TIDMZEN

RNS Number : 0111H

Zenith Energy Ltd

30 November 2020

November 30, 2020

ZENITH ENERGY LTD.

("Zenith" or the "Company")

Filing of Half-Year Results

Zenith Energy Ltd. ("Zenith" or the "Company") (LSE: ZEN; OSE:

ZENA-ME), the listed international oil & gas production company

focused on pursuing African development opportunities, is pleased

to announce the filing of its consolidated interim results for the

six months ended September 30, 2020 (the "Interim Results") on

SEDAR ( www.sedar.com ).

A copy of the Interim Results will shortly be made available for

review on the Company's website ( www.zenithenergy.ca ).

Highlights:

-- The Company generated revenues from oil and natural gas of

CAD$145k (2019 - CAD$2,651k) in the six months ended September 30,

2019.

-- During the six months ended September 30, 2020, the Company

sold 8,544 mcf of natural gas from its Italian assets, as compared

to 5,499 mcf of natural gas in the 2019 similar period.

-- On April 20, 2020, the Company announced that its newly

created wholly owned subsidiary Zenith Energy Netherlands B.V. had

signed a conditional sale and purchase agreement with KUFPEC

(Tunisia) Limited, a subsidiary of the State of Kuwait's national

oil company, for the acquisition of a working interest in, inter

alia, the North Kairouan permit and the Sidi El Kilani Concession,

which contains the Sidi El Kilani oilfield.

-- On April 22, 2020, the Company confirmed the full repayment

of its largest outstanding liability.

-- On May 5, 2020, the Company announced the successful

completion of the acquisition from AIM listed Anglo African Oil

& Gas plc ("AAOG") of a 100 percent interest in its fully owned

subsidiary in the Republic of the Congo, Anglo African Oil &

Gas Congo S.A.U ("AAOG Congo"), which at the time had a 56 percent

majority interest in, and was the operator of, the Tilapia

oilfield.

-- On May 28, 2020, the Company announced that the TSX Venture

Exchange ("TSX-V") had confirmed that effective at the close of

business Friday, May 29, 2020, the common shares of the Company

would be delisted from the TSX-V at Zenith's request.

-- On June 11, 2020, the Company announced that it had made

payment for a total of US$250,000 (approximately CAD$350k) to

Kuwait Foreign Petroleum Exploration Company K.S.C.C ("KUFPEC"), a

subsidiary of the State of Kuwait's national oil company, in

relation to the acquisition of a 22.5% working interest in the

North Kairouan permit and the Sidi El Kilani Concession, which

contains the Sidi El Kilani oilfield.

-- On June 25, 2020, the Company announced it had completed the

handover process (the "Handover") of the Contract Rehabilitation

Area to SOCAR in the Republic of Azerbaijan. As a result of the

Handover, Zenith has ceased all oil production operations in

Azerbaijan and all field production personnel, approximately 170

employees, have been transferred to a division of SOCAR.

-- On June 30, 2020, the Company announced that it had fully

paid the semi-annual interest in relation to the following debt

instrument: "ZENITH ENERGY LTD 8% NOTES - 2021". The payment in

relation to the Notes is the third such payment, with previous

interest payments having taken place during the months of June 2019

and December 2019 respectively.

-- On August 10, 2020, the Company announced that it had

incorporated Zenith Energy Congo SA ("Zenith Congo"), a fully owned

subsidiary of the Company, created under the laws of the Republic

of Congo. Zenith Congo was established for the purpose of

submitting a comprehensive commercial and technical offer to the

Ministry of Hydrocarbons of the Republic of the Congo for the award

of a new 25-year licence for the Tilapia oilfield to be named

"Tilapia II".

-- On August 26, 2020, the Company announced that BCRA Credit

Rating Agency AD ("BCRA") had assigned Zenith a "B-" with Stable

Outlook long-term debt issuer credit rating.

-- On September 8, 2020, the Company announced that its wholly

owned subsidiary, Zenith Energy Netherlands B.V. had signed a

conditional sale and purchase agreement with CNPC International

(Tunisia) Ltd., a 100% subsidiary of CNPCI, China National

Petroleum Corporation International Ltd., for the acquisition of a

working interest in, inter alia, the North Kairouan permit and the

Sidi El Kilani Concession, which contains the Sidi El Kilani

oilfield.

Further Information:

Zenith Energy Ltd

Andrea Cattaneo, Chief Executive Tel: +1 (587) 315 9031

Officer

-----------------------------

E-mail: info@zenithenergy.ca

-----------------------------

Allenby Capital Limited - Financial

Adviser & Broker

-----------------------------

Nick Harriss Tel: + 44 (0) 203 328

Nick Athanas 5656

-----------------------------

Notes to Editors:

Zenith Energy Ltd. is an international oil and gas production

company, listed on the London Stock Exchange (LSE:ZEN) and the

Merkur Market of the Oslo Stock Exchange (ZENA:ME).

Zenith's development strategy is to identify and rapidly seize

value-accretive hydrocarbon production opportunities in the onshore

oil & gas sector, specifically in Africa. The Company's board

of directors and senior management team have the experience and

technical expertise to develop the Company successfully.

CEO Statement

Zenith Energy Ltd. ("Zenith" or "the Group") is an international

oil and gas production Group, incorporated in Canada, listed on the

Main Market for listed securities of the London Stock Exchange

under the ticker symbol "ZEN" and on the Merkur Market of the Oslo

Børs under the ticker "ZENA:ME". The Company has also issued two

series of EMTN, that are listed on the third Vienna Stock Exchange

Market.

Zenith's strategic objective is to become a mid-tier, Africa

focused hydrocarbon production and exploration Group. Specific

attention is directed towards assets with proven development

potential via development drilling, field rehabilitation, and

low-risk exploration activities.

