spodumene price of US$1,464/t (5.5% Li(2) O

grade) over the life of the Project versus the current spot price

of US$2,750/t (6% Li(2) O grade). I believe the post-tax free cash

flow of US$1.7 billion, net present value at an 8% discount rate of

US$953m, internal rate of return of 77%, and payback period of just

1.3 years, clearly demonstrate the outstanding economics of the

Project. Furthermore, it is satisfying for Savannah that this level

of value creation can be achieved while also: providing a tax and

royalty income for Portugal of over US$900m; generating over 300

new jobs; investing over US$40m in infrastructure, which will

either directly benefit local communities (e.g., the new bypass

road) or further reduce the Project's impact for them; the

EUR0.5m/year which we have committed to providing to a new

foundation focused on funding community initiatives; and over

US$100m in rehabilitation costs.

We now look forward to confirming the Project's potential in the

Definitive Feasibility Study, which our team is currently working

on and which we expect to complete in the second half of 2024. I

hope this will give the market the greater level of confidence it

appears to need to allow more of the underlying value of this

Project (e.g., NPV/share of 41p) to be reflected in Savannah's

share price.

Definitive Feasibility Study & Decarbonisation Study

While we did not receive APA's positive decision on the Project

until the end of May, preparations were being made during the first

half of the year for the potential restart of work relating to the

DFS. It is pleasing that work is soon to get underway again with

the restart of drilling on Savannah owned land at the Project after

a near four-year break. This is the first of two phases of

drilling, scheduled for around 6 months in total, focused on

upgrading existing mineral resources, providing further samples for

metallurgical test work and geotechnical drilling for the final

open pit designs.

We were also pleased to announce recently that the DFS

processing work package was awarded to a collaboration between the

plant construction experts Sedgman Pty Ltd ('Sedgman') and the

processing experts Minsol Engineering Pty Ltd ('Minsol').

Shareholders will be familiar with Minsol, which has already played

a key role in the Project, producing the plant's final processing

circuit design which combines conventional spodumene processing

methodologies with near neutral pH conditions and environmentally

friendly reagents suitable for use under Portuguese and European

legislation. We look forward to building a strong relationship with

Sedgman, which will also see us working with their sister company,

the Spanish engineering group, DRAGADOS.

We look forward to awarding the contract for the DFS'

infrastructure package soon, following completion of that tendering

process over the summer.

In parallel with the DFS, Savannah will also be continuing with

its decarbonisation study work. As announced in February, the

initial study showed that battery powered electric mining equipment

will provide the most effective and flexible means to reduce Scope

1 emissions at the Project to zero. It also concluded that a number

of viable options are available to secure 100% renewable energy

supply to the Project including regional solar and wind generation,

on market purchase, direct Power Purchase Agreements, or a

combination of these. Portugal's grid power already features a

contribution from renewables of over 70%, but use of 100% renewable

energy would reduce the Project's Scope 2 emissions to zero.

Over the next 12 months, Savannah and its consultants will

conduct a more detailed analysis of these and other initiatives and

Studies, with a number of mining equipment manufacturers to

determine a site-specific solution for a future transition to a

battery-operated mining fleet as and when appropriate equipment

becomes available.

Savannah has also committed to reducing its Scope 3 emissions as

much as possible and looks forward to working with its future

suppliers, customers and haulage partners on that front.

Stakeholder Engagement

Management of the Project's social impact as well as effective

sharing of its socio-economic benefits with stakeholders was a

major theme within the overall environmental impact assessment

process conducted by APA.

As a result, the 'Social Issues Scoping Report', written by

Community Insights Group ('Community Insights') and incorporating

the views of local people about the Project and Savannah,

accompanied Savannah's revised EIA submission in March alongside

Savannah's proposed frameworks for its Benefit Sharing Plan, its

Good Neighbour Plan and its financial proposals to acquire access

to land required for the Project from two relevant Baldios

Community groups in the area (see Land acquisition and land access

section below).

Stakeholder feedback collected by Community Insights during 2022

included requests for more information on the Project. Therefore,

to accompany the EIA submission and public consultation period in

the EIA process, Savannah held a number of community meetings,

produced two Community Information Sheets, 17 Fact Sheets and a new

corporate video (the documents and video can be found on Savannah's

website and at our local Information Centres), all aimed at

explaining the key aspects of the new Barroso Lithium Project.

Savannah remains firmly committed to ongoing stakeholder

engagement and remains open for dialogue on any aspect of the

Project which stakeholders would like to discuss. There are also

some formal actions which Savannah has been requested to undertake

in relation to the Project's stakeholders as part of the RECAPE

process. Community Insights has been selected to provide support in

responding to two elements within the RECAPE which relate to the

Project's interaction with local communities and stakeholders. Work

is now underway on these and is expected to take around 8 months to

complete.

Commercial Discussions

As our shareholders will know, the Project contains the largest

JORC (2012) Compliant spodumene resource in Europe making it hugely

strategic in the continent's plans for a domestic lithium battery

value chain. Savannah owns 100% of the Project with no offtake

committed to date, giving it full leverage to the potential value

that can be created by advancing the Project in this supportive

environment.

