TIDMZIOC

RNS Number : 6544E

Zanaga Iron Ore Company Ltd

03 July 2023

3 July 2023

Subscription Agreement with Shard Merchant Capital Ltd

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM:

ZIOC), is pleased to announce that it has entered into an equity

subscription agreement ("ESA") with Shard Merchant Capital Ltd

("SMC"), an institutional investor, dated 1 July 2023. This follows

the successful implementation of an equity subscription agreement

on similar terms in June 2020.

Under the ESA the Company will issue and SMC will subscribe for

up to 36 million ordinary shares of no par value in the Company

("Subscription Shares") in up to three tranches of up to 12 million

shares each (as described below).

In the event the maximum number of Subscription Shares are

issued by ZIOC and subscribed for by SMC, the share capital of ZIOC

will be increased by c.5.9% on a fully diluted basis, based on the

593,374,746 ordinary shares in the Company in issue as at today's

date.

Pursuant to the ESA, SMC has undertaken to use its reasonable

endeavours to place the relevant Subscription Shares that it has

subscribed for and to pay to ZIOC 95% of the gross proceeds of any

such sales.

The ESA provides a number of attractive advantages to ZIOC,

which are highlighted below:

-- Relatively low level of dilution to ZIOC shareholders

-- ZIOC has the ability to repurchase any unsold Subscription

Shares from SMC, subject to legal requirements - an important

element of flexibility for ZIOC. Any Subscription Shares

re-purchased will be cancelled, limiting dilution further

-- Low cost of capital - SMC will retain only 5% of the gross

proceeds of any sale of Subscription Shares

Structure Overview:

Issues of Tranches of Subscription Shares

Under the ESA, Subscription Shares will be issued and SMC will

subscribe for the Subscription Shares in tranches of up to 12

million shares. The first tranche of 12 million Subscription Shares

(the "First Tranche") will be subscribed for by SMC within three

trading days of the date of the ESA.

A second Tranche of 12 million Subscription Shares (the "Second

Tranche") will be subscribed for by SMC 10 trading days following

the earlier of: (a) the date on which SMC has sold all the

Subscription Shares subscribed for in the First Tranche; and (b)

such other date as SMC and the Company agree.

Solely at the discretion of the Company, a third tranche of up

to 12 million Subscription Shares will be subscribed for by SMC

(the "Third Tranche" and together with the First Tranche and the

Second Tranche, each a "Tranche"). Any such subscription will take

place within 14 trading days of the earlier of: (a) the date on

which SMC has sold all the Subscription Shares subscribed for in

the Second Tranche; or (b) such other date as SMC and the Company

agree.

Sales of Subscription Shares

As regards each Tranche, SMC has agreed to use its reasonable

endeavours to place all the Subscription Shares comprised in that

Tranche within a three month period from the date of issue of the

relevant Subscription Shares to it (the "Relevant Three Month

Period"). Such period can be extended prior to the end of the

Relevant Three Month Period by either the Company or ZIOC giving

notice to the other. Any such extension is for a three month period

from the giving of the extension notice. All such sales are subject

to trading restrictions, as mentioned below.

Payment of proceeds of Subscription Shares

In respect of each Tranche, the amount which SMC has undertaken

to pay for the Subscription Shares issued to it in that Tranche is

95% of the gross proceeds of sale received by SMC from all sales of

the relevant Subscription Shares made by it during the Relevant

Three Month Period (as extended, if that occurs).

The ESA provides for regular payments to be made by SMC to ZIOC

following any sales of Subscription Shares.

-- Payments under the First Tranche are to be made weekly and then fortnightly.

-- Payments under the Second Tranche and any Third Tranche

payments are to be made every two weeks (unless an alternative time

for payment is agreed between the parties).

Illustrative example

For illustrative purposes only, if the average price at which

SMC places the 24 million Subscription Shares comprised in the

First Tranche and the Second Tranche was 13.30 pence (being ZIOC's

mid-market closing share price on Thursday 29 June 2023), the net

proceeds received by ZIOC from such sales would be approximately

GBP3.19m. Further, ZIOC has the discretion to elect to issue up to

a further 12 million shares by way of the Third Tranche.

Custodian

The ESA provides that the Subscription Shares are to be held by

a custodian authorized by the Financial Conduct Authority (FCA).