In view of the recent decline in oil prices, as well as

macroeconomic developments caused by the COVID-19 pandemic,

opportunities have arisen for companies such as Zenith to acquire,

at commercially advantageous terms, oil and gas production and

exploration assets being divested by many oil majors and leading

oil and gas companies. As a leadership team, we are seeking to

maximize this opportunity in order to ensure Zenith emerges from

the current low oil price environment a stronger and more

attractive entity with significant future development

potential.

We are very pleased to have entered into two separate

conditional transactions in relation to working interests in an

onshore oil production asset in Tunisia. The first with KUFPEC, a

subsidiary of Kuwait Petroleum Corporation, and the second with

China National Petroleum Corporation, to acquire their respective

working interests of 22.5% in the Sidi El Kilani Concession and the

North Kairouan permit, which contain the producing Sidi El Kilani

oilfield. It is our expectation to receive regulatory approval from

the Comité Consultatif des Hydrocarbures of the Republic of Tunisia

in respect of the transfer of ownership for both acquisitions in

due course.

Further, we are delighted to have established a presence in the

Republic of the Congo following our acquisition of Anglo African

Oil & Gas Congo S.A.U ("AAOG Congo"), the former Congolese

subsidiary of Anglo African Oil & Gas plc (a company listed on

the AIM of the London Stock Exchange) in May 2020. The decline in

oil prices brought about by the COVID-19 pandemic, as well as

renegotiations with the seller, enabled Zenith to acquire, at

advantageous terms, an interest, albeit brief, in the now expired

Tilapia I license (expired on July 18, 2020), as well as

receivables, now amounting to approximately US$5.7 million dollars

owed by SNPC ( Société Nationale des Pétroles du Congo), the

National Oil Company.

As publicly announced, the Company has presented a comprehensive

commercial and technical offer (the "Offer") to the Ministry of

Hydrocarbons of the Republic of the Congo in order to be awarded a

new 25-year license for the Tilapia oilfield (to be named Tilapia

II). We are confident that we shall be successful in obtaining a

new 25-year license.

The results for the six months ended September 30, 2020, reflect

the significant changes the Group has undergone during the course

of this period, specifically in result of the impairment resulting

from the handover of the CRA in Azerbaijan and its associated

reserves.

We are very excited about our countercyclical acquisition

campaign in Africa in the current low oil price environment,

especially the highly prospective development production potential

of the Tilapia oilfield and the material daily production revenue

to be obtained from completion of our acquisitions in Tunisia.

Indeed, we are hopeful to conclude further acquisitions of a

similar kind in due course.

I thank shareholders for their loyal support. As is clear, my

confidence in Zenith, as well as that of the team, remains

unchanged. We fully believe that our new geographic concentration

in Africa, in less geologically challenging assets acquired at

highly advantageous commercial terms, will enable the Group to

achieve its operational objectives and deliver value to our

investors.

We shall continue to evaluate the acquisition of additional

energy production opportunities building on the momentum of our

recent progress to further support the Group's expansion.

Andrea Cattaneo

President, CEO and Director

Brazzaville, Republic of the Congo

November 30, 2020

Consolidated Statement of Comprehensive Income

Six month ended

September 30, 2020 September 30, 2019

Continuing operations Note CAD $'000 CAD $'000

Revenue 145 344

Cost of sales

Production costs (656) (1,158)

Depletion and depreciation 8 (198) (203)

Gross loss (709) (1,017)

---------------------------------------------------- -------- ----------------------- -----------------------

Administrative expenses 5 (3,548) (1,989)

Operating loss (4,257) (3,006)

---------------------------------------------------- -------- ----------------------- -----------------------

Finance expense 6 (284) 1,038

Loss for the period before taxation (4,541) (1,968)

---------------------------------------------------- -------- ----------------------- -----------------------

Taxation 7 (3) -

Gain/(loss) for the period from continuing

operations attributable to owners of the parent (4,544) (1,968)

---------------------------------------------------- -------- ----------------------- -----------------------

Profit/(loss) from discontinued operations

(attributable to owners of the parent) 18 563 (5)

Loss for the period attributable to owners of the

parent (3,981) (1,973)

---------------------------------------------------- -------- ----------------------- -----------------------

Other comprehensive income

Items that may be subsequently reclassified to

profit or loss:

Exchange differences on translating foreign

operations, net of tax 314 (65)

---------------------------------------------------- -------- ----------------------- -----------------------

Other comprehensive income for the period, net of

tax 314 (65)

---------------------------------------------------- -------- ----------------------- -----------------------

Total comprehensive loss for the period

attributable to owners of the parent (3,667) (2,038)

---------------------------------------------------- -------- ----------------------- -----------------------

Earnings per share 20 CAD $ CAD $

Loss for the period - basic (0.01) (0.01)

Loss for the period - diluted (0.01) (0.01)

From continuing operations - basic (0.01) (0.01)

From continuing operations - diluted (0.01) (0.01)

From discontinued operations - basic and diluted 0.001 (0.00)

Consolidated Statement of Financial Position

Six month ended

September 30, 2020 September 30, 2019

ASSETS Note CAD $'000 CAD $'000

Non-current assets

Property, plant and equipment 8 33,230 1,080,311

Financial assets at amortised cost 9 12 408

----------------------- -----------------------

33,242 1,080,719

----------------------- -----------------------

Current assets

Inventory 10 682 161

Trade and other receivables 11 15,258 3,889

Director's loan account 11 136 (50)

