UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-39966

| New Found Gold Corp. |

| (Exact name of registrant as specified in its charter) |

|

555 Burrard Street, P.O. Box 272

Vancouver,

British Columbia

Canada V7X 1M8 |

| (Address of principal executive office) |

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or 40-F:

Form 20-F o

Form 40-F þ

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf by the undersigned, thereunto duly

authorized.

| |

|

|

NEW FOUND GOLD CORP. |

| |

|

|

(Registrant) |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| Date: |

November 12, 2024 |

|

By: |

/s/ Collin Kettell |

| |

|

|

|

Collin Kettell |

| |

|

|

|

Chief Executive Officer |

EXHIBIT 99.1

|

|

Meeting Date and Location |

|

Notice of Availability of Proxy Materials

for

NEW FOUND GOLD CORP.

(the “Company”)

Annual General Meeting

(the “Meeting”)

|

WHEN |

Tuesday, December 17, 2024

10:00 a.m. (Pacific Time) |

| WHERE |

3500 – 1133 Melville Street

Vancouver, British Columbia

V6E 4E5 Canada

|

| |

|

The Company is using ‘notice-and-access’

to deliver its Management Information Circular (the “Circular”) dated October 18, 2024, to you by providing you with

electronic access to the document, instead of mailing a paper copy. Notice-and-access is a more environmentally friendly and cost-conscious

way to deliver meeting materials, reducing paper consumption and printing and mailing costs to shareholders.

Enclosed with this notice you will find a form of

proxy so you can vote your shares. Please follow the voting instructions provided on your form of proxy, which must be received by 10:00

a.m. (Pacific Time) on Friday, December 13, 2024. The Company reminds shareholders that it is important to review the Circular

before voting.

To access the Circular, please go to:

https://newfoundgold.ca/investors/#agm

OR

www.sedarplus.ca

Obtaining Paper Copies of the Circular

Shareholders

may request to receive paper copies of the Circular related to the Meeting by mail at no cost. Requests for paper copies must be received

by 5:00 p.m. (Pacific Time) on Friday, November 29, 2024, in order to provide ample time to mail paper copies in advance of the Meeting.

A Shareholder may request to receive a paper copy of the materials for up to one year from the date the materials were filed on www.sedarplus.ca.

For

more information regarding notice-and-access or to obtain a paper copy of the materials you may contact the Company via email to contact@newfoundgold.ca

or by telephone at 1-833-345-2291 (toll-free within North America) or 1-845-535-1486 (direct from outside North America).

Please note you will not be sent another form of proxy.

Please retain the form of proxy mailed to you to vote your shares.

Notice of Meeting

The resolutions to be voted on at the Meeting, described

in detail in the Circular are as follows:

| 1. | to receive the audited financial statements of the Company for the year

ended December 31, 2023, together with the auditor’s report thereon (see the section entitled “Section 4 - Particulars

of Matters to be Acted Upon –1. Presentation of Financial Statements” on page 7 of the Circular); |

| 2. | to fix the number of directors to be elected at the Meeting at five (5)

(see the section entitled “Section 4 - Particulars of Matters to be Acted Upon – 2. Fixing the Number of Directors”

on page 7 of the Circular); |

| 3. | to elect directors of the Company to hold office until the next annual meeting

of shareholders (see section entitled “Section 4 - Particulars of Matters to be Acted Upon – 3. Election of Directors”

on pages 7-10 of the Circular); |

| 4. | to appoint KPMG LLP, Chartered Professional Accountants, as auditor of the

Company for the ensuing year and to authorize the directors of the Company to fix the remuneration to be paid to the auditor (see the

section entitled “Section 4 - Particulars of Matters to be Acted Upon – 4. Appointment of Auditor” on page 10

of the Circular); |

| 5. | to consider and, if deemed advisable, to pass, with or without variation,

an ordinary resolution approving the Company’s 10% “rolling” stock option plan, dated for reference December 8, 2022,

as more particularly described in the Circular (see the section entitled “Section 4 - Particulars of Matters to be Acted Upon

– Approval of Stock Option Plan” on pages 11-12 of the Circular); and |

| 6. | to transact such other business as may properly come before the Meeting

or any adjournment thereof. |

Stratification: The Company will not

use a procedure known as ‘stratification’ in relation to its use of notice-and-access provisions. Stratification occurs when

a reporting issuer using notice-and-access provisions also provides a paper copy of its management information circular to some shareholders

with this notice-and-access notice. All shareholders will receive only the notice-and-access notice, which must be mailed to them pursuant

to notice-and-access provisions, and which will not include a paper copy of the Circular. Shareholders will not receive a paper copy of

the Circular from the Company, or from any intermediary, unless a shareholder specifically requests one.

Annual Financial Statements: The Company

is providing paper copies or emailing electronic copies of its annual financial statements to registered shareholders and beneficial shareholders

who have opted to receive annual financial statements and have indicated a preference for either delivery method.

EXHIBIT 99.2

|

|

Notice OF

Meeting

and

Management

information circular

FOR THE

ANNUAL GENERAL

MEETING

OF SHAREHOLDERS

OF

NEW FOUND GOLD CORP.

To be held

TUESDAY,

DECEmber 17, 2024

Dated: october

18, 2024

|

| Notice of Annual General Meeting of Shareholders |

.................... |

i |

| Management Information Circular |

.................... |

1 |

| Section 1 - Introduction |

.................... |

1 |

| Date and Currency |

.................... |

1 |

| Notice-and-Access |

.................... |

1 |

| Section 2 - Proxies and Voting Rights |

.................... |

2 |

| Management Solicitation |

.................... |

2 |

| Appointment of Proxy |

.................... |

3 |

| Voting by Proxy and Exercise of Discretion |

.................... |

3 |

| Non-Registered (or Beneficial) Holders |

.................... |

4 |

| Advice to Non-Registered (or Beneficial) Holders |

.................... |

4 |

| Revocation of Proxies |

.................... |

5 |

| Notice to Shareholders in the United States |

.................... |

5 |

| Section 3 - Voting Securities and Principal Holders of Voting Securities |

.................... |

6 |

| Record Date |

.................... |

6 |

| Voting Rights |

.................... |

6 |

| Principal Holders of Shares |

.................... |

6 |

| Quorum |

.................... |

6 |

| Section 4 - Particulars of Matters to be Acted Upon |

.................... |

7 |

| 1. Presentation of Financial Statements |

.................... |

7 |

| 2. Fixing the Number of Directors |

.................... |

7 |

| 3. Election of Directors |

.................... |

7 |

| 4. Appointment of Auditor |

.................... |

10 |

| 5. Approval of Stock Option Plan |

.................... |

11 |

| 6. Other Business |

.................... |

12 |

| Section 5 - Statement of Executive Compensation |

.................... |

12 |

| Named Executive Officers |

.................... |

12 |

| Compensation Discussion & Analysis |

.................... |

12 |

| Compensation Governance |

.................... |

16 |

| Summary Compensation Table |

.................... |

18 |

| Employment, Consulting and Management Agreements |

.................... |

19 |

| Incentive Plan Awards |

.................... |

20 |

| Director Compensation |

.................... |

23 |

| Option Plan |

.................... |

24 |

| Section 6 - Audit Committee |

.................... |

28 |

| Audit Committee Charter |

.................... |

28 |

| Composition of the Audit Committee |

.................... |

29 |

| Section 7 - Corporate Governance |

.................... |

31 |

| Corporate Governance Practices |

.................... |

32 |

| Section 8 - Other Information |

.................... |

36 |

| Schedule “A” - Charter of the Audit Committee |

.................... |

39 |

| Schedule “B” - Board Mandate |

.................... |

46 |

NOTICE

OF MEETING

|

New Found Gold Corp.

