TIDMTYM

RNS Number : 0561B

Tertiary Minerals PLC

30 May 2023

30 May 2023

TERTIARY MINERALS PLC

("Tertiary" or "the Company")

HALF-YEARLY REPORT 2023

Tertiary Minerals plc is pleased to announce its unaudited

interim results for the six-month period ended 31 March 2023.

Six-Month Operational highlights:

Tertiary continues to develop its mineral project portfolio,

focused on copper opportunities in Zambia and copper and precious

metals projects in Nevada.

Zambia

-- JV agreement signed with Mwashia Resources recognising the

Company's 90% interest and right to purchase the remaining 10%

interest in the Jacks Copper Project.

-- Jacks Copper Project soil sampling programme generated

multiple copper soil anomalies with a peak value of 535ppm copper

and high Cu:Sc ratios which can indicate hydrothermal copper

sulphide and compare favourably with soil anomalies in the vicinity

of various ore zones at current and past producing mines on the

Copperbelt. Drill testing is planned.

-- Data transfer completed from First Quantum Minerals for the

Mukai and Mushima North Copper Projects under a data sharing and

technical cooperation agreement.

-- Resampling of 1970s drill hole RKN800 at Mushima North

returned 33m grading 0.24% copper from 122m-155m downhole,

including 9m grading 0.43% copper from 140m-149m. The drillhole

ended in mineralisation grading 0.19% copper from 154-155m (EOH)

and lies on the edge of an untested gravity anomaly defined and

targeted for drilling by BHP for possible Iron-Oxide-Copper-Gold

style mineralisation.

-- Extensive exploration targeting undertaken in preparation for

the 2023 field season. Project Focus presentations published for

the Mukai and Konkola West Projects. Mushima North Project Focus

presentation to follow.

-- 2023 field season commenced with soil sampling programme at

the Lubuila Copper Project. In-field portable X-Ray Fluorescence

(pXRF) analytical results indicate a large open-ended

copper-in-soil anomaly defined over an area of approximately 1,000m

x 680m with a peak copper value of 306 ppm and an average value of

125ppm Cu.

Nevada

Brunton Pass Copper Gold Project:

-- Results received from trenching programme showed wide

intervals of low-grade copper skarn mineralisation including 27m

grading 1,010ppm copper (0.1% Cu) in T7, open to the east, and 78m

grading 473ppm copper in T8 also open to the east.

-- Results suggest the possible presence of a deeper porphyry copper target.

-- Two trenches testing the north and south ends of a 1.2km long

zone of mercury/arsenic soil anomalies intersected substantial

widths of hydrothermally altered rock with approximately 1,000

times background content of the gold indicator elements, arsenic

and mercury. This zone is a compelling drill target for epithermal

gold mineralisation.

FINANCIAL SUMMARY FOR THE SIX-MONTH PERIODED 31 MARCH 2023:

-- Operating Loss of GBP253,089 comprises:

o Revenue relating to re-charged expenses of GBP75,944.

o Less administration costs of GBP294,796 (including non-cash

share-based payments of GBP14,145).

o Pre-licence and reconnaissance exploration costs totalling

GBP34,237.

-- Total Group Loss of GBP252,854 is after crediting interest income of GBP235.

-- Project expenditure of GBP115,162 was capitalised during the six-month period.

Funding and Cash Position:

-- In February 2023, the Company completed a fundraising with

Peterhouse Capital Limited raising GBP300,000 before expenses.

-- The closing cash (and cash equivalent) position at the end of the period was GBP217,967.

Enquiries

Tertiary Minerals plc

Patrick Cheetham, Executive

Chairman +44 (0)1625 838 679

SP Angel Corporate Finance

LLP

Nominated Adviser & Joint Broker

Richard Morrison/Harry Davies-Ball +44 (0) 20 3470 0470

Peterhouse Capital Limited

Joint Broker

Lucy Williams/Duncan Vasey +44 (0) 207 469 0930

CAUTIONARY NOTICE

The news release may contain certain statements and expressions

of belief, expectation or opinion which are forward looking

statements, and which relate, inter alia, to the Company's proposed

strategy, plans and objectives or to the expectations or intentions

of the Company's directors. Such forward-looking statements involve

known and unknown risks, uncertainties and other important factors

beyond the control of the Company that could cause the actual

performance or achievements of the Company to be materially

different from such forward-looking statements. Accordingly, you

should not rely on any forward-looking statements and save as

required by the AIM Rules for Companies or by law, the Company does

not accept any obligation to disseminate any updates or revisions

to such forward-looking statements.

