TIDMBVS

RNS Number : 9438L

Bovis Homes Group PLC

19 August 2013

19 August 2013

BOVIS HOMES GROUP PLC

RESULTS FOR THE HALF YEAR ENDED 30 JUNE 2013

50% INCREASE IN HOUSING PROFIT AND ACCELERATING GROWTH IN

RETURNS EXPECTED

Bovis Homes Group PLC today announces its half year results for

2013.

Financial and operational highlights for H1 2013

H1 2013 H1 2012 Change

----------------------------- ----------- ---------- ---------

Housing revenue ** GBP183.2m GBP157.1m +17%

GBP13.6m

Housing operating profit ** GBP20.4m * +50%

Housing operating margin ** 11.1% 8.7% * +2.4ppts

GBP17.5m

Operating profit GBP20.5m * +17%

Operating margin 11.1% 10.3% * +0.8ppts

GBP15.6m

Profit before tax GBP18.6m * +19%

Earnings per share 10.8p 8.6p * +26%

Dividend per share 4.0p 3.0p +33%

Net (debt) / cash GBP(48.4)m GBP22.2m

-- With market house price increases estimated at 1% to 2% to

date, average sales price increased by 15% to GBP188,500 (H1 2012:

GBP164,400) primarily due to mix, modestly ahead of Group's

expectations

-- Legal completions of 963 homes (H1 2012: 944 homes)

-- Average active sales outlets increased by 11% to 91 in H1 2013 (2012: 82)

-- 2,767 consented plots on 18 sites added to the land bank during H1 2013

-- Contracts in place as at 30 June 2013 to acquire another

1,018 plots on 11 sites, the majority of which are expected to be

added to the consented land bank in H2 2013

-- Consented land bank of 15,579 plots as at 30 June 2013, with

potential gross profit of GBP733 million, calculated using

prevailing sales prices and build costs (31 December 2012: 13,776

plots with gross profit potential of GBP600 million)

-- 19,341 potential plots of strategic land (31 December 2012: 19,318 potential plots)

Current trading and outlook

-- Strong trading in the 32 weeks to 9 August 2013 with a 43%

increase in private reservations to 1,712 homes (2012: 1,195)

-- Sales rate improvement of 28% to 0.59 net private

reservations per site per week (2012: 0.46)

-- Cumulative sales achieved to 9 August for 2013 legal

completion of 2,505 homes (2012: 1,844), with the Group now circa

90% sold for legal completions in 2013

-- Average sales price for 2013 legal completions expected to be

at least 10% greater than 2012, primarily reflecting mix benefits

with modest market price improvements

-- Housing gross margin expected to be between 23% and 24% for

2013 full year (2012: 22.6%), with an expected operating margin

approaching 15% (2012*: 13.3%)

-- Further significant improvement in return on capital employed

for the 2013 full year, now expected to be at least 10.0% (2012*:

7.7%)

Commenting on the results, David Ritchie, Chief Executive of

Bovis Homes Group PLC said:

"The Group has performed strongly during the first half of 2013

and has delivered a 50% increase in housing operating profit. This

significant increase is a result of the ongoing successful

execution of the Group's strategy reflecting the compound positive

effect of increased volumes, improved average sales price and

stronger profit margins.

"The Group has delivered a 43% increase in private reservations

in the year to date, resulting from the improving quality and

increasing number of active sales outlets. This improvement has

been further assisted by the positive effect of stronger home buyer

sentiment, supported by the Help to Buy scheme launched in April

2013.

"The Group is circa 90% sold for the current financial year.

This will allow the Group to deliver the required remaining

reservations over the next few weeks and to build a significantly

enhanced forward order book for 2014.

"The positive trading position, combined with an increasing

proportion of legal completions on new, more profitable sites, will

enable the Group to increase profits significantly in 2013 in line

with its expectations, subject to stable market conditions. With a

further increase in capital turn, this strong profit is expected to

generate a return on capital for 2013 of at least 10%.

"The success of the Group in acquiring high quality, consented

residential land, combined with the strong pipeline of future land

opportunities, will support further sales outlet growth into 2014

and beyond. This in turn is expected to lead to further strong

improvements in return on capital employed going forward.

"With the progressive, sustainable improvement in the Group's

profits and the Board's confidence in the Group's growth strategy,

the interim dividend has been increased by 33% to 4.0 pence per

share."

* 2012 has been restated following the adoption of IAS19R

"Employee Benefits"

** Housing revenue, Housing operating profit and Housing

operating margin exclude revenue and profit from land sales

Enquiries: David Ritchie, Chief Results issued Andrew Jaques / Reg Hoare

Executive by /

Jonathan Hill, Finance James White / Giles Robinson

Director

Bovis Homes Group MHP Communications

PLC

On 19 August - tel: 020 3128 8100 On 19 August - tel: 020

3128 8756

Thereafter - tel: 01474 876200

Analysts wishing to remotely listen in to the presentation at

09:30am may dial +44 (0) 203 139 4830 followed by the participant

code 97251425#.

