Paramount Global (NASDAQ:PARA) – Some investors

in Paramount Global are concerned about a potential merger with

Skydance Media and are calling for a fair approach. Skydance, known

for hits such as “Top Gun: Maverick,” is in exclusive talks. Four

board members of Paramount Global have announced they will resign

amid reports of merger talks with Skydance Media. This will reduce

the board to seven directors, including Shari Redstone and CEO

Robert Bakish. The departure of board members is seen as a

precautionary measure to avoid litigation, and the deal could help

the company pay off its debt.

Morgan Stanley (NYSE:MS) – The wealth

management arm of Morgan Stanley is under scrutiny from regulators,

such as the SEC and the OCC, for allegations of lacking due

diligence in identifying clients and monitoring financial

activities. This means they are investigating whether the bank

conducted an adequate investigation into who its clients are, the

origin of their wealth, and how they are conducting their financial

transactions. These investigations may also relate to international

clients. In addition, Morgan Stanley has increased its commitment

to children’s mental health to $50 million over five years. The

Morgan Stanley Alliance for Children’s Mental Health funds

nonprofits addressing youth mental health, including an educational

center for marginalized children, in partnership with the American

Academy of Pediatrics and Sesame Workshop.

Amazon (NASDAQ:AMZN) – Amazon’s shares reached

a new record on Thursday, rising 1.7% to close at $189.05. The

company is now part of the elite group of tech giants, including

Meta Platforms, Microsoft, and Nvidia, which have reached all-time

highs during the post-pandemic recovery. Analysts are optimistic

about Amazon’s cost-cutting efforts and restructuring, seeing

potential for increased profitability and free cash flow.

Additionally, Amazon named Andrew Ng, a computer scientist known

for his work in artificial intelligence at Alphabet and Baidu, to

its board of directors. This occurs as Amazon faces competition in

cloud and voice assistants. Andrew is also a professor at Stanford

and an AI investor.

Alphabet (NASDAQ:GOOGL) – Investors are

optimistic about Alphabet’s AI strategy, with its shares

approaching the record $2 trillion market cap. Despite recent

stumbles, the company is rebounding, highlighting its AI growth

potential to attract investors. Shares have risen 12% this year,

fueled by advances in hardware and news about the possible adoption

of Gemini technology by Apple. Despite this, some question the

discount, arguing that Alphabet should focus on higher ROI. In

other news, Epic Games is urging a federal judge in California to

force Google to open its Play Store to more competition, following

a jury’s conclusion that Google abused its power on the Android

platform. The request, made to James Donato, aims to allow

competing app stores for six years. Google has until May 3 to

respond.

Apple (NASDAQ:AAPL) – Apple is advancing in the

production of M4 processors for computers, featuring AI

capabilities. According to Bloomberg, Apple aims to upgrade all Mac

models with these chips by the end of this year and early next

year, including new iMacs, 14-inch MacBook Pros, and Mac minis.

Apple’s shares jumped 4.3% on Thursday to $175.04, marking the

stock’s best daily gain since May 5, 2023, when it rose 4.7%.

Shares are down 0.4% in Friday’s pre-market.

Microsoft (NASDAQ:MSFT) – Russian

government-backed hackers exploited a Microsoft email system to

steal correspondence between employees and the company. The US

Cybersecurity Agency issued an emergency directive alerting about

the breach, which also targeted government agencies. Microsoft is

cooperating with the investigation.

HP Inc (NYSE:HPQ), Wex Inc

(NYSE:WEX) – Wex Inc., a company specializing in payment processing

and information management, has sued HP Inc. for trademark

infringement, alleging misuse of the name “Wex” to brand competing

software from HP, which could confuse

customers.

Meta Platforms (NASDAQ:META) – Australian

prosecutors have halted the criminal case of Andrew Forrest against

Meta due to fraudulent cryptocurrency ads on Facebook using his

image. Forrest, Australia’s second-richest person, claims these ads

caused losses to investors. Despite this, he continues to pursue

civil accountability in a separate case in California. Meta asserts

its commitment to combating scams, while Forrest insists on his

claims.

Advanced Micro Devices (NASDAQ:AMD),

Intel (NASDAQ:INTC) – Advanced Micro Devices saw a

1.9% drop, while Intel fell 1.5% in Friday’s pre-market, in

response to reports from the Wall Street Journal about the guidance

of Chinese authorities for the country’s major telecom operators,

instructing the gradual replacement of foreign processors.

Goldman Sachs (NYSE:GS) – A Goldman Sachs

economist predicts that the Nigerian naira may continue its

appreciation, following a 12% rise in April. Recent measures by the

central bank, including interest rate hikes, have helped the

currency recover. Goldman maintains a long-term projection for the

naira at 1,200 per dollar.

UBS Group AG (NYSE:UBS) – UBS may need to

retain between $10 billion and $15 billion in excess capital, due

to Swiss plans for stricter capital requirements. This could impact

share buybacks. The government plans to finalize the plans by

2025.

Reddit (NYSE:RDDT) – Reddit’s first earnings

report after its public offering will be on May 7. The company will

involve users in the process, allowing questions in a subreddit.

After an IPO in March, its shares soared 48% on the first day,

mainly driven by advertising and data licensing deals.