Cash and cash equivalents 1,453 1,681

17,529 5,681

----------------------- -----------------------

TOTAL ASSETS 50,771 1,086,400

======================= =======================

EQUITY AND LIABILITIES

Equity attributable to equity holders of the parent

Share capital 13 45,706 33,557

Share warrants & option reserve 14 947 1,142

Contributed surplus 4,431 4,125

Retained earnings (42,361) 533,021

----------------------- -----------------------

Total equity 8,723 571,845

----------------------- -----------------------

Non-current liabilities

Loans 16 1,903 2,299

Non-convertible bonds 17 4,456 4,759

Deferred consideration payable 18 - 482,839

Deferred tax liabilities 7 2,398 2,398

Decommissioning provision 19 13,307 8,807

Retirement provision 48 -

----------------------- -----------------------

Total non-current liabilities 22,112 501,102

----------------------- -----------------------

Current Liabilities

Trade and other payables 15 17,739 10,731

Loans 16 1,903 1,762

Non-convertible bonds 17 294 104

Deferred consideration payable 18 - 857

----------------------- -----------------------

Total current liabilities 19,936 13,454

TOTAL EQUITY AND LIABILITIES 50,771 1,086,400

======================= =======================

Attributable to owners of the parent

Consolidated Share capital Share warrants & Contributed Retained earnings Total

Statement of option reserve surplus

Changes in Equity

CAD $'000 CAD $'000 CAD $'000 CAD$'000 CAD $'000

Balance as at

April 1, 2019 28,866 1,147 4,125 534,943 569,081

------------------- -------------- ------------------- ------------------- ------------------ -------------

Loss for the

period - - - (1,973) (1,973)

Other

comprehensive

income - - - (65) (65)

------------------- -------------- ------------------- ------------------- ------------------ -------------

Total

comprehensive

income - - - (2,038) (2,038)

------------------- -------------- ------------------- ------------------- ------------------ -------------

Share issue net of

costs - debt

settlement 303 - - - 303

Share issue net of

costs - private

placement 4,230 - - - 4,230

Fair value of

warrants issued - 111 - - 111

Options exercised 158 (116) - 116 158

Total transactions

with owners

recognized

directly in

equity 4,691 (5) - 116 4,802

------------------- -------------- ------------------- ------------------- ------------------ -------------

Balance as at

September 30,

2019 33,557 1,142 4,125 533,021 571,845

------------------- -------------- ------------------- ------------------- ------------------ -------------

Balance as at

April 1, 2020 40,400 1,010 4,320 (35,901) 9,829

------------------- -------------- ------------------- ------------------- ------------------ -------------

Prior year

adjustment - - - (2,793) (2,793)

------------------- -------------- ------------------- ------------------- ------------------ -------------

Balance as at

April 1, 2020

restated 40,400 1,010 4,320 (38,694) 7,036

------------------- -------------- ------------------- ------------------- ------------------ -------------

Loss for the

period - - - (3,981) (3,981)

Other

comprehensive

income - - - 314 314

------------------- -------------- ------------------- ------------------- ------------------ -------------

Total

comprehensive

income - - - (3,667) (3,667)

------------------- -------------- ------------------- ------------------- ------------------ -------------

Share issue net of

costs - debt

settlement - - - - -

Share issue net of

costs - private

placement 5,306 - - - 5,306

Value of warrants

issued - 48 - - 48

Warrants expired - (111) 111 - -

Total transactions

with owners

recognised

directly in

equity 5,306 (63) 111 - 5,354

Balance as at

September 30,

2020 45,706 947 4,431 (42,361) 8,723

------------------- -------------- ------------------- ------------------- ------------------ -------------

Reserve Description and purpose

Share capital Amount subscribed for share capital

Share warrants & Relates to increase in equity for services

received - equity settled

option reserve share transactions

Contributed surplus Expired share options and warrants issued in

previous years

Retained earnings Cumulative net gains and losses recognised in

the consolidated statement of comprehensive income.

Consolidated statement of cash flows Six months ended

September 30, 2020 September 30, 2019

OPERATING ACTIVITIES Note CAD $'000 CAD $'000

Loss for the period before taxation (3,978) (1,973)

Options/warrants charge 17 48 111

Foreign exchange (3,318) (9,660)

Depletion and depreciation 11 198 913

Reversal of impairment (1,128) -

Other gains and losses 8 - (1,376)

Finance expense 9 284 372

Change in working capital 15 (4,623) 548

--------------------------------------------------------- ----- -------------------- -------------------

Net cash used in operating activities (12,517) (11,065)

INVESTING ACTIVITIES

Purchase of property, plant and equipment 11 (8) (1,951)

Proceeds from disposal of property, plant and equipment 11 - -

--------------------------------------------------------- ----- -------------------- -------------------

Net cash used in investing activities (8) (1,951)

--------------------------------------------------------- ----- -------------------- -------------------

FINANCING ACTIVITIES

Proceeds from issue of shares, net of transaction costs 11,739 6,617

Proceeds from exercise of options - 333

Repayments of loans 19 (1,889) (2,382)

Proceeds from loans 19 1,091 1,453

Proceeds from issue of bonds 1,442 3,143

Repayment of bonds 20 (86) (385)

Proceeds from bonds in treasury 20 - 1,720

Net cash generated from financing activities 12,297 10,500

--------------------------------------------------------- ----- -------------------- -------------------

Net (decrease)/increase in cash and cash equivalents (228) (2,516)

Cash and cash equivalents at beginning of period 1,681 4,197

--------------------------------------------------------- ----- -------------------- -------------------

Cash and cash equivalents at end of period 1,453 1,681

--------------------------------------------------------- ----- -------------------- -------------------

The cash transactions from discontinued operations included

above are as follows:

Operating activities 424 4,787

Investing activities - (1,014)

Net cash generated in discontinued operations 424 3,773

------------------------------------------------- ---- --------

Notes to the condensed financial statements

1. Corporate and Group information

The consolidated financial statements of Zenith Energy Ltd. and

its subsidiaries (collectively, the "Group") have been prepared on

the basis set out below. The Group is exempt from preparing

separate parent company financial statements for the period ended

September 30, 2020, in accordance with the Canada Business

Corporations Act.

