false

Q3

--03-31

2025

0000066418

Yes

0000066418

2024-04-01

2024-12-31

0000066418

2025-02-07

0000066418

2024-12-31

0000066418

2024-03-31

0000066418

2024-10-01

2024-12-31

0000066418

2023-10-01

2023-12-31

0000066418

2023-04-01

2023-12-31

0000066418

MXC:OilSalesMember

2024-10-01

2024-12-31

0000066418

MXC:OilSalesMember

2023-10-01

2023-12-31

0000066418

MXC:OilSalesMember

2024-04-01

2024-12-31

0000066418

MXC:OilSalesMember

2023-04-01

2023-12-31

0000066418

MXC:NaturalGasSalesMember

2024-10-01

2024-12-31

0000066418

MXC:NaturalGasSalesMember

2023-10-01

2023-12-31

0000066418

MXC:NaturalGasSalesMember

2024-04-01

2024-12-31

0000066418

MXC:NaturalGasSalesMember

2023-04-01

2023-12-31

0000066418

MXC:OtherMember

2024-10-01

2024-12-31

0000066418

MXC:OtherMember

2023-10-01

2023-12-31

0000066418

MXC:OtherMember

2024-04-01

2024-12-31

0000066418

MXC:OtherMember

2023-04-01

2023-12-31

0000066418

us-gaap:CommonStockMember

2024-03-31

0000066418

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0000066418

us-gaap:RetainedEarningsMember

2024-03-31

0000066418

us-gaap:TreasuryStockCommonMember

2024-03-31

0000066418

us-gaap:CommonStockMember

2024-06-30

0000066418

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0000066418

us-gaap:RetainedEarningsMember

2024-06-30

0000066418

us-gaap:TreasuryStockCommonMember

2024-06-30

0000066418

2024-06-30

0000066418

us-gaap:CommonStockMember

2024-09-30

0000066418

us-gaap:AdditionalPaidInCapitalMember

2024-09-30

0000066418

us-gaap:RetainedEarningsMember

2024-09-30

0000066418

us-gaap:TreasuryStockCommonMember

2024-09-30

0000066418

2024-09-30

0000066418

us-gaap:CommonStockMember

2023-03-31

0000066418

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0000066418

us-gaap:RetainedEarningsMember

2023-03-31

0000066418

us-gaap:TreasuryStockCommonMember

2023-03-31

0000066418

2023-03-31

0000066418

us-gaap:CommonStockMember

2023-06-30

0000066418

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0000066418

us-gaap:RetainedEarningsMember

2023-06-30

0000066418

us-gaap:TreasuryStockCommonMember

2023-06-30

0000066418

2023-06-30

0000066418

us-gaap:CommonStockMember

2023-09-30

0000066418

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0000066418

us-gaap:RetainedEarningsMember

2023-09-30

0000066418

us-gaap:TreasuryStockCommonMember

2023-09-30

0000066418

2023-09-30

0000066418

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0000066418

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0000066418

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0000066418

us-gaap:TreasuryStockCommonMember

2024-04-01

2024-06-30

0000066418

2024-04-01

2024-06-30

0000066418

us-gaap:CommonStockMember

2024-07-01

2024-09-30

0000066418

us-gaap:AdditionalPaidInCapitalMember

2024-07-01

2024-09-30

0000066418

us-gaap:RetainedEarningsMember

2024-07-01

2024-09-30

0000066418

us-gaap:TreasuryStockCommonMember

2024-07-01

2024-09-30

0000066418

2024-07-01

2024-09-30

0000066418

us-gaap:CommonStockMember

2024-10-01

2024-12-31

0000066418

us-gaap:AdditionalPaidInCapitalMember

2024-10-01

2024-12-31

0000066418

us-gaap:RetainedEarningsMember

2024-10-01

2024-12-31

0000066418

us-gaap:TreasuryStockCommonMember

2024-10-01

2024-12-31

0000066418

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0000066418

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0000066418

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0000066418

us-gaap:TreasuryStockCommonMember

2023-04-01

2023-06-30

0000066418

2023-04-01

2023-06-30

0000066418

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0000066418

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0000066418

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0000066418

us-gaap:TreasuryStockCommonMember

2023-07-01

2023-09-30

0000066418

2023-07-01

2023-09-30

0000066418

us-gaap:CommonStockMember

2023-10-01

2023-12-31

0000066418

us-gaap:AdditionalPaidInCapitalMember

2023-10-01

2023-12-31

0000066418

us-gaap:RetainedEarningsMember

2023-10-01

2023-12-31

0000066418

us-gaap:TreasuryStockCommonMember

2023-10-01

2023-12-31

0000066418

us-gaap:CommonStockMember

2024-12-31

0000066418

us-gaap:AdditionalPaidInCapitalMember

2024-12-31

0000066418

us-gaap:RetainedEarningsMember

2024-12-31

0000066418

us-gaap:TreasuryStockCommonMember

2024-12-31

0000066418

us-gaap:CommonStockMember

2023-12-31

0000066418

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0000066418

us-gaap:RetainedEarningsMember

2023-12-31

0000066418

us-gaap:TreasuryStockCommonMember

2023-12-31

0000066418

2023-12-31

0000066418

us-gaap:GeneralAndAdministrativeExpenseMember

2024-10-01

2024-12-31

0000066418

us-gaap:GeneralAndAdministrativeExpenseMember

2023-10-01

2023-12-31

0000066418

MXC:BoardOfDirectorsMember

2023-04-01

2023-12-31

0000066418

us-gaap:EmployeeStockOptionMember

2024-03-31

0000066418

us-gaap:EmployeeStockOptionMember

2023-04-01

2024-03-31

0000066418

us-gaap:EmployeeStockOptionMember

2024-04-01

2024-12-31

0000066418

us-gaap:EmployeeStockOptionMember

2024-12-31

0000066418

MXC:LoanAgreementMember

MXC:WestTexasNationalBankMember

2018-12-28

0000066418

MXC:LoanAgreementMember

MXC:WestTexasNationalBankMember

2018-12-28

2018-12-28

0000066418

MXC:LoanAgreementMember

MXC:WestTexasNationalBankMember

2020-02-28

0000066418

MXC:LoanAgreementMember

MXC:WestTexasNationalBankMember

2020-02-28

2020-02-28

0000066418

MXC:LoanAgreementMember

MXC:WestTexasNationalBankMember

2023-03-28

2023-03-28

0000066418

MXC:LoanAgreementMember

MXC:WestTexasNationalBankMember

2024-12-31

0000066418

MXC:LoanAgreementMember

MXC:WestTexasNationalBankMember

2024-04-01

2024-12-31

0000066418

MXC:ShareholderMember

2024-12-31

0000066418

2024-06-01

2024-06-30

0000066418

us-gaap:RelatedPartyMember

2024-10-01

2024-12-31

0000066418

us-gaap:RelatedPartyMember

2023-10-01

2023-12-31

0000066418

us-gaap:RelatedPartyMember

2024-04-01

2024-12-31

0000066418

us-gaap:RelatedPartyMember

2023-04-01

2023-12-31

0000066418

us-gaap:PrincipalOwnerMember

2024-10-01

2024-12-31

0000066418

us-gaap:PrincipalOwnerMember

2023-10-01

2023-12-31

0000066418

us-gaap:PrincipalOwnerMember

2024-04-01

2024-12-31

0000066418

us-gaap:PrincipalOwnerMember

2023-04-01

2023-12-31

0000066418

srt:MaximumMember

MXC:BoardOfDirectorsMember

2024-04-30

0000066418

2024-04-30

0000066418

MXC:O2025Q3DividendsMember

2024-04-01

2024-12-31

0000066418

2024-06-04

2024-06-04

0000066418

MXC:S2024Q3DividendsMember

2023-04-01

2023-12-31

0000066418

2023-05-15

2023-05-15

0000066418

us-gaap:SubsequentEventMember

MXC:BoneSpringSandFormationMember

stpr:NM

2025-01-01

2025-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

utr:sqft

utr:acre

xbrli:pure

MXC:Integer

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended December 31, 2024

OR

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from to

Commission

File No. 1-31785

MEXCO

ENERGY CORPORATION

(Exact

name of registrant as specified in its charter)

| Colorado |

|

84-0627918 |

| (State

or other jurisdiction of |

|

(IRS

Employer |

| incorporation

or organization) |

|

Identification

Number) |

| 415

West Wall Street, Suite 475 |

|

|

| Midland,

Texas |

|

79701 |

| (Address

of principal executive offices) |

|

(Zip

code) |

(432)

682-1119

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.50 per share |

|

MXC |

|

NYSE

American |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. YES

☒ NO ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No

☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company as defined in Rule 12b-2 of the Exchange Act.

| |

Large

Accelerated Filer ☐ |

Accelerated

Filer ☐ |

| |

Non-Accelerated

Filer ☐ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO

☒

The

number of shares outstanding of the registrant’s common stock, par value $.50 per share, as of February 7, 2025 was 2,046,000.

