Strip Tinning Holdings PLC Q3 Trading Update (7666R)

October 31 2023 - 2:00AM

UK Regulatory

TIDMSTG

RNS Number : 7666R

Strip Tinning Holdings PLC

31 October 2023

31 October 2023

Strip Tinning Holdings plc

("Strip Tinning" or the "Company")

Q3 Trading Update

Strip Tinning Holdings plc (AIM: STG), a leading supplier of

specialist connection systems to the automotive sector, is pleased

to provide an update on trading covering the period 1 July to 30

September 2023 ("Q3").

Trading in the third quarter of the financial year ending 31

December 2023 ("FY23") has been in line with management's

expectations, and accordingly the Board expects to meet FY23 market

guidance (1) .

Year-to-date revenues of GBP8.2m (Q3 YTD FY22: GBP8.0m) and a

positive adjusted EBITDA performance represents a steady

continuation of the turn-around from the losses of 2022. Improved

performance has primarily been driven by the prioritisation of

increased gross margins due to price rises which came into effect

on 1 January 2023, as well as enhanced productivity.

The European automotive market continues to grow strongly, with

ACEA reporting that overall year-to-date new car registrations are

up by 16.9% (2) . Strip Tinning continues to be well-positioned to

capitalise on the improving prospects across the wider market. This

is reflected in the full year sales outlook which is ahead of

expectations, and in the growing new nominations pipeline which we

expect will benefit sales in FY24 and beyond.

On the Glazing side, the Company is supplying prototypes on

multiple high value programmes which are expected to result in

nominations, both in the current year and FY24. These programmes

are in the target segment of higher technology applications, often

including flexible printed circuit elements produced on the

recently completed new production line.

The EV pipeline continues to develop well and the Company now

has in hand orders for protype parts on five new EV programmes. The

Board had expected the announcement of a major EV nomination with a

Tier 1 by now, and whilst the Company remains confident of securing

the nomination, this is now likely to be in early 2024, with the

Tier 1 award from the end customer yet to be determined. The start

of production date for the programme remains unchanged.

The Company is pleased to announce that it has secured a GBP166k

grant from the Advanced Propulsion Centre (3) UK ("APC")

Feasibility Studies competition which supports projects which will

develop large-scale manufacturing facilities in the UK. This grant

is further to the GBP1.4m of funding previously awarded by the

APC's Scale-up Readiness Validation ("SuRV") scheme. The new grant

is being primarily spent with a leading automotive consultancy who

will complete their study in the first quarter on 2024.

Adam Robson, Executive Chair of Strip Tinning, commented:

"It is pleasing that the operational enhancements implemented

have driven improved financial performance in the current year to

date. Having learnt valuable lessons from the external difficulties

faced in FY22, we have emerged a more mature business and well

placed to exploit the increasing number of opportunities we are

seeing across the wider automotive sector. We are encouraged with

the growing size, as well as quality of our sales pipeline for both

our EV and Glazing programmes, and we look forward to announcing

new production nominations as they arise."

(1) Strip Tinning understands that market expectations for the

year ended 31 December 2023 are for revenues of GBP9.4m, Adjusted

EBITDA of GBP0.1 m and net cash/debt of -GBP3.6m. (Source:

FactSet)

(2)

https://www.acea.auto/pc-registrations/new-car-registrations-9-2-in-september-battery-electric-14-8-market-share/

(3) The APC is a non-profit organisation that collaborates with

UK Government, the automotive industry and academia to accelerate

the transition to a net-zero automotive industry -

https://www.apcuk.co.uk/86-9-million-for-scale-up-and-rd-of-net-zero-vehicle-technology/

Enquiries:

Strip Tinning Holdings plc Via Alma PR

Adam Robson, Executive Chairman

Richard Barton, Chief Executive Officer

Adam Le Van, Chief Financial Officer

Singer Capital Markets (Nominated Adviser and Sole Broker) +44 (0) 20 7496 3000

Rick Thompson

James Fischer

Alma (Financial PR) +44 (0) 20 3405 0205

Josh Royston striptinning@almastrategic.com

Joe Pederzolli

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRBDGBSXDGXG

(END) Dow Jones Newswires

October 31, 2023 03:00 ET (07:00 GMT)

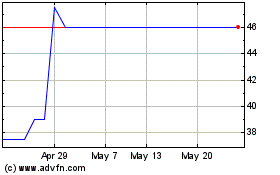

Strip Tinning (LSE:STG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Strip Tinning (LSE:STG)

Historical Stock Chart

From Nov 2023 to Nov 2024