Zenith Energy Ltd. ("Zenith" or the "Group") was incorporated

pursuant to the provisions of the British Columbia Business

Corporations Act on September 20, 2007 and is domiciled in Canada.

The address of the Group's registered office is 20(th) Floor, 250

Howe Street, Vancouver, BC. VC6 3R8, Canada and its business

address is 15th Floor, 850 - 2nd Street S.W., Calgary, Alberta T2P

0R8, Canada. The Group's primary business activity is the

international development of oil and gas production and development

assets. As publicly reported, the Group is currently in the process

of seeking to complete a number of acquisitions in Africa.

The Company's website is www.zenithenergy.ca.

Zenith is a public company listed on the Main Market of the

London Stock Exchange under the ticker "ZEN", as well as being

listed on the Merkur Market of the Oslo Børs under the ticker

"ZENA-ME".

2. Basis of preparation

The consolidated financial statements presented in this document

have been prepared in accordance with International Financial

Reporting Standards ("IFRS") as issued by the International

Accounting Standards Board ("IASB").

The financial statements have been prepared under the historical

cost convention except for financial instruments which are measured

at fair value through profit or loss. The financial statements are

presented in Canadian Dollars (CAD$) and have been rounded to the

nearest thousand (CAD$'000) except where otherwise indicated.

The Board has reviewed the accounting policies set out below,

which have been applied consistently, and considers them to be the

most appropriate to the Group's business activities.

Presentation and functional currency

The presentation currency of the Group is the Canadian dollar

("CAD$").

Functional currency is the currency of the primary economic

environment in which a company operates. The functional currency of

the Group's subsidiaries are; United States dollar ("US$") for the

subsidiaries in Dubai, British Virgin Islands (including Azerbaijan

operations) and Democratic Republic of Congo, Euros ("EUR") for the

subsidiary in Italy, Sterling ("GBP") for the subsidiary in the

United Kingdom, Swiss Francs ("CHF") for the subsidiary in

Switzerland and Norwegian Krone ("NOK") for the subsidiary in

Norway.

The functional currency is determined by the Directors by

looking at a number of relevant factors including the currency in

which Group entities usually generate and spend cash and in which

business transactions are normally denominated.

All of the transactions that are not in the functional currency

are treated as foreign and indicate currency transactions.

The factors that have determined the adoption of the CAD$ as

presentation currency include:

-- mainly affects the prices at which the goods or services are consolidated;

-- Canada is the country whose regulations, market conditions

and competitive forces mainly affect the pricing policy of the

entity;

-- influences the costs and expenses of the entity;

-- the funds are usually generated in that currency; and

-- the receipts from operating activities are retained in that currency.

3. Significant accounting policies

Consolidation

The following entities have been consolidated within the Group's

financial statements:

Name Country of incorporation Proportion of Principal activity

and place of business ownership interest

Canoel Italia Genova, Italy 98.6% Gas, electricity

S.r.l. (1) and condensate

production

------------------------- --------------------- ---------------------

Ingenieria Petrolera Argentina 100% Not trading

del Rio de la

Plata S.r.l.

------------------------- --------------------- ---------------------

Zenith Aran Oil British Virgin 100% Oil production

Company Limited Islands

------------------------- --------------------- ---------------------

Aran Oil Operating British Virgin 80% owned subsidiary Oil production

Company Limited Islands of Zenith Aran

Oil Company Limited

------------------------- --------------------- ---------------------

Zenith Energy United Kingdom 100% Administrative

(O&G) Ltd services

------------------------- --------------------- ---------------------

Zena Drilling Incorporated in 100% Oil and gas drilling

Limited UAE

------------------------- --------------------- ---------------------

Altasol SA Switzerland 100% Oil trading

------------------------- --------------------- ---------------------

Zenith Norway Norway 100% Holding Company

AS (2)

------------------------- --------------------- ---------------------

Anglo African Republic of the 100% Oil production

Oil & Gas Congo Congo

S.A.U. (3)

------------------------- --------------------- ---------------------

Zenith Energy Netherlands 100% Holding Company

Netherlands BV

------------------------- --------------------- ---------------------

(1) Zenith Energy Ltd. has 100% control over Canoel Italia

S.r.l. The Group granted 1.4% to the Director managing the Italian

subsidiary in order to limit the risk of any liability to that

entity. Therefore, no non-controlling interest arises from the

consolidation of this subsidiary.

(2) On January 30, 2020, the Company announced the establishment

of its fully owned Norwegian subsidiary, Zenith Energy AS ("Zenith

Norway"), to be used as a vehicle for intended participation in

future licensing bids to be organized by the Norwegian Ministry of

Petroleum and Energy, as well as to actively pursue the potential

acquisition of working interests in mature energy production assets

across Northern Europe.

(3) On January 13, 2020, the Company announced the passing of a

resolution by the shareholders of Anglo African Oil & Gas plc

to approve the share purchase agreement, signed between the parties

on December 27, 2019, for the acquisition of its fully owned

subsidiary in the Republic of the Congo, Anglo African Oil &

Gas Congo S.A.U.

Subsidiaries are entities over which the Group has control. The

Group controls an entity when it is exposed to, or has rights to,

variable returns from its involvement with the entity and has the

ability to affect those returns through its power over the entity.

The financial statements of subsidiaries are included in the

consolidated financial statements from the date on which control

commences until the date on which control ceases. Adjustments are

made to the results of subsidiaries to bring the accounting

policies used by them, with those used by the Group.

Intercompany balances and transactions are eliminated on

consolidation, and any unrealized income and expenses arising from

intercompany transactions are eliminated in preparing the

consolidated financial statements.

