TIDMBVS

RNS Number : 5361F

Bovis Homes Group PLC

23 February 2015

23 February 2015

BOVIS HOMES GROUP PLC

FINAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2014

STRONGLY IMPROVING RETURNS AND GROWTH STRATEGY ON TRACK

Bovis Homes Group PLC today announced its final results for the

financial year ended 31 December 2014 which have been prepared in

accordance with International Financial Reporting Standards as

adopted by the EU ('IFRS').

Financial highlights for 2014

2014 2013 Change

Revenue GBP809.4m GBP556.0m +46%

Profit before tax GBP133.5m GBP78.8m +69%

Basic earnings per share 78.6p 44.9p +75%

Dividend per share 35.0p 13.5p +159%

Net profit margin * 17.0% 14.9% +2.1ppts

ROCE ** 16.2% 10.6% +5.6ppts

Net cash / (debt) GBP5.2m GBP(18.0)m

-- Significant profit improvement from record legal completions

with stronger average sales price and improved net profit

margin

-- Return on capital employed target for 2014 achieved

-- Strong balance sheet

Operational highlights for 2014

2014 2013 Change

Legal Completions

Number of legal completions 3,635 2,813 +29%

Average sales price GBP216,600 GBP195,100 +11%

Reservations

Private reservations in year 3,218 2,773 +16%

Net private reservations per

site per week *** 0.64/0.54 0.59 +8%/-8%

Forward sales at year end 1,752 1,377 +27%

Consented land

Consented plots added 7,300 3,737 +95%

Sites added 42 27 +56%

Sites owned at year end 128 102 +25%

Plots in consented land bank

at year end 18,062 14,638 +23%

-- Record year of legal completions

-- Strong forward order book for 2015

-- Record year of land investment at the right point in the cycle

-- Strong growth in sites in land bank at the year end

Robust current trading (to 20 February 2015)

-- 479 private reservations achieved in first seven weeks of 2015 (2014: 468)

-- 2,336 cumulative sales achieved at 20 February 2015 for 2015 legal completion (2014: 1,875)

-- Sales prices achieved on cumulative sales to date circa 2% ahead of Group expectations

-- 575 plots on four sites added to the consented land bank to date in 2015

* Net profit margin is calculated as operating profit and share

of profit of joint venture, divided by revenue

** ROCE is calculated as operating profit and share of profit of

joint venture, divided by average opening and closing capital

employed excluding net cash

*** Net private reservations per site per week including /

excluding PRS reservations

Commenting, David Ritchie, the Chief Executive of Bovis Homes

Group PLC said:

"I am delighted to report excellent results for 2014. With a

record number of homes delivered and stronger sales prices and

profit margins, profit before tax has increased by 69%. We have

also achieved our return on capital employed target for 2014 and

are confident in our ability to deliver a further improvement in

return on capital employed in 2015.

"We laid out our strategic ambitions for the Group at the time

of our Half Year Results. This plan envisages the business, in a

stable housing market, delivering sustainable growth over the next

few years to annual volumes of between 5,000 and 6,000 new homes.

We are on track to deliver this strategic plan, supported by record

land investment in 2014 at the right point in the cycle.

"Given its confidence in our future prospects and having

considered ongoing capital requirements, the Board is maintaining

its guidance on dividends and will be recommending a full year

dividend of 35 pence, an increase of 159%. The Board also intends

to pay a dividend of at least 35 pence per share in 2015.

"I would like to recognise the considerable effort, commitment

and hard work of our employees during 2014 and thank them all for

their contribution to the Group's success."

Enquiries: David Ritchie, Chief Executive Results issued Reg Hoare / James

by White /

Jonathan Hill, Finance Giles Robinson

Director

Bovis Homes Group PLC MHP Communications

On 23 February On 23 February

tel: 07855 432 699 tel: 020 3128 8100

Thereafter - tel: 01474 876200

Certain statements in this press release are forward looking

statements. Forward looking statements involve evaluating a number

of risks, uncertainties or assumptions that could cause actual

results to differ materially from those expressed or implied by

those statements. Forward looking statements regarding past trends,

results or activities should not be taken as a representation that

such trends, results or activities will continue in the future.

Undue reliance should not be placed on forward looking

statements.

Chief Executive's Statement

Bovis Homes has made considerable progress during 2014,

achieving a record number of legal completions with a strong

improvement in profit and driving a further significant improvement

in return on capital employed. Profit before tax has increased by

69% to GBP133.5 million and the Group has achieved a return on

capital employed of 16.2%, 53% higher than 2013. Basic earnings per

share has increased by 75% to 78.6 pence (2013: 44.9 pence).

The Group has delivered a record year, acquiring high quality

land assets in its target areas, while maintaining a robust balance

sheet with year end net cash of GBP5.2 million.

