TIDMZEN

RNS Number : 6848A

Zenith Energy Ltd

30 September 2020

September 30, 2020

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR"). Upon

publication of this announcement via a regulatory information

service ("RIS"), the inside information contained in this document

is now considered to be in the public domain.

ZENITH ENERGY LTD.

("Zenith" or the "Company")

Preliminary unaudited financial results for the year ended March

31, 2020

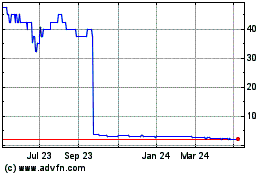

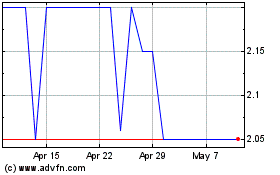

Zenith Energy Ltd. ("Zenith" or the "Company") (LSE: ZEN; OSE:

ZENA-ME), the listed international oil & gas production company

focused on pursuing African development opportunities, is pleased

to announce its preliminary unaudited consolidated financial

results for the year ended March 31, 2020.

Following consultations with its independent auditor, PKF

LittleJohn, and a result of the imminent potential award of a new

25-year license in the Republic of the Congo for the Tilapia

oilfield, the Company will publish its audited financial results

for the year ended March 31, 2020 around the week starting October

19, 2020.

Zenith can also confirm that it has engaged the auditors to

perform an ISRE 2410 review on the interim financial statements for

the six months ended September 30, 2020.

Further, the Company is in the process of engaging a Big 4

accounting firm to perform a Purchase Price Allocation exercise

("PPA") in respect of the acquisition of Anglo African Oil &

Gas Congo S.A.U ("AAOG Congo").

Shareholders are cautioned not to place undue reliance on these

preliminary results as material differences may arise once the

audited financial results are published.

The Company and its subsidiaries have been impacted by the

COVID-19 pandemic and continue to be affected. The pandemic has

caused problems with international travel and in the availability

of appropriate individuals both within the Company and among

suppliers and government-sector bodies with which it interacts. In

addition, the sharp decline in world economic output as a result of

the pandemic, has had a negative impact on oil prices and demand

for oil products. While the Board believes matters will improve

substantially in the future as the effects of the COVID-19 pandemic

are progressively overcome, there remains a material possibility

that the pandemic situation may deteriorate further, which would

impact the financial situation of the Company.

Commenting on the results, Mr. Andrea Cattaneo, Chief Executive

Officer, stated:

"We are pleased to have achieved significant reductions in our

G&A expenses for the year ended March 31, 2020.

These results also reflect the reconfiguration of the Company's

geographic footprint following the cessation of oil production

activities in Azerbaijan and our new focus on acquiring onshore oil

production and development assets in Africa.

We are fully confident our recently announced acquisitions will

strongly position the Company, especially in terms of

profitability, when oil prices progressively recover with a return

to normalised worldwide economic activity following the progressive

alleviation of the COVID-19 pandemic.

In agreement with our independent auditors, we have delayed the

publication of our audited financial results for the year ended

March 31, 2020 whilst we await a final decision from the Ministry

of Hydrocarbons of the Republic of the Congo in response to our

comprehensive technical and commercial offer for a new 25-year

license for the Tilapia oilfield.

I look forward to reporting on our exciting progress in due

course."

Further Information:

Zenith Energy Ltd

Andrea Cattaneo, Chief Executive Officer Tel: +1 (587) 315 9031

-----------------------------

E-mail: info@zenithenergy.ca

-----------------------------

Allenby Capital Limited - Financial

Adviser & Broker

-----------------------------

Nick Harriss Tel: + 44 (0) 203 328

Nick Athanas 5656

-----------------------------

Notes to Editors :

Zenith Energy Ltd. is an international oil and gas production

company, listed on the London Stock Exchange (LSE:ZEN) and the

Merkur Market of the Oslo Stock Exchange (ZENA:ME).

Zenith's development strategy is to identify and rapidly seize

value-accretive hydrocarbon production opportunities in the onshore

oil & gas sector, specifically in Africa. The Company's board

of directors and senior management team have the experience and

technical expertise to develop the Company successfully.

Chairman's statement

Introduction

In the year ended March 31, 2020, a number of material changes

took place with regards to the Company's development strategy and

geographic concentration.

The Company is pursuing an ambitious acquisition campaign in

Africa by maximizing the use of its financial resources to enrich

its portfolio, at a time of singular opportunity made possible by

the significant decline in oil prices caused by the COVID-19

pandemic, to acquire highly prospective production, development and

exploration assets in Tunisia and the Republic of the Congo.

The Board believes this strategy will enable Zenith to develop

successfully and, in doing so, create value for all

stakeholders.

New African development strategy

On March 2, 2020, the Company announced that, in view of

Zenith's strategic focus on pursuing large-scale oil production and

development opportunities in Africa, it would return the Contract

Rehabilitation Area ("CRA") to SOCAR.

The Company's publicly reported difficulties in increasing

production from the CRA since 2016, as well as its past and future

investment obligations, led the Board of Directors to unanimously

agree, in the interest of shareholders, that the Company's future

success could be better achieved in other assets with existing

production and near-term development and exploration potential in

Africa.

The low oil price environment has facilitated access to a number

of highly attractive acquisition opportunities as a result of large

international oil companies restructuring their portfolios and

selling, at advantageous commercial terms, their working interests

in small to medium size assets across the region.

Zenith's recent acquisitions in Tunisia from KUFPEC and CNPC,

two world-renowned oil companies, are evidence of this strategy

being implemented. Upon completion, conditional upon regulatory

approval being granted by the Comité Consultatif des Hydrocarbures

("CCH") of the Republic of Tunisia, it is expected that Zenith will

have a daily production ranging between 250-300 barrels of oil per

day. The Board of Directors is highly satisfied with the commercial

terms agreed for both transactions and is currently exploring

further opportunities of this kind.

The acquisition of Anglo African Oil & Gas Congo S.A.U

("AAOG Congo") from AAOG plc (a company quoted on the AIM of the

London Stock Exchange), the former operator of the highly

prospective Tilapia license in the Republic of the Congo,

represents a potentially transformational opportunity for the

Company. The Board is pleased to have been able to renegotiate the

initially agreed consideration of GBP1 million for an 80% interest

(announced on December 27, 2020) to a final consideration of

GBP200,000 for a 100% interest in AAOG Congo (announced on April

17, 2020). The acquisition of AAOG Congo has not only enabled

Zenith to acquire an existing operator in the Republic of the

Congo, but also US$5.3 million in receivables owed to AAOG Congo by

Société Nationale des Pétroles du Congo ("SNPC"), the national oil

company of the Republic of the Congo, and the novation to Zenith of

100% of the inter-company loans between AAOG Congo and AAOG plc,

equivalent to approximately to approximately GBP12.5 million as of

the date of completion of the acquisition.

As publicly announced, the Company has submitted a comprehensive

commercial and technical offer to the Ministry of Hydrocarbons of

the Republic of the Congo for the award of a new 25-year license

for the Tilapia oilfield. The Company has established Zenith Energy

Congo SA ("Zenith Congo"), at the request of the Ministry of

Hydrocarbons of the Republic of the Congo, for the purpose of

participating in the bid process and, it is hoped, receive a new

25-year license for the Tilapia oilfield.

We thank shareholders for their support during what have been

unprecedented times and we look forward with enthusiasm to

delivering on our publicly announced objectives.

Dr. JOSÉ RAMÓN LÓPEZ-PORTILLO

Chairman

September 30, 2020

Production activities

During the financial year ended March 31, 2020, the Group:

a) Produced 74,290 bbls of oil from its assets in Azerbaijan, as

compared to 85,524 bbls of oil produced in the 2019 similar

period.

b) Sold 70,005 bbls of oil from its assets in Azerbaijan, as

compared to 75,913 bbls of oil sold in the 2019 similar period. As

at March 31, 2020, inventory consists of CAD $264 (2019 - CAD $nil)

of crude oil that has been produced but not yet sold, and CAD

$1,623k of materials (2019 - CAD $156k ).

c) Sold 17,666 mcf of natural gas from its Italian assets, as

compared to 10,868 mcf of natural gas in the 2019 similar

period.

d) Sold 10,500 MWh of electricity from its Italian electricity

production assets, as compared to 9,433 MWh for the corresponding

period of 2019.

e) Sold 214 bbls of condensate from its Italian assets, as

compared 628 bbls of condensate in the 2019 similar period.