555 Burrard Street, P.O. Box 272

Vancouver, British Columbia

V7X 1M8 Canada

Telephone:

(845) 535-1486

|

| Notice of Annual General Meeting of Shareholders |

NOTICE IS HEREBY GIVEN that the annual

general meeting (the “Meeting”) of the holders of common shares (“Shareholders”) of New Found Gold

Corp. (the “Company” or “New Found”) will be held on Tuesday,

December 17, 2024, at 10:00 a.m. (Pacific Time) at 3500 - 1133 Melville Street,

Vancouver, British Columbia, V6E 4E5 for the following purposes:

| 1. |

to receive the audited financial statements of the Company for the year ended December 31, 2023, together with the report of the auditor thereon; |

| |

|

| 2. |

to fix the number of directors to be elected at the Meeting at five (5); |

| |

|

| 3. |

to elect five (5) directors to hold office until the next annual meeting of Shareholders; |

| |

|

| 4. |

to appoint KPMG LLP, Chartered Professional Accountants, as auditor of the Company for the ensuing year and to authorize the directors of the Company to fix the remuneration to be paid to the auditor; |

| |

|

| 5. |

to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution approving the Company’s “10% rolling” stock option plan, dated for reference December 8, 2022, as more particularly described in the accompanying Management Information Circular of the Company dated October 18, 2024 (the “Circular”); and |

| |

|

| 6. |

to transact such other business as may properly come before the Meeting or any adjournment thereof. |

The accompanying Circular provides additional information

relating to the matters to be dealt with at the Meeting and is deemed to form part of this Notice. Although no other matters are contemplated,

the Meeting may also consider the transaction of such other business, and any permitted amendment to or variation of any matter identified

in this Notice, as may properly come before the Meeting or any adjournment thereof. Shareholders are advised to review the Circular before

voting.

The board of directors of the Company (the “Board”)

has fixed Friday, October 18, 2024, as the record date (the “Record Date”) for determining Shareholders who are entitled

to receive notice and to vote at the Meeting. Only Shareholders of record at the close of business on the Record Date and duly appointed

proxyholders will be entitled to vote at the Meeting.

Registered Shareholders unable to attend the Meeting

in person and who wish to ensure that their common shares (“Shares”) will be voted at the Meeting are requested to

complete, date, and sign a form of proxy and deliver it in accordance with the instructions set out in the form of proxy and in the Circular.

Non-registered (or beneficial) Shareholders who plan

to attend the Meeting must follow the instructions set out in the voting instruction form to ensure that their Shares will be voted at

the Meeting. If you hold your Shares in a brokerage account, you are a non-registered (or beneficial) Shareholder.

The Company is using “Notice-and-Access”

to provide Shareholders with easy access to the Circular and other proxy-related materials (collectively, the “Meeting Materials”)

prepared in connection with the Meeting, rather than mailing paper copies.

The Meeting Materials are available on the internet

at:

https://newfoundgold.ca/investors/#agm

or

www.sedarplus.ca

Shareholders are reminded to review all of the important

information contained in the Meeting Materials before voting. Instructions on obtaining paper copies of the Meeting Materials can be found

on pages 1-2 of the Circular under the heading “Notice-and-Access”.

DATED at Vancouver, British Columbia, this

18th day of October, 2024.

BY ORDER OF THE BOARD

/s/ Collin Kettell

Collin Kettell

Chief Executive Officer and

Executive Chairman

management

information circular

MANAGEMENT INFORMATION CIRCULAR

This management information circular (the “Circular”)

accompanies the notice of annual general meeting (the “Notice”) and is furnished to the holders (the “Shareholders”

and each, a “Shareholder”) of common shares (“Shares”) in the capital of New Found Gold Corp. (the

“Company”) in connection with the solicitation by the management of the Company of proxies to be voted at the annual

general meeting (the “Meeting”) of the Shareholders to be held Tuesday, December

17, 2024, at 10:00 a.m. (Pacific Time) at 3500 - 1133 Melville Street, Vancouver, British Columbia, V6E 4E5,

and any adjournment thereof, for the purposes set forth in the Notice of the Meeting.

Date and Currency

Unless otherwise indicated, all information in this

Circular is given as at October 18, 2024, and all dollar amounts referenced herein are in Canadian dollars (“$” or “C$”).

Certain information in this Circular is presented in United States dollars (“US$”). The exchange rate as at December 29, 2023,

was C$1.00 = US$0.7561.

Notice-and-Access

The Company has chosen to deliver proxy materials,

including the Notice of Meeting of Shareholders and this Circular (together, the “Proxy Materials”), in reliance on

the provisions of Notice-and-Access, which govern the delivery of proxy materials to Shareholders utilizing the internet. Notice-and-Access

provisions are found in section 9.1.1 of National Instrument 51-102 - Continuous Disclosure Obligations (“NI 51-102”)

for delivery to registered Shareholders and in section 2.7.1 of National Instrument 54-101 - Communication with Beneficial Owners of

Securities of a Reporting Issuer (“NI 54-101”) for delivery to non-registered (or beneficial) Shareholders (together,

“Notice-and-Access Provisions”).

Notice-and-Access Provisions permit the Company to

deliver the Proxy Materials to Shareholders by posting them on a non-System for Electronic Document Analysis and Retrieval+ (SEDAR+) website

(usually the reporting issuer’s website or the website of its transfer agent), provided that the conditions of NI 51-102 and NI

54-101 are met, rather than by printing and mailing the Proxy Materials. This method reduces paper waste and the Company’s printing

and mailing costs. Under Notice-and-Access Provisions, the Company must send a Notice-and-Access notification and form of proxy or voting

instruction form, as applicable (together, the “Notice Package”) to each Shareholder, including registered and non-registered

(or beneficial) Shareholders, indicating that the Proxy Materials have been posted online and explaining how a Shareholder can access

such materials and how they may obtain a paper copy of the Circular from the Company.

This Circular has been posted in full, together with

the Notice of Annual General Meeting, the form of proxy, and the financial statements request form, on the Company’s website at

https://newfoundgold.ca/investors/#agm and under the Company’s profile at SEDAR+ (www.sedarplus.ca),

the Canadian Securities Administrators’ national system that all market participants use for

filings and disclosure.

management information circular |

How to

Obtain a Paper Copy of the Circular

Any Shareholder may request a paper copy of the Circular

be mailed to them, at no cost, by contacting the Company via email to contact@newfoundgold.ca

or by telephone at 1-833-345-2291 (toll-free within North America) or 1-845-535-1486 (direct from outside North America).

To allow adequate time for a Shareholder to receive

and review a paper copy of the Circular and then to submit their vote by 10:00 a.m. (Pacific Time) on Friday, December 13, 2024, a Shareholder

requesting a paper copy of the Circular as described above, should ensure such request is received by the Company no later than 5:00 p.m.

(Pacific Time) on Friday, November 29, 2024. Under Notice-and-Access Provisions, Proxy Materials must be available for viewing for up

to one year from the date of posting and a paper copy of the Circular can be requested at any time during this period. To obtain a paper

copy of the Circular after the Meeting date, please contact the Company.

The Company will not use a procedure known as ‘stratification’

in relation to its use of Notice-and-Access Provisions. Stratification occurs when a reporting issuer using Notice-and-Access Provisions

also provides a paper copy of its management information circular to some Shareholders with the Notice Package. All Shareholders will

receive only the Notice Package, which must be mailed to them pursuant to Notice-and-Access Provisions, and which will not include a paper

copy of the Circular. Shareholders will not receive a paper copy of the Circular from the Company, or from any intermediary, unless a

Shareholder specifically requests one.