MEXCO

ENERGY CORPORATION AND SUBSIDIARIES

Table

of Contents

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements

Mexco

Energy Corporation and Subsidiaries

CONSOLIDATED

BALANCE SHEETS

| | |

December 31, | | |

March 31, | |

| | |

2024 | | |

2024 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 910,005 | | |

$ | 2,473,484 | |

| Accounts receivable: | |

| | | |

| | |

| Oil and natural gas sales | |

| 1,037,754 | | |

| 1,001,709 | |

| Trade | |

| 48,759 | | |

| 9,186 | |

| Prepaid costs and expenses | |

| 26,050 | | |

| 56,193 | |

| Prepaid drilling | |

| 29,085 | | |

| 148,748 | |

| Total current assets | |

| 2,051,653 | | |

| 3,689,320 | |

| Property and equipment, at cost | |

| | | |

| | |

| Oil and gas properties, using the full cost method | |

| 51,263,675 | | |

| 48,304,585 | |

| Other | |

| 121,926 | | |

| 121,926 | |

| Accumulated depreciation, depletion and amortization | |

| (35,945,246 | ) | |

| (34,184,837 | ) |

| Property and equipment, net | |

| 15,440,355 | | |

| 14,241,674 | |

| Investments – cost basis | |

| 1,900,000 | | |

| 1,100,000 | |

| Operating lease, right-of-use asset | |

| 138,577 | | |

| 19,263 | |

| Other noncurrent assets | |

| 5,373 | | |

| 8,597 | |

| Total assets | |

$ | 19,535,958 | | |

$ | 19,058,854 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 220,550 | | |

$ | 221,603 | |

| Income tax payable | |

| 312,036 | | |

| 189,254 | |

| Operating lease liability, current | |

| 49,872 | | |

| 19,263 | |

| Total current liabilities | |

| 582,458 | | |

| 430,120 | |

| Long-term liabilities | |

| | | |

| | |

| Operating lease liability, long-term | |

| 88,705 | | |

| - | |

| Asset retirement obligations | |

| 682,061 | | |

| 688,808 | |

| Deferred income tax liabilities | |

| 155,975 | | |

| 311,661 | |

| Total long-term liabilities | |

| 926,741 | | |

| 1,000,469 | |

| Total liabilities | |

| 1,509,199 | | |

| 1,430,589 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

Preferred stock - $1.00 par value;

10,000,000 shares authorized; none outstanding |

|

|

- |

|

|

|

- |

|

| Common stock - $0.50 par value; 40,000,000 shares authorized; 2,239,283 and 2,226,916 shares issued;

2,046,000 and 2,091,399 shares outstanding as of December 31, 2024 and March 31, 2024, respectively |

|

|

1,119,641 |

|

|

|

1,113,458 |

|

| Additional paid-in capital | |

| 8,795,013 | | |

| 8,567,856 | |

| Retained earnings | |

| 9,990,851 | | |

| 9,122,481 | |

| Treasury stock, at cost (193,283 and 135,517 shares, respectively) | |

| (1,878,746 | ) | |

| (1,175,530 | ) |

| Total stockholders’ equity | |

| 18,026,759 | | |

| 17,628,265 | |

| Total liabilities and stockholders’ equity | |

$ | 19,535,958 | | |

$ | 19,058,854 | |

The

accompanying notes are an integral part of the consolidated financial statements.

Mexco

Energy Corporation and Subsidiaries

CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating revenue: | |

| | | |

| | | |

| | | |

| | |

| Oil sales | |

$ | 1,563,663 | | |

$ | 1,387,008 | | |

$ | 4,595,585 | | |

$ | 3,916,492 | |

| Natural gas sales | |

| 264,741 | | |

| 223,587 | | |

| 616,728 | | |

| 789,903 | |

| Other | |

| 62,861 | | |

| 45,848 | | |

| 156,014 | | |

| 105,077 | |

| Total operating revenues | |

| 1,891,265 | | |

| 1,656,443 | | |

| 5,368,327 | | |

| 4,811,472 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Production | |

| 460,241 | | |

| 401,035 | | |

| 1,311,066 | | |

| 1,143,116 | |

| Accretion of asset retirement obligation | |

| 7,705 | | |

| 7,225 | | |

| 23,229 | | |

| 22,121 | |

| Depreciation, depletion, and amortization | |

| 636,424 | | |

| 400,337 | | |

| 1,760,409 | | |

| 1,268,703 | |

| General and administrative | |

| 340,514 | | |

| 335,152 | | |

| 1,042,084 | | |

| 981,664 | |

| Total operating expenses | |

| 1,444,884 | | |

| 1,143,749 | | |

| 4,136,788 | | |

| 3,415,604 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| 446,381 | | |

| 512,694 | | |

| 1,231,539 | | |

| 1,395,868 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expenses): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 7,315 | | |

| 36,936 | | |

| 50,891 | | |

| 86,995 | |

| Interest expense | |

| (2,868 | ) | |

| (1,075 | ) | |

| (5,026 | ) | |

| (3,235 | ) |

| Net other income (expense) | |

| 4,447 | | |

| 35,861 | | |

| 45,865 | | |

| 83,760 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| (Benefit from) provision for income taxes | |

| (18,305 | ) | |

| 202,945 | | |

| 200,034 | | |

| 398,971 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense (benefit): | |

| | | |

| | | |

| | | |

| | |

| Current | |

| 257,042 | | |

| 32,959 | | |

| 355,720 | | |

| 79,123 | |

| Deferred | |

| (275,347 | ) | |

| 169,986 | | |

| (155,686 | ) | |

| 319,848 | |

| Total income tax (benefit) expense | |

| (18,305 | ) | |

| 202,945 | | |

| 200,034 | | |

| 398,971 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 469,133 | | |

$ | 345,610 | | |

$ | 1,077,370 | | |

$ | 1,080,657 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic: | |

$ | 0.23 | | |

$ | 0.16 | | |

$ | 0.52 | | |

$ | 0.51 | |

| Diluted: | |

$ | 0.22 | | |

$ | 0.16 | | |

$ | 0.51 | | |

$ | 0.50 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic: | |

| 2,046,000 | | |

| 2,103,503 | | |

| 2,070,086 | | |

| 2,120,611 | |

| Diluted: | |

| 2,091,808 | | |

| 2,151,783 | | |

| 2,114,936 | | |

| 2,169,708 | |

| | |

| | | |

| | | |

| | | |

| | |

| Dividends declared per share | |

$ | - | | |

$ | - | | |

$ | 0.10 | | |

$ | 0.10 | |

The

accompanying notes are an integral part of the consolidated financial statements.

