The

information contained within this announcement is deemed by the

Company (Companies House registration number 08873361) to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014 ("MAR"). With the publication of this

announcement via a Regulatory Information Service ("RIS"), this

inside information is now considered to be in the public

domain.

20 December

2024

Tekcapital

plc

("Tekcapital" or the

"Company")

Portfolio Company Update:

Guident Ltd

Awarded New European Patent

No. 4097550

Tekcapital Plc (AIM: TEK) the UK

intellectual property investment group focused on creating valuable

products that can improve people's lives, is pleased to announce

that its portfolio company Guident Ltd ("Guident") has received

European Patent Grant No. 4097550, entitled Artificial Intelligence Method and Apparatus

for Remote Monitoring and Control of Autonomous

Vehicles.

The patent is directed to an

autonomous vehicle remote monitoring and control centre (RMCC)

employing distributed sensor fusion and artificial intelligence

techniques that is configured to receive sensor data across

multiple independently governed autonomous vehicles, including

sensor data from vehicles not operating under RMCC control,

determine incident risk levels, and take control of one or more of

the autonomous vehicles operating at an unsafe incident risk level,

implement safety measures, and return control when the level is

safe.

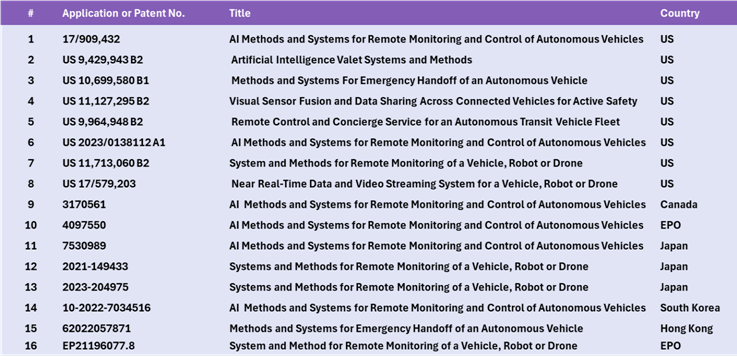

Guident has built one of the first

commercial-grade remote monitoring and control centres for

autonomous vehicles in Florida, with additional facilities underway

in Michigan, and Europe, and has developed what we believe is a

comprehensive intellectual property portfolio as illustrated

below:

The adoption of autonomous

vehicles (AVs) across the United States is accelerating, and Guident welcomes

the accompanying regulatory developments that put the safety of

passengers and the public at the forefront of autonomous vehicle

fleet rollouts.

Market Traction and Strategic Outlook

·

The Total Addressable Market for automotive active

safety systems (which includes driver monitoring) is projected to

exceed $25 billion by 2030.[1]

·

Autonomous vehicles are expected to transition

from embryonic to the beginning of mainstream adoption across

global markets. Waymo LLC is now providing 150,000 paid AV trips a

week[2] and Tesla, Inc. is

planning to launch its robotaxi service in

2026.[3]

·

Safety remains pivotal to the adoption of AVs for

all stakeholders, including consumers, government bodies,

manufacturers, technology developers, and AV fleet

operators.

Harald Braun, Executive Chairman of Guident,

commented:

"We are very excited about the

recent patent and commercial progress of Guident. We believe the

timing for Guident's potential IPO next year is excellent and our

experience with remote monitoring and control coupled with our

proprietary intellectual property provides a first mover

advantage."

Guident's

RMCC in Boca Raton Florida, USA, Photo courtesy of

Guident:

Guident will be exhibiting its RMCC

teleoperations solution for autonomous vehicles at CES Las Vegas,

NV from January 7-10th, 2025 at

booth #8255. CES® is one of

the leading consumer electronics trade shows in the world

connecting innovators, decision-makers, media, influencers,

visionaries, and potential customers across the entire tech

ecosystem.

About Guident

Guident commercializes patented

technology to enable safer autonomous vehicles and devices by

providing industry-leading AV remote monitoring, control,

assistance, and passenger support services. To learn more, please

visit https://guident.com/.

About Tekcapital plc

Tekcapital creates value from

investing in new, university-developed discoveries that can enhance

people's lives. Tekcapital is quoted on the AIM market of the

London Stock Exchange (AIM: symbol TEK) and is headquartered in the

UK. For more information, please visit www.tekcapital.com.