Certain statements in this press release are forward looking

statements. Forward looking statements involve evaluating a number

of risks, uncertainties or assumptions that could cause actual

results to differ materially from those expressed or implied by

those statements. Forward looking statements regarding past trends,

results or activities should not be taken as a representation that

such trends, results or activities will continue in the future.

Undue reliance should not be placed on forward looking

statements.

Introduction

During the first half of 2013, Bovis Homes has made significant

progress in the ongoing delivery of its strategy to improve

shareholder returns with a strong improvement in housing profit, an

increase in the number of active sales outlets, a material

improvement in the rate of sale per site and the successful

continuation of investment in consented and strategic land.

The general UK economy remains weak, but is showing initial

signs of a recovery in growth. In the first half of 2013 the UK

housing market has been measurably stronger than in 2012. Home

buyers have greater access to mortgages and appear more confident

about buying a home. This has been supported by the Help to Buy

shared equity scheme, launched by the Government in April 2013.

Strategy

The focus of the Group's strategy remains to deliver material

improvements in shareholder returns by increasing profitability

whilst improving the efficiency of capital employed.

The Group will deliver enhanced profits from the compound

positive effect of:

-- Volume growth from a greater number of sales outlets,

primarily in the south of England, and improving the sales rate per

site.

-- Higher average sales price from traditional homes on better located sales outlets.

-- Stronger profit margins from an increasing proportion of

legal completions from new higher margin sites.

Building the future profit potential in the land bank will be

delivered by:

-- Adding new consented sites to the land bank which will achieve higher profit margins.

-- Continuing investment in strategic land and delivering

strategic land conversion through achievement of residential

planning consent.

-- Progressively trading through older, lower margin sites.

Greater efficiency of capital employed will be delivered by:

-- Efficient cash utilisation with more sites being acquired on deferred terms.

-- Maintaining tight control of work in progress.

-- Managing the land bank through acquiring smaller sites on

average and selectively selling consented plots on larger

sites.

Significant progress has been made in the delivery of this

growth strategy with c12,000 consented plots across c80 new sites

acquired since the housing market downturn. The majority of these

new sites are in the south of England and are expected to deliver

stronger sales prices and profit margins. These new sites are

contributing to an increase in the number of sales outlets operated

by the Group, which reached 92 during the first half of 2013, an

increase of over 50% compared to the low point of 60 sales outlets

reached during the first half of 2010.

The ongoing successful execution of this strategy will enable

the Group, assuming the continuation of current market conditions,

to continue to increase output capacity and, therefore increase

revenue and further improve profit margins in the full year 2013.

As a result, return on capital employed is now expected to increase

to at least 10.0% in 2013. In the foreseeable future, with capital

turn and margins expected to continue to improve, the Group

believes that the return on capital employed can achieve a level

within the range of 15% to 18%, assuming current market conditions

continue.

Revenue

The Group generated total revenue of GBP184.4 million during the

first half of 2013, compared to total revenue in H1 2012 of

GBP170.3 million.

Units H1 2013 H1 2012

------------------------------- ------- -------

Private legal completions 839 806

Social legal completions 124 138

------------------------------- ------- -------

Total legal completions 963 944

------------------------------- ------- -------

Revenue (GBPm)

Private legal completions 168.0 141.1

Social legal completions 13.6 14.1

------------------------------- ------- -------

Revenue from legal completions 181.6 155.2

Other revenue 1.6 1.9

------------------------------- ------- -------

Housing revenue 183.2 157.1

Land sales revenue 1.2 13.2

------------------------------- ------- -------

Total revenue 184.4 170.3

------------------------------- ------- -------

Revenue from legal completions in the first six months of 2013

was GBP181.6 million, 17% ahead of the same period in the prior

year. With other revenue of GBP1.6 million (H1 2012: GBP1.9

million), housing revenue was GBP183.2 million (H1 2012: GBP157.1

million). The land sales revenue during H1 2013 related to the

recognition of deferred land sales income, associated with the

delivery of services to a parcel of land sold in 2011 (H1 2012:

GBP13.2 million).

The Group legally completed 963 homes in the first six months of

2013 (H1 2012: 944). Of these, 839 were private homes (H1 2012: 806

homes), an increase of 4%. Social homes comprised 13% of total

legal completions (124 homes), compared to 15% (138 homes) in the

first half of 2012.

In the first six months of 2013 the average sales price of homes

legally completed increased by 15% to GBP188,500 (H1 2012:

GBP164,400), reflecting an improving mix of homes. The average

sales price of the Group's private legal completions was 14% higher

at GBP200,200 (H1 2012: GBP175,000), benefiting from stronger sales

prices on new sites. The underlying year to date increase in

housing market prices is considered to have been modest at some 1%

to 2%.

Operating profit

The Group delivered an operating profit for the six months ended

30 June 2013 of GBP20.5 million at an operating margin of 11.1% (H1

2012*: GBP17.5 million at an operating margin of 10.3%). Excluding

land sales, the Group increased operating profit by 50% to GBP20.4

million with an operating margin of 11.1% (H1 2012*: GBP13.6

million at an operating margin of 8.7%).