Proceeds of any sale of Subscription Shares by SMC will be held by

the Custodian until remitted by the Custodian to SMC and SMC shall

pay to ZIOC 95% of the gross proceeds of any such sales. To secure

SMC's payment obligations, any proceeds of sale, as well as SMC's

beneficial interest in the Subscription Shares, are to be held by

SMC on trust for the benefit of the Company.

Termination and Unsold Shares

The ESA can be terminated by the Company at any time and by SMC

on the occurrence of certain specified events.

If on termination of the ESA, any Subscription Shares subscribed

for by SMC have not been sold by it (the "Unsold Shares"), the ESA

provides that such Unsold Shares shall be bought back by the

Company from SMC at the same price that SMC has subscribed for such

Unsold Shares (the "Buy-Back") . Completion of the Buy-Back may be

deferred if at the relevant time the Company is precluded from

completing the buy-back arrangement under any applicable

legislation.

Suspension of sales of Subscription Shares:

The Company has the right to require that SMC cease to make (or

procuring) sales of Subscription Shares under any Tranche for such

time as the Company determines ("Suspension Period"). In such

event, the relevant Three Month Period will be extended for the

same amount of time as the Suspension Period.

Trading restrictions:

In order to preserve an orderly market in the Company's shares,

SMC has agreed to effect any sales of Subscription Shares made by

it in accordance with customary orderly market provisions.

Future updates:

The Company will make appropriate further announcements in due

course.

The Company's cash balance at 27 June 2023 was US$530,000, with

US$1,250,000 of drawn debt and incurred interest under the Glencore

Facility and the Company continues with its prudent cash

management. The proceeds received by the Company from SMC pursuant

to the ESA will be applied to general working capital, including

the provision of further contributions to the Zanaga Iron Ore

Project's operations.

An application for the admission of the 12 million Subscription

Shares in the First Tranche will be made shortly and the 12 million

Subscription Shares in the First Tranche are expected to be

admitted to trading on AIM on 5 July 2023. The First Tranche of

Subscription Shares will rank pari passu with the Company's

existing Ordinary Shares. The Company does not hold any shares in

treasury. Following admission of the First Tranche of Subscription

Shares, the total number of Ordinary Shares and voting rights in

the Company will be 605,374,746.

This figure of 605,374,746 Ordinary Shares may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT

FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ("MAR"), AND IS DISCLOSED IN ACCORDANCE WITH

THE COMPANY'S OBLIGATIONS UNDER ARTICLE 17 OF MAR

Clifford Elphick, Chairman of ZIOC commented:

"Following entry into of the Equity Subscription Agreement, ZIOC

is pleased that a financing structure has been put in place which

will give the Company access to funding through a relatively low

cost structure which minimises dilution to shareholders.

This transaction enables ZIOC to secure capital in the future as

the project progresses and further milestones are achieved."

The Zanaga Iron Ore Company Limited LEI number is

21380085XNXEX6NL6L23.

For further information, please contact:

Zanaga Iron Ore

Corporate Development and Andrew Trahar

Investor Relations Manager +44 20 7399 1105

Liberum Capital Limited

Nominated Adviser Scott Mathieson, Kane Collings

and Corporate Broker +44 20 3100 2000

About us:

Zanaga Iron Ore Company Limited (AIM ticker: ZIOC) is the owner

of 100% of the Zanaga Iron Ore Project based in the Republic of

Congo (Congo Brazzaville). The Zanaga Iron Ore Project is one of

the largest iron ore deposits in Africa and has the potential to

become a world-class iron ore producer.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSSMESEEDSEFW

(END) Dow Jones Newswires

July 03, 2023 02:00 ET (06:00 GMT)

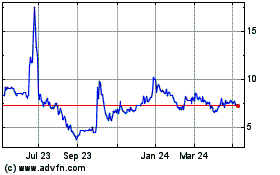

Zanaga Iron Ore (LSE:ZIOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

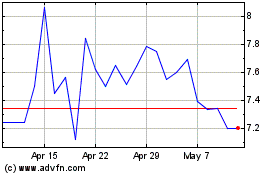

Zanaga Iron Ore (LSE:ZIOC)

Historical Stock Chart

From Apr 2023 to Apr 2024