Tight LNG Market to Benefit Shell, TotalEnergies -- Analysis

July 06 2021 - 7:54AM

Dow Jones News

By Jaime Llinares Taboada

Global demand for liquefied natural gas is expected to outpace

supply until 2025, and Royal Dutch Shell PLC and TotalEnergies SE

are best placed to benefit from this tight market, Jefferies says

in a report.

LNG consumption should grow at a compound annual rate of 5%

through 2030, and at 2% during the 2030s, Jefferies estimates. This

will be driven by new Asian importing countries, continued high

growth in Chinese demand and new transport fuel applications.

"We see gas as a key transition fuel for developing economies

with India and China being the biggest growth drivers, more than

offsetting demand decline in Europe, Japan and North America,"

Jefferies analysts say.

Combined with limited project start-ups in 2021 and 2022, this

should keep the market tight and spot LNG prices at an elevated

level in the medium term, the bank says. This will particularly

favor companies such as Shell and Total, which have a relatively

higher degree of exposure to spot pricing--as opposed to contracted

sales which remain under pressure by Qatar's aggressive

marketing.

Shell has the best LNG business among the big energy companies,

according to Jefferies. The Anglo-Dutch group has the largest

production capacity portfolio and is expected to increase it by at

least 7 million tons a year by the middle of the decade. Moreover,

Shell has a low break-even point and the highest proportion of spot

LNG sales of all integrated oil companies. It also has the greatest

number of LNG carriers and holds equity stakes in three

regasification facilities.

TotalEnergies is seen as a close second. However, the French

company lags behind Shell in terms of LNG shipping capacity and ESG

credentials, according to Jefferies.

From 2025 onward, however, this should change, as a wave of

projects will be commissioned and new volumes will enter the

market, Jefferies says. Those include Shell's LNG Canada, Exxon

Mobil Corp.'s Golden Pass, Gazprom PJSC's Baltic LNG, and Qatar

Petroleum's North Field East.

As a result, the U.S. bank expects the market to become looser

from 2025 until the end of the decade, which will weigh on spot

prices for the super-chilled gas.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

July 06, 2021 08:53 ET (12:53 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

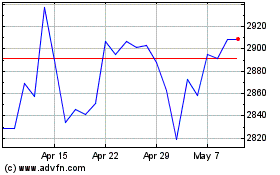

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2025 to Apr 2025

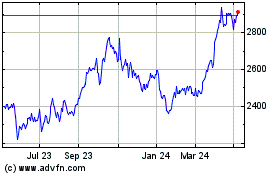

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2024 to Apr 2025