MARKET ABUSE REGULATION (MAR) DISCLOSURE

The information contained within this announcement is deemed by

the Company to constitute

inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014 which

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ('MAR').

Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this

inside information is now considered to be in the public

domain.

Chairman's Statement

I am pleased to present our Interim Report for the six-month

period ended 31 March 2023 and a summary of our principal

activities which continue to be the identification, acquisition,

and exploration of mineral projects prospective for copper and

precious metals in Zambia and Nevada, USA, both stable democratic

and mining friendly jurisdictions.

Copper is often overlooked in the rush for critical minerals for

the green economy, yet it is used extensively in renewable power

generation and electric vehicles. Long-term demand for copper is

forecast to enjoy sustained growth as developed economies look to

move towards net zero carbon emissions. Government-backed stimulus

projects will add tailwinds to this, whilst infrastructure projects

in developing economies will also pressure supply going

forward.

In Zambia, this six-month reporting period spans the end of the

2022 dry season, the main field season, and the majority of the

2022-23 wet season where exploration access is largely restricted.

We made the most of the wet season, however, by carrying out

extensive data collection, evaluation and exploration planning for

the 2023 field season, now underway.

This planning has been helped enormously by our data sharing and

technical cooperation agreement with multi-national copper miner,

First Quantum Minerals ("FQM"). FQM has provided extensive and

valuable databases for our Mukai Project, which lies adjacent to

FQM's Sentinel copper and Enterprise nickel mines, and for our

Mushima North Project, where recent sampling of a 1970s drillhole

has returned wide intervals of low-grade copper mineralisation,

open at depth. These are exciting results as the drillhole lies on

the margins of a significant untested gravity anomaly, now a target

for Iron-Oxide-Copper-Gold ("IOCG") stye mineralisation.

The agreement with FQM has saved us hundreds of thousands of

dollars in exploration expenditures and will harness the experience

of FQM's technical staff for the benefit of our projects.

Shareholders can find extensive information on our Zambian

Projects on our website where we have published project specific

presentations on our Mukai and the Konkola West copper projects.

Notably, our Mukai Project lies to the east of Arc Minerals'

Zambian Copper Project where mining giant Anglo American recently

signed a joint venture agreement with Arc Minerals and must spend

US$88.5 million to earn a 70% interest in that project.

Our Konkola West Project lies adjacent to, and covers projected,

deep, down dip extensions to, the Lubambe-Konkola mining complexes

and where KoBold Metals is developing the large and high grade

Mingomba deposit with backing from Microsoft's Bill Gates, Amazon's

Jeff Bezos, Virgin's Sir Richard Branson, and mining giant BHP.

The Company's interests in Zambia also include the Jacks Copper

Project where the Company completed an extensive soil sampling

programme and we are delighted that this has defined a number of

high priority copper soil anomalies. These are ready for drill

testing and include anomalies associated with the original Jacks

copper occurrence that we drill tested successfully in 2022 and

where mineralisation is open at depth and along strike.

We anticipate that 2023 will be a busy year for the Company in

Zambia with fieldwork planned on most of our projects in the

country. We hit the ground running at the start of the 2023 field

season having recently completed soil sampling at the Lubuila

copper prospect. Preliminary field analysis using a pXRF analyser

has defined a large open ended copper soil anomaly that now

requires verification with conventional laboratory analysis.

Our objective is to define targets at all our Zambian projects

in the next few months and to drill test priority targets within

the current field season.

Our commitment to Zambia is illustrated by our recent

co-sponsorship of a UK All Party Parliamentary Group for Critical

Minerals reception held in honour of the Zambian President, His

Excellency Hakainde Hichilema, who is ambitious for the growth of

the Zambian copper mining industry and is improving the fiscal

regime to encourage this.

We remain committed to testing our projects in Nevada and in

this reporting period received results for a trenching programme at

the Brunton Pass Project that has defined drill targets for copper

skarn, porphyry copper and epithermal gold. However, Nevada is, at

least in the short term, taking a backseat to Zambia where we have

immediate expenditure commitments to the Government and to our

local partner, Mwashia Resources. The two geographical regions are

complementary for us in that exploration is not seasonal in most

areas of Nevada.