While there has always been significant commercial interest in

the Project, following the endorsement of the DIA and publication

of the new positive Scoping Study, there has been additional

interest received from groups across the lithium value chain. From

the dozens of commercial inquiries which Savannah has received, the

Company is currently working through an orderly process to

shortlist potential strategic partners for the Project. Savannah is

focusing on identifying groups which are willing to assist with the

financing of the Project's construction and bring complementary

skills or additional opportunities to a long-term partnership with

Savannah. We expect to provide an update on this later in the

year.

Land acquisition & access arrangements

To develop the Project, Savannah must either own or have agreed

access rights to the land which is to be developed. Due to the

distance of the Project from the communities in the area, there is

no requirement to purchase any houses or other buildings from local

people for the Project to progress. Nor is there a requirement for

any resident to leave their home. All agreements and proposed

agreements relate only to land.

From an extensive mapping exercise, Savannah estimates that the

total area of land that is required for the Project, spread across

the Mining Lease, the proposed road, and ancillary areas is

approximately 840 hectares (8.4km(2) ) with private landowners

holding around 24% of the total. The remainder is managed on behalf

of the community by management groups ('Baldios'). The land is

spread across four parishes.

Since 2021, Savannah has been operating a land acquisition

programme. To date more than 40 private landowners have sold, or

agreed to sell, their land to Savannah and Savannah has acquired,

or is in the process of acquiring, over 90 hectares of land in the

local area for which it has paid approximately EUR1.8m (including

relevant taxes). Based on the attractive rates which Savannah is

offering, prior to mine construction the Company expects to spend

approximately EUR5m in total on acquisition of land identified to

date, with the money going directly to local people. Further

investment on private land will depend on matters including the

progress of private property identification and the completion of

agreements.

Savannah has also engaged with the local Baldios communities

from Covas do Barroso and Dornelas, and presented financial

proposals to access the Baldios lands. The Company has benchmarked

its offer against other relevant land access agreement and

transactions in Portugal and believes it to be a highly attractive

figure. For its total financial proposal, Savannah has added to its

land access fee, a royalty linked to the volume of spodumene

concentrate production and compensation for drilling platforms.

Savannah is also offering: direct payments to all the community

members in the impacted parishes, compensation for anyone losing

agricultural grants as a result of the Project, and financial

support for the local firefighters. Overall, Savannah estimates it

will pay approximately EUR10m for access to the community lands

managed by the Baldios over the Project's life, with approximately

EUR4m being paid directly to community members.

Savannah remains open to discussions with private landowners,

Baldios representatives, and other stakeholders around its land

acquisition programme and land access proposals. The Company's

preferred option is to secure the land or access to the land it

needs to develop the Project through direct negotiation and

agreement.

The 30-year Mining Lease granted in 2006 safeguards Savannah's

access to land that may be necessary for the development of the

Barroso Lithium Project. This condition applies to both private

land and land managed by the representatives of the Baldios.

Despite the existing legal coverage, Savannah will always favour

direct agreement with the owners of the lands and representatives

of the Baldios. The Company will use the mechanisms provided in

Portuguese law but only when it is not possible to reach an

agreement.

As shareholders will know, Savannah is committed to responsible

land management and will be comprehensively rehabilitating,

relandscaping and revegetating impacted areas during the operating

life of the Project (beginning in the second year of operation) and

after it closes. At the end of the Project's life, the land will be

returned to the community for its own use.

Legal Proceedings

The use of 'lawfare' is a common tool used by parties seeking to

disrupt project developments, and there are three such cases

relating to the Project, for which the Company has continued to

provide updates when appropriate. Two of these cases relate to

challenges by the Parish of Covas do Barroso to the Portuguese

Government (including the environmental regulator, APA) and seek to

nullify administrative acts relating to changes to the C-100 mining

lease (which contains the BLP) and the grant of the DIA to the

Project. In respect of the former case, Savannah has contested the

claim and is awaiting news from the court, and in respect of the

latter case, Savannah is preparing the contestation which it shall

submit to the court by the end of October 2023. Importantly:

-- the lawsuits do not impact the Company's activities at the Project

-- the C-100 mining lease is fully granted, has a term of 30

years to 2036 and remains in good standing

-- the DIA remains in force

-- the advice from Savannah's lawyers is that the lawsuits are without foundation.

A third case relates to the Management Commission of the Covas

do Barroso Baldios' challenge against certain private landowners

and Savannah in respect of some land packages at the Project which

were purchased by Savannah. The challenge relates to alleged minor

land border disputes, and no date has been set by the court for a

preliminary hearing.

Financials

Despite continuing prudent cost management contributing to a 28%

reduction in administrative expenses to GBP1.4m during the period

(30 June 2022: GBP1.9m), Savannah recorded an 18% increase in net

losses from continuing operations to GBP1.5m (30 June 2022:

GBP1.3m) due to a swing from a GBP0.6m exchange rate gain in first

half 2022 to a GBP0.1m exchange rate loss in the current period.

The Company finished the period with cash of GBP4.8m (30 June 2022:

GBP9.4m) but pro-forma cash reserves were subsequently increased to

GBP11.4m in July 2023 via the successful completion of a GBP6.5m

equity fundraise.

July's fundraise, which was successfully completed at

4.67p/share, representing a discount of just 0.6% to the Company's

closing share price the day prior to its launch, combined three

elements, a subscription, a placing and, for the first time, an

offer to private investors via the PrimaryBid platform. Seeking to

raise in excess of GBP5.8m, GBP6.1m was raised via the subscription

and placing with a number of existing shareholders taking part

including Savannah's two largest shareholders Al Marjan (now 15.1%)

and Slipstream Resources (now 8.1%) and members of the Board.

