The Marygold Companies, Inc. (“TMC,” or the “Company”) (NYSE

American: MGLD), a diversified global holding firm, today reported

financial results for the 2024 first fiscal quarter ended September

30, 2023.

Net revenues for the three months ended September 30, 2023 were

$8.2 million, versus $8.9 million last year. The Company registered

a net loss of $500 thousand, equal to a loss of $0.1 per share, for

the fiscal 2024 first quarter, principally reflecting continued

investment in the Marygold & Co. fintech app, compared with net

income of $497 thousand, or $0.01 per share, last year.

TMC’s balance sheet remained strong at September 30, 2023. Cash

and cash equivalents amounted to $7.0 million at the end of the

quarter, and the Company has essentially no debt. Total assets at

September 30, 2023, were $35.5 million, and total stockholders’

equity at the quarter’s end was $30.0 million.

“Good progress was made during the quarter on an operational

basis, and the Company remains cash flow positive,” said David

Neibert, TMC’s Chief Operations Officer. “Net income at the

operating subsidiary levels was slightly lower than the comparative

year period, due to several factors, including: a strengthening of

the US dollar in our foreign markets, reflecting a lower value in

currency translation; marketing expenses in connection with the

rollout of a new product line by our Original Sprout subsidiary;

and, most impactfully, by higher expenses in connection with the

final stages of development and initial marketing of our mobile

fintech app by our Marygold & Co. subsidiary. Our USCF

Investments subsidiary and our core businesses remain strong, with

the revenue downturn for the first quarter well within our range of

acceptable volatility. We plan to continue investing in the fintech

space, which will continue to impact earnings for the short term,

as we set the stage for TMC’s renewed focus on the financial

services sector in the coming years.”

Nicholas Gerber, TMC’s Chief Executive Officer, said, “While we

strive to maintain cash flow neutral operating results as we

calculate our investment in Marygold & Co., economic conditions

beyond our control impacted our performance for the quarter ended

September 30, 2023. Our goal is to successfully put the

foundational building blocks together for a sustainable,

profitable, long-term future, while remaining debt free and

maintaining a high level of cash reserves. From our exciting new

mobile fintech app and financial services offerings to the

innovative new products and services produced and provided by our

other operating units, our objective is to enhance long-term value

for all of our stakeholders.”

Business Units

The Company’s USCF Investments subsidiary,

www.uscfinvestments.com, acquired in December 2016 and based in

Walnut Creek, Calif., serves as manager, operator or investment

adviser to 15 exchange traded products, structured as limited

partnerships or investment trusts that issue shares trading on the

NYSE Arca.

Gourmet Foods, https://gourmetfoodsltd.co.nz/, acquired in

August 2015, is a commercial-scale bakery that produces and

distributes iconic meat pies and pastries throughout New Zealand

under the brand names Pat’s Pantry and Ponsonby Pies. Acquired by

Gourmet Foods in July 2020, Printstock Products Limited

https://www.printstocknz.com/, is a printer of specialized food

wrappers and is located in Napier, New Zealand. Its operations are

consolidated with those of Gourmet Foods.

Brigadier Security Systems, www.brigadiersecurity.com, acquired

in June 2016 and headquartered in Saskatoon, Canada, provides

comprehensive security solutions to homes and businesses,

government offices, schools and other public buildings throughout

the province under the brands Brigadier Security Systems in

Saskatoon and Elite Security in Regina, Canada.

Acquired at the end of 2017, San Clemente, Calif.-based Original

Sprout, www.originalsprout.com, produces and distributes a full

line of vegan, safe, non-toxic hair and skin care products,

including a “reef safe” sun screen, in the U.S. and its

territories, the U.K., E.U., Turkey, Middle East, Africa, Taiwan,

Mexico, South America, Singapore, Hong Kong, Malaysia, New Zealand,

Australia and Canada among other areas.

Marygold & Co., formed in the U.S. during 2019 and operating

from offices in Denver, CO, together with its wholly owned

subsidiary, Marygold & Co. Advisory Services, LLC, was

established to explore opportunities in the financial technology

sector. The company continues further development of a fintech

mobile banking app., having completed the initial development stage

and soft launch in the U.S. in June 2023.

https://marygoldandco.com/

Marygold & Co. (UK) Limited, formed in the U.K. during

August 2021, operates through its subsidiary acquired in 2022,

Tiger Financial & Asset Management Limited (“Tiger”), a U.K.

based investment adviser. Tiger’s core business is managing

clients’ financial wealth across a diverse product range, including

cash, national savings, individual savings accounts, unit trusts,

insurance company products such as investment bonds and other

investment vehicles. http://www.tfam.co.uk/

About The Marygold Companies, Inc.