All Shareholders may call 1-833-345-2291 (toll-free

within North America) or 1-845-535-1486 (direct from outside North America) in order to obtain additional information relating to Notice-and-Access

Provisions or to request a paper copy of the Circular, up to and including the date of the Meeting, including any adjournment of the Meeting.

This Circular contains details of matters to be considered

at the Meeting. Please review the Circular before voting.

| Section 2 - proxies and voting rights |

management

solicitation

The solicitation of proxies by the management of the

Company will be conducted by mail and may be supplemented by telephone or other personal contact to be made without special compensation

by the directors, officers and employees of the Company. The Company does not reimburse Shareholders, nominees or agents for costs incurred

in obtaining from their principals’ authorization to execute forms of proxy, except that the Company has requested brokers and nominees

who hold stock in their respective names to furnish this proxy material to their customers, and the Company will reimburse such brokers

and nominees for their related out-of-pocket expenses. No solicitation will be made by specifically engaged employees or soliciting agents.

The cost of solicitation will be borne by the Company.

No person has been authorized to give any information

or to make any representation other than as contained in this Circular in connection with the solicitation of proxies. If given or made,

such information or representations must not be relied upon as having been authorized by the Company. The delivery of this Circular shall

not create, under any circumstances, any implication that there has been no change in the information set forth herein since the date

of this Circular. This Circular does not constitute the solicitation of a proxy by anyone in any jurisdiction in which such solicitation

is not authorized, or in which the person making such solicitation is not qualified to do so, or to anyone to whom it is unlawful to make

such an offer of solicitation.

management information circular |

Appointment

of proxy

The purpose of a proxy is to designate persons who

will vote the proxy on a Shareholder’s behalf in accordance with the instructions given by the Shareholder in the proxy. The persons

whose names are printed on the enclosed form of proxy (the “Management Proxyholders”) are officers and/or directors

of the Company.

A Shareholder has the right to appoint a person

or company to attend and act for or on behalf of that Shareholder at the Meeting, other than the Management Proxyholders named in the

enclosed form of proxy. A proxyholder need not be a Shareholder.

To exercise the right, the Shareholder may do so

by inserting the name of such other person in the blank space provided in the form of proxy. Such Shareholder should notify the nominee

of the appointment, obtain the nominee’s consent to act as proxy and should provide instruction to the nominee on how the Shareholder’s

Shares should be voted. The nominee should bring personal identification to the Meeting.

Those Shareholders desiring to be represented at the

Meeting by proxy - either by a Management Proxyholder or another person - must deposit their respective forms of proxy with the Company’s

registrar and transfer agent, Computershare Investor Services Inc. (“Computershare”), 8th Floor, 100 University

Avenue, Toronto, Ontario, M5J 2Y1, Attention: Proxy Department, by mail, facsimile transmission, telephone voting system or via the internet

at least two business days (excluding Saturdays, Sundays and holidays) prior to the scheduled time of the Meeting, or any adjournment

thereof.

A proxy may not be valid unless it is dated and signed

by the Shareholder who is giving it or by that Shareholder’s attorney-in-fact duly authorized by that Shareholder in writing or,

in the case of a corporation, dated and executed by a duly authorized officer or attorney-in-fact for the corporation. If a form of proxy

is executed by an attorney-in-fact for an individual Shareholder or joint Shareholders, or by an officer or attorney-in-fact for a corporate

Shareholder, the instrument so empowering the officer or attorney-in-fact, as the case may be, or a notarially certified copy thereof,

must accompany the form of proxy.

The Company may refuse to recognize any instrument

of proxy deposited in writing or by the internet received later than forty-eight (48) hours (excluding Saturdays, Sundays and statutory

holidays in British Columbia) prior to the Meeting or any adjournment thereof.

Voting By

Proxy and Exercise of Discretion

Only registered Shareholders and duly appointed

proxyholders are permitted to vote at the Meeting. Shares represented by a properly executed proxy will be voted or withheld from

voting on each matter referred to in the Notice of Meeting in accordance with the instructions of the Shareholder on any ballot that may

be called for and if the Shareholder specifies a choice with respect to any matter to be acted upon, the Shares will be voted accordingly.

If a Shareholder does not specify a choice and

the Shareholder has appointed one of the Management Proxyholders as proxyholder, the Management Proxyholder will vote in favour of the

matters specified in the Notice of Meeting and in favour of all other matters proposed by management at the Meeting.

The form of proxy, when properly signed, also confers

discretionary authority to the person named therein as proxyholder with respect to amendments or variations to matters identified in the

Notice of Meeting and with respect to other matters which may properly come before the Meeting. As of the date of this Circular, management

of the Company knows of no such amendments, variations, or other matters to come before the Meeting.

management information circular |

Non-Registered

(or Beneficial) Shareholders

The following information is of significant importance

to Shareholders who do not hold Shares in their own name. These Shareholders are called beneficial Shareholders. Beneficial Shareholders

should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered Shareholders

(those whose names appear on the records of the Company as the registered holders of Shares). If Shares are listed in an account statement

provided to a Shareholder by a broker or custodian banks (an “Intermediary”), then in almost all cases those Shares

will not be registered in the Shareholder’s name on the records of the Company. Such Shares will more likely be registered under

the name of the Shareholder’s broker or an agent of that broker or the custodian bank. In Canada, the vast majority of such Shares

are registered under the name of CDS & Co. (the registration name for the Canadian Depository for Securities Limited, which acts as

nominee for many Canadian brokerage firms and custodian banks), and in the United States, under the name of Cede & Co. as nominee

for The Depository Trust Company (which acts as depositary for many United States brokerage firms and custodian banks). Intermediaries

are required to seek voting instructions from beneficial Shareholders in advance of Shareholders’ meetings. Every Intermediary has

its own mailing procedures and provides its own return instructions to clients.

There are two types of non-registered holders: (i)

those who object to their identity being made known to the issuers of securities which they own (“OBOs”), and (ii)

those who do not object to their identity being made known to the issuers of securities which they own (“NOBOs”).

The Company will not be sending these Meeting Materials

directly to NOBOs.

The Company does not intend to pay for Intermediaries

to forward to OBOs the Meeting Materials. OBOs will not receive the materials unless the OBO’s Intermediary assumes the cost of

delivery.

Advice to

Non-Registered (or Beneficial) Shareholders

You should carefully follow the instructions of your

Intermediary in order to ensure that your Shares are voted at the Meeting. The form of proxy supplied to you by your broker will be similar

to the proxy provided to registered Shareholders by the Company. However, its purpose is limited to instructing the intermediary on how

to vote on your behalf. Many brokers delegate responsibility for obtaining instructions from clients to an investor communication service

(“ICS”) in Canada/the United States. The ICS will typically mail a voting instruction form in lieu of a proxy provided

by the Company. The voting instruction form will name the same persons as the Company’s form of proxy to represent you at the Meeting.