The strategic plan communicated at the time of the 2014 Half

Year Results laid out the ambitions for the Group. The Group aims

to deliver market leading performance over the cycle from long term

land investment with a focus on building and selling quality family

homes. The Group's strategies to achieve this are as follows:

-- Acquiring, designing and developing quality traditional

housing sites, focusing primarily in the south of England

(excluding London)

-- Creating aspirational homes using its well specified

Portfolio traditional housing range in desirable settings,

delivered with excellent customer service

-- Growing to an optimal scale to suit the selected geography

and product range, which enables ongoing high quality management of

risk and reward through short lines of management control

-- Managing the business across the housing cycle to maximise

returns, while effectively stewarding shareholders' capital

-- Enabling motivated and engaged employees and business

partners to work ethically within a safe and healthy

environment

With the excellent progress made during 2014 delivering on these

strategies, the Group is confident that its strategic plan is on

track.

Acquiring, designing and developing quality traditional housing

sites, focusing primarily in the south of England (excluding

London)

2014 was the Group's most successful year for land investment,

acquiring high quality consented land assets focused on specific

search areas in the south of England and prime locations in the

midlands and northwest. The Group has maintained strong discipline

in its approach to land investment and applies rigorous criteria

for the acquisition of consented land, reflecting not only the

anticipated profit margin and return on capital employed, but also

site specific risks and geographic concentration risk.

During the year the Group added 7,300 plots on 42 sites to the

consented land bank at a cost of GBP340 million (2013: 3,737 plots

on 27 sites at a cost of GBP225 million). The plots added have an

estimated future revenue of GBP1,717 million and an estimated

future gross profit potential of GBP447 million, based on appraisal

sales prices and build costs. On average the plots are expected to

deliver a gross margin of circa 26% and a return on capital

employed between 25% and 30%. Of these plots, 82% were located in

the south of England, taking the proportion of plots in the

consented land bank to 75% in the south. On the sites acquired

during 2014, traditional homes represented 86% of the private homes

to be built.

The strong performance in purchasing land has continued in 2015,

with 575 consented plots on four sites added to date in 2015, and a

significant pipeline of sites with terms agreed being positively

progressed.

In order to drive improved use of capital, the Group completed

three land sales totalling 237 plots during 2014. The selected land

sale parcels were on some of the Group's larger sites. Further land

sales are planned in 2015.

The consented land bank was approximately five years supply at

2014 legal completion volume, amounting to 18,062 plots as at 31

December 2014 (2013: 14,638). The gross profit potential on these

consented plots at the 2014 year end, based on current sales prices

and current build costs, was estimated at GBP1,017 million with a

gross margin of 25.2% (2013: GBP727 million at 24.2%). At that

point, the consented land bank contained 128 sites with 25 of these

sites still to be launched for sale. This provides confidence in

the Group's growth for 2015 as these sites progress to being active

sales outlets.

Creating aspirational homes using its well specified Portfolio

traditional housing range in desirable settings, delivered with

excellent customer service

During 2014 the Group achieved record production of circa 3,500

homes, a 20% increase on 2013 to support the delivery of new homes,

whilst effectively managing housing work in progress. Work in

progress turn increased to 3.6 times (2013: 2.7). Housing work in

progress ended 2014 at 923 units worth of production (2013: 1,040),

equivalent to less than one quarter's worth of anticipated volume

at the start of 2015.

During 2010, the Group reviewed its private housing range and

designed the "Portfolio" range of traditional homes for modern

living, incorporating great space with efficient design and build.

Not only have these homes been excellently received by customers,

but they are also highly efficient to build. The Group has migrated

across to the Portfolio range, where planning allows. During 2014,

38% of the private homes legally completed were from the Portfolio

range, up from 23% in 2013. This percentage is expected to grow

further in 2015.

The Portfolio range is ideally suited to edge of town and

village locations, which are precisely the locations where the

Group has invested in 2014, including attractive market towns from

Bovey Tracy and Ottery St Mary in Devon and Tetbury and Kemble in

Gloucestershire, to Godalming in Surrey, Salisbury and Bursledon in

Hampshire and Elsenham and Takeley in Essex.

As a result of moving towards a more traditional housing mix,

the proportion of traditional private homes sold has increased to

66% in 2014 from 59% in 2013. Three storey homes reduced to 21% of

legal completions (2013: 22%) and apartments have decreased to 13%

(2013: 19%).

In 2014, the average sales price of homes legally completed

increased by 11% to GBP216,600 (2013: GBP195,100). The average

sales price of private legal completions, excluding private rental

sector ("PRS"), was 18% higher at GBP250,800 (2013: GBP212,700),

benefiting from the mix effect of higher sales prices on new sites

and market pricing improvements of circa 5% ahead of expectations

set prior to the start of 2014. The average sales price for PRS

homes was GBP166,900, reflecting their location and the smaller

product delivered under these agreements.

Improving activity levels and higher sales prices in the new

homes market has led to increasing construction costs, with the

main driver being subcontract labour. The Group's average

construction cost for legal completions in 2014 was 12% higher than

in 2013, compared to an increase in private sales prices of 14%.

The Group estimates the market driven element of this build cost

increase to be circa 7% with other cost increases arising from the

increasing size of the Group's average home, specification

improvements and the ongoing impact of switching the mix of homes

to the south of England where subcontractor rates are higher.