The Marygold Companies, Inc., which changed its name from

Concierge Technologies, Inc. in March 2022, was founded in 1996 and

repositioned as a global holding firm in 2015. The Company

currently has operating subsidiaries in financial services, food

manufacturing, printing, security systems and beauty products,

under the trade names USCF Investments, Tiger Financial & Asset

Management Limited, Gourmet Foods, Printstock Products, Brigadier

Security Systems and Original Sprout, respectively. Offices and

manufacturing operations are in the U.S., New Zealand, U.K., and

Canada. For more information, visit

www.themarygoldcompanies.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of U.S. federal securities laws. Words such as

“expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may” “will,” “could,” “should”

“believes,” “predicts,” “potential,” “continue” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements, including, but not

limited to, tangible benefits expected to be realized in the 2024

calendar year from current investments, involve significant risks

and uncertainties that could cause actual results to differ

materially from the expected results and, consequently, should not

be relied upon as predictions of future events. These

forward-looking statements, including the factors disclosed in the

Company’s Annual Report on Form 10-K filed with the Securities and

Exchange Commission on September 25, 2023, and in the Company’s

other filings with the Securities and Exchange Commission, are not

exclusive. Readers are cautioned not to place undue reliance upon

any forward-looking statements, which speak only as of the date

made. Except as required by law, the Company disclaims any

obligation to update or publicly announce any revisions to any of

the forward-looking statements contained in this press release.

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

September 30, 2023

June 30, 2023

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

6,987,062

$

8,161,167

Accounts receivable, net

851,570

1,352,210

Accounts receivable - related parties

1,669,886

1,673,895

Inventories

2,194,827

2,254,139

Prepaid income tax and tax receivable

1,350,165

991,797

Investments, at fair value

13,261,783

11,480,981

Other current assets

973,562

904,153

Total current assets

27,288,855

26,818,342

Restricted cash

413,454

425,043

Property, plant and equipment, net

1,209,739

1,255,302

Operating lease right-of-use asset

701,248

821,021

Goodwill

2,307,202

2,307,202

Intangible assets, net

2,220,755

2,329,970

Deferred tax assets, net - United

States

771,287

771,287

Other assets

552,660

552,660

Total assets

$

35,465,200

$

35,280,827

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES

Accounts payable and accrued expenses

$

3,491,543

$

2,711,931

Expense waivers – related parties

107,213

58,685

Operating lease liabilities, current

portion

361,013

457,309

Purchase consideration payable

604,990

604,990

Loans - property and equipment, current

portion

346,282

358,802

Total current liabilities

4,911,041

4,191,717

LONG-TERM LIABILITIES

Loans - property and equipment, net of

current portion

82,543

88,516

Operating lease liabilities, net of

current portion

352,347

380,535

Deferred tax liabilities, net -

foreign

242,289

242,289

Total long-term liabilities

677,179

711,340

Total liabilities

5,588,220

4,903,057

STOCKHOLDERS’ EQUITY

Preferred stock, $0.001 par value;

50,000,000 shares authorized Series B: 49,360 shares issued and

outstanding at September 30, 2023 and at June 30, 2023

49

49

Common stock, $0.001 par value;

900,000,000 shares authorized; 39,383,459 shares issued and

outstanding at June 30, 2023 and at June 30, 2023

39,384

39,384

Additional paid-in capital

12,490,352

12,396,722

Accumulated other comprehensive loss

(239,079

)

(144,840

)

Retained earnings

17,586,274

18,086,455

Total stockholders’ equity

29,876,980

30,377,770

Total liabilities and stockholders’

equity

$

35,465,200

$

35,280,827

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF (LOSS) INCOME

(UNAUDITED)

Three Months Ended September

30, 2023

Three Months Ended September

30, 2022

Net revenue

Fund management – related party

$

5,049,550

$

5,419,435

Food products

1,730,527

1,937,426

Security systems

553,719

628,892

Beauty products

774,626

804,078

Financial services

127,092

133,457

Net revenue

8,235,514

8,923,288

Cost of revenue

2,037,188

2,023,664

Gross profit

6,198,326

6,899,624

Operating expense

Salaries and compensation

2,589,949

2,368,368

General and administrative expense

2,248,540

1,686,658

Fund operations

1,270,128

1,140,588

Marketing and advertising

972,011

777,710

Depreciation and amortization

153,977

149,208

Total operating expenses

7,234,605

6,122,532

(Loss) income from operations

(1,036,279

)

777,092

Other income (expense):

Interest and dividend income

193,043

52,569

Interest expense

(3,559

)

(7,794

)

Other income (expense), net

43,993

(98,369

)

Total other income (expense), net

233,477

(53,594

)

(Loss) income before income taxes

(802,802

)

723,498

Benefit (Provision) of income taxes

302,621

(226,330

)

Net (loss) income

$

(500,181

)

$

497,168

Weighted average shares of common

stock

Basic

40,397,375

40,370,659

Diluted

40,397,375

40,399,873

Net (loss) income per common share

Basic

$

(0.01

)

$

0.01

Diluted

$

(0.01

)