Mexco

Energy Corporation and Subsidiaries

CONSOLIDATED

STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited)

| | |

Common Stock Par Value | | |

Additional Paid-In Capital | | |

Retained Earnings | | |

Treasury Stock | | |

Total Stockholders’ Equity | |

| Balance at April 1, 2024 | |

$ | 1,113,458 | | |

$ | 8,567,856 | | |

$ | 9,122,481 | | |

$ | (1,175,530 | ) | |

$ | 17,628,265 | |

| Net income | |

| - | | |

| - | | |

| 291,039 | | |

| - | | |

| 291,039 | |

| Dividends paid | |

| - | | |

| - | | |

| (209,000 | ) | |

| - | | |

| (209,000 | ) |

| Issuance of stock through options exercised | |

| 6,183 | | |

| 71,458 | | |

| - | | |

| - | | |

| 77,641 | |

| Purchase of stock | |

| - | | |

| - | | |

| - | | |

| (188,637 | ) | |

| (188,637 | ) |

| Stock based compensation | |

| - | | |

| 52,439 | | |

| - | | |

| - | | |

| 52,439 | |

| Balance at June 30, 2024 | |

$ | 1,119,641 | | |

$ | 8,691,753 | | |

$ | 9,204,520 | | |

$ | (1,364,167 | ) | |

$ | 17,651,747 | |

| Net income | |

| - | | |

| - | | |

| 317,198 | | |

| - | | |

| 317,198 | |

| Purchase of stock | |

| - | | |

| - | | |

| - | | |

| (514,579 | ) | |

| (514,579 | ) |

| Stock based compensation | |

| - | | |

| 51,630 | | |

| - | | |

| - | | |

| 51,630 | |

| Balance at September 30, 2024 | |

$ | 1,119,641 | | |

$ | 8,743,383 | | |

$ | 9,521,718 | | |

$ | (1,878,746 | ) | |

$ | 17,505,996 | |

| Net income | |

| - | | |

| - | | |

| 469,133 | | |

| - | | |

| 469,133 | |

| Stock based compensation | |

| - | | |

| 51,630 | | |

| - | | |

| - | | |

| 51,630 | |

| Balance at December 31, 2024 | |

$ | 1,119,641 | | |

$ | 8,795,013 | | |

$ | 9,990,851 | | |

$ | (1,878,746 | ) | |

$ | 18,026,759 | |

| | |

Common Stock Par Value | | |

Additional Paid-In Capital | | |

Retained Earnings | | |

Treasury Stock | | |

Total Stockholders’ Equity | |

| Balance at April 1, 2023 | |

$ | 1,110,708 | | |

$ | 8,321,145 | | |

$ | 7,991,129 | | |

$ | (590,495 | ) | |

$ | 16,832,487 | |

| Net income | |

| - | | |

| - | | |

| 465,614 | | |

| - | | |

| 465,614 | |

| Dividends paid | |

| - | | |

| - | | |

| (213,600 | ) | |

| - | | |

| (213,600 | ) |

| Issuance of stock through options exercised | |

| 250 | | |

| 2,712 | | |

| - | | |

| - | | |

| 2,962 | |

| Stock based compensation | |

| - | | |

| 54,975 | | |

| - | | |

| - | | |

| 54,675 | |

| Balance at June 30, 2023 | |

$ | 1,110,958 | | |

$ | 8,378,832 | | |

$ | 8,243,143 | | |

$ | (590,495 | ) | |

$ | 17,142,438 | |

| Net income | |

| - | | |

| - | | |

| 269,433 | | |

| - | | |

| 269,433 | |

| Prurchase of stock | |

| - | | |

| - | | |

| - | | |

| (325,256 | ) | |

| (325,256 | ) |

| Stock based compensation | |

| - | | |

| 58,848 | | |

| - | | |

| - | | |

| 58,848 | |

| Balance at September 30, 2023 | |

$ | 1,110,958 | | |

$ | 8,437,680 | | |

$ | 8,412,576 | | |

$ | (915,751 | ) | |

$ | 17,145,463 | |

| Balance | |

$ | 1,110,958 | | |

$ | 8,437,680 | | |

$ | 8,412,576 | | |

$ | (915,751 | ) | |

$ | 17,145,463 | |

| Net income | |

| - | | |

| - | | |

| 345,610 | | |

| - | | |

| 345,610 | |

| Stock based compensation | |

| - | | |

| 58,847 | | |

| - | | |

| - | | |

| 58,847 | |

| Purchase of stock | |

| - | | |

| - | | |

| - | | |

| (129,876 | ) | |

| (129,876 | ) |

| Balance at December 31, 2023 | |

$ | 1,110,958 | | |

$ | 8,496,527 | | |

$ | 8,858,186 | | |

$ | (1,045,627 | ) | |

$ | 17,420,044 | |

| Balance | |

$ | 1,110,958 | | |

$ | 8,496,527 | | |

$ | 8,858,186 | | |

$ | (1,045,627 | ) | |

$ | 17,420,044 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| SHARE ACTIVITY | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock shares, issued: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at April 1, 2024 | |

| | | |

| 2,226,916 | | |

| | | |

| | | |

| | |

| Issued | |

| | | |

| 12,367 | | |

| | | |

| | | |

| | |

| Balance at December 31, 2024 | |

| | | |

| 2,239,283 | | |

| | | |

| | | |

| | |

| Common stock shares, held in treasury: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at April 1, 2024 | |

| | | |

| (135,517 | ) | |

| | | |

| | | |

| | |

| Acquisitions | |

| | | |

| (57,766 | ) | |

| | | |

| | | |

| | |

| Balance at Dec. 31, 2024 | |

| | | |

| (193,283 | ) | |

| | | |

| | | |

| | |

Common stock shares, outstanding

at December 31, 2024 |

|

|

|

|

|

|

2,046,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

The

accompanying notes are an integral part of the consolidated financial statements.

Mexco

Energy Corporation and Subsidiaries

CONSOLIDATED

STATEMENTS OF CASH FLOWS

For

the Nine Months Ended December 31,

(Unaudited)

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 1,077,370 | | |

$ | 1,080,657 | |

| Adjustments to reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

| Deferred income tax (benefit) expense | |

| (155,686 | ) | |

| 319,848 | |

| Stock-based compensation | |

| 155,699 | | |

| 172,670 | |

| Depreciation, depletion and amortization | |

| 1,760,409 | | |

| 1,268,703 | |

| Accretion of asset retirement obligations | |

| 23,229 | | |

| 22,121 | |

| Amortization of debt issuance costs | |

| 3,224 | | |

| 3,235 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| (Increase) decrease in accounts receivable | |

| (75,618 | ) | |

| 454,133 | |

| (Increase) decrease in right-of-use asset | |

| (119,314 | ) | |

| 42,076 | |

| Decrease in prepaid expenses | |

| 30,143 | | |

| 36,023 | |

| Increase in accounts payable and accrued expenses | |

| 15,651 | | |

| 32,042 | |

| Settlement of asset retirement obligations | |

| (16,088 | ) | |

| (14,715 | ) |

| Increase in income taxes payable | |

| 122,782 | | |

| - | |

| Decrease (increase) in operating lease liability | |

| 119,314 | | |

| (42,076 | ) |

| Net cash provided by operating activities | |

| 2,941,115 | | |

| 3,374,717 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Additions to oil and gas properties | |

| (3,072,589 | ) | |

| (1,471,543 | ) |

| Investment in limited liability companies at cost | |

| (800,000 | ) | |

| (200,000 | ) |

| Proceeds from sale of oil and gas properties and equipment | |

| 202,570 | | |

| 306,513 | |

| Net cash used in investing activities | |

| (3,670,019 | ) | |

| (1,365,030 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from exercise of stock options | |

| 77,641 | | |

| 2,962 | |

| Debt issuance costs | |

| - | | |

| (750 | ) |

| Proceeds from long-term debt | |

| 650,000 | | |

| - | |

| Reduction of long-term debt | |

| (650,000 | ) | |

| - | |

| Dividends paid | |

| (209,000 | ) | |

| (213,600 | ) |

| Acquisition of treasury stock | |

| (703,216 | ) | |

| (455,132 | ) |

| Net cash used in financing activities | |

| (834,575 | ) | |

| (666,520 | ) |

| | |

| | | |

| | |

| Net (decrease) increase in cash and cash equivalents | |

| (1,563,479 | ) | |

| 1,343,167 | |

| | |

| | | |

| | |

| Cash and cash equivalents at beginning of period | |

| 2,473,484 | | |

| 2,235,771 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

$ | 910,005 | | |

$ | 3,578,938 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 1,802 | | |

$ | - | |

| Cash paid for income taxes | |

$ | 200,683 | | |

$ | - | |

| Accrued capital expenditures included in accounts payable | |

$ | 4,991 | | |

$ | 15,667 | |

| | |

| | | |

| | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Asset retirement obligations | |

$ | 3,631 | | |

$ | 2,838 | |

The

accompanying notes are an integral part of the consolidated financial statements.

