Better Choice Company Inc. (NYSE American: BTTR) (the “Company” or

“Better Choice”), a pet health and wellness company, today

announced its results for the third quarter ended

September 30, 2024 ("Q3 2024").

THIRD QUARTER 2024

FINANCIAL HIGHLIGHTS

- Revenue increased 33% to

$11.4 million from the second quarter 2024

- Gross margin increased 591 basis points

year-over-year (“YOY”) to 40%

- Operating margin improved 1,003 basis

points YOY to (10)%

- Net income increased 194% YOY to

$1.5 million

- Earnings per share (“EPS”) improved

132% YOY to $0.73

- $2.6 million gain on

extinguishment of debt

- Adjusted EBITDA increased 255% YOY to

$0.2 million1

“For the third quarter of 2024, we exceeded our internal

projections across all key financial metrics," commented Chief

Executive Officer, Kent Cunningham. "The most encouraging for me

was the double-digit year-over-year growth we saw across our

primary Digital customers. We can see our marketing shifts are

paying off as we have grown our new-to-brand consumer base, and we

know our product performance is delivering as we've generated more

repeat consumers. In our International channel, we generated 9%

year-over-year growth with particularly strong performance across

the Asia-Pacific region. We’re excited about the

once-in-a-generation demographic shift occurring in Asia, where the

pet food market is experiencing rapid growth. "

Nina Martinez, Chief Financial Officer, also commented, "Our

ability to achieve 255% growth in adjusted EBITDA1 to a nearly 2%

adjusted EBITDA margin1 on the quarter marks the Company's first

profitable quarter in over four years. In addition to the gross

margin accretion realized, we generated a $2.7 million gain through

the paydown of short-term obligations as we significantly shifted

to a healthy working capital position of $9.5 million. The

company’s positive financial results with a third consecutive

quarter of improved gross margin, as well as second consecutive

quarter of net income and EPS growth, gives us confidence that we

can deliver significant growth upside as we head into 2025."

1 Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP

measures. Reconciliation of Adjusted EBITDA to net income (loss),

the most directly comparable GAAP financial measure, is set forth

in the reconciliation table accompanying this release.

About Better Choice Company Inc.

Better Choice Company Inc. is a pet health and

wellness company focused on providing pet products and services

that help dogs and cats live healthier, happier and longer lives.

We offer a broad portfolio of pet health and wellness products for

dogs and cats sold under our Halo brand across multiple forms,

including foods, treats, toppers, dental products, chews, and

supplements. We have a demonstrated, multi-decade track record of

success and are well positioned to benefit from the mainstream

trends of growing pet humanization and consumer focus on health and

wellness. Our products consist of kibble and canned dog and cat

food, freeze-dried raw dog food and treats, vegan dog food and

treats, oral care products and supplements. Halo’s core products

are made with high-quality, thoughtfully sourced ingredients for

natural, science-based nutrition. Each innovative recipe is

formulated with leading veterinary and nutrition experts to deliver

optimal health. For more information, please visit

https://www.betterchoicecompany.com.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. The words “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “could,”

“target,” “potential,” “is likely,” “will,” “expect” and similar

expressions, as they relate to us, are intended to identify

forward-looking statements. The Company has based these

forward-looking statements largely on our current expectations and

projections about future events and financial trends that we

believe may affect our financial condition, results of operations,

business strategy and financial needs. Some or all of the results

anticipated by these forward-looking statements may not be

achieved. Further information on the Company’s risk factors is

contained in our filings with the SEC. Any forward-looking

statement made by us herein speaks only as of the date on which it

is made. Factors or events that could cause our actual results to

differ may emerge from time to time, and it is not possible for us

to predict all of them. The Company undertakes no obligation to

publicly update any forward-looking statement, whether as a result

of new information, future developments or otherwise, except as may

be required by law.

Company Contact:Better Choice Company Inc.Kent

Cunningham, CEO

Investor Contact:KCSA Strategic

CommunicationsValter Pinto, Managing DirectorT:

212-896-1254Valter@KCSA.com

| |

|

Better Choice Company Inc.Unaudited

Condensed Consolidated Statements of Operations(Dollars in

thousands) |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net sales |

$ |

11,372 |

|

|

$ |

13,117 |

|

|

$ |

27,817 |

|

|

$ |

32,890 |

|

| Cost of goods sold |

|

6,854 |

|

|

|

8,681 |

|

|

|

17,432 |

|

|

|

21,625 |

|

| Gross profit |

|

4,518 |

|

|

|

4,436 |

|

|

|

10,385 |

|

|

|

11,265 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

5,645 |

|

|

|

7,052 |

|

|

|

14,703 |

|

|

|

19,721 |

|

| Total operating expenses |

|

5,645 |

|

|

|

7,052 |

|

|

|

14,703 |

|

|

|

19,721 |

|

| Loss from operations |

|

(1,127 |

) |

|

|

(2,616 |

) |

|

|

(4,318 |

) |

|

|

(8,456 |

) |

| Other income

(expense): |

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

6 |

|

|

|

(344 |

) |

|

|

(536 |

) |

|

|

(952 |

) |

|

Change in fair value of warrant liabilities |

|

— |

|

|

|

1,339 |

|

|

|

— |

|

|

|

1,339 |

|

|

Gain on extinguishment of debt and accounts payable |

|

2,645 |

|

|

|

— |

|

|

|

6,206 |

|

|

|

— |

|

| Total other income, net |

|

2,651 |

|

|

|

995 |

|

|

|

5,670 |

|

|

|

387 |

|

| Income (loss) before income

taxes |

|

1,524 |

|

|

|

(1,621 |

) |

|

|

1,352 |

|

|

|

(8,069 |

) |

|

Income tax (benefit) expense |

|

(2 |

) |

|

|

— |

|

|

|

3 |

|

|

|

— |

|

| Net income (loss) |

$ |

1,526 |

|

|

$ |

(1,621 |

) |

|

$ |

1,349 |

|

|

$ |

(8,069 |

) |

| Weighted average number of

shares outstanding, basic |

|

2,085,715 |

|

|

|

703,990 |

|

|

|

1,257,006 |

|

|

|

697,271 |

|

| Weighted average number of

shares outstanding, diluted |

|

2,085,715 |

|

|

|

703,990 |

|

|

|

1,257,006 |

|

|

|

697,271 |

|

| Net income (loss) per share,

basic |

$ |

0.73 |

|

|

$ |

(2.30 |

) |

|

$ |

1.07 |

|

|

$ |

(11.57 |

) |

| Net income (loss) per share,

diluted |

$ |

0.73 |

|

|

$ |

(2.30 |

) |

|

$ |

1.07 |

|

|

$ |

(11.57 |

) |

| |

|

Better Choice Company Inc.Unaudited

Condensed Consolidated Balance Sheets(Dollars in

thousands, except share amounts) |

| |

| |

September 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

|

Cash and cash equivalents |

$ |

4,743 |

|

|

$ |

4,455 |

|

| Accounts receivable, net |

|

5,726 |

|

|

|

4,354 |

|

| Note receivable |

|

1,450 |

|

|

|

— |

|

| Inventories, net |

|

3,930 |

|

|

|

6,611 |

|

| Prepaid expenses and other

current assets |

|

477 |

|

|

|

812 |

|

| Total Current Assets |

|

16,326 |

|

|

|

16,232 |

|

| Fixed assets, net |

|

158 |

|

|

|

230 |

|

| Right-of-use assets, operating

leases |

|

78 |

|

|

|

120 |

|

| Goodwill |

|

405 |

|

|

|

— |

|

| Other assets |

|

205 |

|

|

|

155 |

|

| Total Assets |

$ |

17,172 |

|

|

$ |

16,737 |

|

| Liabilities &

Stockholders’ Equity |

|

|

|

| Current

Liabilities |

|

|

|

| Accounts payable |

$ |

3,217 |

|

|

$ |

6,928 |

|

| Accrued and other

liabilities |

|

1,631 |

|

|

|

2,085 |

|

| Credit facility, net |

|

1,944 |

|

|

|

1,741 |

|

| Term loan, net |

|

— |

|

|

|

2,881 |

|

| Operating lease liability |

|

60 |

|

|

|

57 |

|

| Total Current Liabilities |

|

6,852 |

|

|

|

13,692 |

|

| Non-current

Liabilities |

|

|

|

| Operating lease liability |

|

21 |

|

|

|

67 |

|

| Total Non-current

Liabilities |

|

21 |

|

|

|

67 |

|

| Total Liabilities |

|

6,873 |

|

|

|

13,759 |

|

| Stockholders’

Equity |

|

|

|

| Common Stock, $0.001 par

value, 200,000,000 shares authorized, 1,755,139 & 729,026

shares issued and outstanding as of September 30, 2024, and

December 31, 2023, respectively |

|

2 |

|

|

|

1 |

|

| Additional paid-in

capital |

|

330,290 |

|

|

|

324,319 |

|

| Accumulated deficit |

|

(319,993 |

) |

|

|

(321,342 |

) |

| Total Stockholders’