You have the right to appoint a person (who need not be a Shareholder of the Company), other than the persons designated in the voting

instruction form, to represent you at the Meeting. To exercise this right, you should insert the name of the desired representative in

the blank space provided in the voting instruction form. The completed voting instruction form must then be returned to the ICS by mail

or facsimile or given to the ICS by phone or over the internet, in accordance with the ICS’ instructions. The ICS then tabulates

the results of all instructions received and provides appropriate instructions respecting the voting of Shares to be represented at the

Meeting. If you receive a voting instruction form from an ICS, you cannot use it to vote Shares directly at the Meeting - the voting instruction

form must be completed and returned to the ICS, in accordance with its instructions, well in advance of the Meeting in order to have the

Shares voted. Although as a beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting Shares

registered in the name of your broker, you, or a person designated by you, may attend at the Meeting as proxy holder for your broker and

vote your Shares in that capacity. If you wish to attend at the Meeting and indirectly vote your Shares as proxy holder for your broker,

or have a person designated by you do so, you should enter your own name, or the name of the person you wish to designate, in the blank

space on the voting instruction form provided to you and return the same to your broker in accordance with the instructions provided by

such broker (or agent), well in advance of the Meeting. Alternatively, you can request in writing that your broker send you a legal proxy

which would enable you, or a person designated by you, to attend at the Meeting and vote your Shares.

management information circular |

Revocation

of Proxies

Registered Shareholders

A registered shareholder who has submitted a proxy

may revoke it at any time prior to the exercise thereof by:

| • | completing and signing a proxy bearing a later date and delivering such proxy to Computershare by 10:40

a.m. (Pacific Time) on Friday, December 13, 2024, or the last business day prior to the day the Meeting is reconvened if it is adjourned; |

| • | sending a signed written statement (or have your attorney sign a statement with your written authorization)

to: |

Corporate Secretary

New Found Gold Corp.

1133 Melville Street

Suite 3500, The Stack

Vancouver, BC Canada

V6E 4E5

Email: issuers@keystonecorp.ca

The Company must receive your written

statement prior to 5:00 p.m. (Pacific Time) on Monday, December 16, 2024, or the last business day prior to the day the meeting is

reconvened if it is adjourned;

| • | providing a signed written statement, at the Meeting, to the chair of the Meeting prior to the vote being

taken; or |

| • | any other manner permitted by law. |

If you have followed the instructions for attending

and voting at the Meeting, voting at the Meeting will revoke any previous proxy.

Beneficial Shareholders

If you change your mind, contact your broker or nominee.

Notice to

Shareholders in the United States

The solicitation of proxies involves securities of

an issuer located in Canada and is being effected in accordance with the corporate laws of the Province of British Columbia, Canada, and

securities laws of the provinces of Canada. The proxy solicitation rules under the United States Securities Exchange Act of 1934, as amended,

are not applicable to the Company or this solicitation, and this solicitation has been prepared in accordance with the disclosure requirements

of the securities laws of the provinces of Canada. Shareholders should be aware that disclosure requirements under the securities laws

of the provinces of Canada differ from the disclosure requirements under United States securities laws.

The enforcement by Shareholders of civil liabilities

under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the Business

Corporations Act (British Columbia), certain of its directors and its executive officers are residents of Canada and a substantial

portion of its assets and the assets of such persons are located outside the United States. Shareholders may not be able to sue a foreign

company or its officers or directors in a foreign court for violations of United States federal securities laws. It may be difficult to

compel a foreign company and its officers and directors to subject themselves to a judgement by a United States court.

management information circular |

| Section 3 - voting sECURITIES and principal holders OF VOTING SECURITIES |

Record Date

The board of directors of the Company (the “Board”)

has set the close of business on Friday, October 18, 2024, as the record date (the “Record Date”) for the Meeting.

Only Shareholders of record as at the Record Date are entitled to receive notice of and to attend and vote at the Meeting or any adjournment

thereof, unless after that date a Shareholder of record transfers his or her Shares and the transferee, upon producing properly endorsed

certificates evidencing such Shares or otherwise establishing that he or she owns such Shares, requests at least ten (10) days prior to

the Meeting that the transferee’s name be included in the list of Shareholders entitled to vote, in which case such transferee is

entitled to vote such Shares at the Meeting.

Persons who are non-registered or beneficial Shareholders

as at the Record Date will be entitled to exercise their voting rights in accordance with the procedures established under NI 54-101.

See “Section 2 - Proxies and Voting Rights - Advice to Non-Registered (or

Beneficial) Shareholders”.

Voting

Rights

The Company is authorized to issue an unlimited number

of Shares. As at the Record Date, there were 198,838,411 Shares issued and outstanding. Each Share carries the right to one vote. No group

of Shareholders has the right to elect a specified number of directors, nor are there cumulative or similar voting rights attached to

the Shares.

Principal

Holders of Shares

To the knowledge of the directors and executive officers

of the Company, no holder beneficially owns, or controls or directs, directly or indirectly, voting securities of the Company carrying

10% or more of the voting rights attached to any class of outstanding voting securities of the Company as at the Record Date, except as

follows:

| Name and Address |

Number of Shares |

Percentage of

Outstanding Shares (1) |

| Palisades Goldcorp Ltd. (2) |

43,386,425 |

21.82% |

| Eric Sprott (3) |

36,611,100 |

18.41% |

| (1) | Based on 198,838,411 outstanding Shares as at October 18, 2024. |

| (2) | The principal securityholder of Palisades Goldcorp Ltd. is Collin Kettell, Chief Executive Officer and

Director of the Company. |

| (3) | Mr. Sprott holds (a) 1,900,000 Shares directly; (b) 10,412,400 Shares through 2176423 Ontario Inc., a

corporation he wholly owns; and (c) 24,298,700 Shares through Sprott Mining Inc. |

Quorum

Pursuant to the Articles of the Company, subject to

the special rights and restrictions attached to the shares of any class or series of shares, the quorum for the transaction of business

at the Meeting is one person who, in the aggregate, holds, or who represents by proxy, Shareholders who, in the aggregate, hold, at least

5% of the issued Shares entitled to be voted at the Meeting.

management information circular |

| Section 4 - particulars of matters to be acted upon |

Management

of the Company knows of no other matters to come before the Meeting other than those referred to in the Notice of Meeting. However, if

any other matters that are not known to management should properly come before the Meeting, the accompanying form of proxy confers discretionary

authority upon the persons named therein to vote on such matters in accordance with their best judgment.

Additional details regarding

each of the matters to be acted upon at the Meeting is set forth below.

1. Presentation

of Financial Statements

The audited annual financial

statements of the Company for the year ended December 31, 2023, and the auditor’s report thereon, will be placed before Shareholders

at the Meeting.

Copies of these documents will

be available at the Meeting and may also be obtained by a Shareholder upon request without charge from the Company, 555 Burrard Street,

P.O. Box 272, Vancouver, British Columbia, V7X 1M8. These documents are also available under the Company’s profile on SEDAR+ at

www.sedarplus.ca and on the Company’s website at www.newfoundgold.ca.

Shareholders and proxyholders will be given an opportunity

to discuss the Company’s financial results with management. Shareholder approval is not required and no formal action will be

taken at the Meeting to approve the financial statements.

2. Fixing

the Number of Directors

At the Meeting, it will be proposed that five (5)

directors be elected to hold office until the next annual general meeting or until their successors are elected or appointed. Shareholders

will be asked to consider and, if deemed advisable, to approve an ordinary resolution, the text of which is as follows:

“BE IT RESOLVED, as an ordinary resolution

of Shareholders, that the number of directors to be elected at the Meeting, to hold office until the close of the next annual meeting

of Shareholders or until their successors are duly elected or appointed pursuant to the constating documents of the Company, unless their

offices are earlier vacated in accordance with the provisions of the Business Corporations Act (British Columbia) or the Company’s

constating documents, be and is hereby fixed at five (5).”

In order for the foregoing resolution to be passed,

it must be approved by a simple majority of the votes cast by Shareholders in person or by proxy in respect of the resolution at the Meeting.