Mexco

Energy Corporation and Subsidiaries

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1.

Nature of Operations

Mexco

Energy Corporation (a Colorado corporation) and its wholly owned subsidiaries, Forman Energy Corporation (a New York corporation), Southwest

Texas Disposal Corporation (a Texas corporation) and TBO Oil & Gas, LLC (a Texas limited liability company) (collectively, the “Company”)

are engaged in the acquisition, exploration, development and production of crude oil, natural gas, condensate and natural gas liquids

(“NGLs”). Most of the Company’s oil and gas interests are centered in West Texas and Southeastern New Mexico; however,

the Company owns producing properties and undeveloped acreage in fifteen states. All of the Company’s oil and gas interests are

operated by others.

2.

Basis of Presentation and Significant Accounting Policies

Principles

of Consolidation. The consolidated financial statements include the accounts of Mexco Energy Corporation and its wholly owned subsidiaries.

All significant intercompany balances and transactions associated with the consolidated operations have been eliminated.

Estimates

and Assumptions. In preparing financial statements in conformity with accounting principles generally accepted in the United States

of America (“GAAP”), management is required to make informed judgments, estimates and assumptions that affect the reported

amounts of assets and liabilities as of the date of the consolidated financial statements and affect the reported amounts of revenues

and expenses during the reporting period. In addition, significant estimates are used in determining proved oil and gas reserves. Although

management believes its estimates and assumptions are reasonable, actual results may differ materially from those estimates. The estimate

of the Company’s oil and natural gas reserves, which is used to compute depreciation, depletion, amortization and impairment of

oil and gas properties, is the most significant of the estimates and assumptions that affect these reported results.

Interim

Financial Statements. In the opinion of management, the accompanying unaudited consolidated financial statements contain all adjustments

(consisting only of normal recurring accruals) necessary to present fairly the financial position of the Company as of December 31, 2024,

and the results of its operations and cash flows for the interim periods ended December 31, 2024 and 2023. The consolidated financial

statements as of December 31, 2024 and for the three and nine month periods ended December 31, 2024 and 2023 are unaudited. The consolidated

balance sheet as of March 31, 2024 was derived from the audited balance sheet filed in the Company’s 2024 annual report on Form

10-K filed with the Securities and Exchange Commission (“SEC”). The results of operations for the periods presented are not

necessarily indicative of the results to be expected for a full year. The accounting policies followed by the Company are set forth in

more detail in Note 2 of the “Notes to Consolidated Financial Statements” in the Form 10-K. Certain information and footnote

disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United

States of America have been condensed or omitted in this Form 10-Q pursuant to the rules and regulations of the SEC. However, the disclosures

herein are adequate to make the information presented not misleading. It is suggested that these financial statements be read in conjunction

with the financial statements and notes thereto included in the Form 10-K.

Oil and Natural Gas Properties. The Company uses the full cost method

of accounting for oil and natural gas properties. Under this method, all costs (direct and indirect) associated with acquisition, exploration,

and development of oil and natural gas properties are capitalized. Costs capitalized include acquisition costs, geological and geophysical

expenditures, lease rentals on undeveloped properties and costs of drilling and equipping productive and non-productive wells. Drilling

costs include directly related overhead costs. All of the Company’s capitalized costs are subject to amortization.

In addition, capitalized costs less accumulated depletion and related deferred

income taxes are not allowed to exceed an amount (the full cost ceiling) equal to the sum of: 1)the present value of estimated future

net revenues discounted at ten percent computed in compliance with SEC guidelines; 2)plus the cost of properties not being amortized;

3)plus the lower of cost or estimated fair value of unproven properties included in the costs being amortized; 4)less income tax effects

related to differences between the book and tax basis of the properties.

No impairments on oil and natural gas properties as a result of the ceiling

test were recorded for the three and nine months ended December 31, 2024 and 2023.

Investments.

The Company accounts for investments of less than 3% of any limited liability companies at cost. The Company has no control of the

limited liability companies. The cost of the investment is recorded as an asset on the consolidated balance sheets and when income from

the investment is received, it is immediately recognized on the consolidated statements of operations.

Segments. Based on the Company’s organizational

structure, the Company has one operating segment, which is crude oil and natural gas development, exploration and production. In

addition, the Company has a single, company-wide management team that allocates capital resources to maximize profitability and

measures financial performance as a single enterprise.

3.

Asset Retirement Obligations

The

Company’s asset retirement obligations (“ARO”) relate to the plugging of wells, the removal of facilities and equipment,

and site restoration on oil and gas properties. The fair value of a liability for an ARO is recorded in the period in which it is incurred,

discounted to its present value using the credit adjusted risk-free interest rate, and a corresponding amount capitalized by increasing

the carrying amount of the related long-lived asset. The liability is accreted each period until the liability is settled or the well

is sold, at which time the liability is removed. The related asset retirement cost is capitalized as part of the carrying amount of our

oil and natural gas properties. The ARO is included in the consolidated balance sheets with the current portion being included in the

accounts payable and other accrued expenses.

The

following table provides a rollforward of the AROs for the first nine months of fiscal 2025:

Schedule of Rollforward of Asset Retirement Obligations

| | |

| | |

| Carrying amount of asset retirement obligations as of April 1, 2024 | |

$ | 718,808 | |

| Liabilities incurred | |

| 3,631 | |

| Liabilities settled | |

| (33,607 | ) |

| Accretion expense | |

| 23,229 | |

| Carrying amount of asset retirement obligations as of December 31, 2024 | |

| 712,061 | |

| Less: Current portion | |

| 30,000 | |

| Non-Current asset retirement obligation | |

$ | 682,061 | |

4.

Stock-based Compensation

The

Company recognized stock-based compensation expense of $51,630 and $58,847 in general and administrative expense in the Consolidated

Statements of Operations for the three months ended December 31, 2024 and 2023, respectively. Stock-based compensation expense recognized

for the nine months ended December 31, 2024 and 2023 was $155,699 and $172,670, respectively. The total cost related to non-vested awards

not yet recognized at December 31, 2024 totals $330,113 which is expected to be recognized over a weighted average of 1.78 years.

During

the nine months ended December 31, 2024, no stock options were granted. During the nine months ended December 31, 2023, the Compensation

Committee of the Board of Directors approved and the Company granted 32,000 stock options exercisable at $12.68 per share with an estimated

fair value of $279,360. These options are exercisable at a price not less than the fair market value of the stock at the date of grant,

have an exercise period of ten years and generally vest over four years.

Included

in the following table is a summary of the grant-date fair value of stock options granted and the related assumptions used in the Binomial

models for stock options granted during the nine months ended December 31, 2024 and 2023. All such amounts represent the weighted average

amounts.

