Somic PLC - Proposed Disposal, etc

March 15 1999 - 10:04AM

UK Regulatory

RNS No 0940q

SOMIC PLC

15th March 1999

Somic plc (the "Company")

to be renamed

Tarpan plc

Proposed Disposal of the whole of the business and assets of the Company

Proposed change of name

Introduction

The Non-executive Directors of the Company have received a proposal from the

Executive Directors under which Harlspun Limited, a company owned by the

Executive Directors and others, would acquire the whole of the business and

assets (other than book debts) of the Company and will also assume all of its

liabilities.

The consideration will be #850,000 in cash payable on completion and a further

sum in cash payable two months after completion equal to the amount (if any)

by which the Company's book debts realised during that two month period fall

short of #850,000. If the amount realised exceeds #850,000 the Company will

pay the excess to Harlspun. Following the Disposal, the Company's assets will

therefore comprise #1.7 million in cash (less the expenses of the Proposals,

estimated by the Directors to be approximately #100,000) with no debt.

Due to its size, the Disposal is conditional upon the approval of

Shareholders. In addition, since Harlspun is partly owned by the Executive

Directors, the Disposal is also a related party transaction as defined by the

Listing Rules and is for that reason also conditional upon the approval of

Shareholders.

Subject to Shareholder approval of the Disposal, it is also proposed to change

the name of the Company to Tarpan plc.

Details of the Proposals are included in a circular (the "Circular") which is

being sent to Shareholders today.

A notice of the Extraordinary General Meeting to be held on 7 April 1999, at

which the necessary resolution will be proposed to approve the Proposals, is

also being sent to Shareholders today.

Information on the Group

The Company manufactures cords, twines, braids, woven fabrics and yarns which

it exports worldwide for both industrial and domestic purposes. A separate

plastics coating division offers a complete facility for the processing of

customers' fabrics with PVC and acrylic emulsion.

The Company has one active subsidiary undertaking, Mason Fabrics Limited,

which is engaged in the sale of textile and related products. The Company

also has a 12.5 per cent. interest in the ordinary share capital of W Lusty &

Sons Limited, which is engaged in the manufacture and distribution of

furniture.

The Company owns its own manufacturing premises at Alliance Works, off New

Hall Lane, Preston. It also owns certain residential investment properties in

Stefano Road, Preston, adjoining the manufacturing site.

In the year ended 31 March 1998, the Group made consolidated pre-tax profits

of #293,515 on turnover of #5,968,036. At 31 March 1998 the Group had

consolidated net assets of #2,317,756.

Terms of the Disposal

Under the Agreement, the Company will dispose of its entire business and

trade, including all its assets (other than book debts) and liabilities, to

Harlspun. The consideration will be #850,000 in cash payable on completion

which, together with the value of the book debts which are guaranteed by

Harlspun to realise not less than #850,000 represents a total of 80 pence per

share. Harlspun assumes responsibility for the existing net overdraft of the

Group (which, as at 12 March 1999 (being the latest practicable date) stands

at #269,307), trade creditors, taxation and all other liabilities of the

Company. The assets and liabilities are principally:

- manufacturing premises at Alliance Works, Preston;

- plant and machinery;

- stock and debtors;

- creditors;

- shares held in Mason Fabrics Limited and W Lusty & Sons Limited; and

- investment properties in Stefano Road, adjacent to Alliance Works.

The allocation of the consideration to the various assets and liabilities to

be sold is specified in the Agreement. The manufacturing premises will be

transferred at their existing use value and the residential investment

properties will be transferred at their open market value, as set out in the

valuation report in Part III of the Circular. Plant, machinery and stock will

be transferred at their book values.

The consideration represents a discount to the aggregate value of the assets

to be sold, after taking account of the assumed liabilities. The discount

reflects the fact that the whole of the business and assets of the Company

(other than book debts) are being sold in their entirety, rather than in a

piecemeal fashion, thereby reducing management time and other associated costs

involved in disposing of the assets in their constituent parts. The Company

will also receive a benefit in the form of immediate cash consideration.

Under the Agreement, Harlspun will indemnify the Company against any

litigation or other contingent liabilities materialising after completion

which relate to facts or circumstances arising prior to completion.