Financing activities

The Company issued equity during the course of the financial

year ended March 31, 2020, raising a combined net total of

CAD$20.226m to finance its operational activities and fund the

purchase of key operational equipment for the development of its

operational activities in Azerbaijan.

During the year, 316,645,857 new common shares were issued, as

detailed in the financial statements (note 15).

On January 20, 2020, the Company announced the issuance of the

following unsecured, multi-currency Euro Medium Term Notes at par

value (the "Notes"):

-- EURO 1,000,000 bearing an interest of 10.125 per cent per year (the "EUR-Notes")

-- GBP 1,000,000 bearing an interest of 10.50 per cent per year (the "GBP-Notes")

-- USD 1,000,000 bearing an interest of 10.375 per cent per year (the "USD-Notes")

-- CHF 1,000,000 bearing an interest of 10.00 per cent per year (the "CHF-Notes")

The Notes were issued under Zenith's EUR 25,000,000

multi-currency Euro Medium Term Notes Programme, as announced by

the Company on November 6, 2019, and will be due on January 27,

2024. The Notes were admitted to trading on the Third Market (MTF)

of the Vienna Stock Exchange ("Wiener Borse AG").

The Notes are governed by Austrian law and, since the Notes are

not convertible into equity of Zenith, the issuance of the Notes

was not subject to the approval of the TSX Venture Exchange in

Canada.

The issue of the Notes is aligned with the Company's strategy of

diversifying its financing towards non-equity dilutive funding to

support its successful development.

Financial Results

The Group recorded an after-tax loss of CAD$562,551k for the

year ended March 31, 2020, compared to a loss of CAD$9,762k for the

year ended March 31, 2019.

Group production costs for the year were CAD$1,626k, compared to

CAD$4,900k in 2019.

Net finance income for the year was CAD$ 35k (2019: CAD$1,188k

expense).

Cash balances of CAD$ 1,209k (2019: CAD$3,058k) were held at the

end of the financial year.

Total equity attributable to the ordinary shareholders of the

Group was CAD$ 17,632k as at March 31, 2020, (2019: CAD$ 569,081k

).

Post Balance Sheet Events

The Group continued it financing activities through issuing

465,000,000 shares, with gross proceeds of CAD$5,022k.

Details of the capital raising are available in note 29 to the

Financial Statements.

-- On April 17, 2020, the Company announced that it has

successfully renegotiated the terms for the acquisition from AIM

listed Anglo African Oil & Gas plc ("AAOG") of its fully owned

subsidiary in the Republic of the Congo, Anglo African Oil &

Gas Congo S.A.U, ("AAOG Congo") which has a 56 per cent. majority

interest in, and is the operator of, the Tilapia oilfield in the

Republic of the Congo (the "License").

The Company entered into a new conditional Deed of Variation

(the "Deed of Variation") which included the acquisition of a 100

per cent interest in AAOG Congo and related intercompany loans (the

"Acquisition") for a revised total consideration of GBP200,000

("Revised Consideration").

-- On April 20, 2020, the Company announced that its newly

created wholly owned subsidiary Zenith Energy Netherlands B.V.

("Zenith Netherlands") has signed a conditional sale and purchase

agreement ("SPA") with KUFPEC (Tunisia) Limited ("Seller"), a 100%

subsidiary of Kuwait Foreign Petroleum Exploration Company K.S.C.C,

a subsidiary of the State of Kuwait's national oil company, for the

acquisition of a working interest in, inter alia, the North

Kairouan permit and the Sidi El Kilani Concession (the "Tunisian

Acquisition"), which contains the Sidi El Kilani oilfield

("SLK").

The Seller holds an undivided 22.5% interest in the Tunisian

Acquisition, together with 25 Class B shares in Compagnie

Tuniso-Koweito-Chinoise de Pétrole (CTKCP), the operator,

representing 22.5% of the issued share capital of the company.

The Seller agreed to sell, assign and transfer to Zenith

Netherlands the Tunisian Acquisition on the terms and subject to

the conditions set out in the SPA.

The consideration payable by Zenith Netherlands under the SPA

was US$500,000.

-- On April 22, 2020, the Company announced the total repayment

of the Loan Facility for US$1,485,000 and accrued interest.

The amount of the principal, and related accrued interest, of

the Loan Facility is represented and accounted as a liability in

the audited Annual Financial Report of the Company as of March 31,

2019, and in the unaudited Q2 Financial Statements as of September

30, 2019, for an aggregate amount of US$2,080,523.

On October 1, 2019, the Company announced that, following

negotiations with the lender, it had successfully agreed to settle

the aforementioned liability for a reduced amount of US$1,000,000,

representing a profit of US$1,080,523.

The Company subsequently confirmed that the liability had been

settled in full.

-- On May 5, 2020, the Company announced the successful

completion of the acquisition from AIM listed Anglo African Oil

& Gas plc ("AAOG") of a 100 percent interest in its fully owned

subsidiary in the Republic of the Congo, Anglo African Oil &

Gas Congo S.A.U ("AAOG Congo"), which has a 56 percent majority

interest in, and is the operator of, the Tilapia oilfield.

In accordance with the terms of the amended share purchase

agreement, completion ("Completion") has taken place within one

business day of AAOG shareholder approval being obtained at the

AAOG general meeting held yesterday, May 4, 2020.

-- On May 28, 2020, the Company announced the TSX Venture

Exchange ("TSX-V") has confirmed that effective at the close of

business Friday, May 29, 2020, the common shares of the Company

will be delisted from the TSX-V at Zenith's request.

-- On June 11, 2020, the Company announced that it has made

payment for a total of US$250,000 to Kuwait Foreign Petroleum

Exploration Company K.S.C.C ("KUFPEC"), a subsidiary of the State

of Kuwait's national oil company, in relation to the acquisition of

a 22.5% working interest in the North Kairouan permit and the Sidi

El Kilani Concession (the "Tunisian Acquisition"), which contains

the Sidi El Kilani oilfield ("SLK").

Completion of the Tunisian Acquisition remains conditional on

approval being granted by the Comité Consultatif des Hydrocarbures

of the Republic of Tunisia in respect of the transfer of the

Seller's right, title and interest in and under the Tunisian

Acquisition to Zenith Netherlands. Zenith has initiated the

necessary formalities in relation to the aforementioned approval

process, and that a decision is expected in due course.

-- On June 25, 2020, the Company announced it completed the

handover process (the "Handover") of the Contract Rehabilitation

Area to SOCAR in the Republic of Azerbaijan. As a result of the

Handover, Zenith has ceased all oil production operations in

Azerbaijan and all field production personnel, approximately 170

employees, have been transferred to a division of SOCAR.

-- On July 7, 2020, the Company announced that it has entered

into a joint venture agreement (the "Agreement") with a local oil

& gas company in the Republic of the Congo.

The primary objective of the Agreement is the potential

acquisition of an onshore oil production license (the "Potential

Acquisition"), last producing at a rate of approximately 300

barrels of oil per day from the regionally proven Mengo formation

as recently as 2019. Production has currently been suspended

pending the assignation of a new license.

The Potential Acquisition is located in the Kouilou region of

the Republic of the Congo in proximity of Pointe-Noire, the

country's second largest city, and is also in the vicinity of

Tilapia, the Company's recently acquired oil production asset with

transformational production potential.

Under the terms of the Agreement, the Company and its local

partner will jointly submit an application to the relevant

authorities in the Republic of the Congo, including the Ministry of

Hydrocarbons, for the award of a new license in relation to the

Potential Acquisition.