Schedule of Grant-date Fair Value of Stock Options Granted and Assumptions Used Binominal Models

| | |

Nine Months Ended | |

| | |

December 31 | |

| | |

2024 | | |

2023 | |

| Grant-date fair value | |

| - | | |

$ | 8.73 | |

| Volatility factor | |

| - | | |

| 56.5 | % |

| Dividend yield | |

| - | | |

| - | |

| Risk-free interest rate | |

| - | | |

| 3.44 | % |

| Expected term (in years) | |

| - | | |

| 6.25 | |

The

following table is a summary of activity of stock options for the nine months ended December 31, 2024:

Summary of Activity of Stock Options

| | |

Number of Shares | | |

Weighted Average Exercise Price | | |

Weighted Average Remaining Contract Life in Years | | |

Intrinsic Value | |

| Outstanding at April 1, 2024 | |

| 165,750 | | |

$ | 9.36 | | |

| 6.62 | | |

$ | 103,275 | |

| Granted | |

| - | | |

| - | | |

| | | |

| | |

| Exercised | |

| (12,367 | ) | |

| 6.28 | | |

| | | |

| | |

| Forfeited or Expired | |

| (2,500 | ) | |

| - | | |

| | | |

| | |

| Outstanding at December 31, 2024 | |

| 150,883 | | |

$ | 9.52 | | |

| 6.23 | | |

$ | 265,761 | |

| | |

| | | |

| | | |

| | | |

| | |

| Vested at December 31, 2024 | |

| 105,508 | | |

$ | 7.69 | | |

| 5.55 | | |

$ | 378,561 | |

| Exercisable at December 31, 2024 | |

| 105,508 | | |

$ | 7.69 | | |

| 5.55 | | |

$ | 378,561 | |

During

the nine months ended December 31, 2024, stock options covering 12,367 shares were exercised with a total intrinsic value of $92,316.

The Company received proceeds of $77,641 from these exercises. During the nine months ended December 31, 2023, stock options covering

500 shares were exercised with a total intrinsic value of $2,416. The Company received proceeds of $2,962 from these exercises.

During

the nine months ended December 31, 2024, 1,875 unvested stock options and 625 vested stock options were forfeited due to the resignation

of an employee. There were no stock options forfeited or expired during the nine months ended December 31, 2023. No forfeiture rate is

assumed for stock options granted to directors or employees due to the forfeiture rate history of these types of awards.

Outstanding

options at December 31, 2024 expire between September 2028 and April 2033 and have exercise prices ranging from $3.34 to $18.05.

5.

Long Term Debt

On

December 28, 2018, the Company entered into a loan agreement (the “Agreement”) with West Texas National Bank (“WTNB”),

which originally provided for a credit facility of $1,000,000 with a maturity date of December 28, 2021. The Agreement has no monthly

commitment reduction and a borrowing base to be evaluated annually.

On

February 28, 2020, the Agreement was amended to increase the credit facility to $2,500,000, extend the maturity date to March 28, 2023

and increase the borrowing base to $1,500,000. On March 28, 2023, the Agreement was amended to extend the maturity date to March 28,

2026.

Under

the Agreement, interest on the facility accrues at a rate equal to the prime rate as quoted in the Wall Street Journal plus one-half

of one percent (0.5%) floating daily. Interest on the outstanding amount under the Agreement is payable monthly. In addition, the Company

will pay an unused commitment fee in an amount equal to one-half of one percent (0.5%) times the daily average of the unadvanced amount

of the commitment. The unused commitment fee is payable quarterly in arrears on the last day of each calendar quarter. As of December

31, 2024, there was $1,500,000 available for borrowing by the Company on the facility.

No

principal payments are anticipated to be required through the maturity date of the credit facility, March 28, 2026. Upon closing the

second amendment to the Agreement, the Company paid a loan origination fee of $9,000 plus legal and recording expenses totaling $12,950,

which were deferred over the life of the credit facility.

Amounts

borrowed under the Agreement are collateralized by the common stock of the Company’s wholly owned subsidiaries and substantially

all of the Company’s oil and gas properties.

The

Agreement contains customary covenants for credit facilities of this type including limitations on change in control, disposition of

assets, mergers and reorganizations. The Company is also obligated to meet certain financial covenants under the Agreement and requires

senior debt to earnings before interest, taxes, depreciation and amortization (“EBITDA”) ratios (Senior Debt/EBITDA) less

than or equal to 4.00 to 1.00 measured with respect to the four trailing quarters and minimum interest coverage ratios (EBITDA/Interest

Expense) of 2.00 to 1.00 for each quarter.

In

addition, this Agreement prohibits the Company from paying cash dividends on its common stock without written permission of WTNB. The

Company obtained written permission from WTNB prior to declaring the special dividend on April 30, 2024 as discussed in Note 10. The

Agreement does not permit the Company to enter into hedge agreements covering crude oil and natural gas prices without prior WTNB approval.

There

was no balance outstanding on the line of credit as of December 31, 2024.

6.

Leases

The

Company leases approximately 4,160 rentable square feet of office space from an unaffiliated third party for our corporate office located

in Midland, Texas. This includes 702 square feet of office space shared with and paid by our majority shareholder. In June 2024, the

Company agreed to re-extend its lease at a flat (unescalated) rate for another 36 months. The amended lease now expires on July 31, 2027.

The

Company determines an arrangement is a lease at inception. Operating leases are recorded in operating lease right-of-use asset, operating

lease liability, current, and operating lease liability, long-term on the consolidated balance sheets.

Operating

lease right-of-use assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent

its obligation to make lease payments arising from the lease. Operating lease assets and liabilities are recognized at the commencement

date based on the present value of lease payments over the lease term. As the Company’s lease does not provide an implicit rate,

the Company uses the incremental borrowing rate based on the information available at commencement date in determining the present value

of lease payments. The incremental borrowing rate used at adoption was 9%. Significant judgement is required when determining the incremental

borrowing rate. Rent expense for lease payments is recognized on a straight-line basis over the lease term.

The

balance sheets classification of lease assets and liabilities was as follows:

Schedule of Operating Lease Assets and Liabilities

| | |

December 31, 2024 | |

| Assets | |

| | |

| Operating lease right-of-use asset, beginning balance | |

$ | 19,263 | |

| Current period amortization | |

| (38,759 | ) |

| Lease extension | |

| 158,073 | |

| Total operating lease right-of-use asset | |

$ | 138,577 | |

| | |

| | |

| Liabilities | |

| | |

| Operating lease liability, current | |

$ | 49,872 | |

| Operating lease liability, long term | |

| 88,705 | |

| Total lease liabilities | |

$ | 138,577 | |

Future

minimum lease payments as of December 31, 2024 under non-cancellable operating leases are as follows:

Schedule of Future Minimum Lease Payments

| | |

Lease Obligation | |

| Fiscal Year Ended March 31, 2025 | |

$ | 15,080 | |

| Fiscal Year Ended March 31, 2026 | |

| 60,320 | |

| Fiscal Year Ended March 31, 2027 | |

| 60,320 | |

| Fiscal Year Ended March 31, 2028 | |

| 20,107 | |

| Total lease payments | |

$ | 155,827 | |

| Less: imputed interest | |

| (17,250 | ) |

| Operating lease liability | |

| 138,577 | |

| Less: operating lease liability, current | |

| (49,872 | ) |

| Operating lease liability, long term | |

$ | 88,705 | |

Net

cash paid for our operating lease for the nine months ended December 31, 2024 and 2023 was $35,116 and $32,001, respectively. Rent expense,

less sublease income of $9,430 is included in general and administrative expenses.

7.