The employment of all the Company's staff (including the Executive Directors,

but excluding the Non-executive Directors) will transfer to Harlspun on

existing terms of employment. Harlspun will also assume responsibility for

the defined benefit staff pension scheme, including pensions in payment, and

for the Directors' defined contribution pension scheme.

Reasons for the Disposal

The Executive Directors believe that because of the size and specialist nature

of its main business (paper spinning and weaving) there are limited

possibilities for organic growth. This, they believe, makes the business more

suited to being private than remaining part of a quoted public company.

Trading conditions have been difficult for some time for manufacturing

companies due to a combination of increasing raw material prices and lower

margins, caused in part by the strength of sterling relative to the currencies

of those European countries to which Somic exports its products. At the same

time, stock market sentiment towards smaller quoted companies has been

relatively poor recently.

Furthermore, the Executive Directors are conscious of their responsibilities

to outside shareholders. As a private company their shareholder

responsibility will be principally to themselves and they believe that in

difficult trading conditions which the manufacturing industry experiences from

time to time, being relieved of their responsibility to outside shareholders

will increase their management flexibility and will thereby benefit the

business.

The Non-executive Directors believe that the Disposal offers an opportunity to

eliminate the Company's current exposure to volatility of earnings and wish to

seek worthwhile opportunities. They intend to use the proceeds of the

Disposal to fund the research of, investigation into and acquisition of

companies in growth industries which require additional funding and for whom a

Stock Exchange listing is an essential prerequisite of their growth strategy.

The Non-executive Directors have substantial experience and expertise to offer

such companies.

On completion, which, subject to the approval of Shareholders at the

Extraordinary General Meeting, will take place on 7 April 1999, Jonathan Marsh

and John Thornley will resign as Directors, Richard Blackburn will resign as

chairman and managing director but will remain as a non-executive Director and

Neville Buch will become Chairman.

Following implementation of the Proposals, the Company will have no employees

or full time executive directors. However, each of the Non-executive

Directors intends to research and investigate acquisition opportunities.

Change of name

The name Somic plc is inextricably linked with the existing manufacturing and

selling activities at Alliance Works in Preston. Harlspun and the Executive

Directors wish to continue to use this name; the Non-executive Directors also

believe it is appropriate for the Company to have a new name. Accordingly, it

is proposed to change the name of the Company to Tarpan plc. The change of

name is subject to the approval of Shareholders at the Extraordinary General

Meeting.

In addition, if the Proposals are approved at the Extraordinary General

Meeting, the Non-executive Directors intend to change the registered office of

the Company to 7th Floor, 39 St James's Street, London SW1A 1JD, which is more

suitably located for the Company's purposes for the foreseeable future.

Prospects

Following the Disposal, the Company will have approximately #1.6 million

available for acquisition opportunities. Until the Company acquires a

business the cash will be invested in gilt-edged stock or the money markets

with a view to generating sufficient investment income to cover the Company's

overheads.

Any classifiable transaction (as defined in the Listing Rules) will require

shareholder approval and any acquisition will constitute a reverse takeover

which will lead to the temporary suspension of the Ordinary Shares.

Accordingly, any proposed acquisition will itself need to be suitable for

admission to the Official List in order that the Ordinary Shares are re-

admitted to the Official List.

Dividend policy

The Non-executive Directors intend to pay dividends only when it becomes

commercially prudent to do so and subject to the availability of distributable

reserves. They do not currently intend to pay a final dividend in respect of

the year ending 31 March 1999.

Extraordinary General Meeting

The Extraordinary General Meeting will be held at the offices of Peel, Hunt &

Company Limited, on the fifth floor of 62 Threadneedle Street, London EC2R 8HP

at 10.00 a.m. on 7 April 1999.

Further information:

Richard Blackburn Somic plc 01772 790000

Neville Buch Somic plc 0171 243 4390

END

DISAVRUKKRKOAAR

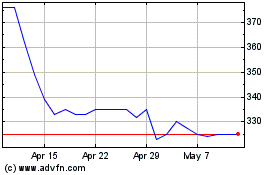

Somero Enterprise (LSE:SOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Somero Enterprise (LSE:SOM)

Historical Stock Chart

From Jul 2023 to Jul 2024