Interim Management Statement

May 06 2010 - 1:00AM

UK Regulatory

TIDMBVS

Bovis Homes Group PLC

Interim Management Statement

Thursday 6 May 2010

Bovis Homes Group PLC is holding its Annual General Meeting at 11.00am today. This statement makes comment on the financial performance of the Group for the period from 1 January 2010 to the date of this statement, and provides guidance on the outlook for the current financial year. This statement constitutes Bovis Homes Group PLC's Interim Management Statement as required by the UK Listing Authority's Disclosure and Transparency Rules.

During 2010 to date, weekly reservation rates have been consistent and in line with the Group's expectations. The first two weeks in January were affected by poor weather. In the following 15 weeks to 30 April 2010 the Group has achieved an average private sales rate of 0.47 reservations per week per outlet, as compared to 0.41 per week throughout 2009. By 30 April 2010, the Group held 1,208 total sales for 2010 legal completion of which 643 sales were brought forward from 2009 and 565 sales were achieved in the first 17 weeks of 2010. This is an 11% increase on the comparable 1,092 sales for 2009 legal completion held at the same point in 2009. At 30 April, the Group held 938 private sales for 2010 legal completion, up 14% on the prior year comparable of 823 sales. Given the anticipated build completion of the reservations achieved to date, it is expected that the delivery of legal completion volumes and hence profits will be more second half weighted in 2010 than in 2009.

Positively, as well as achieving this consistent weekly sales performance, sales prices have been modestly ahead of internal expectations on reservations taken to date. This, when taken together with the benefit of build cost reductions should enable housing profit margins to be maintained having absorbed the negative impact on 2010 cost of sales from the inventory provision write back in 2009.

As previously outlined, the Group is focusing on the acquisition of land which will both support an increase in trading activity from a greater number of sales outlets and improve its profit margins over time. Progress in the year to date has been encouraging, with 811 plots added to the consented land bank across seven sites and terms agreed in principle on a further 18 sites which will provide circa 2,500 plots. This strong progress to date means the Group has already agreed land acquisition opportunities well in excess of the GBP59 million raised in the share placing in September 2009 to support land acquisition.

The Group continues to focus on the prudent management of its balance sheet, its net cash position strengthening over the first quarter, with GBP130 million of net cash in hand at 30 April 2010. This continues to provide the Group with a strong competitive advantage in its ability to fund new investments.

Looking ahead, the Group expects trading to continue to be stable, although the general election does create uncertainty, in particular as regards the macro-economic backdrop. Notwithstanding this uncertainty, the Group is selling homes in line with its targeted weekly sale rate and a continuation of this will allow the Group to achieve its volume expectations for 2010. The Group continues to regard its strategy of output capacity growth through the acquisition of high quality residential land, alongside an ongoing focus on cost control and strong working capital management, as the right way to grow both revenue and profits in the mid term, and thereby deliver future shareholder value.

Enquiries: David Ritchie, Chief Executive

Neil Cooper, Finance Director

Bovis Homes Group PLC

Tel: 07773 012 971

Shared Valued Limited

Tel: 07773 012 971

Conference Call for analysts

David Ritchie, Chief Executive, and Neil Cooper, Finance Director, of Bovis Homes will host a conference call at 08:30am today, Thursday 6 May 2010, to discuss this IMS. To access the call please dial +44 (0)20 7138 0822 and quote passcode: 2849444. Please dial in 5 minutes prior to the start of the conference call to allow time for registration. A recording of the conference call will be available until midnight on 13 May 2010, commencing approximately 30 minutes after the live call has finished, on: +44 (0)20 7111 1244, access code: 2849444#.

Certain statements may be forward looking statements.Forward looking statements involve evaluating a number of risks, uncertainties or assumptions that could cause actual results to differ materially from those expressed or implied by those statements.Forward looking statements regarding past trends, results or activities should not be taken as a representation that such trends, results or activities will continue in the future.Undue reliance should not be placed on forward looking statements.

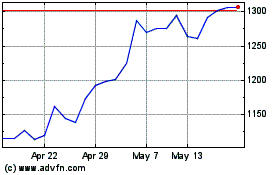

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

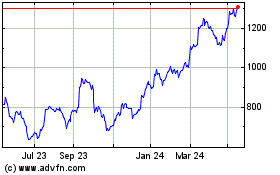

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024