Income Taxes

The

income tax provision consists of the following for the nine months ended December 31, 2024 and 2023:

Schedule of Income Tax Provision

| | |

2024 | | |

2023 | |

| | |

Nine Months Ended | |

| | |

December 31 | |

| | |

2024 | | |

2023 | |

| Current income tax expense: | |

| | | |

| | |

| Federal | |

$ | 322,708 | | |

$ | - | |

| State | |

| 33,012 | | |

| 79,123 | |

| Total current income tax expense | |

| 355,720 | | |

| 79,123 | |

| Deferred income tax (benefit) expense: | |

| | | |

| | |

| Federal | |

| (94,746 | ) | |

| 319,848 | |

| State | |

| (60,940 | ) | |

| - | |

| Total deferred income tax (benefit) expense | |

| (155,686 | ) | |

| 319,848 | |

| Total income tax expense: | |

$ | 200,034 | | |

$ | 398,971 | |

| | |

| | | |

| | |

The

following table summarizes our income tax expense and effective income tax rate for the nine months ended December 31 follows:

Schedule of Reconciliation of Provision for Income Taxes

| | |

2024 | | |

2023 | |

| Income tax expense | |

$ | 200,034 | | |

$ | 398,971 | |

| Effective income tax rate (1) | |

| 16 | % | |

| 27 | % |

Total

income tax expense from continuing operations for the nine months ended December 31, 2024 and 2023 differed from amounts computed by

applying the U.S. federal statutory tax rate to pre-tax income primarily due to state income taxes net of federal benefit and the impact

of permanent differences between book and taxable income.

8.

Related Party Transactions

Related

party transactions for the Company primarily relate to shared office expenditures in addition to administrative and operating expenses

paid on behalf of the principal stockholder. The total billed to and reimbursed by the stockholder for the three months ended December

31, 2024 and 2023 was $16,174 and $3,625, respectively. The total billed to and reimbursed by the stockholder for the nine months ended

December 31, 2024 and 2023 was $21,462 and $21,619, respectively. The principal stockholder pays for his share of the lease amount for

the shared office space directly to the lessor. Amounts paid by the principal stockholder directly to the lessor for the three months

ending December 31, 2024 and 2023 were $2,544 and $3,893, respectively. Amounts paid by the principal stockholder directly to the lessor

for the nine months ending December 31, 2024 and 2023 were $9,430 and $11,679, respectively.

9.

Income Per Common Share

The

following is a reconciliation of the number of shares used in the calculation of basic and diluted net income per share for the three

and nine month periods ended December 31, 2024 and 2023:

Schedule of Reconciliation of Basic and Diluted Net Income (loss) Per Share

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

December 31 | | |

December 31 | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income | |

$ | 469,133 | | |

$ | 345,610 | | |

$ | 1,077,370 | | |

$ | 1,080,657 | |

| | |

| | | |

| | | |

| | | |

| | |

| Shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Weighted avg. shares outstanding – basic | |

| 2,046,000 | | |

| 2,103,503 | | |

| 2,070,086 | | |

| 2,120,611 | |

| Effect of assumed exercise of dilutive stock options | |

| 45,808 | | |

| 48,280 | | |

| 44,850 | | |

| 49,097 | |

| Weighted avg. shares outstanding – dilutive | |

| 2,091,808 | | |

| 2,151,783 | | |

| 2,114,936 | | |

| 2,169,708 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.23 | | |

$ | 0.16 | | |

$ | 0.52 | | |

$ | 0.51 | |

| Diluted | |

$ | 0.22 | | |

$ | 0.16 | | |

$ | 0.51 | | |

$ | 0.50 | |

For

the three and nine months ended December 31, 2024, 60,500 shares relating to stock options were excluded from the computation of diluted

net income because their inclusion would be anti-dilutive. Anti-dilutive stock options have a weighted average exercise price of $15.34

at December 31, 2024. For the three and nine months ended December 31, 2023, 63,000 shares relating to stock options were excluded from

the computation of diluted net income because their inclusion would be anti-dilutive. Anti-dilutive stock options have a weighted average

exercise price of $15.32 at December 31, 2023.

10.

Stockholders’ Equity

In

April 2024, the Board of Directors authorized the use of up to $1,000,000 to repurchase shares of the Company’s common stock, par

value $0.50, for the treasury account. This program does not have an expiration date and may be modified, suspended or terminated at

any time by the board of directors. Under the repurchase program, shares of common stock may be purchased from time to time through open

market purchases or other transactions. The amount and timing of repurchases will be subject to the availability of stock, prevailing

market conditions, the trading price of the stock, our financial performance and other conditions. Repurchases may also be made from

time-to-time in connection with the settlement of our share-based compensation awards. Repurchases will be funded from cash flow.

During

the nine months ended December 31, 2024, the Company repurchased 57,766 shares for the treasury at an aggregate cost of $703,216. During

the nine months ended December 31, 2023, the Company repurchased 37,161 shares for the treasury at an aggregate cost of $455,133.

On

April 30, 2024, the Board of Directors declared a regular annual dividend of $0.10 per common share. The Company paid the dividend of

$209,000 on June 4, 2024 to the stockholders of record at the close of business on May 21, 2024. On April 10, 2023, the Board of Directors

declared a special dividend of $0.10 per common share. The Company paid the dividend of $213,600 on May 15, 2023 to the stockholders

of record at the close of business on May 1, 2023. The Company can provide no assurance that dividends will be declared in the future

or as to the amount of any future dividend.

Dividends

declared by the Board and stock repurchased during the period are presented in the Company’s consolidated statements of changes

in stockholders’ equity as dividends paid and purchases of treasury stock, respectively. Dividends paid and stock repurchased during

the period are presented as cash used in financing activities in the Company’s consolidated statements of cash flows. Stock repurchases

are included as treasury stock in the consolidated balance sheets.

11.

Acquisitions

During

the nine months ended December 31, 2024, the Company incurred approximately $2,000,000 in acquisition costs to acquire various royalty

interests in approximately 700 wells located in Adams, Broomfield and Weld Counties, Colorado; DeSoto Parish, Louisiana; Eddy County,

New Mexico; Karnes, Live Oak, Reagan, Reeves and Upton Counties, Texas; Laramie County, Wyoming; and multiple counties in Nebraska, North

and South Dakota and Montana.

During

the nine months ended December 31, 2023, the Company incurred approximately $490,000 in acquisition costs to acquire various royalty

interests in approximately 60 producing wells in Crane, Ector, Howard, Midland, Reeves and Upton Counties, Texas.

12.

Subsequent Events

In

January 2025, the Company expended approximately $70,000 for the drilling of six horizontal wells in the Bone Spring Sand formation of

the Delaware Basin in Lea County, New Mexico.

The

Company completed a review and analysis of all events that occurred after the consolidated balance sheet date to determine if any such

events must be reported and has determined that there are no other subsequent events to be disclosed.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Unless

the context otherwise requires, references to the “Company”, “Mexco”, “we”, “us” or “our”

mean Mexco Energy Corporation and its consolidated subsidiaries.

Cautionary

Statements Regarding Forward-Looking Statements. Management’s Discussion and Analysis of Financial Condition and Results of

Operations (“MD&A”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Forward-looking statements include statements regarding our plans, beliefs or current expectations and may be signified

by the words “could”, “should”, “expect”, “project”, “estimate”, “believe”,

“anticipate”, “intend”, “budget”, “plan”, “forecast”, “predict”

and other similar expressions. Forward-looking statements appear throughout this Form 10-Q with respect to, among other things: profitability;

planned capital expenditures; estimates of oil and gas production; future project dates; estimates of future oil and gas prices; estimates

of oil and gas reserves; our future financial condition or results of operations; and our business strategy and other plans and objectives

for future operations. Forward-looking statements involve known and unknown risks and uncertainties that could cause actual results to

differ materially from those contained in any forward-looking statement.

While

we have made assumptions that we believe are reasonable, the assumptions that support our forward-looking statements are based upon information

that is currently available and is subject to change. All forward-looking statements in the Form 10-Q are qualified in their entirety

by the cautionary statement contained in this section. We do not undertake to update, revise or correct any of the forward-looking information.

It is suggested that these financial statements be read in conjunction with the financial statements and notes thereto included in the

Form 10-K.

