Half Yearly Report -6-

August 23 2010 - 1:00AM

UK Regulatory

| recognised on sale of | | | | | | |

| assets to joint ventures | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Operating profit before | 6,352 | | 6,739 | | 17,925 | |

| changes in working capital | | | | | | |

| and provisions | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| (Increase)/decrease in | (14,039 | )| 4,366 | | (7,555 | )|

| trade and other receivables | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| (Increase)/decrease in | (70,150 | )| 82,422 | | 152,762 | |

| inventories | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Increase/(decrease) in | 51,016 | | (19,210 | )| (17,173 | )|

| trade and other payables | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| (Decrease)/increase in | (51 | )| 852 | | (611 | )|

| provisions and employee | | | | | | |

| benefits | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Cash generated from | (26,872 | )| 75,169 | | 145,348 | |

| operations | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Interest paid | (1,363 | )| (4,154 | )| (6,684 | )|

+-----------------------------+----------+--+----------+--+----------+--+

| Income taxes received | 1,906 | | 22,460 | | 21,688 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Net cash from operating | (26,329 | )| 93,475 | | 160,352 | |

| activities | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Cash flows from investing | | | | | | |

| activities | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Interest received | 448 | | 522 | | 1,481 | |

+-----------------------------+----------+--+----------+--+----------+--+

| Acquisition of property, | (270 | )| (15 | )| (44 | )|

| plant and equipment | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Proceeds from sale of plant | 12 | | 57 | | 45 | |

| and equipment | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Purchase of investment in | (4,210 | )| - | | - | |

| joint ventures | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Movement in loans with | (1,450 | )| - | | - | |

| joint ventures | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Net cash from investing | (5,470 | )| 564 | | 1,482 | |

| activities | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Cash flows from financing | | | | | | |

| activities | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Proceeds from the issue of | 254 | | 118 | | 60,662 | |

| share capital | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Costs associated with share | - | | - | | (1,535 | )|

| placing | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Drawdown/(repayment) of | 8,305 | | (101,000 | )| (118,000 | )|

| borrowings | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Costs associated with | (2,041 | )| - | | - | |

| refinancing | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Net cash from financing | 6,518 | | (100,882 | )| (58,873 | )|

| activities | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Net (decrease)/increase in | (25,281 | )| (6,843 | )| 102,961 | |

| cash and cash equivalents | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Cash and cash equivalents | 114,595 | | 11,634 | | 11,634 | |

| at the start of period | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

| Cash and cash equivalents | 89,314 | | 4,791 | | 114,595 | |

| at the end of period | | | | | | |

+-----------------------------+----------+--+----------+--+----------+--+

Notes to the accounts

1 Basis of preparation

Bovis Homes Group PLC ('the Company') is a company domiciled in the United

Kingdom. The condensed consolidated interim financial statements of the

Company for the six months ended 30 June 2010 comprise the Company and its

subsidiaries (together referred to as 'the Group') and the Group's interest in

associates.

The condensed consolidated interim financial statements were authorised for

issue by the directors on 20 August 2010. The financial statements are

unaudited but have been reviewed by KPMG Audit Plc.

The condensed interim financial statements do not constitute statutory accounts

within the meaning of Section 434 of the Companies Act 2006.

The figures for the half years ended 30 June 2010 and 30 June 2009 are

unaudited. The comparative figures for the financial year ended 31 December

2009 are not the Company's statutory accounts for that financial year. Those

accounts have been reported on by the Company's auditors and delivered to the

Registrar of Companies. The report of the auditors was (i) unqualified, (ii)

did not include a reference to any matters to which the auditors drew attention

by way of emphasis without qualifying their report and (iii) did not contain a

statement under Section 498 (2) or (3) of the Companies Act 2006.

The

preparation of a condensed set of financial statements requires management to

make judgements, estimates and assumptions that affect the application of

accounting policies and the reported amount of assets, liabilities, income and

expenses. Actual results may differ from these estimates.

Judgements made by management in the application of adopted IFRSs that have

significant effect on the financial statements and estimates with a significant

risk of material adjustment in following years remain those published in the

Company's consolidated financial statements for the year ended 31 December 2009.

The condensed interim financial statements have been prepared in accordance with

IAS34 'Interim Financial Reporting' as endorsed by the EU. As required by the

Disclosure and Transparency Rules of the Financial Services Authority, the

condensed consolidated interim financial statements have been prepared applying

the accounting policies and presentation that were applied in the preparation of

the Company's published consolidated financial statements for the year ended 31

December 2009, which were prepared in accordance with IFRSs as adopted by the

EU.

The following new standards, amendments to standards or interpretations are

mandatory for the first time for the Company's year ending 31 December 2010.

They are not expected to have a material impact on the Group's financial

statements:

IFRS2 - (Amended) Group Cash-settled Share-based Payment Transactions. The

amendments clarify the accounting for group cash-settled share-based payment

transactions and how an individual subsidiary in a group should account for some

share-based payment arrangements in its own financial statements. This

amendment is not expected to have any material impact on the Group's financial

statements as the Group already applies IFRIC11.

IFRS3 - (Revised) Business Combinations. This revision has no impact on

implementation although it will alter the accounting treatment for future

potential acquisitions.

IAS27 - (Revised) Consolidated and Separate Financial Statements. This

primarily relates to accounting for non-controlling interests and the loss of

control of a subsidiary. The Group has not disposed of any subsidiaries in the

period and therefore the revision of this accounting standard is not considered

to have a material impact on the Group's financial statements.

IAS39 - (Amended) Financial Instruments. This standard is amended such that

gains or losses on a hedged instrument should be reclassified from equity to

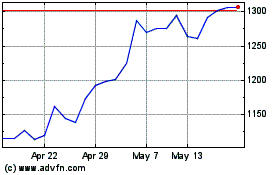

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

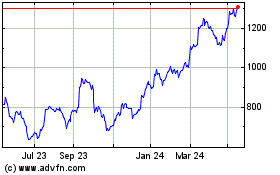

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024