Our activities during the period have been funded through

existing cash resources and a share placing with our joint broker,

Peterhouse Capital Limited, that raised GBP300,0000 before

expenses, and the sale of a shareholding in TSX-V listed Aurion

Resources.

We anticipate strong news flow in 2023 and are hopeful that this

will result in a rerating of the Company by investors - a

justifiable expectation highlighted by research initiated by our

joint broker, SP Angel, and which can be accessed via our website.

SP Angel has recommended the Company's shares as a "buy" and

provides a comparison to other junior copper explorers across the

AIM, TSX, and ASX markets which clearly emphasises the relatively

undervalued nature of the Company.

Patrick L Cheetham

Managing Director

30 May 2023

Consolidated Income Statement

for the six-months' period to 31 March 2023

Six months Six months Twelve months

to 31 to 31 March to 30 September

March 2022 2022

2023 Unaudited Audited

Unaudited

GBP GBP GBP

------------------------------------------ ------------ ------------- -----------------

Revenue 75,944 89,906 171,052

Administration costs (294,796) (305,933) (566,675)

Pre-licence exploration costs/impairment

costs (34,237) (26,807) (80,843)

Impairment of deferred exploration

asset - (361,379) (699,484)

Operating loss (253,089) (604,213) (1,175,950)

Interest receivable 235 20 133

Loss before income tax (252,854) (604,193) (1,175,817)

Income tax - - -

------------------------------------------ ------------ ------------- -----------------

Loss for the period attributable

to equity holders of the parent (252,854) (604,193) (1,175,817)

========================================== ============ ============= =================

Loss per share - basic and diluted

(pence)

(Note 2) (0.02) (0.05) (0.08)

========================================== ============ ============= =================

Consolidated Statement of Comprehensive Income

for the six-months' period to 31 March 2023

Six months Six months Twelve months

t to to

31 March 31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

------------------------------------------ ------------ ------------ --------------

Loss for the period (252,854) (604,193) (1,175,817)

Items that could be reclassified

subsequently to the Income Statement:

Foreign exchange translation differences

on foreign currency net investments

in subsidiaries (44,041) 11,229 136,753

Items that will not be reclassified

to the Income Statement:

Changes in the fair value of equity

investments (3,647) (23,053) (26,346)

Total comprehensive loss for the

period attributable to equity holders

of the parent (300,542) (616,017) (1,065,410)

========================================== ============ ============ ==============

Company Registration Number 03821411

Consolidated Statement of Financial Position

at 31 March 2023

As at As at As at

31 March 31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

----------------------------------- ------------- ------------- --------------

Non-current assets

Intangible assets 603,889 624,920 542,907

Property, plant & equipment 2,476 3,071 2,398

Other investments 18,003 27,443 24,150

----------------------------------- ------------- ------------- --------------

624,368 655,434 569,455

----------------------------------- ------------- ------------- --------------

Current assets

Receivables 62,857 103,569 272,667

Cash and cash equivalents 217,967 620,626 59,414

280,824 724,195 332,081

Current liabilities

Trade and other payables (67,815) (119,784) (80,929)

----------------------------------- ------------- ------------- --------------

Net current assets 213,009 604,411 251,152

----------------------------------- ------------- ------------- --------------

Provisions for liabilities

and charges (13,825) (7,154) (15,158)

Net assets 823,552 1,252,691 805,449

=================================== ============= ============= ==============

Equity

Called up Ordinary Shares 180,251 153,626 153,626

Share premium account 12,379,636 12,101,760 12,101,761

Capital redemption reserve 2,644,061 2,644,061 2,644,061

Merger reserve 131,096 131,096 131,096

Share option reserve 105,931 99,835 101,985

Fair value reserve (20,663) (13,723) (17,016)

Foreign currency reserve 416,428 334,945 460,469

Accumulated losses (15,013,188) (14,198,909) (14,770,533)

----------------------------------- ------------- ------------- --------------

Equity attributable to the owners

of the parent 823,552 1,252,691 805,449

=================================== ============= ============= ==============

Consolidated Statement of Changes in Equity

Capital

Ordinary Share redemption Share Fair Foreign

Share Premium reserve Merger Warrant Value Currency Accumulated

Capital Account Reserve Reserve Reserve Reserve Losses Total

GBP GBP GBP GBP GBP GBP GBP GBP

--------------- ---------- ----------- ----------- --------- --------- --------- ---------- ------------- ----------

