0000002178FALSE00000021782025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2025

ADAMS RESOURCES & ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-7908 | 74-1753147 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

| Wortham Tower Building, 2727 Allen Parkway, 9th Floor, Houston, Texas | 77019 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 881-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.10 par value | | AE | | NYSE American LLC |

| | | | | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | Emerging growth company | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 5.07. Submission of Matters to a Vote of Security Holders.

On January 29, 2025, Adams Resources & Energy, Inc. (the “Company”) held a virtual special meeting of its stockholders via live audio webcast (the “Special Meeting”). As of the close of business on December 20, 2024, the record date for the Special Meeting, there were 2,574,275 shares of the Company’s common stock, par value $0.10 per share (the “Common Stock”), outstanding and entitled to vote at the Special Meeting. A total of 2,000,487 shares of the Company’s Common Stock, or approximately 77.71% of the shares of the Company’s Common Stock issued and outstanding and entitled to vote at the close of business on the record date, were represented in attendance via the virtual meeting website or by proxy at the Special Meeting, which constituted a quorum to conduct business.

A summary of the matters voted upon at the Special Meeting and the voting results for each such matter are presented below. The proposals related to each such matter are described in greater detail in the Definitive Proxy Statement filed by the Company with the Securities and Exchange Commission on December 20, 2024.

Proposal 1 – The Merger Proposal

To approve and adopt the Agreement and Plan of Merger, dated November 11, 2024, by and among the Company, ARE Equity Corporation (“ARE Equity”), a Texas corporation (as successor-in-interest to Tres Energy LLC, a Texas limited liability company), and ARE Acquisition Corporation, a Delaware corporation (“Merger Sub”), pursuant to which Merger Sub will merge with and into the Company with the Company surviving the merger as a wholly owned subsidiary of ARE Equity (the “Merger Proposal”).

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Votes |

| | | | | | |

| 1,971,685 | | 28,443 | | 359 | | N/A |

Proposal 2 – The Compensation Proposal

To approve, on a non-binding, advisory basis, certain compensation that will or may be paid by the Company to the Company’s named executive officers that is based on or otherwise relates to the Merger Agreement and the transactions contemplated by the Merger Agreement.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Votes |

| | | | | | |

| 1,726,489 | | 82,820 | | 191,178 | | N/A |

Proposal 3 – The Adjournment Proposal

To approve an adjournment of the Special Meeting, including, if necessary, to solicit additional proxies in favor of the Merger Proposal if there are not sufficient votes at the time of such adjournment to approve the Merger Proposal.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Votes |

| | | | | | |

| 1,946,896 | | 27,931 | | 25,660 | | N/A |

Although Proposal 3 was approved, the adjournment of the Special Meeting was not necessary because the Company’s stockholders approved the Merger Proposal.

Item 8.01. Other Events.

On January 29, 2025, the Company issued a press release announcing the preliminary results of the Special Meeting. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File — the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | ADAMS RESOURCES & ENERGY, INC. |

| | | |

| | | |

| | | |

| Date: | January 30, 2025 | By: | /s/ Tracy E. Ohmart |

| | | Tracy E. Ohmart |

| | | Chief Financial Officer |

| | | (Principal Financial Officer and |

| | | Principal Accounting Officer) |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Adams Resources & Energy, Inc. Stockholders Approve

Acquisition by an Affiliate of Tres Energy LLC

Houston, Texas (Wednesday, January 29, 2025) -- Adams Resources & Energy, Inc. (NYSE AMERICAN: AE) (“Adams” or the “Company”) announced today that its stockholders have voted at a special meeting of the Company’s stockholders (the “Special Meeting”) to approve the pending acquisition of the Company by an affiliate of Tres Energy LLC. Under the terms of the merger agreement that was approved at the Special Meeting, Adams stockholders will receive $38.00 per share in cash for each share of Adams common stock they own immediately prior to the effective time of the merger.

Approximately 77% of the Company’s outstanding shares were voted at the Special Meeting, and the merger was approved by over 76% of the Company's outstanding shares. The final voting results on the proposals voted on at the Special Meeting will be set forth in a Form 8-K that will be filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”).

The merger is expected to close in early February 2025, subject to customary closing conditions.