Tekcapital owns 100% of the share

capital of Guident Ltd. Guident Ltd. owns approximately 91% of

Guident Corp., its US subsidiary, and 100% of Revive Energy

Solutions Ltd, its UK subsidiary.

LEI: 213800GOJTOV19FIFZ85

For further information, please

contact:

|

Tekcapital Plc

|

|

Via Flagstaff

|

|

Clifford M. Gross,

Ph.D.

|

|

|

|

|

|

|

|

SP Angel Corporate Finance

LLP (Nominated Adviser and

Broker)

|

|

+44 (0) 20 3470

0470

|

|

Richard Morrison/Charlie Bouverat

(Corporate Finance)

|

|

|

|

Richard Parlons/Abigail Wayne

(Corporate Broking)

|

|

|

|

|

|

|

|

Flagstaff Strategic and Investor

Communications

|

|

+44

(0) 20 7129 1474

|

|

Tim Thompson/Andrea Seymour/Fergus

Mellon

|

|

|

General Risk Factors and Forward-Looking

Statements

This Press Release is directed only

at Relevant Persons and must not be acted on or relied upon by

persons who are not Relevant Persons. Any other person who receives

this Press Release should not rely or act upon it. By accepting

this Press Release the recipient is deemed to represent and warrant

that: (i) they are a person who falls within the above description

of persons entitled to receive the Press Release; (ii) they have

read, agreed and will comply with the contents of this notice.

Tekcapital securities mentioned herein have not been and will not

be, registered under the U.S. Securities Act of 1933, as amended

(the "Securities Act"), or under any U.S. State securities laws,

and may not be offered or sold in the United States of America or

its territories or possessions (the "United States") unless they

are registered under the Securities Act or pursuant to an exemption

from or in a transaction not subject to the registration

requirements of the Securities Act. This Press Release is not being

made available to persons in Australia, Canada, Japan, the Republic

of Ireland, the Republic of South Africa or any other jurisdiction

in which it may be unlawful to do so, and it should not be

delivered or distributed, directly or indirectly, into or within

any such jurisdictions.

Investors must rely on their own

examination of the legal, taxation, financial and other

consequences of an investment in the Company, including the merits

of investing and the risks involved. Prospective investors should

not treat the contents of this Press Release as advice relating to

legal, taxation or investment matters and are advised to consult

their own professional advisers concerning any acquisition of

shares in the Company. Certain of the information contained in this

Press Release has been obtained from published sources prepared by

other parties. Certain other information has been extracted from

unpublished sources prepared by other parties which have been made

available to the Company. The Company has not carried out an

independent investigation to verify the accuracy and completeness

of such third-party information. No responsibility is accepted by

the Company or any of its directors, officers, employees or agents

for the accuracy or completeness of such information.