Equity |

|

10,299 |

|

|

|

2,978 |

|

| Total Liabilities and

Stockholders’ Equity |

$ |

17,172 |

|

|

$ |

16,737 |

|

Better Choice Company

Inc.Non-GAAP Measures

Adjusted EBITDA and Adjusted EBITDA Margin

We define Adjusted EBITDA and Adjusted EBITDA

margin to supplement the financial measures prepared in accordance

with GAAP. Adjusted EBITDA and Adjusted EBITDA margin adjusts

EBITDA to eliminate the impact of certain items that we do not

consider indicative of our core operations. Adjusted EBITDA is

determined by adding the following items to net (loss) income:

interest expense, tax expense, depreciation and amortization,

share-based compensation, gain on extinguishment of debt, loss on

disposal of assets, transaction-related expenses, and other

non-recurring expenses. Adjusted EBITDA margin is determined by

dividing Adjusted EBITDA by Net sales.

We present Adjusted EBITDA and Adjusted EBITDA

margin as it is a key measure used by our management and board of

directors to evaluate our operating performance, generate future

operating plans and make strategic decisions regarding the

allocation of capital. We believe that the disclosure of Adjusted

EBITDA and Adjusted EBITDA margin is useful to investors as this

non-GAAP measure forms the basis of how our management team reviews

and considers our operating results. By disclosing this non-GAAP

measure, we believe that we create for investors a greater

understanding of and an enhanced level of transparency into the

means by which our management team operates our company. We also

believe this measure can assist investors in comparing our

performance to that of other companies on a consistent basis

without regard to certain items that do not directly affect our

ongoing operating performance or cash flows.

Adjusted EBITDA does not represent cash flows

from operations as defined by GAAP. Adjusted EBITDA has limitations

as a financial measure and you should not consider it in isolation,

or as a substitute for, or superior to, financial measures

calculated in accordance with GAAP. Because of these limitations,

you should consider Adjusted EBITDA alongside other financial

performance measures, including various cash flow metrics, net

(loss) income, gross margin, and our other GAAP results.The

following table presents a reconciliation of net income (loss), the

closest GAAP financial measure, to EBITDA and Adjusted EBITDA for

each of the periods indicated (in thousands):

|

Reconciliation of Net Income (Loss) to EBITDA and Adjusted

EBITDA |

| |

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income (loss) |

$ |

1,526 |

|

|

$ |

(1,621 |

) |

|

$ |

1,349 |

|

|

$ |

(8,069 |

) |

| Interest expense, net |

|

(6 |

) |

|

|

344 |

|

|

|

536 |

|

|

|

952 |

|

| Income tax expense |

|

(2 |

) |

|

|

— |

|

|

|

3 |

|

|

|

— |

|

| Depreciation and

amortization |

|

31 |

|

|

|

416 |

|

|

|

99 |

|

|

|

1,262 |

|

| EBITDA |

|

1,549 |

|

|

|

(861 |

) |

|

|

1,987 |

|

|

|

(5,855 |

) |

| Share-based compensation |

|

84 |

|

|

|

473 |

|

|

|

762 |

|

|

|

1,618 |

|

| Gain on extinguishment of

debt |

|

(2,645 |

) |

|

|

|

|

(6,206 |

) |

|

|

| Loss on disposal of

assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11 |

|

| Transaction-related expenses

(a) |

|

418 |

|

|

|

— |

|

|

|

907 |

|

|

|

— |

|

| Strategic branding initiatives

(b) |

|

33 |

|

|

|

41 |

|

|

|

102 |

|

|

|

73 |

|

| Co-manufacturing partner

transition (c) |

|

— |

|

|

|

|

|

— |

|

|

|

6 |

|

| Other single occurrence

expenses (d) |

|

776 |

|

|

|

208 |

|

|

|

1,232 |

|

|

|

397 |

|

| Adjusted

EBITDA |

$ |

215 |

|

|

$ |

(139 |

) |

|

$ |

(1,216 |

) |

|

$ |

(3,750 |

) |

| (a) Legal fees,

professional fees, and other expenses for transaction-related

business matters. |

| (b) One-time

costs related to marketing agency and design, strategic re-branding

initiatives, Elevate® launch, product innovation and

reformulations |

| (c) One-time

costs related to marketing agency and design, strategic re-branding

initiatives, Elevate® launch, product innovation and

reformulations |

| (d) One-time

costs related to employee severance, executive recruitment, and

other non-recurring professional fees |

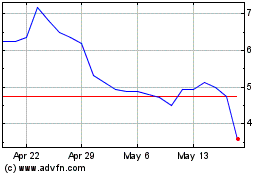

Better Choice (AMEX:BTTR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Better Choice (AMEX:BTTR)

Historical Stock Chart

From Feb 2024 to Feb 2025