The following entities have not been consolidated within the

Group's financial statements because they are considered to be

immaterial to the Group:

Name Country of incorporation Proportion of Principal activity

and place of business ownership interest

Leonardo Energy Genova, Italy 48% Dormant

Consulting S.r.l.

------------------------- -------------------- -------------------

5. Administrative expenses

During the six months ended September 30, 2020, the Group

incurred CAD$ 3,548k (2019 - CAD$ 1,989k) of administrative

expenses. Furthermore, during the same period the Group incurred

CAD$ 703k (2019 - CAD$ 345k) of non-recurring expenses which relate

to the cost of raising funds, negotiation costs for the potential

acquisition of producing assets and share based payments costs,

which is a non-cash item.

Six months ended September

30,

2020 2019

------------------------------------

CAD$'000 CAD$'000

------------------------------------ -------------------------- -------------------------

Auditors remuneration - audit - -

fees Group

Accounting and bookkeeping 19 16

Legal 39 28

Other professional fees 320 269

Office 365 222

Administrative expenses 178 43

Foreign exchange loss 645 274

Other administrative expenses 271 59

Salaries 669 579

Travel 339 154

General and administrative

expenses 2,845 1,644

------------------------------------ -------------------------- -------------------------

Non-recurring expenses

Listing costs 524 182

Negotiation costs for acquisitions 131 50

Transaction Costs - 2

Share based payments 48 111

Total non-recurring expenses 703 345

------------------------------------ -------------------------- -------------------------

Total general and administrative

expenses 3,548 1,989

------------------------------------ -------------------------- -------------------------

6. Finance expense

Six months ended September 30,

2020 2019

CAD $'000 CAD $'000

Debt reduction on settlement of loan - 643

Interest reduction on settlement of loan - 733

Effective interest on financial liabilities held at amortised cost (284) (316)

Interest expense - (22)

Net finance (expense)/income (284) 1,038

--------------------------------------------------------------------- ---------- ----------

7. Taxation

Six months ended September 30,

2020 2019

CAD $'000 CAD $'000

Current tax 3 -

Deferred tax - -

-------------------------------- ---------- ----------

Total tax charge for the period 3 -

-------------------------------- ---------- ----------

8. Property, plant and equipment

D&P Assets

CAD$'000

Carrying amount at April 1, 2019 1,079,639

--------------------------------------- -----------

Additions 1,951

Disposals -

Depletion and depreciation (913)

Compensatory oil delivered (159)

Foreign exchange differences (207)

--------------------------------------- -----------

Carrying amount at September 30, 2019 1,080,311

--------------------------------------- -----------

Carrying amount at April 1, 2020 34,305

--------------------------------------- -----------

Additions 8

Depletion and depreciation (198)

Foreign exchange differences (885)

--------------------------------------- -----------

Carrying amount at September 30, 2020 33,230

--------------------------------------- -----------

9. Non-current financial assets held at amortised cost

September 30, 2020 September 30, 2019

CAD $'000 CAD $'000

Italian prepaid insurance - 408

Other assets 12 -

12 408

-------------------------------- ------------------------ ------------------------

10. Inventory

As of September 30, 2020, inventory consists of CAD $nil (2019 -

CAD $nil) of crude oil that has been produced but not yet sold, and

CAD $682k of materials (2019 - CAD $161k ) . The amount of

inventory recognised in the statement of comprehensive income is

CAD $ nil (2019 - CAD $ 8k ).

September 30, 2020 September 30, 2020

CAD $'000 CAD $'000

Congo - materials 674 -

Azerbaijan - materials - 155

Italy - materials 8 6

------------------------------ ------------------------ ------------------------

682 161

----------------------------- ------------------------ ------------------------

11. Trade and other receivables

September 30, September

2020 30, 2019

CAD $'000 CAD $'000

Trade receivables 1,255 1,512

Other receivables 14,003 2,377

Directors loan account 136 (50)

------------------------------------ -------------- ----------

Total trade and other receivables 15,394 3,839

------------------------------------ -------------- ----------

12. Change in working capital

September 30, September 30,

2020 2019

CAD $'000 CAD $'000

Trade and other receivables 11,595 623

Inventory 520 (2)

Prepaid expenses (40) (14)

Prepaid property and equipment

insurance (396) (8)

Trade and other payables (7,056) (1,147)

Total change in working capital 4,623 (548)

---------------------------------- -------------- --------------

13. Share Capital

Zenith is authorised to issue an unlimited number of Common

Shares, of which 465,000,000 were issued at no par value and fully

paid during the six months ended September 30, 2020 (2019 -

107,695,043).

Following the issue of the new Ordinary Shares, the Company had

1,042,072,921 common shares in issue and admitted to trading on the

Mekur Market of the Oslo Bors, as of September 30, 2020. As of the

same date, Zenith had 313,400,824 common shares in issue and

admitted to trading on the Main Market of the London Stock

Exchange.

Issued Number of Amount

Description common shares CAD $'000

Balance - 30 September 2019 368,122,107 33,557

Settlement of debts 11,421,402 445

Non-brokered unit private placement 37,000,000 1,857

Finder's fee - 97

Non-brokered unit private placement 35,000,000 1,124

Balance - 31 December 2019 451,543,509 36,886

Non-brokered unit private placement 55,529,412 1,610

Non-brokered unit private placement 9,000,000 232

Equity sharing agreement (vi) 50,000,000 1,389

Non-brokered unit private placement 11,000,000 283

Balance - 31 March 2020 577,072,921 40,400

Non-brokered unit private placement 75,000,000 907

Finder's fee (4)