As well as cost increases, the industry has faced challenges to

deliver adequate levels of production during the last eighteen

months. This has resulted primarily from shortages in subcontract

labour, which has impacted Bovis Homes, given the Group's

significant growth. Production delays have also had an adverse

effect on the customer experience leading to the Group's internal

"recommend a friend" score reducing to 82% in 2014 from 90% in

2013. Actions plans have been put in place to improve performance

in this important area.

Growing to an optimal scale to suit the selected geography and

product range, which enables ongoing high quality management of

risk and reward through short lines of management control

The Group has laid out its ambitious plan to grow annual volume

to between 5,000 and 6,000 homes, through an increase in active

sales outlets which can be delivered through the acquisition of

circa 40 consented sites annually.

In 2014 the Group has taken a major step forward in scale,

delivering a 29% increase in legal completions to 3,635 homes

(2013: 2,813). Private legal completions, including 286 PRS homes,

increased by 26% to 2,931 (2013: 2,330). Legal completions of

social homes were 704 (2013: 483), representing 19% of total legal

completions (2013: 17%).

Average active sales outlets of 97 were 8% higher than the 90 in

2013. This combination of active sales outlet growth in 2014

supported by PRS reservations enabled the Group to achieve 3,218

private reservations, a 16% increase on the 2,773 achieved in 2013.

Net private reservations per site per week was 0.64 and, excluding

the PRS reservations, was 0.54 (2013: 0.59). This reduction

resulted from a more normal seasonal market during the summer

period of 2014 compared to 2013, which benefited from the first

year of Help to Buy, as well as a moderating of the overall housing

market in the second half of the year.

This level of private reservations enabled the Group to carry

forward into 2015 a significantly enhanced private forward order

book of 979 private reservations (2014: 692). When combined with

increased active sales outlets of 103 at the start of 2015 and the

expected site openings in 2015 driven by the 42 consented sites

acquired in 2014, the Group is confident that further growth

towards its optimal scale can be achieved during 2015. The sites

acquired in 2015 to date and the pipeline of further sites either

already contracted or at an advanced stage of negotiation should

support further growth into 2016.

The Group's new organisational structure which became effective

at the start of 2014 has bedded in well and the six operating

businesses are functioning effectively. The two developing

businesses in Thames Valley and South Midlands, which continue to

be run on modest overheads, are progressing towards being fully

operational and are expected to deliver their first legal

completions during 2016.

Managing the business across the housing cycle to maximise

returns, while effectively stewarding shareholders' capital

Driving shareholder value across the housing cycle requires

strong land acquisition at the bottom of the cycle and slowing

investment before the peak. The Group continues to view the housing

market, excluding London, as being at an early stage of its growth

phase in this cycle. After a long period of stable pricing and

activity between 2009 and H1 2013, significant market house price

increases have only occurred in the last year and a half. While

there continues to be a shortage of credit to smaller

housebuilders, discipline is being demonstrated by those

participating in the consented land market. This is evidenced by

the recently published view by Knight Frank that greenfield

residential land values increased by only 2.3% in 2014, reflecting

the interplay between sales prices and build costs and the

competitive landscape. The Group continues to believe that this is

the right time to be investing assertively in consented land.

Demand for new housing remains strong with UK household

formation continuing to be projected above 200,000 per annum and

new housing targeted by the Government for delivery above this

number while completions fall significantly short of this target.

The UK planning system has increased its delivery of planning

consents leading to an improving flow of available, cost effective

residential consented land. The opportunity exists for well

capitalised housebuilders to invest in this land to increase

housing supply.

Strategic land is critical to the Group to contribute to the

supply of land into the consented land bank through the housing

cycle. During 2014 the Group made a strong investment in new

strategic land with the addition of circa 4,500 new plots to the

strategic land bank. Circa 3,000 plots were converted to the

consented land bank, making up 41% of plots added during the

year.

As a result, the strategic land bank at 31 December 2014 had

increased to 21,350 potential plots (2013: 20,108). These plots are

spread across 76 sites. The Group's long-term investment in and

promotion of strategic land has resulted in the consented land bank

as at 31 December 2014 having been sourced 45% from the strategic

land bank (2013: 49%). Within the Group's strategic land bank are

2,900 plots across nine sites where residential planning consent

has already been agreed and progress is being made by the Group to

finalise planning agreements and acquire these sites. Additionally,

a plan for the Group's controlled land for 3,200 plots at

Wellingborough, Northamptonshire is being developed. This is

expected to lead to site development commencing with the first new

homes being completed in 2016.

The Group continues to promote effectively its existing

strategic sites, working with local stakeholders to secure planning

consent. A good proportion of the Group's existing strategic land

is approaching a point where planning consents are expected to be

achieved. This strategic land will allow the Group to continue to

be highly selective in the consented land market, especially

important as and when this market shows signs of increased

competition. The Group anticipates that circa 50% of its land bank

in the future is likely to be sourced from strategic land. The

combined effect of consented land market investment with strategic

land conversion is expected to provide the Group with a strong

pipeline of sites with profit margins and returns at the point of

investment above its existing hurdle rates.

