Half Yearly Report -2-

August 23 2010 - 1:00AM

UK Regulatory

the income statement as incurred, the overhead charge in the income statement

for the first half of 2010 has, as anticipated, increased to 12.1% of revenue

(2009: 10.3% of revenue). The Group expects the benefit of this overhead

investment to be realised in future years as the Group increases its output

capacity.

The Group achieved an operating profit margin of 4.2% in the first half of 2010

as compared to an operating profit margin pre exceptional items of 5.9%

(operating loss margin of -2.2% after exceptional items) in the first half of

2009. This reduction in operating margin reflects the effect of the JV income

de-recognition and the write off of overheads associated with land acquisition.

These effects are anticipated to have less of an impact on the full year results

for 2010, allowing the operating margin to return to a level ahead of 2009's

full year operating margin of 6.2%.

The Group incurred net financing costs in the first half of 2010 of GBP1.3

million compared to GBP6.0 million incurred in the first half of 2009. This

reduction in finance costs arose firstly, from the strong net cash position of

the Group throughout the first half of 2010, and secondly, from the

significantly more cost effective bank facilities agreed in January 2010. As a

result, interest charges, commitment fees and arrangement fee amortisation were

all significantly lower in the first half of 2010. Within its finance costs,

the Group charged GBP1.0 million (2009: GBP0.7 million), reflecting the

difference between the cost and the nominal price of land bought on deferred

terms which is charged to the income statement over the life of the deferral of

the consideration payable. This reflects the increased land purchase activity

of the Group.

For the six months ended 30 June 2010 the Group achieved a pre tax profit of

GBP3.5 million as compared to a pre-tax loss of GBP8.6 million in the first half

of 2009 (pre tax profit of GBP1.2 million before exceptional items). Basic

earnings per share for the first half of 2010 was 1.8p as compared to a loss per

share of 5.5p in the first half of 2009 (earnings per share of 0.4p before

exceptional items).

The Group has established a rental joint venture, with a private investor, in

which it holds a 50% equity share. Into this joint venture, in March 2010, the

Group legally completed 215 homes, including the balance of stock on a number of

apartment schemes in the north of England, at a modest discount to open market

value. This portfolio of homes is intended to be rented in the private market

over a number of years with the view of generating both an acceptable investment

income return and a capital profit. The portfolio sale of these 215 homes

generated revenue of GBP25.7 million. By the end of July 2010, 98% of the

portfolio was let on private open market rents. The Group's equity investment

in the joint venture is GBP4 million.

Dividends

Given the confidence the Board has in the medium term prospects of the Group

arising from its investment in new land opportunities and the Group's strong net

cash position, assuming the continuation of current market conditions in the new

homes market, the Board intends to resume declaring dividends at the end of the

current financial year.

Cash flow

As at 30 June 2010, the Group held net cash in hand of GBP78.7 million (31

December 2009: net cash in hand of GBP112.3 million). The Group generated GBP48

million of cash inflow from current trading during the six month period

confirming its ongoing cash generative operations. The Group expended GBP82

million on land during the first six months, part in payment of existing land

creditors and part in payment for new land investments. In total, there was a

cash outflow in the first six months of GBP34 million, reflecting the first

period of the Group's near term strategy of investment in consented land.

Average net cash for the first half of 2010 was GBP114 million (2009: average

net debt of GBP69 million). In addition, the Group has substantial financial

headroom against its existing committed loan facilities of GBP150 million signed

in January 2010 and maturing in September 2013.

The Group anticipates the second half of 2010 will be cash generative from

current trading, before cash expenditure on land, as revenue will significantly

exceed cash expenditure on construction, overheads, tax and interest. On this

basis, it is expected that the Group will have net cash in hand at 31 December

2010, subject only to the extent of cash expenditure for consented land

purchases in the second half of the year.

Land

The Group is pleased to report good progress with its near term strategy of

acquiring land with residential planning consent. This strategy will enable the

Group to grow its output capacity over the coming years and deliver increased

levels of revenue and improved profit margins, thereby generating shareholder

value. The Group has been active in the consented land market since its equity

share placing in September 2009, using its considerable cash resources to agree

land purchases which are expected to generate returns in line with the Group's

hurdle rates for land investment.