At 30

September

2021 118,332 11,567,055 2,644,061 131,096 80,048 9,330 323,716 (13,604,166) 1,269,472

--------------- ---------- ----------- ----------- --------- --------- --------- ---------- ------------- ----------

Loss for the

period - - - - - - - (604,193) (604,193)

Change in fair

value - - - - - (23,053) - - (23,053)

Exchange

differences - - - - - - 11,229 - 11,229

Total

comprehensive

loss

for the

period - - - - - (23,053) 11,229 (604,193) (616,017)

--------------- ---------- ----------- ----------- --------- --------- --------- ---------- ------------- ----------

Share issue 35,294 534,706 - - - - - - 570,000

Share based

payments

expense - - - - 29,237 - - - 29,237

Transfer of

expired

warrants - - - - (9,450) - - 9,450 -

---------------

At 31 March

2022 153,626 12,101,761 2,644,061 131,096 99,835 (13,723) 334,945 (14,198,909) 1,252,692

Loss for the

period - - - - - - - (571,624) (571,624)

Change in fair

value - - - - - (3,293) - - (3,293)

Exchange

differences - - - - - - 125,524 - 125,524

--------------- ---------- ----------- ----------- --------- --------- --------- ---------- ------------- ----------

Total

comprehensive

loss

for the

period - - - - - (3,293) 125,524 (571,624) (449,393)

--------------- ---------- ----------- ----------- --------- --------- --------- ---------- ------------- ----------

Share issue - - - - - - - - -

Cancellation - - - - - - - - -

of deferred

shares

Share based

payments

expense - - - - 2,150 - - - 2,150

Transfer of - - - - - - - - -

expired

warrants

--------------- ---------- ----------- ----------- --------- --------- --------- ---------- ------------- ----------

At 30

September

2022 153,626 12,101,761 2,644,061 131,096 101,985 (17,016) 460,469 (14,770,533) 805,449

--------------- ---------- ----------- ----------- --------- --------- --------- ---------- ------------- ----------

Loss for the

period - - - - - - - (252,854) (252,854)

Change in fair

value - - - - - (3,647) - - (3,647)

Exchange

differences - - - - - - (44,041) - (44,041)

--------------- ---------- ----------- ----------- --------- --------- --------- ---------- ------------- ----------

Total

comprehensive

loss

for the

period - - - - - (3,647) (44,041) (252,854) (300,542)

--------------- ---------- ----------- ----------- --------- --------- --------- ---------- ------------- ----------

Share issue 26,625 277,875 - - - - - - 304,500

Share based

payments

expense - - - - 14,145 - - - 14,145

Transfer of

expired

warrants - - - - (10,199) - - 10,199 -

At 31 March

2023 180,251 12,379,636 2,644,061 131,096 105,931 (20,663) 416,428 (15,013,188) 823,552

=============== ========== =========== =========== ========= ========= ========= ========== ============= ==========

Consolidated Statement of Cash Flows

for the six-months' period to 31 March 2023

Six months Six months Twelve months

to 31 to 31 March to 30 September

March 2022 2022

2023 Unaudited Audited

Unaudited

GBP GBP GBP

------------------------------------------ ----------- ------------- -----------------

Operating activity

Operating Lloss (253,089) (604,213) (1,175,950)

Depreciation charge 768 869 1,661

Share based payment charge 14,145 29,237 31,387

Broker fee paid in shares 4,500 - -

Impairment of deferred exploration

asset - 361,379 699,484

Reclamation provision - (8,840) -

(Increase)/decrease in receivables 209,810 (22,545) (35,049)

Increase/(decrease) in payables (13,114) 42,934 4,079

Net cash outflow from operating

activity (36,980) (201,179) (474,388)

------------------------------------------ ----------- ------------- -----------------

Investing activity

Interest received 235 20 133

Exploration and development expenditures (115,162) (222,876) (561,431)

Purchase of property, plant &

equipment (769) (245) (107)

Cash receipt from disposal of 28,333 - -

equity investments

Net cash outflow from investing

activity (87,363) (223,101) (561,405)

------------------------------------------ ----------- ------------- -----------------