Management believes the passing of the above resolution

is in the best interests of the Company and recommends Shareholders vote in favour of the ordinary resolutions fixing the number of directors

to be elected at the Meeting as set out above. Unless directed to the contrary, it is the intention of the Management Proxyholders, if

named as proxy, to vote in favour of the ordinary

resolutions fixing the number of directors to be elected at the Meeting at five (5).

3. Election

of Directors

The directors of the Company are elected annually

and hold office until the next annual general meeting of Shareholders or until their successors are elected or until such director’s

earlier death, resignation or removal.

management information circular |

Advance Notice Provisions

The Articles of the Company include advance notice

provisions (the “Advance Notice Provisions”), which requires, among other things, advance notice be given to the Company

in circumstances where nominations of persons for election to the Board are made by Shareholders. In the case of an annual meeting of

Shareholders (including an annual and special meeting), notice to the Company must be made not later than 5:00 p.m. (Pacific Time) on

the 30th day before the date of the meeting of Shareholders (or 40th day before the date of the meeting of Shareholders

if notice-and-access (as defined in NI 54-101) is used for delivery of proxy related materials); provided, however, if the first public

announcement made by the Company of the date of the meeting (the “Notice Date”) is less than 50 days before the meeting

date, notice by the nominating Shareholder may be given not later than the close of business on the 10th day following the

Notice Date. In the case of a special meeting (which is not also an annual meeting) of Shareholders called for any purpose which includes

the election of directors to the Board, notice to the Company must be made not later than the close of business on the 15th

day following the Notice Date. In addition, the Advance Notice Provisions set forth the information that a Shareholder must include in

the notice to the Company and establishes the form in which the Shareholder must submit the notice for that notice to be in proper written

form. The foregoing is merely a summary of the Advance Notice Provisions, is not comprehensive and is qualified by the full text of such

provision which is available in the Company’s Information Circular filed on October 27, 2023, under the Company’s profile

on SEDAR+ at www.sedarplus.ca.

As at the date of this Circular, the Company has not

received notice of a nomination in compliance with the Advance Notice Provisions. If no nominations are received by November 7, 2024,

being the date which is 40 days prior to the Meeting, management’s nominees for election as directors set forth below shall be the

only nominees eligible to stand for election at the Meeting.

Proposed Management Nominees for Election to

the Board

Management of the Company proposes to nominate the

persons listed below for election as directors of the Company to serve until their successors are elected or appointed. All of the nominees

have agreed to stand for election and management of the Company does not contemplate that any of the nominees will be unable to serve

as a director.

The following tables set out certain information as

at the date of this Circular (unless otherwise indicated) with respect to the five persons being nominated at the Meeting for election

as directors of the Company. Each director elected will hold office until the next annual meeting of Shareholders or until his successor

is duly elected or appointed. Information as to principal occupation, business or employment, and Shares beneficially owned or controlled

is not necessarily within the knowledge of management of the Company and has been furnished by the respective nominees or from information

available on the System for Electronic Disclosure by Insiders (SEDI) at www.sedi.ca. Information regarding Board and committee

meeting attendance is presented for meetings held in 2023. As used below, “TSXV” shall mean the TSX Venture Exchange, “TSX”

shall mean the Toronto Stock Exchange, and “CSE” shall mean the Canadian Securities Exchange.

| COLLIN KETTELL |

Principal Occupation, Business or Employment for Last Five Years |

|

Puerto Rico, USA

Director since: January

6, 2016

Chief Executive Officer and

Executive Chairman of Board

NOT INDEPENDENT |

Chief Executive Officer, New Found Gold Corp. (April 2022 - present) (2016 - 2022); Executive Chairman, New Found Gold Corp. (March 2020 - present); Chief Executive Officer and Director, Nevada King Gold Corp. (January 2019 - present); Chief Executive Officer and Director, Palisades Goldcorp Ltd. (August 2019 - present) |

| Current Board/Committee Membership |

2023 Meeting Attendance |

Other Public Directorships |

|

Board

Compensation

NCG |

5 of 5

4 of 4

4 of 4 |

100%

100%

100%

|

Nevada King Gold Corp. (TSXV)

Palisades Goldcorp Ltd. (TSXV)

|

| Number of Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly |

5,155,000 |

| |

|

|

|

management information circular |

| VIJAY MEHTA |

Principal Occupation, Business or Employment for Last Five Years |

|

New Jersey, USA

Director since: April 13, 2022

INDEPENDENT |

Co-Founder, Arkview Capital LLC (January 2020 - present) |

| Current Board/Committee Membership |

2023 Meeting Attendance |

Other Public Directorships |

|

Board

Audit

Compensation

NCG |

5 of 5

4 of 4

4 of 4

4 of 4 |

100%

100%

100%

100% |

None |

| Number of Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly |

Nil |

| |

|

|

|

| PAUL HUET |

Principal Occupation, Business or Employment for Last Five Years |

|

Nevada, USA

Director since: N/A

|

Director, Chairman, and Chief Executive Officer, Culico Metals Inc. (April 2024 - present); Director, Chairman, and Chief Executive Officer, Karora Resources Inc. (November 2018 - August 2024); Director, 1911 Gold Corporation (May 2018 - August 2020) |

| Current Board/Committee Membership |

2023 Meeting Attendance |

Other Public Directorships |

| N/A |

N/A |

Culico Metals Inc., TSXV |

| Number of Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly |

Nil |

| WILLIAM HAYDEN |

Principal Occupation, Business or Employment for Last Five Years |

|

New South Wales, Australia

Director since: N/A

|

Director, Ivanhoe Mines Ltd. (March 2007 - present); Director, Trilogy Metals Inc. (June 2015 - present); Director, Nevada King Gold Corp. (June 2022 - present); Director, Palisades Goldcorp Ltd. (June 2022 - October 2024) |

| Current Board/Committee Membership |

2023 Meeting Attendance |

Other Public Directorships |

| N/A |

N/A |

Ivanhoe Mines Ltd., TSX

Nevada King Gold Corp., TSXV

Trilogy Metals Inc., TSX, NYSE American |

| Number of Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly |

Nil |

| MELISSA RENDER |

Principal Occupation, Business or Employment for Last Five Years |

|

Newfoundland and Labrador, Canada

Director since: N/A |

Vice President of Exploration, New Found Gold Corp. (January 2022 - present); Consulting Geologist, Red Geologic (June 2018 - January 2022) |

| Current Board/Committee Membership |

2023 Meeting Attendance |

Other Public Directorships |

| N/A |

N/A |

N/A |

| Number of Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly |

2,000 |

management information circular |

Cease Trade Orders, Bankruptcies, Penalties

and Sanctions

To the knowledge of the management of the Company,

no proposed nominee for election as a director of the Company:

| (a) | is, at the date of this Circular, or has been within 10 years before the date of this Circular, a director,

chief executive officer, or chief financial officer of any company (including the Corporation) that, |

| (i) | was subject to a cease trade order, an order similar to a cease trade order, or an order that denied the

relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days

(an “Order”) that was issued while the proposed director was acting in the capacity as a director, chief executive

officer or chief financial officer; or |

| (ii) | was subject to an Order that was issued after the proposed director ceased to be a director, chief executive

officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director,

chief executive officer or chief financial officer, |

| (b) | is, at the date of this Circular, or has been within 10 years before the date of this Circular, a director

or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that

person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or

was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee

appointed to hold its assets, |

| (c) | has, within the 10 years before the date of this Circular, become bankrupt, made a proposal under any

legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors,

or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director, or |

| (d) | has been subject to any penalties or sanctions imposed by a court relating to securities legislation or

by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority or has been subject

to any other penalties or sanctions imposed by a court or regulatory body that would be likely to be considered important to a reasonable

shareholder in deciding whether to vote for a proposed director. |

A Shareholder may vote for all of the above nominees,

vote for some of the above nominees and withhold for other of the above nominees, or withhold for all of the above nominees. Management

recommends Shareholders vote in favour of the election of each of the nominees listed above for election as a director of the Company

for the ensuing year. Unless directed to the contrary, it is the intention of the Management Proxyholders named in the enclosed instrument

of proxy to vote proxies IN FAVOUR of each of the nominees.