Enabling motivated and engaged employees and business partners

to work ethically within a safe and healthy environment

The Group recognises the critical role that its people play in

the delivery of the strategic plan. The increased activity in the

new build market has made attracting and retaining talent ever more

important. With a growing business, employees have increased from

771 at the start of 2014 to 928 at the end 2014, which has been

supported by higher levels of investment to support recruitment,

training and development.

In the build department where staff turnover is most pronounced,

a site manager training programme has been established during 2014,

which welcomed its first cohort of trainees primarily from military

backgrounds with further programmes to be run in the future.

Additionally, the apprentice programme is being expanded in 2015 to

increase the intake across the business.

The Board

Jonathan Hill, the Group Finance Director, announced his

intention in September 2014 to leave the Group in order to pursue

other career options. Jonathan will continue serving with the Group

until 6 March 2015. The Board would like to thank Jonathan for his

significant contribution to both the Board and to the strong

performance of the Group during his period of service. The Board is

pleased to confirm that the search process for Jonathan's

replacement is close to finalisation. An announcement is expected

to be made in the near future.

John Warren will retire from the Board at the 2015 AGM to be

held on 15 May 2015 after the allotted nine years as a

non-executive director and eight years as Audit Committee Chairman.

The Board would like to thank John for his valuable contribution

during his time on the Board. The Board is pleased to announce that

Ralph Findlay, currently Chief Executive of Marston's PLC, will be

appointed as a non-executive director with effect from 7 April 2015

and will chair the Audit Committee from the conclusion of the 2015

AGM.

Market conditions

The first half of 2014 was a period of strong levels of customer

demand in the housing market supported by good availability of

mortgage finance. Monthly mortgage approvals, according to the Bank

of England, averaged 67,500 during the first half of 2014. The

summer period returned to a more typical seasonal pattern with

lower activity during July and August. At the same time consumer

confidence reduced resulting in a weaker autumn trading period.

During the second half of 2014, monthly mortgage approvals reduced

to an average of 61,700.

The extension of Help to Buy through to 2020, announced in March

2014, provided the industry with increased certainty of support in

the medium term. The Group views this development positively,

providing further time for the mortgage market to develop under the

positive control delivered by the Mortgage Market Review.

House prices have been rising at a positive rate across many

regional markets with stronger rises in the south of England,

offset by more modest changes in the midlands and north of England.

The Group experienced an increase in sales prices during 2014

compared to its expectations set prior to the start of the year of

circa 5% due to market pricing improvements.

With the improvements in activity levels and higher sales

prices, the cost of building new homes has increased and the supply

of additional labour to fully support the higher production levels

remained constrained in 2014. The main driver of the increase in

costs has been subcontract labour, but material prices have also

contributed to the increase. The pressure experienced during 2014

seems to be reducing at the start of 2015.

Customer demand appears robust at the start of 2015. Mortgage

rates are at historic low rates and real wages are growing,

supporting affordability. The changes to stamp duty announced by

the Government in 2014 are also positive for consumers. The

forthcoming general election brings a period of uncertainty.

History would suggest that sales activity will moderate for a few

weeks before the election, followed by a rebound after. The Group

is aware of this likely impact and is presently working to maximise

the current positive sales activity to grow the order book.

Current trading

The Group entered 2015 with forward sales of 1,752 homes, a 27%

improvement on the 1,377 homes brought forward at the start of

2014. Of these, 979 were private homes (2014: 692) and 773 were

social (2014: 685).

The Group has delivered 479 private reservations in the first

seven weeks of 2015, modestly ahead of the 468 private reservations

achieved in the strong market conditions enjoyed in early 2014.

Operating from an average of 101 active sales outlets during this

period (2014: 93), the Group has achieved a sales rate per site per

week of 0.68 (2014: 0.72). Sales prices achieved on these private

reservations to date have been ahead of the Group's expectations

set prior to the start of 2015 by circa 2%.

As at 20 February 2015, the Group held 2,336 sales for legal

completion in 2015, as compared to 1,875 sales at the same point in

2014, an increase of 25%. Of these, private sales amounted to 1,458

homes (2014: 1,160), with social housing sales of 878 homes (2014:

715).

Overall this represents a robust start to 2015.

Outlook

The strong sales position brought forward from 2014 combined

with robust trading in the first seven weeks of 2015 has positioned

the Group well for 2015. With the expectation of further growth in

active sales outlets during 2015 driven by the land acquisitions

achieved in 2014, the Group is confident that it can deliver its

expected legal completion growth in 2015.

The housing market is demonstrating a strong correlation between

sales prices and costs, such that further increases in build costs

are expected to be at least covered by increases in sales prices.

The Group continues to benefit from an increasing proportion of

legal completions from post downturn sites which are in better

locations with a stronger product offering and have higher returns.

These legal completions are expected to contribute to a stronger

profit margin. With firm control of capital employed, capital turn

is expected to improve to in excess of 1.0 in 2015. Based on stable

market conditions, the Group expects to deliver a further positive

step in 2015 towards its ambition of at least 20% return on capital

employed in 2016.