Alongside investments from our existing institutional shareholders,

two natural resource focused funds joining the register for the

first time invested a total of GBP3.4m. With good demand via the

PrimaryBid offer raising a further GBP0.4m at the same price, the

gross total of GBP6.5m was achieved.

Outlook

The remainder of 2023 and 2024 is set to be another very busy

and exciting period for Savannah as our growing team, under the new

leadership of Emanuel Proença, look to take the Company towards a

final investment decision on the Barroso Lithium Project. To get

there we must complete the Project's licencing process and DFS,

identify the strategic partners we wish to work with, and leverage

our valuable Project and its spodumene concentrate to attract the

finance we need for construction.

We will continue to secure the land or access to the land we

need for the Project, which we hope to do via negotiation and

agreement with relevant parties. This will be part of our wider

stakeholder engagement programme through which we aim to reach

mutually beneficial resolution on how our commitments to benefit

sharing from the Project are tailored to the area's specific needs,

and then delivered.

We will also continue our efforts to have more of the Project's

value reflected in the Company's share price. Significant strides

to de-risk the Project have been made in the first half of 2023 and

more are expected to follow over the coming months. I remain

hopeful that the backdrop to our strong investment case will also

improve with global EV sales expected to accelerate in the second

half of the year, which should in turn improve the recent negative

trend in lithium prices. Progress should be made in the adoption of

the European Commission's Critical Raw Materials Act, which is

targeting 10% of European demand to be met by domestic supply by

2030, and hopefully wider sentiment in stock markets will also

improve. I believe a broader pool of investors should see a

compelling backdrop to complement Savannah's investment case. In

the meantime, I would like to thank our old and new shareholders

alike for their ongoing support and enthusiasm for the Company and

its goal to become a major supplier of responsibly sourced lithium

raw material for Europe.

Matthew King

Chairman

Date: 28 September 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE SIX

MONTHSED 30 JUNE 2023

Unaudited Unaudited Audited

Six months Six months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

Notes GBP GBP GBP

CONTINUING OPERATIONS

Revenue - - -

Other Income - - -

Administrative Expenses (1,383,467) (1,932,032) (3,531,894)

Foreign Exchange (Loss) / Gain (148,008) 628,980 814,468

OPERATING LOSS (1,531,475) (1,303,052) (2,717,426)

Finance Income 32,588 341 34,695

Finance Costs - - (265)

----------------------------------------- ------- ------------- ------------- --------------

LOSS FROM CONTINUING OPERATIONS

BEFORE TAX (1,498,887) (1,302,711) (2,682,996)

Tax Expense - - -

LOSS FROM CONTINUING OPERATIONS

AFTER TAX (1,498,887) (1,302,711) (2,682,996)

LOSS ON DISCONTINUED OPERATIONS

NET OF TAX (48,060) (50,838) (176,396)

----------------------------------------- ------- ------------- ------------- --------------

LOSS AFTER TAX ATTRIBUTABLE

TO EQUITY OWNERS OF THE PARENT (1,546,947) (1,353,549) (2,859,392)

----------------------------------------- ------- ------------- ------------- --------------

OTHER COMPREHENSIVE INCOME

Items that will not be reclassified

to Profit or Loss:

Net Change in Fair Value through

Other Comprehensive Income of

Equity Investments (4,111) (13,844) (19,598)

Items that will or may be reclassified

to Profit or Loss:

Exchange (Loss) / Gains arising

on translation of foreign operations (414,958) 397,464 665,656

----------------------------------------- ------- ------------- ------------- --------------

OTHER COMPREHENSIVE INCOME FOR

THE PERIOD (419,069) 383,620 646,058

----------------------------------------- ------- ------------- ------------- --------------

TOTAL COMPREHENSIVE LOSS FOR

THE PERIOD ATTRIBUTABLE TO EQUITY

OWNERS OF THE PARENT (1,966,016) (969,929) (2,213,334)

----------------------------------------- ------- ------------- ------------- --------------

Loss per Share attributable

to Equity Owners of the parent

expressed in pence per share:

Basic and Diluted

From Operations 3 (0.09) (0.08) (0.17)

From Continued Operations 3 (0.09) (0.08) (0.16)

From Discontinued Operations 3 (0.00) (0.00) (0.01)

----------------------------------------- ------- ------------- ------------- --------------

The notes form part of this Interim Financial Report.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE

2023

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

Notes GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible Assets 4 16,660,692 15,235,815 16,459,599

Right-of-Use Assets 14,515 18,052 17,627

Property, Plant and Equipment 5 1,598,389 1,366,935 1,583,944

Other Receivables 6 434,350 - 454,651

Other Non-Current Assets 7 92,398 74,863 77,667

TOTAL NON-CURRENT ASSETS 18,800,344 16,695,665 18,593,488

CURRENT ASSETS

Equity Instruments at FVTOCI 7,866 17,731 11,977

Trade and Other Receivables 6 408,502 1,035,356 560,060

Other Current Assets 7 395 18,211 1,036

Cash and Cash Equivalents 4,839,155 9,433,689 7,202,334

TOTAL CURRENT ASSETS 5,255,918 10,504,987 7,775,407

----------------------------------- ------- -------------- -------------- --------------

TOTAL ASSETS 24,056,262 27,200,652 26,368,895

----------------------------------- ------- -------------- -------------- --------------