The gross margin achieved in the first half of 2013 was 23.0%,

which compared to 21.6% in H1 2012. The land sales profit

recognised during H1 2013 was GBP0.1 million, compared to GBP3.9

million in H1 2012. Housing gross margin increased to 23.1% (H1

2012: 20.9%), which was generated by an increasing contribution

from the higher margin sites acquired since the downturn.

As anticipated, overheads increased by 13% and constituted 12.0%

of housing revenue in the first half of 2013 (H1 2012*: 12.2%). The

Group has invested in sales and marketing activity, given the

increasing number of active sales outlets, and in progressing newly

acquired sites through the detailed planning and design phases to

start work on site. All such costs are written off as incurred. The

Group expects that overheads as a percentage of revenue will reduce

from 9.5% in 2012* to below 9% for the 2013 full year.

* 2012 has been restated following the adoption of IAS19R

"Employee Benefits"

Profit before tax

The Group achieved profit before tax of GBP18.6 million,

comprising operating profit of GBP20.5 million, net financing

charges of GBP2.0 million and a profit from joint ventures of

GBP0.1 million. This compares to GBP17.5 million of operating

profit, GBP2.0 million of net financing charges and a profit from

the joint venture of GBP0.1 million in the first six months of

2012, generating a profit before tax of GBP15.6 million in that

period, restated for IAS19R. There were no exceptional items in the

first six months of either 2013 or 2012.

Dividends

With the accelerating delivery of the Group's growth strategy

and a strong improvement in the performance and future prospects of

the Group, an interim dividend of 4.0p per share has been declared

(2012 interim dividend: 3.0p). The Board expects to continue to

increase dividends progressively as earnings per share

increase.

The interim dividend will be paid on 22 November 2013 to holders

of ordinary shares on the register at the close of business on 27

September 2013. The dividend reinvestment plan, introduced in 2012,

gives shareholders the opportunity to reinvest their dividends.

Financing & cashflow

The Group incurred net financing charges of GBP2.0 million in

the first half of 2013 (H1 2012*: GBP2.0 million). The effect of

IAS19R on the H1 2012 finance charge was an increased charge of

GBP0.5 million.

Having started the year with a net cash balance of GBP18.8

million, significant land investment has resulted in net debt

outstanding as at 30 June 2013 of GBP48.4 million. This comprised

GBP11.7 million of cash in hand, offset by GBP55.0 million of bank

debt, GBP4.8 million of loans received from the Government and a

GBP0.3 million liability, representing the fair market value of an

interest rate swap.

In the first six months of 2013, the Group generated an

operating cash inflow before land expenditure of GBP51.1 million

(H1 2012: GBP33.8 million), continuing to demonstrate strong

underlying cash generation from the Group's existing assets. As a

result of the Group's assertive land investments, payments in H1

2013 associated with land purchases less cash recoveries on land

sales were GBP107.7 million (H1 2012: GBP50.9 million). With a cash

outflow from non-trading items of GBP10.6 million, the overall net

cash outflow for the six months ending 30 June 2013 was GBP67.2

million (H1 2012: GBP28.6 million).

Taxation

The Group has recognised a tax charge of GBP4.2 million on

profit before tax of GBP18.6 million at an effective tax rate of

22.6% (H1 2012*: tax charge of GBP4.1 million at an effective rate

of 26.3%).

Pensions

The Group had a pension scheme surplus of GBP1.8 million as at

30 June 2013, compared to a deficit of GBP3.2 million at 31

December 2012. Scheme assets grew over the six months to GBP87.3

million from GBP85.2 million. Scheme liabilities decreased to

GBP85.5 million from GBP88.4 million, primarily due to an increase

in the discount rate applied to liabilities, as a result of rising

bond yields.

Net assets

Net assets per share as at 30 June 2013 was 577p as compared to

547p at 30 June 2012.

Analysis of net assets 2013 2012*

GBPm GBPm

------------------------------------------------- ------ -------

Net assets at 1 January 758.8 728.6

Profit after tax for the six months 14.4 11.5

Share capital issued 0.9 0.3

Net actuarial movement on pension scheme through

reserves 3.8 (4.1)

Adjustment to reserves for share based payments 0.3 0.2

Dividends settled (8.0) (4.7)

------------------------------------------------- ------ -------

Net assets at 30 June 770.2 731.8

------------------------------------------------- ------ -------

As at 30 June 2013 net assets were GBP11.4 million higher than

at the start of the year. Inventories increased during the six

months by GBP142.6 million to GBP1,006.2 million. As a result of

the strong investment in consented land, the land bank increased by

GBP119.2 million. Work in progress increased from the start of 2013

by GBP27.7 million, as the Group built a larger number of homes on

a greater number of sites for legal completion in H2 2013. Other

movements in inventories relate to a decrease in part exchange

properties of GBP4.3 million. Trade and other receivables reduced

by GBP21.2 million, as a result of a reduction in debtors related

to land sales of GBP8.9 million and recovery of amounts due from

housing associations at the 2012 year end. Available for sale

financial assets held as current assets at the 2012 year end of

GBP7.2 million have reduced to Nil, with the full recovery of cash

on units held in an investment fund into which the Group had sold

show home properties. Trade and other payables totalling GBP291.3

million (31 December 2012: GBP249.3 million) comprised land

creditors of GBP169.8 million (31 December 2012: GBP123.8 million)

and trade and other creditors of GBP121.5 million (31 December

2012: GBP125.5 million). Net cash reduced by GBP67.2 million.