Further, in accordance with the Agreement, it is stipulated that

Zenith shall have the role of joint operator and majority partner

in the event that a new license is successfully obtained in

relation to the Potential Acquisition.

Following preliminary technical analysis of the Potential

Acquisition, as part of the due diligence activities conducted

prior to entering into the Agreement, Zenith is confident that

profitable oil production operations can be achieved following the

reactivation of the Potential Acquisition and the performance of

targeted, low-intensity workover activities.

-- On July 31, 2020, the Company announced the termination, by

mutual agreement between the parties, of the sale and purchase

agreement entered into with Coro Energy plc ("Coro") relating to

the proposed acquisition by Zenith of Coro's entire Italian natural

gas production and exploration portfolio.

-- On August 10, 2020, the Company announced it had incorporated

Zenith Energy Congo SA ("Zenith Congo"), a fully owned subsidiary

of the Company, created under the laws of the Republic of Condo.

Zenith Congo has been established at the request of the Ministry of

Hydrocarbons for the purpose of receiving a new 25-year license

following the submission of a comprehensive commercial and

technical offer (the "Offer") to the Ministry of Hydrocarbons of

the Republic of the Congo for the award of a new 25-year license

for the Tilapia oilfield to be named "Tilapia II". As a result, and

in agreement with the Ministry of Hydrocarbons, the Company has

terminated the Plan for the Continuation of Activities, first

announced to the market on July 20, 2020, and returned operatorship

of the Tilapia license from AAOG Congo to a subsidiary of SNPC. It

is planned that, in the event the Offer is accepted by the Ministry

of Hydrocarbons of the Republic of the Congo, the new operator of

Tilapia II will be Zenith Congo.

-- On August 26, 2020, the Company announced that BCRA Credit

Rating Agency AD ("BCRA") has assigned Zenith a "B-" with Stable

Outlook long-term debt issuer credit rating.

-- On September 8, 2020, the Company announced that its wholly

owned subsidiary Zenith Energy Netherlands B.V. ("Zenith

Netherlands") had signed a conditional sale and purchase agreement

("SPA") with CNPC International (Tunisia) Ltd., ("Seller"), a 100%

subsidiary of CNPCI, CNPC International Ltd., for the acquisition

of a working interest in, inter alia, the North Kairouan permit and

the Sidi El Kilani Concession (the " Tunisian Acquisition"), which

contains the Sidi El Kilani oilfield ("SLK").

The Seller holds an undivided 22.5% interest in the Tunisian

Acquisition, together with 25 Class B shares in Compagnie

Tuniso-Koweito-Chinoise de Pétrole (CTKCP), the operator,

representing 25% of the issued share capital of the company.

The Seller agreed to sell, assign and transfer to Zenith

Netherlands the Tunisian Acquisition on the terms and subject to

the conditions set out in the SPA.

The consideration payable by Zenith Netherlands under the terms

of the SPA was US$300,000 (the "Consideration").

Completion of the SPA is conditional on approval being granted

by the Comité Consultatif des Hydrocarbures ("CCH") of the Republic

of Tunisia in respect of the transfer of the Seller's right, title

and interest in and under the SLK Concession to Zenith Netherlands

("Completion").

CEO Statement

Zenith Energy Ltd. ("Zenith" or the "Group") is an international

oil and gas production Group, incorporated in Canada, listed on the

Main Market for listed securities of the London Stock Exchange

under the ticker symbol "ZEN" and on the Merkur Market of the Oslo

Stock Exchange under the ticker "ZENA:ME".

Zenith's strategic objective is to become a mid-tier, Africa

focused hydrocarbon production and exploration company. Specific

attention is directed towards assets with proven development

potential via development drilling, field rehabilitation, and

low-risk exploration activities.

In view of the recent decline in oil prices, as well as

macroeconomic developments caused by the COVID-19 pandemic, a

singular time of opportunity has come about for companies such as

Zenith to acquire, at highly commercially advantageous terms, oil

and gas production and exploration assets being divested by many

oil majors and leading oil and gas companies. As a leadership team,

we are seeking to maximize this opportunity in order to ensure

Zenith emerges from the current low oil price environment a much

stronger and larger entity with significant future development

potential.

We are very pleased to have recently concluded two separate

transactions with CNPC, one of the largest oil and gas corporations

in the world, and KUFPEC, a subsidiary of the State of Kuwait's

national oil company, to acquire their respective working interests

of 22.5% in the Sidi El Kilani Concession and the North Kairouan

permit in Tunisia, which contain the producing Sidi El Kilani

oilfield. We look forward with confidence to receiving regulatory

approval from the Comité Consultatif des Hydrocarbures of the

Republic of Tunisia in respect of the transfer of ownership for

both acquisitions in due course.

Similarly, we are delighted to have established a presence in

the Republic of the Congo following our acquisition of Anglo

African Oil & Gas Congo S.A.U ("AAOG Congo"), the former

Congolese subsidiary of Anglo African Oil & Gas plc (a company

listed on the AIM of the London Stock Exchange) in May 2020. The

decline in oil prices brought about by the COVID-19 pandemic, as

well as renegotiations with the seller, enabled Zenith to acquire,

at highly advantageous terms, an interest, albeit brief, in the now

expired Tilapia I license (expired on July 18, 2020), as well as

receivables of approximately US$5.3 million dollars owed by SNPC

(Société Nationale des Pétroles du Congo) and the full novation to

Zenith of intercompany loans between AAOG plc and AAOG Congo

equivalent to US$16 million.

As publicly announced, the Company has presented a comprehensive

commercial and technical offer (the "Offer") to the Ministry of

Hydrocarbons of the Republic of the Congo in order to be awarded a

new 25-year license for the Tilapia oilfield (to be named Tilapia

II). We are confident that we shall be successful in obtaining a

new 25-year license. In the event our Offer is accepted, the

Company will look to begin drilling activities in well TLP-103C at

the earliest opportunity.

We are aware that the Company's operational track record in

Azerbaijan, and the handover of the Contract Rehabilitation Area

("CRA") to SOCAR announced to the market on March 2, 2020,

disappointed market expectations. However, in view of the

significant resources deployed to date and the future obligations

required for future development, as well as the underwhelming

operational results, the Board of Directors is firmly of the view

that this outcome was in the best interests of shareholders and the

future commercial success of the Company. The operational

challenges, as publicly communicated on a number of occasions, was

due, inter alia, to the severely dilapidated condition of the wells

from the Soviet era, the unreliability of historical data, and the

highly challenging geology of the field.

The results for the year ended March 31, 2020, ("2020 FY")

reflect the significant changes the Group has undergone during the

course of the 2020 Financial Year, specifically in result of the

impairment resulting from the handover of the CRA in Azerbaijan and

its associated reserves. However, it should be underlined, on a

positive note, that we have been able to achieve a significant

reduction in our General and Administrative Expenses during the

2020 FY to CAD$3,361k, compared to CAD$5,251k incurred in the

preceding financial year ended March 31, 2019.

We are very excited about our countercyclical acquisition

campaign in Africa in the current low oil price environment,

especially the highly prospective development production potential

of the Tilapia oilfield in the event we are successful in being

awarded a new 25-year license and the material daily production

revenue to be obtained from completion of our acquisitions in

Tunisia. Indeed, we are hopeful to conclude further acquisitions of

a similar kind in due course.

I thank shareholders for their loyal support. As is clear, my

confidence in Zenith, as well as that of the team, remains

unchanged. We fully believe that our new geographic concentration

in Africa, in less geologically challenging assets acquired at

highly advantageous commercial terms, will enable the Company to

achieve its operational objectives and deliver value to our

investors.

The Board is committed to sustained growth and exploiting any

value accretive opportunities that may present themselves. We shall

continue to evaluate the acquisition of additional energy

production opportunities building on the momentum of our recent

progress to further support the Group's expansion.