The Group anticipates 2015 being another successful year of

growth and strong returns.

Financial Review

Revenue

During 2014, the Group generated total revenue of GBP809.4

million, an increase of 46% on the previous year (2013: GBP556.0

million). Housing revenue was GBP783.6 million, 43% ahead of the

prior year (2013: GBP548.7 million) and other income was GBP4.2

million (2013: GBP4.3 million). Land sales revenue, associated with

three land sales, was GBP21.6 million in 2014, compared to one land

sale achieved in 2013 with a total revenue of GBP3.0 million.

Profit before interest and tax

The Group delivered a 66% increase in profit before interest and

tax for the year ended 31 December 2014 to GBP137.9 million (2013:

GBP83.1 million) at a net profit margin of 17.0% (2013: 14.9%).

Housing net profit margin in 2014 was 17.0% (2013: 15.0%) and

reached 17.7% in the second half of 2014.

Housing gross margin increased to 24.5% in 2014 from 23.5% in

2013, in line with the circa 1% improvement expected by the Group.

The gross margin benefited from the increased contribution from

legal completions on sites acquired post the housing market

downturn. During 2014, market sales price gains enabled the Group

to cover construction cost increases, supporting a continuing

strong profit margin.

Total gross profit was GBP197.2 million (gross margin: 24.4%),

compared with GBP130.3 million (gross margin: 23.4%) in 2013. The

profit on land sales in 2014 was GBP3.9 million (2013: GBP0.1

million).

Overheads, including sales and marketing costs, increased by 26%

in 2014, as the Group invested early to support the large number of

land assets acquired and the increased number of sales outlets. The

overheads to housing revenue ratio improved to 7.5% in 2014 from

8.5% in 2013.

Profit before tax and earnings per share

Profit before tax increased by 69% to GBP133.5 million,

comprising operating profit of GBP137.6 million, net financing

charges of GBP4.4 million and a profit from joint ventures of

GBP0.3 million. This compares to GBP78.8 million of profit before

tax in 2013, which comprised GBP82.8 million of operating profit,

GBP4.3 million of net financing charges and a profit from joint

ventures of GBP0.3 million. Basic earnings per share for the year

improved by 75% to 78.6p compared to 44.9p in 2013.

Financing

Net financing charges during 2014 were GBP4.4 million (2013:

GBP4.3 million). Net bank charges were GBP4.5 million (2013: GBP3.5

million), as a result of higher net debt during 2014 compared to

2013. The Group incurred a GBP3.0 million finance charge (2013:

GBP3.1 million charge), reflecting the imputed interest on land

bought on deferred terms. The Group also benefited from a finance

credit of GBP3.0 million (2013: GBP2.3 million) arising from the

unwinding of the discount on its available for sale financial

assets during 2014 and other credits of GBP0.1 million.

Taxation

The Group has recognised a tax charge of GBP28.3 million at an

effective tax rate of 21.2% (2013: tax charge of GBP18.7 million at

an effective rate of 23.7%). The Group has a current tax liability

of GBP14.0 million in its balance sheet as at 31 December 2014

(2013: current tax liability of GBP9.2 million).

Dividends

As previously communicated the Board will propose a 2014 final

dividend of 23.0p per share. This dividend will be paid on 22 May

2015 to holders of ordinary shares on the register at the close of

business on 27 March 2015. The dividend reinvestment plan gives

shareholders the opportunity to reinvest their dividends in

ordinary shares. Combined with the interim dividend paid of 12.0p,

the dividend for the full year totals 35.0p compared to a total of

13.5p paid in 2013, an increase of 159%.

Net assets

2014 2013

GBPm GBPm

------------------------------------------------ ------ -----

Net assets at 1 January 810.3 758.8

Profit after tax for the year 105.2 60.1

Share capital issued 0.5 1.0

Net actuarial movement on pension scheme

through reserves (5.7) 2.9

Deferred tax on other employee benefits 0.3 -

Adjustment to reserves for share based payments 0.8 0.8

Net movement in shared equity (3.5) -

Dividends paid to shareholders (28.8) (13.3)

---------------------------------------------------- ----- -----

Net assets at 31 December 879.1 810.3

---------------------------------------------------- ----- -----

As at 31 December 2014 net assets of GBP879.1 million were

GBP68.8 million higher than at the start of the year. Net assets

per share as at 31 December 2014 were 655p (2013: 604p).

Inventories increased during the year by GBP154.5 million to

GBP1,125.5 million. The value of residential land, the key

component of inventories, increased by GBP124.3 million, as the

Group invested ahead of usage. At the end of 2014, the remaining

provision held against land carried at net realisable value was

GBP12.9 million, after utilisation of GBP6.7 million during the

year. Other movements in inventories were an increase in work in

progress of GBP23.3 million and an increase in part exchange

properties of GBP6.9 million.

Trade and other receivables increased by GBP18.1 million,

primarily due to higher amounts owing from housing associations.