Non-brokered unit private placement 60,000,000 900

Non-brokered unit private placement 80,000,000 1,339

Balance - 30 June 2020 792,072,921 43,542

Non-brokered unit private placement 60,000,000 467

Non-brokered unit private placement 90,000,000 1,060

Non-brokered unit private placement 100,000,000 637

Balance - 30 September 2020 1,042,072,921 45,706

14. Warrants and options

Number of options Number of warrants Weighted average Amount CAD$'000

exercise price

------------------------- ------------------ ------------------- ------------------------ ----------------

Balance - April 1, 2019 11,100,000 19,796,378 0.12 1,147

------------------------- ------------------ ------------------- ------------------------ ----------------

Option exercised (1,311,204) 0.12 (116)

Warrants issued - 47,812,500 0.10 111

Balance - September 30,

2019 9,788,796 67,608,878 0.12 1,142

------------------------- ------------------ ------------------- ------------------------ ----------------

Balance - April 1, 2020 9,085,225 55,663,984 0.12 1,010

------------------------- ------------------ ------------------- ------------------------ ----------------

Warrants issued - 45,000,000 0.10 (111)

Warrants expired - (47,812,500) 0.02 48

Balance - September 30,

2020 9,085,225 52,851,484 0.03 947

------------------------- ------------------ ------------------- ------------------------ ----------------

Options

Grant Date September 30, 2020 September 30, 2019

Exercise Exercise

Number of price per Number of price per

options unit CAD$ options unit CAD$ Expiry Date

---------- ----------- ---------- -----------

November November

2016 1,100,000 0.10 1,100,000 0.10 2021

---------- ----------- ---------- ----------- ------------

November November

2017 500,000 0.18 500,000 0.18 2022

---------- ----------- ---------- ----------- ------------

April 2018 7,485,225 0.12 8,188,796 0.12 April 2023

---------- ----------- ---------- ----------- ------------

9,085,225 0.12 9,788,796 0.12

---------- ----------- ---------- ----------- ------------

Warrants

Type Grant Date Number of Warrants Price per unit CAD$ Expiry Date

--------------------- ------------------------- ------------

Warrants January-18 180,000 0.16 January-20

Warrants April-18 93,750 0.40 May-21

Warrants June-18 1,280,000 0.07 June-21

Warrants Septeber-18 6,977,988 0.10 February-20

Warrants February-19 10,364,640 0.10 February-20

Warrants February 19 900,000 0.10 February 20

Warrants August 19 47,812,500 0.10 August 20

---------------------

Total warrants at 30 September 2019 67,608,878

Warrants April-18 93,750 0.40 May-21

Warrants June-19 1,280,000 0.07 June-21

Warrants October-19 6,477,734 0.06 October-22

Warrants August 20 45,000,000 0.022 August 21

Total warrants at 30 September 2020 52,851,484

15. Trade and other payables

September 30, September 30,

2020 2019

CAD $'000 CAD $'000

Trade payables 16,458 10,174

Other payables 1,281 557

Total trade and other payables 17,739 10,731

--------------------------------- -------------- --------------

16. Loans

Six months ended September 30

2020 2019

CAD$'000 CAD$'000

---------------------------- --------- ---------

Loan payable - current 1,903 1,762

Loan payable - non-current 1,903 2,299

----------------------------- --------- ---------

Total 3,806 4,061

----------------------------- --------- ---------

2020 2019

--------------------------------------

Loans - current CAD $'000 CAD $'000

-------------------------------------- ---------- ----------

As at 1 April 2,210 3,776

Transfer from non-current 73 1,246

Repayments (408) (2,298)

Debt reduction on settlement of loan - (643)

Interest - 7

Foreign exchange 28 (326)

--------------------------------------- ---------- ----------

As at September 30 1,903 1,762

--------------------------------------- ---------- ----------

2020 2019

--------------------------------------

Loans - non current CAD $'000 CAD $'000

-------------------------------------- ---------- ----------

As at 1 April 2,260 3,417

Loan receipt (252) 177

Conersion into shares (19) -

Transfer to current (73) (1,246)

Foreign exchange (13) (49)

--------------------------------------- ---------- ----------

As at September 30 1,903 2,299

--------------------------------------- ---------- ----------

17. Non-convertible bonds

Non-convertible bonds September 30, 2020 September 30, 2019

CAD $'000 CAD $'000

----------------------- ------------------- -------------------

Current 294 104

Non-current 4,456 4,759

------------------------ ------------------- -------------------

Total 4,750 4,863

------------------------ ------------------- -------------------

Non-convertible bonds

CAD $'000

Balance - April 1, 2019 4,958

------------------------------- ----------

Interest 63

Repayment of bonds (158)

Balance - September 30, 2019 4,863

------------------------------- ----------

Balance - April 1, 2020 4,359

------------------------------- ----------

Issue of bonds 477

Payment of interest (86)

Balance - September 30, 2020 4,750

------------------------------- ----------

18. Loss from discontinued operations

The Group has re-focused the geographic area of its activities.

On March 2, 2020, the Company announced that, in view of Zenith's

strategic focus on pursuing large-scale oil production and

development opportunities in Africa, it would return the Contract

Rehabilitation Area to SOCAR.

As a result of this decision, the results of the subsidiary in

Azerbaijan have been included in the loss from discontinued

operations in the statement of comprehensive income and they are

comprised as follows:

September 30, 2020 September 30, 2019

CAD$'000 CAD$000

---------------------------------------------- -------------------- -------------------

Revenue - 2,325

Operating expenses (579) (1,078)

Depletion and depreciation (68) (710)

Administrative expenses (97) (508)

Reversal of impairment from previous period 1,326 -

Finance expenses (19) (34)

-------------------- -------------------

Profit/(loss) from operations in the period 563 (5)

-------------------- -------------------

19. Decommissioning provision

The following table presents the reconciliation of the carrying

amount of the obligation associated with the reclamation and

abandonment of the Group's oil and gas properties:

September 30,

September

30, 2020 2019

CAD $'000 CAD $'000

Balance - April 1 13,543 9,089

Accretion 41 (31)

Foreign currency translation (277) (251)

------------------------------------ ---------- --------------

Balance - September 30 13,307 8,807

------------------------------------ ---------- --------------

The provision has been made by estimating the decommissioning

cost at current prices using existing technology.