4. Appointment

of Auditor

Shareholders will be asked to vote for the appointment

of KPMG LLP, Chartered Professional Accountants, of 777 Dunsmuir Street, 11th floor, Vancouver, British Columbia, V7Y 1K3, as auditor

of the Company to hold office until the next annual meeting of Shareholders, or until a successor is appointed, and to authorize the directors

of the Company to fix the remuneration of the auditor.

management information circular |

KPMG LLP, Chartered Professional Accountants, was

appointed as auditor of the Company on July 31, 2023.

Management recommends Shareholders vote in favour

of the appointment of KPMG LLP, Chartered Professional Accountants, as auditor of the Company for the ensuing year and authorize the Board

to fix the auditor’s remuneration. Unless directed to the contrary, it is the intention of the Management Proxyholders named in

the enclosed instrument of proxy to vote proxies IN FAVOUR of the resolution approving the appointment of KPMG LLP, Chartered Professional

Accountants, as auditor of the Company until the close of its next annual meeting and to authorize the Board to fix the remuneration to

be paid to the auditor.

5. Approval

of Stock Option Plan

The Company has established a stock option plan, dated

for reference December 8, 2022 (the “Option Plan”), under which directors, officers, employees and consultants of the

Company may be granted options to acquire Shares (“Options”). It is a key component of the Company’s compensation

program with the purpose to provide the Company with an equity-based mechanism to attract, retain and motivate directors, officers, employees,

and consultants and to such persons by the grant of Options under the Option Plan from time to time for their contributions toward the

long-term goals of the Company and to enable and encourage them to acquire Shares as long-term investments.

The Option Plan is a “rolling” stock option

plan, whereby the aggregate number of Shares reserved for issuance shall not exceed ten (10%) percent of the total number of issued Shares

(calculated on a non-diluted basis) at the time an Option is granted. The Option Plan was last approved by Shareholders at the Company’s

Annual General

and Special Meeting of Shareholders held December 7, 2023, and subsequently by the

TSX Venture Exchange (the “TSXV”). The policies of the TSXV respecting the granting of Options require that all companies

listed on the TSXV implement a stock option plan and that any “rolling” stock option plan must receive Shareholder approval

on an annual basis and subsequent acceptance by the TSXV.

The Option Plan is subject to acceptance by the TSXV.

For a summary of the material terms

of the Option Plan, see “Section 5 - Statement of Executive Compensation - Option Plan.” For additional details, see

“Section 8 - Other Information - Securities Authorized for Issuance Under Equity Compensation Plans.” Any summary is qualified

in its entirety by the full text of the Option Plan, a copy of which will be available at the Meeting and which is also available in Schedule

B of the Company’s Information Circular filed on November 11, 2022 on SEDAR+ at www.sedarplus.ca

under the Company’s profile.

Shareholder Approval

At the Meeting, Shareholders will be asked to consider

and, if deemed advisable, to pass, with or without variation, an ordinary resolution approving the Option Plan. The text of the ordinary

resolution - the Option Plan Resolution - which management intends to place before the Meeting is as follows:

“BE IT RESOLVED, as an ordinary resolution

of Shareholders, that:

| 1. | the stock option plan of the Company, dated for reference December 8, 2022, be and is hereby ratified,

confirmed and approved as the stock option plan of the Company (the “Option Plan”) until such time as further ratification

is required pursuant to the rules of the TSX Venture Exchange (the “TSXV”) or other applicable regulatory requirements; |

management information circular |

| 2. | the board of directors of the Company be and is hereby authorized in its absolute discretion to administer

the Option Plan, in accordance with its terms and conditions and to further amend or modify the Option Plan to ensure compliance with

the policies of the TSXV; and |

| 3. | any one director or officer of the Company be and is hereby authorized and directed to do all such acts

and things and to execute and deliver, under the corporate seal of the Company or otherwise, all such deeds, documents, instruments and

assurances as in his opinion may be necessary or desirable to give effect to the foregoing resolutions, including, without limitation,

making any changes to the Option Plan required by the TSXV or applicable securities regulatory authorities and to complete all transactions

in connection with the administration of the Option Plan.” |

In order for the foregoing Option Plan Resolution

to be passed, it must be approved by a simple majority of the votes cast by Shareholders in person or by proxy at the Meeting. If the

Option Plan is not approved at the Meeting, the Company will not be permitted to grant further Options until Shareholder approval is obtained.

However, all Options previously granted will continue unaffected.

Management of the Company has reviewed the Option

Plan Resolution, concluded that it is fair and reasonable to the Shareholders and in the best interest of the Company, and recommends

Shareholders vote in favour of ratifying, confirming and approving the Option Plan. Unless directed to the contrary, it is the intention

of the Management Proxyholders named in the enclosed instrument of proxy to vote proxies IN FAVOUR of the Option Plan Resolution.

6. Other

Business

As at the date of this Circular, management of the

Company is not aware of any other matters to be presented for action at the Meeting. However, if any other matters should properly come

before the Meeting, the proxies hereby solicited will be exercised on such matters in accordance with the best judgment of the proxy holders,

exercising discretionary authority with respect to such other matters and with respect to amendments or variations of matters set out

in the Notice of Meeting.

| SECTION 5 - STATEMENT OF EXECUTIVE COMPENSATION |

The following information with respect to the Company

is provided in accordance with Form 51-102F6 - Statement of Executive Compensation (“Form 51-102F6”). Information

contained in this Statement of Executive Compensation is as of December 31, 2023, unless otherwise indicated, and all dollar amounts referenced

herein are in Canadian dollars, unless otherwise specified.

Named Executive

Officers

The named executive officers (“NEOs”)

of the Company for the financial year ended December 31, 2023, were Collin Kettell, Executive Chairman and Chief Executive Officer; Denis

Laviolette, President; Michael Kanevsky, Chief Financial Officer; Greg Matheson, Chief Operating Officer; and Ronald Hampton, Chief Development

Officer.

Compensation

Discussion & analysis

Compensation Philosophy and Objectives

The objective of the Company’s compensation

program is to attract and continue to retain NEOs that have the necessary attributes, experience, skills and competencies that represent

the best fit for the Company and to ensure that the compensation for its NEOs is appropriate and aligned with shareholder interests. The

Company’s Compensation Committee (the “Compensation Committee”) reviews director and NEO compensation on an annual

basis.

management information circular |

The Company’s general philosophy is that compensation

for non-executive directors and NEOs plays an important role in achieving short and long-term business objectives that ultimately drive

business success and should include a mix of cash (base salary and discretionary annual bonus) and equity (Options) with Options being

more heavily weighted than base salary and bonuses to better align the interests of management with that of the Shareholders.

Compensation Elements

The compensation of the NEOs consists of three main

components: base salary, discretionary annual cash bonuses and long-term incentives, currently in the form of Options. Each element of

compensation is a subjective decision by the Board based on recommendations of the Compensation Committee. The following discussion describes

the components of compensation and discusses how each component relates to the Company’s overall executive compensation objective.