Trade and other payables totalled GBP360.5 million (2013: GBP242.6

million). Land creditors increased to GBP198.2 million (2013:

GBP123.8 million) with the Group taking advantage of the

opportunity to defer payments to land vendors. Trade and other

creditors increased to GBP162.3 million (2013: GBP118.8 million),

with higher build activity leading to increased amounts owed to

subcontractors and material suppliers.

Pensions

Taking into account the latest estimates provided by the Group's

actuarial advisors, the Group's pension scheme on an IAS19R basis

had a deficit of GBP0.7 million at 31 December 2014 (2013: surplus

of GBP3.2 million). Scheme assets grew over the year to GBP103.3

million from GBP94.7 million and the scheme liabilities increased

to GBP104.0 million from GBP91.5 million.

Net cash and cashflow

Having started the year with net debt of GBP18.0 million, the

Group generated an increased operating cash inflow before land

expenditure of GBP336 million (2013: GBP204 million), owing to

higher profitability and increased land recovery on record legal

completions. Net cash payments for land investment grew to GBP246

million (2013: GBP203 million), as a result of the increased land

investment offset by higher land creditors. Non-trading cash

outflow increased to GBP67 million (2013: GBP38 million) with the

greater dividend and corporation tax payments. As at 31 December

2014 the Group's net cash balance was GBP5.2 million with GBP52.3

million of cash in hand, offset by bank loans of GBP43.0 million,

GBP4.0 million of loans received from the Government and GBP0.1

million being the fair value of an interest rate swap.

At 31 December 2014, the Group had in place a committed

revolving credit facility of GBP175 million, of which GBP50 million

expires in December 2015 and GBP125 million in March 2017.

Additionally, the Group had a fully drawn three year term loan of

GBP25 million, repayable in January 2016.

Bovis Homes Group PLC

Group income statement

For the year ended 31 December 2014 2013

GBP000 GBP000

---------------------------------------- -------- --------

Revenue 809,365 556,000

Cost of sales (612,129) (425,693)

----------------------------------------- -------- --------

Gross profit 197,236 130,307

Administrative expenses (59,672) (47,476)

----------------------------------------- -------- --------

Operating profit before financing costs 137,564 82,831

Financial income 3,360 2,815

Financial expenses (7,727) (7,134)

----------------------------------------- -------- --------

Net financing costs (4,367) (4,319)

Share of profit of joint venture 287 283

Profit before tax 133,484 78,795

Income tax expense (28,276) (18,727)

----------------------------------------- -------- --------

Profit for the period attributable

to equity holders of the parent 105,208 60,068

----------------------------------------- -------- --------

Earnings per share

---------------------------------------- -------- --------

Basic 78.6p 44.9p

Diluted 78.2p 44.8p

----------------------------------------- -------- --------

Group statement of comprehensive income

For the year ended 31 December 2014 2013

GBP000 GBP000

------------------------------------------------------- ------- ------

Profit for the period 105,208 60,068

Other comprehensive income

Items that will be reclassified to profit and

loss:

Shared equity movement (2,887) -

Deferred tax on shared equity movement (621) -

Items that will not be reclassified to profit

and loss:

Actuarial (losses) / gains on defined benefit

pension scheme (7,166) 3,693

Deferred tax on actuarial movements on defined

benefit pension scheme 1,481 (748)

Total comprehensive income for the period attributable

to equity holders of the parent 96,015 63,013

--------------------------------------------------------- ------- ------

Bovis Homes Group PLC

Group balance sheet

At 31 December 2014 2013

GBP000 GBP000

------------------------------------ --------- ---------

Assets

Property, plant and equipment 13,634 13,526

Investments 8,107 5,089

Restricted cash 1,426 1,823

Deferred tax assets 2,645 1,451

Trade and other receivables 2,534 1,560

Available for sale financial assets 39,433 44,844

Retirement benefit asset - 3,237

Total non-current assets 67,779 71,530

-------------------------------------- --------- ---------

Inventories 1,125,518 971,016

Trade and other receivables 58,862 41,713

Cash and cash equivalents 52,257 12,025

Total current assets 1,236,637 1,024,754

-------------------------------------- --------- ---------

Total assets 1,304,416 1,096,284

-------------------------------------- --------- ---------

Equity

Issued capital 67,114 67,048

Share premium 213,850 213,428

Retained earnings 598,154 529,786

-------------------------------------- --------- ---------

Total equity attributable to equity

holders of the parent 879,118 810,262

-------------------------------------- --------- ---------

Liabilities

Bank and other loans 47,010 30,064

Trade and other payables 99,092 29,631

Retirement benefit obligations 668 -

Provisions 1,840 2,052

-------------------------------------- --------- ---------

Total non-current liabilities 148,610 61,747

-------------------------------------- --------- ---------

Trade and other payables 261,436 212,926

Other financial liabilities - 784

Provisions 1,236 1,411

Current tax liabilities 14,016 9,154

Total current liabilities 276,688 224,275

-------------------------------------- --------- ---------

Total liabilities 425,298 286,022

-------------------------------------- --------- ---------

Total equity and liabilities 1,304,416 1,096,284

-------------------------------------- --------- ---------

These financial statements were approved by the Board of

directors on 20 February 2015.