Land

Land investments

The Group has continued to take advantage of opportunities to

acquire high quality consented land. In the six months ended 30

June 2013, the Group added 2,767 consented plots on 18 sites to the

land bank at a cost of GBP166 million. These plots have an

estimated future revenue of GBP629 million and an estimated future

gross profit potential of GBP163.3 million based on prevailing

sales prices and build costs, delivering an estimated future gross

margin of 26.0%. Of these, 866 plots were delivered through

conversion of strategic land.

As at 30 June 2013, the Group held contracts to acquire 1,018

plots on 11 sites, the majority of which are expected to be added

to the consented land bank in H2 2013.

Land bank

The Group held 15,579 consented plots in its land bank at 30

June 2013 (31 December 2012: 13,776). 73% of the plots within the

land bank were located in the south of England, where the housing

market continues to show greater strength, and 61% of the consented

land bank (9,522 plots) has been added since the low point of house

prices in the market downturn. The Group estimates that the gross

profit potential on the plots within the consented land bank at 30

June 2013, based on prevailing sales prices and build costs, has

increased to GBP733 million with a gross margin of 23.5% (31

December 2012: gross profit of GBP600 million at a gross margin of

22.7%).

The average consented land plot cost at the start of 2013 was

GBP45,800. This has increased to GBP48,200 at 30 June 2013 as a

result of the addition of new traditional housing sites in higher

value locations, where the average plot cost is higher, and a lower

number of written down plots held in the land bank at the end of

the half year (11% of land plots versus 13% at the start of the

year). The remaining provision on written down plots as at 30 June

2013 was GBP25.3 million.

The Group continues to recognise the importance of strategic

land. During the first half of 2013, the Group has continued to

invest in strategic land and also to convert strategic land into

the consented land bank. Good progress is being made in the

promotion of a number of major strategic sites with potential to

obtain planning in the near term. As at 30 June 2013, the Group's

strategic land bank stood at 19,341 potential plots, compared to

19,318 potential plots at 31 December 2012.

Principal risks and uncertainties

The Group is subject to a number of risks and uncertainties as

part of its activities. The Board regularly considers these and

seeks to ensure that appropriate processes are in place to manage,

monitor and mitigate these risks. The directors consider that the

principal risks and uncertainties facing the Group are those which

were outlined on page 22 of the Annual report and accounts 2012,

which is available from www.bovishomesgroup.co.uk, and additionally

risks relating to the supply chain in respect of the availability

and cost of labour and materials, which have heightened in recent

months. The Group has in place processes to monitor and mitigate

these risks.

Market conditions

In the first half of 2013, the UK housing market has

demonstrated signs of improvement with evidence of increased

mortgage availability and stronger home buyer confidence. Monthly

mortgage approvals which were previously steady at circa 50,000

approvals per month have increased to circa 58,000 approvals in

both May and June 2013, representing a significant increase in the

rate of approvals. Given the long standing constraint on activity

in the housing market arising from low levels of mortgage finance,

this recent increase is a positive indicator for the market.

The launch of the Government's Help to Buy shared equity scheme

on 1 April 2013 added to what was already a more confident housing

market backdrop and early signs are that this shared equity product

is having a positive effect on transactional activity in the new

homes market.

As a result of these market positives, trading across the new

build sector has been strong during the first half of 2013 and in

the early weeks of the third quarter, with good sales rates and a

less pronounced summer lull in reservations than in previous years.

As such, the trading environment appears robust at this time and is

creating a growing sense of confidence in the market.

With the increase in home buyer confidence and a greater ability

to transact, overall market pricing is showing an increased level

of resilience with marginal market sales price increases becoming

evident in certain locations, particularly in the south of

England.

Current trading

The Group has experienced strong trading in the year to date

with an increase in private reservations over the 32 trading weeks

to 9 August 2013 of 43% to 1,712 homes (2012: 1,195 homes). In this

period, the average private sales rate has been 0.59 net

reservations per site per week, 28% ahead of the sales rate of 0.46

achieved in the same period of the prior year. The growth in

reservations has also been delivered through an 11% increase in

active sales outlets, which have averaged 91 to date, compared to

an average of 82 in the prior period. Sales prices achieved to date

have been modestly ahead of the Group's expectations. Circa 500

customers have reserved using the Government's Help to Buy shared

equity scheme since its launch.

As at 9 August 2013, the Group had achieved 2,505 net sales for

legal completion in 2013, as compared to 1,844 net sales at the

same point in 2012, an increase of 661 homes.

Outlook

The Group is now around 90% sold for the current financial year.

