3 Bond ETFs Popular in the 'No Taper' Aftermath - ETF News And Commentary

October 08 2013 - 1:00PM

Zacks

The fixed income world has been struggling over the past couple of

months on the Fed’s taper talks and the growing investor appetite

for rising equity markets which has resulted in rising yields.

However, this trend seems to be reversing as the Fed refrained from

withdrawing the stimulus, keeping the current bond buying program

intact. This surprise move by the Fed breathed life into the

depressed bond market, sending yields lower. Yields on 10-year

Treasury notes are now hovering around 2.6%, down from 3% reached

in early September (read: 3 ETF Winners from the 'No Taper'

Shocker).

As such, bond ETFs experienced the biggest inflows in five months,

according to the data from Bank of America Merrill Lynch. Total

bond funds accumulated net $4.5 billion in the week (ending

September 25) immediately following the ‘no taper’ announcement.

High yield bonds led the pack, followed by emerging market

bonds.

Bond inflows have begun raising bond prices as many investors are

now buying bonds in order to take advantage from the falling yield.

Further, the looming concerns on the government shutdown and the

debt ceiling are compelling investors to enter the bond market.

Below, we have highlighted the three bond ETFs with highest inflows

in the past few trading session following the Fed ‘zero taper’:

iShares iBoxx $ High Yield Corporate Bond ETF

(HYG)

This is the largest and one of the most widely-traded funds in the

high yield bond space with AUM of over $15.2 billion and average

daily volume of just under five million shares. The product has

accumulated about $495 million in assets in the past few trading

sessions while charging 50 bps in fees per year from investors.

The fund tracks the iBoxx $ Liquid High Yield Index and holds 854

securities in the basket. About 95% of the product’s holdings

mature in less than 10 years, giving HYG an effective duration of

4.24 years and average maturity of 4.83 years. In terms of credit

quality, the fund focuses on higher quality non-investment grade

bonds, allocating just 35% of the portfolio to bonds rated ‘B’ or

lower.

The ETF is up over 2% in the year-to-date time frame and has a

30-day SEC yield of 5.33% (see: all the High Yield Bond ETFs

here).

iShares 20+ Year Treasury Bond ETF

(TLT)

This product provides exposure to the long-term Treasury bond

market by tracking the Barclays Capital U.S. 20+ Year Treasury Bond

Index and holds 20 securities (read: Time to Buy Treasury Bond

ETFs?).

The fund sees inflows of roughly $364 million in the week following

the Fed taper hold, propelling the asset base to $3.22 billion. The

ETF charges 0.15% in expenses while it trades in solid volume of

more than nine million shares per day.

The product targets the long end of the yield curve with maturity

of greater than 20 years. The average maturity comes in 27.45 years

and effective duration is 16.39 years.

The fund focuses on the top credit rating bonds (AA+ and higher).

TLT lost 10.93% year-to-date but added 2% in the past two weeks.

However, the fund sports a 30-Day SEC yield of 3.67%.

PowerShares Senior Loan ETF

(BKLN)

This ETF tracks the S&P/LSTA U.S. Leveraged Loan 100 Index

which acts as a benchmark for the largest institutional leveraged

loans based on market weightings, spreads and interest payments.

The fund has gathered nearly $321 million alone within a week

following the no taper shocker and total AUM comes to $5.8

billion.

The product holds 129 securities in the basket with the vast

majority maturing between one and 10 years. With the average days

to reset being just over 15, interest rate risk is minimal. Though

senior loans account for a hefty 89% of the assets, high yield

securities also make up for the remaining portion in the basket

(read: Senior Loan ETFs: The Best Bet for Rising Rates?).

BKLN is quite expensive, charging 66 bps a year in annual fees but

sees good average daily trading volume of 3.1 million shares. The

ETF is up 2.30% so far this year and has a 4.15% 30-Day SEC

yield.

Bottom Line

Investors seeking a bond investment are still keeping a close eye

on the movement of these funds due to the uncertainty over

government shutdown and the upcoming debt-ceiling debacle. If the

debt limit is not raised within the deadline, then it could lead to

credit defaults which could really rock the bond market.

Either way, the above funds have been winners (so-far) in the

post-Fed 'no taper' environment, and thus could be barometers for

the fixed income world in the short term. Look for these to be

among the most impacted by both the Fed minutes release and the

next Fed meeting, as more bond market uncertainty may definitely

boost these funds to close out the year.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-SNR LN PR (BKLN): ETF Research Reports

ISHARS-IBX HYCB (HYG): ETF Research Reports

ISHARS-20+YTB (TLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

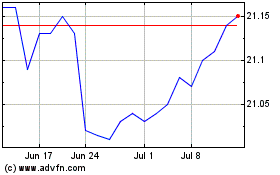

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

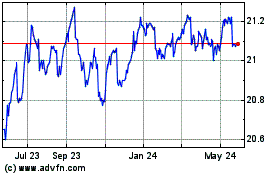

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Jan 2024 to Jan 2025