Forward-Looking Statements and Information

This communication contains “forward-looking statements” within the Private Securities Litigation Reform Act of 1995. Any statements contained in this communication that are not statements of historical fact, including statements about the timing of the proposed transaction, Adams’s ability to consummate the proposed transaction and the expected benefits of the proposed transaction, may be deemed to be forward-looking statements. All such forward-looking statements are intended to provide management’s current expectations for the future of the Company based on current expectations and assumptions relating to the Company’s business, the economy and other future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “signs,” and other words of similar meaning in connection with the discussion of future performance, plans, actions or events. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Such risks and uncertainties include, among others: (i) the risk that a condition of closing of the proposed transaction may not be satisfied or that the

closing of the proposed transaction might otherwise not occur, (ii) risks related to disruption of management time from ongoing business operations due to the proposed transaction, (iii) the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of Adams, (iv) the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Adams to retain customers and retain and hire key personnel and maintain relationships with its suppliers and customers, (v) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Merger Agreement, including in circumstances requiring the Company to pay a termination fee, (vi) unexpected costs, charges or expenses resulting from the Merger, (vii) potential litigation relating to the Merger that could be instituted against the parties to the Merger Agreement or their respective directors, managers or officers, including the effects of any outcomes related thereto, (viii) worldwide economic or political changes that affect the markets that the Company’s businesses serve which could have an effect on demand for the Company’s products and services and impact the Company’s profitability, and (ix) disruptions in the global credit and financial markets, including diminished liquidity and credit availability, cyber-security vulnerabilities, crude oil pricing and supply issues, retention of key employees, increases in fuel prices, and outcomes of legal proceedings, claims and investigations. Accordingly, actual results may differ materially from those contemplated by these forward-looking statements. Investors, therefore, are cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in Adams’s filings with the SEC, including the risks and uncertainties identified in Part I, Item 1A - Risk Factors of Adams’s Annual Report on Form 10-K for the year ended December 31, 2023 and in the Company’s other filings with the SEC.

These forward-looking statements speak only as of the date of this communication, and Adams does not assume any obligation to update or revise any forward-looking statement made in this communication or that may from time to time be made by or on behalf of the Company, whether in response to new information, future events, or otherwise, except as required by applicable law.

There can be no assurance that the proposed transaction will in fact be consummated. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this communication. The Company undertakes no obligation or duty to update or revise any of these forward-looking statements after the date of this communication, whether in response to new information, future events, or otherwise, except as required by applicable law.

About Adams Resources & Energy, Inc.

Adams Resources & Energy, Inc. is engaged in crude oil marketing, transportation, terminalling and storage, tank truck transportation of liquid chemicals and dry bulk and recycling and repurposing of off-spec fuels, lubricants, crude oil and other chemicals through its subsidiaries, GulfMark Energy, Inc., Service Transport Company, Victoria Express Pipeline, L.L.C., GulfMark Terminals, LLC, Phoenix Oil, Inc., and Firebird Bulk Carriers, Inc. For more information, visit www.adamsresources.com.

About Tres Energy LLC

Tres Energy LLC is a privately held limited liability company that invests in and operates strategic energy assets across the United States. For more information, visit www.tres-energy.com.

Company Contact

Tracy E. Ohmart

EVP, Chief Financial Officer

tohmart@adamsresources.com

(713) 881-3609

v3.24.4

Cover Page

|

Jan. 29, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2025

|

| Entity Registrant Name |

ADAMS RESOURCES & ENERGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-7908

|

| Entity Tax Identification Number |

74-1753147

|

| Entity Address, Address Line One |

Wortham Tower Building

|

| Entity Address, Address Line Two |

2727 Allen Parkway

|

| Entity Address, Address Line Three |

9th Floor

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77019

|

| City Area Code |

713

|

| Local Phone Number |

881-3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

AE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000002178

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

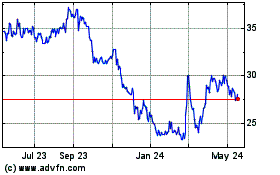

Adams Resources and Energy (AMEX:AE)

Historical Stock Chart

From Jan 2025 to Feb 2025

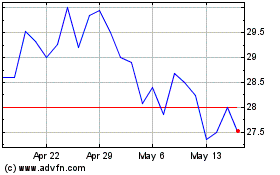

Adams Resources and Energy (AMEX:AE)

Historical Stock Chart

From Feb 2024 to Feb 2025