Given stable market conditions, reservations achieved over the next

few weeks will deliver the targeted volume for 2013. This will

enable the Group to build a significantly enhanced forward order

book for 2014 from an earlier date than in prior years. The

delivery of an enhanced forward order book will provide a strong

base on which volume growth for the first half of 2014 can be

achieved. This is also expected to enable the Group to deliver a

more even balance of legal completions between the first and second

half years in 2014.

For 2013, the combination of the expected legal completion

volume and an expected increase of at least 10% in average sales

price will deliver strong year on year revenue growth.

The Group has achieved a strong profit margin improvement in the

first half of 2013 over H1 2012 and expects that, on the basis of

current reservations and subject to stable market conditions, the

housing gross margin for the full year will be between 23% and

24%.

With overheads as a percentage of total revenue expected to

reduce to below 9% for 2013 (2012*: 9.5%), the Group expects to

deliver an operating margin approaching 15% (2012*: 13.3%). Return

on capital employed for 2013 is now expected to be at least 10.0%

(2012*: 7.7%), representing a further significant improvement

arising from the Group's growth strategy.

Looking ahead to 2014, given the strong land acquisitions

achieved during 2013 to date, many of which were added early in the

year, the Group is confident that it can deliver another strong

year of sales outlet growth. Furthermore the strength of the

pipeline of further land acquisition opportunities gives the Group

confidence that sales outlet growth can continue through 2014 and

into 2015.

With an increasing proportion of legal completions expected from

sites acquired since the housing market downturn and with a greater

number of active sales outlets, the Group expects that, based on

stable market conditions, volumes, average sales price and profit

margins will continue to increase in 2014. This is expected to

deliver another strong increase in return on capital employed and

enable the Group to achieve a shareholder return in excess of the

Group's WACC. The Group considers that it has the resources and

opportunities to continue its strong growth beyond 2014 and,

subject to current market conditions continuing, the Group is well

positioned to further enhance shareholder returns.

Bovis Homes Group PLC

Group income statement

For the six months ended 30 June 2013 Six months Six months Year

(unaudited) ended ended ended

30 June 30 June 31 Dec

2013 2012 2012

restated restated

- note - note

1 1

GBP000 GBP000 GBP000

---------------------------------------- ----------------- ----------------- ------------

Revenue 184,412 170,275 425,533

Cost of sales (141,999) (133,516) (328,634)

---------------------------------------- ----------------- ----------------- ------------

Gross profit 42,413 36,759 96,899

Administrative expenses (21,896) (19,307) (40,186)

---------------------------------------- ----------------- ----------------- ------------

Operating profit before financing costs 20,517 17,452 56,713

Financial income 1,175 1,375 2,933

Financial expenses (3,110) (3,319) (6,656)

---------------------------------------- ----------------- ----------------- ------------

Net financing costs (1,935) (1,944) (3,723)

Share of profit of Joint Venture 59 127 254

Profit before tax 18,641 15,635 53,244

Income tax expense (4,238) (4,125) (13,051)

---------------------------------------- ----------------- ----------------- ------------

Profit for the period attributable

to equity holders of the parent 14,403 11,510 40,193

---------------------------------------- ----------------- ----------------- ------------

Earnings per share

Basic 10.8p 8.6p 30.2p

---------------------------------------- ----------------- ----------------- ------------

Diluted 10.8p 8.6p 30.1p

---------------------------------------- ----------------- ----------------- ------------

Group statement of comprehensive income

For the six months ended 30 June 2013 Six months Six months Year

(unaudited) ended ended ended

30 June 30 June 31 Dec

2013 2012 2012

restated restated

- note - note

1 1

GBP000 GBP000 GBP000

--------------------------------------- ----------------- ----------------- ------------

Profit for the period 14,403 11,510 40,193

Actuarial gains/(losses) on defined

benefit pension scheme 4,930 (5,420) (3,500)

Deferred tax on actuarial movements

on defined benefit pension scheme (1,134) 1,278 797

Total comprehensive income for the

period attributable to equity holders

of the parent 18,199 7,368 37,490

--------------------------------------- ----------------- ----------------- ------------