EQUITY AND LIABILITIES

SHAREHOLDERS' EQUITY

Share Capital 9 16,889,598 16,889,598 16,889,598

Share Premium 41,693,178 41,693,178 41,693,178

Merger Reserve 6,683,000 6,683,000 6,683,000

Foreign Currency Reserve 211,972 358,738 626,930

Share Based Payment Reserve 495,612 425,019 403,749

FVTOCI Reserve (45,146) (35,281) (41,035)

Retained Earnings (42,546,826) (39,606,088) (40,999,879)

TOTAL EQUITY ATTRIBUTABLE

TO EQUITY HOLDERS OF THE PARENT 23,381,388 26,408,164 25,255,541

LIABILITIES

NON-CURRENT LIABILITIES

Lease Liabilities 9,306 11,051 12,263

----------------------------------- ------- -------------- -------------- --------------

TOTAL NON-CURRENT LIABILITIES 9,306 11,051 12,263

----------------------------------- ------- -------------- -------------- --------------

CURRENT LIABILITIES

Lease Liabilities 5,210 5,214 5,364

Trade and Other Payables 8 638,389 776,223 1,085,778

Other Current Liabilities 21,969 - 9,949

TOTAL CURRENT LIABILITIES 665,568 781,437 1,101,091

TOTAL LIABILITIES 674,874 792,488 1,113,354

----------------------------------- ------- -------------- -------------- --------------

TOTAL EQUITY AND LIABILITIES 24,056,262 27,200,652 26,368,895

----------------------------------- ------- -------------- -------------- --------------

The Interim Financial Report was approved by the Board of

Directors on 28 September 2023 and was signed on its behalf by:

........................................................

Dale Ferguson

Executive Director

Company number: 07307107

The notes form part of this Interim Financial Report.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE SIX MONTHSED

30 JUNE 2023

Share

Merger Foreign Based

Share Share Reserve Currency Payment FVTOCI Retained Total

Capital Premium GBP Reserve Reserve Reserve Earnings Equity

GBP GBP 6,683,000 GBP GBP GBP GBP GBP

At 1 January

2022 16,889,598 41,693,178 (38,726) 305,095 (21,437) (38,284,665) 27,226,043

---------------- ------------ ------------ ------------ ----------- ----------- ------------------- -------------- -------------

Loss for the

period - - - - - - (1,353,549) (1,353,549)

Other

Comprehensive

Income - - - 397,464 - (13,844) - 383,620

---------------- ------------ ------------ ------------ ----------- ----------- ------------------- -------------- -------------

Total

Comprehensive

Income for

the

period - - - 397,464 - (13,844) (1,353,549) (969,929)

Share Based

Payment

charges - - - - 152,050 - - 152,050

Lapse of

Options - - - - (32,126) - 32,126 -

At 30 June

2022 16,889,598 41,693,178 6,683,000 358,738 425,019 (35,281) (39,606,088) 26,408,164

---------------- ------------ ------------ ------------ ----------- ----------- ------------------- -------------- -------------

Loss for the

period - - - - - - (1,505,843) (1,505,843)

Other

Comprehensive

Income - - - 268,192 - (5,754) - 262,438

---------------- ------------ ------------ ------------ ----------- ----------- ------------------- -------------- -------------

Total

Comprehensive

Income for

the

period - - - 268,192 - (5,754) (1,505,843) (1,243,405)

Share Based

Payment

charges - - - - 90,782 - - 90,782

Lapse of

Options - - - - (112,052) - 112,052 -

At 31 December

2022 16,889,598 41,693,178 6,683,000 626,930 403,749 (41,035) (40,999,879) 25,255,541

---------------- ------------ ------------ ------------ ----------- ----------- ------------------- -------------- -------------

Loss for the

period - - - - - - (1,546,947) (1,546,947)

Other

Comprehensive

Income - - - (414,958) - (4,111) - (419,069)

---------------- ------------ ------------ ------------ ----------- ----------- ------------------- -------------- -------------

Total

Comprehensive

Income for

the

period - - - (414,958) - (4,111) (1,546,947) (1,966,016)

Share Based

Payment

charges - - - - 91,863 - - 91,863

At 30 June

2023 16,889,598 41,693,178 6,683,000 211,972 495,612 (45,146) (42,546,826) 23,381,388

---------------- ------------ ------------ ------------ ----------- ----------- ------------------- -------------- -------------

The notes form part of this Interim Financial Report.

CONSOLIDATED CASH FLOW STATEMENT FOR THE SIX MONTHSED 30 JUNE

2023

Unaudited Unaudited Audited

Six months Six months Year ended

to June to June December

2023 2022 2022

Notes GBP GBP GBP

Cash Flows used in Operating

Activities

Loss for the period (1,546,947) (1,353,549) (2,859,392)

Depreciation and Amortisation

charges 5 5,472 12,137 23,456

Share Based Payments Reserve

charge 91,863 152,050 242,832

Finance Income (32,588) (12,697) (34,695)

Finance Expense - 3,557 265

Exchange Losses / (Gains) 166,683 (628,090) (858,679)

Cash Flow from Operating Activities

before changes in Working Capital (1,315,517) (1,826,592) (3,486,213)

Decrease / (Increase) in Trade

and Other Receivables 137,471 (97,472) (78,217)