Andrea Cattaneo

President, CEO and Director

September 30, 2020

Consolidated Statement of Comprehensive Income

Continuing operations Financial year ended

Unaudited Audited

March 31, 2020 March 31, 2019

CAD $'000 CAD $'000

Revenue 718 6,567

Cost of sales

Production costs (2,952) (4,900)

Depletion and depreciation (726) (2,283)

Gross loss (2,960) (616)

------------------------------------------------- --- ------------------------ -----------------------------

Administrative expenses (5,479) (7,957)

Operating loss (8,439) (8,573)

------------------------------------------------- --- ------------------------ -----------------------------

Gain on business combination 20,111 -

Finance income/(expense) 25 (1,188)

Gain/(loss) for the year before taxation 11,697 (9,761)

------------------------------------------------- --- ------------------------ -----------------------------

Taxation (4) (1)

Gain/(loss) for the year from continuing

operations attributable to owners of the

parent 11,693 (9,762)

------------------------------------------------- --- ------------------------ -----------------------------

Loss from discontinued operations (580,404) -

Loss for the year attributable to owners of the

parent (568,711) (9,762)

------------------------------------------------- --- ------------------------ -----------------------------

Other comprehensive income

Items that may be subsequently reclassified to

profit or loss:

Exchange differences on translating foreign

operations, net of tax (655) (132)

------------------------------------------------- --- ------------------------ -----------------------------

Other comprehensive income for the year, net of

tax (655) (132)

------------------------------------------------- --- ------------------------ -----------------------------

Total comprehensive income for the year

attributable to owners of the parent (569,366) (9,894)

------------------------------------------------- --- ------------------------ -----------------------------

Earnings per share CAD $ CAD $

Basic from loss for the year (1.42) (0.04)

Diluted from loss for the year (1.42) (0.04)

From continuing operations - basic 0.03 (0.04)

From continuing operations - diluted 0.02 (0.04)

From discontinued operations - basic and diluted (1.45) -

Consolidated Statement of Financial Position

Financial year ended

Unaudited Audited

March 31, 2020 March 31, 2019

ASSETS CAD $'000 CAD $'000

Non-current assets

Property, plant and equipment 33,537 1,079,639

Financial assets at amortised cost 13 422

------------------------ -----------------------------

33,550 1,080,061

------------------------ -----------------------------

Current assets

Inventory 799 156

Trade and other receivables 30,902 5,413

Cash and cash equivalents 1,221 3,058

32,922 8,627

------------------------ -----------------------------

TOTAL ASSETS 66,472 1,088,688

======================== =============================

EQUITY AND LIABILITIES

Equity attributable to equity holders of the parent

Share capital 40,400 28,866

Share warrants & option reserve 1,010 1,147

Contributed surplus 4,320 4,125

Retained earnings (34,307) 534,943

------------------------ -----------------------------

Total equity 11,423 569,081

------------------------ -----------------------------

Non-current liabilities

Loans 1,266 3,417

Non-convertible bonds 20,669 4,759

Deferred consideration payable - 483,178

Deferred tax liabilities - 2,398

Decommissioning provisions 13,501 9,089

Retirement provision 50 -

------------------------ -----------------------------

Total non-current liabilities 35,486 502,841

------------------------ -----------------------------

Current Liabilities

Trade and other payables 17,289 12,115

Loans 2,188 3,776

Non-convertible bonds 86 199

Deferred consideration payable - 676

------------------------ -----------------------------

Total current liabilities 19,563 16,766

TOTAL EQUITY AND LIABILITIES 66,472 1,088,688

======================== =============================

Signed

Jose Ramon Lopez-Portillo

Chairman

Attributable to owners of the parent

Consolidated Share capital Share warrants & Contributed surplus Retained earnings Total

Statement of option reserve

Changes in Equity

CAD $'000 CAD $'000 CAD $'000 CAD$'000 CAD $'000

Balance as at 1

April 2018 22,792 875 3,390 544,837 571,894

-------------------- -------------- -------------------- -------------------- ------------------ ----------

Loss for the year - - - (9,762) (9,762)

Other comprehensive

income - - - (132) (132)

-------------------- -------------- -------------------- -------------------- ------------------ ----------

Total comprehensive

income - - - (9,894) (9,894)

-------------------- -------------- -------------------- -------------------- ------------------ ----------

Share issue net of

costs - debt

settlement 371 - - - 371

Share issue net of

costs - private

placement 5,703 - - - 5,703

Value of warrants

issued - 167 - - 167

Issue of options - 928 - - 928

Fair value of

options expired - (401) 313 - (88)

Warrants expired - (422) 422 - -

-------------------- -------------- -------------------- -------------------- ------------------ ----------

Total transactions

with owners

recognised

directly in equity 6,074 272 735 - 7,081

-------------------- -------------- -------------------- -------------------- ------------------ ----------

Balance as at March

31, 2019 28,866 1,147 4,125 534,943 569,081

-------------------- -------------- -------------------- -------------------- ------------------ ----------

Loss for the year - - - (568,711) (568,711)

Other comprehensive

income - - - (655) (655)

-------------------- -------------- -------------------- -------------------- ------------------ ----------

Total comprehensive

income - - - (569,366) (569,366)

-------------------- -------------- -------------------- -------------------- ------------------ ----------

Share issue net of

costs - debt

settlement 748 - - - 748

Share issue net of

costs - private

placement 10,628 - - - 10,628

Value of warrants

issued - 174 - - 174

Exercise of options 158 (116) - 116 158

Warrants expired - (195) 195 - -

Total transactions

with owners

recognised

directly in equity 11,534 (137) 195 116 11,708

Balance as at March

31, 2020

(unaudited) 40,400 1,010 4,320 (34,307) 11,423

-------------------- -------------- -------------------- -------------------- ------------------ ----------

Reserve Description and purpose

Share capital Amount subscribed for share capital

Share warrants & Relates to increase in equity for services

received - equity settled

option reserve share transactions

Contributed surplus Expired share options issued in previous

years

Retained earnings Cumulative net gains and losses recognised in

the consolidated statement of comprehensive income.

Consolidated statement of cash flows Financial year ended

Unaudited Audited

March 31, 2020 March 31, 2019

OPERATING ACTIVITIES CAD $'000 CAD $'000

Loss for the year before taxation (568,707) (9,761)

Shares issued for services - 371

Options/warrants charge 58 1,007

Foreign exchange 23,176 (441)

Gain on business combination (20,111) -

Depletion and depreciation 726 2,283

Discontinued operations 580,404 -

Finance (income)/expense (538) 1,188

Change in working capital (20,118) (1,401)

----------------------------------------------------------- --------------------- ----------------------

Net cash outflows from operating activities (5,110) (6,754)

INVESTING ACTIVITIES

Purchase of property, plant and equipment (22,017) (5,205)

Proceeds from disposal of property, plant and equipment 1,066 378

----------------------------------------------------------- --------------------- ----------------------

Net cash outflows from investing activities (20,951) (4,827)

----------------------------------------------------------- --------------------- ----------------------

FINANCING ACTIVITIES

Proceeds from issue of shares, net of transaction costs 11,376 5,703

Proceeds from exercise of options 158 -

Proceeds from issue of bonds 8,692 1,099

Repayments of loans (5,029) (208)

Proceeds from loans 2,004 2,109

Repayment of bonds (2,790) (375)

Proceeds from bonds in treasury 9,813 3,814

Net cash flows from financing activities 24,224 12,142

----------------------------------------------------------- --------------------- ----------------------

Net (decrease)/increase in cash and cash equivalents (1,837) 561

Cash and cash equivalents at beginning of year 3,058 2,497

----------------------------------------------------------- --------------------- ----------------------

Cash and cash equivalents at end of year 1,221 3,058

----------------------------------------------------------- --------------------- ----------------------

Notes to the financial statements

1. Corporate and Group information

The unaudited financial information for the year ended March 31,

2020 contained in this preliminary announcement was approved by the

Board on September 30, 2020. This announcement does not constitute

the final accounts for the Group but is derived from those

accounts. Accounts for the year ended March 31, 2019 have been

lodged as required. Statutory accounts for the year ended March 31,

2020 will be lodged as required. The auditors have reported on the

2019 accounts. Their reports were not qualified but within the key

audit matter in relation to the carrying value of D and P assets

drew attention to the fact the licenses may be lost should the

required production levels within the REDSPA not be satisfied. It

also included a material uncertainty in relation to going

concern.