Bovis Homes Group PLC

Group balance sheet

As at 30 June 2013 (unaudited) 30 June 30 June 31 Dec

2013 2012 2012

GBP000 GBP000 GBP000

------------------------------------ --------- ------- ---------

Assets

Property, plant and equipment 12,155 11,521 11,910

Investments 5,126 5,236 5,387

Restricted cash 1,567 770 1,152

Deferred tax assets 2,411 4,435 3,097

Trade and other receivables 1,833 2,146 1,930

Available for sale financial assets 45,113 41,098 43,869

Retirement benefit assets 1,760 - -

Total non-current assets 69,965 65,206 67,345

------------------------------------ --------- ------- ---------

Inventories 1,006,208 820,460 863,597

Trade and other receivables 42,538 79,446 64,844

Available for sale financial assets - - 7,119

Cash and cash equivalents 11,706 27,794 24,396

Total current assets 1,060,452 927,700 959,956

------------------------------------ --------- ------- ---------

Total assets 1,130,417 992,906 1,027,301

------------------------------------ --------- ------- ---------

Equity

Issued capital 67,024 66,871 66,908

Share premium 213,287 212,318 212,550

Retained earnings 489,912 452,620 479,391

------------------------------------ --------- ------- ---------

Total equity attributable to equity

holders of the parent 770,223 731,809 758,849

------------------------------------ --------- ------- ---------

Liabilities

Bank and other loans 60,096 5,606 5,606

Other financial liabilities 599 1,102 706

Trade and other payables 81,006 65,888 50,681

Retirement benefit obligations - 7,980 3,171

Provisions 1,863 1,859 1,668

------------------------------------ --------- ------- ---------

Total non-current liabilities 143,564 82,435 61,832

------------------------------------ --------- ------- ---------

Trade and other payables 210,282 173,090 198,620

Provisions 1,413 1,535 2,065

Current tax liabilities 4,935 4,037 5,935

Total current liabilities 216,630 178,662 206,620

------------------------------------ --------- ------- ---------

Total liabilities 360,194 261,097 268,452

------------------------------------ --------- ------- ---------

Total equity and liabilities 1,130,417 992,906 1,027,301

------------------------------------ --------- ------- ---------

These condensed consolidated interim financial statements were

approved by the Board of directors on 16 August 2013.

Bovis Homes Group PLC

Group statement of changes in equity

For the six months ended 30 Total Issued Share Total

June 2013

(unaudited) retained capital premium

earnings

GBP000 GBP000 GBP000 GBP000

------------------------------- --------- ------- ------- -------

Balance at 1 January 2013 479,391 66,908 212,550 758,849

Total comprehensive income

and expense 18,199 - - 18,199

Deferred tax on other employee

benefits 51 - - 51

Issue of share capital - 116 737 853

Share based payments 281 - - 281

Dividends to shareholders (8,010) - - (8,010)

Balance at 30 June 2013 489,912 67,024 213,287 770,223

------------------------------- --------- ------- ------- -------

Balance at 1 January 2012 449,671 66,836 212,064 728,571

Total comprehensive income

and expense 37,490 - - 37,490

Deferred tax on other employee

benefits 33 - - 33

Issue of share capital - 72 486 558

Share based payments 861 - - 861

Dividends paid to shareholders (8,664) - - (8,664)

Balance at 31 December 2012 479,391 66,908 212,550 758,849

------------------------------- --------- ------- ------- -------

Balance at 1 January 2012 449,671 66,836 212,064 728,571

Total comprehensive income

and expense 7,368 - - 7,368

Deferred tax on other employee

benefits 14 - - 14

Issue of share capital - 35 254 289

Share based payments 230 - - 230

Dividends to shareholders (4,663) - - (4,663)

Balance at 30 June 2012 452,620 66,871 212,318 731,809

------------------------------- --------- ------- ------- -------

Bovis Homes Group PLC

Group statement of cash flows

For the six months 30 June 2013 (unaudited) Six months Six months Year

ended ended ended

30 June 30 June 31 Dec 2012

2013 2012 restated

restated -

- note note 1

1

GBP000 GBP000 GBP000

--------------------------------------------- ----------------- ----------------- -------------------

Cash flows from operating activities

Profit for the period 14,403 11,510 40,193

Depreciation 491 435 906

Impairment of available for sale assets 87 490 889

Financial income (1,175) (1,375) (2,933)

Financial expense 3,110 3,319 6,656

Profit on sale of property, plant and

equipment (19) (7) (14)

Equity-settled share-based payment

expense 281 230 861

Income tax expense 4,238 4,125 13,051

Share of results of Joint Venture (59) (127) (254)

Decrease/(increase) in trade and other

receivables 30,809 (5,243) (3,587)

Increase in inventories (142,611) (22,701) (65,841)

Increase/(decrease) in trade and other

payables 40,599 (10,781) 1,093

Decrease/(increase) in provisions and

employee benefits (457) 139 (2,401)

--------------------------------------------- ----------------- ----------------- -------------------

Cash generated from operating activities (50,303) (19,986) (11,381)

Interest paid (3,519) (863) (1,707)

Income taxes paid (5,635) (3,770) (9,922)

--------------------------------------------- ----------------- ----------------- -------------------

Net cash generated from operating activities (59,457) (24,619) (23,010)

--------------------------------------------- ----------------- ----------------- -------------------

Cash flows from investing activities

Interest received 95 813 773

Acquisition of property, plant and

equipment (744) (350) (1,213)

Proceeds from sale of plant and equipment 27 15 25

Dividends received from Joint Venture 417 243 243

Investment in restricted cash (415) (111) (493)

Net cash generated from investing activities (620) 610 (665)

--------------------------------------------- ----------------- ----------------- -------------------

Cash flows from financing activities

Dividends paid (8,010) (4,574) (8,664)

Proceeds from the issue of share capital 853 200 558

Drawdown of borrowings 54,544 - -

Net cash generated from financing activities 47,387 (4,374) (8,106)

