TIDMWTI

RNS Number : 5315V

Weatherly International PLC

15 January 2013

Weatherly International Plc

Quarterly Operations and Production Update

Weatherly International Plc ("Weatherly" or "the Company") is

pleased to present its quarterly update for the second quarter of

its 2012/13 fiscal year.

Highlights

-- Bankable Feasibility Study ("BFS") for the Tschudi Copper Project completed.

-- $88m project financing term sheet signed with RK Capital

covering 100% debt funding of project.

-- Tschudi financing due diligence underway.

-- Preliminary work on the expansion of Central Operations into Old Matchless started.

-- Second quarter production from Central Operations was 5,780

tonnes of copper concentrate containing 1,328 tonnes of copper

metal, produced at a higher than budgeted head grade and

recovery.

Rod Webster CEO of Weatherly commented:

"Weatherly is moving into a significant period in the Company's

life. The progression of the Tschudi Project is set to transform

the Company from a junior to a mid-sized copper producer.

2012 was a very successful year for Weatherly. Not only did we

announce a substantial profit for the fiscal year ended in June

2012, but most importantly we completed the BFS for Tschudi which

will put us onto a growth trajectory over the coming years.

The Central Operations continue to serve their original

strategic purpose of providing Weatherly with a platform to

generate cashflow, enabling us to pull together a strong operating

base and establish a team of people capable of driving the business

through its next stage of growth. Old Matchless offers us an

additional opportunity to reduce our unit costs and give our

operating revenues a significant boost through increased copper

production. We are looking forward to driving the business through

an exciting period in 2013."

Tschudi Copper Project

The Company completed the BFS for the Tschudi Copper Project.

The study evaluated an open-pit, heap leach, solvent extraction,

electro-winning project capable of producing 17,000tpa of copper

with an 11 year mine life.

The key elements of the BFS are:

Production

Mine type Open pit

Resources 50.1mt at 0.86% Cu

Reserve 22.7mt at 0.95% Cu

Mining rate 17mt/yr

Mine life 11 years

Stripping ratio 7.45/1

Processing method Solvent Extraction, Electro-Winning

(SX-EW)

Processing rate 2.0-2.6mt/yr ore

Recovered copper 184,275t

Annual production 17,000t/yr

Financial

Initial capital $N693m (US$81m)

Life of mine capital $N941m (US$109m)

Life of min cash cost (C1) US$4,267/t Cu (US$1.94/lb)

After tax NPV (8%) - Consensus Case(1) $N915m (US$105m)

After tax IRR - Consensus Case(1) 32.1%

Payback from start of production 2.43 yrs

After tax NPV (8%) - Alternative Case(2) $N2,055m (US$238m)

After Tax IRR - Alternative Case(2) 50.8%

Payback from start of production 1.98 yrs

(1) Consensus Case - uses industry consensus forecasts for

exchange rates and copper price.

(2) Alternative Case - uses exchange rates and copper price as

at December 2012.

Subsequent to the completion of the BFS the Company has signed a

term sheet for an US$88m project financing facility with RK

Capital. The financing agreement is subject to due diligence, which

commenced this month.

Reopening Old Matchless

During the quarter the Weatherly Board approved a work program

for the development of the Old Matchless Mine, which will

effectively double the production of an asset with an already sound

operating base. It will also enable the company to make increased

use of the underutilised Otjihase concentrator and reduce the per

unit cash cost of production at Central Operations.

Production

Production results for the quarter are set out in the table

below.

Quarter Quarter Quarter

Quarter to to 30 Jun to 30 Sep to 31 Dec

31 Mar 2012 2012 2012 2012

Ore Treated (t) 82,558 85,153 87,645 79,330

Grade (%) 1.58 1.66 1.8 1.81

Recovery (%) 92.98 91.52 93.31 92.58

Copper concentrate

(t) 5,148 5,605 6,499 5,780

Copper contained

(t) 1,214 1,292 1,470 1,328

Central Operations

Quarterly production from Central Operations was 5,780 tonnes of

copper concentrate containing 1,328 tonnes of copper. Production

was adversely affected by poor mechanical availability and the

shorter working month in December. Mined grades and metal recovery

remained strong with cash costs largely unchanged from the previous

quarter at US$5,829/t copper.

Commercial

During the quarter, the Company delivered 1,341 tonnes of copper

contained in 5,840 tonnes of concentrate to metal trader Louis

Dreyfus at a weighted average price of US$ 8,438 /t copper. The

Company continues to maintain its policy of forward selling a

portion of its production up to 18 months ahead.

As at 31 December 2012, the Company had:

(1) cash at bank of US$3.5m equivalent*

(2) reduced its loan with Louis Dreyfus to US$4.4m, having made

loan repayments of US$0.4m in the quarter

(3) forward contracts over 3,600 tonnes copper at an average price of US$7,877 /t

The Company's next quarterly operations and production update

will be on 16(th) April 2013.

* not directly comparable with previous quarters as creditors

were paid early for Christmas and sales normally received during

the month moved to January.

About Weatherly

Weatherly is an AIM listed, copper focused mining company, the

principal assets of which are located in Namibia. It currently has

two producing copper mines (Otjihase and Matchless), and has

recently completed a bankable feasibility study for the Tschudi

Copper Project. These assets will enable Weatherly to achieve its

medium term strategy of establishing a copper mining business

capable of sustaining approximately 20,000tpa of copper at industry

average costs of production.

The Company also has a 25% stake in an AIM listed company, China

Africa Resources Plc (CAF), which is currently focused on the

development of a lead/zinc project at Berg Aukas in Northern

Namibia.

For further information please contact:

Weatherly International Plc +44 (0) 20 7917 2989

Rod Webster, Chief Executive Officer

Dean Friday, Investor Relations

Canaccord Genuity Limited +44 (0) 20 7523 8000

Andrew Chubb, Sebastian Jones

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBIGDBSBBBGXS

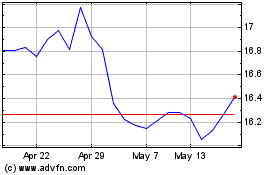

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Jun 2024 to Jul 2024

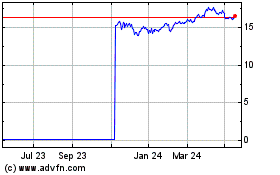

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Jul 2023 to Jul 2024