New standards and interpretations

a. Adoption of new and revised standards

The following IFRSs or IFRIC interpretations are those that were

effective for the first time for the financial year beginning April

1, 2019 and relevant to the entity:

Standard / Interpretation/Amendments

----------------------------------------- --------------------------------------------------------

IFRS 9 Pre-pay-ment Features with Negative Com-pen-sa-tion

to address the concerns about how IFRS 9 'Financial

In-stru-ments' clas-si-fies par-tic-u-lar

pre-payable financial assets. In addition,

the IASB clarified an aspect of the accounting

for financial li-a-bil-i-ties following a

mod-i-fi-ca-tion.

----------------------------------------- --------------------------------------------------------

IFRS 16 Leases

----------------------------------------- ------------------------------------------------------

IAS 19 (plan amend-ments) P lan Amendment, Cur-tail-ment or Set-tle-ment

to harmonise accounting practices and

to provide more relevant in-for-ma-tion

for de-ci-sion-mak-ing.

----------------------------------------- ------------------------------------------------------

IAS 28 (long-term interests) Long-term Interests in As-so-ci-ates

and Joint Ventures to clarify that

an entity applies IFRS 9 'Financial

In-stru-ments' to long-term interests

in an associate or joint venture that

form part of the net in-vest-ment in

the associate or joint venture but

to which the equity method is not applied.

----------------------------------------- ------------------------------------------------------

IFRIC 23 Un-cer-tainty over Income Tax Treat-ments.

----------------------------------------- ------------------------------------------------------

Annual Im-prove-ments Amend-ments to IAS 12 "Income Taxes",

to IFRS Standards 2015-2017 IAS 23 "Borrowing Costs", IFRS 3 "Business

Cycle Combinations" and IFRS 11 "Joint Arrangements"

as result of the IASB's annual im-prove-ments

project.

----------------------------------------- ------------------------------------------------------

The adoption of these new and revised Standards and

Interpretations has not resulted in significant changes to the

Group's accounting policies that have affected the amounts reported

for the current or prior years.

b. New standards and interpretations in issue but not yet effective

At the date of authorization of these financial statements, the

Group has not applied the following new and revised IFRSs that have

been issued but are not yet effective:

Standard / Interpretation impact on initial application effective date

--------------------------- ------------------------------- ----------------

IFRS 17 Insurance contracts. 1 January 2021

=========================== =============================== ================

The Directors do not expect that the adoption of the Standards

listed above, in particular IFRS 16, will have a material impact on

the financial statements of the Group in future periods.

Business combinations

The acquisition method of accounting is used to account for

acquisitions of subsidiaries and assets that meet the definition of

a business under IFRS. The cost of an acquisition is measured as

the fair value of the assets given, equity instruments issued and

liabilities incurred or assumed at the date of exchange. The

consideration transferred includes the fair value of any asset or

liability resulting from a contingent consideration agreement.

Identifiable assets acquired and liabilities and contingent

liabilities assumed in a business combination are measured

initially at fair value at the acquisition date. The excess of the

cost of acquisition over the fair value of the identifiable assets,

liabilities and contingent liabilities acquired is recorded as

goodwill. If the cost of an acquisition is less than the fair value

of the net assets of the subsidiary acquired, a bargain purchase

gain is recognised immediately in the consolidated statement of

comprehensive income.

Transaction costs that are incurred in connection with a

business combination other than those associated with the issue of

debt or equity instruments are expensed as incurred.

Intercompany balances and transactions are eliminated on

consolidation, and any unrealized income and expenses arising from

intercompany transactions are eliminated in preparing the

consolidated financial statements.

2. Administrative expenses

During the year ended March 31, 2020, the Group incurred CAD$

5,479k (2019 - CAD$ 7,957k) of Administrative Expenses.

Furthermore, during the same period the Group incurred CAD$ 2,118k

(2019 - CAD$ 2,706k) of non-recurrent expenses which relate to the

cost of raising funds, negotiation for potential acquisition of

producing assets and the share based payments costs, which is a

non-cash item.

Unaudited Audited

March 31, 2020 March 31,

2019

------------------------------------

CAD$'000 CAD$'000

------------------------------------ ---------------- -----------

Auditors remuneration - audit

fees Group 105 129

Auditors remuneration - associates - -

of Group auditors

Accounting and bookkeeping 23 30

Consultancy fees 538 1,021

Legal 45 163

Office 630 627

Administrative expenses 420 481

Foreign exchange (gain)/loss (150) (314)

Salaries 1,325 2,547

Travel 425 567

General and administrative

expenses 3,361 5,251

------------------------------------ ---------------- -----------

Non-recurring expenses

Bond issue costs 44 127

Listing costs (Norway and

UK) 658 1,167

Negotiation costs for acquisitions 823 -

Aborted Transaction Costs - 405

Share based payments 174 1,007

Release of prepaid insurance 419 -

Total non-recurring expenses 2,118 2,706

------------------------------------ ---------------- -----------

Total general and administrative

expenses 5,479 7,957

------------------------------------ ---------------- -----------

3. Business combinations

On May 5, 2020, the Company announced it had successfully

completed the acquisition of a 100 percent interest in Anglo

African Oil & Gas Congo S.A.U ("AAOG Congo") from AIM listed

Anglo African Oil & Gas plc (the "Seller"). At the time of the

acquisition, AAOG Congo had a 56 percent majority interest in, and

was the operator of, the Tilapia oilfield in the Democratic

Republic of the Congo.

As previously announced on April 17, 2020, the Company had

entered into a conditional deed of variation to vary the terms of a

share purchase agreement with AAOG for the acquisition of a 100 per

cent

interest in AAOG Congo and related intercompany loans (the

"Acquisition") for a revised total consideration of GBP200,000

("Consideration").

Pursuant to the terms of the Acquisition, the Seller novated

100% of the intercompany loans with AAOG Congo, thereby

transferring all its rights and obligations relating to these

intercompany loans, to Zenith as of the date of Completion,

equivalent to approximately GBP12.5 million. As a result, this

credit balance has been transferred to Zenith's balance sheet.

The Business Combinations outlines the accounting process to be

followed when an acquirer obtains control of a business. Such

business combinations are accounted for using the 'acquisition

method', which generally requires assets acquired and liabilities

assumed to be measured at their fair values at the acquisition

date.

The Company has engaged a Big 4 accounting firm to perform a

Purchase Price allocation exercise ("PPA") in respect of the

acquisition of Anglo African Oil & Gas Congo S.A.U ("AAOG

Congo").

Zenith can also confirm that it has engaged PKF LittleJohn to

perform an ISRE 2410 review on the interim financial statements for

the six months ended September 30, 2020.

This number may change as a result of the above reviews and

would also be impacted in the event that Zenith did not receive a

new license in relation to the oil and gas assets owned by AAOG

Congo at the time of the acquisition.

Fair value of net assets acquired CAD$'000 (unaudited)

CAD$'000

Development and production assets 20,184

Other net assets 5,839

Decommissioning obligations (5,561)

Less consideration payable (351)

----------------------------------- ---------

Gain on business combination 20,111

----------------------------------- ---------

4. Staff cost

(a) Employee compensation cost

During the year, the Group had an average of 190 (2019: 207)

full time employees based in its offices in London in the UK, Baku

in Azerbaijan, and Genoa in Italy.

