TIDMZEN

RNS Number : 1157X

Zenith Energy Ltd

17 December 2019

December 17, 2019

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR"). Upon

publication of this announcement via a regulatory information

service ("RIS"), the inside information contained in this document

is now considered to be in the public domain.

ZENITH ENERGY LTD.

("Zenith" or the "Company")

Private Placement in Norway

Zenith Energy Ltd., ("Zenith" or the "Company"), (LSE: ZEN;

TSX.V: ZEE; OSE: ZENA-ME), the international oil & gas

production company, is pleased to announce a Private Placement

("Private Placement") on the Merkur Market of the Oslo Stock

Exchange.

The Company has successfully raised gross proceeds of NOK

7,700,000 (approximately GBP638,000 or CAD$1,123,430) to subscribe

for 35,000,000 common shares of no par value in the capital of the

Company ("New Common Shares") at a price of NOK 0.22 per New Common

Share (approximately GBP0.02 or CAD$0.03).

Payment and issue of the New Common Shares to complete the

Private Placement is expected on or around December 18, 2019, and

an update will be provided upon completion.

The Private Placement attracted strong interest from both

private and institutional investors.

Zenith intends to use the net proceeds of the Private Placement

to purchase drilling equipment and to provide additional general

working capital.

The Private Placement is subject to approval from the TSX

Venture Exchange.

Director Dealing/ PDMR Shareholding

Mr. Andrea Cattaneo, Chief Executive Officer & President of

Zenith, has advised the Company that, in relation to the

aforementioned Private Placement, he subscribed 8,500,000 common

shares of no par value ("Common Shares") in the capital of the

Company.

Following the aforementioned dealing, Mr. Cattaneo is directly

beneficially interested in a total of 35,334,115 Common Shares in

the capital of the Company, representing 7.8 per cent of the total

issued and outstanding common share capital of the Company admitted

to trading on the TSX Venture Exchange and Merkur Market of the

Oslo Stock Exchange.

Mr. Cattaneo is also indirectly interested in a total of 480,000

Common Shares, today representing 0.11 per cent of the Company's

issued and outstanding common share capital admitted to trading on

the TSX Venture Exchange and Merkur Market of the Oslo Stock

Exchange.

Total Voting Rights

The Company wishes to announce, in accordance with the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules, the

following information following Admission of the Common Shares

issued in the Placing.

Class of share Total number Number of Total number

of shares voting rights of voting rights

per share per class of

share

Common Shares

in issue and

admitted to trading

on the Main Market

of the London

Stock Exchange 277,403,856 1 277,403,856

--------------- ---------------- -------------------

Common Shares

in issue and

admitted to trading

on the TSXV 451,543,509 1 451,543,509

--------------- ---------------- -------------------

Common Shares

in issue and

admitted to trading

on the Merkur

Market of the

Oslo Børs 451,543,509 1 451,543,509

--------------- ---------------- -------------------

No Common Shares are held in treasury. The above figure for

total number of Common Shares may be used by shareholders in the

Company as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as such term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Further Information:

Zenith Energy Ltd

Andrea Cattaneo, Chief Executive Tel: +1 (587) 315 9031

Officer

-----------------------------

E-mail: info@zenithenergy.ca

-----------------------------

Peterhouse Capital - Joint Broker Tel: + 44 (0) 207 469

0930

-----------------------------

Lucy Williams

-----------------------------

Charles Goodfellow

-----------------------------

Novum Securities Limited - Joint Tel: + 44 (0) 207 399

Broker 9400

-----------------------------

Charlie Brook-Partridge

-----------------------------

Hugh McAlister

-----------------------------

IFC Advisory Limited - Financial Tel: + 44 (0) 203 934

PR & IR 6630

-----------------------------

Graham Herring

-----------------------------

Zach Cohen

-----------------------------

Notes to Editors:

Zenith Energy Ltd. is an international oil and gas production

company, listed on the TSX Venture Exchange (TSX.V:ZEE) and London

Stock Exchange (LSE:ZEN). In addition, the Company's common share

capital was admitted to trading on the Merkur Market of the Oslo

Børs (ZENA:ME) on November 8, 2018. The Merkur Market is a

multilateral trading facility owned and operated by the Oslo

Børs.

The Company was assigned a medium to long-term issuer credit

rating of "B+ with Positive Outlook" on October 9, 2019 by Arc

Ratings, S.A. On November 18, 2019, the Company was assigned a "B+"

with Stable Outlook debt issuer credit rating by Rating-Agentur

Expert RA.

The Company operates the largest onshore oilfield in Azerbaijan

by cumulative acreage following the signing of a 25-year REDPSA,

(Rehabilitation, Exploration, Development and Production Sharing

Agreement), with SOCAR, State Oil Company of the Republic of

Azerbaijan, in 2016.

The Company's primary focus is the development of its Azerbaijan

operations by leveraging its technical expertise and financial

resources to maximise low-cost oil production via a systematic

field rehabilitation programme intended to achieve significantly

increased revenue. Zenith also operates, or has working interests

in, a number of natural gas production concessions in Italy. The

Company's Italian operations produce natural gas, condensate and

electricity.

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Andrea Cattaneo

---------------------------------------- ---------------------------------------

2 Reason for the notification

---------------------------------------------------------------------------------

a) Position/status Chief Executive Officer & President

---------------------------------------- ---------------------------------------

b) Initial notification/Amendment Initial Notification

---------------------------------------- ---------------------------------------

3 Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor

---------------------------------------------------------------------------------

a) Name Zenith Energy Ltd.

---------------------------------------- ---------------------------------------

b) LEI 213800AYTYOYD61S4569

---------------------------------------- ---------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each place

where transactions have been conducted

---------------------------------------------------------------------------------

a) Description of the Common Shares

financial instrument,

type of instrument

---------------------------------------- ---------------------------------------

Identification code CA98936C1068

---------------------------------------- ---------------------------------------

b) Nature of the transaction Purchase of Common Shares

---------------------------------------- ---------------------------------------

c) Price(s) and volumes(s) Price(s) Volume(s)

---------------------------------------- ------------------- ------------------

NOK 0.22 8,500,000

----------------------------------------------------------------- ------------------

d) Date of the transaction(s) December 16, 2019

---------------------------------------- ---------------------------------------

e) Place of the transaction Merkur Market, Oslo Stock Exchange

---------------------------------------- ---------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEQDLBFKLFEFBD

(END) Dow Jones Newswires

December 17, 2019 02:00 ET (07:00 GMT)

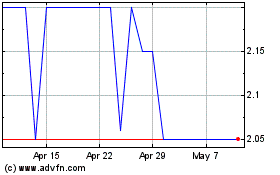

Zenith Energy (LSE:ZEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

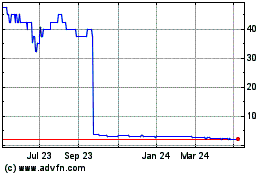

Zenith Energy (LSE:ZEN)

Historical Stock Chart

From Jul 2023 to Jul 2024