20. Earnings per share

2020 2019

CAD $'000 CAD $'000

------------------------------------------------ ---------- --- ----------

Net loss for the period (3,981) (1,973)

Net loss from continuing operations (4,544) (1,968)

Net profit/(loss) from discontinued operations 563 (5)

------------------------------------------------ ---------- --- ----------

Basic weighted average number of shares 519,319 296,866

Potential dilutive effect on shares issuable n/a n/a

under warrants

Potential diluted weighted average number n/a n/a

of shares

------------------------------------------------ ---------- --- ----------

Net earnings per share - basic and diluted

(1) $ (0.01) $ (0.01)

From continuing operations - basic and

diluted $ (0.01) $ (0.01)

From discontinued operations - basic

and diluted $ 0.001 $ (0.00)

------------------------------------------------ ---------- --- ----------

(1) The Group did not have any in-the-money convertible notes,

warrants and stock options during the six months ended September

30, 2020 and 2019.

21. Commitments and contingencies

Asset Purchase commitments

The Company acquired the Congolese asset for a consideration of

GBP 200,000, that was fully paid in May 2020.

On April 20, 2020, and on September 8, 2020, Zenith entered into

two separate conditional acquisitions in Tunisia from KUFPEC and

CNPC, two world-renowned oil companies, for their respective

working interests in the Sidi El Kilani Concession. Upon

completion, conditional upon regulatory approval being granted by

the Comité Consultatif des Hydrocarbures ("CCH") of the Republic of

Tunisia, it is expected that Zenith will have a daily production

ranging between 250-300 barrels of oil per day.

The acquisition from KUFPEC was agreed for a consideration of

US$500,000, of which US$250,000 was paid in June 2020, as per the

terms of the conditional share purchase agreement in relation to

this transaction. The balance of the purchase price is due upon

completion of the acquisition, which is expected to be obtained

within December 31, 2020.

The acquisition from CNPC was agreed for a consideration of

US$300,000, as per the terms of the conditional share purchase

agreement in relation to this transaction. The payment of the

purchase price is due upon completion of the acquisition.

22. Financial risk management and financial instruments

September 30, September 30,

2020 2019

Financial assets at amortised

cost CAD $'000 CAD $'000

Non-current financial assets

at amortised cost 12 408

Trade and other receivables 15,258 3,839

Director's loan account 136 -

Cash and cash equivalents 1,453 1,681

-------------------------------- -------------- --------------

Total financial assets 16,859 5,928

-------------------------------- -------------- --------------

September 30,

September 30, 2020 2019

Financial liabilities at amortised

cost CAD $'000 CAD $'000

Trade and other payables 17,739 10,731

Loans 3,806 4,061

Non-convertible bond and notes 4,750 4,863

Deferred consideration - 483,696

------------------------------------ ------------------- --------------

Total financial liabilities 26,295 503,351

------------------------------------ ------------------- --------------

Zenith's main financial risks are foreign currency risk,

liquidity risk, interest rate risk, commodity price risk and credit

risks. Set out below are policies that are used to manage such

risks:

a) Credit risk

Credit risk is the risk of an unexpected loss if a customer or

counter party to a financial instrument fails to meet its

commercial obligations. The Group's maximum credit risk exposure is

limited to the carrying amount cash of CAD$1,453k (2019 -

CAD$1,681k) and trade and other receivables of CAD$15,258k (2019 -

CAD$3,839k).

Deposits are, as a general rule, placed with banks and financial

institutions that have credit rating of not less than AA or

equivalent which are verified before placing the deposits.

The composition of trade and other receivables is summarized in

the following table:

September September

30, 2020 30, 2019

CAD $'000 CAD $'000

--------------------------- ---------- ----------

Oil and natural gas sales 1,255 1,512

Other 14,003 2,327

15,258 3,839

--------------------------- ---------- ----------

The Group's receivables are aged as follows:

September September

30, 2020 30, 2019

CAD $'000 CAD $'000

----------- ---------- ----------

Current 15,258 3,839

90 + days - -

15,258 3,839

----------- ---------- ----------

b) Liquidity risk

As of September 30, 2020, the contractual cash flows, including

estimated future interest, of current and non-current financial

assets mature as follows:

Due on Due on

or before or before Due after

Carrying Contractual 30 September 30 September 30 September

Amount cash flow 2021 2022 2022

CAD $'000 CAD $'000 CAD $'000 CAD $'000 CAD $'000

Non-current financial

assets at amortised

cost 12 12 12 - -

Trade and other receivables 15,258 15,258 15,258 - -

Director's loan account 136 136 136

Cash and cash equivalents 1,453 1,453 1,453

16,859 16,859 16,859 - -

----------------------------- ---------- ------------ -------------- -------------- --------------

As of September 30, 2020, the contractual cash flows, including

estimated future interest, of current and non-current financial

liabilities mature as follows:

Due on Due on

or before or before Due after

Carrying Contractual 30 September 30 September 30 September

Amount cash flow 2021 2022 2022

CAD $'000 CAD $'000 CAD $'000 CAD $'000 CAD $'000

Trade and other payables 17,739 17,739 17,739 - -

Loans 3,806 3,887 3,036 851 -

Non-convertible bond 4,750 4,750 294 3,099 357

26,295 26,376 21,069 3,950 357

-------------------------- ---------- ------------ -------------- -------------- --------------

c) Foreign currency risk

Foreign currency exchange risk is the risk that the fair value

of future cash flows will fluctuate as a result of changes in

foreign exchange rates. Foreign exchange rates to Canadian dollars

for the noted dates and periods are as follows:

Closing rate Average rate

2020 2019 2020 2019

US dollars 1.3363 1.3240 1.3592 1.3200

Euro 1.5667 1.4453 1.5413 1.4674

Swiss Franc 1.4505 1.3306 1.4429 1.3391

British Pound 1.7199 1.6282 1.7199 1.6269

Norwegian Crown 0.1420 - 0.1421 -

d) Commodity price risk

Commodity price risk is the risk that the fair value of future

cash flows will fluctuate as a result of changes in commodity

prices.