Base Salary

The Company’s view is that a competitive base

salary or consulting fee is a necessary element for attracting and retaining qualified executive officers. The base salary for each executive

is established by the Board, on the recommendation of the Compensation Committee, based upon the position held by such executive, competitive

market conditions, such executive’s related responsibilities, experience and the NEO’s skill base, the functions performed

by such executive and the salary ranges for similar positions. Individual and corporate performance are also taken into account in determining

base salary levels for executives. To better align the interests of management with those of the Shareholders, base salary is less heavily

weighted in the Company’s overall compensation of NEOs as compared to the other elements of NEO compensation.

Bonuses

In determining to award annual bonuses, including

the amounts thereof, the Board uses its discretion and takes into consideration the Company’s annual achievements, without assigning

any quantifiable weight or factor in respect of any particular achievement or corporate milestone. Bonuses were granted to NEOs in 2023

based on the Compensation Committee’s assessment of the Company’s performance for the year. The purpose of granting cash bonuses

specifically linked to individual and Company-wide performance is to ensure management is motivated to work towards the success of the

Company.

Long-term Incentives

Long-term incentives for NEOs and directors take the

form of Options which are granted under the direction of the Compensation Committee in accordance with the Company’s Option Plan.

The purpose of granting long-term incentives is to assist the Company in compensating, attracting, retaining and motivating directors,

NEOs, employees and consultants and to closely align the personal interests of such persons to that of the Company’s shareholders

and motivate such individuals to work towards ensuring the long-term success of the Company. The value of Options granted to NEOs is determined

on both qualitative and quantitative levels. Changes in executive positions or roles and ongoing contribution to the Company are factors

which affect the decision-making process. Outstanding Options and previous grants are reviewed by the Compensation Committee on an annual

basis and again when considering new Option grants. The terms of the Option Plan are also reviewed from time to time by the Compensation

Committee and changes suggested are discussed with NEOs prior to approval by the Board, then regulatory and shareholder approval as necessary.

management information circular |

Clawback Policy

In compliance with listing requirements of the NYSE

American, the Board has adopted a clawback policy (the “Clawback Policy”) specifying the consequences with respect

to incentive awards in the event of any accounting restatement (“Restatement”) due to the Company’s material

non-compliance with financial reporting requirements under applicable U.S. federal securities laws, in accordance with Rule 10D-1 of the

Securities Exchange Act of 1934 (“Rule 10D-1”).

The Clawback Policy applies to the executive officers

of the Company (as defined under Rule 10D-1) of the Company (the “Executive Officers”) and covers all incentive-based

compensation (including any cash or equity compensation) that is granted, earned or vested based wholly or in part upon the attainment

of any “financial reporting measure” (“Incentive-Based Compensation”). This Clawback Policy applies to

any Incentive-Based Compensation “received” by an Executive Officer during the period consisting of any of the three completed

fiscal years immediately preceding:

| • | the date that the Board (or Audit Committee) concludes, or reasonably should have concluded, that the

Company is required to prepare a Restatement, or |

| • | the date that a court, regulator, or other legally authorized body directs the Company to prepare a Restatement. |

The amount of Incentive-Based Compensation that must

be repaid by the Executive Officer (subject to certain limitations) is the amount of Incentive-Based Compensation received by the Executive

Officer that exceeds the amount of Incentive-Based Compensation that otherwise would have been received had it been determined based on

the Restatement (the “Recoverable Amount”). Applying this definition, after a Restatement, the Company will recalculate

the applicable financial reporting measure and the Recoverable Amount in accordance with applicable rules. The Company will determine

whether, based on that financial reporting measure as calculated relying on the original financial statements, the Executive Officer received

a greater amount of Incentive-Based Compensation than would have been received applying the recalculated financial measure. Where Incentive-Based

Compensation is based only in part on the achievement of a financial reporting measure performance goal, the Company will determine the

portion of the original Incentive-Based Compensation based on or derived from the financial reporting measure which was restated and will

recalculate the affected portion based on the financial reporting measure as restated to determine the difference between the greater

amount based on the original financial statements and the lesser amount that would have been received based on the Restatement.

For Incentive-Based Compensation based on stock price

or total shareholder return, where the Recoverable Amount is not subject to mathematical recalculation directly from the information in

an accounting restatement: (a) the amount shall be based on a reasonable estimate of the effect of the accounting restatement on the stock

price or total shareholder return upon which the incentive-based compensation was received; and (b) the Company shall maintain and provide

documentation of the determination of that reasonable estimate as required. The Recoverable Amounts will be calculated on a pre-tax basis

to ensure that the Company recovers the full amount of Incentive-Based Compensation that was erroneously awarded.

Peer Group

While the Board considers amounts paid by other companies

in similar industries at similar stages of development in determining compensation, no specifically selected peer group was identified

in 2023.

management information circular |

Performance Goals

The Company does not have specific performance goals

in respect of an NEOs compensation. Specific compensation recommendations are made to the Board by the Compensation Committee after discussion

amongst the members of the Compensation Committee. Each component of compensation and the decisions of the Compensation Committee about

each component have an impact on the Compensation Committee’s decisions regarding other compensation components. All of the compensation

components together are intended to meet the Company’s compensation objectives, which are intended to allow the Company to attract

and retain qualified and experienced executives who are motivated to achieve the Company’s business plans, strategies and goals

on an annual and long-term basis, in order to increase shareholder value.

Risk Considerations

The Board reviews from time to time and at least once

annually, the risks, if any, associated with the Company’s compensation policies and practices at such time. Such a review occurred

at the time of preparation of this Statement of Executive Compensation. Implicit in the Board’s mandate is that the Company’s

policies and practices respecting compensation, including those applicable to the Company’s executives, be designed in a manner

which is in the best interests of the Company and its shareholders, and risk implications is one of many considerations which are taken

into account in such design.

A significant portion of the Company’s executive

compensation consists of Options granted under the Option Plan. Such compensation is both “long term” and “at risk”

and, accordingly, is directly linked to the achievement of long-term value creation. As the benefits of such compensation, if any, are

not realized by the executives until a significant period of time has passed, the ability of executives to take inappropriate or excessive

risks that are beneficial to them from the standpoint of their compensation at the expense of the Company and its shareholders is extremely

limited.

Due to the relatively small size of the Company, and

the current level of the Company’s activity, the Board is able to closely monitor and consider any risks which may be associated

with the Company’s compensation policies and practices. Risks, if any, may be identified and mitigated through regular Board meetings,

during which financial and other information pertaining to the Company will be reviewed, which review will include executive compensation.

No risks have been identified arising from the Company’s compensation policies and practices that are reasonably likely to have

a material adverse effect on the Company.

No director, officer or member of senior management

are permitted to enter into financial instruments that are designed to hedge or offset any decrease in the market value of the Company’s

equity securities that are held directly or indirectly by them or granted as compensation to them. Such prohibited financial instruments

include prepaid variable forward contracts, equity swaps, collars, put or call options and similar financial instruments.