The following table details the amounts of total employee

compensation included in the consolidated statement of

comprehensive income:

Unaudited

March 31. Audited

2020 March 31, 2019

CAD $'000 CAD $'000

Operating 42 2,285

General and administrative 1,325 2,547

Share based payments 174 1,007

------------------------------ ----------- ----------------

Total employee compensation

cost 1,541 5,839

------------------------------ ----------- ----------------

(b) Key management compensation

Key management personnel are those people having authority and

responsibility for planning, directing and controlling the

activities of an entity, either directly or indirectly. The

following table summarises annual compensation and long-term

compensation of the Group's "Named Executive Officers" for the two

most recently completed financial years that ended on March 31,

2020. The named executive officers equate to key management

personnel:

Short term Other Other

Name and employee short-term long-term Share based Other

principal benefit benefits benefits payments benefits Total

position Year(2) CAD $'000 CAD $'000 CAD $'000 CAD $'000 CAD $'000 CAD $'000

Andrea

Cattaneo

(1) 2019 667 - - 462 419 1,548

-------- ---------- ----------- ---------- ----------- ---------- ----------

2020 567 - - - 181 748

------------------------- ---------- ----------- ---------- ----------- ---------- ----------

Luigi

Regis

Milano

(2) 2019 60 - - 36 17 113

-------- ---------- ----------- ---------- ----------- ---------- ----------

2020 61 - - - - 61

------------------------- ---------- ----------- ---------- ----------- ---------- ----------

Jose Ramon

Lopez-Portillo 2019 - - - 22 - 22

-------- ---------- ----------- ---------- ----------- ---------- ----------

2020 - - - - - -

-------- ---------- ----------- ---------- ----------- ---------- ----------

Dario

Sodero(3) 2019 8 - - 18 - 26

-------- ---------- ----------- ---------- ----------- ---------- ----------

2020 19 - - - - 19

------------------------- ---------- ----------- ---------- ----------- ---------- ----------

Erik Larre 2019 - - - 62 - 62

-------- ---------- ----------- ---------- ----------- ---------- ----------

2020 - - - - - -

-------- ---------- ----------- ---------- ----------- ---------- ----------

Sergey

Borovskiy 2019 - - - 62 - 62

-------- ---------- ----------- ---------- ----------- ---------- ----------

2020 - - - - - -

-------- ---------- ----------- ---------- ----------- ---------- ----------

Luca (4)

Benedetto 2019 199 - - 116 23 338

-------- ---------- ----------- ---------- ----------- ---------- ----------

2020 231 - - - 7 238

------------------------- ---------- ----------- ---------- ----------- ---------- ----------

Notes:

1. Andrea Cattaneo was appointed President and Chief Executive

Officer effective 01 January 2009. As proposed by the Compensation

Committee, Mr. Cattaneo's annual consulting fee payment is

approximately GBP210k (CAD $367k), payable in equal monthly

instalments, plus benefits for the year ended March 31, 2020, and

yearly bonus compensation of CAD$200k from the parent Company.

During the FY 2019, Mr. Cattaneo has agreed to swap his full salary

for new Common Shares (" Salary Sacrifice Shares "), with effect

from 1 April 2019. The new Common Shares were issued on a quarterly

basis at a price that is the average price at which the Common

Shares traded during the period, based on the mid-market closing

price on the London Stock Exchange.

2. Mr. Luigi Regis Milano had a yearly compensation of CAD$61k

from subsidiary undertakings for the year ended March 31, 2020

3. Mr. Sodero received a fee for professional consulting

services of approximately CAD$19k during the year ended March 31,

2020.

4. Mr. Luca Benedetto was appointed as Chief Financial Officer

from April 2017 and received a compensation of CAD$168k from the

parent Company and CAD$63k from subsidiary undertakings, as well as

benefits for CAD$7k, during the year ended March 31, 2020.

5. Finance expense

Unaudited Audited

March 31. 2020 March 31, 2019

CAD $'000 CAD $'000

Interest and debt waived (1,376) -

Interest expense 621 469

Accretion of decommissioning provision 356 363

Effective interest on financial liabilities held at amortised cost 424 356

Decretion of bonds - -

---------------- ----------------

Net finance expense 25 1,188

---------------- ----------------

6. Taxation

Unaudited Audited

March 31. 2020 March 31, 2019

CAD $'000 CAD $'000

Current tax 4 1

Deferred tax - -

------------------------------- ---------------- ----------------

Total tax charge for the year 4 1

-------------------------------- ---------------- ----------------

The difference between tax expense for the year and expected

income taxes based on the statutory tax rate arises as follows:

Unaudited, Audited

March 31, 2020 March 31, 2019

CAD $'000 CAD $'000

Profit/(loss) before taxation (563,496) (9,761)

Expected tax at 27% (152,144) (2,635)

Differences on tax rates attributable to other jurisdictions 39,590 85

Non-deductible expenses 109,622 272

Changes in enacted rates and other - (48)

Temporary differences (115,118) (30)

Tax losses carried forward 118,046 2,355

Under(over)provided in prior years -

--------------------------------------------------------------

Tax charge (4) (1)

--------------------------------------------------------------- ---------------- ----------------

The tax (charge) / credit for the year ended March 31, 2020

comprised CAD $4 (2019 - CAD $1) of current tax expense and CAD

$Nil deferred tax expense (2019 - CAD $Nil deferred tax

expense).

Recognised deferred tax liabilities are attributable to the

following:

Unaudited Audited

March 31, 2020 March 31, 2019

CAD $'000 CAD $'000

Property and equipment (2,109) (2,554)

Decommissioning obligations 1,751 47

Non--capital loss carry forwards 358 109

-------------------------------------- ----------------------- -----------------------

Recognised deferred tax liabilities - (2,398)

-------------------------------------- ----------------------- -----------------------

Deferred tax assets have not been recognised in respect of the

following temporary differences as it is not considered probable

that sufficient taxable income will allow the deferred tax assets

to be utilised and recovered:

Unaudited Audited

March 31, 2020 March 31, 2019

CAD $'000 CAD $'000

Non--capital loss carry forwards 606,733 64,980

Share issuance costs 603 156

Decommissioning obligations 1,827 -

Capital losses 1,467 3,408

Other 76 978

----------------------------------- ----------------------- -----------------------

Unrecognised deferred tax assets 610,706 69,522

----------------------------------- ----------------------- -----------------------

As at March 31, 2020, the Group has accumulated non-capital

losses in Canada totalling CAD $604,796 (2019 - CAD $638,484k)

which expire in varying amounts between 2022 and 2040 and CAD

$2,295k (2019 - CAD $795k) of non-capital losses with no expiry

date.

7. Property, plant and equipment

D&P Assets

CAD $'000

Carrying amount at March 31, 2018 1,077,445

------------------------------------------------ ------------

Additions 5,205

Disposals (378)

Depletion and depreciation (2,283)

Compensatory oil delivered (347)

Foreign exchange differences (3)

------------------------------------------------ ------------

Carrying amount at March 31, 2019 (audited) 1,079,639

------------------------------------------------ ------------

Additions 22,017

Disposals (1,066)

Depletion and depreciation (726)

Impairment - Discontinued operations (note 20) (1,066,570)

Foreign exchange differences 243

------------------------------------------------ ------------

Carrying amount at March 31, 2020 (unaudited) 33,537

------------------------------------------------ ------------

Impairment test for property, plant and equipment

As of March 31, 2020, a review was undertaken of the carrying

amounts of property, plant and equipment to determine whether there

was any indication of a trigger that may have led to these assets

suffering an impairment loss. Following this review impairment

triggers were noted in relation to the Azerbaijan assets due to the

carrying amount of the Group net assets exceeding the Company's

market capitalization and also the Group encountered some

operational difficulty with well workovers which led to lower than

expected production levels compared to forecasts for the same

period.

As there is no readily available market for the Group's oil and

gas properties, fair value is derived as the net present value of

the estimated future cash flows arising from the continued use of

the assets, incorporating assumptions that a typical market

participant would take into account. The value in use of an oil and

gas property is generally lower than its Fair Value Less Costs of

Disposal ('FVLCD') as value in use reflects only those cash flows

expected to be derived from the asset in its current condition.