Decrease in Trade and Other

Payables (396,205) (765,133) (538,972)

---------------------------------------- --------- -------------- -------------- --------------

Net Cash used in Operating Activities (1,574,251) (2,689,197) (4,103,402)

---------------------------------------- --------- -------------- -------------- --------------

Cash flow used in Investing

Activities

Purchase of Intangible Exploration

Assets 4 (607,380) (939,423) (1,771,821)

Purchase of Tangible Fixed Assets 5 (63,940) (665,952) (852,127)

Interest received 32,589 12,697 28,438

Proceeds from Relinquishment

of the Rights and Obligations

of Discontinued Operations - 86,675 89,981

---------------------------------------- --------- -------------- -------------- --------------

Net Cash used in Investing Activities (638,731) (1,506,003) (2,505,529)

---------------------------------------- --------- -------------- -------------- --------------

Cash Flow used in Financing

Activities

Principal paid on Lease Liabilities (2,605) (2,275) (5,022)

Interest paid - (3,557) (265)

---------------------------------------- --------- -------------- -------------- --------------

Net Cash used in Financing Activities (2,605) (5,832) (5,287)

---------------------------------------- --------- -------------- -------------- --------------

Decrease in Cash and Cash Equivalents (2,215,587) (4,201,032) (6,614,218)

Cash and Cash Equivalents at

beginning of period 7,202,334 13,002,083 13,002,084

Exchange (Losses) / Gains on

Cash and Cash Equivalents (147,592) 632,638 814,468

---------------------------------------- --------- -------------- -------------- --------------

Cash and Cash Equivalents at

end of period 4,839,155 9,433,689 7,202,334

---------------------------------------- --------- -------------- -------------- --------------

The notes form part of this Interim Financial Report.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL REPORT FOR THE SIX

MONTHSED 30 JUNE 2023

1. BASIS OF PREPARATION

The financial information set out in this report is based on the

Consolidated Financial Statements of Savannah Resources Plc (the

'Company') and its subsidiary companies (together referred to as

the 'Group'). The Interim Financial Report of the Group for the six

months ended 30 June 2023, which is unaudited, was approved by the

Board on 28 September 2023. The financial information contained in

this interim report does not constitute statutory accounts as

defined by s434 of the Companies Act 2006. The statutory accounts

for the year ended 31 December 2022 have been filed with the

Registrar of Companies. The Auditors' Report on those accounts was

unqualified and did not contain a statement under section 498 (2)

or 498 (3) of the Companies Act 2006.

The financial information set out in this report has been

prepared in accordance with the accounting policies set out in the

Annual Report and Financial Statements of Savannah Resources Plc

for the year ended 31 December 2022. New standards and amendments

to IFRS effective as of 1 January 2023 have been reviewed by the

Group and there has been no material impact on the financial

information set out in this report as a result of these standards

and amendments.

The Group Interim Financial Report is presented in Pound

Sterling.

Going Concern

In common with many mineral exploration companies, the Company

has in the past raised equity to fund its exploration activities

and to date has not earned any revenues from its exploration

projects.

In July 2023 the Company raised GBP6.5m (before expenses),

effectively at market price, providing a pro-forma cash balance of

GBP11.4m. T he Company confirmed that it would use this to focus on

the completion of the DFS drilling programmes, the Mineral Resource

Estimate upgrade, the RECAPE submission, the processing plant and

infrastructure design, plus team expansion and community relations

development. The Directors prepared cash flow forecasts for the

period to December 2024. This indicates that additional funding

will be required in 2024 in order to fund through Final Investment

Decision and into Project construction. The Directors believe that

following the granting of the DIA the Group's Barroso Lithium

Project and the publication of the Company's new Scoping Study it

is attractive to investors and are confident that funding for the

Project's development would be obtained through options which may

include equity, strategic partnership or offtake, in a lithium

market with a bright outlook as the green energy revolution is

driven by burgeoning EV demand and the increasing emergence of ESS

(energy storage systems).

While the Company has been successful at raising equity finance

in the past, and while the Directors are confident of raising

additional funding should it be required, their ability to do this

is not completely within their control and the lack of a binding

agreement means there can be no certainty that the additional

funding required by the Group and the Company will be secured

within the necessary timescale. These conditions indicate the

existence of a material uncertainty which may cast significant

doubt about the Group and the Company's ability to continue as a

Going Concern, and its ability to realise its assets and discharge

its liabilities in the normal course of business. The Financial

Statements do not include any adjustments that would result if the

Group and Company were unable to continue as a going concern.

2. SEGMENTAL REPORTING

The Group complies with IFRS 8 Operating Segments, which

requires operating segments to be identified on the basis of

internal reports about components of the Group that are regularly

reviewed by the chief operating decision maker, which the Company

considers to be the Board of Directors. In the opinion of the

Directors, the operations of the Group are comprised of exploration

and development in Portugal, headquarter and corporate costs and

the discontinued operation in Mozambique.

Based on the Group's current stage of development there are no

external revenues associated to the segments detailed below. For

exploration and development in Portugal and the discontinued

operation in Mozambique the segments are calculated by the

summation of the balances in the legal entities which are readily

identifiable to each of the segmental activities. Recharges between

segments are at cost (including transfer price charge) and included

in each segment below. Inter-company loans are eliminated to zero

and not included in each segment below.