Lyft (NASDAQ:LYFT), Uber

Technologies (NYSE:UBER) – Lyft and Uber will extend their

services in Minneapolis until July 1. The decision follows the City

Council’s vote to delay the wage increase for shared transport

drivers from May to July, securing a minimum wage of $15.57 per

hour.

Lockheed Martin (NYSE:LMT) – Lockheed Martin

announced on Thursday it secured a contract of up to $4.1 billion

from the US Missile Defense Agency to continue developing its

battle command system, C2BMC-Next. This system is crucial for

defense against ballistic missiles, with a focus on global

integration. The contract spans from May 1, 2024, to April 30,

2029, with an option to extend until April 30, 2034, and will

involve upgrades at facilities in Huntsville, Alabama, and Colorado

Springs, Colorado.

Spirit Aerosystems (NYSE:SPR) – The CEO of

Airbus indicated that the company might take over two factories

managed by Spirit Aerosystems in the US and the UK, as Boeing seeks

to purchase one of its main suppliers. The final decision depends

on Boeing’s actions, but Airbus (USOTC:EADSY) has significant

influence.

Boeing (NYSE:BA) – The US Senate Commerce

Committee will hold a hearing next week with members of a panel

that criticized Boeing’s actions, seeking improvements in safety

culture.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines is facing challenges due to reduced deliveries of Boeing

aircraft, affecting its growth plans. Initially expected to receive

46 aircraft, they now anticipate about 20, as they deal with

production delays and certification uncertainties. The company is

reviewing strategies to mitigate the impacts.

Ford Motor (NYSE:F) – US safety investigators

stated that a Ford Mustang Mach-E, equipped with the advanced

driver assistance system “BlueCruise,” was involved in a rear-end

collision with a stationary Honda CR-V on I-10 in San Antonio,

Texas, on February 24, resulting in a fatal accident. The NTSB is

investigating the incident, along with another similar accident in

Philadelphia on March 3. Ford also announced on Thursday that it

will begin shipping 144,000 redesigned F-150 and Ranger pickups to

dealers in the US, after holding them back due to quality concerns.

Additionally, Ford Motor has reduced the prices of some variants of

the electric F-150 Lightning by up to $5,500, facing a competitive

electric vehicle (EV) market. The XLT variant now costs $62,995,

while the Lariat dropped 3.14% to $76,995. The Flash variant has a

discount of $5,500, totaling $67,995.

Rivian Automotive (NASDAQ:RIVN) – Rivian

Automotive’s shares plummeted 6.8% to close at a record low on

Thursday after Ford Motor announced price cuts for its electric

vehicles F-150 Lightning.

VinFast (NASDAQ:VFS) – The Vietnamese

conglomerate Vingroup, boosting its electric vehicle branch, faces

growing financial risks due to the loss-making unit VinFast Auto.

Dependence on domestic sales and financial support raises concerns.

The company struggles to attract retail buyers and faces challenges

in the global electric vehicle market.

Exxon Mobil (NYSE:XOM) – The CEO of Exxon

Mobil, Darren Woods, received total compensation of $36.9 million

for 2023, an increase of nearly 3%. The company recommended that

investors vote against shareholder proposals, including emission

reductions and additional reports on social and environmental

issues.

Petrobras (NYSE:PBR) – A Brazilian judge has

suspended the chairman of the Petrobras board, Pietro Sampaio

Mendes, due to a conflict of interest with his role at the Ministry

of Energy. The decision included the suspension of his salary

payments and highlighted other alleged irregularities, as tensions

persist over dividends withheld by the company.

AstraZeneca (NASDAQ:AZN) – Shareholders of

AstraZeneca approved a salary policy for 2024, raising CEO Pascal

Soriot’s remuneration to up to 18.9 million pounds this year. Over

a third of investors opposed the package, reflecting concerns about

salary disparities and global competitiveness.

Zumiez (NASDAQ:ZUMZ) – Shares of Zumiez have

fallen more than 25% this year, but an executive of the company

took the opportunity to acquire devalued shares. Adam Ellis,

president of international operations, purchased 10,000 shares for

$143,100, increasing his stake to 57,917 shares.

Archer-Daniels-Midland (NYSE:ADM) –

Archer-Daniels-Midland announced on Thursday an expansion of the

recall of 17 additional lots of feeds for poultry, pigs, and

rabbits due to elevated levels of magnesium, sodium, calcium,

and/or phosphorus, posing risks to the animals.

Nike (NYSE:NKE) – Bank of

America (NYSE:BAC) now sees Nike’s estimates as

achievable, upgrading its recommendation to ‘Buy’ after 3 years of

‘Neutral’ rating, and raising the target price for the shares from

$110 to $113. The brand’s focus on innovation and reduction of

styles may cause a temporary drop in sales but could strengthen its

position in the long term.

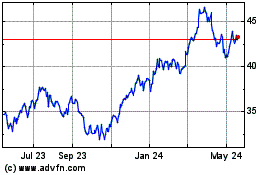

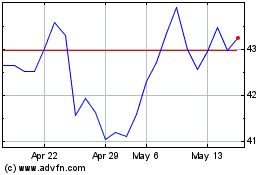

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Feb 2024 to Feb 2025