Financing activity

Issue of share capital (net of

expenses) 304,500 570,000 570,000

Net cash inflow from financing

activity 304,500 570,000 570,000

------------------------------------------ ----------- ------------- -----------------

Net increase /(decrease) in cash

and cash equivalents 180,157 145,720 (465,793)

Cash and cash equivalents at start

of period 59,414 472,733 472,733

Exchange differences (21,604) 2,173 52,474

Cash and cash equivalents at

end of period 217,967 620,626 59,414

========================================== =========== ============= =================

Notes to the Interim Statement

1. Basis of preparation

The consolidated interim financial information has been prepared

in accordance with the accounting policies that are expected to be

adopted in the Group's full financial statements for the year

ending 30 September 2023 which are not expected to be significantly

different to those set out in Note 1 of the Group's audited

financial statements for the year ended 30 September 2022. These

are based on the recognition and measurement requirements of

applicable law and UK adopted International Accounting Standards.

The financial information has not been prepared (and is not

required to be prepared) in accordance with IAS 34. The accounting

policies have been applied consistently throughout the Group for

the purposes of preparation of this financial information.

The financial information in this statement relating to the

six-month period ended 31 March 2023 and the six-month period ended

31 March 2022 has neither been audited nor reviewed by the

Independent Auditor, pursuant to guidance issued by the Auditing

Practices Board. The financial information presented for the year

ended 30 September 2022 does not constitute the full statutory

accounts for that period. The Annual Report and Financial

Statements for the year ended 30 September 2022 have been filed

with the Registrar of Companies. The Independent Auditor's Report

on the Annual Report and Financial Statement for the year ended 30

September 2022 was unqualified, although it did draw attention to

matters by way of emphasis in relation to going concern, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006.

The directors prepare annual budgets and cash flow projections

for a 15-month period. These projections include the proceeds of

future fundraising necessary within the period to meet the

Company's and the Group's planned discretionary project

expenditures and to maintain the Company and the Group as a going

concern. Although the Company has been successful in raising

finance in the past, there is no assurance that it will obtain

adequate finance in the future. These factors represent a material

uncertainty related to events or conditions which may cast

significant doubt on the entity's ability to continue as a going

concern and, therefore, that it may be unable to realise its assets

and discharge its liabilities in the normal course of business.

However, the directors have a reasonable expectation that they will

secure additional funding when required to continue meeting

corporate overheads and exploration costs for the foreseeable

future and therefore believe that the going concern basis is

appropriate for the preparation of the financial statements.

2. Loss per share

Loss per share has been calculated on the attributable loss for

the period and the weighted average number of shares in issue

during the period.

Six months Six months Twelve months

to 31 March to 31 March to 30 September

2023 2022 2022

Unaudited Unaudited Audited

---------------------------- -------------- -------------- -----------------

Loss for the period (GBP) (252,854) (604,193) (1,175,817)

Weighted average shares

in issue (No.) 1,340,117,157 1,320,361,876 1,428,608,504

Basic and diluted loss per

share (pence) (0.02) (0.05) (0.08)

============================ ============== ============== =================

The loss attributable to ordinary shareholders and the weighted

average number of ordinary shares used for the purpose of

calculating diluted earnings per share are identical to those used

to calculate the basic earnings per ordinary share. This is because

the exercise of share warrants would have the effect of reducing

the loss per ordinary share and is therefore not dilutive under the

terms of IAS33.

3. Share capital

During the six-month period to 31 March 2023 the following share

issues took place:

An issue of 250,000,000 0.01p Ordinary Shares at 0.12p per

share, by way of placing, for a total consideration of GBP300,000

before expenses (3 February 2023).

An issue of 16,250,000 0.01p Ordinary Shares at 0.12p per share,

as part of placing and settlement of broker commission and fee, for

a total consideration of GBP19,500 (3 February 2023).

The total number of Ordinary Shares in issue on 31 March 2023

was 1,802,513,621 (30 September 2022: 1,536,263,621).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR AMMJTMTJJBFJ

(END) Dow Jones Newswires

May 30, 2023 09:40 ET (13:40 GMT)

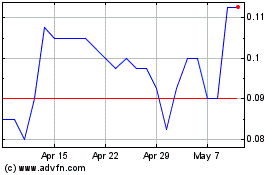

Tertiary Minerals (LSE:TYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tertiary Minerals (LSE:TYM)

Historical Stock Chart

From Apr 2023 to Apr 2024