Liquidity

and Capital Resources. Historically, we have funded our operations, acquisitions, exploration and development expenditures from cash

generated by operating activities, bank borrowings, sales of non-core properties and issuance of common stock. Our primary financial

resource is our base of oil and gas reserves. We have pledged our producing oil and gas properties to secure our credit facility. We

do not have any delivery commitments to provide a fixed and determinable quantity of its oil and gas under any existing contract or agreement.

Our

long-term strategy is on increasing profit margins while concentrating on obtaining reserves with low cost operations by acquiring and

developing oil and gas properties with potential for long-lived production. We focus our efforts on the acquisition of royalties and

working interests in non-operated properties in areas with significant development potential.

At

December 31, 2024, we had working capital of $1,469,195 compared to working capital of $3,259,200 at March 31, 2024, a decrease of $1,790,005

for the reasons set forth below.

Cash

Flows

Changes

in the net funds provided by or (used in) each of our operating, investing and financing activities are set forth in the table below:

| | |

For the Nine Months Ended

December 31, | | |

| |

| | |

2024 | | |

2023 | | |

Change | |

| Net cash provided by operating activities | |

$ | 2,941,115 | | |

$ | 3,374,717 | | |

$ | (433,602 | ) |

| Net cash used in investing activities | |

$ | (3,670,019 | ) | |

$ | (1,365,030 | ) | |

$ | 2,304,989 | |

| Net cash used in financing activities | |

$ | (834,575 | ) | |

$ | (666,520 | ) | |

$ | 168,055 | |

Cash

Flow Provided by Operating Activities. Cash flow from operating activities is primarily derived from the production of our crude

oil and natural gas reserves and changes in the balances of non-cash accounts, receivables, payables or other non-energy property asset

account balances. Cash flow provided by our operating activities for the nine months ended December 31, 2024 was $2,941,115 in comparison

to $3,374,717 for the nine months ended December 31, 2023. This decrease of $433,602 in our cash flow operating activities consisted

of an increase in our accounts receivable of $529,751; an increase of $106,391 of our accounts payable and accrued expenses and income

tax payable; and, a decrease in our net income for the current nine months of $3,287. Variations in cash flow from operating activities

may impact our level of exploration and development expenditures.

Our

expenditures in operating activities consist primarily of drilling expenses, production expenses and engineering services. Our expenses

also consist of employee compensation, accounting, insurance and other general and administrative expenses that we have incurred in order

to address normal and necessary business activities of a public company in the crude oil and natural gas production industry.

Cash

Flow Used in Investing Activities. Cash flow from investing activities is derived from changes in oil and gas property balances.

For the nine months ended December 31, 2024, we had net cash of $3,670,019 used for additions to oil and gas properties compared to $1,365,030

for the nine months ended December 31, 2023.

Cash

Flow Provided by Financing Activities. Cash flow from financing activities is derived from our changes in long-term debt and in equity

account balances. Net cash flow used in our financing activities was $834,575 for the nine months ended December 31, 2024 compared to

cash flow used in our financing activities of $666,520 for the nine months ended December 31, 2023. During the nine months ended December

31, 2024, we expended $209,000 to pay the regular annual dividend and $703,216 to purchase 57,766 shares of our stock for the treasury

account and received $77,641 from the exercise of stock options.

Accordingly,

net cash decreased $1,563,479, leaving cash and cash equivalents on hand of $910,005 as of December 31, 2024.

Oil

and Natural Gas Property Development

New

Participations in Fiscal 2025. The Company currently plans to participate in the drilling and completion of 28 horizontal wells at

an estimated cost of approximately $1,500,000 for the fiscal year ending March 31, 2025. Twenty-five of these wells are in the Delaware

Basin located in the western portion of the Permian Basin in Lea and Eddy Counties, New Mexico. The remaining 3 wells are in Grady County,

Oklahoma.

During

the first nine months of fiscal 2025, Mexco expended approximately $207,000 to participate in the drilling of five horizontal wells in

the Bone Spring formation of the Delaware Basin in Lea County, New Mexico. In November 2024, these wells were completed with initial

average production rates of 1,106 barrels of oil, 2,583 barrels of water and 1,165,000 cubic feet of gas per day, or 1,300 BOE per day.

During

the first nine months of fiscal 2025, Mexco expended approximately $293,000 to drill and complete four horizontal wells in the Wolfcamp

Sand formation of the Delaware Basin in Lea County, New Mexico. In November 2024, these wells were completed with initial average production

rates of 1,089 barrels of oil, 4,716 barrels of water and 3,601,000 cubic feet of gas per day, or 1,689 BOE per day.

In

October 2024, the Company expended approximately $74,000 for the drilling of two horizontal wells in the Bone Spring Sand formation of

the Delaware Basin in Lea County, New Mexico. Mexco’s working interest in these wells is .5%. Subsequently, in January 2025, the

Company expended approximately $43,000 to complete these wells.

In

November 2024, the Company expended approximately $78,000 for the drilling of two horizontal wells in the Penn Shale formation of the

Delaware Basin in Lea County, New Mexico. Mexco’s average working interest in these wells is .5%.

In

October 2022, the Company made an approximately 2% equity investment commitment in a limited liability company amounting to $2,000,000

of which $1,600,000 has been funded as of December 31, 2024. The limited liability company is capitalized at approximately $100 million

to purchase mineral interests in the Utica and Marcellus areas in the state of Ohio. To date, this LLC has returned $182,767 or 11% of

the total investment.

Completion

of Wells Drilled in Fiscal 2024. The Company expended approximately $300,000 for the completion of 19 horizontal wells in which the

Company participated during fiscal 2024.

The

Company expended approximately $107,000 for the completion costs of two horizontal wells in the Bone Spring Sand formation of the Delaware

Basin in Lea County, New Mexico that the Company participated in drilling during fiscal 2024. Mexco’s working interest in these

wells is .53%. In July 2024, these wells were completed with initial average production rates of 1,402 barrels of oil, 2,009 barrels

of water and 2,168,000 cubic feet of gas per day, or 1,763 BOE per day.

Five

horizontal wells in the Bone Spring Sand formation of the Delaware Basin in Lea County, New Mexico in which the Company participated

during fiscal 2024 were completed in April 2024 with initial average production rates of 732 barrels of oil, 1,481 barrels of water and

657,000 cubic feet of gas per day, or 842 of oil equivalent per day. Mexco’s working interest in these wells is approximately 1.16%.

A

horizontal well in the Penn Shale formation of the Delaware Basin in Lea County, New Mexico was completed in May 2024 with the initial

production rate of 964 barrels of oil, 2,441 barrels of water and 626,000 cubic feet of gas per day, or 1,068 of oil equivalent per day.

Mexco’s working interest in this well is .165%.

The

Company expended approximately $207,000 for the completion costs of four horizontial wells in the Bone Spring Sand formation of the Delaware

Basin in Lea County, New Mexico that the Company participated in drilling during fiscal 2024. Mexco’s working interest in these

wells is .45%. In October 2024, these wells were completed with initial average production rates of 893 barrels of oil, 2,990 barrels

of water and 1,161,000 cubic feet of gas per day, or 1,087 BOE per day.

Acquisitions.

In April 2024, the Company acquired royalty interests in 21 producing wells operated by Anadarko Petroleum Corporation and Cimarex

Energy Company and located in Reeves County, Texas for a purchase price of $158,000.

In

August 2024, the Company acquired royalty interests in 6 producing wells operated by Marathon Oil and located in Karnes County, Texas

for a purchase price of $50,000. This acquisition was effective August 1, 2024.

In

August 2024, the Company acquired royalty interests in 15 producing wells operated by Anadarko Petroleum Corporation and located in Weld

County, Colorado for a purchase price of $118,000; and, royalty interests in approximately 250 producing wells operated by Samson Exploration,

EOG Resources and others in Laramie County, Wyoming and Adams and Weld Counties, Colorado for a purchase price of $483,000. All of these

acquisitions were effective September 1, 2024.

