Macro Indicators On Radar for S&P 500 Investors This Week

September 04 2023 - 5:01AM

Finscreener.org

The

Dow Jones Industrial Average concluded a strong week with a slight gain on

Friday, influenced by the latest U.S. jobs report. The 30-stock Dow

rose by 115.80 points, or 0.33%, finishing the day at

34,837.71.

Meanwhile, the

S&P 500 rose by

approximately 0.18% to close at 4,515.77, while the

tech-heavy Nasdaq Composite index slightly retreated, ending down 0.02% at

14,031.81.

Last week, the Dow and the Nasdaq

advanced 1.4% and 3.3%, respectively, marking their best

performances since July. The S&P 500 gained 2.5% last week

and had its strongest week since June.

The most recent U.S. nonfarm

payrolls data revealed that the unemployment rate edged up to 3.8%

in August, marking its highest point in over a year. This came as a

surprise to economists, who had forecasted it to stay at

3.5%.

Additionally, average hourly

earnings saw a year-over-year rise of 4.3%, falling short of the

4.4% increase that economists polled by Dow Jones had anticipated.

This could indicate a slowing economy and lessening inflationary

pressures.

Although AugustU+02019s payroll

numbers showed quicker-than-expected growth, adding 187,000 jobs,

there were downward revisions for the prior two months. The job

figures originally reported for June and July were collectively

reduced by 110,000.

Are interest rate hikes coming to an end in the

U.S.?

In an interview with CNBC, Steve

Wyett, chief investment strategist at BOK Financial explained last

Friday, “It would be a mistake to look at today’s employment

report, along with recent data, and say the Fed is done. Even

though trends in inflation are moving the right direction and a

broader view of the employment market would indicate wage

pressures should abate, overall economic growth is above trend and

inflation remains well above the Fed’s recently confirmed 2%

target.”

The CME Group’s FedWatch tool

indicated traders now expect a 93% chance for the Federal Reserve

to hold interest rates at current levels at its next policy meeting

later this month.

This Wednesday, the Federal

Reserve is set to release its updated Beige Book, a regular

snapshot of the U.S. economy that comes out eight times annually

and covers all 12 Fed districts. The forthcoming edition may paint

a picture of an economy holding firm, even in the face of

challenges.

Despite the FedU+02019s rate

increases and sustained high inflation, consumer expenditure—which

constitutes over two-thirds of the U.S. GDP—remains resilient.

Additionally, unemployment continues to hover near its lowest

levels in decades.

All eyes on China

Next week, attention will also be

on China as it is slated to unveil its inflation data for August.

This is particularly significant as ChinaU+02019s economy, the

second largest in the world, experienced deflation last

month.

Consumer prices declined 0.3%

year-over-year and are expected to have seen a minor uptick of 0.1%

annually in August. ChinaU+02019s economic landscape is presently

fraught with challenges, including rising debt levels, declining

exports, a collapsing property market, and elevated youth

joblessness.

Deflation typically gains ground

during economic slumps as households put off spending, expecting

prices to drop further. This, in turn, affects businesses and their

profitability, compelling them to reduce staff, which further

curtails consumer spending. The trend initiates a vicious cycle of

economic decline that poses significant challenges for government

and central bank interventions.

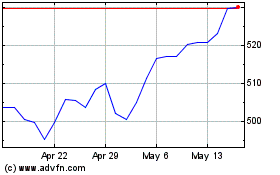

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Oct 2024 to Nov 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Nov 2023 to Nov 2024