Bovis Homes Group PLC

Group statement of changes in equity

Total Issued Share Total

For the year ended 31 December retained capital premium

earnings

GBP000 GBP000 GBP000 GBP000

------------------------------- --------- ------- ------- -------

Balance at 1 January 2013 479,391 66,908 212,550 758,849

Total comprehensive income

and expense 63,013 - - 63,013

Issue of share capital - 140 878 1,018

Deferred tax on other employee

benefits (23) - - (23)

Share based payments 766 - - 766

Dividends paid to shareholders (13,361) - - (13,361)

Balance at 31 December

2013 529,786 67,048 213,428 810,262

------------------------------- --------- ------- ------- -------

Balance at 1 January 2014 529,786 67,048 213,428 810,262

Total comprehensive income

and expense 96,015 - - 96,015

Issue of share capital - 66 422 488

Deferred tax on other employee

benefits 304 - - 304

Share based payments 838 - - 838

Dividends paid to shareholders (28,789) - - (28,789)

Balance at 31 December

2014 598,154 67,114 213,850 879,118

------------------------------- --------- ------- ------- -------

Bovis Homes Group PLC

Group statement of cash flows

For the year ended 31 December 2014 2013

GBP000 GBP000

-------------------------------------------- -------- --------

Cash flows from operating activities

Profit for the year 105,208 60,068

Depreciation 1,853 1,180

Revaluation of available for sale financial

assets (1,288) (47)

Financial income (3,360) (2,815)

Financial expense 7,727 7,134

Profit on sale of property, plant and

equipment (115) (24)

Equity-settled share-based payment

expense 838 766

Income tax expense 28,276 18,727

Share of result of joint venture (287) (283)

(Increase) / decrease in trade and

other receivables (13,956) 28,737

Increase in inventories (154,501) (107,419)

Increase / (decrease) in trade and

other payables 116,475 (4,911)

Decrease in provisions and retirement

benefit obligations (3,795) (2,845)

--------------------------------------------- -------- --------

Cash generated from operations 83,075 (1,732)

Interest paid (3,746) (5,781)

Income taxes paid (23,708) (14,634)

--------------------------------------------- -------- --------

Net cash from operating activities 55,621 (22,147)

--------------------------------------------- -------- --------

Cash flows from investing activities

Interest received 107 269

Acquisition of property, plant and

equipment (2,084) (2,802)

Proceeds from sale of plant and equipment 238 30

Movement in loans with Joint Venture (2,751) 360

Purchase of investment in Joint Ventures (373) -

Dividends received from Joint Venture 283 267

Reduction / (investment) in restricted

cash 397 (671)

Net cash from investing activities (4,183) (2,547)

--------------------------------------------- -------- --------

Cash flows from financing activities

Dividends paid (28,789) (13,361)

Proceeds from the issue of share capital 488 1,018

Increase in borrowings 17,095 24,666

Net cash from financing activities (11,206) 12,323

--------------------------------------------- -------- --------

Net increase / (decrease) in cash and

cash equivalents 40,232 (12,371)

Cash and cash equivalents at 1 January 12,025 24,396

--------------------------------------------- -------- --------

Cash and cash equivalents at 31 December 52,257 12,025

--------------------------------------------- -------- --------

Notes to the financial statements

1 Basis of preparation

Bovis Homes Group PLC ('the Company') is a company domiciled in

the United Kingdom. The consolidated financial statements of the

Company for the year ended 31 December 2014 comprise the Company

and its subsidiaries (together referred to as 'the Group') and the

Group's interest in associates and joint ventures.

The consolidated financial statements were authorised for issue

by the directors on 20 February 2015. The financial statements were

audited by KPMG LLP.

The financial information set out above does not constitute the

company's statutory financial statements for the years ended 31

December 2014 or 2013 but is derived from those financial

statements. Statutory financial statementsfor 2013 have been

delivered to the registrar of companies, and those for 2014 will be

delivered in due course. The auditors have reported on those

financial statements; their reports were (i) unqualified, (ii) did

not include a reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

The consolidated financial statements have been prepared in

accordance with IFRS as adopted by the EU, and the accounting

policies have been applied consistently for all periods presented

in the consolidated financial statements.

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses. The estimates and

associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements about carrying values of assets and liabilities that are

not readily apparent from other sources. Actual results may differ

from these estimates.

2 Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries) made up to 31 December. Control is achieved

where the Company has the power to govern the financial and

operating policies of an entity so as to obtain benefits from its

activities. The existence and effect of potential voting rights

that are currently exercisable or convertible are considered when

assessing whether the Group controls another entity. The financial

statements of subsidiaries are included in the consolidated

financial statements from the date that control commences until the

date that control ceases.

Associates are those entities in which the Group has significant

influence, but not control, over the financial and operating

policies. The consolidated financial statements include the Group's

share of the total recognised gains and losses of associates on an

equity accounted basis, from the date that significant influence

commences until the date that significant influence ceases.

