Time to Buy the Australian Dollar ETF? - ETF News And Commentary

April 01 2013 - 9:08AM

Zacks

So far in 2013, the story in the currency ETF world has been

strength of the U.S. dollar. The greenback has surged against a

variety of currencies to start the year and many investors think

this trend can continue.

This is largely thanks to a huge level of weakness seen in the

currency’s main competitors, the euro, the yen, and the British

pound. All three are facing issues with their economies and appear

poised to slump in Q2 as well (see Can Currency ETF Trends

Continue?).

Yet while many developed market currencies have seen weakness in

2013, a few have managed to stay firm against the dollar. One such

currency is definitely the Aussie dollar, as represented by the

CurrencyShares Australian Dollar Trust (FXA).

The currency has still underperformed UUP to start the new year,

but it is up since January 1st, adding about half a

percent in the first three months of 2013. This is largely because

of uncertainty in other developed markets, and the relatively high

discount rate in the Aussie economy (also read Inside the Only

Singapore Dollar ETF).

Currently, rates come in at 3%, a pretty healthy level when

compared to what investors see in countries like the U.S. or Japan.

This makes the Australian dollar a decent choice for a carry trade,

while it also suggests that the RBA has a great deal of policy

flexibility going forward, something that cannot be said for many

other developed markets.

In addition, the currency is also becoming increasingly popular

with central bankers around the globe, largely thanks to its

insulation from many other weakened markets like Japan or Britain.

This makes it a great diversifier in portfolios, and an

increasingly important part of forex baskets.

If that wasn’t enough, there are also some new rumors of

Australia and China setting up an agreement to make the Aussie

dollar freely convertible to yuan. If approved, this would make the

Australian dollar just the third currency—after the dollar and the

yen—to achieve this status, a net positive for Australian

businesses and the reputation of the nation’s currency alike (read

The Key to International ETF Investing).

Technical perspective

Beyond the strong fundamentals underlying the currency, there

are also a number of positives from a technical perspective as

well. FXA cannot seem to break below its longer term moving

averages, as the 15-day SMA remains above its longer term

level.

This has been the trend for at least the past six months, and

both times we were in danger of seeing a crossover, the currency

rallied and then proceeded to surge to new heights. Given that we

just witnessed a similar situation a few days ago, now could be a

great time to get in on the Aussie dollar wave in hopes of another

continued appreciation streak.

Bottom Line

FXA, and the Aussie economy, have some strong fundamentals at

their back, and we look for these to continue for quite some time.

That is why we currently have a Zacks ETF Rank of 2 or ‘Buy’ on FXA

going forward (see Currency Hedged ETFs: Top International

Picks?).

So, for investors seeking a currency play but are squeamish

about making a long bet on the U.S. dollar, FXA could be a great

alternative. It is highly ranked, has strong momentum, and its

fundamentals suggest that the trend could continue for at least a

bit longer.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-AUSTRAL (EWA): ETF Research Reports

CRYSHS-AUS DOLR (FXA): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

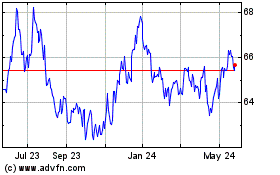

Invesco CurrencyShares A... (AMEX:FXA)

Historical Stock Chart

From Dec 2024 to Jan 2025

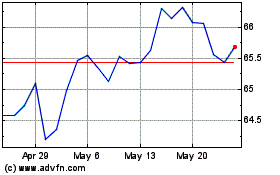

Invesco CurrencyShares A... (AMEX:FXA)

Historical Stock Chart

From Jan 2024 to Jan 2025