All statements of opinion and/or

belief contained in this Press Release and all views expressed

represent the directors' own current assessment and interpretation

of information available to them as at the date of this Press

Release. In addition, this Press Release contains certain

"forward-looking statements", including but not limited to, the

statements regarding the Company's overall objectives and strategic

plans, timetables and capital expenditures. Forward-looking

statements express, as at the date of this Press Release, the

Company's plans, estimates, valuations, forecasts, projections,

opinions, expectations or beliefs as to future events, results or

performance. Forward-looking statements involve a number of risks

and uncertainties, many of which are beyond the Company's control,

and there can be no assurance that such statements will prove to be

accurate. No assurance is given that such forward looking

statements or views are correct or that the objectives of the

Company will be achieved. Further, valuations of Company's

portfolio investments and net asset value can and will fluctuate

over time due to a wide variety of factors both company specific

and macro-economic. Changes in net asset values can have a

significant impact on revenue and earnings of the Company and its

future prospects. As a result, the reader is cautioned not to place

reliance on these statements or views and no responsibility is

accepted by the Company or any of its directors, officers,

employees or agents in respect thereof. The Company does not

undertake to update any forward-looking statement or other

information that is contained in this Press Release. Neither the

Company nor any of its shareholders, directors, officers, agents,

employees or advisers take any responsibility for, or will accept

any liability whether direct or indirect, express or implied,

contractual, tortious, statutory or otherwise, in respect of, the

accuracy or completeness of the information contained in this Press

Release or for any of the opinions contained herein or for any

errors, omissions or misstatements or for any loss, howsoever

arising, from the use of this Press Release. Neither the issue of

this Press Release nor any part of its contents is to be taken as

any form of contract, commitment or recommendation on the part of

the Company or the directors of the Company. In no circumstances

will the Company be responsible for any costs, losses or expenses

incurred in connection with any appraisal, analysis or

investigation of the Company. This Press Release should not be

considered a recommendation by the Company or any of its affiliates

in relation to any prospective acquisition or disposition of shares

in the Company. No undertaking, Press Release, warranty or other

assurance, express or implied, is made or given by or on behalf of

the Company or any of its affiliates, any of its directors,

officers or employees or any other person as to the accuracy,

completeness or fairness of the information or opinions contained

in this Press Release and no responsibility or liability is

accepted for any such errors or omissions. or opinions or for any

errors or Intellectual Property Risk Factors.

Tekcapital's mission is to create

valuable products from university intellectual property that can

improve people's lives. Therefore, our ability to compete in

the market may be negatively affected if our portfolio companies

lose some or all of their intellectual property rights, if patent

rights that they rely on are invalidated, or if they are unable to

obtain other intellectual property rights. Our success will depend

on the ability of our portfolio companies to obtain and protect

patents on their technology and products, to protect their trade

secrets, and for them to maintain their rights to licensed

intellectual property or technologies. Their patent applications or

those of our licensors may not result in the issue of patents in

the United States or other countries. Their patents or those of

their licensors may not afford meaningful protection for our

technology and products. Others may challenge their patents or

those of their licensors by proceedings such as interference,

oppositions and re-examinations or in litigation seeking to

establish the invalidity of their patents. In the event that one or

more of their patents are challenged, a court may invalidate the

patent(s) or determine that the patent(s) is not enforceable, which

could harm their competitive position and ours. If one or more of

our portfolio company patents are invalidated or found to be

unenforceable, or if the scope of the claims in any of these

patents is limited by a court decision, our portfolio companies

could lose certain market exclusivity afforded by patents owned or

in-licensed by us and potential competitors could more easily bring

products to the market that directly compete with our own. The

uncertainties and costs surrounding the prosecution of their patent

applications, and the cost of enforcement or defence of their

issued patents could have a material adverse effect on our business

and financial condition.

To protect or enforce their patent

rights, our portfolio companies may initiate interference

proceedings, oppositions, re-examinations or litigation against

others. However, these activities are expensive, take significant

time and divert management's attention from other business

concerns. They may not prevail in these activities. If they are not

successful in these activities, the prevailing party may obtain

superior rights to our claimed inventions and technology, which

could adversely affect their ability of our portfolio companies to

successfully market and commercialise their products and services.

Claims by other companies may infringe the intellectual property

rights on which our portfolio companies rely, and if such rights

are deemed to be invalid it could adversely affect our portfolio

companies and ourselves as investors in these companies.

From time to time, companies may

assert patent, copyright and other intellectual proprietary rights

against our portfolio company's products or technologies. These

claims can result in the future in lawsuits being brought against

our portfolio companies or their holding company. They and we may

not prevail in any lawsuits alleging patent infringement given the

complex technical issues and inherent uncertainties in intellectual

property litigation. If any of our portfolio company products,

technologies or activities, from which our portfolio companies

derive or expect to derive a substantial portion of their revenues

and were found to infringe on another company's intellectual

property rights, they could be subject to an injunction that would

force the removal of such product from the market or they could be

required to redesign such product, which could be costly. They

could also be ordered to pay damages or other compensation,

including punitive damages and attorneys' fees to such other

company. A negative outcome in any such litigation could also

severely disrupt the sales of their marketed products to their

customers, which in turn could harm their relationships with their

customers, their market share and their product revenues. Even if

they are ultimately successful in defending any intellectual

property litigation, such litigation is expensive and time

consuming to address, will divert our management's attention from

their business and may harm their reputation and ours.

Several of our portfolio companies

may be subject to complex and costly regulation and if government

regulations are interpreted or enforced in a manner adverse to

them, they may be subject to enforcement actions, penalties,

exclusion, and other material limitations on their operations that

could have a negative impact on their financial performance. All of

the above-listed risks can have a material, negative affect on our

net asset value, revenue, performance and the success of our

business and the portfolio companies we have invested

in.

- Ends

-