As of September 30, 2020, a 5% change in the price of natural

gas produced in Italy would represent a change in net loss for the

six-month ended September 30, 2020 of approximately CAD $ nil (2019

- CAD $2k) and a 5% change in the price of electricity produced in

Italy would represent a change in net loss for the six month ended

September 30, 2020 of approximately CAD $nil (2019 - CAD $15k).

e) Interest rate risk

Interest rate risk is the risk that future cash flows will

fluctuate as a result of changes in market interest rates. The

Group has fixed interest on notes payable, loans payable and

convertible notes and therefore is not currently exposed to

interest rate risk.

23. Capital management

The Group's objective when managing capital is to safeguard the

Group's ability to continue as a going concern, so that it can

continue to explore and develop its projects to provide returns for

shareholders and benefits for other stakeholders. The Group manages

its working capital deficiency, long--term debt, and shareholders'

equity as capital.

September 30,

September

30, 2020 2019

CAD $'000 CAD $'000

---------------------- ---- ------------------- ---------------------

Working capital (2,407) (7,772)

Long--term debt 1,903 2,299

Shareholders' equity 8,723 571,845

---------------------------- ------------------- ---------------------

24. Operating segments

The Group's operations are conducted in one business sector, the

oil and natural gas industry. Geographical areas are used to

identify Group's reportable segments. A geographic segment is

considered a reportable segment once its activities are regularly

reviewed by the Board of the Directors.

The Group has three reportable segments which are as

follows:

-- Italy, which commenced gas operations following the acquisition of assets in June 2013

-- The Republic of the Congo, which was acquired during the 2020 FY

-- Other, which includes corporate assets and the operations in

the Canadian, Swiss, Argentinian and Norwegian entities.

Azerbaijan, which was acquired during the FY 2017 and divested

during FY 2020, is mentioned only for comparative purposes with the

past financial year. The results for Azerbaijan as of September 30,

2019 are included in the " Discontinued Operations" (note 18).

PERIOD 2019 Azerbaijan Italy Other Total

CAD $000 CAD $000 CAD $000 CAD $000

Property and equipment 1,065,259 8,101 6,951 1,080,311

Other assets 1,139 1,072 3,879 6,090

Total liabilities 492,575 8,187 13,794 514,556

Capital Expenditures 1,014 60 877 1,951

----------- --------- --------- ----------

Revenue - 344 - 344

Operating and transportation - (182) (976) (1,158)

General and Administrative - (122) (1,867) (1,989)

Depletion and depreciation - (38) (165) (203)

Loss on discontinued operations (5) - - (5)

Finance and other expenses - (4) 1,042 1,038

Taxation - - - -

----------- --------- --------- ----------

Segment loss (5) (2) (1,966) (1,973)

----------- --------- --------- ----------

PERIOD 2020 Azerbaijan Congo Italy Other Total

CAD $000 CAD $000 CAD $000 CAD $000 CAD $000

---------------- ------------------ ------------------- -------------------

Property and

equipment - 19,023 8,093 6,114 33,230

Other assets 275 10,172 898 6,195 17,540

Total

liabilities 4,580 11,146 12,093 14,228 42,047

Capital

Expenditures - - 8 - 8

---------------- ------------------ ------------------- -------------------

Revenue 144 1 - 145

Operating and

transportation (93) (200) (363) (656)

General and

Administrative (525) (55) (2,968) (3,548)

Depletion and

depreciation - - (198) (198)

Loss on

discontinued

operations 563 563

Finance and

other expenses 8 (292) (284)

Taxation (3) - (3)

Segment loss 563 (477) (246) (3,821) (3,981)

-------------------

Further Information:

Zenith Energy Ltd

Andrea Cattaneo, Chief Executive Officer Tel: +1 (587) 315 9031

-----------------------------

E-mail: info@zenithenergy.ca

-----------------------------

Allenby Capital Limited - Financial

Adviser & Broker

-----------------------------

Nick Harriss Tel: + 44 (0) 203 328

Nick Athanas 5656

-----------------------------

Notes to Editors:

Zenith Energy Ltd. is an international oil and gas production

company, listed on the London Stock Exchange (LSE:ZEN) and the

Merkur Market of the Oslo Stock Exchange (ZENA:ME).

Zenith's development strategy is to identify and rapidly seize

value-accretive hydrocarbon production opportunities in the onshore

oil & gas sector, specifically in Africa. The Company's board

of directors and senior management team have the experience and

technical expertise to develop the Company successfully.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VBLFXBFLLFBV

(END) Dow Jones Newswires

November 30, 2020 13:31 ET (18:31 GMT)

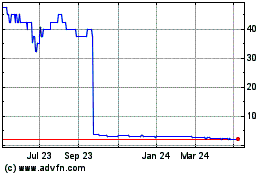

Zenith Energy (LSE:ZEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

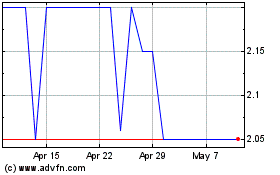

Zenith Energy (LSE:ZEN)

Historical Stock Chart

From Jul 2023 to Jul 2024