Schroder Real Estate Retail Asset Management Update

February 26 2019 - 1:00AM

UK Regulatory

TIDMSREI

For release 26 February 2019

Schroder Real Estate Investment Trust Limited

("SREIT"/ the "Company" / "Group")

RETAIL ASSET MANAGEMENT UPDATE

Schroder Real Estate Investment Trust, the actively managed UK-focused REIT,

announces that it has completed two new lease agreements at Bedford and Milton

Keynes which improve the portfolio's defensive qualities.

St. John's Retail Park, Bedford

A lease agreement has been exchanged with TJ Morris Limited (trading as Home

Bargains) for a 14,500 sq ft store on a fifteen-year term at GBP190,000 per

annum. This space makes up the balance of the vacant former Homebase where an

agreement has already been exchanged with Lidl to lease a 21,630 sq ft store on

a fifteen-year term at GBP335,000 per annum. The lettings are subject to securing

planning consent and SREIT delivering a refurbished unit with associated

improvements to the car park and wider site at a cost of approximately GBP3.7

million.

Matalan, Milton Keynes

An agreement has been exchanged with Matalan that extends its current lease by

eight years until March 2029, at a new rent of GBP572,000 per annum. As part of

the transaction Carpetright, who currently sublet 8,500 sq ft from Matalan,

will become a direct tenant paying GBP95,000 per annum on a lease until March

2021. The new lease to Matalan is conditional on improvement works to the

roof, cladding and car park at a cost of approximately GBP1 million.

These transactions are part of an active pipeline of retail asset management

and realisations. In addition to the previously announced realisation of a

retail asset in Portsmouth for GBP1.6 million, contracts have been exchanged to

sell a retail property in Yeovil for GBP300,000 which is in line with the

independent valuation at 31 December 2018. The Company will keep the market

updated as further realisations are completed post asset management

initiatives.

-ENDS-

For further information:

Schroder Real Estate Investment Management 020 7658 6000

Limited:

Duncan Owen / Nick Montgomery / Frank Sanderson

Northern Trust: 01481 745529

Sean Walsh / James Machon

FTI Consulting: 020 3727 1000

Dido Laurimore / Richard Gotla

END

(END) Dow Jones Newswires

February 26, 2019 02:00 ET (07:00 GMT)

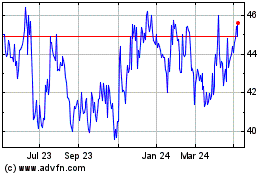

Schroder Real Estate Inv... (LSE:SREI)

Historical Stock Chart

From Apr 2024 to May 2024

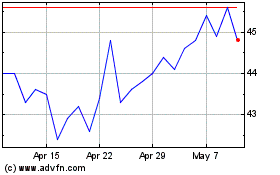

Schroder Real Estate Inv... (LSE:SREI)

Historical Stock Chart

From May 2023 to May 2024