--------------------------------------------- ----------------- ----------------- -------------------

Net decrease in cash and cash equivalents (12,690) (28,383) (31,781)

Cash and cash equivalents at start

of period 24,396 56,177 56,177

--------------------------------------------- ----------------- ----------------- -------------------

Cash and cash equivalents at end of

period 11,706 27,794 24,396

--------------------------------------------- ----------------- ----------------- -------------------

Notes to the condensed consolidated interim financial

statements

1 Basis of preparation

Bovis Homes Group PLC ('the Company') is a company domiciled in

the United Kingdom. The condensed consolidated interim financial

statements of the Company for the six months ended 30 June 2013

comprise the Company and its subsidiaries (together referred to as

'the Group') and the Group's interest in associates.

The condensed consolidated interim financial statements were

authorised for issue by the directors on 16 August 2013. The

financial statements are unaudited but have been reviewed by KPMG

LLP.

The condensed interim financial statements do not constitute

statutory accounts within the meaning of Section 434 of the

Companies Act 2006.

The figures for the half years ended 30 June 2013 and 30 June

2012 are unaudited. The comparative figures for the financial year

ended 31 December 2012 are not the Company's statutory accounts for

that financial year. Those accounts have been reported on by the

Company's auditors and delivered to the Registrar of Companies. The

report of the auditors was (i) unqualified, (ii) did not include a

reference to any matters to which the auditors drew attention by

way of emphasis without qualifying their report and (iii) did not

contain a statement under Section 498 (2) or (3) of the Companies

Act 2006.

The preparation of a condensed set of financial statements

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amount of assets, liabilities, income and expenses. Actual results

may differ from these estimates.

Judgements made by management in the application of adopted

IFRSs that have significant effect on the financial statements and

estimates with a significant risk of material adjustment in

following years have been reviewed by the directors and remain

those published in the Company's consolidated financial statements

for the year ended 31 December 2012, with the exception of the

application of new accounting standards.

The Group has adopted the following new standards and amendments

to standards, including any consequential amendments to other

standards, with a date of initial application of 1 January

2013:

IFRS 13 establishes a single framework for measuring fair value

and making disclosures about fair value measurements, when such

measurements are required or permitted by other IFRSs. In

particular, it unifies the definition of fair value as the price at

which an orderly transaction to sell an asset or to transfer a

liability would take place between market participants at the

measurement date. In accordance with the transitional provisions of

IFRS 13, the Group has applied the new fair value measurement

guidance prospectively, and has not provided any comparative

information for new disclosures.

IAS 19 (Revised 2011) "Employee Benefits" outlines the

accounting requirements for employee benefits. The Standard

establishes the principle that the cost of providing employee

benefits should be recognised in the period in which the benefit is

earned by the employee, rather than when it is paid or payable, and

outlines how each category of employee benefits are measured,

providing detailed guidance in particular about post-employment

benefits. This impacts the measurement of various components

representing movements in the defined benefit pension obligation

and associated disclosures, but not the Group's total

obligation.

The application of IAS 19 (Revised 2011) has resulted in the

interest cost and expected return on assets being replaced by a net

interest charge/credit on the net defined benefit pension

liability/surplus. Certain costs previously recorded as part of

finance costs or other comprehensive income have now been presented

within administrative expenses.

The comparative period and full year have been restated with

profit being GBP0.4 million lower and GBP0.7 million lower

respectively, and other comprehensive income is GBP0.4 million

higher and GBP0.7 million higher including the tax impact of the

changes. The Group records actuarial adjustments immediately so

there has been no affect on the prior year pension deficit.

The condensed interim financial statements have been prepared in

accordance with IAS34 'Interim Financial Reporting' as endorsed by

the EU. As required by the Disclosure and Transparency Rules of the

Financial Conduct Authority, the condensed consolidated interim

financial statements have been prepared applying the accounting

policies and presentation that were applied in the preparation of

the Company's published consolidated financial statements for the

year ended 31 December 2012, which were prepared in accordance with

IFRSs as adopted by the EU.

2 Seasonality

In common with the rest of the UK housebuilding industry,

activity occurs year round, but there are two principal selling

seasons: spring and autumn. As these fall into two separate half

years, the seasonality of the business is not pronounced, although

it is biased towards the second half of the year under normal

trading conditions.

3 Segmental reporting

All revenue and profit disclosed relate to continuing activities

of the Group and are derived from activities performed in the

United Kingdom.

4 Earnings per share

(Unaudited) Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

2013 2012 2012

restated restated

- -

note 1 note 1

pence pence pence

--------------------------- ---------- ---------- ---------

Basic earnings per share 10.8 8.6 30.2

Diluted earnings per share 10.8 8.6 30.1

--------------------------- ---------- ---------- ---------

Basic earnings per share

Basic earnings per ordinary share for the six months ended 30

June 2013 is calculated on a profit after tax of GBP14,403,000 (six

months ended 30 June 2012 restated: profit after tax of

GBP11,510,000; year ended 31 December 2012 restated: profit after

tax of GBP40,193,000) over the weighted average of 133,464,080 (six

months ended 30 June 2012: 133,248,378; year ended 31 December

2012: 133,294,726) ordinary shares in issue during the period.