FVLCD includes appraisal and development expenditure that a market

participant would consider likely to enhance the productive

capacity of an asset and optimize future cash flows. Consequently,

the Group determines recoverable amount based on FVLCD using a

Discounted Cash Flow ('DCF') methodology.

The DCF was derived by estimating discounted after-tax cash

flows for each CGU based on estimates that a typical market

participant would use in valuing such assets. The impairment tests

compared the recoverable amount of the respective CGUs noted below

to the respective carrying values of their associated assets. The

estimates of FVLCD meet the definition of level three fair value

measurements as they are determined from unobservable inputs.

Italian Cash Generating Unit

Key assumptions:

-- Production profiles: these were based on the latest available information from management.

-- Capital and operating costs: these were based on the current

operating and capital costs in Italy.

-- Gas price: An average 2020 gas price of $4.944/Mscf based on

information from the World Bank European gas price forecast and

information provided by management.

-- Discount rate: The estimated fair value less costs to sell of

the Italian CGU was based on 15% (2019 - 15%). This was based on a

Weighted Average Cost of Capital analysis consistent with that used

in previous impairment reviews.

Based on the key assumptions set out above:

-- The estimated recoverable amount of the Italian CGU on March

31, 2020 was higher than its carrying amount by CAD$8m, therefore,

no impairment was recognized in the year ended March 31, 2020 (2019

- CAD $nil) in the consolidated statement of comprehensive

income.

Congo Cash Generating Unit

The assets in the Congo CGU were transferred to the group on 20

January 2020. As of the date of these financial statements no

impairment review has been carried out because the assets have been

in the group for less than three months. An impairment review will

be undertaken in the next financial year.

8. Inventory

As of March 31, 2020, inventory consists of CAD $14 (2019 - CAD

$nil) of crude oil that has been produced but not yet sold, and CAD

$785k of materials (2019 - CAD $156k ). The amount of inventory

recognised in the statement of comprehensive income is CAD $ 167 k

(2019 - CAD $ 220k ).

Unaudited Audited

March 31, 2020 March 31, 2019

Barrels CAD $'000 Barrels CAD $'000

Congo - 14 - -

Congo - materials - 765 - -

Azerbaijan - - - -

Azerbaijan - materials - - - 148

Dubai - materials - 12 - -

Italy - 8 - 8

----------------------------- -------------- --------------- ------------- ---------------

- 799 - 156

-------------------------------------------- --------------- ------------- ---------------

9. Trade and other receivables

Unadited Audited

March 31, 2020 March 31,

2019

CAD $'000 CAD $'000

Trade receivables 2,394 1,362

Bonds in treasury 16,550 3,835

Other receivables 11,958 52

Directors loan account - 164

Total trade and other receivables 30,902 5,413

------------------------------------ ---------------- -----------

The Group applies the IFRS 9 simplified approach to measuring

expected credit losses using a lifetime expected credit loss

provision for trade receivables. To measure expected credit losses

on a collective basis, trade receivables are grouped based on

similar credit risk and ageing. The Group's customer base is of a

similar bracket and share the same characteristics, as such these

have been treated as one population. The Group's customers are all

State customers, therefore, the lifetime expected losses are

considered to be CAD$ nil.

10. Change in working capital

Unadited Audited

March 31, March 31, 2019

2020

CAD $'000 CAD $'000

Trade and other receivables (25,445) (3,510)

Inventory (644) 21

Prepaid expenses (39) 5

Prepaid property and equipment

insurance 422 19

Trade and other payables 5,588 2,064

Total change in working capital (20,118) (1,401)

---------------------------------- ----------- ----------------

11. Share Capital

Zenith is authorised to issue an unlimited number of Common

Shares, of which 316,645,857 were issued at no par value and fully

paid during the year ended March 31, 2020 (2019 - 101,628,366). All

Common Shares have the right to vote and the right to receive

dividends. Zenith is authorised to issue an unlimited number of

preferred shares, issuable in series, of which none have been

issued as of the date of these Financial Statements. The Directors

of the Group may by resolution fix the rights, privileges,

restrictions and conditions of the preferred shares of each

series.

Following the issue of the new Ordinary Shares, the Company had

577,072,921 common shares in issue and admitted to trading on the

Mekur Market of the Oslo Bors, as of March 31, 2020.

As of the same date, Zenith had 286,403,856 common shares in

issue and admitted to trading on the Main Market of the London

Stock Exchange.

Issued Number of Amount

common shares CAD $'000

Balance - April 1, 2018 158.798.698 22.792

Settlement of debt (i) 1.123.068 185

Non-brokered unit private placement

(ii) 54.172.451 3.694

Finder's fee - - 187

Balance - June 30, 2018 214.094.217 26.484

Finder's fee - - 5

Balance - September 30, 2018 214.094.217 26.479

Settlement of debt (iii) 2.225.941 186

Non-brokered unit private placement

(iv) 20.782.429 1.141

Non-brokered unit private placement

(v) 2.857.143 157

Finder's fee - - 107

Balance - December 31, 2018 239.959.730 27.856

Non-brokered unit private placement

(vi) 10.364.640 517

Non-brokered unit private placement

(vi) 10.102.694 519

Finder's fee - - 26

Balance - 31 March 2019 260.427.064 28.866

Non-brokered unit private placement

(vii) 20.000.000 1.000

Finder's fee - - 40

Non-brokered unit private placement

(vii) 17.647.059 794

Finder's fee - - 63

Non-brokered unit private placement

(viii) 14.334.602 702

Finder's fee - - 42

Balance - 30 June 2019 312.408.725 31.217

Exercise of stock option (ix) 622.407 75

Exercise of stock option (x) 688.797 83

Non-brokered unit private placement

(xi) 47.812.500 1.913

Finder's fee - - 34

Settlement of debts (xii) 6.589.678 303

Balance - 30 September 2019 368.122.107 33.557

Settlement of debts (xiii) 11.421.402 445

Non-brokered unit private placement

(xiv) 37.000.000 1.857

Finder's fee - 97

Non-brokered unit private placement

(xv) 35.000.000 1.124

Balance - 31 December 2019 451.543.509 36.886

Non-brokered unit private placement

(xvi) 55.529.412 1.610

Non-brokered unit private placement

(xvii) 9.000.000 232

Equity sharing agreement (xviii) 50.000.000 1.389

Non-brokered unit private placement

(xix) 11.000.000 283

Balance - 31 March 2020 (unaudited) 577.072.921 40.400

12. Warrants and options

Number of options Number of warrants Weighted average exercise Amount CAD$'000

price

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Balance - April 1, 2018 4,100,000 27,027,644 0.19 875

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Options issued 10,500,000 - 0.12 927

Warrants issued - 1,280,000 0.07 43

Warrants expired - (1,807,500) 0.25 (192)

Warrants expired - (8,628,813) 0.15 -

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Balance - June 30, 2018 14,600,000 17,871,331 0.19 1,653

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Warrants issued - 6,977,988 0.05 59

Warrants expired - (1,350,000) 0.25 (46)

Options expired (1,000,000) - 0.15 (119)

Options expired (1,500,000) - 0.17 (193)

Options expired (1,000,000) - 0.12 (88)

Warrants expired - (4,214,125) 0.25 (107)

Warrants expired - (732,920) 0.20 -

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Balance - December 31, 2018 11,100,000 18,552,274 0.15 1,159

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Warrants issued - 11,358,390 0.10 65

Warrants expired - (10,114,286) 0.18 (77)

Balance - March 31, 2019 11,100,000 19,796,378 0.12 1,147

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Balance - June 30, 2019 11,100,000 19,796,378 0.12 1,147

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Warrants issued - 47,812,500 0.10 111

Options exercised (1,311,204) 0.12 (116)

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Balance - September 30, 2019 9,788,796 67,608,878 0.12 1,142

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Options expired (703,571) - 0.12 (62)

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Balance - December 31, 2019 9,085,225 67,608,878 0.12 1,080

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Warrants expired - (18,422,628) 0.14 (133)

Warrants issued - 6,477,734 0.06 63

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Balance - March 31, 2020

(unaudited) 9,085,225 55,663,984 0.12 1,010

----------------------------- ------------------ ------------------- ---------------------------- ----------------

Type Grant Date Number of options Exercise price per unit CAD$ Expiry Date

--------------- ---------------- ------------------ ----------------------------- --------------

Stock options November 2016 1,100,000 0.10 November 2021

Stock options November 2017 500,000 0.18 November 2022

Stock options April 2018 9,500,000 0.18 April 2023

TOTAL OPTIONS 11,100,000

Stock options November 2016 1,100,000 0.10 November 2021

Stock options November 2017 500,000 0.18 November 2022

Stock options April 2018 7,485,225 0.12 April 2023

TOTAL OPTIONS 9,085,225

Options

The Group has a stock options plan (the "Plan") for its

directors, employees and consultants. The maximum number of shares

available under the Plan is limited to 10% of the issued and

outstanding common shares at the time of granting options. Granted

options are fully vested on the date of grant, at which time all

related share--based payment expense is recognized in the

consolidated statements of income (loss) and comprehensive income

(loss). Share options expire five years from the date of

granting.