Discontinued

Operation

Mozambique

Mineral Sands Portugal HQ and

(2) Lithium Corporate Elimination Total

GBP GBP GBP GBP GBP

Period 1 January 2023

to 30 June 2023

Revenue (1) - 429,358 321,171 (750,529) -

Interest Income - - 32,588 - 32,588

Share Based Payments - - (91,863) - (91,863)

Loss for the period (48,060) (571,419) (927,468) - (1,546,947)

Total Assets 601,133 18,694,198 4,760,931 - 24,056,262

Total Non-Current

Assets 434,350 18,365,994 - - 18,800,344

Additions to Non-Current

Assets - 638,991 - - 638,991

Total Current

Assets 166,783 328,204 4,760,931 - 5,255,918

Total Liabilities (46,971) (237,496) (390,407) - (674,874)

--------------------------- ----------------- -------------- --------------- --------------- --------------

Discontinued

Operation

Mozambique Portugal HQ and

Mineral Sands(2) Lithium Corporate Elimination Total

GBP GBP GBP GBP GBP

Period 1 July 2022

to 31 December 2022

Revenue (1) - 843,542 500,566 (1,344,108) -

Finance Costs - (265) - - (265)

Interest Income - - 34,354 - 34,354

Share Based Payments - - (394,882) - (394,882)

Loss for the period (125,558) (729,413) (650,872) - (1,505,843)

Total Assets 607,124 18,575,420 7,186,351 - 26,368,895

Total Non-Current

Assets 456,490 18,130,222 6,776 - 18,593,488

Additions to Non-Current

Assets 454,651 1,150,536 - - 1,605,187

Total Current

Assets 150,635 445,197 7,179,575 - 7,775,407

Total Liabilities (111,567) (326,564) (675,223) - (1,113,354)

--------------------------- ------------------- -------------- --------------- --------------- --------------

Discontinued Portugal HQ and Elimination Total

Operation Lithium Corporate

Mozambique

Mineral Sands(2)

GBP GBP GBP GBP GBP

Period 1 January 2022

to 30 June 2022

Revenue (1) - 1,065,095 471,016 (1,536,111) -

Finance Costs - - - - -

Interest Income - - 341 - 341

Share Based Payments - - (152,050) - (152,050)

Impairment of Assets - - - - -

Loss for the period (50,838) (932,463) (370,248) - (1,353,549)

Total Assets 752,409 17,298,526 9,149,717 - 27,200,652

Total Non-Current

Assets 1,831 16,687,058 6,776 - 16,695,665

Additions to Non-Current

Assets - 1,516,978 - - 1,516,978

Total Current Assets 750,578 611,468 9,142,941 - 10,504,987

Total Liabilities (96,113) (315,723) (380,652) - (792,488)

--------------------------- -------------------- -------------- --------------- --------------- --------------

(1) Revenues included in the Portugal Lithium segment include

GBP429,358 (31 December 2022: GBP843,542; 30 June 2022:

GBP1,065,096) related to intercompany recharges within this segment

and therefore eliminated in the Elimination column.

(2) This is including costs related to the Company's Mozambican

subsidiary, Matilda Minerals Lda.

3. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to the ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

In accordance with IAS 33 as the Group is reporting a loss for

both this and the preceding period the share options are not

considered dilutive because the exercise of share options and

warrants would have the effect of reducing the loss per share.

Reconciliations are set out below:

Unaudited Unaudited Audited Year

Six months Six months ended 31

to 30 June to 30 June December

2023 2022 2022

Basic and Diluted Loss per

Share:

Losses attributable to Ordinary

Shareholders (GBP):

Total Loss for the period

(GBP) (1,546,947) (1,353,549) (2,859,392)

Total Loss for the period

from Continuing Operations

(GBP) (1,498,887) (1,302,711) (2,682,996)

Total Loss for the period

from Discontinued Operations

(GBP) (48,060) (50,838) (176,396)

Weighted average number of

shares (number) 1,688,959,820 1,688,959,820 1,688,959,820

Loss per Share - Total Loss

for the period from Operations

(GBP) (0.00092) (0.00080) (0.00169)

Loss per Share - Total Loss

for the period from Continuing

Operations (GBP) (0.00089) (0.00077) (0.00159)

Loss per Share - Total Loss

for the period from Discontinued

Operations (GBP) (0.00003) (0.00003) (0.00010)

------------------------------------ --------------- --------------- ---------------

4. INTANGIBLE ASSETS

Exploration

and Evaluation

Assets

GBP

Cost

At 1 January 2022 14,137,817

Additions 840,532

Exchange differences 257,466

------------------------- ------------------

At 30 June 2022 15,235,815

Additions 890,791

Exchange difference 332,993

------------------------- ------------------

At 31 December 2022 16,459,599

------------------------- ------------------

Additions 557,175

Exchange differences (356,082)

------------------------- ------------------

At 30 June 2023 16,660,692

------------------------- ------------------

Amortisation and Impairment

At 1 January 2022 -

At 30 June 2022 -

At 31 December 2022 -

At 30 June 2023 -

------------------------------ ------------

Net Book Value

At 30 June 2022 15,235,815

At 31 December 2022 16,459,599

-------------------------------- ------------

At 30 June 2023 16,660,692

-------------------------------- ------------

All Exploration and Evaluation Assets relate to the Barroso

Lithium Project.