Joint ventures are those entities in which the Group has joint

control over the financial and operating policies. The consolidated

financial statements include the Group's share of the total

recognised gains and losses of joint ventures on an equity

accounted basis, from the date that joint control commenced until

joint control ceases.

3 Accounting policies

There have been no changes to the Group's accounting policies.

These accounting policies will be disclosed in full within the

Group's forthcoming financial statements.

4 Reconciliation of net cash flow to net cash / (debt)

2014 2013

GBP000 GBP000

------------------------------------- ------- -------

Net increase / (decrease) in net

cash and cash equivalents 40,232 (12,371)

Increase in borrowings (17,095) (24,546)

Fair value adjustments to interest

rate swaps 149 209

Fair value adjustment to interest

free loans - (121)

Net (debt) / cash at start of period (18,039) 18,790

-------------------------------------- ------- -------

Net cash / (debt) at end of period 5,247 (18,039)

-------------------------------------- ------- -------

Analysis of net cash / (debt):

Cash and cash equivalents 52,257 12,025

Unsecured loans (46,951) (29,856)

Fair value of interest rate swaps (59) (208)

Net cash / (debt) 5,247 (18,039)

-------------------------------------- ------- -------

5 Income taxes

Current tax

Current tax is the expected tax payable or receivable on the

taxable income or loss for the year, calculated using a corporation

tax rate of 21.5% applied to the pre-tax income or loss, adjusted

to take account of deferred taxation movements and any adjustments

to tax payable for previous years. Current tax receivable for

current and prior years is classified as a current asset.

6 Dividends

The following dividends were declared by the Group:

2014 2013

GBP000 GBP000

Prior year final dividend per share

of 9.5p (2013: 6.0p) 12,715 8,010

Current year interim dividend per share

of 12.0p (2013: 4.0p) 16,074 5,351

------------------------------------------ ------ ------

Dividends declared 28,789 13,361

------------------------------------------ ------ ------

The Board has decided to propose a final dividend of 23.0p per

share in respect of 2014.

7 Earnings per share

Basic earnings per share

The calculation of basic earnings per share at 31 December 2014

was based on the profit attributable to ordinary shareholders of

GBP105,208,000 (2013: GBP60,068,000) and a weighted average number

of ordinary shares outstanding during the year ended 31 December

2014 of 133,902,247 (2013: 133,643,311), calculated as follows:

Profit attributable to ordinary shareholders

2014 2013

GBP000 GBP000

------------------------------------ -------- -------

Profit for the period attributable

to ordinary shareholders 105,208 60,068

Weighted average number of ordinary shares

2014 2013

------------------------------------- ------------ ------------

Issued ordinary shares at 1 January 133,643,311 133,294,726

Effect of own shares held (241,111 ) (288,388 )

Effect of shares issued in year 500,047 636,973

------------------------------------- ------------ ------------

Weighted average number of ordinary

shares at 31 December 133,902,247 133,643,311

------------------------------------- ------------ ------------

Diluted earnings per share

The calculation of diluted earnings per share at 31 December

2014 was based on the profit attributable to ordinary shareholders

of GBP105,208,000 (2013: GBP60,068,000) and a weighted average

number of ordinary shares outstanding during the year ended 31

December 2014 of 134,573,167 (2013: 133,933,279).

The average number of shares is increased by reference to the

average number of potential ordinary shares held under option

during the period. This reflects the number of ordinary shares

which would be purchased using the aggregate difference in value

between the market value of shares and the share option exercise

price. The market value of shares has been calculated using the

average ordinary share price during the period. Only share options

which have met their cumulative performance criteria have been

included in the dilution calculation.

Weighted average number of ordinary shares (diluted)

2014 2013

---------------------------------------- ------------ ------------

Weighted average number of ordinary

shares at 31 December 133,902,247 133,643,311

Effect of share options in issue which

have a dilutive effect 670,920 289,968

---------------------------------------- ------------ ------------

Weighted average number of ordinary

shares (diluted) at 31 December 134,573,167 133,933,279

---------------------------------------- ------------ ------------

8 Circulation to shareholders

The consolidated financial statements will be sent to

shareholders on or about 23 March 2015. Further copies will be

available on request from the Company Secretary, Bovis Homes Group

PLC, The Manor House, North Ash Road, New Ash Green, Longfield,

Kent, DA3 8HQ.

Further information on Bovis Homes Group PLC can be found on the

Group's corporate website www.bovishomesgroup.co.uk, including the

slide presentation document which will be presented at the Group's

results meeting on 23 February 2015.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR TMMLTMBTTBFA

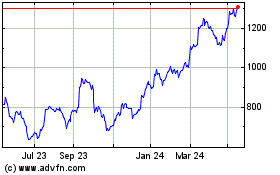

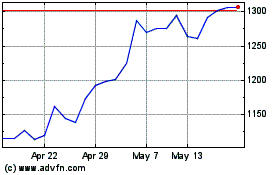

Vistry (LSE:VTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vistry (LSE:VTY)

Historical Stock Chart

From Jul 2023 to Jul 2024