$

0.01

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(UNAUDITED)

Three Months Ended September

30, 2023

Three Months Ended September

30, 2022

Net (loss) income

$

(500,181

)

$

497,168

Other comprehensive (loss) income:

Foreign currency translation (loss)

(94,239

)

(313,759

)

Comprehensive (loss) income

$

(594,420

)

$

183,409

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE THREE MONTH PERIODS

ENDED SEPTEMBER 30, 2023 AND SEPTEMBER 30, 2022

(UNAUDITED)

Period Ending September 30,

2023

Preferred Stock (Series

B)

Common Stock

Additional

Accumulated

Other

Total

Number of Shares

Amount

Number of Shares

Par Value

Paid – in Capital

Comprehensive (Loss)

Retained Earnings

Stockholders’ Equity

Balance at July 1, 2023

49,360

$

49

39,383,459

$

39,384

$

12,396,722

$

(144,840

)

$

18,086,455

$

30,377,770

Loss on currency translation

-

-

-

-

-

(94,239

)

-

(94,239

)

Stock-based compensation

-

-

-

-

93,630

-

-

93,630

Net (loss)

-

-

-

-

-

-

(500,181

)

(500,181

)

Balance at September 30, 2023

49,360

$

49

39,383,459

$

39,384

$

12,490,352

$

(239,079

)

$

17,586,274

$

29,876,980

Period Ending September 30,

2022

Preferred Stock (Series

B)

Common Stock

Additional

Accumulated

Other

Total

Number of Shares

Amount

Number of Shares

Par Value

Paid – in Capital

Comprehensive (Loss)

Retained Earnings

Stockholders’ Equity

Balance at July 1, 2022

49,360

$

49

39,383,459

$

39,384

$

12,313,205

$

(234,790

)

$

16,921,426

$

29,039,274

Loss on currency translation

-

-

-

-

-

(313,759

)

-

(313,759

)

Stock-based compensation

-

-

-

-

6,700

-

-

6,700

Net income

-

-

-

-

-

-

497,168

497,168

Balance at September 30, 2022

49,360

$

49

39,383,459

$

39,384

$

12,319,905

$

(548,549

)

$

17,418,594

$

29,229,383

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

For the Three Months

Ended

September 30,

2023

2022

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net (loss) income

$

(500,181

)

497,168

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

153,977

149,208

Bad debt expense

213

-

Stock-based compensation

93,630

6,700

Net realized and unrealized (gains) losses

on investments

(269,381

)

111,855

Operating lease right-of-use asset -

non-cash lease cost

128,403

231,070

Decrease (increase) in current assets:

Accounts receivable

478,096

(179,083

)

Accounts receivable - related party

4,009

565,296

Prepaid income taxes and tax

receivable

(359,021

)

61,872

Inventories

34,198

(194,695

)

Other current assets

(70,130

)

(34,814

)

(Decrease) increase in operating

liabilities:

Accounts payable and accrued expenses

668,487

(149,343

)

Operating lease liabilities

(118,480

)

(233,992

)

Expense waivers - related party

48,528

70,448

Purchase consideration payable

-

(22,493

)

Net cash provided by operating

activities

292,348

879,197

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchase of property, plant and

equipment

(25,189

)

(9,418

)

Proceeds from sale of investments

7,829,645

-

Purchase of investments

(9,341,066

)

(257,624

)

Net cash (used in) investing

activities

(1,536,610

)

(267,042

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Repayment of property and equipment

loans

(3,656

)

(3,476

)

Net cash (used in) by financing

activities

(3,656

)

(3,476

)

Effect of exchange rate change on cash and

cash equivalents

62,224

(237,331

)

NET (DECREASE) INCREASE IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH

(1,185,694

)

371,348

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH, BEGINNING BALANCE

8,586,210

13,928,899

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH, ENDING BALANCE

$

7,400,516

14,300,247

Cash and cash equivalents

6,987,062

13,370,714

Restricted cash

413,454

929,533

Total cash, cash equivalents and

restricted cash shown in statement of cash flows

$

7,400,516

14,300,247

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION:

Cash paid during the period for:

Interest paid

$

4,727

4,018

Income taxes paid, net

$

86,978

70,557

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231113014886/en/

Media and investors, for more Information, contact: Roger

S. Pondel PondelWilkinson Inc. 310-279-5965 rpondel@pondel.com

Contact the Company: David Neibert, Chief Operations

Officer 949-429-5370 dneibert@themarygoldcompanies.com

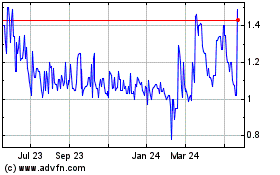

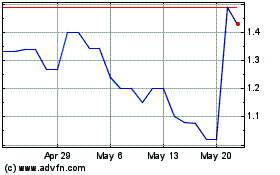

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Nov 2023 to Nov 2024