As at March 31, 2020, the Group had 9,085,225 stock options

outstanding (relating to 9,085,225 shares) and exercisable at a

weighted average exercise price shown on the table above per share

with a weighted average life remaining of 2.73 years.

The fair value of the options was calculated using the

Black-Scholes pricing model calculations based on the following

significant assumptions:

Risk-free interest rate 0.50% - 0.70%

Expected volatility 100%

Expected life 5 years

Dividends Nil

Granting of options

On April 3, 2018, the Board of Directors resolved to grant its

directors, certain employees and consultants a total of 10,500,000

stock options (the "Options"), in accordance with the Company's

Stock Option Plan. The exercise price of the Options was equivalent

to the Company's TSXV closing price of March 26, 2018, being

CAD$0.12 (approximately GBP0.067). The Options are fully vested and

have an expiry date of five years from the date of granting.

Exercise of options

-- On July 3, 2019, the Chief Executive Officer & President

of the Company, Mr. Andrea Cattaneo, exercised stock options to

acquire 622,407 common shares of no-par value in the capital of the

Company, at an exercise price of CAD$0.12 per New Share.

-- On July 4, 2019, the Chief Executive Officer & President

of the Company, Mr. Andrea Cattaneo, exercised stock options and

acquire 688,797 common shares of no-par value in the capital of the

Company, at an exercise price of CAD$0.12 per New Share.

Expiry of options

A director, who had been granted share options, left the Group

in previous quarters and, as stipulated in the stock option

agreements, these options expired upon the elapsing of three months

from the date of leaving. During the quarter ending December 31,

2019, the Group updated their holdings for the 703,571 (2018 -

3,500,000) expired stock options.

Type Grant Date Number of Warrants Price per unit CAD$ Expiry Date

--------------------- ------------------------- ------------

Warrants January-18 180,000 0.16 January-20

Warrants April-18 93,750 0.40 May-21

Warrants June-18 1,280,000 0.07 June-21

Warrants Septeber-18 6,977,988 0.05 February-20

Warrants February-19 10,364,640 0.10 February-20

Warrants February 19 900,000 0.10 February 20

---------------------

TOTAL WARRANTS 19,796,378

Warrants April-18 93,750 0.40 May-21

Warrants June-18 1,280,000 0.07 June-21

Warrants August 19 47,812,500 0.10 August 20

Warrants October-19 6,477,734 0.06 October-22

TOTAL WARRANTS 55,663,984

As of March 31, 2020, the Group had 55,663,984 warrants

outstanding (relating to 55,663,984 shares) and exercisable at a

weighted average exercise price of CAD$0.10 per share with a

weighted average life remaining of 0.42 year.

The fair value of the warrants was calculated using the

Black-Scholes pricing model calculations based on the following

significant assumptions:

Risk-free interest rate 0.50% - 0.70%

Expected volatility 75-100%

Expected life 2 years

Dividends Nil

13. Trade and other payables

Unaudited Audited

March 31, March 31,

2020 2019

CAD $'000 CAD $'000

Trade payables 16,097 10,990

Other payables 1,192 290

Accrued interest - 835

Total trade and other payables 17,289 12,115

--------------------------------- ----------- -----------

14. Loans

Unaudited Audited

Loans March 31, 2020 March 31, 2019

CAD $'000 CAD $'000

---------------------------- ---------------- ----------------

Loan payable - current 2,188 3,776

Loan payable - non-current 1,266 3,417

----------------------------- ---------------- ----------------

Total 3,454 7,193

----------------------------- ---------------- ----------------

Unaudited Audited

March 31, 2020 March 31, 2019

---------------------------

Loans - current CAD $'000 CAD $'000

--------------------------- ---------------- ----------------

As at 1 April 3,776 237

Transfer from non-current 2,151 3,747

Loan receipt 2,004 -

Loan waived (584) -

Repayments (5,029) (208)

Foreign exchange (130) -

As at 31 March 2,188 3,776

---------------------------- ---------------- ----------------

Unaudited Audited

March 31, 2020 March 31, 2019

---------------------------

Loans - non current CAD $'000 CAD $'000

--------------------------- ---------------- ----------------

As at 1 April 3,417 4,949

Loan receipt - 2,109

Transfer to current (2,151) (3,747)

Foreign exchange - 106

---------------------------- ---------------- ----------------

As at 31 March 1,266 3,417

---------------------------- ---------------- ----------------

15. Non-convertible bonds

Unaudited Audited

Non-convertible bonds March 31, 2020 March 31, 2019

CAD $'000 CAD $'000

----------------------- ---------------- ----------------

Current 86 199

Non-current 20,669 4,759

------------------------ ---------------- ----------------

Total 20,755 4,958

------------------------ ---------------- ----------------

Non-convertible bonds

CAD $'000

Balance - March 31, 2018 407

--------------------------------------- ----------

Interest 14

Issue of notes 153

Loan notes 4,759

Repayment of bonds (375)

Balance - March 31, 2019 4,958

--------------------------------------- ----------

Interest 82

Issue of notes -

Loan notes 18,505

Repayment of bonds (2,790)

Balance - March 31, 2020 (unaudited) 20,755

--------------------------------------- ----------

(a) Loan Notes

To avoid the risk of the excessive dilution of the capital, the

Company issued two different sets of EMTN (Bond) accruing interest

payable semi-annually and listed on European Stock Exchanges.

a. Zenith 8% EMTN - ISIN AT0000A23S79

During the financial year 2019, as announced in September 2018

and January 2019, the Company issued Loan Notes to finance its

development activities in Azerbaijan for a total amount of

CAD$4,759k, with the duration of 2 years.

During the financial year ended March 21, 2020, the Company

issued additional loan Notes for a total amount of CAD$9.8M.

The maturity date of the Notes is 20 December 2021, and they

carry an interest charge of 8% per annum, payable upon the maturity

of 20 December 2021.

b. Zenith EMTN Programme up to Euro 25M

On January 20, 2020, the Company announced the issuance of the

following unsecured, multi-currency Euro Medium Term Notes at par

value (the "Notes"):

-- EURO 1,000,000 bearing an interest of 10.125 per cent per year

-- GBP 1,000,000 bearing an interest of 10.50 per cent per year

-- USD 1,000,000 bearing an interest of 10.375 per cent per year

-- CHF 1,000,000 bearing an interest of 10.00 per cent per year

The Notes, as announced by the Company on November 6, 2019

(https://www.zenithenergy.ca/investors/at-prospectus/), are due on

January 27, 2024. The Notes are admitted to trading on the Third

Market (MTF) of the Vienna Stock Exchange ("Wiener Borse AG").

The Notes are governed by Austrian law and, since the Notes are

not convertible into equity of Zenith.

The issue of the Notes is aligned with the Company's strategy of

diversifying its financing towards non-equity dilutive funding to

support its successful development.

The EMTN Programme was carried out primarily with the purpose of

financing the Company's development activities in Azerbaijan