5. PROPERTY, PLANT AND EQUIPMENT

Motor Office

Vehicles Equipment Land Total

GBP

Cost

At 1 January 2022 54,401 37,748 649,180 741,329

Additions - 8,068 657,884 665,952

Exchange differences 1,350 1,106 30,477 32,933

----------------------- ----------- ------------ ----------- ------------------

At 30 June 2022 55,751 46,922 1,337,541 1,440,214

----------------------- ----------- ------------ ----------- ------------------

Additions - 1,027 185,148 186,175

Exchange difference 1,604 1,259 37,127 39,990

----------------------- ----------- ------------ ----------- ------------------

At 31 December 2022 57,355 49,208 1,559,816 1,666,379

----------------------- ----------- ------------ ----------- ------------------

Additions - 1,521 62,419 63,940

Exchange differences (1,648) (4,197) (46,010) (51,855)

----------------------- ----------- ------------ ----------- ------------------

At 30 June 2023 55,707 46,532 1,576,225 1,678,464

----------------------- ----------- ------------ ----------- ------------------

Depreciation

At 1 January 2022 46,333 18,460 - 64,793

Charge for the period 5,767 971 - 6,738

Exchange differences 1,276 472 - 1,748

------------------------ --------- --------- --- ---------

At 30 June 2022 53,376 19,903 - 73,279

------------------------ --------- --------- --- ---------

Charge for the period 2,425 4,473 - 6,898

Exchange difference 1,554 704 - 2,258

------------------------ --------- --------- --- ---------

At 31 December 2022 57,355 25,080 - 82,435

------------------------ --------- --------- --- ---------

Charge for the period - 2,817 - 2,817

Exchange differences (1,648) (3,529) - (5,177)

------------------------ --------- --------- --- ---------

At 30 June 2023 55,707 24,368 - 80,075

------------------------ --------- --------- --- ---------

Net Book Value

At 30 June 2022 2,375 27,019 1,337,541 1,366,935

At 31 December 2022 - 24,128 1,559,816 1,583,944

---------------------- ------- -------- ----------- -----------

At 30 June 2023 - 22,164 1,576,225 1,598,389

---------------------- ------- -------- ----------- -----------

The additions in land reflect the land acquisition program that

Savannah has in place in Portugal to acquire the land required for

the future development of the Barroso Lithium project.

All Property, Plant and Equipment Assets relate to the Barroso

Lithium Project.

6. TRADE AND OTHER RECEIVABLES

Unaudited Unaudited Audited

30 June 30 June 2022 31 December

2023 2022

GBP GBP GBP

Non-Current

Other Receivables 434,350 - 454,651

----------- --------------- --------------

Total Non-Current

Trade and Other Receivables 434,350 - 454,651

----------- --------------- --------------

Unaudited Unaudited Audited

30 June 30 June 2022 31 December

2023 2022

GBP GBP GBP

Current

VAT Recoverable 125,078 109,117 155,205

Other Receivables 283,424 926,239 404,855

----------- --------------- --------------

Total Current Trade

and Other Receivables 408,502 1,035,356 560,060

----------- --------------- --------------

7. OTHER CURRENT AND NON-CURRENT ASSETS

Unaudited Unaudited Audited

30 June 30 June 2022 31 December

2023 2022

GBP GBP GBP

Non-Current

Guarantees 62,755 66,257 64,611

Other 29,643 8,606 13,056

----------- --------------- --------------

Total Other Non-Current

Assets 92,398 74,863 77,667

----------- --------------- --------------

Current

Other 395 18,211 1,036

Total Other Current

Assets 395 18,211 1,036

----- -------- -------

8. TRADE AND OTHER PAYABLES

Unaudited Unaudited Audited

30 June 30 June 2022 31 December

2023 2022

GBP GBP GBP

Current

Trade Payables 392,612 276,820 618,805

Other Payables 16,385 54,646 56,745

Accruals 190,829 435,275 410,228

Taxes 38,563 9,482 -

Total Current Trade

and Other Payables 638,389 776,223 1,085,778

----------- --------------- --------------

9. SHARE CAPITAL

Six months to Six months to Six months to

30 June 2023 30 June 2022 31 December 2022

GBP0.01 GBP GBP0.01 GBP GBP0.01 GBP

ordinary ordinary ordinary

shares number shares number shares number

Allotted, issued

and fully paid

At beginning

of period 1,688,959,820 16,889,598 1,688,959,820 16,889,598 1,688,959,820 16,889,598

Issued during

the period:

Share placement - - - - - -

------------------- ---------------- ------------ ---------------- ------------ ---------------- ------------

At end of period 1,688,959,820 16,889,598 1,688,959,820 16,889,598 1,688,959,820 16,889,598

------------------- ---------------- ------------ ---------------- ------------ ---------------- ------------

The par value of the Company's shares is GBP0.01.

10. GROUP CONTINGENT LIABILITIES

Details of contingent liabilities where the probability of

future payments is not considered remote are set out below, as well

as details of contingent liabilities, which although considered

remote, the Directors consider should be disclosed. The Directors

are of the opinion that provisions are not required in respect of

these matters, as at the reporting date it is not probable that a

future sacrifice of economic benefits will be required and the

amount is not capable of reliable measurement.