In

September 2024, the Company acquired royalty interests in 20 producing wells operated by Marathon Oil and Murphy Exploration and located

in Karnes County, Texas for a purchase price of $90,000 and effective August 1, 2024.

In

October 2024, the Company acquired a .3% royalty interest in 15 producing wells operated by Civitas Resources, Inc. and located in Broomfield

and Adams Counties, Colorado for a purchase price of $450,000. This acquisition was effective November 1, 2024.

In

October 2024, the Company acquired a .5% royalty interest in 3 producing wells operated by Mewbourne Oil Company and located in Eddy

County, New Mexico for a purchase price of $260,000. This acquisition was effective November 1, 2024 and includes acreage for further

development.

In

October 2024, the Company acquired royalty interests in 8 producing wells operated by Marathon Oil and located in Live Oak County, Texas

for a purchase price of $20,000; royalty interests in 6 producing wells operated by SWN Production Company, LLC and located in DeSoto

Parish, Louisiana for a purchase price of $25,000; royalty interests in 10 producing wells operated by Ovintiv, Inc. and located in Upton

County, Texas for a purchase price of $65,000; and, royalty interests in 12 producing wells operated by Pioneer Natural Resources and

located in Reagan and Upton Counties, Texas for a purchase price of $65,000. All of these acquisitions were effective November 1, 2024.

Also

in October 2024 and effective November 1, 2024, the Company acquired various small royalty interests in over 300 producing wells operated

by Petro-Hunt Corporation, Hess Bakken Investments II, LLC, Marathon Oil, WPX Energy and others in multiple counties throughout the states

of Nebraska, North Dakota, South Dakota and Montana for a purchase price of $185,000.

Other

Projects. We are participating in other projects and are reviewing projects in which we may participate. The cost of such projects

would be funded, to the extent possible, from existing cash balances and cash flow from operations. The remainder may be funded through

borrowings on the credit facility and, if appropriate, sales of non-core properties.

Sale

of Properties. In November 2024, the Company conveyed its working and royalty interests in 13.5 net acres in Ward County, Texas.

The Company received $15,000 per acre in the total amount of $202,500. The Company retained an overriding royalty interest equal to the

positive difference between 25% and any existing burdens of record as of the effective date. The divestitures of this non-core oil and

gas asset did not result in a significant alteration of the relationship between the Company’s capitalized costs and proved reserves

and, accordingly, the Company recorded the proceeds as sales proceeds, a reduction of its full cost pool, with no gain or loss recognized

on the sale.

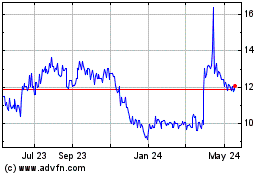

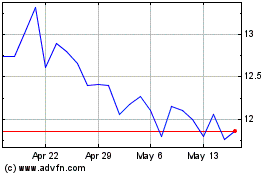

Pricing.

Crude oil and natural gas prices generally remained volatile during the last year. The volatility of the energy markets makes it

extremely difficult to predict future oil and natural gas price movements with any certainty. For example, in the last twelve months,

the NYMEX West Texas Intermediate (“WTI”) posted price for crude oil has ranged from a low of $61.73 per bbl in September

2024 to a high of $82.89 per bbl in April 2024. The Henry Hub Spot Market Price (“Henry Hub”) for natural gas has ranged

from a low of $1.21 per MMBtu in November 2024 to a high of $3.40 per MMBtu in December 2024.

On

December 31, 2024, the WTI posted price for crude oil was $67.70 and the Henry Hub spot price for natural gas was $3.40 per MMBtu. See

Results of Operations below for realized prices. Pipeline capacity constraints and maintenance in the Permian Basin area has contributed

to a wider difference between the WaHa Hub and the Henry Hub and at times prices were negative.

Contractual

Obligations. We have no off-balance sheet debt or unrecorded obligations and have not guaranteed the debt of any other party. The

following table summarizes our future payments we are obligated to make based on agreements in place as of December 31, 2024:

| | |

| | |

Payments due in: | |

| | |

Total | | |

less than 1 year | | |

1 - 3 years | | |

over 3 years | |

| Contractual obligations: | |

| | | |

| | | |

| | | |

| | |

| Leases (1) | |

$ | 155,827 | | |

$ | 60,320 | | |

$ | 95,507 | | |

$ | - | |

| |

(1) |

The

lease amount represents the monthly rent amount for our principal office space in Midland, Texas under a 36-month lease agreement

expiring July 31, 2027. Of this total obligation for the remainder of the lease, our majority shareholder will pay $10,175 less than

1 year and $16,110 1-3 years for his portion of the shared office space. |

Results

of Operations – Three Months Ended December 31, 2024 and 2023. For the quarter ended December 31, 2024, there was net income

of $469,133 compared to $345,610 for the quarter ended December 31, 2023 as a result of an increase in operating revenues due to a increase

in oil and gas production volumes partially offset by a decrease in oil and gas prices and an increase in operating expenses that is

further explained below.

Oil

and gas sales. Revenue from oil and gas sales was $1,828,404 for the third quarter of fiscal 2025, a 14% increase from $1,610,595

for the same period of fiscal 2024. This resulted from an increase in oil and natural gas production volumes partially offset by a decrease

in oil and natural gas prices. Natural gas prices have been negatively impacted by limited pipeline capacity in the Permian

Basin.

| | |

2024 | | |

2023 | | |

% Difference | |

| Oil: | |

| | | |

| | | |

| | |

| Revenue | |

$ | 1,563,663 | | |

$ | 1,387,008 | | |

| 12.7 | % |

| Volume (bbls) | |

| 22,451 | | |

| 17,636 | | |

| 27.3 | % |

| Average Price (per bbl) | |

$ | 69.65 | | |

$ | 78.65 | | |

| (11.4) | % |

| | |

| | | |

| | | |

| | |

| Gas: | |

| | | |

| | | |

| | |

| Revenue | |

$ | 264,741 | | |

$ | 223,587 | | |

| 18.4 | % |

| Volume (mcf) | |

| 149,945 | | |

| 122,794 | | |

| 22.1 | % |

| Average Price (per mcf) | |

$ | 1.77 | | |

$ | 1.82 | | |

| (2.7) | % |

Other

operating revenues. Other revenues increased to $62,861 for the three months ended December 31, 2024, from $45,848 for the three

months ended December 31, 2023. This increase resulted from a settlement in a class action lawsuit from Contango Resources and an increase

in income from one of our limited liability company investments.

Interest

income. Interest income on corporate funds decreased to $7,315 for the three months ended December 31, 2024, from $36,936 for the

three months ended December 31, 2023. This decrease resulted from using the corporate funds for property acquisitions.

Production

and exploration. Production costs were $460,241 for the third quarter of fiscal 2025, a 15% increase from $401,035 for the same

period of fiscal 2024. This is the result of an increase in production taxes due to an increase in oil revenues and an increase in

marketing and other charges due to the current natural gas pricing environment from limited pipeline takeaway capacity in the

Permian and an increase in lease operating expenses on new wells in which we own an interest.

Depreciation,

depletion and amortization. Depreciation, depletion and amortization expense was $636,424 for the third quarter of fiscal 2025, a

59% increase from $400,337 for the same period of fiscal 2024, primarily due to an increase in the full cost amortization base, an increase

in oil and gas production and a decrease in gas reserves partially offset by a increase in oil reserves.

General

and administrative expenses. General and administrative expenses were $340,514 for the third quarter of fiscal 2025, a 2% increase

from $335,152 for the same period of fiscal 2024. This was primarily due to an increase in contract services.

Income taxes. There was an income

tax benefit of $18,305 for the three months ended December 31, 2024 compared to an expense of $202,945 for the three months ended December

31, 2023, primarily due to a decrease in state income taxes and a decrease in the deferred tax provision. The effective tax rate for

state and federal taxes combined for the three months ended December 31, 2024 and 2023 was (4%) and 37%, respectively. The decrease in