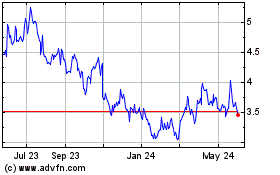

Performance Graph

The following graph compares the cumulative shareholder

return for C$100 invested in Shares on August 11, 2020, against the cumulative shareholder return for the GDXJ Index for the period beginning

August 11, 2020, and ending December 31, 2023, assuming reinvestment of all dividends. The GDXJ is an exchange traded fund (ETF) and is

compiled of stocks from small and medium-capitalization companies in the gold and/or silver mining industry. The Company believes tracking

its share price against the GDXJ is an appropriate measure of the relative market performance of the Company. The graph also depicts total

annual compensation for the NEOs in each particular year since the Company began trading on the TSXV on August 11, 2020.

management information circular |

Comparison of Cumulative Total Returns

The performance graph shows that the cumulative shareholder

returns for $100 invested in Shares outperformed the GDXJ index in 2023, 2022, 2021 and 2020. Compensation paid to the Company’s

NEOs decreased in 2023 compared to 2022 as a result of no option-based awards granted to NEOs in fiscal year 2023.

Option-based Awards

The Company has the Option Plan in place for the granting

of Options to the directors, officers, employees and consultants of the Company. The purpose of granting such Options is to assist the

Company in compensating, attracting, retaining and motivating such persons and to closely align the personal interests of such persons

to that of the Company’s shareholders. The allocation of Options under the Option Plan is determined by the Board which, in determining

such allocations, considers such factors as previous grants to individuals, overall performance of the Company, share price, the role

and performance of the individual in question, the amount of time directed to the Company’s affairs and time expended in serving

on the Company’s committees.

For further information, please see “Option

Plan” below for a summary of the material terms of the Option Plan.

Compensation

Governance

Composition of the Compensation Committee

The Compensation Committee must consist of three or

more directors, at least two of whom must qualify as “independent” as such term is defined in National Policy 58-101 - Corporate

Governance Guidelines. The Compensation Committee currently consists of three directors, Collin Kettell (the Chair), Douglas Hurst

and Vijay Mehta. Messrs. Hurst and Mehta are independent directors. Mr. Kettell is not considered to be independent as Mr. Kettell is

an executive officer of the Company.

management information circular |

Relevant Education

and Experience

The members of the Compensation Committee have a range

of skills and experience which the Company believes provides the expertise necessary to oversee the Company’s executive compensation

structure. The relevant experience of the Compensation Committee members is summarized below.

| Collin Kettell (Chair) |

Mr. Kettell is the founder, Executive Chairman and

Chief Executive Officer of the Company and is responsible for co-founding Nevada King Gold Corp., for which he serves as a director and

Chief Executive Officer, and Palisades Goldcorp Ltd., for which he serves as a director and Chief Executive Officer. In his capacity as

a senior executive and/or director, Mr. Kettell is currently, or has been, involved with the compensation matters of each of Nevada King

Gold Corp. and Palisades Goldcorp Ltd.

|

| Douglas Hurst |

Mr. Hurst has over 30 years’ experience in the

mining and natural resource industries having acted as a geologist, consultant, mining analyst, senior executive and board member. Mr.

Hurst was a founding executive of International Royalty Corporation, which was purchased by Royal Gold for $700 million and, more recently,

was one of the founders of Newmarket Gold Inc., which was purchased for $1.0 billion by Kirkland Lake Gold Ltd. in November 2016. In his

capacity as a senior executive and/or director, Mr. Hurst was involved with compensation matters of each of the foregoing companies and

is currently or has been involved with the compensation matters of several other public companies, including Calibre Mining Inc., Northern

Vertex Mining Corp. and Newcore Gold Ltd. Mr. Hurst holds a Bachelor of Science in Geology from McMaster University (1986).

|

| Vijay Mehta |

Mr. Mehta is a co-founder of Arkview Capital, a private equity fund that invests in diversity-oriented companies, where he is directly involved in compensation decisions. Prior to founding Arkview Capital, Mr. Mehta was an Investment Professional and member of the Investment Committee at Ziff Brothers Investments with broad responsibilities across the investment portfolio and also worked at private equity fund, Texas Pacific Group, and investment bank, Morgan Stanley. Mr. Mehta graduated summa cum laude from the University of Pennsylvania’s Huntsman Program and earned an MBA from the Harvard Business School, where he was named a Baker Scholar. |

Compensation Committee Responsibilities

The Compensation Committee is appointed by and reports

to the Board. The Compensation Committee assists the Board in discharging the Board’s oversight responsibilities relating to the

attraction, compensation, evaluation and retention of key senior management personnel, and in particular, the Chief Executive Officer,

primarily through:

| • | reviewing and assessing the overall compensation

strategy of the Company based on industry standards and characteristic needs and objectives of the Company, including consultation with

independent experts; |

| • | setting compensation parameters; |

| • | assessing the CEO’s performance against

pre-agreed objectives; |

| • | reviewing performance assessments of other senior

officers, new executive appointments, terminations and employment agreements; |

| • | making recommendations to the Board on salary

changes, short-term and long-term incentive plans or benefit plans; and |

| • | reviewing and recommending disclosure pertaining

to all of the foregoing. |

management information circular |

Summary

Compensation Table

The following table contains a summary of the compensation

paid to the NEOs of the Company during the three most recently completed financial years.

| Name and principal position |

Year |

Salary

($) |

Share-based awards

($) |

Option-based awards

($) |

Non-equity incentive plan compensation |

Pension value

($) |

All other compensation

($) |

Total compensation

($) |

Annual incentive plans

($) |

Long-term incentive plans

($) |

|

Collin Kettell (1) (2)

CEO, Executive Chairman and Director |

2023 |

388,800 |

N/A |

Nil |

129,600 |

Nil |

N/A |

N/A |

518,400 |

| 2022 |

360,000 |

N/A |

1,844,584 |

180,000 |

Nil |

N/A |

N/A |

2,384,584 |

| 2021 |

300,000 |

N/A |

1,291,220 |

100,000 |

Nil |

N/A |

N/A |

1,691,220 |

|

Michael Kanevsky

CFO |

2023 |

116,640 |

N/A |

Nil |

38,880 |

Nil |

N/A |

N/A |

155,520 |

| 2022 |

108,000 |

N/A |

507,261 |

54,000 |

Nil |

N/A |

N/A |

669,261 |

| 2021 |

72,000 |

N/A |

Nil |

Nil |

Nil |

N/A |

N/A |

72,000 |

|

Denis Laviolette (3)

President and Director |

2023 |

272,160 |

N/A |

Nil |

90,720 |

Nil |

N/A |

N/A |

362,880 |

| 2022 |

252,000 |

N/A |

1,291,209 |

126,000 |

Nil |

N/A |

N/A |

1,669,209 |

| 2021 |

210,000 |

N/A |

1,291,220 |

70,000 |

Nil |

N/A |

N/A |

1,571,220 |

|

Greg Matheson

Chief Operating Officer |

2023 |

252,720 |

N/A |

Nil |

84,240 |

Nil |

N/A |

N/A |

336,960 |

| 2022 |

234,000 |

N/A |

461,146 |

117,000 |

Nil |

N/A |

N/A |

812,146 |

| 2021 |

195,000 |

N/A |

544,192 |

65,000 |

Nil |

N/A |

N/A |

804,192 |

|

Ronald Hampton (4)

Chief Development Officer |

2023 |

336,960 |

N/A |

235,560 |

112,320 |

Nil |

N/A |

N/A |

684,840 |

| 2022 |

182,000 |

N/A |

391,207 |

78,000 |

Nil |

N/A |

N/A |

651,207 |

| 2021 |

N/A |

N/A |

Nil |

Nil |

Nil |

N/A |

N/A |

N/A |

Notes

(1) On

April 13, 2022, Mr. Kettell was appointed CEO.

| (2) | Mr. Kettell served as a director of the Company for the financial years ended December 31, 2023, December