Consideration payable in relation to the acquisition of Mining

Lease Application for lithium, feldspar and quartz (Portugal

lithium project)

In June 2019 the Company exercised its option to acquire a

Mining Lease Application for lithium, feldspar and quartz from

private Portuguese company, Aldeia & Irmão, S.A.. The total

purchase price for the acquisition is EUR EUR3,250,000 ( GBP

GBP2,794,000), which will only become due once the Mining Lease

Application has been granted and the Mining Rights transferred to

an entity within the Group, at which point the agreed payment

schedule will consist of an initial EUR EUR55,000 ( GBP GBP47,000)

payment with the balance due in 71 equal monthly instalments. Upon

delivery of the request for transfer of the Mining Rights to an

entity within the Group, the Group shall provide with a bank

guarantee of EUR EUR3,195,000 ( GBP GBP2,747,000) that will be

reduced in accordance with the 71 monthly instalments. As at 30

June 2023 the mining lease has not been granted.

Contingent tax liability in relation to the relinquishment of

the rights and obligations of discontinued operations in

Mozambique

In October 2016 the Savannah Group and Rio Tinto entered into a

Consortium Agreement ('CA'), whereby both Savannah Group and Rio

Tinto combined their respective projects in Mozambique to form an

unincorporated consortium. On the 1 December 2021 Savannah signed a

Deed of Termination relating to the CA. Under the Deed of

Termination, a compensation amounting to $9.5m (GBP7.0m) cash was

agreed (the "Transaction"). The advice received from the Company's

tax advisers was clear that the Transaction was not in scope for

tax under Mozambique law, and this continues to be the Company's

and its advisers' view. However, the Mozambican Tax Authority has

indicated that it considers that the Transaction is in scope for

Mozambican tax. The Company is working with its tax and legal

advisers on this matter, and notes that in the 2021 Audited

Consolidated Financial a gain on relinquishment of the rights and

obligations of discontinued operations in Mozambique of GBP627,078,

was recorded.

11. EVENTS AFTER THE REPORTING DATE

In July 2023 the Company approved a share placement and

subscription of GBP6.5m (before expenses) through the issue of

139,190,084 ordinary shares at an issue price of 4.67 pence per

share.

On 12 September 2023 the Company appointed two new Non-Executive

Directors. Bruce Griffin joined as an Independent Non-Executive

Director, and Mohamed Sulaiman joined as Non-Executive Director,

replacing the retiring Imad Sultan (Non-Executive Director) as the

Board representative of Savannah's largest shareholder, Al Marjan

Ltd. Mohamed Sulaiman has become the Chairman of the Board's Audit

and Risk Committee and a member of the Nomination Committee, and

Bruce Griffin has become a member of the Remuneration

Committee.

On 18 September 2023 Emanuel Proença was appointed as the

Company's new Chief Executive Officer.

It was with deep sadness that the Board of Savannah announced on

19 September 2023 the passing of Manohar Pundalik Shenoy,

Non-Executive Director of the Company. He also was Chairman of the

Board's Audit and Risk Committee and served on the Remuneration

Committee.

Regulatory Information

This Announcement contains inside information for the purposes

of the UK version of the market abuse regulation (EU No. 596/2014)

as it forms part of United Kingdom domestic law by virtue of the

European Union (Withdrawal) Act 2018 ("UK MAR").

Savannah - Enabling Europe's energy transition.

**ENDS**

Follow @SavannahRes on X (Formerly known as Twitter)

Follow Savannah Resources on LinkedIn

For further information please visit www.savannahresources .com

or contact:

Savannah Resources PLC Tel: +44 20 7117 2489

Emanuel Proença, CEO

SP Angel Corporate Finance LLP (Nominated Advisor Tel: +44 20 3470 0470

& Joint Broker)

David Hignell/ Charlie Bouverat (Corporate Finance)

Grant Barker/Abigail Wayne (Sales & Broking)

RBC Capital Markets (Joint Broker) Tel: +44 20 7653 4000

Farid Dadashev/ Jamil Miah

Tel: +44 20 3757 4980

Camarco (Financial PR)

Gordon Poole/ Emily Hall / Fergus Young

LPM (Portugal Media Relations) Tel: +351 218 508 110

Herminio Santos/ Jorge Coelho

About Savannah

Savannah Resources is a mineral resource development company and

sole owner of the Barroso Lithium Project in northern Portugal.

Savannah is focused on the responsible development and operation

of the Barroso Lithium Project so that its impact on the

environment is minimised and the socio-economic benefits that it

can bring to all its stakeholders are maximised. Through the

Barroso Lithium Project, Savannah can help Portugal to play an

important role in providing a long-term, locally sourced, lithium

raw material supply for Europe's rapidly developing lithium battery

value chain. Production is targeted to begin in 2026, producing

enough lithium for approximately half a million vehicle battery

packs per year.

The Company is listed and regulated on AIM and the Company's

ordinary shares are also available on the Quotation Board of the

Frankfurt Stock Exchange (FWB) under the symbol FWB: SAV, and the

Börse Stuttgart (SWB) under the ticker "SAV".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GZGZLRRZGFZM

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

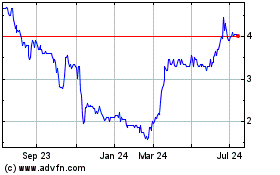

Savannah Resources (LSE:SAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

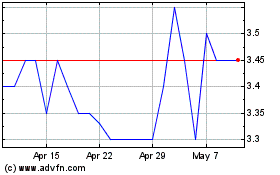

Savannah Resources (LSE:SAV)

Historical Stock Chart

From Apr 2023 to Apr 2024