The Group held 13,113 plots in its consented land bank at 30 June 2010, an

increase of 1,071 plots on the 12,042 plots at the start of the year. The Group

added 1,874 consented plots to its consented land bank in the first half of

2010, 80% of which are located in the south of England, at a land cost of

approximately GBP107 million. In addition, the Group has agreed terms to

acquire a further c3,000 plots with many at an advanced stage in the acquisition

process. New land has been acquired on deferred terms where appropriate,

although the Group has taken advantage of opportunities where more cost

effective land deals are achievable when supported by up front cash

consideration.

The Group believes its strategy of acquiring consented land at this point in the

housing market cycle will add significant value to the medium term prospects of

the Group for a number of reasons: strong demand for new homes given the ongoing

shortage of homes being built in England and Wales; good development land supply

for the Group during a challenging period for achieving residential planning

consents in the near term as the Government's localism agenda is debated and

implemented; and the current surplus of land vendors over land buyers which is

keeping land prices attractive.

At each period end, the Group is required to assess the carrying value of its

inventory. Based on current estimates of achievable sales prices in the market

at normal sales rates, there has been no net land provision adjustment at the

half year. The Group land provision at 30 June 2010 stood at GBP48 million (31

December 2009: GBP54 million), reflecting GBP6 million of provision utilisation

during the first half year. At 30 June 2010, 32% of the plots in the consented

land bank were subject to a provision, 51% of the plots were held at acquisition

cost and were acquired prior to the nadir in house prices in the recent housing

market downturn, and the balancing 17%, held at acquisition cost, have been

acquired since the nadir of house prices in the housing market downturn.

The Group's existing consented land bank continues to show a robust quality, set

against the current housing market conditions. Of the 13,113 plots, 67% are

located in the south of England, where the housing market has shown greater

signs of recovery, and 55% of the land bank has been sourced through the

conversion of strategic land at a discount to market value at the date of its

acquisition.

The strategic land bank at 30 June 2010 stood at 17,270 potential plots as

compared to 16,363 potential plots held at the start of the year. The Group has

successfully converted 567 potential plots into consented land during the first

half year. The Group has secured a further c1,500 strategic plots, of which

c1,050 plots already have a planning consent and will be converted to the

consented land bank in a number of phases over the coming years.

Net assets

At 30 June 2010, the Group held net assets of GBP692.8 million, which equates to

a net assets per share value of GBP5.20. Of this net asset value, land held at

the lower of cost and net realisable value amounted to GBP530.2 million (GBP3.98

per share) and net cash was GBP78.7 million (GBP0.59 per share).

As at 30 June 2010, the Group's actuary estimated that the Group's defined

benefits pension scheme had moved from a deficit of GBP8.9 million at the end of

2009 to a deficit of GBP12.2 million. The main driver of this adverse movement

has been the impact of assumption changes on the value of the scheme's

liabilities, in particular assumptions relating to pension liability discount

rates.

Other key performance indicators

The Group has continued to perform well in other key areas. In respect of

health & safety, the Group has achieved a strong level of performance as

measured by independent inspection of all of its sites. The Group was one of

only two housebuilders to receive a Gold award for health & safety in the 2010

National House-Building Council's health & safety awards and has for the 14th

year running received a Gold Award from RoSPA.

The Group's quality of build has been at the top of industry standards, with

strong results achieved in independent quality inspections. The Group has been

ranked first of a large group of housebuilders in respect of these quality

inspections in six of the last twelve months reported.

In terms of customer service, the Group continues to receive strong levels of

satisfaction from its customers. In the Group's latest quarter results, 95% of

customers stated they would 'Recommend to a friend or relative' and 93% of

customers stated they were satisfied with the 'Overall quality of the new home',

with only 1% stating they were not satisfied. The Group achieved a four star

rating in the 2010 HBF customer satisfaction survey which confirmed the high

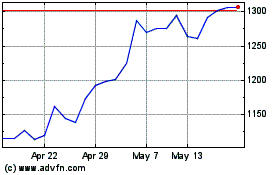

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

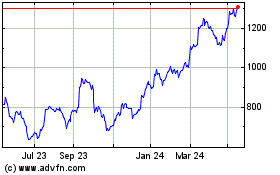

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024