Diluted earnings per share

The calculation of diluted earnings per share at 30 June 2013

was based on the profit attributable to ordinary shareholders of

GBP14,403,000 (six months ended 30 June 2012 restated: profit after

tax of GBP11,510,000; year ended 31 December 2012 restated: profit

after tax of GBP40,193,000).

The Group's diluted weighted average ordinary shares potentially

in issue during the six months ended 30 June 2013 was 133,719,575

(six months ended 30 June 2012: 133,372,229; year ended 31 December

2012: 133,432,911).

5 Dividends

The following dividends per qualifying ordinary share were

settled by the Group.

(Unaudited) Six months Six months

ended ended Year ended

30 June 30 June 31 Dec

2013 2012 2012

GBP000 GBP000 GBP000

May 2013: 6.0p (May 2012: 3.5p) 8,010 4,663 4,663

November 2012: 3.0p - - 4,001

-------------------------------- ---------- ---------- ------------

8,010 4,663 8,664

-------------------------------- ---------- ---------- ------------

The Board determined on 16 August 2013 that an interim dividend

of 4.0p for 2013 be paid. The dividend will be settled on 22

November 2013 to shareholders on the register at the close of

business on 27 September 2013. This dividend has not been

recognised as a liability at the balance sheet date.

6 Related party transactions

Transactions between fellow subsidiaries, which are related

parties, during the first half of 2013 have been eliminated on

consolidation, as have transactions between the Company and its

subsidiaries during this period. The Group's associates and joint

ventures are disclosed in the Group's Annual report and accounts

2012.

Transactions between the Group and key management personnel in

the first half of 2013 were limited to those relating to

remuneration, previously disclosed as part of the Group's Report on

directors' remuneration published with the Group's Annual report

and accounts 2012. No material change has occurred in these

arrangements in the first half of 2013.

Mr Malcolm Harris, a Group Director, is a non-executive director

of the Home Builders Federation (HBF), to whom the Group pays

subscription fees and fees for research as required. Net amounts

payable for each period were as follows:

(Unaudited) Six months Six months

ended ended Year ended

30 June 30 June 31 Dec

2013 2012 2012

GBP000 GBP000 GBP000

------------ ---------- ---------- ------------

HBF 59 47 93

------------ ---------- ---------- ------------

There have been no related party transactions in the first six

months of the current financial year which have materially affected

the financial performance or position of the Group, and which have

not been disclosed.

Transactions with Joint Venture

Bovis Homes Limited is contracted to provide property and

letting management services to Bovis Peer LLP. Fees charged in the

period, inclusive of VAT, were GBP73,000 (six months ended 30 June

2012: GBP72,000; year ended 31 December 2012: GBP144,000).

Loans totalling GBP1,575,355 were provided in prior years at an

annual interest rate of LIBOR plus 2.4%. No other loans or sales of

inventory have taken place.

Interest charges made in respect of the loans were GBP24,000

(six months ended 30 June 2012: GBP26,000; year ended 31 December

2012: GBP49,000).

7 Reconciliation of net cash flow to net cash

(Unaudited) Six months Six

ended months Year ended

ended

30 June 30 June 31 Dec

2013 2012 2012

GBP000 GBP000 GBP000

------------------------------------------ ---------------- -------- --------------------------------------

Net decrease in cash and cash equivalents (12,690) (28,383) (31,781)

Drawdown of borrowings (54,544) - -

Fair value adjustments to interest

rate swaps 115 (76) (9)

Fair value adjustment to interest free

loans (61) (128) (195)

Net cash at start of period 18,790 50,775 50,775

------------------------------------------ ---------------- -------- --------------------------------------

Net cash at end of period (48,390) 22,188 18,790

------------------------------------------ ---------------- -------- --------------------------------------

Analysis of net cash:

Cash 11,706 27,794 24,396

Bank and other loans (59,795) (5,123) (5,190)

Fair value of interest rate swaps (301) (483) (416)

Net cash (48,390) 22,188 18,790

------------------------------------------ ---------------- -------- --------------------------------------

8 Circulation to shareholders

This interim report is sent to shareholders. Further copies are

available on request from the Company Secretary, Bovis Homes Group

PLC, The Manor House, North Ash Road, New Ash Green, Longfield,

Kent DA3 8HQ. Further information on Bovis Homes Group PLC can be

found on the Group's corporate website www.bovishomesgroup.co.uk,

including the analyst presentation document which will be presented

at the Group's results meeting on 19 August 2013.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DQLFFXVFFBBD

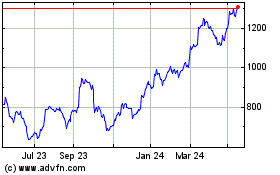

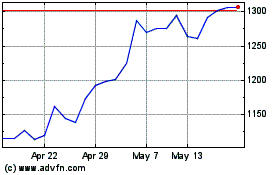

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024